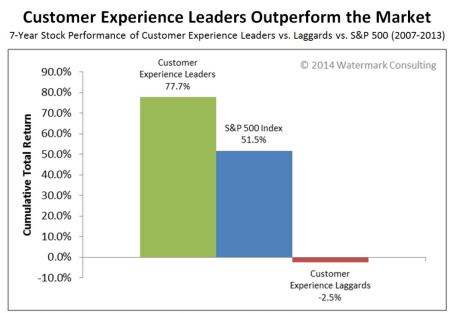

The study calculated the cumulative total stock returns for two model portfolios -- composed of the Top 10 (“leaders”) and Bottom 10 (“laggards”) publicly traded companies in Forrester Research’s annual Customer Experience Index rankings.

For the seven-year period ending in 2013, the Customer Experience Leader portfolio outperformed the S&P 500 market index by an astounding 26 percentage points. Perhaps even more striking was the performance of the Customer Experience Laggard portfolio, which posted a 2.5% decline in value, despite a big rally in the broader market.

The results underscore the benefits enjoyed by companies that invest in, and effectively execute on, a customer-experience strategy: higher revenues (because of better retention, less price sensitivity, greater wallet share and positive word-of-mouth) and lower expenses (because of reduced acquisition costs, fewer complaints and the less intense service requirements of happy, loyal customers).

Conversely, the study also provides a sober reminder of how customer dissatisfaction saps business value, by depressing revenues and inflating expenses.

Whether your firm is a public or private entity, the lesson here is clear: The market believes that companies that deliver a great customer experience over the long-term are simply more valuable than those that do not.

And that’s a message that insurance traditionalists should take to heart, because a great policyholder experience really is good for business.

Note: A complimentary report describing the 2014 Customer Experience ROI Study, including commentary on how the leading firms differentiate themselves, is available from Watermark Consulting.

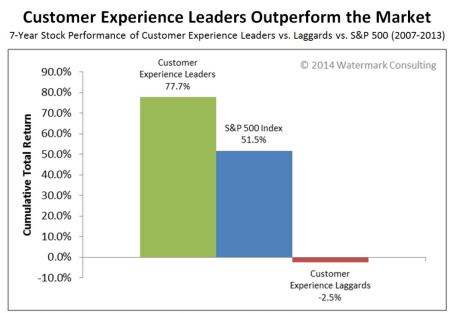

The study calculated the cumulative total stock returns for two model portfolios -- composed of the Top 10 (“leaders”) and Bottom 10 (“laggards”) publicly traded companies in Forrester Research’s annual Customer Experience Index rankings.

For the seven-year period ending in 2013, the Customer Experience Leader portfolio outperformed the S&P 500 market index by an astounding 26 percentage points. Perhaps even more striking was the performance of the Customer Experience Laggard portfolio, which posted a 2.5% decline in value, despite a big rally in the broader market.

The results underscore the benefits enjoyed by companies that invest in, and effectively execute on, a customer-experience strategy: higher revenues (because of better retention, less price sensitivity, greater wallet share and positive word-of-mouth) and lower expenses (because of reduced acquisition costs, fewer complaints and the less intense service requirements of happy, loyal customers).

Conversely, the study also provides a sober reminder of how customer dissatisfaction saps business value, by depressing revenues and inflating expenses.

Whether your firm is a public or private entity, the lesson here is clear: The market believes that companies that deliver a great customer experience over the long-term are simply more valuable than those that do not.

And that’s a message that insurance traditionalists should take to heart, because a great policyholder experience really is good for business.

Note: A complimentary report describing the 2014 Customer Experience ROI Study, including commentary on how the leading firms differentiate themselves, is available from Watermark Consulting.Why Focus on Customer Experience? Here's Why

A study reveals the ROI of a great customer experience -- and the penalty for a bad one.

The study calculated the cumulative total stock returns for two model portfolios -- composed of the Top 10 (“leaders”) and Bottom 10 (“laggards”) publicly traded companies in Forrester Research’s annual Customer Experience Index rankings.

For the seven-year period ending in 2013, the Customer Experience Leader portfolio outperformed the S&P 500 market index by an astounding 26 percentage points. Perhaps even more striking was the performance of the Customer Experience Laggard portfolio, which posted a 2.5% decline in value, despite a big rally in the broader market.

The results underscore the benefits enjoyed by companies that invest in, and effectively execute on, a customer-experience strategy: higher revenues (because of better retention, less price sensitivity, greater wallet share and positive word-of-mouth) and lower expenses (because of reduced acquisition costs, fewer complaints and the less intense service requirements of happy, loyal customers).

Conversely, the study also provides a sober reminder of how customer dissatisfaction saps business value, by depressing revenues and inflating expenses.

Whether your firm is a public or private entity, the lesson here is clear: The market believes that companies that deliver a great customer experience over the long-term are simply more valuable than those that do not.

And that’s a message that insurance traditionalists should take to heart, because a great policyholder experience really is good for business.

Note: A complimentary report describing the 2014 Customer Experience ROI Study, including commentary on how the leading firms differentiate themselves, is available from Watermark Consulting.

The study calculated the cumulative total stock returns for two model portfolios -- composed of the Top 10 (“leaders”) and Bottom 10 (“laggards”) publicly traded companies in Forrester Research’s annual Customer Experience Index rankings.

For the seven-year period ending in 2013, the Customer Experience Leader portfolio outperformed the S&P 500 market index by an astounding 26 percentage points. Perhaps even more striking was the performance of the Customer Experience Laggard portfolio, which posted a 2.5% decline in value, despite a big rally in the broader market.

The results underscore the benefits enjoyed by companies that invest in, and effectively execute on, a customer-experience strategy: higher revenues (because of better retention, less price sensitivity, greater wallet share and positive word-of-mouth) and lower expenses (because of reduced acquisition costs, fewer complaints and the less intense service requirements of happy, loyal customers).

Conversely, the study also provides a sober reminder of how customer dissatisfaction saps business value, by depressing revenues and inflating expenses.

Whether your firm is a public or private entity, the lesson here is clear: The market believes that companies that deliver a great customer experience over the long-term are simply more valuable than those that do not.

And that’s a message that insurance traditionalists should take to heart, because a great policyholder experience really is good for business.

Note: A complimentary report describing the 2014 Customer Experience ROI Study, including commentary on how the leading firms differentiate themselves, is available from Watermark Consulting.