Few people wake up in the morning excited to purchase an insurance product. At best, insurance is considered a "push" rather than a "pull" product. Often, it's a requirement based on legislation or contractual conditions. Rational buyers aim for the best possible deal (based on lowest price and perhaps coverage considerations) -- but what if we could influence the way that consumers perceived the value of risk mitigation and insurance in relation to a personalized asset?

Embedded insurance at the point-of-design may be a way to address this challenge and thereby support insurance sales and distribution.

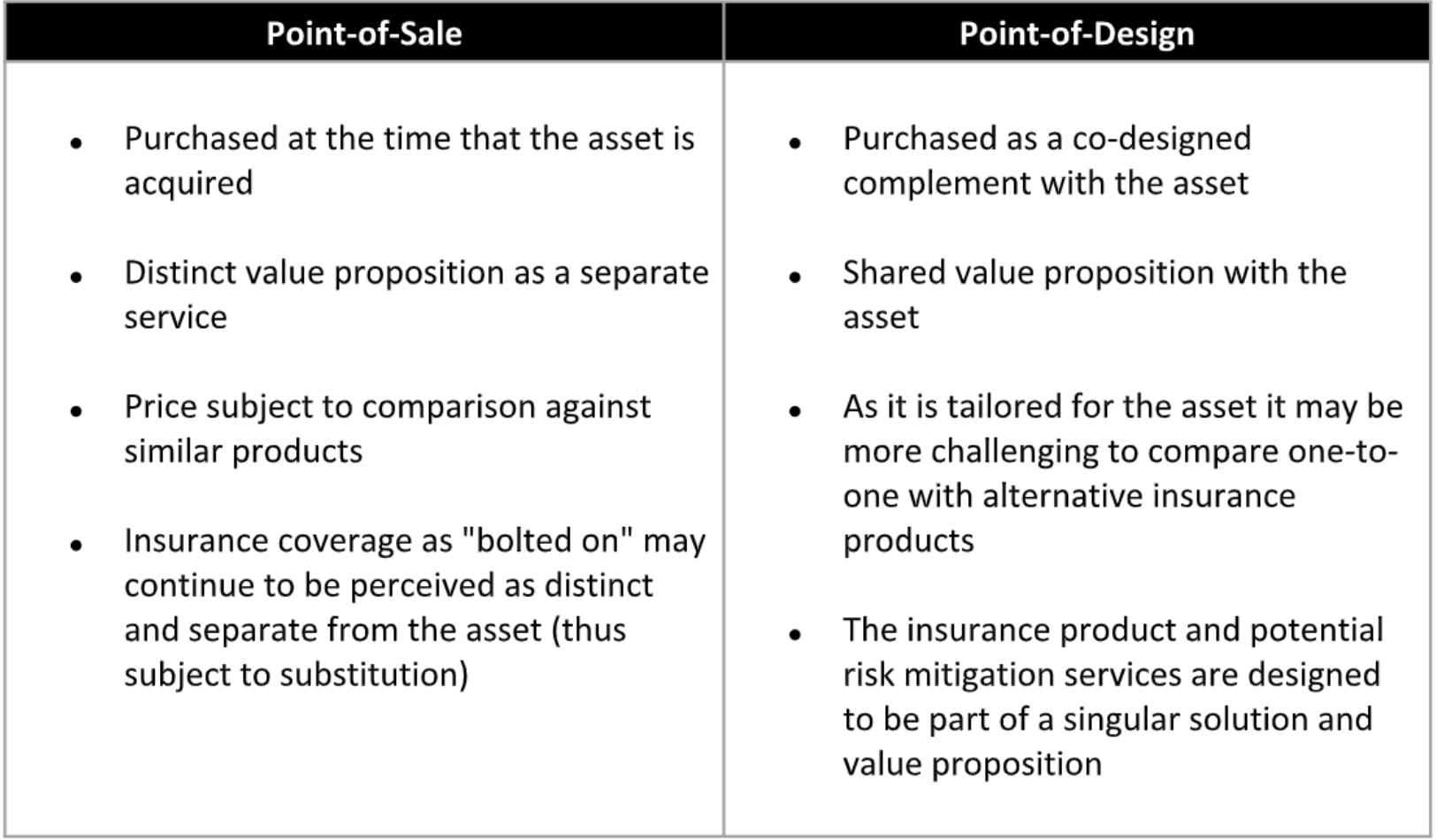

Embedded insurance at the point-of-design involves creating assets that incorporate insurance products as natural complements with a shared value proposition. This process involves re-imagining the role of risk mitigation and insurance coverage as both a means of protecting the value of the asset and a source of resilience.

Embedded insurance at point-of-sale, by contrast, is an add-on product that is discrete from the asset and, as such, is an arbitrary complement.

Embedded Insurance at Point-of-Design as Part of a Distribution Strategy

What if the structure of point-of-design embedded insurance supported insurance distribution growth by wrapping a "push" product within a "pull" product?

We can visualize this concept as a set of layers:

- The first layer is the asset. Perhaps the asset may be personalized by the consumer such that it can be modified to suit preferences or may engage with them in a way that's tailored to them. Over time, consumers see themselves reflected in the asset.

- The second layer is the cost of ownership. We may divide this into two categories -- pure expense and protection of value:

- Pure expenses may include maintenance, fuel, replacement parts and so on;

- Costs associated with protecting the value of the asset may include risk mitigation (recommended activities that consumers may adopt to manage the risk associated with damage or loss to the personalized asset) and insurance (the cost of resilience or the capacity to return to a pre-loss state after a defined event).

If the asset is sufficiently desirable and engaging -- "pulled" by the consumer -- and the risk mitigation and insurance components are considered to be part of the overall proposition and help to protect the value of the asset, then it follows that consumers may be prepared to purchase the overall bundle on the basis of the asset's desirability.

Further, the more that consumers consider the asset to have intrinsic value the more they may see these costs as an investment in mitigating loss of value -- and may be prepared to increase risk and insurance spending. An example may be if insurers provide guidance on how to increase a property's utility or overall valuation or boost the resale value of a vehicle.

If we leverage personalized recommendations to help consumers enhance the perceived or actual value of the asset, we may increase both its attractiveness and consumer preparedness to pay for further insurance services.

See also: Time to Raise Your Embedded Insurance Game

Personal Lines Examples

Prevention and protection become a dynamic part of home ownership.

- Insurers could provide home buyers with a home-styling app that scanned the dwelling inside and out and provided personalized recommendations on how to redesign based on the owner's personal preferences -- perhaps recommending artworks, sound systems and acoustic materials or renovations such as skylights or natural heating and cooling options.

- The app may also recommend ways to enhance the property value, such as landscape gardening, adding a patio or renovating a kitchen, calculating estimated benefits once complete.

- The service could provide options for smart devices that mitigate risk of property damage or loss.

- Further, the insurer may provide access to trusted service providers who can fulfil these recommendations.

- Complementing the property redesign, a flexible homeowners coverage could recognize the individual characteristics of the property and provide coverage accordingly, offering additional coverages and updates as changes are introduced.

The insurance program becomes a risk and resilience service that helps to optimize resale value as well as supporting driver safety.

- Existing auto telematics programs for insurance typically focus on improving driving behavior through incentives such as reduced premiums.

- Insurers may collaborate with original equipment manufacturers (OEMs) to incorporate pay-as-you-drive coverage, tailored for each line of vehicles and recognizing their individual risk factors and features, with an in-car customer experience that emphasized safe driving to protect the re-sale value of the asset.

- The interface may provide personalized guidance on aesthetic or performance enhancements, such as addressing scratches and dints or detailing services, with recommended providers to support.

Summary

Increasing perceived value does not necessitate that willingness to pay for insurance services will increase -- studies have demonstrated that the factors that influence willingness to pay are numerous and differ by customer segment -- yet it is reasonable to suggest that helping consumers enhance actual or perceived asset value, coupled with risk mitigation activity and protection, may lead to greater retention and potentially upselling opportunity.

With embedded insurance, by tailoring it to the risk and the individual's choices we tie the value proposition of the asset and the insurance product together. By helping consumers increase the real and perceived value of the asset through personalized recommendations, and making it easy to protect, we can give consumers more reason to pay for risk mitigation and protection. Regular engagement and genuinely valuable guidance may create benefit for consumers and insurers alike.