Quantum Computers: Bigger Than AI?

A lot of good will come from quantum computing, including better weather forecasting, but it could also open up a Pandora’s box for security.

A lot of good will come from quantum computing, including better weather forecasting, but it could also open up a Pandora’s box for security.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Vivek Wadhwa is a fellow at Arthur and Toni Rembe Rock Center for Corporate Governance, Stanford University; director of research at the Center for Entrepreneurship and Research Commercialization at the Pratt School of Engineering, Duke University; and distinguished fellow at Singularity University.

The pharmaceutical pricing system is opaque and perverse — and it’s the only system we know. But it doesn’t have to be this way.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Pramod John is the founder and CEO at Vivo Health. Pramod John is team leader of VIVIO Health, a startup that’s solving out of control specialty drug costs; a vexing problem faced by self-insured employers. To do this, VIVIO Health is reinventing the supply side of the specialty drug industry.

What is often overlooked in California's wildfires is the threat of flood – not covered by homeowner’s insurance - that the fires create.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Terry Black is vice president of business development for Aon National Flood Services, with nearly 20 years’ experience in the flood insurance industry and more than 30 years’ experience in property/casualty insurance.

It’s hard to change when you’re going 100 mph every day. Yet, despite challenges across the industry, a lot of innovation models are appearing.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Deb Smallwood, the founder of Strategy Meets Action, is highly respected throughout the insurance industry for strategic thinking, thought-provoking research and advisory skills. Insurers and solution providers turn to Smallwood for insight and guidance on business and IT linkage, IT strategy, IT architecture and e-business.

In 2018, the key word is going to be “agile,” and human resource teams will be responsible for making it a reality across the organization.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Keith Johnstone is the head of marketing at Peak Sales Recruiting, a leading B2B sales recruiting company launched in 2006. Johnstone leads all marketing activities and has successfully grown revenue and lead volume every quarter.

Savvy businesses are responding to a tight labor environment by reevaluating their recruitment, retention and compensation practices.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Cynthia Marcotte Stamer is board-certified in labor and employment law by the Texas Board of Legal Specialization, recognized as a top healthcare, labor and employment and ERISA/employee benefits lawyer for her decades of experience.

Merely adding a digital channel or an app doesn't work. This only adds cost and increases complexity in the IT landscape,

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Roger Peverelli is an author, speaker and consultant in digital customer engagement strategies and innovation, and how to work with fintechs and insurtechs for that purpose. He is a partner at consultancy firm VODW.

Reggy de Feniks is an expert on digital customer engagement strategies and renowned consultant, speaker and author. Feniks co-wrote the worldwide bestseller “Reinventing Financial Services: What Consumers Expect From Future Banks and Insurers.”

Many insurers still struggle to even provide real omnichannel customer service, or offer timely and transparent claims settlement.

Many insurers are focused on how to innovate, but most do not have a stable, cost-efficient core to support and fund their innovation efforts. Both are necessary.

We’ve all read the productivity articles about the world leader who eats the same thing for breakfast, repeats the same 40-minute workout and reads the newspaper in the exact same order. We’ve heard about elite athletes with rigid pre-game routines, down to the music they’ll listen to before the match. The take-home message from this is that you need a stable foundation if you’re going to do amazing things. And in the case of insurers, a stable, efficient core is essential to enabling innovation. A stable core is essential for innovation It’s easy to focus on the shiny, emerging technologies that promise to up-end the insurance industry: artificial intelligence (AI), the Internet of Things (IoT) and blockchain, to name a few. Do these things have far-reaching implications for insurance? Yes. Are there startups leveraging new technologies that may eventually disrupt the industry? Of course. But when many insurers still struggle to provide real omnichannel customer service, or offer timely and transparent claims settlement, it’s almost irresponsible to be asking which company or technology will disrupt insurance. Part of the issue is that the industry tends to clump two distinct opportunities together. First, there are the core competencies that insurers must master: the user experience, personalized offers, timely and transparent claims service. Get these pieces right, and you may not win—but do them poorly, and you will inevitably lose. Separate from this are the new technologies that capture headlines; if scaled successfully, these cool innovations can pave the way to an insurer’s future revenue streams.

Brilliant basics and cutting new ground

At Accenture, we call these two opportunities the Brilliant Basics and Cutting New Ground. By getting the Brilliant Basics right, insurers foster a stable core—the strong foundation that’s necessary to enable innovation, in the form of Cutting New Ground.

By injecting new digital technologies to transform the core, it becomes cheaper and more efficient to do the Brilliant Basics. This approach is aligned with what’s recommended by the Accenture Disruptability Index, which identified insurance as being vulnerable to disruption and recommended optimizing to improve structural productivity.

See also: Core Transformation – Start Your Engines!

Successful core transformation can create efficiencies, reduce the cost to serve and improve growth—all of which frees investment capital to fund Cutting New Ground initiatives. These innovation initiatives should be viewed like a portfolio of digital investments. Low-risk, low-reward projects may be more likely to succeed and deliver incremental growth. High-risk, high-reward projects may be less likely to succeed—but if they do, they can enable an insurer to establish a definitive competitive advantage. Given insurance’s risk aversion, it’s definitely a cultural shift to embark on a project knowing it may not succeed, so viewing Cutting New Ground as a portfolio of investments can be one way to mitigate cultural concerns.

Part of the issue is that the industry tends to clump two distinct opportunities together. First, there are the core competencies that insurers must master: the user experience, personalized offers, timely and transparent claims service. Get these pieces right, and you may not win—but do them poorly, and you will inevitably lose. Separate from this are the new technologies that capture headlines; if scaled successfully, these cool innovations can pave the way to an insurer’s future revenue streams.

Brilliant basics and cutting new ground

At Accenture, we call these two opportunities the Brilliant Basics and Cutting New Ground. By getting the Brilliant Basics right, insurers foster a stable core—the strong foundation that’s necessary to enable innovation, in the form of Cutting New Ground.

By injecting new digital technologies to transform the core, it becomes cheaper and more efficient to do the Brilliant Basics. This approach is aligned with what’s recommended by the Accenture Disruptability Index, which identified insurance as being vulnerable to disruption and recommended optimizing to improve structural productivity.

See also: Core Transformation – Start Your Engines!

Successful core transformation can create efficiencies, reduce the cost to serve and improve growth—all of which frees investment capital to fund Cutting New Ground initiatives. These innovation initiatives should be viewed like a portfolio of digital investments. Low-risk, low-reward projects may be more likely to succeed and deliver incremental growth. High-risk, high-reward projects may be less likely to succeed—but if they do, they can enable an insurer to establish a definitive competitive advantage. Given insurance’s risk aversion, it’s definitely a cultural shift to embark on a project knowing it may not succeed, so viewing Cutting New Ground as a portfolio of investments can be one way to mitigate cultural concerns.

Consequently, insurers need both pieces. Brilliant Basics can enable a stable core and generate investment capital that make it possible for insurers to focus on Cutting New Ground. Brilliant Basics is the elite athlete’s pre-game routine; Cutting New Ground is the game-winning performance, and maybe a record-breaking one at that.

To get started, insurers should consider the following questions:

Consequently, insurers need both pieces. Brilliant Basics can enable a stable core and generate investment capital that make it possible for insurers to focus on Cutting New Ground. Brilliant Basics is the elite athlete’s pre-game routine; Cutting New Ground is the game-winning performance, and maybe a record-breaking one at that.

To get started, insurers should consider the following questions:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Costonis is Accenture’s global insurance lead. He manages the insurance practice across P&C and life, helping clients chart a course through digital disruption and capitalize on the opportunities of a rapidly changing marketplace.

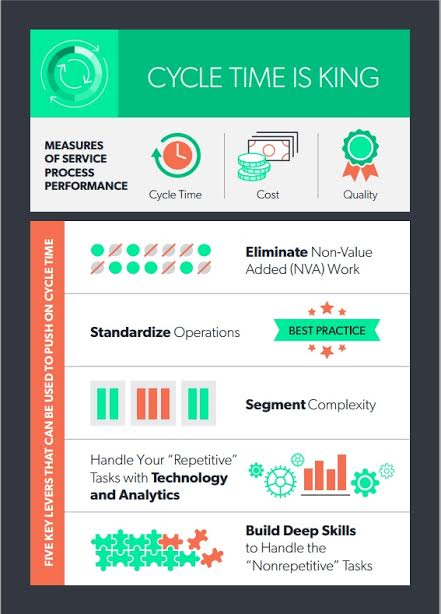

What is the best way to get injured workers rapidly back on track? Five levers are key to solving the problem.

Here are five key levers that can be used to push on cycle time:

Here are five key levers that can be used to push on cycle time:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Laura B. Gardner is chief scientist and vice president, products, CLARA analytics. She is an expert in analyzing U.S. health and workers’ compensation data with a focus on predictive modeling, outcomes assessment, design of triage and provider evaluation software applications, program evaluation and health policy research.

Insurers must consider how to incorporate digital transformation, insurtech, emerging technologies and others into their strategies.

Senior executives at insurance companies, like their peers in other industries, are charged with developing and executing the right set of strategies that will lead to success. In years past, strategists at insurance companies have had at their disposal a relatively standard array of strategies to chose from, their job being to prioritize and balance the investments and resources devoted to each. Do we expand our distribution channel network? Put more focus on new products and services? Modernize our foundational policy, billing and claim systems?

These questions and others were the traditional types of questions that executives had to address. Those traditional areas are still important and must be part of the mix for modern insurer strategies. However, a new class of strategic initiatives has emerged that is growing in importance. Now, insurers must consider how to incorporate digital transformation, insurtech, emerging technologies and others into their business and technology strategies.

These “New World” initiatives are poised to reshape the insurance industry, and it is essential that every insurer build them into their plans. A sizable challenge ensues – combining the traditional strategic initiatives with these new world initiatives into just the right blend to make each company successful, today and in the future. This is the new balancing act that executives must tackle – and some may feel like they are teetering on a high wire.

SMA has been tracking the evolution of insurers' strategic initiatives for many years. The changes in these initiatives paint a picture of an industry in transformation and are highlighted in a new SMA e-book, "Strategic Initiatives in Insurance, 2018 and Beyond." The e-book covers the different paths that property/casualty and life/annuity insurers are taking and identifies how companies are prioritizing 12 strategic initiatives (five traditional, six new world and innovation, which spans the old and new).

Several interesting phenomena are occurring. For one thing, more and more executives consider their companies to be in transformation mode, actively trying to redesign and reshape the company for higher growth in the digital age. In addition, both innovation and digital have swept over the industry like a tsunami. About 90% of insurers have significant initiatives for digital transformation and corporate-wide innovation. CEOs feature their digital strategies and investments in their letters to shareholders and earnings calls with Wall Street financial analysts. Chief digital officers are a hot commodity in the industry. Regarding innovation, more insurers are trying to move beyond the early stages to create a broad-based culture of innovation that is sustainable and organic.

One other interesting development is the clear recognition that core systems must be modern to support the demands of a digital, connected world. Modern policy, billing and claim systems are the essential enablers that allow insurers to capitalize on the opportunities for new products, new channel partners, new business models and significant operational improvements.

See also: Strategies to Combat Barriers to InsurtechFinally, it is fascinating to observe the industry as it engages with insurtech and emerging technologies. Not that long ago, technologies like mobile and analytics were considered “emerging.” Now they are table stakes and supportive of a new class of technologies like artificial intelligence, drones, the Internet of Things and many more. The insurtech movement has exploded onto the scene, with well over a thousand startups relevant to the industry. The industry is increasingly engaging with insurtechs and exploring emerging tech, with each company prioritizing based on their lines of business and business models. This year – 2018 – is likely to be an exciting one for the industry as the transformation continues. Stay tuned for interesting developments as insurers execute on their strategic initiatives.

Click here for more information on SMA’s recent e-book, Strategic Initiatives in Insurance, 2018 and Beyond.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.