"Your margin is my opportunity.” - Jeff Bezos

Amazon has proven again and again that Bezos and team can bring fundamental change to multiple industries. Adding one of the world’s most respected and trusted business figures in Warren Buffett and the leader of one of the largest financial institutions who pulled it through the 2008 financial crisis in Jamie Dimon, and healthcare’s long overdue overhaul may be upon us. Not since I wrote

Health Insurance's Bunker Buster nearly eight years ago have I seen anything that has the potential to bring a brighter future for all Americans.

In this article, I refer to my book, The CEO’s Guide to Restoring the American Dream. You can get it on Amazon or download it for free here. For simplicity, I’ll refer to the Amazon-Berkshire Hathaway-JP Morgan Chase as “ABC.”

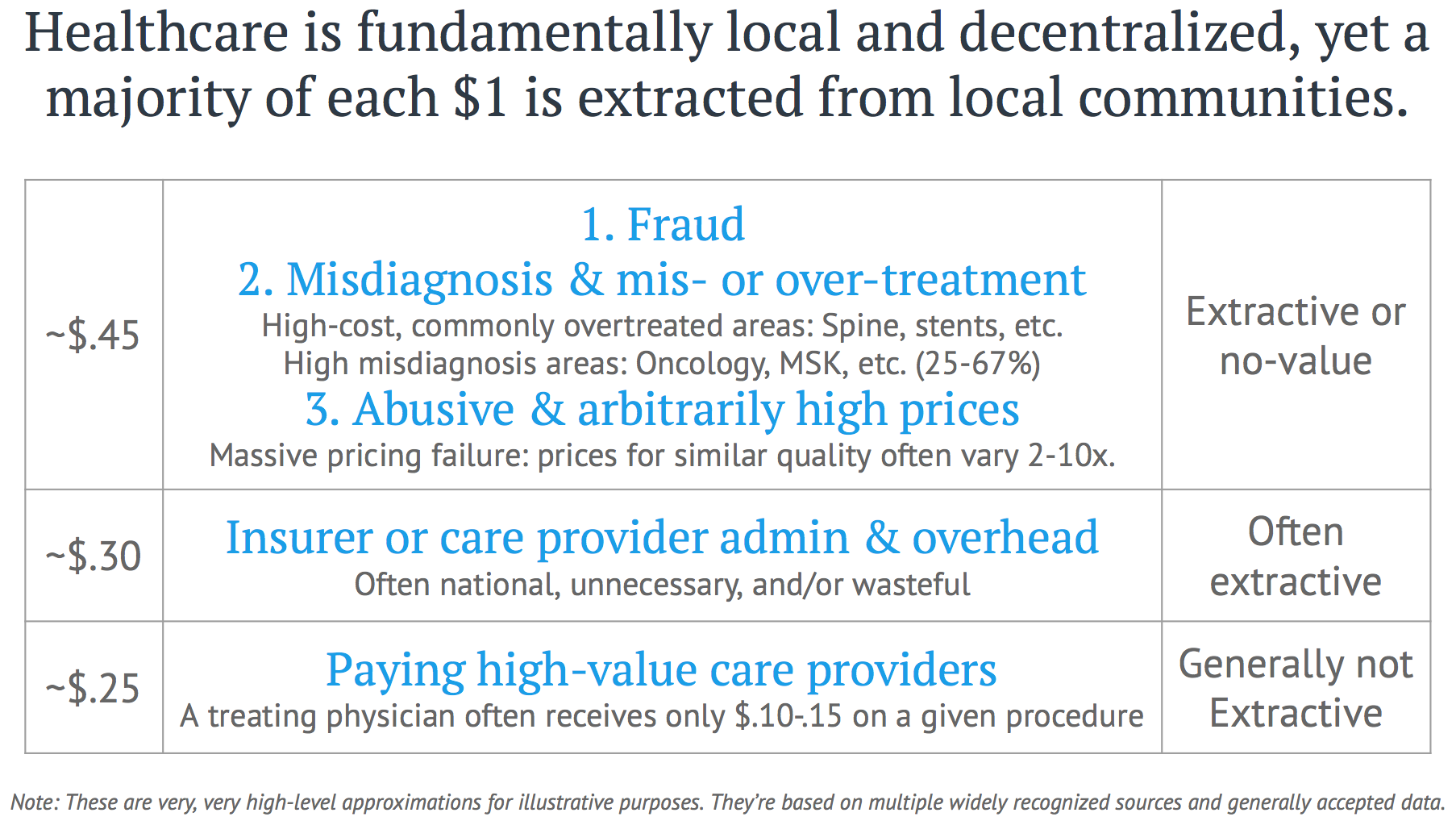

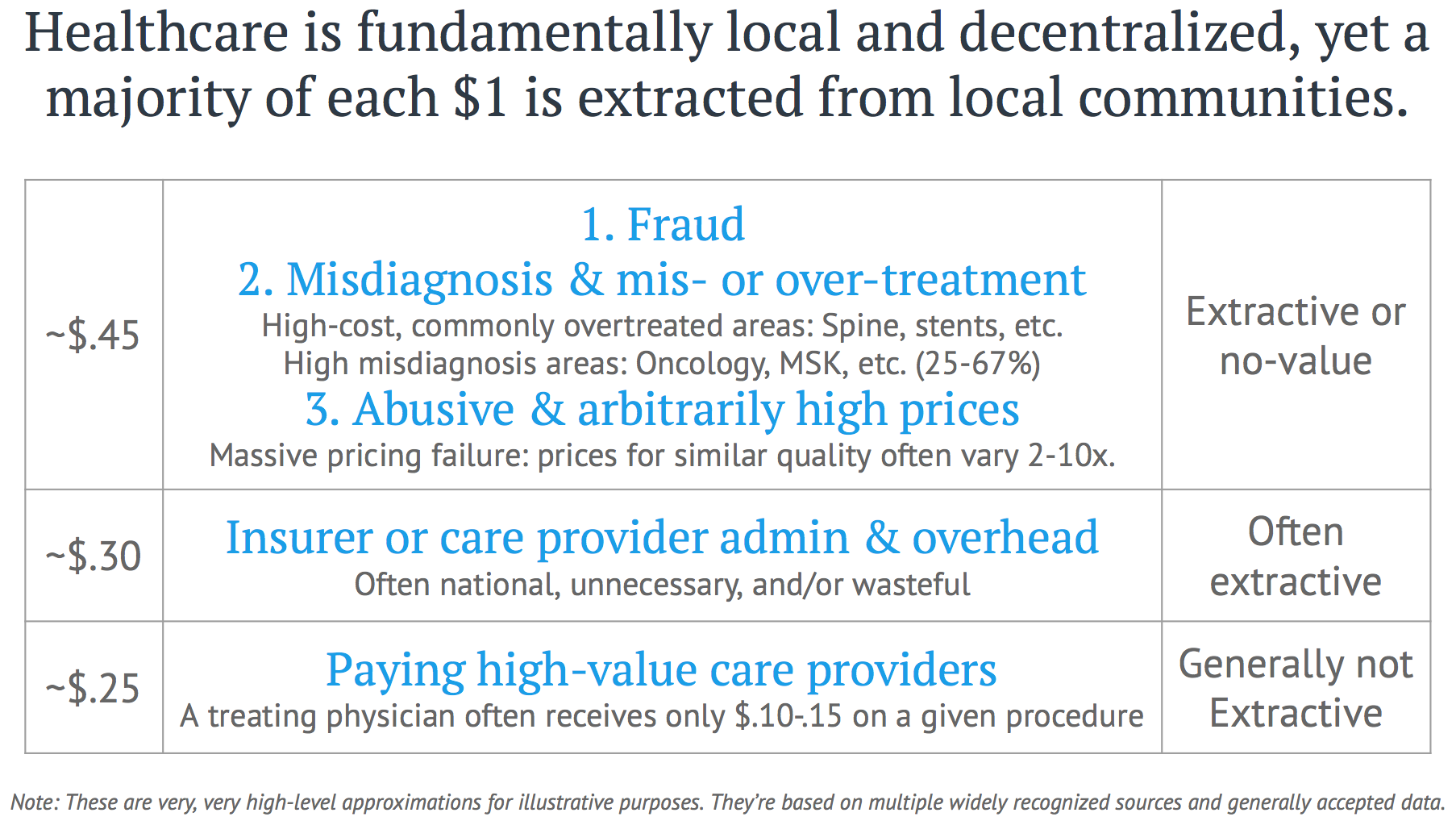

The slide below is a very rough breakdown of where each dollar in the U.S. healthcare system goes. Shockingly little makes its way to the value-creators—primarily nurses, doctors and other clinicians. As I laid out earlier in

10 Mistakes Amazon, Berkshire Hathaway and J.P. Morgan Must Avoid to Make a Dent in Healthcare, conventional employer-led efforts have failed to change healthcare. Few would call Bezos, Buffett or Dimon conventional thinkers, and they collectively bring more weight than most of the world’s developed economies. Given that the U.S. healthcare industry would be tied with Germany as the 4th largest economy in the world, the potential of their influence becomes clear.

The benefits from tackling the extraordinary fraud, waste and abuse in our healthcare system is why employers can and are doing it. More importantly, the collective successes have already created a guiding framework for all healthcare purchasers—private or public. We call this framework the Health Rosetta, but we’re just aggregating these successes. Baked into virtually every U.S. healthcare industry business model is that employers are what healthcare pundit and author Matthew Holt calls “dumb price takers.” Most readily pay 2X-10x more than market-clearing prices. Chapter 6,

PPO Networks Deliver Value—and Other Flawed Assumptions Crushing Your Bottom Line, spells out how this happens. I will spell out below how ABC could tackle the healthcare tapeworm (Warren Buffett’s term for the negative impact of healthcare on the U.S. economy).

See also: Whiff of Market-Based Healthcare Change?

Three key facts potentially differentiate the ABC health initiative from past employer-led efforts:

- The strategic focus and attention of three of the most successful CEOs in America.

- Warren Buffett’s moral authority and trust, which will give the initiative a bully pulpit that can reach the general public.

- Amazon and J.P. Morgan Chase’s technology, financial structuring, and data prowess, which can be applied to root out fraud, waste and abuse, create new care pathways and produce new revenue and financing models.

The following points riff off the line from

The CEO’s Guide that people tell me most resonates with them—

You’re in the healthcare business whether you like it or not. Here’s how to make it thrive. In other words, when ABC applies the same discipline to healthcare that they apply to every other area, modeling the path for other employers, everything will change. Below are 11 ways the ABC initiative could forever change the U.S. healthcare system, followed by a summary treatment of each point.

- New industry norms for benefits-purchasing transparency and conflicts disclosure will emerge

- Cybercrime fraud rates will drop dramatically

- Fraud awareness enabled by healthcare industry will trigger landscape-changing litigation

- Healthcare will stop stealing from retirement savings

- Healthcare will stop stealing millennials' future

- Market clarity will show that employers are the real “insurance” companies

- A spotlight will shine on high rates of overtreatment and misdiagnosis

- Open source will come to healthcare

- Massive new capital restructuring opportunities will appear

- Primary care will experience a rebirth

- There will be a focus on going local to go national

Now that you know where we’re going, let’s dive into each point.

1. New industry norms for benefits purchasing transparency and conflicts disclosure will emerge

The ABC leaders each have deep financial services expertise where meaningful disclosure of compensation and conflicts of interest is deeply embedded both legally and culturally. As they dig in, I would expect them to conclude that new norms are needed in this space, such as what we’ve developed for the Health Rosetta

plan sponsor bill of rights,

benefits adviser code of conduct and

disclosure standards. These are “motherhood and apple pie” concepts that are a 180-degree change from current industry norms, where benefits brokers often sit on both sides of a transactions with significant undisclosed conflicts.

2. Cybercrime fraud rates will drop dramatically

The same sort of algorithms that identify fraud in credit cards can be applied to healthcare, but haven’t been. Simple-to-detect fraud like a single claim being paid 25 times to cybercriminals (a real and all-too-common occurrence that modern payment integrity services find) will be the low-hanging fruit, but these have not been broadly applied. ABC will also see that this blatant fraud is just the tip of the fraud, waste and abuse iceberg. As a bonus, a leader in payment integrity is one of the earliest adopters of Amazon’s AWS cloud service.

3. Fraud awareness enabled by healthcare industry will trigger landscape-changing litigation

Even though cybercrime is only the tip of the iceberg on fraud, waste and abuse, it is so blatant that it is already spurring legal activity. In Chapter 19 of my book, I quote a Big Four risk management practice leader who said, “ERISA fiduciary risk is the largest undisclosed risk I’ve seen in my career.” There are two areas of legal jeopardy that are snapping CEOs to attention as they get awakened to the risk. Chapter 7,

Criminal Fraud is Much Bigger Than You Think, is just the basics on ERISA fiduciary risk, but it is so blatant that there are dozens of cases in the works. An additional thread of fiduciary legal front is emerging—activist shareholders are realizing how straightforward it is to improve earnings by slaying the healthcare cost beast.

The Health Rosetta website has a

simple estimator that translates removal of healthcare waste into EBITDA impact. Here is just one example of the impact. A multinational manufacturer implemented a proper musculoskeletal management program by having physical therapists working with employees and workplace ergonomics. The savings (if applied directly to EBITDA) from this alone create a positive $2 billion of market cap impact (calculate savings x price-earnings multiple).

4. Healthcare will stop stealing from retirement savings

Healthcare has crushed the average boomer’s retirement savings by $1 million. Even if this estimate is off by 10x (unlikely), it’s still $7.6 trillion that could have been under management by financial firms such as JP Morgan. My senior level contacts in the 401k/retirement segment surprised me when they said that government de-privatizing of retirement (due to low savings levels) is on the worry list of folks like Jamie Dimon. If true, it is another reason organizations like JPMorgan Chase would want to redirect money being squandered in healthcare to retirement accounts.

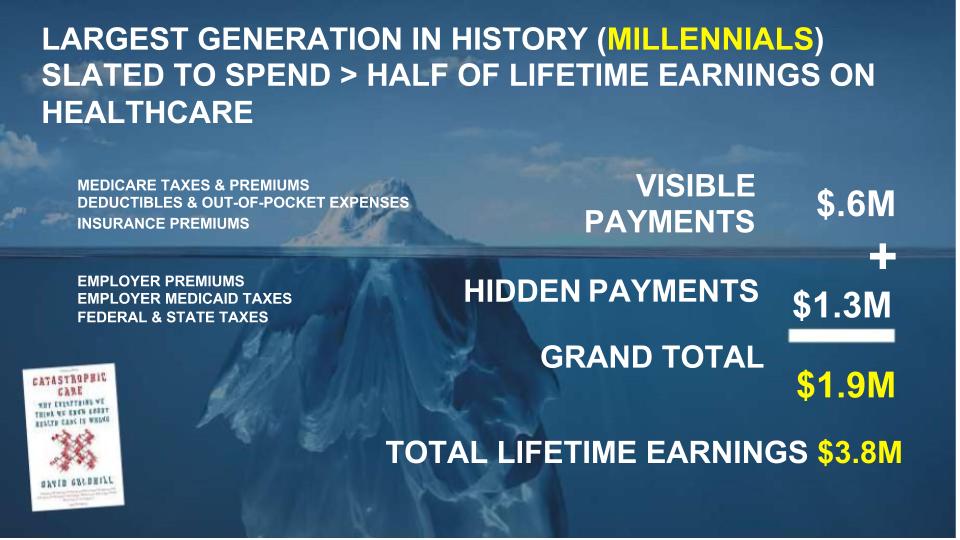

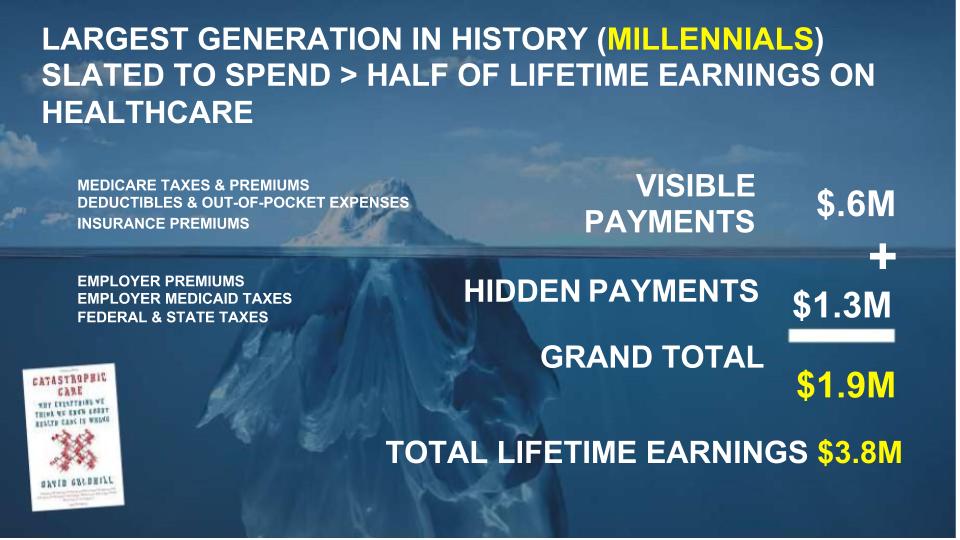

5. Healthcare will stop stealing millennials' future

David Goldhill’s outstanding Catastrophic Care book gave an “optimistic” view of how healthcare is on track to consume half of a typical millennial’s lifetime earnings. He assumed that healthcare costs grew at half the rate of regular inflation (extremely rare—

more typically, it’s 5% to 10%). As the largest generation in history, millennials are the most important generation for all of the ABC organizations. Smart employers find they are natural early adopters of Health Rosetta-type benefits programs. [See Chapter 4,

Millennials Will Revolutionize Health Benefits]

6. Market clarity will show that employers are the real “insurance” companies

This is the

health plan industry’s worst nightmare. There is a growing realization that because less than a third of the claims that insurance companies process actually put the insurance companies’ money at risk, “insurance” companies are more appropriately described as commoditize-able claims processors. It is self-evident that paying a third party to manage risk when they benefit from rising costs hasn’t worked out well. The smart BUCAs already understand this, which is why you see some aggressively diversifying out of the insurance business. They are happy to milk the insurance business until it goes away, but their corporate development actions clearly signal the future. For example, I heard Aetna CEO Mark Bertolini say at a Health 2.0 conference that they increasingly see themselves as a technology company with insurance on the side. [See Chapter 3,

What You Don't Know About the Pressures and Constraints Facing Insurance Executives Costs You Dearly]

7. A spotlight will fall on high rates of overtreatment and misdiagnosis

ABC’s leadership will see past studies such as the Starbucks/Virginia Mason study that found that 90% of spinal procedures did not help at all. They will also be shocked to find extraordinary rates of misdiagnosis across healthcare, like what I outline in Chapter 12,

Centers of Excellence: a Golden Opportunity. They will want to ensure their employees get the best possible care, which also saves tremendous money. It’s commonly known that ~50% of what we do to people in healthcare does not make them better and could make them worse. One of the foremost experts in employer benefits, Brian Klepper, estimates that 2% of the entire U.S. economy is tied up in non-evidence-based, non-value-added musculoskeletal procedures.

8. Open source will come to healthcare

As much as companies such as Amazon keep some information and code proprietary, they also actively benefit from open source. Open source software underpins major parts of Amazon’s business. Some problems are too big to tackle on your own. As big as ABC are, they aren’t big enough to tackle all of healthcare, and they don’t have dominant market share in any single geography.

Because adoption happens so slowly in healthcare, Health Rosetta is catalyzing the creation of a Wikipedia-like resource for the next 100 years of health (a group of visionary doctors call their vision

Health 3.0) to dramatically accelerate the rate of adoption for successful approaches. Those insights will benefit ABC.

In the other direction, ABC should be motivated to share what they are doing with other local employers to more rapidly change norms in a given healthcare market. While the Fair Trade-like model for healthcare transactions we’re working on is non-controversial outside of healthcare, ABC can add heft and use their bully pulpit to normalize more appropriate behavior in this area. For example,

legitimate, known pricing (link to a petition by a former hospital CEO) versus the arguably predatory and arbitrary pricing today would still let healthcare providers set their prices (i.e., not government-set), but pricing would be consistent and known across all payers.

One Health Rosetta component—

Transparent Open Networks—already enables this. In other words, healthcare transactions could operate like every other part of the economy. Single pricing is a subtle, but critical, part of making healthcare functional.

Not tackling this would be one of the biggest mistakes ABC could make.

9. Massive new capital restructuring opportunities will appear

This item could be an entire white paper, but I’ll touch on just two opportunities stemming from the above items. Hundreds of billions of dollars (if not more) have been and are being tied up in fraud, waste and abuse. As large purchasers and others begin to account for this, a subset of it can be treated as bad debt and turned into instruments that are sold to opportunistic, sophisticated investors. The subsequent collection efforts by these purchasers would be dramatic to any person or organization enabling the fraud. Second, it is well known that we have at least 40% overcapacity of hospital beds, fueled by a massive revenue bond bubble. The orderly disposition and restructuring of these assets is another massive opportunity that can be accelerated by the work of ABC and others. Outside of rural settings that have few overcapacity issues, evidence shows that

hospital closings have no impact on outcomes. Freakonomics did a segment on how

health outcomes actually improved when hospital cardiologists were away at a conference. This horrific story about a typical

overtreatment scenario leading to bad outcomes is another example of why this would be the case.

10. Primary care will experience a rebirth

I detailed the critical reasons why ABC must have a strong primary care foundation in my

open letter to Jeff Bezos, Warren Buffett and Jamie Dimon. Just based on the number of employees ABC has, it makes economic sense to fund ~1,500 value-based primary care clinics. They can derisk this investment by making the clinics available to ABC partners and customers. I wasn’t surprised that ABC recently hired my parents' primary care physician, who has deep experience in a vanguard value-based primary care organization. [See Chapter 14 for more on value-based primary care]

11. There will be a focus on going local to go national

From Facebook to Uber and Lyft, the best way to go national with something game-changing is to start with a hyperlocal focus. This lets you prove unit economics in a controllable environment. Despite conventional wisdom, the

future health ecosystem will be local, open and independent, which provides anti-fragility versus easy-to-destroy monoliths. I often draw an analogy between the Health Rosetta and LEED for many reasons. One is that certain locales were early adopters of LEED. Likewise, certain geographies will abandon the current,

silly medical facility arms race.

For example, Portland, OR, is an early adopter of LEED, and it has grown a cluster of sustainable industries by attracting talent and businesses to the area. Over the last year, I have been gathering feedback on creating a competition like Google Fiber or Amazon HQ2 competitions to identify communities where the new health ecosystem forms.

See also: Media Coverage on Amazon Misses Point

Beyond the obvious benefits of defining and pioneering the next century of health, solving the opioid crisis is a profound imperative. As I pointed out in Chapter 20:

The Opioid Crisis: Employers Have the Antidote, the largest public health crisis in 100 years has major employer/economic implications and is simply impossible to solve without active employer involvement. The sad fact is that every addict needs an enabler, and employers have been the biggest (unwitting) enabler in 11 of the 12 major drivers of the crisis. The silver lining is that solving the opioid crisis takes you a long way toward solving broader healthcare dysfunction. Employers implementing Health Rosetta-type benefits have much lower rates of opioid overuse disorders due to the upstream “antidotes” to the crisis.

In short, ABC has the power to demonstrate that employer health benefits are the newspaper classifieds of transforming the healthcare business

Healthcare has many analogies with another industry that has been dominated by regional monopolies/oligopolies—newspapers. Like employer health benefits, the classifieds business was very easy to overlook. However, in both cases, they drove a significant majority of profits for newspapers. Once the classifieds business was undermined, the newspaper industry was never the same. If the ABC initiative plays its cards right, they can catalyze restoring the American Dream for millions of Americans by fixing healthcare. The great news is that there are many microcosms in America where the best healthcare system in the world exists — far more affordable and effective than we’re used to. ABC has the opportunity to help America leapfrog the rest of the world and finally have a truly superior and efficient healthcare system.

“You can always count on Americans to do the right thing - after they've tried everything else.” - Winston Churchill

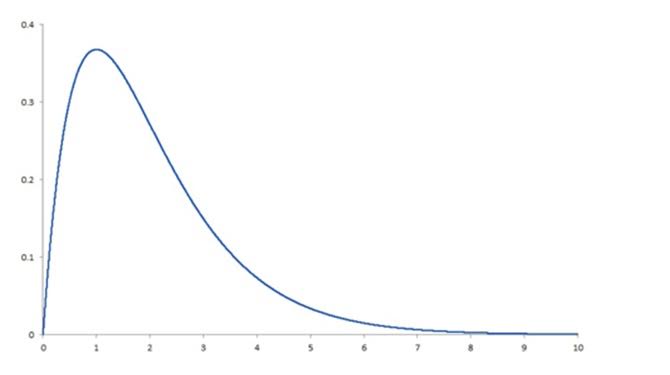

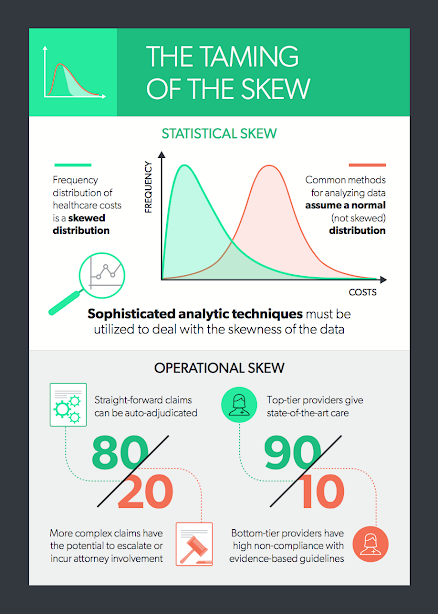

This skewness is present whether we are looking at total claim expense in the workers’ compensation sector or annual expenses in the group health sector. Why is this a problem? Simply because the most common methods for analyzing data depend on the ability to assume that there is a normal distribution, and a right-skewed distribution is clearly not normal. To produce reliable predictions and generalizable results from analyses of healthcare costs, the data need to be “tamed” (i.e., various sophisticated analytic techniques must be used to deal with the right-skewness of the data). Among these techniques are logarithmic transformation of the dependent variable, random forest regression, machine learning and topical analysis.

It’s essential to keep this in mind in any analytic effort with healthcare data, especially in workers’ compensation. To get the required level of accuracy, we need to think “non-normal” and get comfortable with the “skewed” behavior of the data.

Operational Skew

There is an equally pervasive operational skew in workers’ compensation that calls out for a radical change in business models. The operational skew is exemplified by:

This skewness is present whether we are looking at total claim expense in the workers’ compensation sector or annual expenses in the group health sector. Why is this a problem? Simply because the most common methods for analyzing data depend on the ability to assume that there is a normal distribution, and a right-skewed distribution is clearly not normal. To produce reliable predictions and generalizable results from analyses of healthcare costs, the data need to be “tamed” (i.e., various sophisticated analytic techniques must be used to deal with the right-skewness of the data). Among these techniques are logarithmic transformation of the dependent variable, random forest regression, machine learning and topical analysis.

It’s essential to keep this in mind in any analytic effort with healthcare data, especially in workers’ compensation. To get the required level of accuracy, we need to think “non-normal” and get comfortable with the “skewed” behavior of the data.

Operational Skew

There is an equally pervasive operational skew in workers’ compensation that calls out for a radical change in business models. The operational skew is exemplified by:

Read Dr. Gardner’s first two articles in this series:

Five Best Practices to Ensure the Injured Worker Comes First

Cycle Time Is King

As first published in Claims Journal.

Read Dr. Gardner’s first two articles in this series:

Five Best Practices to Ensure the Injured Worker Comes First

Cycle Time Is King

As first published in Claims Journal.