Following on from the

regional profile for Europe, we now move on to North America. We will be taking you through dedicated profiles for all the world's major insurance markets, each taken from our inaugural Insurance Nexus Global Trend Map, an in-depth account of insurance and insurtech trends internationally.

Access all seven of our regional profiles straight away by downloading the full Trend Map here ...

Our North America profile combines quantitative insights derived from our global survey and qualitative perspectives from our two in-region commentators:

- Chicago-based Stephen Applebaum, managing partner at Insurance Solutions Group

- Boston-based Matthew Josefowicz, CEO at Novarica

First, a quick overview of the salient stats from our survey, as they manifested themselves in North America:

Key Stats: A Quick Recap

i) The External Challenges: North America

In North America, the top external challenges for the insurance sector as a whole follow the global trend from our

earlier post on industry challenges, with technological advancement and changing customer expectations taking first and second place, except that in third place we find new emerging risks.

In comparison, new risks comes fourth globally and only makes sixth place in Europe – which, as we indicated in our

Europe profile, likely reflects some parts of the world being more exposed to disasters (and hence concomitant risks) than others. Further down the table, increased competition moves up a place, knocking increased regulation down one spot to seventh.

ii) The Internal Challenges: North America

Looking internally, the top challenges reflect the global trend we outlined in our earlier post on industry challenges, except that legacy systems wrests the top slot from lack of innovation capabilities (which, by way of comparison, comes first in Europe and Asia-Pacific).

Innovation is, at its heart, customer-driven, so, in the course our regional profiles, we compare the insurer-customer relationship in North America with what we find in our other key regions – and this may well explain the different positions ascribed to lack of innovation capabilities in their respective challenge tables. The parallel suggestion is that legacy systems play more of a role in North America, which is another theme our North America profile explores.

iii) Insurer Priorities: North America

These are the priority areas on which North American insurers lead our other regions, out of our shortlist of 15 priority areas as presented in our

earlier post on insurer priorities:

iv) North America Top Trumps

iv) North America Top Trumps

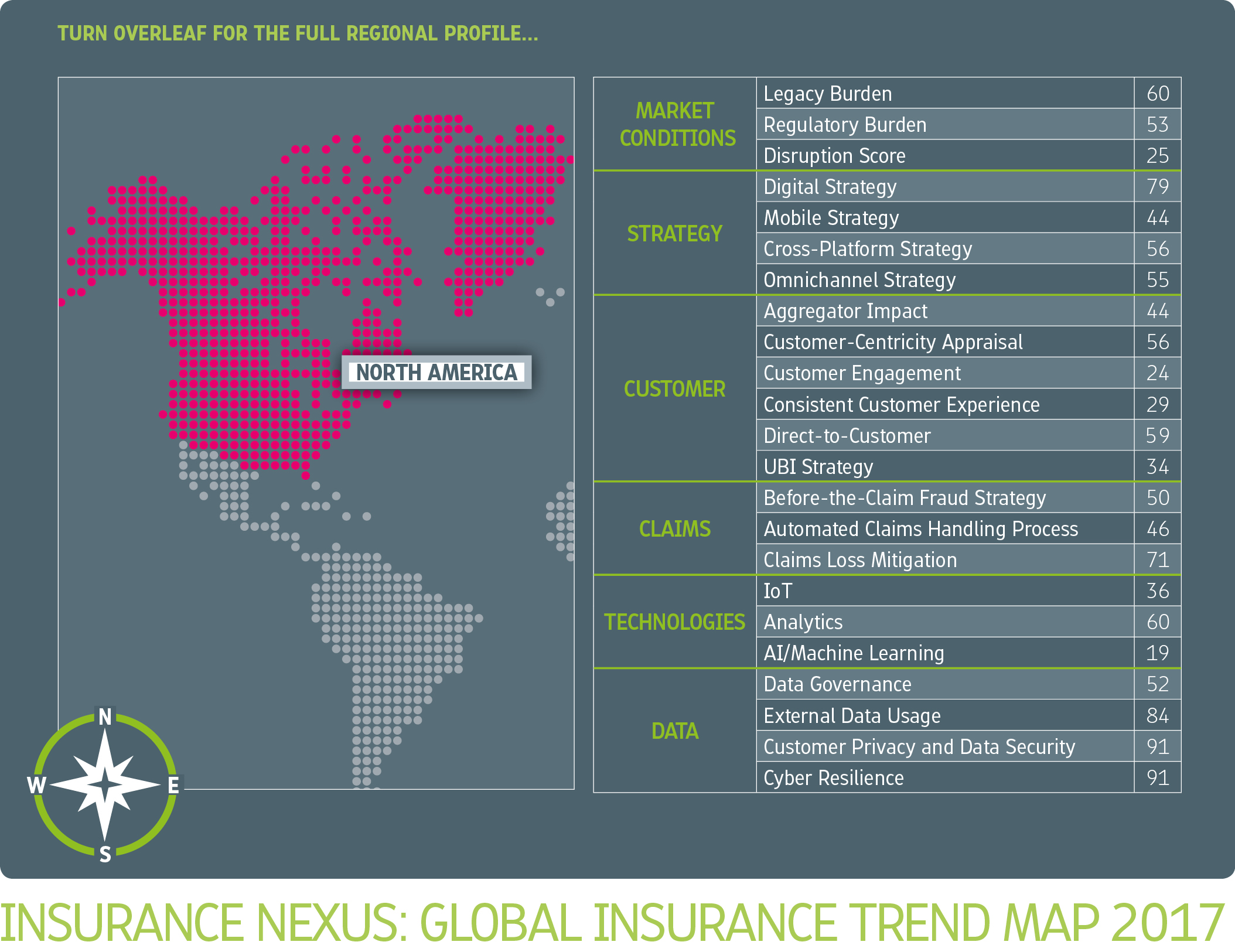

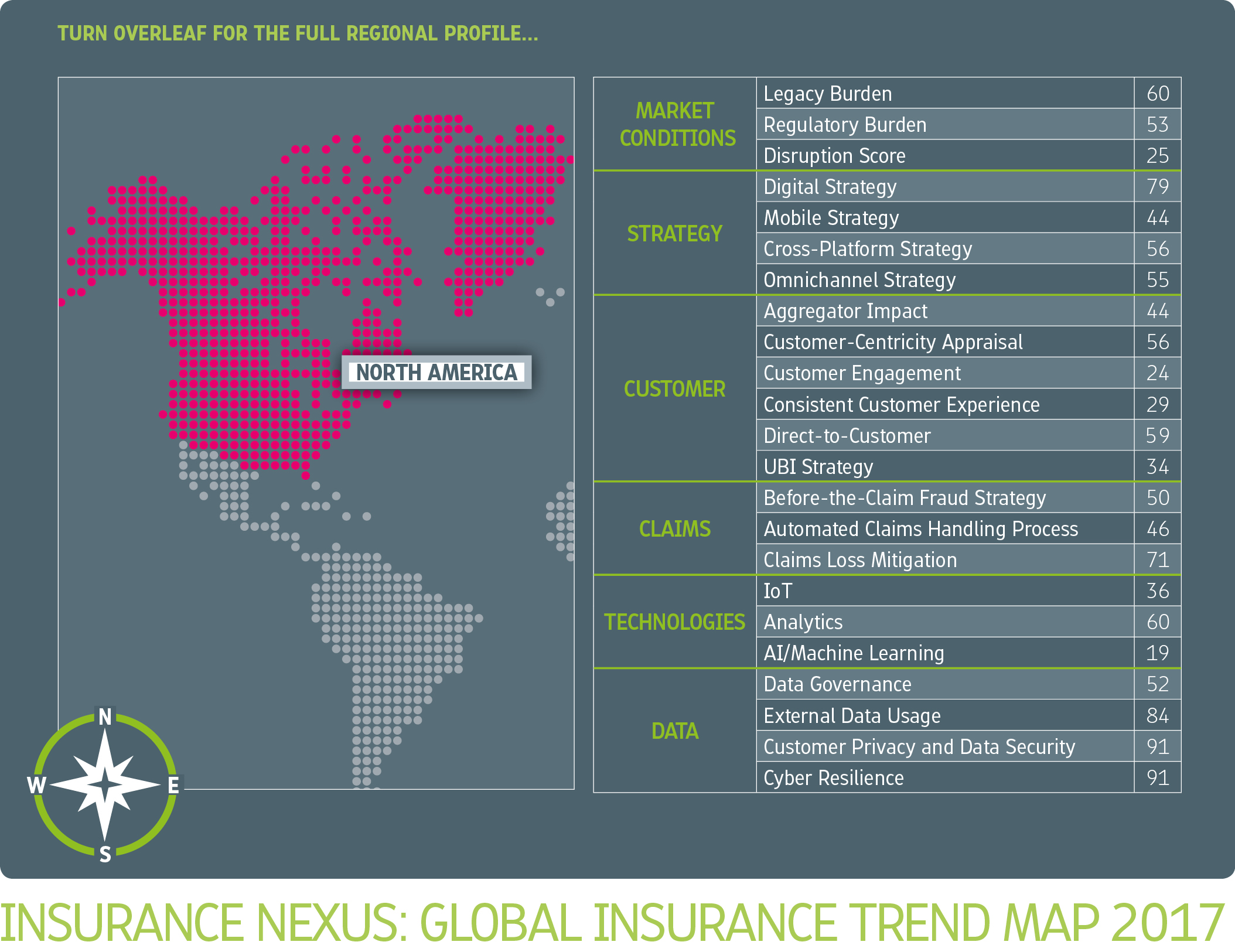

The table below is in the style of

Top Trumps, with a regional score for each characteristic — we have tables for Europe and Asia-Pacific in their respective profiles, too.

See also: Global Trend Map No. 14: Regulation

See also: Global Trend Map No. 14: Regulation

Today's discussion of North America falls into five short chapters, the first two of which we will be covering in today's post:

- Insurers’ renewed focus on their primary underwriting business in the face of low interest rates and impending insurtech disruption

- The rise of the new consumer and how this is changing the insurer-customer relationship

- Customer-centricity as the prime mover of distribution and product

- The impact of legacy systems and regulation on (re)insurers’ innovation and transformation efforts

- How insurers are to unlock new sources of growth in a mature market

1. In the Eye of the Insurtech Storm

North America, as we have defined it (that is, the U.S. and Canada), has a total population of around 350 million people, making it one of our smaller markets at less than 10% the size of Asia-Pacific. Not only are we looking at a smaller population, but it also has the biggest middle-class skew of any of the regions we deal with in the course of our regional profiles.

This is predominantly a market of existing customers, and the low-end market opportunity is much less substantial than in Asia-Pacific, Africa and LatAm, for instance.

So, while insurers in the developing world have to juggle the needs of an emerging middle class and those of the uninsured millions (often microinsurance candidates), in North America they can focus more single-mindedly on retaining and growing the customer of their existing policyholder demographics. Unsurprisingly, then, North American respondents exhibited the most focus on customer loyalty of all our regions.

This focus on existing business has become paramount with the continued pressure (re)insurers are facing from low interest rates (admittedly, a global phenomenon), which is limiting the returns they can make on their investments and shining a spotlight on the profitability and sustainability of underwriting practices.

"The real challenge is focusing on the underwriting itself and using data, analytics and market segmentation in order to really maximize underwriting profitability," Novarica's Matthew Josefowicz says.

Insurance has always been a cyclical industry in this sense, moving with interest rates, so insurers – at least looking at the big picture – are used to periodic readjustments. However, this time is shaping up to be different in the sense that their underwriting market is no longer being served to them on a plate in quite the same way as before. Insurers the world over must now contend with new market entrants, such as insurtechs, which are raising the bar for customer service and lowering it for price.

"Innovative products and the market segments they support are underpinning the design of new insurtech business models, with companies like Lemonade, Slice, TROV, Cuvva, Surify and others establishing new model footholds in the market." — Denise Garth, SVP at Majesco

While insurers are already having to up their game to keep their underwriting customers, the overall turn toward insurtech is still in its infancy and also varies considerably from region to region. So, at what stage is this customer-led disruption in North America?

The indicators we have gathered across this content series lead us to believe that North America is late – though only marginally – compared with Europe and Asia-Pacific, and we will substantiate this perspective in due course.

Looking at things at the highest level, our most telling stat is the disruption score for North America. Only a quarter of (re)insurers in North America indicated that they were losing market share to new entrants, whereas this figure rose to nearly half of (re)insurers in Asia-Pacific.

Whether interpreted literally or as an indication of carriers’ current mood, this implies that disruption – while certainly present – has not yet reached the fever pitch in North America that it has elsewhere, and potentially explains the lower prominence assigned to lack of innovation capabilities among the internal challenges for the region.

Speaking primarily from a P&C/general perspective, Stephen Applebaum acknowledges that the U.S. market at least may be somewhat of a laggard, although he is careful to distinguish it from Canada. He places the Canadian market ahead of the U.S. in terms of innovation and technology adoption.

Applebaum ascribes the notional leadership of the Canadian market to a mixture of culture, infrastructure and population size (Canada having approximately 10% of the population of the U.S.). We also call attention to Canada’s different approach to the broker market, its different regulatory regime and its different methodologies for data exchange. All of this said, though, the sorts of consumer needs that insurers in each market are trying to serve are fundamentally the same.

In any case, regardless of where the North American market stands today, Applebaum believes that a huge amount will change over the coming 18 months and beyond. This is due partly to the steady globalization of technology (Applebaum cites as an example of this the recent push by Italian Octo Telematics into the U.S. market), partly to the size of the prize inevitably attracting takers.

This prize would appear to be more tantalizingly poised in the U.S. than elsewhere, if indeed there is a slight lag in that market, as this makes it easier still for light-footed new entrants to outflank incumbents and capture market share. We have seen the rise of several high-profile insurtechs in the U.S., such as Lemonade on the homeowner and Insureon on the small-business side, and we note also the recent estimate that nearly half of investment money for insurtech in 2016 went to U.S. companies.

"You have to change your culture and embrace experimentation. We’ve set up labs around the world where we incubate innovation. It’s about embedding it through the employee base and being attuned to the customer. And it has to be top-down to be effective." — Cindy Forbes, EVP and chief analytics officer, Manulife Financial

If this gives the impression of a silently massing army waiting to storm the sleepy, unguarded border forts of insurance, then that is certainly a long way from the truth. Incumbent insurers in the U.S. are waking up to the threat of disruption in a big way. Applebaum, once again talking primarily from a P&C/general perspective, explains the twofold consideration going through insurers’ minds:

"The first point to remember is that, while disruptors may still represent less than 5% of the P&C insurance market today, 5% of $200 billion is a significant amount of revenue lost from the traditional carriers," he states. "

And the second point is that the rate of growth seems to be accelerating fairly rapidly, so that what is 5% today could very well be 25% five years from now, and that suddenly represents a material challenge to the industry. Nobody is ignoring it because they know that the adoption curve is going to look like a hockey stick."

This recognition on the part of incumbents is finding expression in their recent insurtech investments – so it is misleading to interpret the high investment figure we invoked earlier as signifying only what is stacked

against insurers. One of the main reasons it is being driven so high is in fact

because of legacy insurers trying to get in on the action.

Josefowicz, whose clients at Novarica include numerous Fortune 100 insurers, also acknowledges insurers’ growing preoccupation with insurtech.

"The number of insurers that have internal development funds and investment funds is skyrocketing, as everyone is trying to stay in touch with all these new developments and approaches to using technology in the industry," he explains.

"I don’t think it’s that the insurers believe the companies they’re investing in are going to be the next Facebook or Snapchat, but I think they do believe that these companies are going to show them the way, and they’re going to be able to learn a lot from them. Not just in terms of how to engage with customers but also how to use analytics and digital channels effectively, as well as all kinds of innovative practices that are difficult for a mature company to come up with on its own."

"The insurtech space got crowded in the last 18 months, with significant funding for new entrants. Now the rubber's hitting the road as startups bring products to market. It should be interesting in the coming year to see who's able to navigate the world of regulations and carrier relationships, and whether they're able to do it at scale." — Ted Devine, CEO at Insureon

2. Rise of the New Consumer

As intimated in the foregoing section, the 21st-century customer represents the ground on which insurtechs stand to challenge insurers: by

raising the bar for customer service and

lowering it for price. In line with this, both Josefowicz and Applebaum identified changing customer expectations – that is, how customers want to buy insurance and interact with insurers – as a key challenge in North America.

"Insurance in the U.S. has long been a product-driven, not a customer-driven industry. Faced with high churn and the specter of ambitious new market entrants, insurers are finally waking up to the need to better engage and service customers. To this end, we are increasingly seeing the creation of cross-functional customer-experience teams within carriers." — Mariana Dumont, head of new projects at Insurance Nexus

We are witnessing what Applebaum describes as the rise of the new consumer, and he believes furthermore that this is the No. 1 challenge facing insurers in the region:

"It’s not only the millennials and the emerging demographic groups but basically the new customers who are almost always connected digitally," he elaborates. "

They have come to expect that all of their interactions will be digital."

Some data:

- North America achieved the lowest priority score for customer-centricity out of all our global regions

- Chief customer officer was a relatively unimportant new appointment within North American companies, at least compared with the prominence attained by chief information security officer, chief data officer and chief analytics officer

- North America is the only region in which lack of innovation capabilities fails to make the top spot

North America has been fractionally late on the current customer-led disruption of insurance compared with our other regions; if customer expectations are more easily met, then this will result both in the customer rising less high up the priorities ladder and in current levels of customer-centricity being deemed more adequate. This is, of course, a question of degree, as the customer is still critically important to North American insurers.

"I think that in a lot of ways North American consumers are behind other advanced markets when it comes to insurance," Josefowicz says. "

For example, in the U.K. a large portion of small-business insurance is now bought online. Here, that’s still very much an emerging segment of the market. The heavy shift to direct auto purchase in other mature markets is evident here but not quite as developed."

At various points in this report we have tied the current consumer-led disruption sweeping through insurance (and all consumer industries for that matter) to changes in distribution. Digital channels have given new, non-traditional players with alternative products and services access to insurers’ customer base. This added element of competition – on both price and customer service – has fundamentally changed the way customers relate to all the products they buy, and this in turn is driving change within the insurance industry.

In line with this view, and with our hypothesis that disruption has not yet arrived with full force in North America, we expected the distribution landscape here to be relatively more stable than elsewhere. This is indeed the impression that we have received:

- Among our three key regions, the direct digital channel appears to feature least prominently in North America

- While our respondents in all our geographies were increasing their distribution through affiliate partners, our broader research points to this channel being less developed in North America than in, for instance, Europe and LatAm

"Digital direct is new in Canada, and there’s a certain profile that it’s most suitable for. We are looking to target and attract the right customer. Then we want to capture as much data as we reasonably can along that journey so we can attract and convert customers while also understanding what’s working effectively to optimize our marketing efforts." — Michael Shostak, SVP and chief marketing officer at Economical Insurance

See also: Global Trend Map No. 15: Products

These measures suggest that traditional channels are indeed relatively more intact in North America than elsewhere, and this may be more the case in the U.S. than in Canada. Josefowicz puts this down in part to the innovator’s dilemma, whereby the need to innovate is mediated by the fear of cannibalizing the existing business:

"If all your money is coming today through the broker channel, it’s very difficult to plan for a future where that’s not true, without disrupting the present," he explains.

As customer behaviors continue to evolve, we expect to see growth across North America in the direct-to-customer channel. This, along with the steady growth in affiliate channels, will increase the number of channels that North American insurers must manage.

"I think that the U.S. will start to look more like Europe in terms of the distribution models across the different product lines," Josefowicz says.

"We don’t believe that intermediary distribution is going to disappear in North America, but it is already losing its monopoly hold on the market. So what insurers are going to be dealing with is not a future where everything is direct, but a future that is much more multichannel."