Despite the critical role played by workers' compensation, the technology infrastructure supporting it—particularly in state-run insurance organizations—has long relied on legacy systems and plan-based software development (PBSD). These systems are often characterized by rigid architectures, lengthy release cycles, and siloed team structures, which hinder responsiveness and innovation.

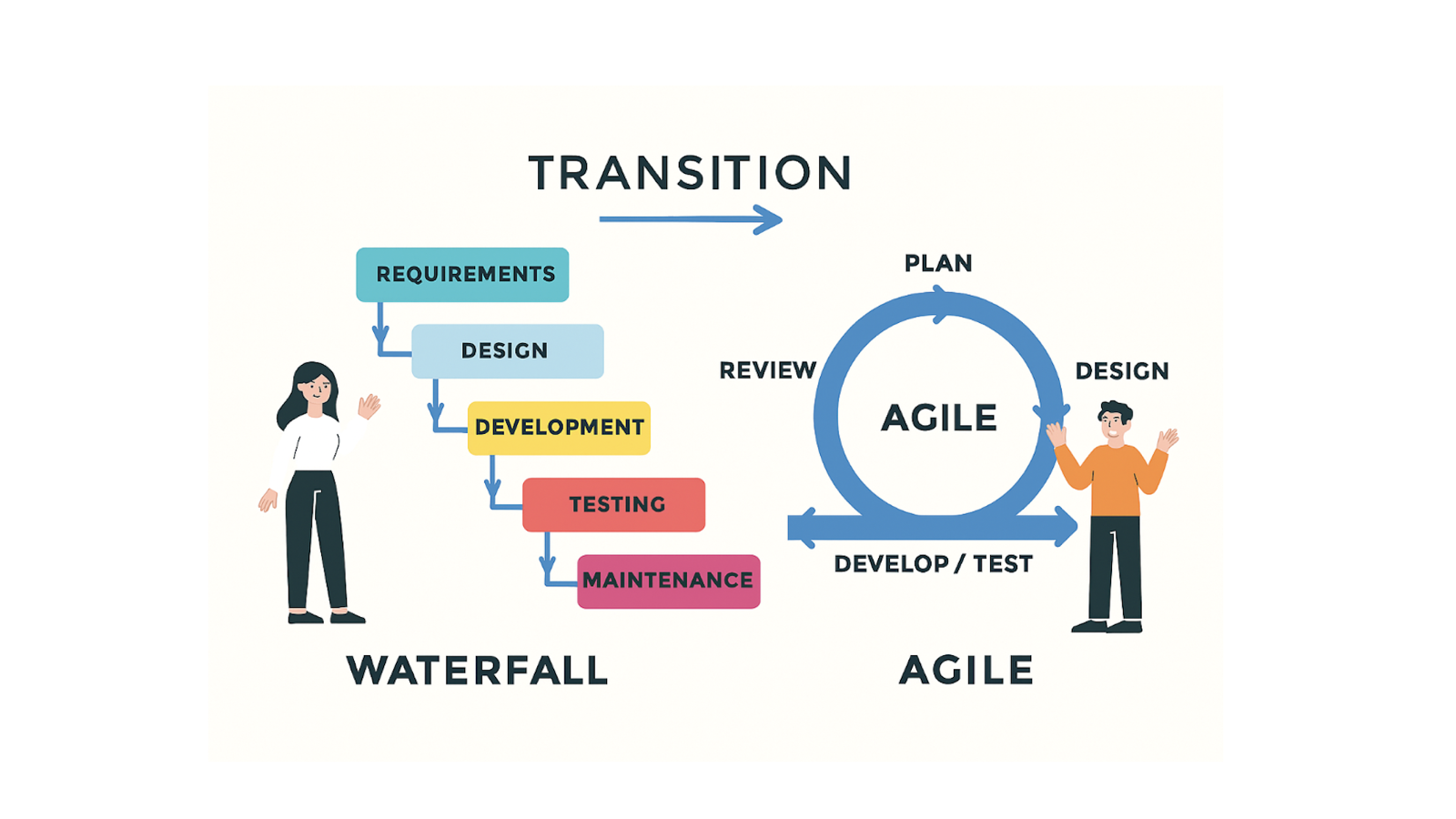

To meet evolving business needs and improve service delivery, many public insurers are moving from traditional waterfall methodologies to agile frameworks. This shift to agile software development (ASD) promises enhanced collaboration, faster feedback loops, and iterative value delivery—laying the foundation for a more adaptive and customer-centric product ecosystem.

Pain Points of Waterfall Methodology

The traditional waterfall methodology presents several drawbacks when applied to managing workers' compensation projects, due to its rigid, sequential nature. While beneficial for static projects, its inflexibility clashes with the dynamic, unpredictable aspects of workers' compensation, such as evolving regulatory requirements, claim complexities, and the need for responsive communication.

• Rigidity and Expensive rework

The workers' compensation landscape is subject to frequent changes in regulations, legislation, and legal precedents. A waterfall approach assumes requirements are fixed from the start, making it difficult and expensive to incorporate new rules or policy changes that emerge during the project lifecycle. If a flaw is discovered late in a waterfall-style project—for instance, how an endorsement/form is implemented in relation to the compliance rules defined by a regulatory body —it can necessitate a complete redesign. This requires reverting to earlier phases, leading to significant delays and cost overruns.

• Limited Feedback Loop and Delayed Testing

There are also the challenges of limited/delayed feedback, scope creep, misaligned stakeholder expectations, and delayed testing. Stakeholders may be involved only at the beginning and end of the project, reducing collaboration and shared ownership. This can lead to a final product, like a policy administration system, that fails to meet their actual needs or new operational demands that arose during the long development process. Testing and quality assurance are typically reserved for the final stages of a waterfall project. This means critical system flaws, integration problems with existing products, or inaccurate claims processing may not be identified until after significant time and resources have been invested. Fixing these issues at this late stage is often very costly and time-consuming.

• Prolonged Delivery Time and Unpredictable Projects

Waterfall methodology comes with prolonged delivery time and risk of obsolescence. The sequential nature of the waterfall model (requirements → design → development → testing → deployment), where each phase must be fully completed and documented before the next begins, can significantly lengthen project timelines. Releases may occur quarterly or even annually, delaying value delivery and feedback loops.

For complex, long-running projects, the final product could be outdated by the time it is deployed. Market needs or new technology may have already surpassed the capabilities of the system, rendering it less effective, affecting policyholder experience and internal efficiency. The linear progression of a waterfall project means that an error or flaw in an early phase can have a cascading, negative effect on all subsequent phases, jeopardizing the entire project.

Because of these limitations, many workers' compensation organizations adopt more flexible, iterative methodologies, such as Agile, to better adapt to change and more closely align the final product with user needs.

Managing the Transition From Waterfall to Agile

Moving from waterfall to agile in a workers' compensation insurance environment requires a strategic blend of cultural change, process reengineering, and stakeholder alignment. Key success factors include executive sponsorship, clear product vision, product-centric road mapping, role adaptation, stakeholder engagement, integration of compliance into agile workflows, and continuous communication across business and IT.

A successful transition from waterfall to agile methodologies in a regulated insurance environment hinges on strong leadership alignment. Executive sponsorship and governance reform are foundational to enabling agile delivery at scale.

• Securing Executive Sponsorship:

Leadership must visibly champion agile adoption, allocate resources, and model the cultural shift required for iterative delivery.

• Establishing Agile-Supportive Governance Models:

Traditional oversight structures must evolve to support decentralized decision-making, adaptive planning, and continuous feedback loops.

• Readiness Assessment Questions for Leadership:

To evaluate organizational preparedness, the following questions can be posed to leadership teams:

- Does the organization's leadership actively support the adoption of agile practices?

- Is there a clear understanding of the benefits of applying agile methods across departments?

- Are the challenges and costs of implementing agile realistically acknowledged?

- Are project teams empowered to make decisions without constant managerial intervention?

- Does progressive product release add measurable value to customers?

- Are expectations aligned with the realities of agile delivery (e.g., iterative progress vs. full-feature launches)?

- Are team members held accountable for both their deliverables and the broader project goals?

- Does the organization have access to resources with prior agile experience?

- These questions help surface gaps in mindset, structure, and capability—enabling leadership to proactively address barriers and set the stage for a successful transformation.

Product Vision & Road Map

Shifting from waterfall to agile in workers' compensation insurance requires a fundamental shift in how initiatives are conceived, prioritized, and delivered. Central to this evolution is the move from project-based execution to product-centric thinking with an emphasis on outcome over output.

• Shifting From Projects to Products

In legacy environments, work is often organized around discrete projects with fixed scopes, timelines, and budgets. Agile reframes this approach by focusing on long-lived products that evolve continuously to meet user needs. This shift enables teams to prioritize customer value, respond to feedback, and iterate based on real-world outcomes rather than static requirements.

• Creating Adaptive Road Maps

Waterfall is characterized by rigid road maps with planned releases scaling over months, sometimes years. Agile roadmaps are dynamic tools that guide delivery without locking teams into rigid timelines. Instead of detailing every feature upfront, adaptive roadmaps emphasize:

- Business outcomes over output

- Short-term goals aligned with long-term vision

- Flexibility to adjust priorities based on stakeholder feedback, regulatory changes, or market shifts

These road maps foster transparency, encourage collaboration, and ensure that product development remains aligned with strategic objectives—critical in regulated domains like workers' compensation.

Role Evolution

By redefining core roles and investing in capability-building, Workers' compensation insurers can unlock the full potential of agile delivery—empowering teams to deliver value faster, with greater alignment and resilience.

• Redefining Core Roles

This role evolution empowers teams to respond faster to change, deliver incremental value, and maintain alignment with customer and regulatory needs.

o Product Owner

From: Project sponsor or business lead with limited day-to-day involvement

To: Embedded decision-maker responsible for prioritizing the product backlog, defining value, and aligning delivery with business goals

Key Shift: Ownership of outcomes over oversight of tasks

o Scrum Master

From: Project coordinator or team lead focused on timelines and task tracking

To: Servant-leader who facilitates agile ceremonies, removes impediments, and fosters team autonomy

Key Shift: Coaching and enablement over command and control

o Business Analyst

From: Requirements gatherer producing static documentation

To: Collaborative partner who co-creates user stories, refines backlog items, and ensures business needs are continuously understood

Key Shift: Continuous engagement over one-time handoffs

o Development & QA Teams

From: Sequential executors of design and testing phases

To: Cross-functional contributors engaged throughout the sprint cycle

Key Shift: Shared accountability for quality and delivery

o Business SMEs:

From: Waterfall SME that provides upfront requirements, reviews documentation, and signs off at key milestones.

To: Agile SME that actively collaborates with the product team throughout the sprint cycle, shaping user stories, validating features, and ensuring business relevance.

Key Shift: Gatekeeper to Collaborator

• Upskilling Legacy Teams for Agile success

Legacy teams must be equipped with the mindset and tools to thrive in agile environments. Key upskilling strategies include:

• Agile Training & Certification

Formal learning paths (e.g., Certified Scrum Product Owner, SAFe Agilist) help establish foundational knowledge.

• Role-Based Coaching

On-the-job mentoring tailored to new responsibilities accelerates adoption and confidence.

• Cross-Functional Exposure

Encouraging collaboration across disciplines builds empathy, shared ownership, and delivery agility.

• Feedback-Driven Learning

Retrospectives and peer reviews create a culture of continuous improvement and accountability.

Change Management & Communication

• Managing cultural resistance

o Acknowledge legacy mindsets: Waterfall teams often value predictability and control. Recognize their concerns about agile's iterative nature.

o Offer role clarity: Redefine responsibilities (e.g., BA to Product Owner, PM to Scrum Master) to reduce ambiguity.

• Transparent communication and stakeholder engagement

o Set a clear transformation vision: Articulate why agile is being adopted—tie it to business outcomes like speed-to-market, adaptability, and customer centricity.

o Visualize progress: Share transformation roadmaps, sprint metrics, and feedback loops to build trust.

o Feedback-driven adaptation: Regularly solicit input and adjust transformation plans accordingly.

Execution & Delivery

• Sprint planning, backlog grooming, and release cadence

o Sprint Planning: Align cross-functional teams around prioritized user stories, capacity, and sprint goals. Use velocity metrics to forecast delivery.

o Backlog Grooming: Conduct regular refinement sessions to clarify acceptance criteria, decompose epics, and ensure stories are INVEST-compliant (Independent, Negotiable, Valuable, Estimable, Small, Testable).

o Release Cadence: Shift from monolithic releases to incremental delivery—e.g., biweekly sprints with quarterly production drops. Use feature toggles to decouple deployment from release.

• Integrating compliance, QA, and UAT into Agile workflows

o Compliance: Embed regulatory checkpoints into the Definition of Done. Use traceability matrices and audit logs within agile tools to satisfy insurance governance.

o Quality Assurance: Shift left with automated unit, integration, and regression testing. Include QA in sprint ceremonies and pair testing with developers.

o User Acceptance Testing (UAT): Replace end-of-cycle UAT with rolling demos and stakeholder reviews. Use personas and business scenarios to validate functionality iteratively.

• Leveraging tools for visibility and collaboration (e.g., Jira, Confluence)

Centralize backlog, sprint boards, and reporting. Use custom workflows for compliance and defect triage. Maintain living documentation—user stories, design decisions, retrospectives, and compliance artifacts. Use burndown charts, velocity reports, and release tracking to drive transparency.

Metrics That Matter

• Velocity, cycle time, defect rates, and customer satisfaction

o Velocity: Story points completed per sprint. Helps forecast capacity and stabilize planning.

o Cycle Time: Time from work start to completion. Shorter cycle times indicate leaner flow and faster value delivery.

o Defect Rates: Track production defects, escaped defects, and test coverage. Use severity-weighted scoring for regulatory impact.

o Burndown/Burnup Charts: Visualize progress against sprint goals and release scope.

o Time to Value: Measures how quickly new features deliver measurable business outcomes (e.g., faster claims intake, improved underwriting accuracy).

• Establishing KPIs that reflect both delivery health and business impact

- Blend delivery health with strategic outcomes:

- KPI Category Sample KPIs

- Delivery Health Sprint predictability, defect leakage rate, test automation coverage

- Business Impact Policyholder satisfaction, claim cycle time reduction, digital adoption rate

- Compliance & Risk Audit traceability, regulatory defect closure time

- Team Maturity Agile ceremony adherence, cross-functional participation, backlog hygiene

Conclusion

Reengineering product delivery from legacy waterfall to lean agile is far more than a methodology swap—it represents a profound cultural and strategic evolution. In the context of state-run workers' compensation insurers, this transformation is especially consequential. These organizations operate under heightened regulatory scrutiny, serve vulnerable populations, and often manage aging technology ecosystems. Moving to agile unlocks the ability to respond faster to legislative changes, deliver policyholder-centric enhancements, and foster cross-functional collaboration.

Agile practices—when thoughtfully adapted to the compliance-heavy insurance domain—enable iterative delivery, transparent stakeholder engagement, and continuous improvement. Teams become more empowered, feedback loops shorten, and systems grow more resilient. Most importantly, the transformation enhances the insurer's ability to serve injured workers and employers with empathy, speed, and precision.

This journey demands intentional change management, robust metrics, and executive sponsorship. But for those who commit, the payoff is clear: a modernized delivery engine that aligns with both business imperatives and human impact.

References & Sources:

1. UST. (2023). From Waterfall to Agile—How an Insurance Giant's QA Transformation Accelerated Delivery & Elevated Quality. Retrieved from https://www.ust.com

2. McKinsey & Company. (2022). Scaling Agility: A New Operating Model for Insurers. Retrieved from https://www.mckinsey.com

3. Agile42. (2021). Insurance Success Story: Enterprise Transition Framework™. Retrieved from https://www.agile42.com