|

In this week's Six Things, Paul Carroll considers will customers turn to big tech? Plus, the key to competitive carrier strategies; eliminating AI bias in insurance; 3 powerful data-driven strategies.

|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Insurance Thought Leadership (ITL) delivers engaging, informative articles from our global network of thought leaders and decision makers. Their insights are transforming the insurance and risk management marketplace through knowledge sharing, big ideas on a wide variety of topics, and lessons learned through real-life applications of innovative technology.

We also connect our network of authors and readers in ways that help them uncover opportunities and that lead to innovation and strategic advantage.

Here are the insurance technology trends, such as automated underwriting and virtual assistants, that will shape our industry in 2022.

1. Automated Underwriting Will Grow

The benefits of saving time and money have led to many insurers implementing automated underwriting. LIMRA says more than a quarter of U.S. life insurers have expanded their automated underwriting practices.

Now carriers are turning to software vendors that offer robotic process automation and AI to enable automated underwriting for group and voluntary benefits providers.

2. Ditto for Automated Claims

More than half of claims activities have already been replaced with automation, McKinsey found. Fully digital claims have reduced the average payment time by up to 5.5 days and assisted in achieving the highest satisfaction scores ever measured by the J.D. Power U.S. Property Claims Satisfaction Study.

Expect major investments in machine learning made in 2021 to accelerate back-end claims processing in 2022. Additionally, as insurers grow their partner ecosystems, application programming interfaces (APIs) will be increasingly deployed to smooth out the transaction and settle claims using third-party anti-fraud algorithms, databases and various machine learning applications.

3. Customers Want More Touchpoints

However, many consumers remain skeptical of the increased use of technology and automation in the insurance industry. A study by Accenture finds only 12% of insurance consumers trust an automated phone/web service when making a claim, while 49% trust a human adviser.

Insurers need to give customers more touchpoints. For example, regular electronic newsletters can highlight new product offerings, and company updates can point out that customer reps are always available.

4. Consumer Resistance to Virtual Assistants Must Be Addressed

Insurers can drastically reduce costs and turnaround time by adopting high-quality digital assistants that use conversational AI-based chatbots. While chatbots pose great opportunities, many consumers are skeptical about doing business with voice assistants. They still want to communicate with humans even if they have to wait in a queue.

Striking a balance between approaches is key, and it will require some trial and error to determine when a chatbot should let a human take over to best meet a customer’s needs.

5. Machine Learning Will Help Detect Fraud

This is an increasingly valuable way for insurers to detect and prevent fraudulent claims. Claims management and fraud prevention will continue in 2022 to advance as one of the most prominent areas where machine learning works for insurers.

6. “Cloudy” Weather Means Security Is Needed

While teams that take care of your system updates also work around the clock to ensure their cloud platform is secure, this does not mean that the cloud is a silver bullet when it comes to security.

Insurers preparing for cloud deployments must understand the importance of the shared responsibility model. While cloud infrastructure providers like Amazon, Microsoft and Google are responsible for the security of the cloud (infrastructure level), SaaS providers and their customers are responsible for security in the cloud at the application level.

Ransomware is growing. Insurers must adhere to security best practices relentlessly.

7. Blockchain Technology Will Advance

Many carriers are improving underwriting with smart contracts and blockchain. Underwriting improves because insurers can review accurate information on past insurance policies and claims and offer more precise pricing and selections for their insurance products using this new insurance technology.

While blockchain and smart contracts possess great opportunities for insurers, many are struggling to adapt. But adoption will continue to grow.

8. The Metaverse Will Draw Interest

The launch of the metaverse got insurance companies thinking about using extended reality to their advantage. A study by Accenture indicates 85% of insurance executives believe it’s essential to leverage XR insurance technology to close the physical distance gap when engaging with employees and customers.

9. Digital Distribution and Self-Service Will Become More Robust

Digital distribution enables customers to buy insurance products online, speeding the purchasing process and improving the customer experience. For example, State Farm’s self-service portal lets clients buy insurance policies online without taking a medical exam. The result has led to State Farm ranking second in client satisfaction among life insurers.

Digital distribution allows agents to do business with more clients, letting insurance companies lower commission costs per sale. In addition, the desire for superior digital tools among agents is more vital than ever. Many agents rate investing in digital or customer tools as the best way their employers can support them.

10. Insurtech Ecosystems Will Improve

McKinsey predicts ecosystems will account for 30% of global insurance revenues by 2025. Additionally, research from Accenture found 84% of insurance executives say ecosystems are essential to their strategy. These numbers indicate ecosystems will continue to be the insurance industry’s next big frontier for disruption.

11. Low-Code/No-Code Platforms Will Grow

Low-code/no-code software can reduce application deployment time from several months to a few hours! In 2022, this will be more pertinent than ever. Appian’s research shows IT departments are losing control over their growing digital infrastructure, and project backlogs are outpacing the addition of new IT resources. Low-code/no-code platforms don’t replace IT departments. Rather, they give IT breathing room to deploy their technical resources more strategically.

Low-code and no-code platforms may run the risk of encouraging “shadow IT” environments – managed outside of the IT department. This could result in security and workflow issues, inconsistencies in business logic and other unforeseen problems. Low-code/no-code solutions should be implemented following software development lifecycle and architectural best practices in collaboration with IT.

12. Predictive Analytics Will Aid in Competitive Benchmarking and Modeling

In 2022, insurers and distribution partners will be able to do much more with their data by using predictive analytics. PA takes historical data and feeds it into models that are trained over time with machine learning to generate predictions about trends and behavior patterns. Insurers can then make informed decisions about quoting, workload optimization, product recommendations and more.

This is especially valuable in employee benefits sales and underwriting. Insurers can leverage machine learning to process historical or synthetic data to identify the most successful sold plan designs for particular group sizes and industries. Using AI to generate a recommended alternative quote provides a valuable benchmark based on reliable data and reduces the guesswork.

13. Accelerated Underwriting Will Expand

Since the pandemic began, many insurers have had to embrace accelerated underwriting, supported by digital self-service tools and insurance technology. Now some lower-risk applicants can fly through the underwriting process without taking tests requiring body fluids. A survey found 74% of insurance companies say accelerated underwriting has reduced wait times for policies, 59% say it has diminished policy issue costs and 37% say it has increased sales.

Additionally, predictive analytics and machine-learning algorithms in underwriting make it easier and faster for customers to obtain life insurance coverage by skipping traditional tedious underwriting processes.

14. Open APIs Will Enable Growth

Open application programming interfaces are publicly available application programming interfaces that give other developers access to a software application or web service. They also manage how applications can communicate and interact with each other.

Open APIs let insurance companies showcase their services to the outside world so external partners can use them and bring added value to their customers. Companies connected through APIs can create an insurance technology ecosystem to offer a best-of-breed customer experience by intertwining digital services provided by multiple companies.

For example, a car dealer that uses open APIs could partner with an auto insurer to help sell car insurance right through the car dealer’s app. This would make it easier for customers to buy a car and insurance simultaneously.

15. Proactive Risk Management Will Grow With AI and Big Data

Life and health insurance companies are increasing their use of AI and predictive analytics to develop more preventative measures for their clients.

Big data offers revolutionary insight into a customer’s lifestyle, diet and general health. Insurers can better understand potential risk factors and make recommendations such as encouraging healthy habits to avoid future health issues. Potentially, an insurer could recommend the insured go to an emergency room because of the acute risk of a heart attack.

Additionally, big data collected from wearable devices can provide critical health and fitness information for life and health insurers. This information is crucial to developing interactive life insurance policies that track fitness and health data wearable devices and smartphones.

16. Tech Will Facilitate Embedded Insurance

InsTech London defines embedded insurance as “abstracting insurance functionality into technology in a way that enables any third-party distributor (usually a product or service providers in other sectors) to seamlessly integrate insurance products and solutions into their own customer propositions and journeys.”

For banks, car manufacturers and other distributors, implementing embedded insurance as part of a sale can help increase revenue and improve the overall value of their products or services. This is a win-win for both insurers and distributors as insurers can save money on distribution costs by implementing their products directly into the distributor’s platform.

17. Machine Vision Will Prove to Be, Well, Visionary

Machine vision refers to the AI-based analysis of images from sources such as smartphones, satellites and drones. In simple terms, machine vision is the eyes of applications and machines. It uses software algorithms to assess visual images based on existing data sets already assessed by humans.

In employee benefits, machine vision can greatly streamline the quoting process. Many requests for proposal still come in as images and PDF documents that cannot be interpreted as text by a typical computer. Moreover, client information cannot be copied and pasted from this format into the quoting tool, requiring manual rekeying of information by a human underwriter or salesperson whose time is better spent elsewhere. Expect adoption to increase in 2022.

18. Health Wearables Will Take Hold

The demand for health wearables is booming as advanced insurance technology allows people to monitor their health progress and get rewards for healthy living.

These services track a wealth of data, such as daily steps, sleeping patterns, activity levels, heart rates, calories consumed, UV levels, temperature preferences, when people are home and not, and distance traveled in cars.

Data collected from wearables can provide critical health and fitness information. This information is vital to developing interactive life insurance policies that track fitness and health data through wearable devices and smartphones. In addition, the data gathered can give complimentary coverage or improved rates for both individuals and employee benefits using health and risk scores.

19. Automated Renewals Will Boom

Automated renewal applications can limit the need for carrier intervention for stock quotes by automatically queuing quotes for manual review and auto-generating policy renewal packages.

Additionally, automated renewal applications can connect with policy administration and claims systems by leveraging data for re-calculations at the anniversary of a policy’s renewal. This allows insurers to not worry about tracking renewals and the manual preparation of renewal quotes and letters. Employee benefits insurers can reduce renewal turnaround and touchpoints by 75%.

20. Automated Workload Balancing for Quotes Will Take Hold

During periods like open enrollment for employee benefits, the high volume of quotes requiring underwriter review can slow processes due to an inefficient allocation of human resources. About 30% to 40% of an underwriter’s time is spent on administrative tasks, such as rekeying data or manually executing analyses.

With AI, workload recommendations can be generated automatically. Carriers can train machine-learning models to assist sales and underwriting managers in suggesting the most effective distribution of quotes across the underwriting team.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike de Waal is senior vice president of sales at Majesco.

The level of change has never been greater, and insurance’s opportunities have never been more numerous.

Let’s try some word association. Maybe we could begin with the word “change.” What does the word mean to you? You can tell a lot about people (and about companies) by their responses to the concept of change. Does change cause excitement or dread or both? Of course, much depends on what is changing. Do we have reason to be excited? Can we embrace a little of the unknown to grab hold of the positive side of change?

If today’s market trends are any indicator, the level of change has never been greater, and insurance’s opportunities have never been more numerous. People and businesses need insurance and they can look at the world right now and see every motivation to protect their interests.

Majesco recently released its 2022 Consumer Report, Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time. The report is both an overview of real insurance trends, as captured by our customer survey, and an analysis of what those trends mean to insurer adaptability and overall opportunity. In today’s blog, we’re going to look at two related segments of the report: individual and family changes that are affecting life and health insurance and numerous demographic trends that will affect life, health and voluntary benefits.

Which trends are most likely to drive insurance purchases?

Family changes will boost life and health products

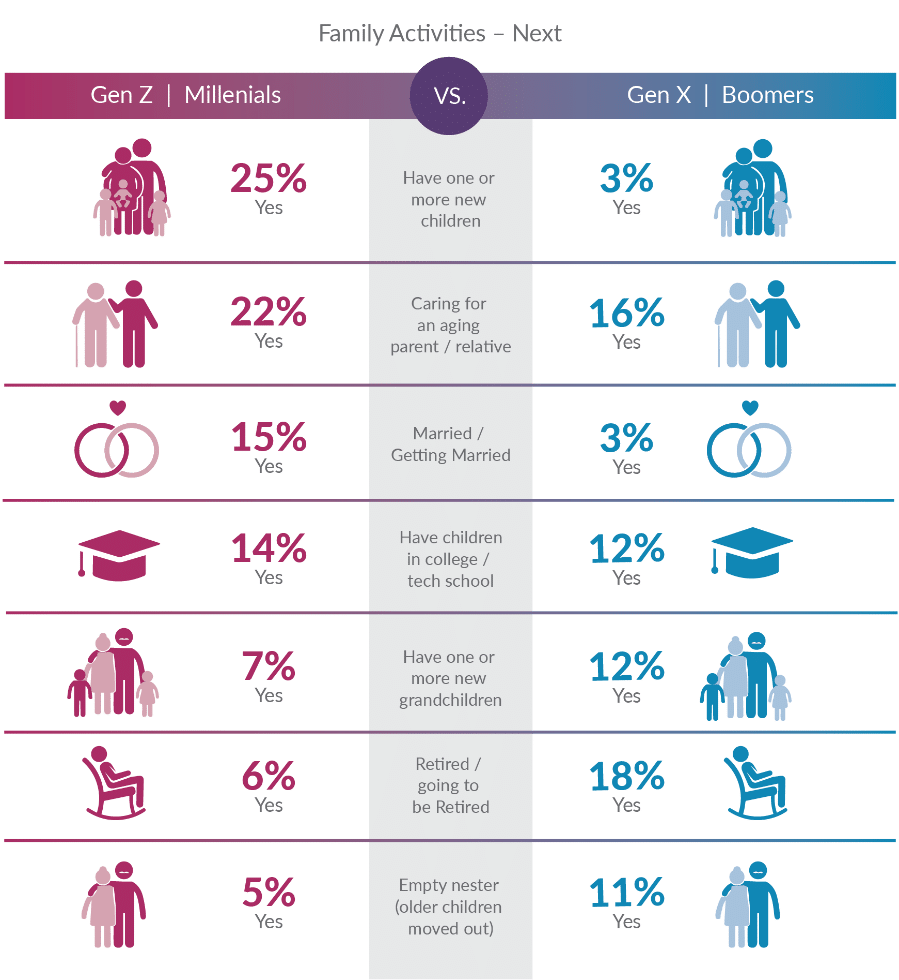

Insurers have commonly looked at the points of family change for opportunities to sell insurance. Today, however, insurers have the opportunity to improve products and placement. In the Majesco report, Gen Z & millennials have high expectations that their families will change soon. This undoubtedly helped raise the importance of insurance to them, with 25% planning to have children and 22% expecting to be caring for an aging parent or relative (Figure 1). Furthermore, 15% expect to get married. Among the older Gen Z and millennials, 14% expect to have a child in college or tech school, reflecting the transition into later family life stage changes and subsequently the opportunity for insurers to offer life and health insurance, both as individual and as voluntary benefits.

In contrast, the older generation is entering their later life stages with retirement and will focus on maximizing their income through life, annuity and other investments as well as retaining coverages they want once they leave full-time employment. The ability for insurers to help them retain their money and manage their income, while also providing insurance to manage the increasing risk of age, is becoming a significant market opportunity that will require new products, services and partnerships to deliver.

Figure 1: Expected family-related changes in the next 3 years

Life insurance takes an unexpected turn

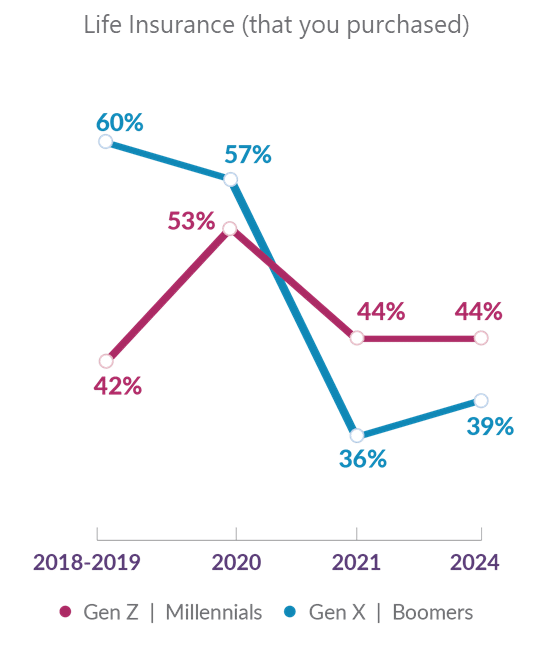

Interest in life insurance in 2021 and beyond had an intriguing decline. (See Figure 2). Majesco’s 2020 survey responses were received as the pandemic was heating up, explaining the jump in individual life insurance among Gen Z and millennials, something we saw play out in the market and media. Gen X and Boomers remained largely unchanged.

What is less understood is the anticipated drop in individual life insurance between 2021 and 2024. A number of factors could be influencing this decline, including not needing any additional purchases, a shift in employment where insurance may not be available, retirement, a lack of life policy portability from employee benefits or even a lack of affordability, because life insurance is a discretionary purchase.

Insurers will need to continue to innovate with digital life products and look at new channels to capture customers and retain growth in this insurance segment. They will also need to continue to track customer sentiment that might be related to the pandemic and consider how the pandemic has, at the very least, exposed areas of family vulnerability. Is life insurance one of the first expenses to get dropped when home budgets get squeezed? Is there a way for insurers to “protect the protection” and give customers a better feeling about all that their coverage supplies? Are the right channels being used to buy insurance? Is the product easy to buy?

Once again, stability is the core motivator. If insurers can isolate those portions of the population who need improved stability and meet them at the easiest points of entry, there will be an overall improvement in coverage and an uptick in policy purchasing.

Figure 2: Households with purchased individual life insurance

Interest in value-added services is high for life and health benefits

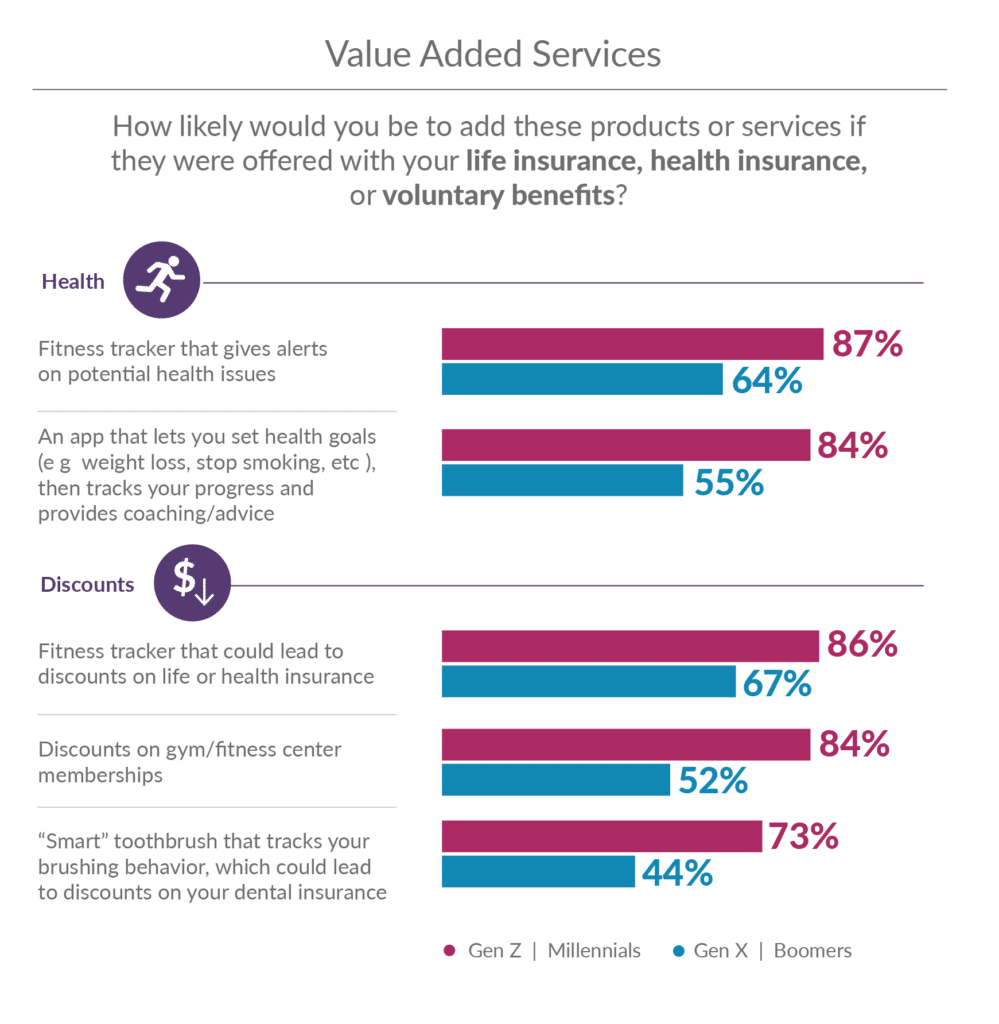

As I mentioned in an earlier blog, Game-Changing Trends in 2022 for the Future of Insurance, there is an increased desire for value-added services within insurance. Value-added services offered within life, health or voluntary benefits received very high marks of 73%-87% for Gen Z & Millennials. (See Figure 3.) While there was lower interest of 44%-67% for Gen X & Boomers, these numbers still suggest specific demographics within this segment would be interested. Together these numbers reflect a strong opportunity for insurers to experiment with new offerings, such as a fitness tracker program that would encourage healthy lifestyles, provide alerts on potential health issues, and assist with financial wellness planning. These offerings would provide a new level of engagement with customers and develop trusting relationships that can ensure retention, but more importantly they can uncover potential new sales opportunities.

Figure 3: Interest in life, health, voluntary benefits value-added services

Sales channel insights for life/health/accident insurance

Sales channel insights for life/health/accident insurance

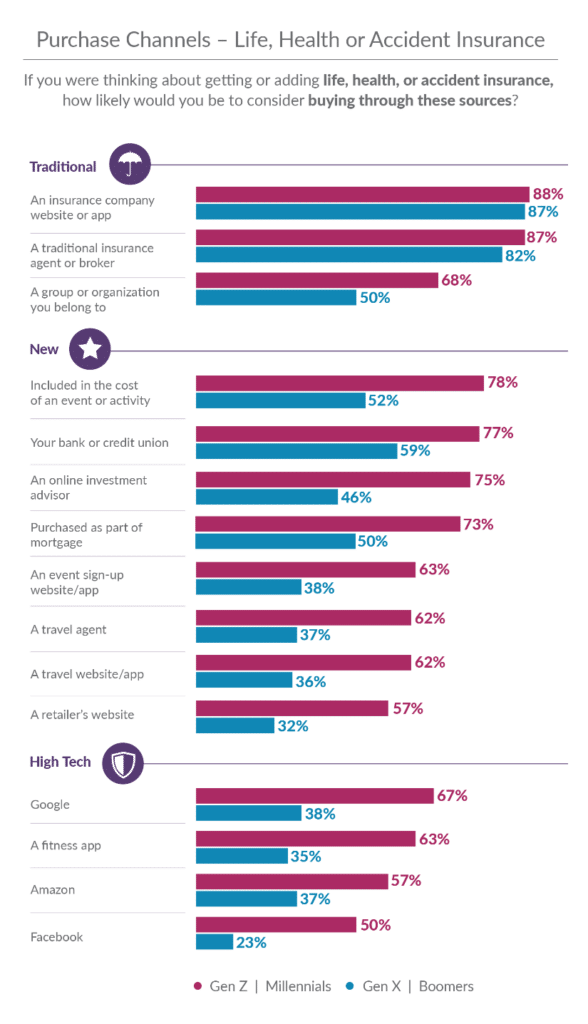

Both generational segments strongly agree that traditional insurance company and agent channels deliver the best purchase experience for this insurance segment, while they split interest for the new and high-tech channels (a pattern for other types of insurance, as we’ll see later) as reflected in Figure 4. Pay special attention to the New and High Tech segments of Figure 4 and the gaps between the generations. Gen Z & Millennials are significantly interested in these newer channels. They use them regularly, building loyalty and trust.

Insurers should rapidly embrace a multi-channel environment with innovative partnerships if they are to capture and retain the business of this younger generation, as they begin to evolve their lives and have increased insurance needs.

Figure 4: Interest in life, health, accident insurance purchase channels

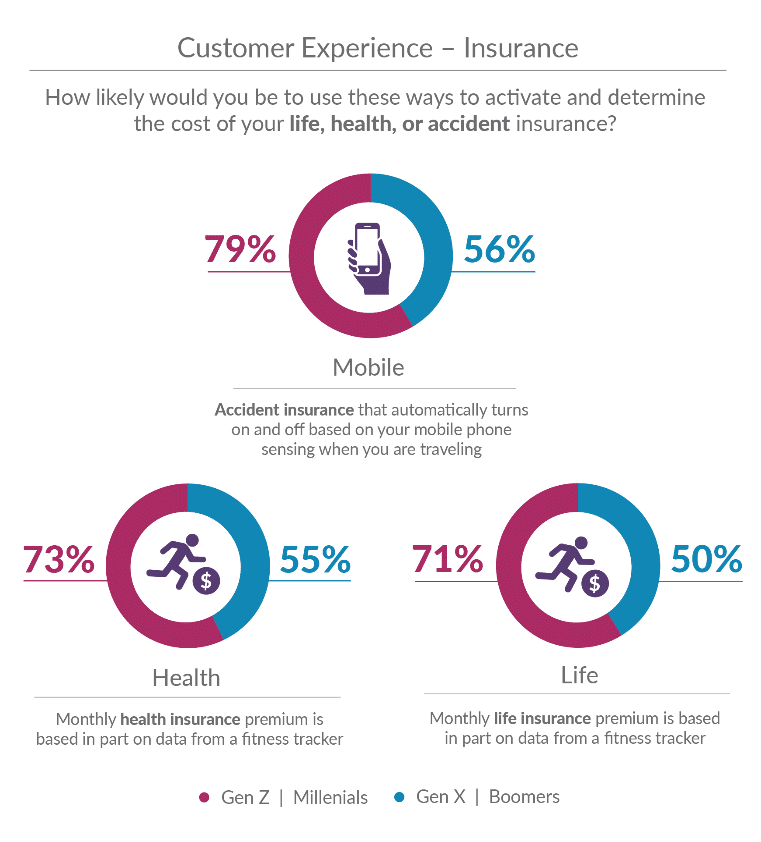

Real premiums based on real life tracked in real time

Overwhelmingly, basing life, health and accident insurance premiums upon digital real-time data is popular with Gen Z & Millennials on a range of 71%-78%. While popularity among Gen X and Boomers is not nearly as high, they still have a solid interest of over 50%. Over our annual surveys, we have seen the younger generation open to using personal and other data as long as they get value. These numbers reflect that perspective.

The use of a fitness tracker for that data is popular and will likely grow given the focus on wellness by both generational groups.

Stability in motion

People love to travel, but they would like the stability of knowing they are covered without the inconvenience of having to sign up for insurance on every trip. There is a high interest in accident insurance coverage triggered when a mobile phone senses traveling. This will require insurers to use new data sources, but it will result in the convenience, ease and stability sought by customers. Both generations are interested, but when you consider the 79% interest level of Gen Z & Millennials (see Figure 5) combined with their plans for increased travel in the next three years, this offers a potential new on-demand product and market opportunity.

Figure 5: Interest in ways to activate and determine the cost of life, health, or accident insurance

Stability through the employer: Are group and voluntary products staying relevant?

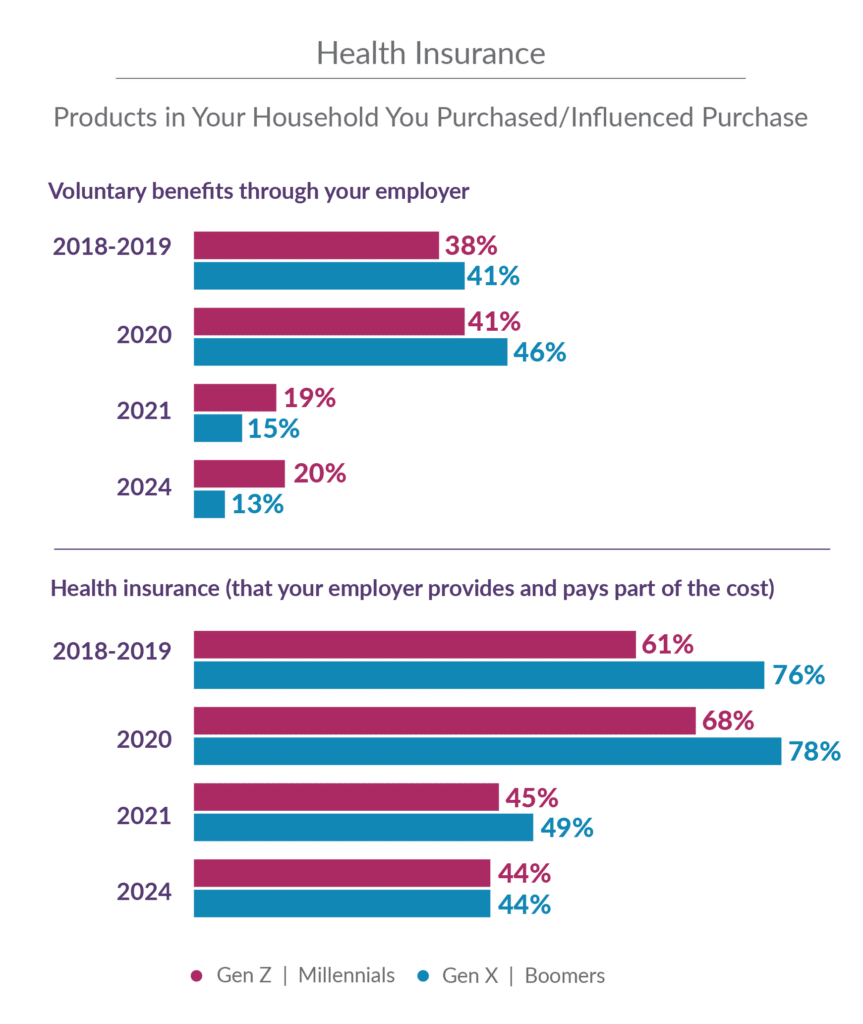

Use of employee health and voluntary benefits showed sharp declines in our current survey, and surprisingly low expected levels of usage in the next three years as highlighted in Figure 6. The decline is another indicator of COVID-driven job loss and the “Great Resignation.” We speculate that the low expectations for the future are driven by the changing nature of work among Gen Z & Millennials described above, and Gen X & Boomers retiring and leaving the workforce in increasing numbers.

It’s clear that group and voluntary benefits companies must innovate around their products with coverages for a younger generation who have different lifestyle needs as well as for on-demand workers who are estimated to be an increasing part of the workforce. Innovative new plans and insurance options such as pet, cyber and identify theft insurance as well as portability will become increasingly important for employers to attract and retain employees, but also for insurers to keep customers as they change jobs. In addition, offering individual insurance products as part of a benefit plan that allows people to keep the insurance if they leave their employer is increasingly important. Portability of group underwritten policies do not always do well because of the higher premiums, whereas offering individual products as a part of a benefit plan avoids that issue. In a roundtable we did late last year, this was a key topic of discussion and interest.

Figure 6: Households with employer and voluntary benefits

Within voluntary benefits, Majesco took a deeper dive into which benefits would be most desirable in the future. It’s important to note, however, that even niche products are showing the potential for growth and some common “traditional” products are showing interest growth through the employer channel. (See Figure 7.)

Traditional benefits for health, dental, vision and life garner the highest interest from both generation segments, with health particularly important to Gen X & Boomers (76%). Accident, disability income, critical illness and long-term care has a medium level of interest, with disability income exceptionally higher for Gen X & Boomers (73%) as compared to Gen Z & Millennials (46%). Newer, non-traditional voluntary benefits averaging 15%-20%, reflecting potential growth opportunities. These products can be significant differentiators for employers to attract and retain talent with the younger generation. For example, homeowners insurance and student loan assistance have strong appeal with Gen Z & Millennials, while others in this group like identity theft and auto insurance appeal to both generation segments.

Figure 7: Breakdown of anticipated/expected Voluntary Benefits

Portability is rising in importance

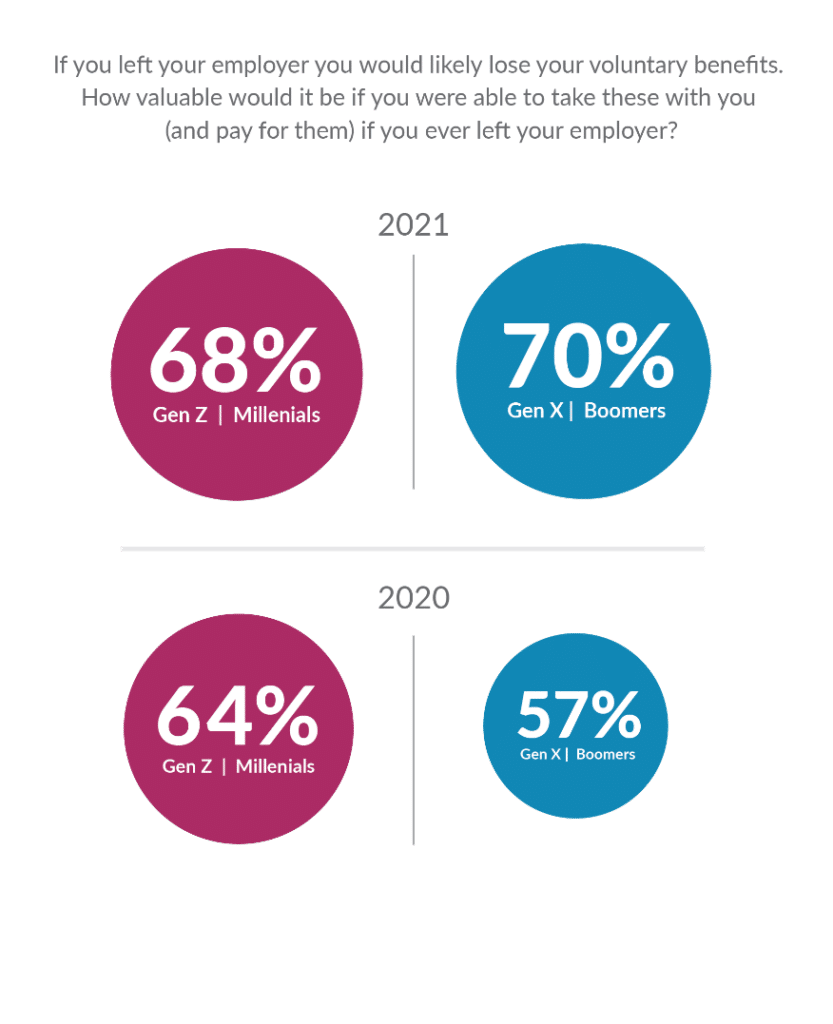

Offering these benefits as part of different plans for different employee demographics and making them portable offers employers an opportunity to strengthen employee satisfaction and address the continuing fight for talent that will continue. As the older generation moves into retirement or semi-retirement, the desire to retain valued benefits via portability is also high, given that Medicare does not cover all their needs. For portability, the key is for the product to be individually underwritten versus group underwritten, where the premium becomes too expensive. In our research last year, 64% of Gen Z & Millennials and 57% of Gen X & Boomers said this would be valuable to them. This jumped significantly for Gen X & Boomers this year, to 70%. (See Figure 8.)

Figure 8: Importance of Voluntary Benefits portability

Seize the future

Seize the future

Stability, for customers, is about seeing into the future and anticipating where issues might crop up that would damage their lives. As Majesco’s report shows, insurers can’t go wrong if they are making every effort to meet these current and future demands for security. The formula is simple: Offer the products desired in the places needed with the convenience of seamless experience. The follow-through is more complicated: Bring systems and processes into line with the customer’s lifestyle and demands.

For a thorough look at the consumer trends that will affect your future, be sure to download Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Denise Garth is senior vice president, strategic marketing, responsible for leading marketing, industry relations and innovation in support of Majesco's client-centric strategy.

Insurers need to embolden change agents and embed courage into their culture so it permeates every level of the organization from top to bottom.

During InsureTech Connect (ITC) 2021, the world’s largest gathering of insurance industry executives, tech entrepreneurs, and investors, Chisel AI’s President and CEO Jason McDermott participated on a panel discussing “The Future of Commercial Insurance Underwriting” moderated by Mike Fitzgerald, principal insurance analyst, CB Insights. Mike posed a timely and compelling question: “What are the traits that make a commercial insurer successful at any digital transformation?”

McDermott’s responded: “As I see it, it has nothing to do with the right technologies or skills – but it has a lot to do with courage. Yes, courage. Don’t get me wrong – change is happening now. Disruption is occurring. But in my opinion, we can do better. We need to be more courageous. We need change agents who want to lead their organizations on this journey of transformation.”

McDermott challenged the audience of commercial lines insurers and insurtech peers to be courageous and take a page out of the "tech startup" playbook: “Having spent 30-plus years of my career working with technology startups, I’ve experienced first-hand how it feels to take a leap of faith and stand on the ledge of uncertainty. We’ve all been scared at one time or another. Change is a constant in our personal and professional lives, but for many it’s not easy to accept or embrace change. So, we need agents of change – to provoke change, to act as the catalyst for change and to emphatically guide co-workers and peers through the transformation. It takes courage and the right level of empowerment to deliver business-changing innovation.”

Championing Your Change Agents

McDermott’s comments echo those of many within the commercial insurance industry and the insurtech ecosystem that serves it. We’ve been talking about the need for commercial insurance to digitize, evolve and transform for many years, but are we moving fast enough to keep pace with changing market conditions and customer expectations, and are we building the right culture and change management practices to encourage bold thinking and mobilize meaningful innovation that can really move the needle for the industry?

“I think our digital aspirations need to be a lot bolder,” argues Tina Osen, president, Hub International Canada. “We’re comfortable with a year where we deliver solid single- or low-double-digit growth, and we think that’s awesome. But I believe that, if we set these bold aspirations for our digital strategies, we can really see tremendous results. I also think, while it’s important that we can get gains in efficiency and cut costs, we really need to look at digital as an enabler to generate new revenue that will drive numbers that are significantly stronger than we’re currently driving as an industry.”

Successful digital transformations are predicated on three factors: people, process and technology. With technology as the enabler, it takes individuals with the grit and determination to thrust innovation forward within their organizations, rally others for the change ahead and reimagine new approaches to drive tangible business outcomes. One of the greatest roadblocks to digital transformation in commercial insurance is a lack of organizational courage. In an industry composed of professional risk managers, courage to challenge the status quo is not a natural strong suit; it must be cultivated and nurtured.

“Change management is a skill that few organizations have mastered,” says Ryan Collier, chief digital officer and president of executive lines at Risk Placement Services, a leading MGA and wholesale insurance broker. “A company with a strong, adaptive digital culture has a far greater chance of successfully transforming and continually growing than one whose culture resists change. To really do business differently, it requires a commitment and vision from leadership. Bold leadership done right inspires and builds trust. When people trust leadership and believe in the vision, they will lean into change rather than fight it.”

"One thing that insurance companies can learn from non-insurance companies is that it’s okay to fail,” says Bob Frady, vice president, HazardHub, part of Guidewire. “One of the hardest things I had to learn is that insurance people are rewarded for not being wrong rather than being rewarded for being right. It makes for some very risk-averse people and processes. Sometimes you just have to spin the wheel and see what comes up. Just because something is different doesn’t mean it’s bad. That’s not something that comes naturally to many people in the insurance industry.”

Brian Falchuk, author of The Future of Insurance: From Disruption to Evolution, TEDx speaker, former insurtech executive and managing partner of Insurance Evolution Partners, believes that this established idea of “That’s not how we’ve always done it” is the “number one killer of change.”

Amy Radin, author of The Change Maker’s Playbook: How to Seek, Seed and Scale Innovation in Any Company, says, “You have to cultivate a culture where people understand that innovation is part of what is going to make us successful and so people feel safe taking risks, putting their necks out and working on things that may take several iterations to pan out or may never pan out. If on the other hand, it’s a culture of fear where people don’t trust each other, and where people don’t feel that management has their back on taking the risks that are inherent in innovation, they will not bring their best innovative selves to work.”

Building and maintaining an innovation-focused culture within established insurance organizations can be easier said than done. Risk aversion is deeply ingrained in the industry, and in the DNA of many insurance professionals. It takes strong, clear and decisive leadership to change a culture.

“First and foremost, culture is critically important, because it is the connection to your strategy and the DNA of the team,” says Tony Fenton, vice president of commercial lines underwriting and product, Nationwide. “Culture is what folks do when someone’s not around, and truly creating that operational principle for the team to really strive toward the results, as well as have that North Star in terms of what you stand for as an organization. I do think that without the right cultural pillars, you probably don't have the North Star in terms of what you're aiming to accomplish."

Fenton continues, “If you don't have a strong culture, if you don't have the pillars, you probably don't have the North Star in terms of what are you strategically trying to accomplish and connecting each of the individuals into that strategy. One thing I've found over the years is all professionals want to see themselves in the strategic picture. Having the right cultural DNA against your operational strategy is the glue that really keeps the company moving forward.”

The ability to sustain momentum is critically important because large-scale digital transformations don’t happen overnight; they’re multi-year initiatives that require a long-term strategic vision as well as the concerted effort of many different people at all levels of the organization who are on the front line of the transformation.

Hub International’s Tina Osen says, “I’m a big believer in bite-size pieces, fail fast, iterate, try again, prove it out and then expand. So, you garner that success, the momentum and energy to move it to the next level."

“Change management truly is an organizational movement; you can’t do a top-down change management or a bottom-up change management. You must do them both together,” Travis MacMillian, chief business officer, Xceedance, believes. “First, you have to have leadership that’s completely on board with a transformational change, and they're sponsoring it, and they're aligning it to their strategic direction to say, 'Organizationally, here's where we want to go.'

“At the same time, they need to surround a group of folks that are the doers. They're the workers doing it every day, and get them to embrace the vision, and how they can see the transformation really impacting their roles from a bottom-up standpoint. And when you attack it from both vantage points, the outcome there is successful. If you do one or the other, you have the potential of failing, from my experience. So, it has to be attacked from both ends, and I think that when it’s done right, I think that companies will be successful. The other thing that I would lay out there is that you can’t take that journey alone.”

Abel Travis, VP and head of Fundamental Underwriters, a division of AF Group, says: “While digital transformation feels like a technology initiative, really, it’s not a technology initiative. It’s a business initiative that impacts the entire culture. You have to have change agents, plural, and not just one owner for all the digital transformation. Because it’s something that is going to have implications for folks all across the entire enterprise, you have to have change agents in each of the different areas across the enterprise. It’s necessary to have a business change agent and a technology change agent.”

Tina Osen says, “I think probably one of the hardest things when you’re doing big change management projects is you have to put your best people that are influencers in the organization on these change management projects. That can be hard to execute because those are the folks that are having such an impact in the day-to-day. But those are the individuals who can identify the business problems that are going to arise, who have that influence through the organization, and who really can create change in a way that anticipates some of the challenges that will come at you.”

Brian Falchuk stresses that you need to think about who is in the room when it comes to planning and executing innovation initiatives: “It takes those teams having the right mix of seniority. If you have really senior people in there, chances are really junior people, especially if you don’t have an ‘obligation to dissent’ kind of culture, they’re going to clam up, and they’re going to be scared to talk. So, you need to think about, culturally, how can you make sure the people in that group are willing to say things. But then you need the right sort of sponsorship…. You don’t want your C-suite executive sitting on them to squash them. You want someone who recognizes, ‘My role here is to help this move forward,’ and to trust that this group of people across lots of different roles and functions and levels in the company really put in the effort to understand this problem and to design a solution.”

Amy Radin believes that a key element of empowering change agents is investing in education and skill development: “You can’t just wake up in the morning and say, ‘Okay, we’re going to be innovative, and now go be innovative.’ It really requires unique skills and capabilities. Part of empowering is making sure that you’re helping people develop the skills and that you’re investing in the capabilities that they need.”

Osen says, “Every time when we have failed on change management projects, it’s usually tied to two things, poor communication or poor training and education.”

To achieve business-changing innovation, insurers need to find ways to embolden change agents and embed courage into their culture so that it permeates every level of the organization from top to bottom.

“You can’t be afraid to try something new,” says Xceedance’s Travis MacMillian. “We’ve done things as an industry very traditionally. Step out, be the change agent, be the leader and push the boundaries. And again, you may fail. Fail fast, correct, try again, until you’re successful. And that’s a repeatable process.”

Chisel AI's Jason McDermott adds, “Forward-thinking insurance organizations that embrace innovation and successfully transform will be the ones that have a change agent at the helm, who have willingly raised their hands to inspire and influence others to change. Make no mistake – it takes courage to step up to the challenge and accept risk. It’s not for the faint of heart, but so rewarding – it will challenge and test you. I promise you that it will be personally and professionally fulfilling and enrich your day tenfold when compared with the alternative of doing nothing and accepting complacency.”

In the coming months, we’ll dig deeper into this topic to define the characteristics of an effective change agent and discuss practical approaches insurers can use to identify and empower these individuals to drive meaningful innovation within their organizations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Steve McOrmond is senior content marketing manager at Chisel AI and editor of the Writing the Future blog, a commercial insurance forum that focuses on digital transformation, change management and the impact of innovative technologies like artificial intelligence on the insurance industry.

Would people go to companies like Amazon, Facebook or Google for insurance? Zillow or Trulia for renters insurance? CVS for health insurance?

Since I got involved with ITL nearly 8 1/2 years ago, a vague threat has been hanging over the industry: that Big Tech would somehow invade and capture all the profits in much the way that Amazon did with retail commerce. That obviously hasn't happened -- but a recent survey shows that customers remain at least a little Big Tech-curious.

The survey of 1,500 consumers, by Breeze, found, for instance, that 55% of consumers would be inclined to buy a hypothetical insurance product from Amazon over traditional insurance carriers. Fewer than half said they'd prefer Google or Facebook to traditional carriers -- but if the 46% who said they'd prefer Google and the 38% who said they'd prefer Facebook actually bought from a Big Tech company, then the whole industry would be turned upside-down. No company has a 20% market share in any insurance line, so Big Tech could become the dominant player if even a fraction of customer interest were turned into purchases.

The potential threat doesn't stop with Big Tech, either. The Breeze survey found that "66% would be interested in buying auto insurance from an automobile manufacturer like Tesla, Ford, or Honda instead of from a traditional carrier." (I've written about how interested car makers are in selling insurance.) "61% would be interested in buying renters or homeowners insurance from a real estate company like Zillow or Trulia instead of from a traditional carrier.... 59% would be interested in buying health or life insurance from a health and wellness company or pharmacy like CVS or Walgreens instead of from a traditional carrier.... 51% would be interested in buying disability insurance from a payroll and HR company like Zenefits or Bill.com."

Now, we all know that surveys are flawed, and they're especially unreliable when a hypothetical product or service is involved. I remember the chairman of Compaq once complaining to me in advance of a much-hyped announcement from IBM that hypothetical products always had "infinite capability and zero cost." (The product line was, in fact, a bust.) Who knows what sort of product an Amazon, Walmart, CVS or Zenefits might come up with, or how customers would react when it comes time to sign a policy?

But the mere fact that so many customers express interest should, I believe, reinforce the need for insurers to maintain a ruthless focus on the sort of operational efficiency (and, thus, low cost) and easy customer experience that makes Big Tech so attractive. Those companies may never make a major incursion into insurance -- but it'd be best to be prepared in case they do.

Cheers,

Paul

Google, Amazon, Walmart… tech powerhouses are moving into the insurance industry, for better or for worse.

That technology will be the fuel that powers the insurance industry machine is inevitable. And with exciting innovations in AI, data and cloud computing, the dreams of many insurers can become reality. Gone are the days of relying on slow, clunky systems and paper-based methods. Instead, insurers today can build, test and run product lines using entirely digital means, managing agile product streams and bringing new lines to market in record time.

In 2022, insurers should continue to fine-tune operations, creating the sleekest and most agile model possible to keep up with the ever-changing requirements of today’s customers. This means incorporating every resource possible into a smoothly running underwriting process -- and data will bring on one of the most radical improvements the industry has seen.

Large players in data will lend a hand

In the world of predicting and pricing risk, the more you know, the better. Data goes hand in hand with knowledge in the insurance industry, as insurers collect larger quantities of more accurate information than ever before as they attempt to build the best quote possible for their customers. It is no surprise, then, that data companies have been slowly but surely building influence in the insurance space, providing carriers with up-to-date insights to enrich their offering.

Tech heavyweights like Google, Apple and Amazon are predicted to affect the industry with their seemingly infinite data stores. Still, insurers are considering just where and how they will do so. Will they simply offer resources for a price? Or could they move into simplistic forms of insurance for themselves, staging a coup? Though possible, the latter seems unlikely; rather, these companies will extend their services to work in the background, nestling up to firms and providing data resources.

This will enable insurers to pinpoint and effectively target niche markets, using the wealth of information they gather to highlight new and evolving risks. Importantly, just having raw information will not be what pushes insurers to progress - if carriers cannot easily extract key insights from the data, the exercise can be fruitless. Large and small data companies alike must provide actionable insights, accessible through user-friendly interfaces and clickable features.

A revolution in product distribution

Big tech not only has resources to offer insurers but also distribution strategies and abilities. Creativity will be the name of the game as powerhouses, like Amazon, apply their recommendation concepts to insurance, as they have done for so many other industries. Perhaps we will see “recommended for you” and “based on your previous purchases” beginning to pepper product pages on insurance sites. Amazon has creative distribution down to a T, making products in multiple verticals and industries extremely easy to purchase. When you can buy so much online in seconds - from clothes to cars to holidays - insurers must question why they aren’t keeping up with other markets. In this sense, Big Tech will help greatly, offering constant availability and instant results.

Recommendations are part of a larger influence that Big Tech wields over the population, as they offer consumers more choice than ever before. Large companies influence not only what customers buy but also how they buy it, what device they use to purchase it, how to pay for it and much more. As a result, markets are more competitive than ever before, and insurance is not far behind. As a result, insurers must expand their offering regarding technology, using every available resource and tactic Big Tech has to offer. The industry does not need to expect “Amazon Insurance” just yet (though we should not rule it out), but forward-thinking insurers will be sure to take advantage of the opportunities that Big Tech can provide.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Greg Murphy is executive vice president for North America at Instanda. He is an accomplished financial services executive with a passion for transforming the customer experience and improving the reputation of the industry.

Read this report to better understand the recent changes in customer behaviors and expectations and how new capabilities and technology can make emerging opportunities become a reality.

New research from Majesco highlights the urgency of rapidly adapting to a new reality for all customers, and Millennials and Gen Z in particular. They are the dominant buyers for both life and non-life insurance products with a focus on five specific segments: life/health/accident, employee/voluntary benefits, auto, mobility, and homeowners/renter’s insurance.

Read this report to better understand:

Sponsored by Majesco

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Majesco isn’t just riding the AI wave — we’re leading it across the P&C, L&AH, and Pension & Retirement markets. Born in the cloud and built with an AI-native vision, we’ve reimagined the insurance and pension core as an intelligent platform that enables insurers and retirement providers to move faster, see farther, and operate smarter. As leaders in intelligent SaaS, we embed AI and Agentic AI across our portfolio of core, underwriting, loss control, distribution, digital, and pension & retirement administration solutions — empowering customers with real-time insights, optimized operations, and measurable business outcomes.

Everything we build is designed to strip away complexity so our clients can focus on what matters most: delivering exceptional products, experiences, and long-term financial security for policyholders and plan participants. In a world of constant change, our native-cloud SaaS platform gives insurers, MGAs, and pension & retirement providers the agility to adapt to evolving risk, regulation, and market expectations, modernize operating models, and accelerate innovation at scale. With 1,400+ implementations and more than 375 customers worldwide, Majesco is the AI-native solution trusted to power the future of insurance and pension & retirement. Break free from the past and build what’s next at www.majesco.com

Carriers that continue to work from vague three- to five-year timelines will lose market share and perhaps wind up as someone else’s acquisition.

The business of insurance is much harder than it used to be. Achieving growth without risking profitability is challenging, climate change is affecting risk profiles and increasing regulatory scrutiny, distribution has become truly omnichannel and customers expect products tailored just for them. At the same time, technology has continued its relentless advance, and an emerging ecosystem is threatening to shake up customer acquisition. Incremental change is not a viable option anymore, and industry executives now have to make deliberate and aggressive strategic choices to succeed.

Of course, these were growing challenges for the industry even before the pandemic, but their pace and impact have greatly increased over the last two years. Customer, employee and other stakeholder expectations have changed more in that time than they did in the previous two decades. This has put immense pressure on the industry, and carriers have had to adjust literally overnight. Even though the pandemic has ebbed and flowed, the pace of change remains relentless.

Are you capitalizing on your strengths?

Despite accelerating disruption, most carriers still have a competitive advantage. They focus on a particular strength, typically:

But many carriers also fritter away their advantage. They typically underinvest in their strengths and fail to act with urgency. This isn’t sustainable in the face of new entrants that are moving quickly, with great focus and discipline, to capitalize on industry disruption. Carriers that continue to work from vague three- to five-year timelines are likely to lose market share and perhaps even wind up as someone else’s acquisition. In other words, commitment without action won’t get you far. You need to fully fund and support your way to play and hold yourself accountable for the results. This may sound self-evident, but we’ve seen time and again that most carriers simply don’t do it.

See also: 2-Speed Strategy: Optimize and Innovate

What makes a winner?

Based on our experience working with all segments of the industry, we’ve observed that most successful insurers in today’s environment have a few key traits. In particular, they:

Market leaders also know that even a clear and consistent strategy is going to founder if their technology can’t enable it. They’ve gone far beyond just “digitization.” A successful technology approach has several components, but flexibility and speed -- attributes that cloud greatly facilitates -- are vital. Practically everything in insurance eventually becomes a margin game, with the advantage going to the carriers that can scale effectively, drive out cost and achieve broad price competitiveness. If you can’t, you’re going to lose customers, employees and investors.

The path forward

None of this is easy, and no single company has mastered all of the ways to win in today’s challenging market. But we’ve never seen a truly competitive insurer that didn’t at least:

Whatever your business focus, these three are essential.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Marie Carr is the global growth strategy lead and a partner with PwC's U.S. financial services practice, where she serves numerous Fortune 500 insurance and financial services clients.

Over more than 30 years, her work has helped executive teams leverage market disruption and innovation to create competitive advantage. In addition, she regularly consults to corporate boards on the impacts of social, technological, economic, environmental and political change.

Carr is the insurance sector champion and has overseen the development of numerous PwC insurance thought leadership pieces, including PwC's annual Next in Insurance and Top Insurance Industry Issues reports.

Cyber perils worry companies even more than business and supply chain disruption, natural disasters or the Covid-19 pandemic.

Cyber perils are the biggest concern for companies globally in 2022, according to the Allianz Risk Barometer. The threat of ransomware attacks, data breaches or major IT outages worries companies even more than business and supply chain disruption, natural disasters or the Covid-19 pandemic, all of which have heavily affected firms in the past year.

Cyber incidents tops the Allianz Risk Barometer for only the second time in the survey’s history (44% of responses), Business interruption drops to a close second (42%) and natural catastrophes rank third (25%), up from sixth in 2021. Climate change climbs to its highest-ever ranking of sixth (17%, up from ninth), while pandemic outbreak drops to fourth (22%). The annual survey from Allianz Global Corporate & Specialty (AGCS) incorporates the views of 2,650 experts in 89 countries and territories, including CEOs, risk managers, brokers and insurance experts. View the full global and country risk rankings.

In the U.S., BI (50%) retains its top spot followed by cyber incidents (37%) and natural catastrophes (35%).

Ransomware drives cyber concerns while awareness of BI vulnerabilities grows

Cyber incidents rank as a top three peril in most countries surveyed. The main driver is the recent surge in ransomware attacks, which are confirmed as the top cyber threat for the year ahead by survey respondents (57%). Recent attacks have shown worrying trends such as "double extortion" tactics combining the encryption of systems with data breaches; exploiting software vulnerabilities that potentially affect thousands of companies (for example, Log4J, Kaseya) or targeting physical critical infrastructure (the Colonial pipeline in the U.S.).

Cyber security also ranks as companies’ major environmental, social and governance (ESG) concern, with respondents acknowledging the need to build resilience and plan for future outages or face the growing consequences from regulators, investors and other stakeholders.

Business interruption (BI) ranks as the second-most-concerning risk. In a year marked by widespread disruption, the extent of vulnerabilities in modern supply chains and production networks is more obvious than ever. According to the survey, the most feared cause of BI is cyber incidents, reflecting the rise in ransomware attacks but also the impact of companies’ growing reliance on digitalization and the shift to remote working. Natural catastrophes and pandemic are the two other important triggers for BI in the view of respondents.

In the past year, post-lockdown surges in demand have combined with disruption to production and logistics, as COVID-19 outbreaks in Asia closed factories and caused record congestion in container shipping ports. Pandemic-related delays compounded other supply chain issues, such as the Suez Canal blockage or the global shortage of semiconductors after plant closures in Taiwan, Japan and Texas from weather events and fires.

According to the recent Euler Hermes Global Trade Report, the COVID-19 pandemic will likely drive supply chain disruption into the second half of 2022, although mismatches in global demand and supply and container shipping capacity are eventually predicted to ease, assuming no further unexpected developments.

See also: Cyber Risk Impact of Working From Home

Pandemic outbreak remains a major concern for companies but drops from second to fourth position (although the survey predated the emergence of the Omicron variant). While the COVID-19 crisis continues to overshadow the economic outlook in many industries, businesses do feel they have adapted well. The majority of respondents (80%) think they are adequately or well-prepared for a future incident. Improving business continuity management is the main action companies are taking to make them more resilient.

The rise of natural catastrophes and climate change to third and sixth position respectively is telling, with the upward trends closely related. Recent years have shown the frequency and severity of weather events are increasing due to global warming. For 2021, global insured catastrophe losses were well in excess of $100 billion – the fourth-highest year on record. Hurricane Ida in the U.S. may have been the costliest event, but more than half of the losses came from so-called secondary perils such as floods, heavy rain, thunderstorms, tornados and even winter freezes, which can often be local but increasingly costly events. Examples included winter storm Uri in Texas, the low-pressure weather system Bernd, which triggered catastrophic flooding in Germany and Benelux countries, the heavy flooding in Zhengzhou, China, and heatwaves and bushfires in Canada and California.

Allianz Risk Barometer respondents are most concerned about climate-change-related weather events causing damage to corporate property (57%), followed by BI and supply chain impact (41%). However, respondents are also worried about managing the transition of their businesses to a low-carbon economy (36%), fulfilling complex regulation and reporting requirements and avoiding potential litigation risks for not adequately addressing climate change (34%).

Other risers and fallers in this year’s Allianz Risk Barometer:

More information on the report is available here: Allianz Risk Barometer 2022.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Rani Christie is regional head of distribution in North America for Allianz Global Corporate & Specialty (AGCS).

What if life insurers could help all policyholders with cancer live at least two years longer than they would have otherwise?

What if life insurers could help all policyholders with cancer live at least two years longer than they would have otherwise? Just imagine what that sort of breakthrough would do to how people perceive life insurance, while delivering massive gains in profitability to the insurers.

“We think that is doable, today,” Greig Woodring, the longtime CEO of RGA, told me when we talked recently about the future of life insurance and, in particular, the phenomenal potential of genomics.

Woodring, who retired as CEO in 2016 after building RGA into a giant with approximately $3.5 trillion of life reinsurance in force and assets of $89 billion, was referring specifically to what’s he’s seen through Genetic Life, a services company he’s been involved with for years. It offers a product that will pay to sequence the genome of a member’s cancer to help inform precision treatment and “provide a cancer support specialist and concierge navigation services that help them get through the disease,” he says. “We’ll also get our members into clinical trials at a much higher rate than they would if left to their own devices and steer them to the best cancer centers.”

He says the goal is “to get to the point of helping insurance companies largely eliminate cancer among their policyholders as cause of death. And right now, for most of them it’s a leading cause of death; underwriters don’t screen out cancers as well as they do, for example, cardiovascular deaths. You’ll be able to tell your policyholder base that, look, we’ll help you increase your health lifespan, at least partially, as best we can. This is a good message for a life insurance company.”

But understanding cancers more precisely and attacking them more effectively is really just the start of what we covered in the interview (whose full text you can read here). The backdrop is that the cost of sequencing a genome is plummeting, so it is becoming ever easier and cheaper to understand the genetic code of, well, everything.

While it took 13 years and billions of dollars to sequence the first human genome, finished in 2003, sequencing now costs less than $1,000 and can be done in hours. A $100 price point is in sight, based on devices under development now, and attachments are already available that let you sequence a genome using an app on your smartphone.

Combine that sort of understanding of the genetic code with the developments in the delivery of mRNA into the body that allowed for the Pfizer and Moderna COVID vaccines, and you can perhaps see the way to vaccines for cancers and many other diseases.

Artificial intelligence is speeding the progress of medicine, and at an accelerating rate. AI is, for instance, letting scientists see how proteins fold, which determines how they interact with each other. Determining how a single protein folded had until recently been too complex a problem for computers to solve and had required a complex chemical process that relied on a special type of X-ray produced by a synchrotron the size of a football stadium. The process could take a year and cost $120,000. But, in a development I wrote about here, Google’s DeepMind research arm used AI to solve the problem in late 2020 and now, within hours, can determine a protein’s folded shape more accurately than that elaborate chemical process. With the omicron variant of COVID, scientists knew from the genome what the virus looked like well before anyone could put it under an electron microscope.

AI will also help scientists and doctors understand how to use CRISPR, the near-magical gene-editing tool, to treat diseases by manipulating an individual’s genome — without causing all sorts of unintended consequences.

If it seems that I’m getting worked up about the potential of genomics here, it’s because I am. I recently published a book with two colleagues that goes into detail on how genomics will deliver nearly unlimited possibilities by 2050, so I’ve been stewing in genomics for years as we worked on the book.

If you’re interested in learning more on the subject than I’ve been able to cram into this short space, you can read an excerpt from the book here. (The excerpt includes the introduction and a chapter on climate change; the genomics material starts on p. 35.) If you’re interested in our vision for how genomics can play out, in combination with technologies in the other six areas (computing, communication, information, energy, water and transportation) where we see nearly limitless bounty by 2050 at near-zero cost, check out the book website.

Add up all the progress, and Woodring says:

“Many researchers believe, and are intensively investing money and effort, in the pursuit to extend the maximum human lifespan beyond the 100-year or 115-year mark to maybe 120 to 150. But who wants to live to 150 unless they’re healthy? So, life insurers may be well-positioned to extend the ‘healthspan’ of their policyholders. Life insurers should be concerned about the health of their policyholders more actively.”

Sign me up.

Cheers,

Paul