For many families, pregnancy and parenthood stir up uncertainty and self-doubt. When a complicated pregnancy and delivery is added to an already overwhelming life transition, it can be incredibly challenging for a new family to adjust to parenthood. A holistic and comprehensive wellness program can help expectant families thrive by developing skills to reinforce a healthy lifestyle. Perinatal wellness education contributes to a healthy pregnancy, a positive birth experience and increased confidence to help them take care of their newborn. Effective perinatal education protocols and resources are evidence-based, clinically vetted and endorsed by a credible organization.

Maternal health continues to be a priority for the U.S. government and healthcare system. It is estimated that 80% of women in the U.S. have healthy pregnancies and deliveries. However, the U.S. is experiencing a rising number of pregnancy and childbirth complications despite a decreasing number of births.

The U.S. Department of Health and Human Services (HHS) released a plan to improve maternal health in December 2020. Sadly, the study cites 2018 data showing the U.S. maternal mortality rate was 17.4 deaths per 100,000 live births. The study reports this is higher than most other developed and high-income countries.

The Rising Risks of Pregnancy and Childbirth Complications

According to the National Center for Health Statistics, the number of births for the U.S. decreased for the sixth consecutive year, dropping 4% in 2020 from 2019. This is the lowest rate since 1979. However, a BlueCross BlueShield (BCBS) study released in July 2020 highlights growing concerns with pregnancy and childbirth complications. The rising complications are associated with gestational diabetes, preeclampsia, preterm labor, cesarean deliveries and postpartum mood disorders.

Impact of Pregnancy and Childbirth on Short- and Long-Term Disability Claims

In September 2020, the International Benefits Institute (IBI) reported pregnancy and childbirth as the leading cause of short-term disability (STD) at 23% of all new claims in 2019. IBI further reported pregnancy and childbirth as the sixth-leading cause of long-term disability (LTD), with 6.8% of new claims in 2019.

In 2017, UNUM reported positive news from their data that “long-term disability claims for complicated pregnancies have decreased nearly 50% over the last decade.” Major reasons UNUM cited include early interventions to specialty care for high-risk mothers, improved prenatal education and reduced deliveries by caesarean section resulting in fewer surgical and post-operative complications.

Pregnancy Risk Growing Due to Increasing Chronic Health Conditions

BCBS conducted a major study of 1.8 million pregnancies between 2015 and 2018 among their insured population. A significant finding of this research showed an increasing number of women are experiencing pregnancy complications and childbirth complications. During the study period, there was a 32% increase in the number of women experiencing complications relating to both the pregnancy and also during childbirth.

See also: Surest Path to Healthy Prospect Pipeline

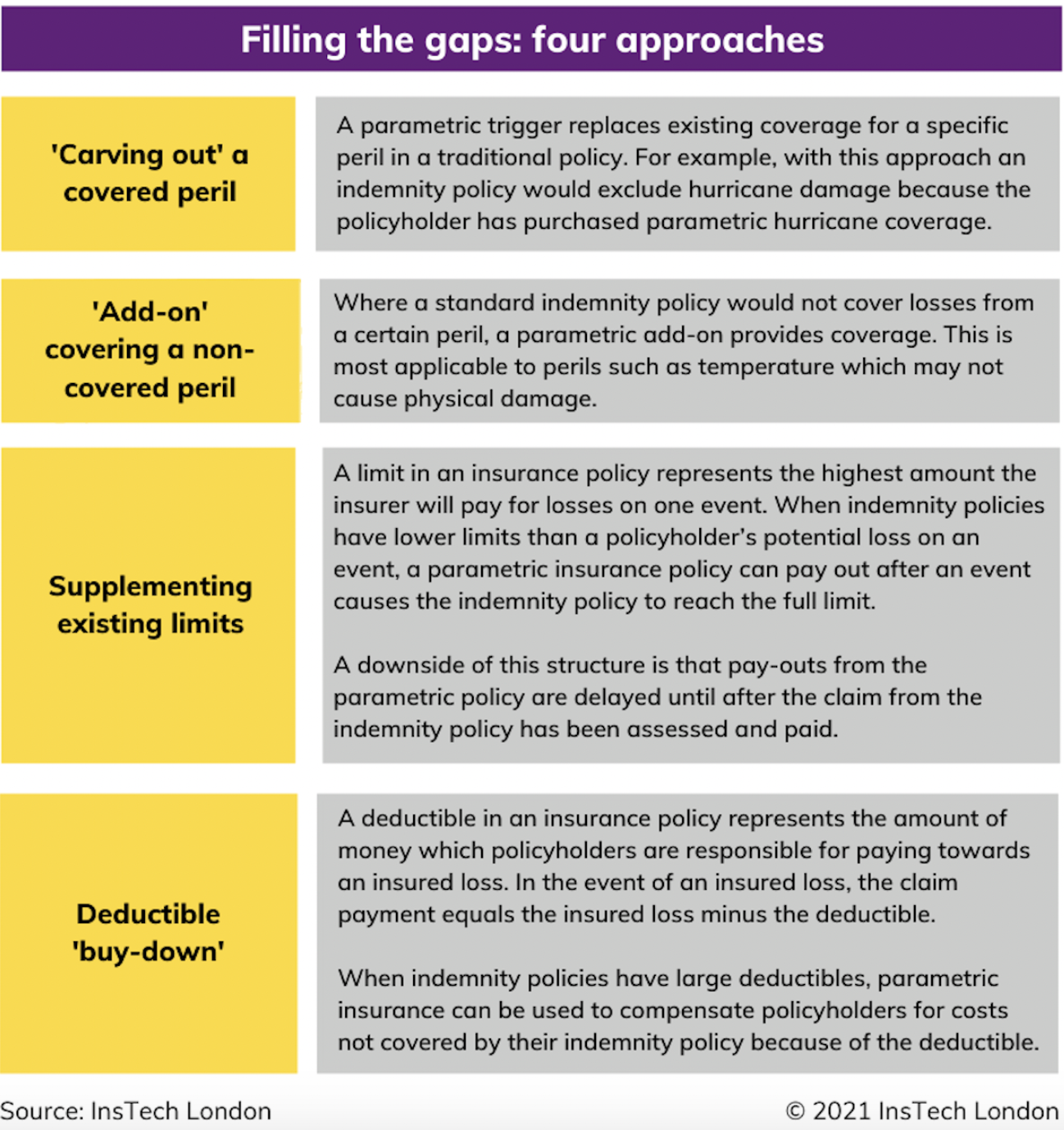

The major finding of this study determined a growing prevalence of chronic physical and behavioral health conditions before becoming pregnant. Pre-existing conditions increase the risk of pregnancy complications and childbirth complications. BCBS data revealed the largest increases were attributable to diagnosed obesity and major depression. The data table below captures the percentage increases of the major existing chronic physical and behavioral health conditions:

Exhibit 1: Prevalence of Pre-Existing Conditions Prior to Pregnancy (Rate per 100 Pregnancies)

Source: BlueCross BlueShield. Trends in Pregnancy and Childbirth Complications in the U.S. https://www.bcbs.com/the-health-of-america/reports/trends-in-pregnancy-and-childbirth-complications-in-the-us

The BCBS study further revealed the number of women diagnosed with postpartum depression (PPD) is rising. In fact, nearly one in 10 women who delivered a baby in 2018 was diagnosed with PPD. That number increased 29% from 2014. The study highlighted a relationship between PPD and pre-existing behavioral health conditions. These findings reinforce the need for perinatal education before, during and after delivery, especially with the growing reports of stress, anxiety, depression and substance misuse during the pandemic.

Although the study period predated the onset of the COVID-19 pandemic, the report included several important effects the pandemic has had in disrupting expected delivery of prenatal care. These disruptions included patients missing vital prenatal care during the first trimester, a high percentages of prenatal care sessions being skipped or shifted from in-person to virtual sessions, as well as patients completing fewer than the recommended 10 prenatal visits.

Examples of Disparities in Maternal and Infant Outcomes by Race and Ethnicity

In 2020, the CDC reported that one in 10 infants were born pre-term, meaning they were delivered before 37 weeks of pregnancy was completed. (A full-term delivery is 40 weeks gestation). However, there are racial and ethnic disparities in pre-term labor rates, especially among Black women, with 14%, compared with 9.8% for Hispanic women and 9.1% for white women.

According to HHS, pregnancy-related mortality for Black Americans and American Indian and Alaska Native women are about three and two times higher, respectively, compared with white, Asian/Pacific Islander and Hispanic women. According to the National Vital Statistics Report, infant mortality has declined 17% since 1995 in the U.S., and 2018 marked the lowest mark of infant mortality ever at 5.67 per 100,000 live births.

However, higher infant mortality rates are another area of racial and ethnicity disparity relating to pregnancy as reported by the CDC for 2018:

The Importance of Perinatal Education to Reduce Pregnancy and Childbirth Complications

More expectant mothers are using the internet, social media and smart phone apps to seek information about pregnancy and infant care. There is concern that mothers are missing a full spectrum of information when they are only looking at parts and not the whole. For example, they may only focus on the development stages of the fetus but miss exercise and nutrition recommendations. Likewise, they could be concerned about gestational diabetes and overlook hypertension or cardiovascular risk factors.

And with all the incomplete or misguided information available today, expectant parents are not sure what to expect, what advice to follow or what information to believe. It is natural for them to feel anxious. With an online comprehensive perinatal wellness program, expectant families get everything they need, not just pieces of a puzzle. They get an entire roadmap for maternal, infant and family health. Ideally, a perinatal program should have an online community (unconnected to social media) that is moderated by a team of clinicians to prevent misguided information and to keep things focused and private within the group. The platform should be HIPPA-compliant, secure, and encrypted.

5 Ways Perinatal Education Is a Strategic Workplace Employee Benefit

Comprehensive perinatal education helps employers address at least five related opportunities:

1. Human Resources Talent Recruitment and Retention

During the war on talent due to the shrinking workforce, employers are increasingly focused on ensuring benefit offerings are viewed favorably as competitive and best in class. Employees are seeking innovative health and wellness benefits focused on improving their personal lifestyle. Such programs help shape the perception of the company as an employer of choice.

2. Organizational Culture Focused on Diversity, Equity, Inclusion and Belonging (D/E/I/B)

Perinatal education can be an effective tool for employers to address D/E/I/B among their employees. An effective perinatal education platform levels the playing field among sub-populations of employees by addressing existing inequities in health outcomes among high-risk populations. As companies increase the use of employee resource groups, greater emphasis is being given to starting new mothers groups and expanding parent mentoring programs.

3. Removing Barriers and Improving Access to Care

An effective strategy being used by employers is requesting employee assistance programs (EAPs) to embed perinatal wellness education for expectant mothers and parents as an employee benefit. This is an excellent way for employers to increase use of their existing EAP by improving access to care and moving behavioral health upstream toward earlier interventions.

4. Risk-Reduction Strategy

Perinatal education programs serve as a risk-reduction method by improving preventive screening. Early interventions for smoking cessation, high blood pressure, obesity and weight management, gestational diabetes, depression and substance use disorders improve maternal health and reduce risks of pregnancy complications. Risk reduction is especially important in populations experiencing health disparities.

5. Healthcare Cost Containment

Perinatal education programs are effective at achieving healthcare cost containment by promoting both stay at work and return to work by teaching healthy prevention techniques. The reduction of complications in pregnancy and childbirth result in significantly reduced healthcare expenditures. For example, the BCBS data revealed “pregnancy complications increase the average cost of a vaginal delivery by 16% and a C-section delivery by 18%, while childbirth complications increase the average cost of these deliveries by 63% and 52% respectively.”

See also: 2022 Will Challenge Health Insurers

Conclusion

Offering comprehensive perinatal wellness education is an important employee benefit strategy. Perinatal wellness can address a broad range of organizational and cultural objectives. At the same time, such programs offer a low cost and potentially high return on investment by targeting risk reduction and cost containment.

Data shows the human capital and financial stakes of complications in pregnancy and childbirth have risen. Thinking about the multiplier impact of the pandemic on these data trends is concerning. Now is the time to consider investing in a comprehensive perinatal educational program to coach expectant mothers to adopt lifestyle choices to reduce chronic health conditions contributing to pregnancy and childbirth complications.