To the max. As much as possible. To the utmost extreme.

All of these define the term “nth degree.” As a math major, I know the term has roots in mathematics, where "nth degree" equations and roots have been around for decades. How does this apply to insurance?

The digital era of insurance is accelerating and shifting the business landscape. The digital era has put new technologies, data and capabilities in the hands of business leaders – offering them the opportunity to transform their business and customer experiences.

But an even more powerful transformation is in insurers’ market reach with the power of multi- and digi-channel partner ecosystems!

Buying vs. Selling

Generally, today’s insurance process is difficult, lacks transparency and is complex and often time-consuming. In contrast, many insurtechs and existing insurer innovations are refocusing to a “buying” over “selling” approach --- through a multi-channel strategy that meets customers where and when they want to buy.

If distribution channels are easy to use with products that are easy to understand, then insurance has the opportunity to grow through friction-free, multi-channel distribution.

With the increasing competitive challenges to attract and retain customers, insurers must develop and use a broader distribution ecosystem that engages customers when and how they want … putting them first. A distribution ecosystem can rapidly reach more markets, potential customers and current customers with more purchase and service options by tapping into a growing array of channels beyond the traditional agent/broker channel. Distribution ecosystems provide new access avenues, capabilities and services that create the nth-degree impact – both for customers and insurers.

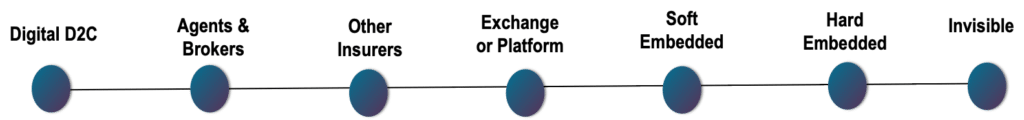

Simply put, this range of channels includes direct-to-customer, agent/broker, other insurers (for products you want to offer your customers), marketplace exchange or platform and embedded --- provided across a range of soft, hard or invisible embedded partnerships as depicted below.

Together, this spectrum of channels represents the new multi- and digi-channel ecosystem for the digital era of insurance.

Multi- and Digi-Channel Ecosystems — Foundation of the Nth Degree

To compete for the next generation of buyers – millennials and Gen Z -- let alone retain today’s Gen X and Boomers, insurers must be a part of and offer a range of distribution channels with which they interact, transact and integrate, to offer customers innovative, optimized solutions.

In our 2020 customer research on auto and life insurance, we found younger generations are open to buying insurance from a wide array of channel options, including:

- For life insurance, they are 33% more open to new channels than older generations.

- The preference gap between new and traditional channels is large for older generations – nearly 50% – as compared with only 21% for Gen Z and millennials. So, customers are much more open to different, new channels – creating an opportunity for growth.

- The younger generation is twice as likely to buy auto insurance from a car shopping website or a vehicle manufacturer website or have it included in the purchase or lease of a vehicle.

- Millennials and Gen Z are open to buying insurance from Big Tech like Amazon, Apple and Google.

Insurers looking to compete are ill-equipped to do it alone. They must create an ecosystem of connected channels, using a range of digital capabilities to connect with customers when and how they want.

Let’s face it…. we all interact with a wide array of different entities, businesses and individuals on a regular basis. Many of these entities have earned our loyalty and trust, providing a platform for future engagement. Many of these are now becoming channels for insurance --- GM, SoFi, Ford, Petco, Airbnb, Uber, Intuit and more. At the same time, we are seeing partnerships form within the insurance industry --- insurers selling each other’s products, leveraging new marketplaces to expand reach and strengthening the traditional agent/broker channel with new digital capabilities.

Together, the partnerships represent a powerful distribution ecosystem that places insurance directly in the path of a customer’s life journey events, where insurance is relevant and needed. Ecosystems provide a greater impact on sales because they are an “outside” customer approach instead of an “inside” product/process approach. This is the shift from selling to buying that is so crucial to today’s insurer growth. It’s an approach that naturally reduces infrastructure, operational and capital expenditures at the same time that it brings in more business with less effort.

However, in our joint research with PIMA last year, we found that of the wide array of 34 channel options, only 18% (or 6 of the 34) are being planned -- reflecting a very narrow view of channels that significantly limit reach and revenue opportunities and create a wide-open field for those who dare to be creative in establishing a multi- and digi-channel partner ecosystem.

Next-Gen-Multi- and Digi-Channel-Gen Leaders

Who is taking advantage of this wide-open field, becoming next-gen multi- and digi-channel leaders? Some are starting in other financial services areas first (which provides insights to broader opportunities) while others are directly entering insurance. But they are all vying for the next-generation customer!

Outdoorsy + Roamly — Online recreational vehicle rental and outdoor travel business Outdoorsy said it is partnering with insurtech Roamly to provide insurance for RVs, travel trailers or campervans. With Roamly, commercial and personal policy owners can safely rent their RV, trailer or camper on marketplaces like Outdoorsy without losing coverage or worrying about loopholes.

SoFi, Ladder Life, Lemonade and Gabi — One of the best examples of a company looking at the customer across life, health, wealth and wellness is SoFi, a fintech organization – under SoFi Protect. SoFi started out as a student loan consolidator and provider and has rapidly expanded to owning the entire customer financial services relationship – life, wealth, health and wellness. The original focus on student loans has been capturing the next generation of customers – millennials, Gen Z and eventually Gen Y. SoFi now has over one million members and 7.5 million contacts, where members may represent family units. The company created “vaults” for customers to use for saving and spending, for categories like insurance, taxes, travel, house, emergency fund, etc. and offer insurance through an ecosystem of partners, including Ladder Life for life insurance, Lemonade for renters or homeowners insurance and Gabi for auto insurance.

State Farm and Ford — State Farm announced a partnership with Ford for usage-based insurance (UBI) using the auto telematics and connected data from eligible, connected Ford vehicles. Ford vehicle owners will be able to opt in to State Farm’s Drive Safe & Save program, which aligns premium to miles driven while also rewarding safe and good driving behavior with potential discounts.

John Hancock and Amazon — John Hancock announced the integration of its Vitality Program with Amazon Halo, allowing Hancock’s Vitality customers to use the Amazon Halo Band to earn Vitality points based on their daily efforts for a healthier lifestyle that should mean a longer life. The Amazon Halo Band, a wearable health and wellness device, will measure and analyze users’ activity, heart rate, sleep and tone of voice to provide individual health insights and help encourage healthier habits – thereby earning Vitality points.

Google, Allianz and Munich Re — Google is partnering with these two global insurers to cover cyber breaches and related risks for client businesses that use Google’s cloud services.

The Guarantors and Property Management Companies — The Guarantors is a fintech company providing innovative insurance products and financial solutions for residential and commercial real estate professionals as well as their residents and tenants. The goal is to be the most trusted “go-to” brand for insurance and financial solutions throughout the real estate industry.

Chubb — Launched Chubb Studio “digital insurance in a box.” Partners can access their products, services and claims digitally and integrate what they do into what the partner does – embedded insurance. Initial products offered include: health and well-being, home contents, gadgets, travel and small businesses.

And on the horizon are more companies whose first focus is financial services (such as banking) but that will be well-positioned to offer and provide insurance. The companies also have the motivation. With low interest rates and increased competition from digital leaders, banks need to grow their service portfolios. Consider their customer bases and the impact if they move into insurance.

Verizon — While fintechs globally have been vying for the next generation of banking customers by offering them custom accounts when they turn 18, Verizon has jumped into the game by offering mobile banking with a checking account for the younger generation. The new tool, called Family Money, has two options -- monitorable checking for parents to observe and track what their children are paying for and a “savings vault” account with real-time alerts, rules, spending limits and locks. Verizon uses Galileo for the application programming interface (API) and payment processing platform and are offering bank accounts and a prepaid Visa card through Metropolitan Commercial Bank.

Google — Similar to Verizon, the company is vying for the customer relationship. Google’s “Plex” accounts are a mobile-first checking and savings account directly integrated into the Google Pay app. The company is partnering with about 10 financial institutions, ranging from big national banks to regional banks and credit unions, and customers will be able to choose which one they want.

Walgreens — Walgreens is launching a bank account in partnership with MetaBank, inclusive of a debit card, as a way to complement its current services and enhance its loyalty program and customer personalization.

H&R Block — H&R Block, in partnership with MetaBank, is offering an Emerald Prepaid Mastercard account that will do more than accept tax refunds loaded onto it, including allowing customers to withdraw cash, pay bills and perform other money management tasks.

Each of these have been dabbling in insurance, and these efforts are further evidence of their customer strategies.

Distribution Partner Ecosystems — Go to the Nth Degree

Market leaders and competitive market position in the future will be how insurers create distribution partner ecosystems that leverage their strengths and embrace partners to fill gaps and expand market reach. It’s all about the multiples!

In our 2021 Strategic Priorities research, we found that insurers with new products are blowing away their traditional product counterparts in leveraging partnerships and ecosystems across many different areas of the distribution spectrum noted previously. Unfortunately, too many insurers seem stuck in their traditional channels rather than expanding channel choice and reach, meeting the customer where and when they want.

We see big bets being made in new business models, products and services from fintech, insurtech and incumbent insurers that are focused on capturing customers when and where they want through a broader market network of partners. But the challenge for those not embracing a distribution partner ecosystem is that they will have decreasing opportunities for partnerships the longer they wait, limiting their market reach and growth opportunities as a new generation of buyers increasingly turns to alternative channels.

The question is… are you ready and willing to take your distribution strategy to the max… to the nth degree? Your customers are waiting.