Traditionally, preferred provider networks take a one-size-fits-all approach, building broad networks of providers to serve a wide range of needs. However, that approach isn’t ideal for every organization. As the industry shifts to a more holistic approach to managing claims, a tailored approach to provider networks, from medical care to ancillary services, is a smarter solution for many payers.

It’s time to examine what injured workers need from their providers, which providers deliver the best outcomes and how a customized network supports the organization’s goals. Leveraging technology to analyze claims data gives the insight to curate a network of providers that matches the requirements of each unique organization.

The Shift to Custom Network Solutions

As the workers’ compensation sector adopts a more patient-centered care model for injured workers, the approach to developing provider networks is changing. Instead of asking, “how many providers can fit in the network?” the question is now, “how many providers in this network can deliver the outcomes our clients require?” It is important to select providers near where injured employees live and work, but an optimized provider network takes a deeper dive into the types of medical care needed for the most common work-related injuries. It is also crucial to identify the providers that produce the best medical outcomes by evaluating the appropriateness of their medical decisions, their ability to engage patients in recovery and their focus on treating the whole patient.

These tailored preferred provider organizations (PPOs) may include specialized physicians for common injuries, diverse office locations, access to remote care, educational or translation services, mental health options and ancillary services. With ancillary services making up an average of 30% of total medical expense, a complete range of ancillary service providers should go through the same vetting process as physicians and physician specialists. These services include physical therapy, durable medical equipment, diagnostic imaging, home health, transportation and translation assistance.

See also: Highlights on New Workers’ Comp Rules

Listening to the Data for Network Development

Today, data analytics is being leveraged to create tailored provider networks. The geographic location of businesses and employees, and details of the nature and severity of injuries, provide insight into the needs of a patient population and the types of services that should be included in the network. Comparing data on diagnosis code, time to initial treatment, total duration of care, total cost of the claim and return-to-work days with industry guidelines allows organizations to assess individual providers and adjust the network to reach performance goals.

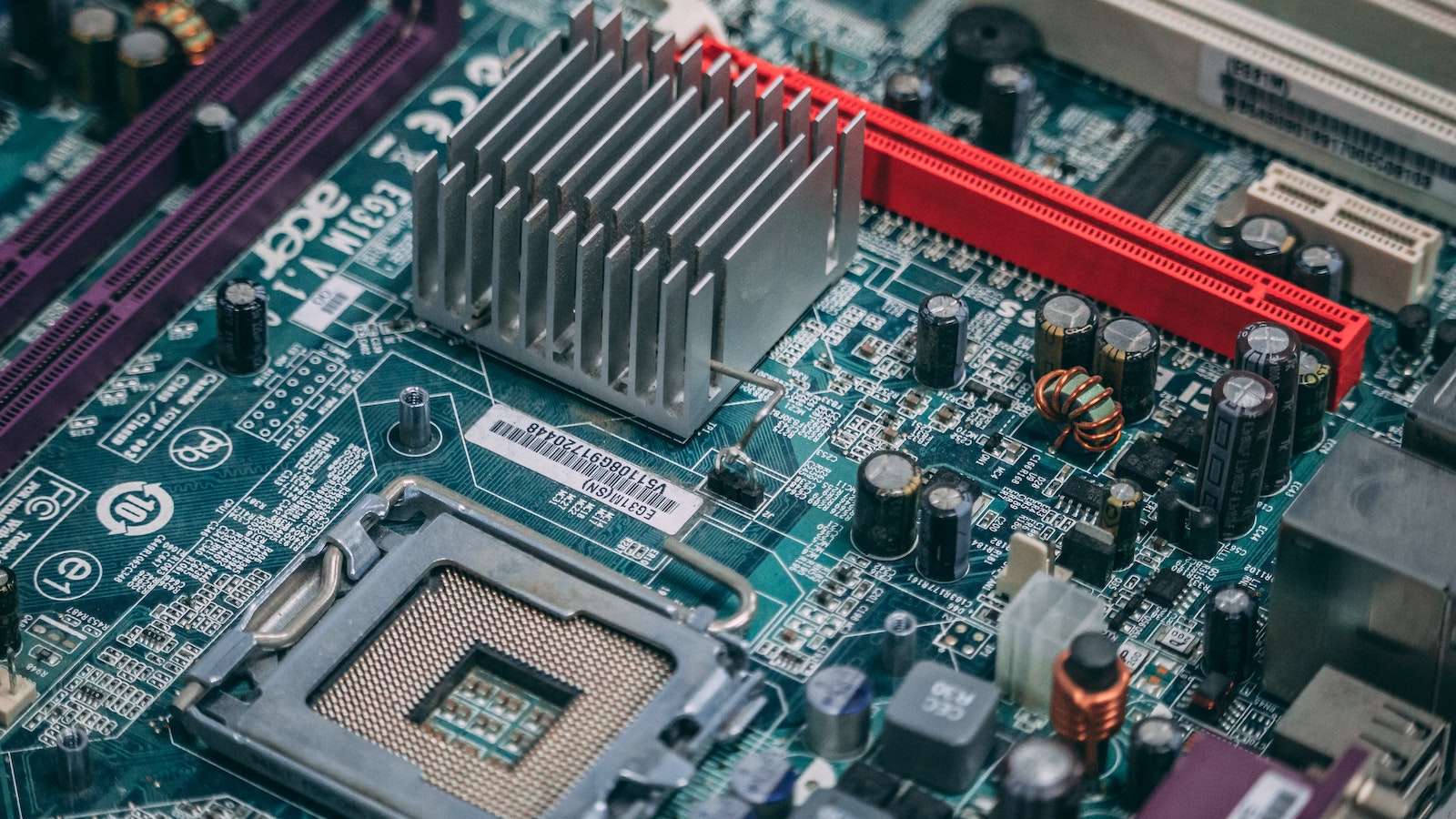

Technology also connects providers to patients through telehealth, improving access and outcomes by delivering care quickly and conveniently. Patients who have difficulty getting to appointments due to distance, transportation or scheduling issues experience delays in treatment and longer claims. Virtual care can close this gap with connectivity from the initial report of injury, to physical therapy and cognitive behavioral therapy, to the delivery of prescriptions and durable medical equipment. Integrated portals link providers for greater visibility and real-time access to information, while frequent touchpoints ensure efficient care and appropriate utilization.

Developments in machine learning and AI-driven technology constantly improve methods for gathering, storing and analyzing data on claims processing and compliance reporting. This data continually informs decisions about network development and management. With assistance from technology and codified data, tailored network solutions are monitored and refreshed to ensure that care options remain current and that the claims process flows seamlessly from beginning to end.

Improved results are a testament to the value of customized, technology-driven networks. Research has shown that networks leveraging these technologies have 30% greater data accuracy, an average of 80% network utilization and a 43% decrease in medical costs.

Customized Networks Deliver Tangible Results

Using advanced technology to create tailored PPOs improves outcomes while delivering significant savings. Companies with custom provider networks experience 50% shorter treatment duration, nearly 60% lower average medical expense and 35% shorter claim duration. For ancillary services, CorVel’s tailored approach results in 21% lower average physical therapy (PT) claims, 32% lower average visits per PT claim and 21% lower total PT costs compared with other providers. Expenses for durable medical equipment are even 40% lower per claim than competitors'.

With the right provider network, patients receive the care they need and return to health more quickly. A holistic network model offers the best value for employers, insurers and everyone else involved.