It has been a long time since I took chemistry as a pre-med student in college – yes I was pre-med before switching to a math and computer science major! I loved science, and I remember the experience. I can’t recall many of the formulas or compounds. But I remember the labs – especially the all-night ones. I remember mixing chemicals, and I remember the role of the catalyst. No matter what you had in the tube or the beaker, we always had to watch out when we added the catalyst. It was the game changer. It was the one that could set the classroom on fire. The catalyst took all of the primary chemicals and created a quicker reaction. Poof.

A catalyst accelerates a chemical process without itself being affected. If you think about it, COVID-19 has acted as a sort of digital demand catalyst.

In an earlier blog, we talked about reading the signs of what is to come in the life insurance industry, and we talked about connecting the dots. If we look at the trends closely, we can make out a picture of where the life insurance industry seems to be headed. Too much is changing not to notice. COVID-19 has added an extra variable – a catalyst – that has accelerated and pushed insurance to the point of reaction.

No test scenarios could have accomplished what COVID has accomplished in seven short months. In fact, Microsoft CEO Satya Nadella stated in April, “We’ve seen two years’ worth of digital transformation in two months.” COVID has compressed time frames for digital utilization as it has ignited a rush for digital capabilities. It is speeding up a demographic and customer engagement shift. That is a catalyst!

We have not seen such a rapid shift like this in our lifetime, one that will demand core systems that will adapt to customer needs and behaviors – moving between jobs regularly, seeking on-demand offerings, looking for value-added services, buying benefits that can port to individual insurance and full digital engagement. These trends are tied to the new dominant insurance buyer of the digital era.

Who are the new dominant insurance buyers? How will they change the nature of insurance?

In Majesco’s latest thought-leadership report, Rethinking Life Insurance: From a Transaction to a Life, Health, Wealth and Wellness Customer Experience, we use our recent consumer survey to paint a picture of this dominant insurance buyer as we chart the similarities and differences between demographic groups. For the purposes of our reporting, we place the segments into two large “super segments.” Gen X and Boomers fit into one segment – the older generation that has been the foundation of growth for 50-plus years. And the younger segment -- Gen Z and millennials, who represent the next generation of buyers and who expect digital-first engagement, products and business models.

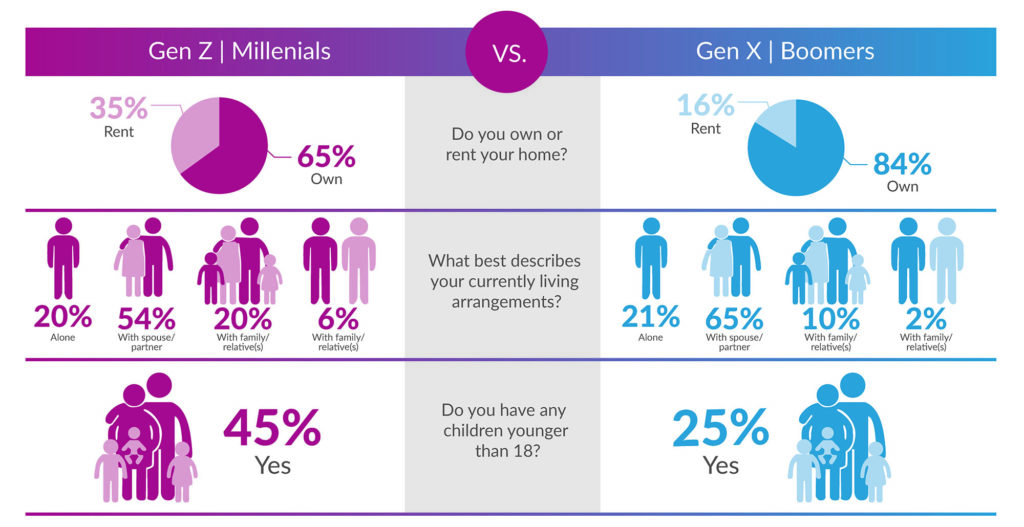

Some interesting insights regarding the younger generation set the stage for a different view on expectations and engagement. Currently, the younger generation rents at twice the rate of the older generation and is two times more likely to live with parents/family or friends/roommates, as seen in Figure 1. However, the younger generation is also 80% more likely to have children under 18 in their household. Yet, they represent a strong segment increasingly ready for insurance as they form new households and raise their families, replacing the older generation as the coveted insurance buying segment.

Figure 1: Demographic profiles of the generational super segments

These segments identify how insurance’s dominant buyers are changing, particularly their expectations, usage and perception of life insurance. The urgency of adapting to millennials and Gen Z is reaching a tipping point. Next year, millennials will overtake the older generation. And by 2025, the combined Gen Z and millennial generations will dominate the 30- to 60-year-old sweet spot for insurance — a complete flip in dominance in the next five years.

Insurers unprepared for this new dominant insurance buyer and their extremely different needs and behaviors will increasingly find they are no longer relevant.

See also: Reigniting Growth in U.S. Life Insurance

Opportunity Within the Dominant Market

As we have been pointing out recently in our webinars and blogs, insurance’s focal shift from transactions to experiences is going to result in a wide range of growth opportunities. The younger generation seems to understand the value of insurance and wants it. However, they expect something that is personalized to them. To get this, they are more willing to share personal data like health and exercise data (including in real time) to underwrite their policy. They want services. And they expect a seamless, digital process.

You may not realize it yet, but this is the generation we’ve all been waiting for! The only drawback is the lack of preparedness and the swiftness with which this is unfolding…now accelerated by COVID-19.

While L&A insurers needed to operationally improve prior to COVID-19, they are now more pressured to do so, both during and after the crisis. The pandemic is rapidly exposing less-than-desirable customer experiences, as insurers deal with paper-bound processes, non-digital post-service transactions, a rise in “fluidless” online life insurance purchases through new competitors and the need for extra caution due to fraud. At the same time, risks have emerged that demand new products such as “pay gap” for employees unable to work during a shutdown, various health products and simple life coverages – either as individual products or voluntary benefits.

To retain the customer and revenue, insurers must rethink their scope away from a life insurance transaction to a broader lifestyle experience across health, wealth and wellness that includes:

- Insurance Product: Product (risk, services, experience) redefined but requires insurance to participate and play within ecosystems, rather than simply existing as a product unto itself.

- Lifestyle - Health, Wealth and Wellness: A unified view to cover all aspects of life from health, wealth and wellness for banking, insurance, wellness activities, brokerage account 401K accounts and more, in a holistic way instead of separate transactions or policies for each.

- Services: Provide services such as wellness discounts, preferred access to gym memberships and access to online brokerage accounts that provide a powerful, single engagement, eliminating points of friction between the different participants of the ecosystem.

- Continuous and Fluidless Underwriting: Constantly updating the risk profile of an individual or thing that changes the terms and pricing that are influenced by the continuous flow of data and use of the data to avoid fluid-based underwriting for a range of life insurance products.

Highly networked, data-driven business models are emerging, within and outside of insurance. They are redefining the customer journey, and the entire customer relationship, across a broader set of health, wealth and wellness options.

The viability of the insurance industry is vitally connected to demographic and market trends, customers’ expectations and their adoption of new technologies. The combination of these factors will pressure the insurance industry to develop products and services that are more affordable, tailored to very specific needs, digital-first, simpler and grounded in trust that not only protect lives but also enhance those lives across a wide array of areas beyond insurance, as reflected in Figure 2. They will also be looking for consolidation. “Can I meet more than one need with this one relationship?”

Customers will expect a different experience that brings solutions to all of these needs together.

Figure 2: Elements of a holistic lifestyle ecosystem

Protecting Themselves and Their Lifestyles

Numerous research studies, including our own primary consumer and SMB research, have highlighted customers’ view that insurance is complex and difficult and unpleasant to deal with. From the multi-page, fluid-oriented applications to the multi-page contracts full of confusing legal terms and exclusions and a variety of different riders, traditional broad policies exacerbate the problem. Understanding what is covered and how much can be like a maze, where the “truth” is difficult to determine, creating frustration and lack of trust.

In contrast, newer coverage options remove complexity, because they are simple, specific coverages for specific needs and time frames. Simplification of the life insurance process and policy has been a major focus of startups like Ladder Life, Haven Life, Bestow, Fabric, Health IQ and others – driving their growth and loyalty with customers. But simplification may also mean a broader approach.

As we mentioned in our recent blogs on mobility ecosystems, organizations are expanding their brands to offer simplicity through tools that meet multiple needs at once. With life insurers, this kind of ecosystem will begin to look much more like a comprehensive life, health and lifestyle management process. Insurance will always be a part of it. The experience created by the insurer, however, might look dramatically expanded and radically simplified. The result will be straightforward – insurers will be contributing, not just to the security of individuals and families, but to holistic life improvement.

Connecting to Better Life, Health and Wellness

Technologies like IoT and wearables have rapidly matured from emerging technologies over the past five years. Fitness trackers and other connected wearables are becoming important connections and hubs for new ecosystems that provide value-added services or insights for people to manage their health and wellness. A 2018 study commissioned by Vitality found that adults who used fitness trackers tied into a rewards scheme could add two years of life expectancy, on average.

Scientists and tech companies are realizing the potential of these devices beyond their original fitness tracker role to predict possible adverse health conditions, including COVID-19. In the 2020 Innovation in Insurance Awards sponsored by Efma and Accenture, a submission by PZU in Poland used a wearable device to measure oxygen and pulse in real time to reduce transfer infections of COVID to medical staff in hospitals.

Michael Snyder, chair of genetics at Stanford School of Medicine, noted that smartwatches and other similar connected devices make at least 250,000 individual measurements a day. This continuous stream of data, fed into powerful predictive algorithms, can be more effective than traditional methods at detecting health issues. For example, Scripps Research Institute found that changes in heart rate caused by an infection can get detected four days before a conventional temperature check detects a fever. Recognizing the health and wellness potential of these devices, Apple has been researching how its watch can be used to detect heart problems, and Fitbit is conducting 500 research studies on issues like cancer, diabetes and respiratory conditions.

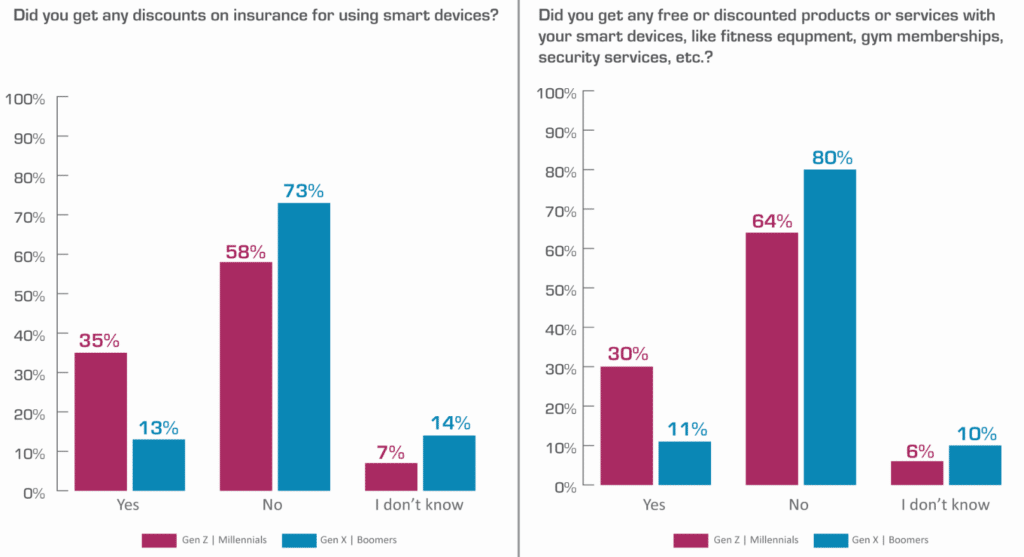

These innovations fit the younger generation. Gen Z and millennials who own a connected device are nearly three times more likely to say they received an insurance discount or free/discounted products or services as part of the device as reflected in Figure 3. Whether these discounts are real or perceived, it’s clear that the younger generation wants a stronger connection between these devices and related products and services – an example of ecosystem thinking. Just as these generations grew up with digital technology as a defining factor of their youth, ecosystem engagement is a defining influence on their behaviors and expectations (just look at Apple and Amazon engagement) as they become the dominant buyers of products and services to protect life, health and wealth.

Figure 3: Discounts and benefits bundled with smart devices

But the use of these devices is not just for wearables; it extends to home IoT as well, offering an opportunity to create a bridge from P&C and home security into home health and wellness. As health awareness technologies arise, IoT home devices can add value to those who choose to age in place, creating an all-in-one connected home and health offering.

See also: Will COVID-19 Spur Life Insurance Sales?

So, if we follow the digital thread properly, the same capabilities that are desired by the younger generation are going to be used to assist the older generations with their health, security and lifestyle during retirement. With more than 10,000 Baby Boomers retiring each day, this is a huge market opportunity. Life insurance’s “new occupation” may be far broader and far more helpful than insurers had ever imagined. In targeting millennials, insurers may find themselves better prepared to meet the needs of all generations.

The Mood to Move

Motivation is the key to insurance sales. Is the new dominant generation motivated to seek life insurance, and are our sales processes advanced enough to capture them at the point of need?