Today, health plans (also referred to as payers) are busier than ever. They strive to deliver efficiency, great customer and stakeholder experiences and improve care outcomes. To do this, they need to use more data, and they have much data at their disposal. But what are they missing?

They can be missing key patient information; that is, they don’t see the whole picture. The insurance industry is no stranger to data gathering, coding, tagging, analyzing. In addition to a long history with data, in the recent decade or two the industry has seriously upped its game in terms of converting legacy data to newer usable forms and has upgraded systems to establish true master data management infrastructure (whether in-sourced or in/out-sourced). We have even seen a flurry of third-party data use and the occasional implementation of new ways to digitize unstructured data. All of this is here to stay, which is good for data purveyors, health plan analysts and application developers and for the business of cost management and reimbursement. Providers and patients alike will benefit.

But the challenge remains: Health plans can’t keep up with everything all the time. And they cannot use all of the data as thoroughly as they want to.

I advise health plans to take stock of their needs and assess whether current data sources will get you where you need to go. If not, additional patient level data — identified or de-identified — from a new outside source could very well be in order.

Let’s review some of the cases where a health plan could tap into some of the available ecosystems to solve key challenges.

Data Efforts Are Getting Budget Dollars

In 2016/17, it was estimated that the life and health insurance industry spent over $3.5 billion on marketing and advertising activities. (Estimate is compiled from more than one source and may include some commission payments).

On top of this, according to Novarica, Gartner and other watchers, the industry plans to spend hundreds of millions of dollars a year through the 2020s on data and analytics talent, technical infrastructure that supports AI and machine learning, advancements in digital capabilities and modeling, as well as improving content and communication management systems. Throughout, every functional department of a health plan will seek data-driven understanding and confidence.

Sample Payer buckets illustrated below:

Large Payers (Top 10): In-house data management leaders and large-scale analytics teams at large payers often can be funded to focus on select hot topics of the day, and sometimes they build things themselves. The opportunity for larger payers is to acquire an assortment of sample datasets in the size and with necessary permissions so they can focus on what they are good at: the analytics, evaluation of new product designs, improvement to sales plans, sales enablement and sales effectiveness, negotiating network contracts (think value-based care) and delivery of care.

Next 100 Payers: While these payers have smaller in-house tech and analytics teams, they can still have resources in terms of staff and dollars to spend on services or data. They might find it very useful for a fixed amount of time to engage third-party data sources so they don’t have to commit to hire permanent staff. I have seen many engage analytics expertise to go with it, or buy/license just the data.

The rest of the market: As we move to smaller, regional or independent health plans, often I see that they have small in-house teams dedicated to data management and small teams dedicated to analytics. (A team might be as small as two or three persons.) It is not uncommon that they outsource part of their data management and data analytics capabilities. They tend to have more updated technology platforms and can easily acquire third-party data on demand, plugging it in quickly, to complement their curated internal data sets.

See also: Overcoming Human Biases via Data

Use Cases Abound

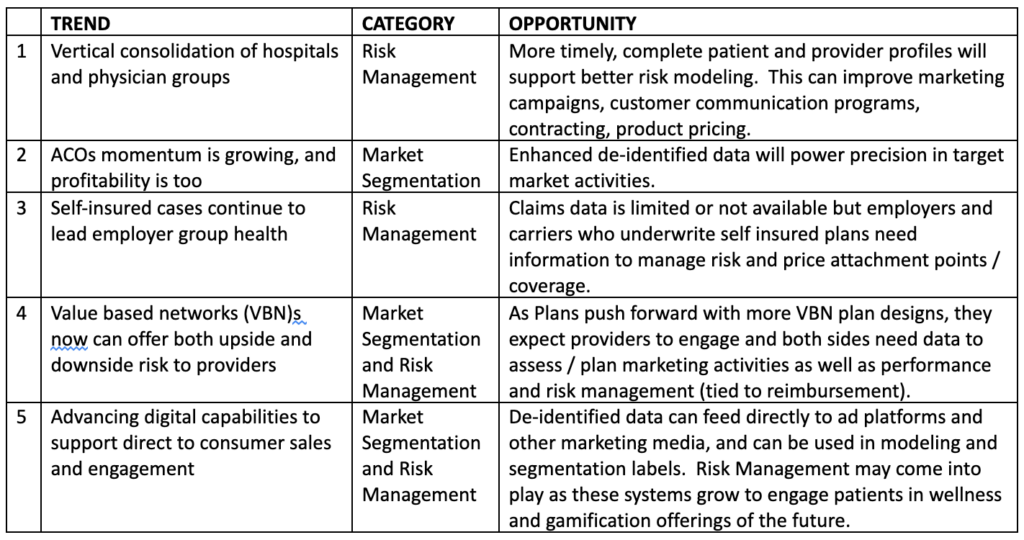

In general, richer patient-level data can help health plans address needs in two big categories: market segmentation and risk management. Below are market trends that drive needs in these categories, with an opinion as to where the opportunity lies for helping plans address them. Please share your thoughts with me in the comments section below.