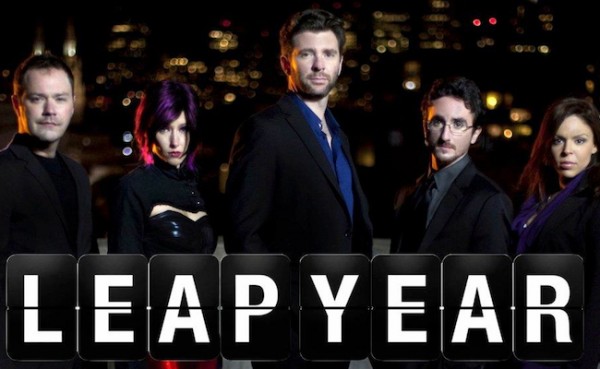

In this episode of the small business series Leap Year, rumored layoffs overshadow Aaron's surprise 30th birthday party as Jack tries to convince his friends and fellow coworkers Olivia and, Aaron's brother, Derek that being laid-off could be an entrepreneurial blessing in disguise.|

Season Two of Hiscox's award-winning

small business series Leap Year begins on June 18, 2012. Take the time now to start catching up on Season One. In this episode, rumored layoffs overshadow Aaron's surprise 30th birthday party as Jack tries to convince his friends and fellow coworkers Olivia and, Aaron's brother, Derek that being laid-off could be an entrepreneurial blessing in disguise.

Hiscox Commentary on Small Business Insurance

Layoffs can be painful and are never welcome, but they're also one of the main spurs that prompt people to start their own small business. Many "take the leap" and turn a moment of uncertainty into opportunity to pursue their dreams and become their own boss. But starting your own business doesn't have to be the all-in bet that some people imagine. Understanding your risks and protecting yourself with the right small business insurance can help you limit your downside and protect your other assets, like your house and your savings.

Whatever your reason for launching your own business, one way to make the start up experience less intimidating is having the security of liability insurance protection such as professional liability insurance (errors and omissions insurance), and general liability insurance tailored to your business. Clients might become dissatisfied, and some mistakes are inevitable no matter how much attention you pay to the details. Having the right coverage can help create the safety net you need to start out on your own.

In a 2011 Hiscox Small Business Survey, almost three quarters of small business executives (72 percent) agreed that a small business should have insurance from the moment it's launched. However, getting small business insurance is useful only to the extent that it is covering the risks specific to your business, and at the right price. Start ups need to be sure they get the most out of every dollar they spend. A good insurance company will be there with protection and support to help you move forward and achieve your dreams.