Since 2019, several casualty lines of business have shown a consistent pattern of adverse development through year-end 2024. Preliminary third-quarter 2025 disclosures signal that this trend is not yet reversing. The underlying experience, however, differs significantly by line and by carrier. This article focuses on where and why reserve shortfalls are occurring. We also provide some high-level suggestions to adjust actuarial methods for more adequate reserves.

Using Annual Statement data from S&P Global Market Intelligence, we examined:

- Commercial auto liability (industrywide), and

- Other liability—occurrence experience for 20 writers concentrating on excess or umbrella coverage.

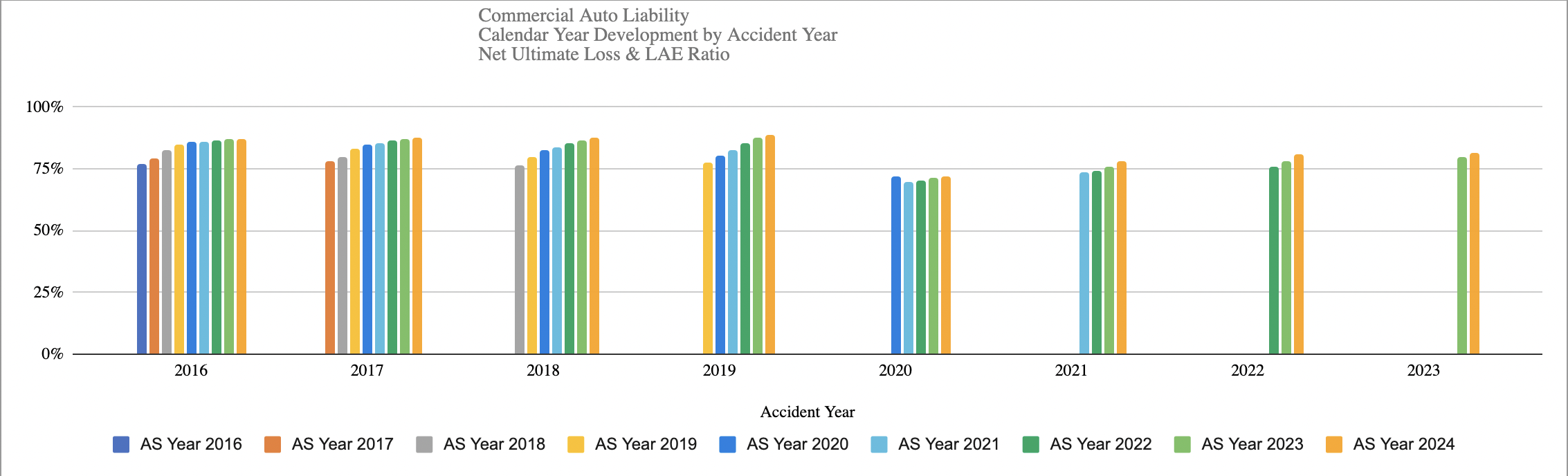

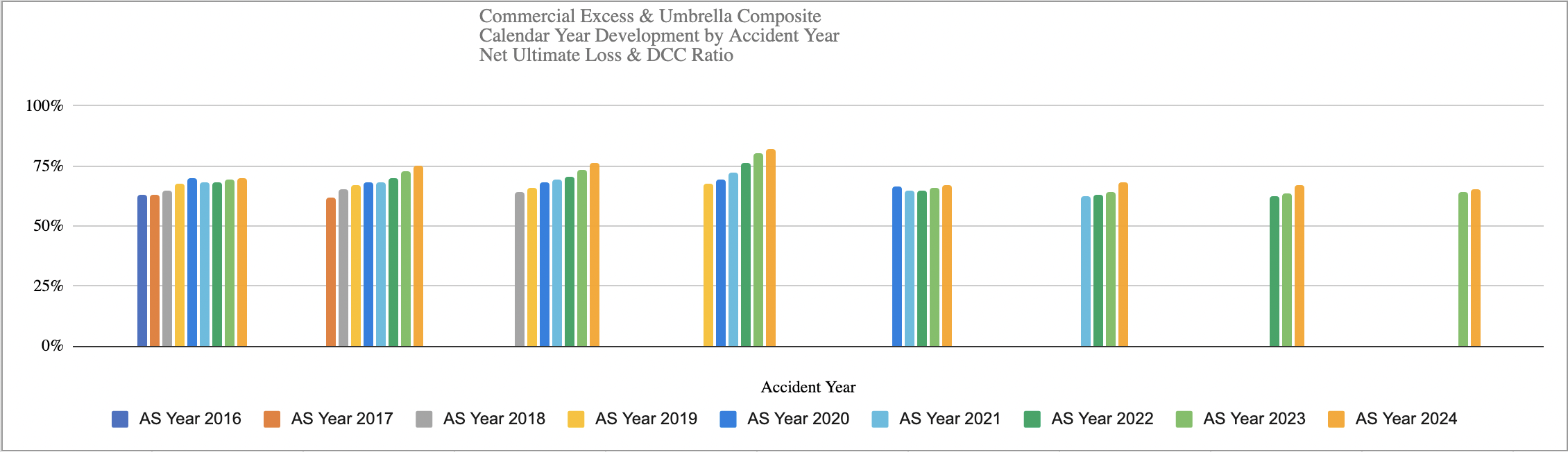

Across accident years 2016–2024, published ultimate loss ratios have increased almost every calendar year. With the benefit of hindsight, initial and subsequent reserves were inadequate.

From Annual Statement data via S&P Global Market Intelligence Industry Commercial Auto Liability

From Annual Statement data via S&P Global Market Intelligence based on Other Liability Occurrence results from 20 companies that predominately write excess and umbrella business.

What is driving this pattern of inadequate reserves? We believe that the following factors are the most significant:

1) Extended Litigation: The expansion of third-party litigation funding and the improved capitalization of certain plaintiff firms mean more lawsuits proceed to trial. This causes challenges with traditional actuarial methods. Actuaries often use the past patterns to predict future patterns; however, if the environment changes significantly the methods become less reliable. With an increasing percentage of claims being litigated, historical loss emergence patterns are less reliably predictive of the future patterns. The industry has observed both longer cycle times (from claim report to claim settlement) due to more litigation and increased settlement costs as jury outcomes increasingly favor plaintiffs.

2) Backward-looking benchmarks: Actuaries often use older years' loss ratios to estimate loss ratio results for more recent years (after adjusting for premium changes and loss trends). However, if the older years' loss ratios consistently increase, the initial assumptions for the newer years start too low.

3) Under-estimated trend in a rising-cost environment: In an environment of increasing costs, it is difficult to estimate trend factors. For example, if average claim costs are increasing, some companies may believe that case reserves are more adequate and therefore not reflect the higher trends in the projections.

4) Management optimism. After the large rate increases and underwriting tightening during 2019-2022, some management teams find it hard to believe that loss ratios are not dramatically improving. This belief can delay the recognition of continuing adverse development.

The published industry results for the last few years clearly indicated adverse industry development as illustrated in the graphs above. Preliminary data published through the third quarter of 2025 indicates adverse development is continuing for some companies.

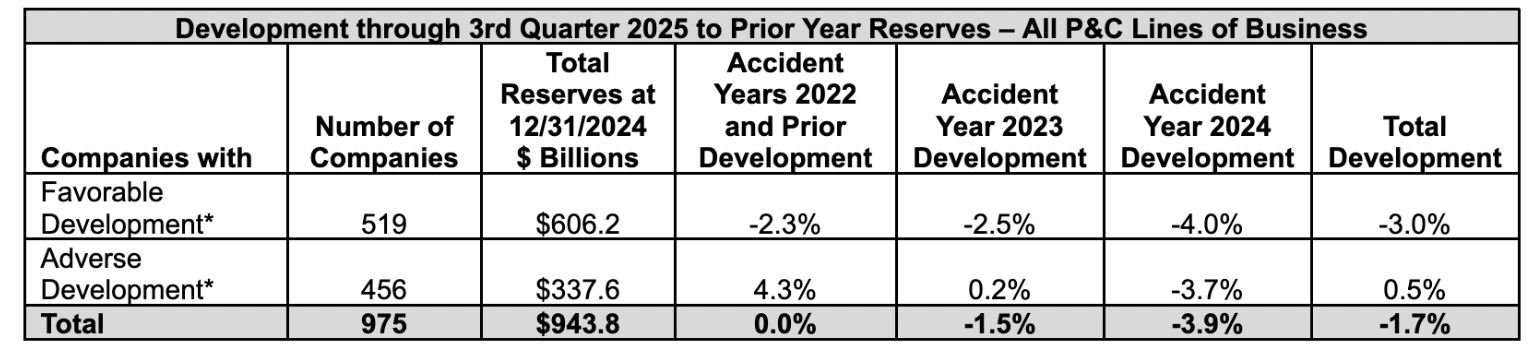

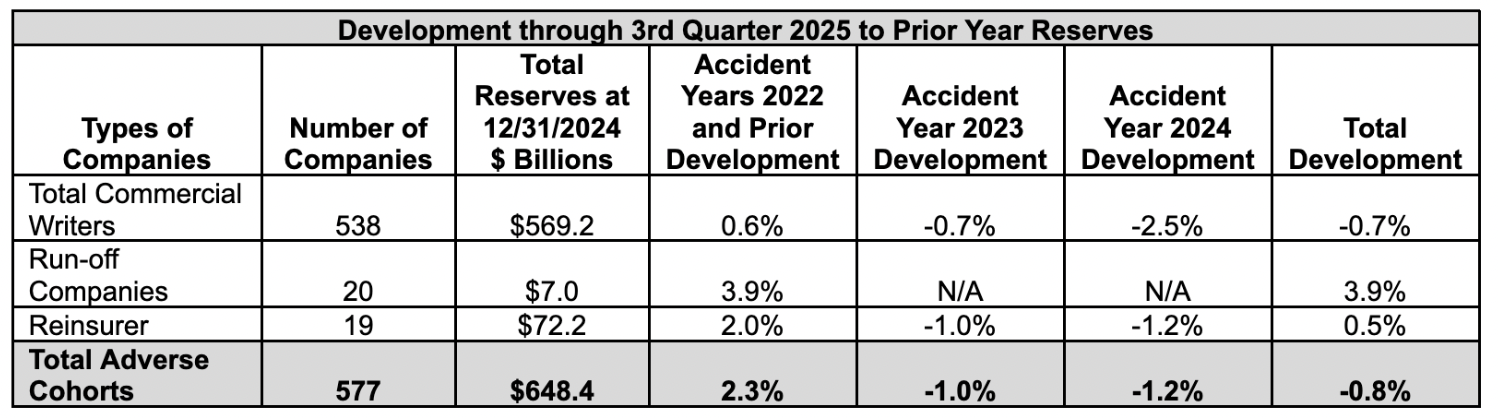

The table below displays development through the third quarter for all lines of business, separated by companies that indicated favorable development for accident years 2022 and prior and those that indicated adverse development.

*Based on Accident Years 2022 and Prior

From Annual and Quarterly Statement data via S&P Global Market Intelligence

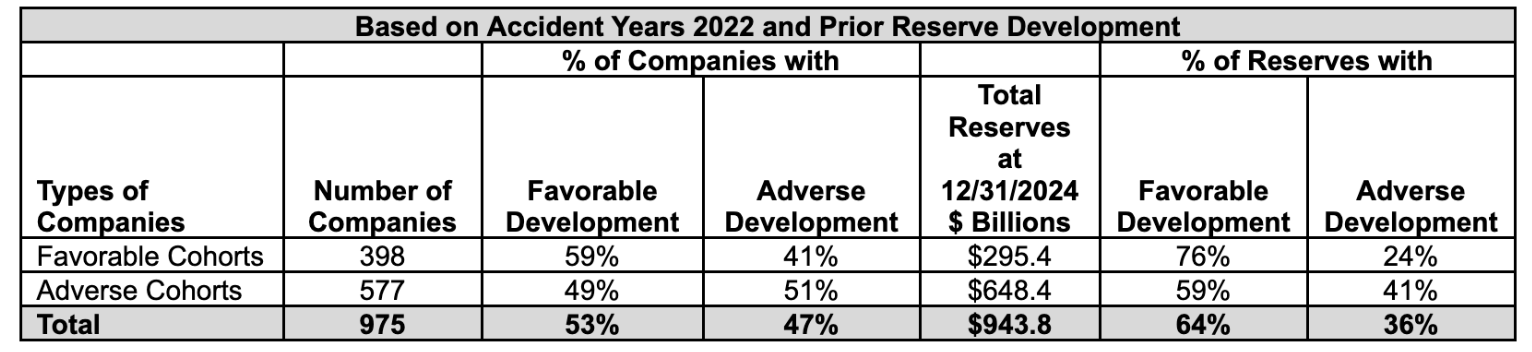

For the companies we have summarized that reported third-quarter data, this industry composite displayed little change in prior year reserves for accident years 2022 and prior, with favorable reserve development for accident years 2023 and 2024. 53% of the companies indicated favorable development and 47% of the companies indicated adverse development for accident years 2022 and prior. We note that reserve development differs by company in the amount and magnitude due to the lines of business written.

The quarterly data reported to the NAIC is not presented in the same level of detail as the year-end data, as Quarterly Statements display development for all lines of business combined. Therefore, we segregated the companies into different groupings based on our assessment of the type of business the companies write. Additionally, the quarterly development is only available for accident years 2022 and prior, 2023 and 2024.

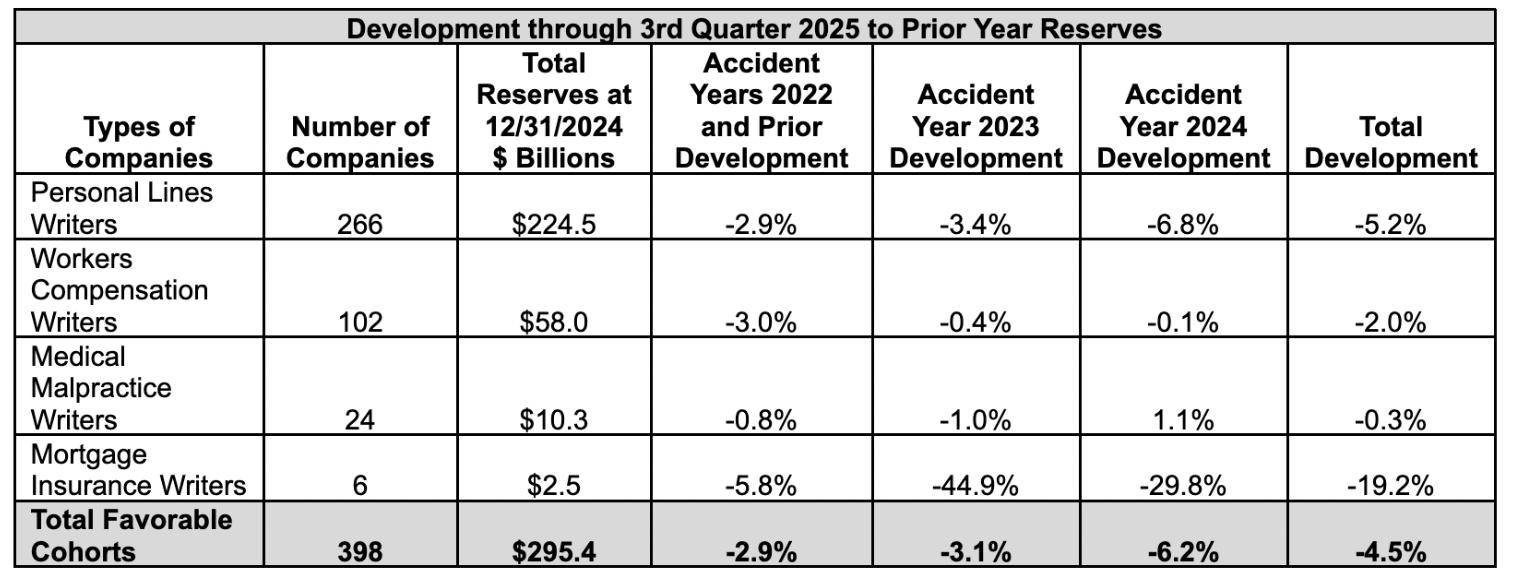

The cohorts of companies that primarily write personal lines business, workers compensation business, medical malpractice business and mortgage insurance displayed favorable reserve development for accident years 2022 and prior, and also for accident years 2023 and 2024. Personal lines business as well as workers compensation business are lines generally less affected by social inflation. For accident years 2022 and prior, the total combined reserves for these cohorts of companies developed favorably by approximately 3%.

From Annual and Quarterly Statement data via S&P Global Market Intelligence

However, the cohort of companies that write primarily commercial insurance, companies in run-off, and reinsurance companies displayed adverse development for accident years 2022 and prior.

From Annual Statement data via S&P Global Market Intelligence

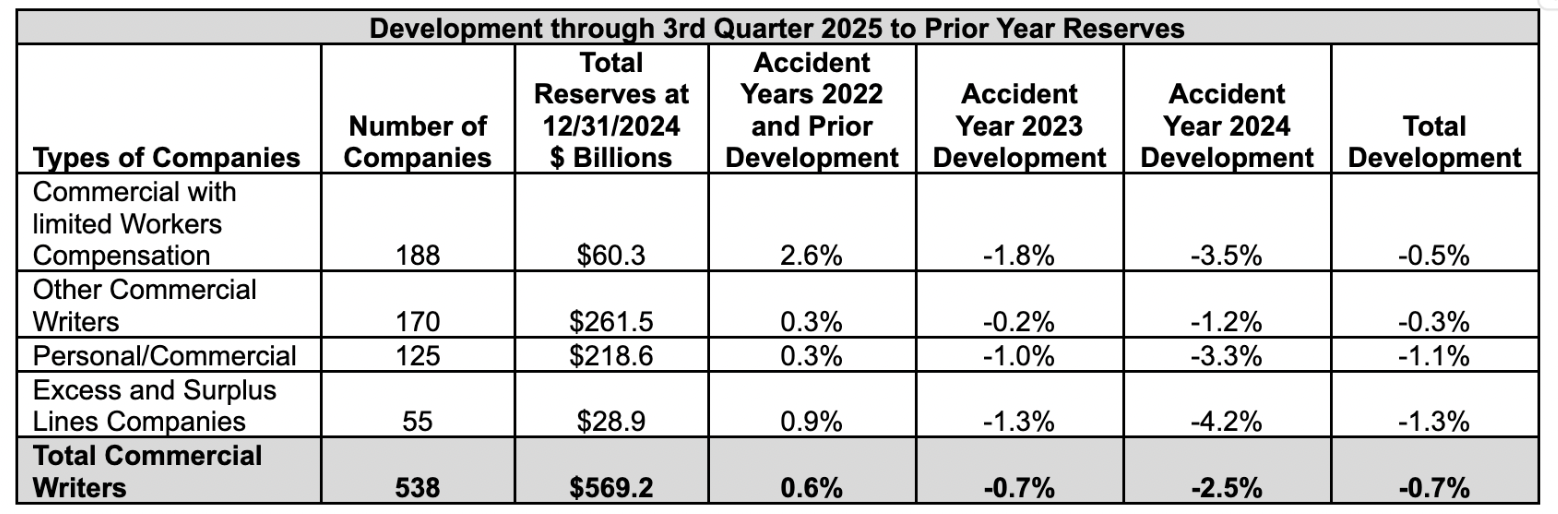

Drilling down within the commercial lines writers provides additional insights. The following table displays the reserve development for commercial lines writers that:

- write limited amounts of workers compensation;

- write both commercial and personal lines;

- are excess and surplus lines companies; and

- are writers of other commercial lines of business including workers compensation (i.e., "other commercial writers").

The cohort of companies that primarily write commercial lines with limited workers compensation business displayed higher adverse development (2.6% of adverse development for accident years 2022 and prior) compared to their more diversified peers that also wrote either workers compensation or personal lines (these cohorts displayed 0.3% of adverse development for accident years 2022 and prior). It is reasonable to assume that commercial lines carriers that are more diversified (e.g., write workers compensation or personal lines business) are benefiting from the favorable development on these lines which mitigates the development they may be experiencing in their commercial business.

The cohort of commercial companies with limited workers compensation business also write commercial automobile liability. The companies that primarily write commercial auto liability are displaying higher adverse development. We did not separately segregate these companies as the reserve base is limited and the development is driven by a few companies. Commercial auto liability is a line of business more affected by social inflation that has had significant rate increases and re-underwriting over the past few years, which increases the uncertainty in the reserve estimation process.

We note there is variability within the various cohorts and for certain cohorts of companies, a few large carriers had a significant effect. Within the "favorable" cohorts, 41% of companies posted adverse development for accident years 2022 and prior. Conversely, 49% of insurers in "adverse" cohorts reported favorable development for those same accident years. For the lines of business affected by social inflation, prior years' development hinges on how effectively each insurer has captured social inflation effects in past analyses and how aggressively they are recognizing those pressures today.

Favorable cohorts: Companies writing personal lines, workers compensation, medical malpractice and mortgage insurance

Adverse cohorts: Companies writing commercial business, companies in run-off and reinsurers

Given the factors outlined, we expect unfavorable reserve development to persist for certain lines of business and companies. However, favorable and adverse development will affect insurance carriers differently depending on the lines of business they write and their prior recognition of social inflation in the actuarial methods.

Although accident years 2023 and 2024 are generally indicating a favorable run-off, we have a concern that adverse development will occur in these accident years as the historical adverse development may not be fully reflected in the actuarial assumptions.

To reflect social inflation in actuarial methods, we recommend companies:

- Reevaluate the expected loss ratios that are used in actuarial methods to not only reflect historical adverse development but also current claim activity; and

- Separate lines of business into more granular groupings which segregate those segments more affected by social inflation and those less affected by social inflation (e.g., litigated versus non-litigated claims).

After year-end 2025 data is released, we will publish a companion article that presents updated results with more details by line of business, along with greater discussion on how to adjust actuarial methods.