Financial metrics improved for most U.S. states during 2022, but the outlook for state credit quality is less favorable as economic conditions soften. As noted in Conning’s recently published 2023 State of the States Report, we have assigned a “declining” 2023 outlook on state credit quality, a change from the “stable” outlook we have had since our 2021 report.

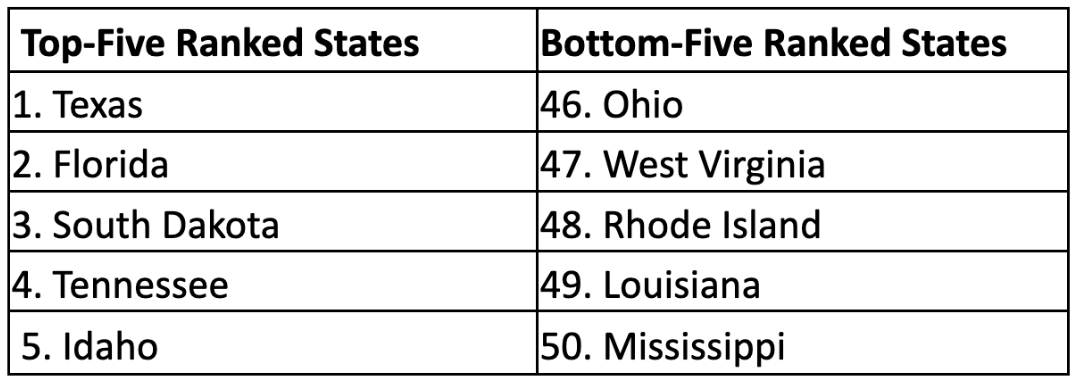

Conning 2023 State of the States Overall Ranking

The previous two years were marked by relatively benign economic and credit conditions, with state credit quality riding the wave of the economy recovering from the impact of the Covid-19 pandemic and an unprecedented amount of federal aid. Moreover, state coffers benefitted from a strong labor market and nominal growth in consumer spending. With the economy in 2022 continuing its pandemic recovery and with people returning to work, income taxes performed very well. Sales tax collections also performed well, again due to federal stimulus-supported consumer spending and a reopening economy.

However, signs are mounting that the extraordinary tax-revenue growth of the past few years will soon moderate. If economic conditions soften, inflation could squeeze budgets, push down sales tax collections, keep expenses high and force states to tap reserve funds to balance budgets. Weakening labor and/or housing markets would impact state finances as well, as would lower corporate profits and depressed financial markets. Some states are already feeling the effect of weaker stock and labor markets on income tax collections, and states that lowered taxes or expanded services could experience additional financial pressure. Furthermore, several states are facing significant infrastructure spending and pension obligations that may challenge their fiscal stability should an economic downturn come soon. Nonetheless, states’ balance sheets are in their best shape since before the Great Financial Crisis with reserves at all-time highs and much-improved pension funding ratios.

Which states will successfully navigate a recession? The impact will likely depend on how a recession plays out. For example, if unemployment jumps, states heavily reliant on income-tax revenue may suffer more. Or If consumers pull back on spending, states counting on sales-tax revenue may be vulnerable. How state leaders respond and leverage available resources in an economic downturn will be a critical test.

See also: Transformation of Jobs in the AI Era

Conning’s Analysis: A Relative View of State Credit Quality

Conning analyzes 13 economic, socioeconomic and financial metrics that are indicative of state credit health in our State of the States Report. Our ranking is relative – comparing states to each other – rather than absolute – quantifying each state’s credit quality. For example, a state that improves its financial condition can still move down in our ranking should other states make even greater strides.

Here are highlights of other findings in our 2023 report.

- Texas, fifth overall in 2022, moved up into first place. Florida, 2022’s #1 ranked state, fell to second. Both states benefitted from a strong economy, population growth and, in Florida’s case, an improved housing market while Texas outperformed in GDP per capita.

- The top-five overall ranked states had GDP growth, employment, revenue and population growth, which skewed to the South and West regions.

- Utah, which had held first place for three years prior to last year, fell to its lowest rank since 2015, in part due to how rising home prices affected affordability.

- New Hampshire, which had benefitted from the pandemic’s work-from-home dynamic, dropped from the top five to 21 as work conditions normalized.

- California was a notable laggard, dropping 14 spots to 42nd place, losing economic ground as reflected by lower tax collections.

- New York’s population declined most, followed by Illinois and Louisiana.

- All 50 states recorded employment growth, with parts of the South and West offering the best jobs picture.

- Nevada, Hawaii and Texas remained in the top five for employment growth, benefiting from an influx of residents.

Conning focuses on state credit quality, as states are large issuers of municipal debt, and their relatively high credit quality is important to many investors, such as insurance companies. Municipal securities offer opportunities for diversification by region and away from securities prevalent in many insurer portfolios, such as corporate and U.S. government debt. Additionally, these securities often offer higher yields than corporate debt of similar quality and duration and, particularly with taxable deals, will typically have a longer duration and a lower history of defaults than corporates. Our State of the States Report is not a definitive position on any state but rather a valuable starting point when evaluating a state’s debt issuance.