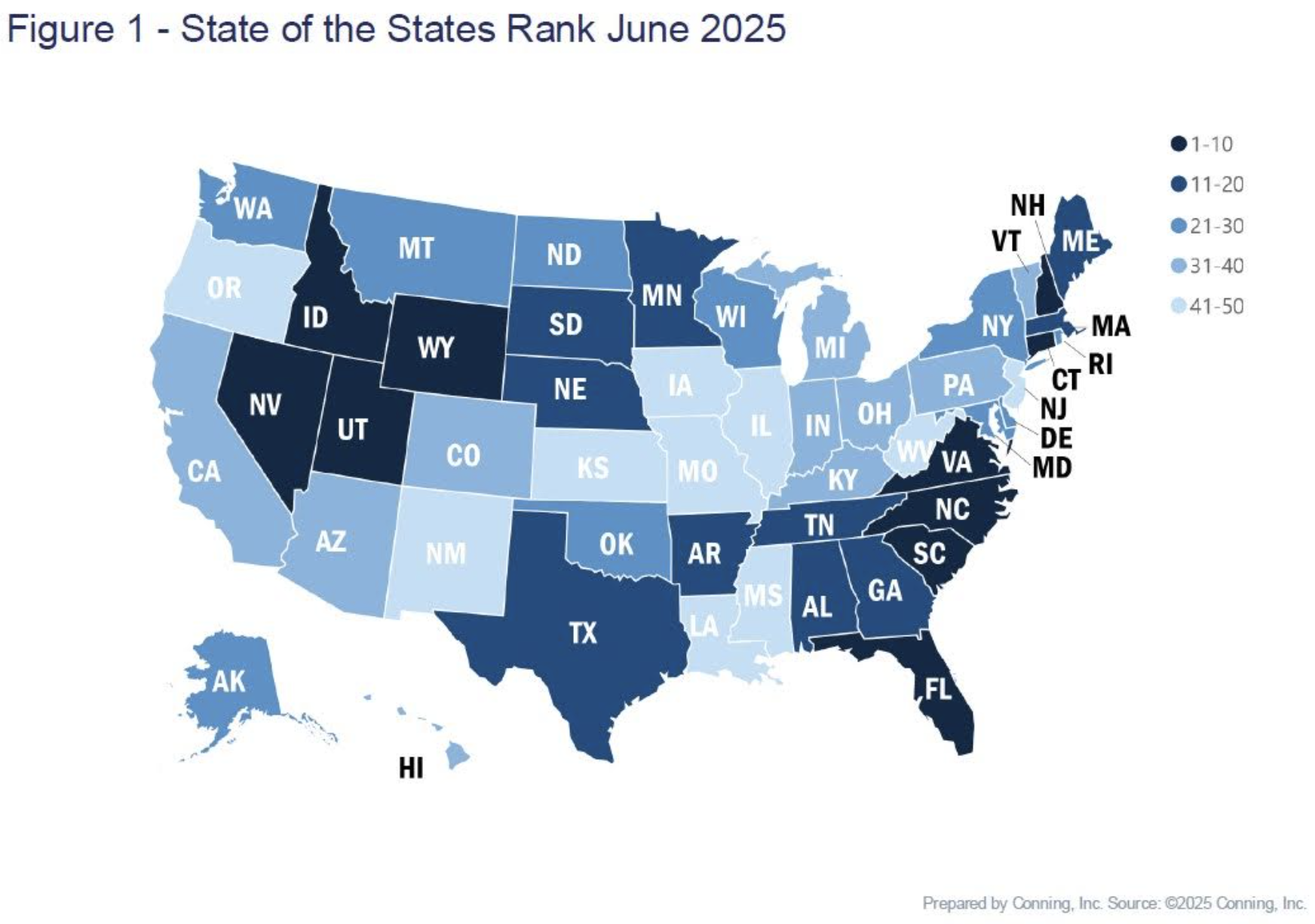

Conning recently released its annual State of the States report, which ranks the credit quality of each U.S. state according to 13 key metrics based on balance sheet strength, economic conditions, and socioeconomic trends that determine states' financial standing. This year, important considerations for insurers like climate risk, insurance market stability, and cost of living played a significant role in the analysis.

Conning maintains its "stable" outlook for state credit quality in 2025 even though, five years post-COVID, states are again facing uncertainties, this time in the form of federal-level changes that will require prudent budget management.

This year's "stable" view is consistent with Conning's 2024 State of the States outlook and has been the general trend for the last five years. The view in 2020 was "negative" due to the threat of COVID-19, and in 2023 it was "declining" in anticipation of a weakening economy, higher inflation and tapering federal aid.

In 2025, states face a period of significant transition as federal policies shift toward increased state responsibility, particularly in infrastructure, education and healthcare, where federal funding is expected to decrease from pandemic-era spending levels. Although states generally began fiscal year 2025 with stable budgets and robust rainy-day funds, some are experiencing shortfalls amid increasing costs and declining tax revenues. Some of these shortfalls are self-inflicted: 10 states reduced income tax rates or implemented automatic tax cuts in recent years, hampering their ability to withstand these new challenges. The fiscal outlook is further complicated by emerging challenges ranging from immigration and high-impact weather events to housing affordability (which remains a concern across regions) and insurance market stability.

Nevertheless, Conning's "stable" outlook is based on the belief that states have demonstrated sufficient fiscal resilience to navigate this combination of known challenges and unpredictable developments, although they differ significantly in balance-sheet strength, governance, socioeconomic conditions and the ability to leverage an improved economic environment. Several states have implemented governance mechanisms to trigger special legislative sessions if federal actions substantially affect their budgets. Others have set aside funds to counter federal funding cuts or have created special committees to monitor and respond to federal actions affecting state finances.

Methodology Changes

Developments of the last five years have led to methodology refinements for this year's State of the States analysis, including strategic adjustments to enhance the predictive nature of the state rankings. Specifically, Conning introduced "Catastrophe Losses per Capita" and "Cost of Living Index" metrics to capture economic pressures and disaster impacts that directly affect state finances.

Measuring Catastrophe Losses per Capita recognizes that climate risk has emerged as a critical factor in state credit quality analysis. States face mounting pressure from recurring disasters that will likely have long-term effects on their finances. Climate-related infrastructure damage creates substantial financial demands on state governments, both in repair costs and preventative investments, and adds to potential revenue challenges as tax bases get reduced during and after high-impact weather events. States experiencing frequent catastrophic events, such as Louisiana, which during the past five years averaged $1.48 a year per capita in catastrophe losses (compared with Nevada, where the average was $0.01 per capita), often see population outflows, further eroding the tax base. Climate vulnerability assessments and adaptation planning offer a path forward, and measuring a state's exposure to these risks provides essential insight into its long-term fiscal outlook.

Cost of Living Index, also a new metric, addresses another crucial determinant of state credit quality. Population changes are correlated to the cost of living and significantly affect credit quality because when people leave a state, they effectively transfer their share of public liabilities to the remaining population base, a potentially greater challenge for states with high fixed costs. This can drive remaining residents to seek affordable alternatives elsewhere, perpetuating a cycle of declining population. A shrinking population can substantially reduce state tax revenue unless there are corresponding tax rate increases. Conversely, states with positive population trends can maintain lower tax rates, enhancing their competitiveness.

Together, these metrics offer a holistic view of state economic sustainability, revealing how catastrophes create a feedback loop: driving up insurance costs, raising the overall cost of living, harming population retention, affecting property values, and ultimately determining a state's fiscal capacity to maintain services and manage debt obligations.

Movement Across Rankings

This year's rankings show significant movement across the board, reflecting both the refined methodology and changing economic conditions. Idaho claimed first place with an impressive 11-position climb. Northeastern states like Connecticut (9), New York (21), Delaware (25) and Massachusetts (15) also showed remarkable improvement, jumping 30, 23, 20 and 18 positions, respectively, partly due to their resilience against catastrophic losses.

Among the top five states, Utah (2), North Carolina (3), Nevada (4), and Virginia (5) all showed notable improvements based on their overall economic strength. At the other end of the spectrum, Louisiana fell two places to 50, preceded by Oregon (49), Illinois (48), West Virginia (47), and New Mexico (46), with Kansas experiencing the steepest decline of 28 positions to 44, as a result of various economic challenges.