For too long, client interaction has largely been confined to the critical junctures of new policies, renewals, and the unfortunate event of a claim. This infrequent contact leaves a vast, untapped potential for fostering deeper relationships and crucially, retaining valuable customers. The challenge for today's broker isn't just about selling policies; it's about becoming an indispensable advisor, a partner in risk management, and a consistent, reassuring presence in their clients' lives.

This article explores groundbreaking strategies and innovative touch points that empower insurance brokers to stay relevant, build lasting connections, and innovate in a fast-moving climate.

Why "Set It and Forget It" No Longer Works

The average policyholder's interaction with their insurance broker can often be summarized as a "set it and forget it" mentality. Once a policy is in place, communication often goes quiet until the next renewal cycle, a question arises, or a life event necessitates a policy change. This silence is not benign; it creates a vacuum that competitors are eager to fill. As Deloitte's 2023 Insurance Industry Outlook highlights, "customer expectations are soaring, driven by experiences with tech giants. Insurers and brokers must evolve from being product providers to trusted advisors offering proactive, personalized service." If brokers aren't actively engaging, clients may perceive their insurance as a commodity, making them susceptible to price shopping and the lure of direct-to-consumer models.

The lack of consistent touch points also means missed opportunities to truly understand evolving client needs. A client's life doesn't stand still for a year; they buy new assets, start businesses, expand families, and face new risks. Without regular, meaningful interaction, brokers are flying blind, unable to offer tailored solutions that truly protect their clients.

Beyond the Renewal: Crafting a Continuous Engagement Strategy

The key to sustained relevance lies in transforming sporadic interactions into a continuous engagement strategy. This isn't about inundating clients with spam, but rather delivering timely, valuable, and personalized information that demonstrates genuine care and expertise.

1. Policy Reviews & Life Event Triggers

Instead of waiting for a renewal notice, brokers can initiate policy reviews based on anticipated life events or general best practices. For instance, a home insurance broker could send an annual reminder to review personal property coverage. This isn't just a transactional ask; it's an opportunity to educate clients on the importance of accurate valuations and the potential pitfalls of being underinsured.

Example Email Touch Point:

Subject: Is Your Home Inventory Up-to-Date? A Quick Check-In

"Hi, [Client Name],

As your home insurance partner, we want to ensure your coverage always aligns with your evolving needs. With the passage of time, it's easy to accumulate new valuables – from electronics to heirlooms – that might not be fully accounted for in your current policy.

We recommend taking a few moments each year to review your personal property coverage. Have you recently made any significant purchases, received gifts, or inherited items of value? Keeping an up-to-date home inventory is crucial for a smooth claims process should the unexpected happen.

For a hassle-free way to manage your inventory, consider using a dedicated home inventory app. It can help you document your belongings with photos and descriptions, making it easier to adjust your coverage as needed and providing vital information if you ever need to file a claim.

If you have any questions or would like to discuss updating your coverage, please don't hesitate to reach out. We're here to help you protect what matters most.

Best regards,

[Your Name/Agency Name]"

2. Hyper-Personalized Content & Educational Newsletters

Generic newsletters are easily ignored. The future of engagement lies in hyper-personalized content. Leveraging client data – policy types, demographics, geographic location – brokers can segment their audience and deliver highly relevant insights.

For auto insurance clients, a newsletter titled "Five Car Modifications That Could Affect Your Insurance Policy" offers practical advice. This not only positions the broker as knowledgeable but also helps clients avoid surprises down the road. For homeowners, content could range from seasonal maintenance tips to understanding flood zone changes.

Example Newsletter Idea: "Protecting Your Ride: Auto Insurance Insights"

● Segment: Auto Insurance Clients

● Content:

- "Performance Upgrades & Your Premium: What to Know"

- "The Rise of ADAS: How Advanced Driver-Assistance Systems Affect Your Coverage"

- "Preparing Your Car for Winter/Summer: Essential Maintenance & Road Trip Tips"

- "Understanding No-Fault vs. At-Fault Accidents: A Quick Guide"

3. Leveraging Weather Events & Local Data

Local weather events offer a potent, timely touch point. A major storm approaching? A property insurance broker can send out proactive tips on securing homes, preparing emergency kits, and understanding what to do if damage occurs. This demonstrates immediate value and care, positioning the broker as a trusted advisor in times of need.

"In the wake of Hurricane Ian, many policyholders realized the crucial role their agents played in guiding them through the claims process," notes Insurance Business America. "Communication before, during, and after a catastrophic event can significantly strengthen client relationships."

4. The AI Advantage: Data-Driven Engagement

Artificial intelligence (AI) is no longer a futuristic concept; it's a powerful tool for enhancing client engagement. Brokers can use AI to:

- Analyze Client Data: Identify patterns in client behavior, policy gaps, or potential needs. AI can flag clients who recently moved, purchased a new vehicle, or had a significant life event, prompting the broker to reach out with relevant policy adjustments.

- Predict Churn Risk: AI algorithms can analyze various data points to identify clients who might be at risk of not renewing. This allows brokers to intervene proactively with targeted retention strategies.

- Automate Personalized Communication: While human touch remains vital, AI can automate the delivery of personalized messages, ensuring timely and consistent communication without overwhelming the broker's workload. Imagine an AI identifying a client's specific interests (e.g., classic cars) and then flagging relevant insurance news or articles for the broker to share.

For example, AI could analyze a client's property records for recent renovations or permit applications, allowing a home insurance broker to proactively suggest a policy review for increased dwelling coverage.

5. Embracing Digital Tools: Beyond Email

While email is effective, brokers should explore a broader suite of digital tools:

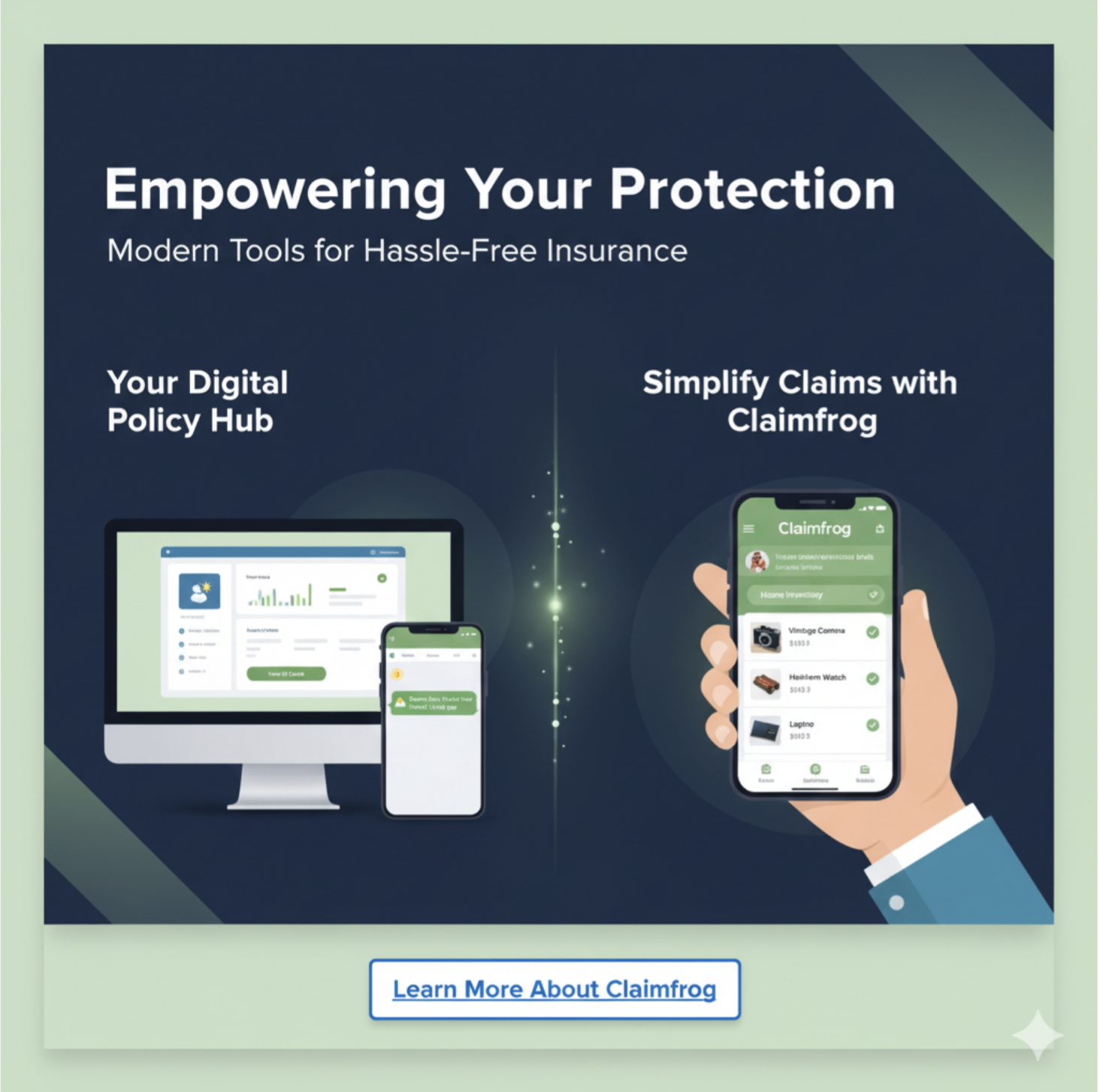

- Client Portals: Secure online portals where clients can view policies, make payments, and update information offer convenience and transparency.

- SMS Messaging: For urgent alerts (e.g., weather warnings, policy reminders), SMS can be highly effective, provided clients have opted in.

- Educational Webinars/Videos: Short, informative webinars on topics like "Understanding Your Deductible" or "What to Do After an Accident" can position brokers as thought leaders.

- Home Inventory Apps: Encouraging clients to use home inventory apps is a game-changer. These tools help clients accurately document their belongings, simplifying the claims process and ensuring adequate coverage. A broker can suggest this and similar tools from trusted sources. Tips such as having a detailed home inventory readily available can significantly expedite claim processing and reduce client frustration. You get the idea.

The Human Touch Remains Paramount

While technology provides incredible tools for efficiency and personalization, the fundamental value of an insurance broker remains the human touch. AI can identify opportunities, but it's the broker's empathy, expertise, and ability to build trust that truly cements client relationships. Technology should augment, not replace, this human connection.

Conclusion: The Future Is Personalized and Present

While some of the ideas floated here can be implemented right now, some may require approval or long adoption road-maps, but the take-away here is to start thinking about how and what you could be using to your advantage. To stay relevant and thrive, brokers must embrace a personalized, and consistently present approach to client engagement.

By leveraging technology for data analysis and communication, while never losing sight of the essential human element, brokers can transform themselves from mere policy providers into indispensable advisors. The future of insurance brokering isn't just about selling policies; it's about building enduring relationships, providing continuous value, and being a constant source of assurance and expertise.