Despite the disruption, the PwC Global Survey finds most insurers focused on doing what they already do, just via a different channel.

The insurance marketplace is transforming, creating openings for some and challenges for others. According to the PwC Global CEO Survey of insurance industry CEOs, 59% of insurance CEOs believe there are more opportunities than there were three years ago, but 61% see more threats.

The fact that people are living longer and have more wealth to protect presents insurers with an opportunity. The threats to insurers include mounting commoditization, the squeeze on margins and increase in self-insurance. These threats reflect both intensifying price competition and difficulties in conveying the true value of the coverage that insurers sell. Regulation is creating upheaval and more costs on the one side and diverting attention from other strategic challenges on the other.

Disruption on multiple fronts

Insurance CEOs believe that new regulation, increasing competition, technological developments and changes in distribution will have more of a disruptive impact over the next five years than CEOs in almost all other industries.

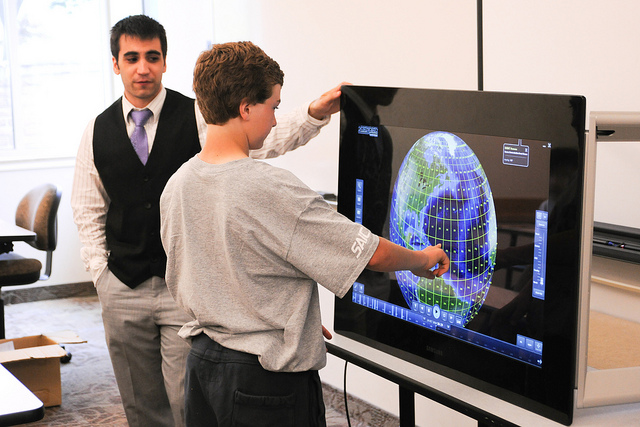

Realizing the digital potential

Insurance CEOs recognize how digital technology can help them sharpen data analytics (90%), strengthen operational efficiency (88%) and enhance customer experience (81%).

Yet are they making the most of digital’s potential? Most insurers are still primarily focused on e-commerce -- doing what they already do just via a different channel. Leaders are using digital to engage more closely with customers, fine-tune underwriting and develop customized risk and financial solutions. They’re also pushing back frontiers in areas like real-time risk monitoring, more active risk prevention and lowering the cost of life and pensions options for younger and less wealthy consumers.

Questions to ponder:

- Can you meet the challenge of a changing business environment, including from technology and other financial services (FS) companies?

- Is change a threat or an opportunity?

Seeking out complementary capabilities

Nearly half of insurance CEOs plan to enter into a joint venture or strategic alliance over the next 12 months. Two-thirds see these tie-ups as an opportunity to gain access to new customers (much more than in other FS sectors).

Business networks, customers and suppliers are seen as the most important focus for strategic collaborations. Examples could include affinity groups or manufacturers. A further possibility is that one of the telecoms or Internet giants will want a tie-up with an insurer to help it move into the market.

More than 30% of insurance CEOs see alliances as an opportunity to strengthen innovation and gain access to new and emerging technologies. Yet two-thirds currently do not have plans to partner with start-ups, even though such alliances could provide valuable access to the new ideas and technologies they need.

Attracting fresh ideas and skills

A rapidly changing market requires a more diverse workforce with new talents. 80% of insurance CEOs now look for a much broader range of skills than before. At the same time, they recognize the challenges; 71% -- even more than last year -- seeing the limited availability of key skills as a threat to growth.

Diversity is now recognized as a key way to enhance business performance, innovation and customer satisfaction. Nearly three-quarters of insurance CEOs have a strategy to promote talent diversity and inclusiveness or plan to adopt one. But nearly 40% have no plans to seek out talent in different geographies, industries or demographic segments.

Questions to ponder:

- How could collaboration help you reach new markets and sharpen innovation?

- Is your definition of diversity broad enough to identify and hire tomorrow’s workforce?