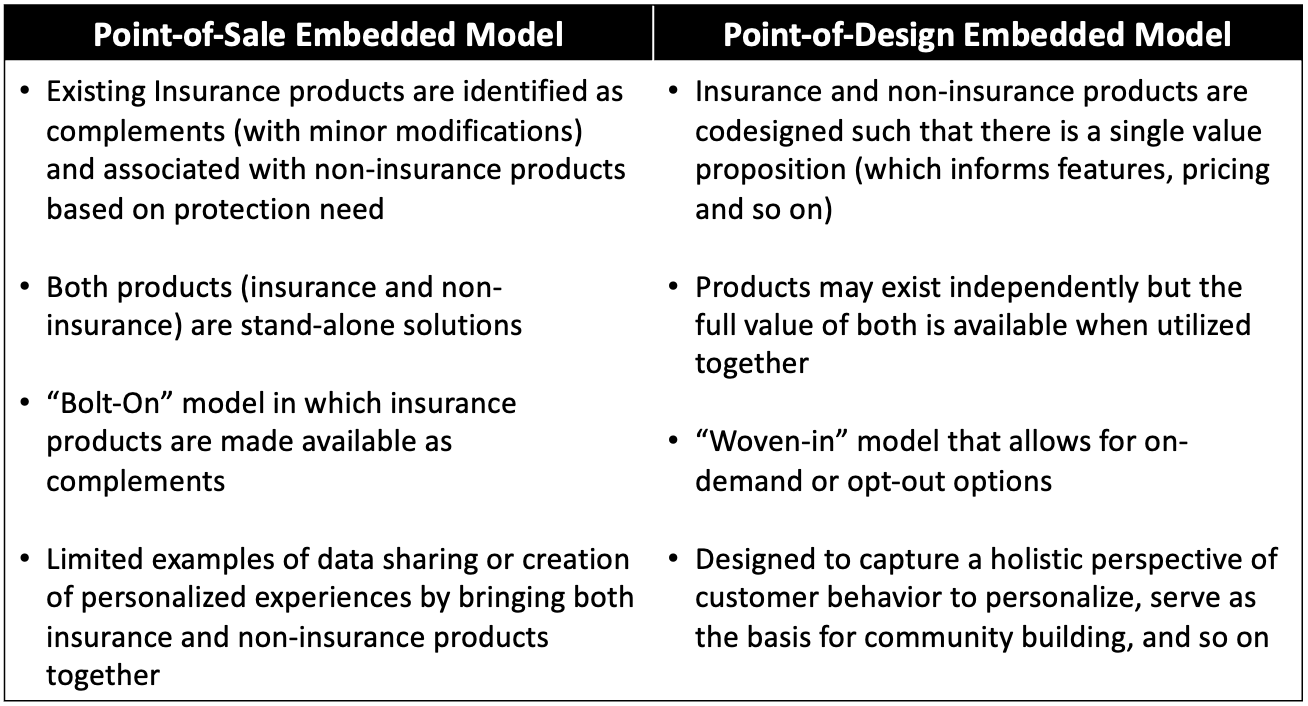

Embedded insurance is one of the most frequently explored topics in insurance today, yet its potential remains largely untapped. We are limited so long as we consider the concept purely with an insurance industry lens. Unlocking the potential of embedded insurance involves a mindset shift from "point-of-sale" to "point-of-design."

The embedded insurance model is not at all new. We define "embedded insurance" as any instance in which an insurance product is sold in conjunction with a non-insurance product. Examples include bancassurance, point-of-sale warranty products, life insurance sold prior to an airline trip and, increasingly, insurance products bundled with vehicles or higher-risk pastimes (such as insurance bundled with ski passes). The emergence of application programming interface (API) platforms has made it possible to bring insurance products closer to their non-insurance vehicles. In these cases, insurance is typically positioned as a "bolt-on" at a point-of-sale (either as an "opt in" or "opt out" choice).

When we approach embedded insurance design as adding a point-of-sale complement, we miss the opportunity to create even more meaningful customer experiences. The opportunity lies in exploring the affinity between the insurance solution and the non-insurance product and how we can build unity in a singular value proposition. Doing so requires introducing insurance at the point-of-design, rather than as a bolt-on at the point-of-sale.

See also: Embedded Insurance: The New Hot Topic

We can think about point-of-design-focused embedded insurance as similar to the example of the original screwdriver set that was included with Google Nest thermostats.

The utility set was designed both to add value to the thermostat (providing an easy-to-use kit to install and remove the device) and to reinforce the overall value proposition of a simple, elegant and functional connected home product. It would have been entirely possible to add an off-the-shelf screwdriver along with the thermostat device that would have served a similar purpose -- yet the development of a point-of-design complement reinforces and extends the core value proposition. Embedded insurance has potential to achieve the same outcome if approached as a design opportunity, rather than a bolt-on feature.

The founder of frog Design, Hartmut Esslinger, articulated customer buying behavior in a way that highlights the need for point-of-design thinking: "Customers don't buy a product; they buy value in the form of experience and emotion." We create a singular experience when we design bundles of products that share an intentional and clear affinity. Weaving the value of protection services into the design of non-insurance products has the potential to render insurance products more tangible. Examples may include, for instance:

- Connected home solutions with advanced safety and maintenance features built into the property that detect and automatically manage risk (turning off appliances or mains supplies and automatically contacting emergency services)

- Personal vehicles designed to support wellness-focused internal recreational spaces as an extension of a bundled life, health and vehicle insurance package

- Sports equipment (shoes and clothing) with sensors woven into them that monitor performance and health as an extension of a goal-directed training and wellness package that includes personalized life and health insurance risk mitigation and protection, and that connects to a branded community of similar users.

See also: Embedded Insurance and the Gig Economy

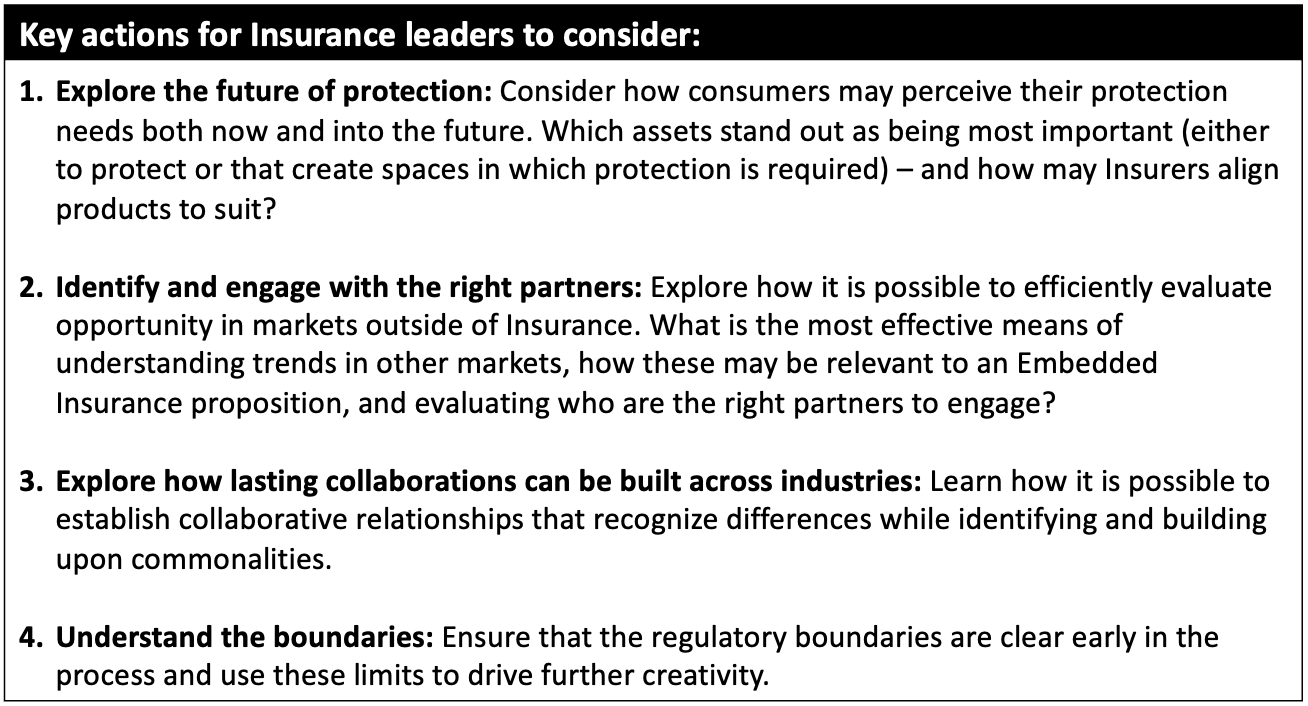

The challenges in creating point-of-design embedded insurance solutions are significant. The first question is where to start. Which industry and which products should we focus on? Secondly, who would be the right partners to engage? Overcoming the obstacle of different industry-focused mental models and practices and ensuring true co-design will not be easy. And thirdly, how can embedded insurance solutions help agents to effectively manage their book of business?