Last month, we had the ITC event in Vegas, and I feel obliged to dedicate this edition of the newsletter to my takeaways from this conference. It took a while to digest the two days of discussions: the first day, nine straight hours of meetings with two dinners after, eight hours of meetings the second day and another two dinners.

My summary, with some anecdotal evidence:

- Some incumbents are getting more and more serious about innovation.

- Innovators understand that agents and brokers are here to stay.

- Shiny new things replaced the old ones.

- Everyone is trying embedding insurance somewhere.

1. Some incumbents are getting more and more serious about innovation

A few months ago, in one of the previous editions of this newsletter, I stressed my belief in the importance of innovation. Well, some incumbents came to ITC well-prepared to meet tech providers, discover new things and exchange thoughts with their peers. This kind of incumbent had a large delegation, a shared agenda among their executives and spaces to efficiently have the meetings.

Other incumbents did not show up, or dramatically reduced the number of their people at the event. Since insurtech stocks got hit and issues such as inflation hit P&Ls, insurance incumbents that were not serious about innovation have happily and quickly canceled insurtech from their agenda.

Since the hype has vanished, we have seen those who were committed to a multiyear innovation journey and those who were only pretending to innovate. To quote Warren Buffett -- he tends to be right -- "when the tide goes out, you discover who’s been swimming naked."

2. Innovators understand that agents and brokers are here to stay

Many (really a ton) of the tech players in the expo area were providing tools to support agents and brokers, and to help carriers to work with agents and brokers better. It looks like the people who work in innovation (finally) get that agents and brokers are here to stay.

The past ITC editions were all about digital sales, DTC (direct-to-consumer) and disintermediation. I have always struggled to make people digest that insurtech was more than D2C (and more than startups). We had tons of articles and interviews for all the pandemic period talking about the "digital shift" in the insurance sector. Even when facts and figures about the premium split were available, people still pretended that the reality was different.

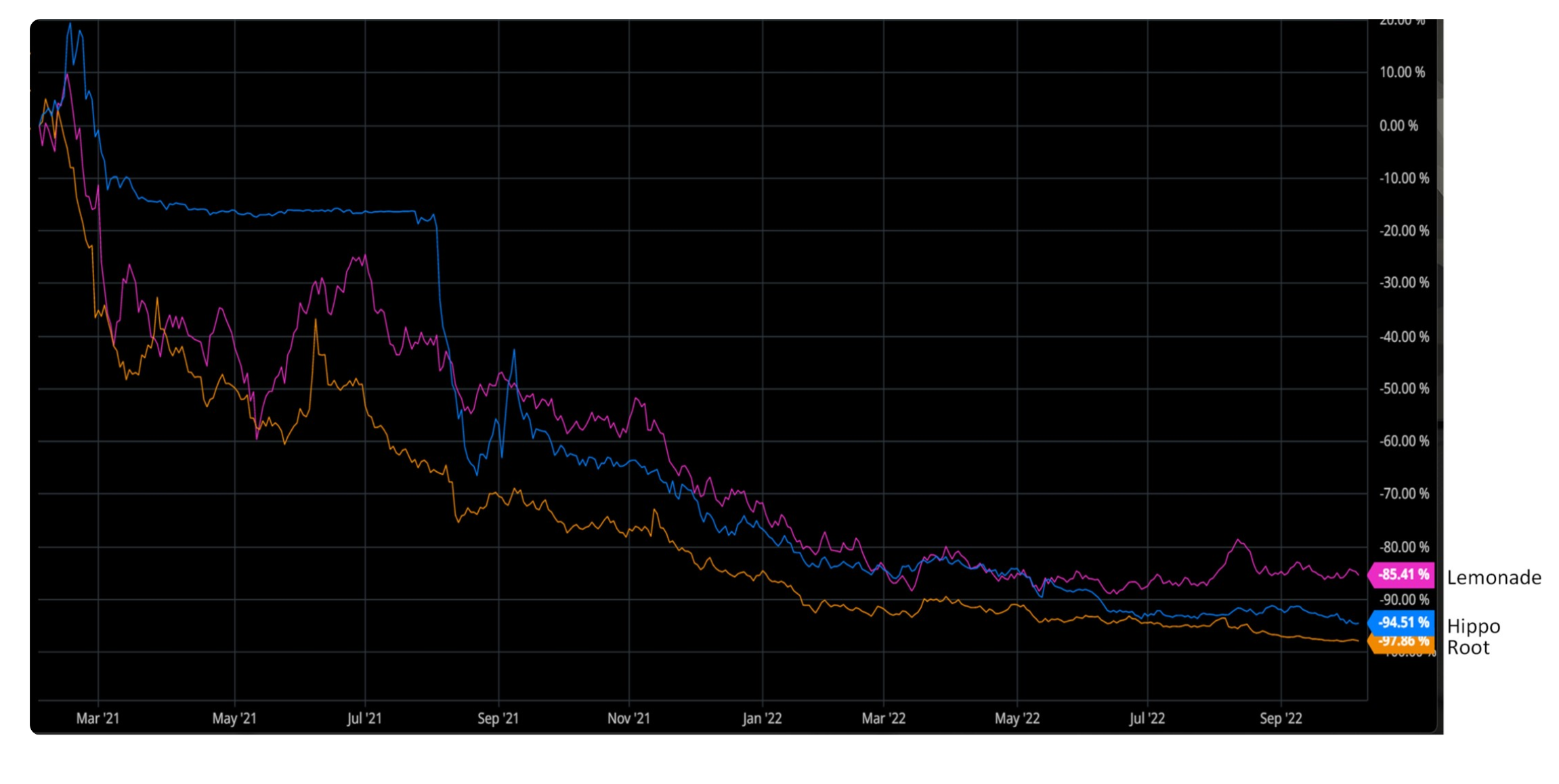

Last year, we had the famous trio (Lemonade, Hippo and Root) doing a U-turn from dissing agents to using them for selling more policies (or selling them with a lower acquisition cost). I commented that "it seems agents and brokers are not useful when you have to raise money from VCs, but they are extremely useful when you want to build an insurance portfolio!" Well, looking at the ITC floor, you can raise money even acknowledging that agents and brokers are here to stay nowadays.

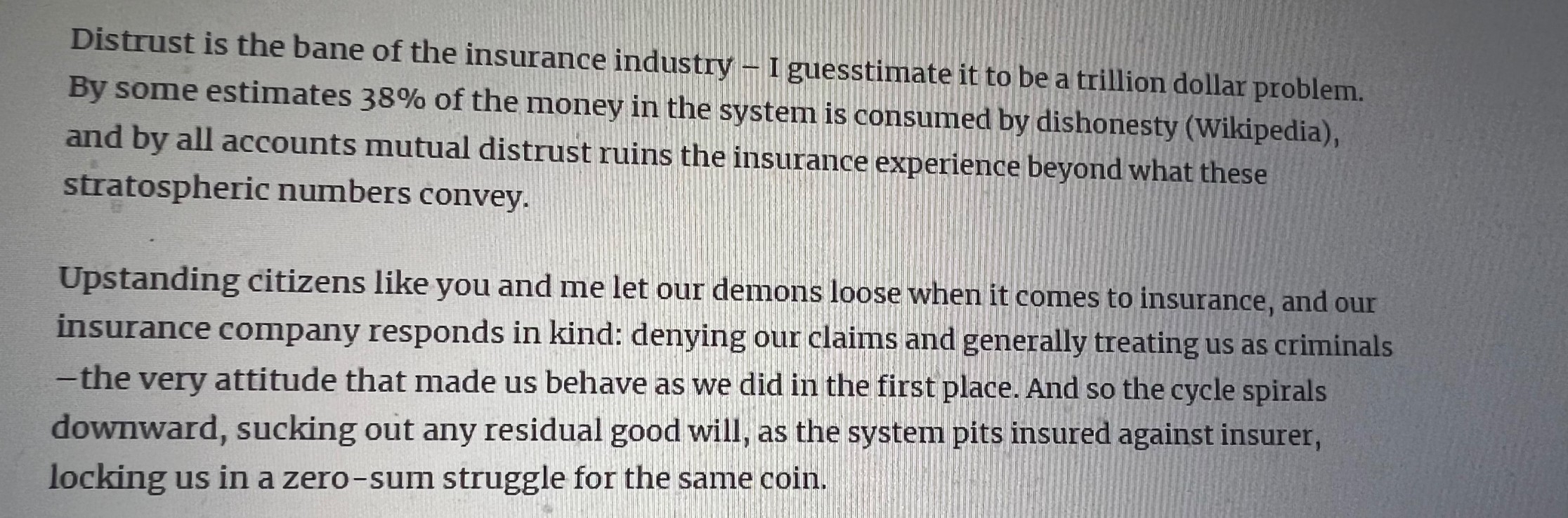

Lemonade has just done another big U-turn. Many of you probably remember when they were screaming daily about how insurance incumbents were bad. Here is a snapshot of Lemonade's CEO blog post from six or seven years ago:

Last week, Lemonade announced proudly that they enter the U.K. market with a partnership with Aviva. Here are the words of Lemonade's CEO now: “Pairing Lemonade’s strengths with Aviva’s promises to deliver insurance that is digitally native, yet rooted in the birth of modern statistics in the 1700s. It’s the best of both worlds, giving people a refreshing experience backed by a company they’ve known and trusted for years”.

Yes, this is the same CEO (even if the stock lost about 86% of its value from the maximum in February 2021). A "disruptor" has moved:

- from believing that insurers were chronically affected by "distrust"

- to acknowledging the policyholders' trust in an incumbent insurance carrier.

3. Shiny new things replaced the old ones

Blockchain was missed at ITC 2022. Nobody mentioned it, even though in previous years just about any ew venture would claim to have some blockchain embedded in their approach.

One of the shiniest new toys seems to be the app marketplace. I heard about so many marketplaces in just two days in Vegas....

4. Everyone is trying to embed insurance somewhere

Everyone -- really, everyone! -- is trying to embed insurance somewhere. Most of the initiatives are still early enough to share only enthusiasm and big/vague expectations. Clearly, the embedded topic is cool among investors, and every funder is adding it to the pitch deck.

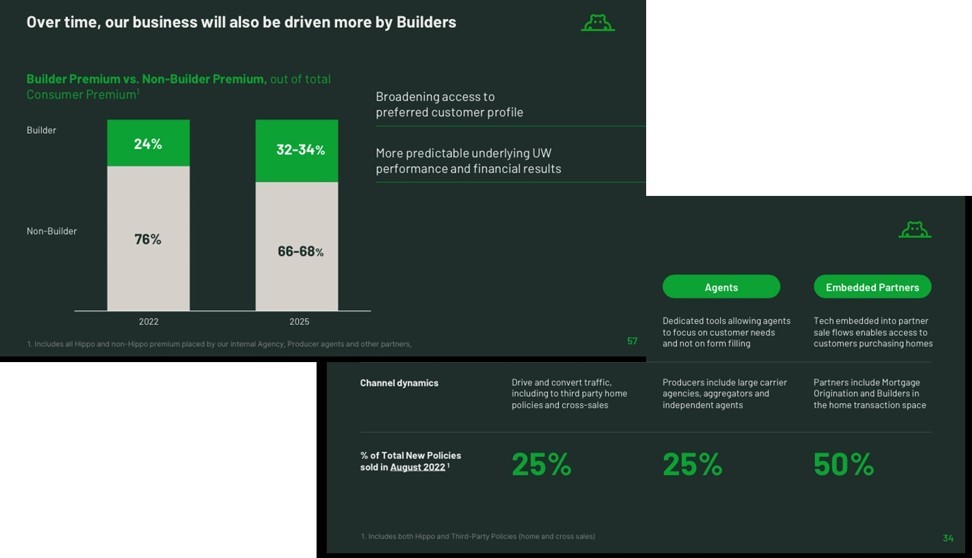

However -- to set expectations -- an embedded approach will not be enough to guarantee favorable evaluations. I described in detail Hippo's business model and results in a past edition of the Facts & Figures Newsletter, and even more about their success in distributing homeowner insurance through builders was shared on their investor day last September.

But, despite good performance on the currently hot topic, their stock doesn't show any sign of recovery.

See also: Insurtech: Still No Sign of Disruption