It’s a sad day when your local water utility or parking enforcement offers a better mobile or online customer experience than your auto or life insurer. Customers cannot easily quit their local utility or government. They can readily switch their insurance carrier -- and customer defection now exceeds 10% (according to J.D. Powers & Associates), awakening CEOs and investors to the need for substantive change.

Consumer markets have changed dramatically. PRNewswire reported in December that 89% of consumers prefer online to in-store shopping. A decade ago, 80% of personal auto policies were placed with an agent, according to McKinsey. Those days are gone. In addition to the alarming rate of customers who have already defected from their insurance carriers, a full 20% of customers are “at risk” of leaving their current carrier, according to J.D. Power & Associates. With the higher costs of acquiring new customers, these trends are expensive and troubling.

Customers have been sending loud and clear messages about their expectations and their willingness to change providers. Customers expect and demand all of the following from their insurers:

- Price transparency

- Self-service

- Multi-channel access

- Enriched and consistent customer experience

- Personalized and painless service

Without all of the above, customers are likely to be dissatisfied and, ultimately, leave. New entrants are making it even easier for consumers to change carriers. In one industry survey of 6,000 insurance customers, nearly one-quarter said they would consider buying insurance from Amazon, Google or another online provider. Moves to online sales and service are accelerating, and new entrants have added a greater sense of urgency to knowing their customers and innovating to better serve them.

Customer loyalty is the key to long-term growth and economic performance for insurers. Bain research shows that the value of a customer who is a loyal promoter of her carrier is worth an average of seven times that of a customer who is a detractor of the carrier and two to three times that of a passive customer. Loyal promoters “stay longer, buy more, recommend the company to friends and family and usually cost less to serve,” according to Bain.

The economic imperative is clear. Insurers are hurrying to transform from product-centric business models to customer-centric business models. Many insurers have made, or are in the process of making, this transformation. Keep reading to discover how and why to jump-start your own digital transformation and evolution from product-centricity to customer-centricity.

The New Normal

Dozens of factors have changed how insurers must sell and service in today’s marketplace. Smart phones, Facebook, telematics and online quotes are only some of the factors. Demands for customer intelligence and customer engagement have never been higher.

The requirements for baseline customer engagement are significant, including integrated and realigned internal technology. The basic technology and data required to support seamless customer experience across channels can also be leveraged to do much more. But, for starters, insurers must implement:

- A single view of the customer across silos, including third-party data and attitudes/preferences

- Cross-channel interactions and access via more channels

- Customized, personalized content

- Continuous technological improvement

Enterprise-wide, comprehensive customer intelligence is the baseline. Gartner reported in August 2014 that insurers are most underinvested in data initiatives targeting customer intelligence (57% of survey respondents indicated that customer intelligence was the area most in need of greater budget). Most insurers continue to lack a single view of their customer -- the major prerequisite to customer intelligence. Without the single, 360-degree customer view, insurers are ineffective at generating better service, segmenting, profitability and loyalty.

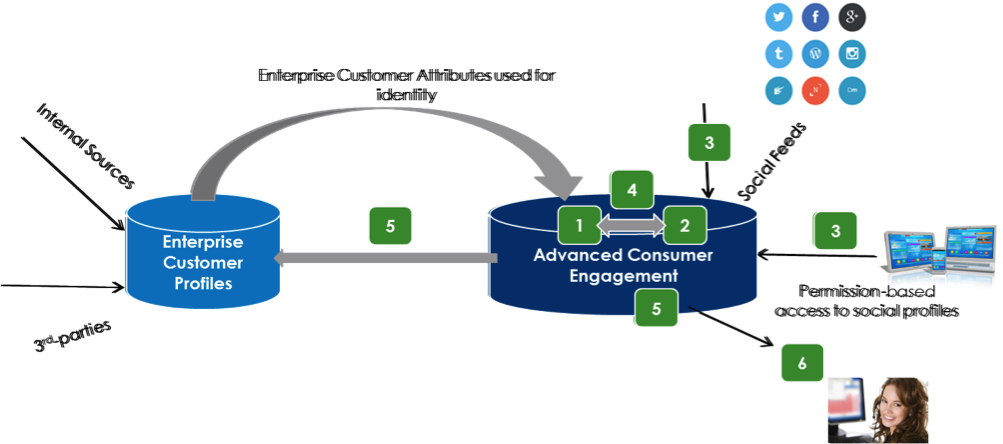

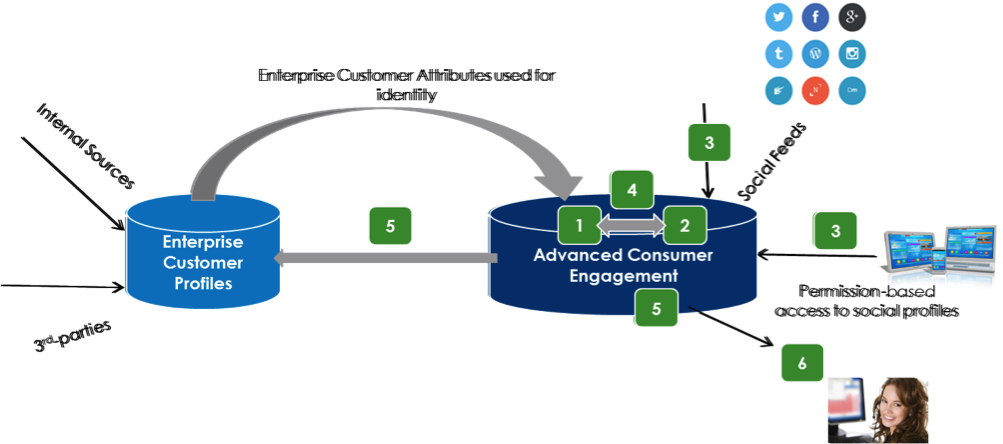

Achieving a complete and reliable enterprise-wide view of a customer is only the first step. The real business opportunities emerge when you synch your enterprise view with the 360-degree online and social media view of your customer or prospect.

Prerequisite: The 360-degree View

Insurance CEOs agree that data and analytics will be the backbone of the transformation required in their industry, with 86% telling Gartner that this is one of their top priorities. The first application for data and analytics in customer intelligence is a single view of the customer. Yet it is estimated that only 25% of carriers have a single customer view.

The 360-degree view is essential for improving both bottom-line and top-line performance. Reliable, unified customer views enable major gains in customer service (retention) and marketing effectiveness (cross-sell and upsell), not to mention claims and fraud. The consumer 360 was the backbone and first step one insurer took to drive cross-sales revenue. This large insurance and financial services firm was able to quantify marketing effectiveness and audience behavior, enabling the company to make informed tactical decisions that ensure more efficient marketing spending.

In this case, the development and implementation of closed-loop marketing analytics across key enterprise business units, utilizing predictive models, segmentation algorithms, churn analysis, modeling and funnel analysis, delivered the ability to continuously analyze and understand data from more than 25 million customers and prospects every week. With 360-degree customer views, insights can be delivered from data that allow this insurer to clearly see how enterprise marketing efforts can improve cross-sell and boost revenues.

Personalization

Once an insurer has a reliable customer view, the work of improving customer experience and satisfaction can begin. Consumers value personalized experience. Two-thirds of consumers are more likely to trust and engage with brands that allow them to customize and share personalization and contact preferences. More than half of consumers feel more positive about a brand when messages are personalized. According to Harris Interactive, 86% of consumers quit doing business with a company because of a bad customer experience, up from 59% four years ago. That statistic should serve as a wake-up call to invest in personalization -- the key to enhancing consumer engagement.

Implementing advanced consumer engagement (ACE) via a variety of data management and analytic strategies and solutions, there are five key elements of personalization:

- Profile-based: Move from generalized segmentation to personalization customer demographics, providing a “segment of one.”

- Behavior-based: Determine customer affinity through individualized understanding of customer insights coming from interactions, enterprise assets, dark enterprise assets and external assets, not just observations. Use these assets and customers’ behaviors to truly understand your customer and drive personalization.

- Collaboration-based: Customization should extend to integration with relevant tools, relationships and touch points (including experiential).

- Adaptive: Personalization features should leverage explicit consumer feedback as well as implicit feedback from closed-loop consumer responses and be flexible to changing behaviors and attitudes.

- Channel-optimized: Identify and personalize combinations of markets, segments and media tactics to adjust integrated marketing efforts to optimize market-specific channel effectiveness.

The following guidelines will also help ensure success, when embarking on an advanced consumer engagement (ACE) program:

Choose platforms that will allow you to grow by scaling hardware, rather than doing costly rewrites. Assume that your next step is market domination. This allows the enterprise to focus on innovative customer experiences rather than performance tuning.

Invest in architecture and standards that enable agility. Solutions should be as simple as possible.

Quality should always trump quantity, when it comes to data. Value your data by focusing on core data-quality issues, first. Information will always be more valuable to your consumers than data. Reliable information comes from quality data in context.

Position your ACE program to engage with consumers and quickly adapt to consumer feedback. Build in processes to show you value consumer feedback. Provide updates and enhancements quickly in smaller releases, continually enhancing the customer experience. By 2020, the customer will manage 85% of the relationship with an enterprise without interacting with a human, according to Gartner. There is plenty of room for improvement via quick iteration, especially in the realm of customer self-service.

Seek partners who specialize in applying a data and analytics mindset to customer engagement.

With ACE and robust data and analytics, the options for business optimization and growth are practically limitless. Three main areas for insurers to make strides in are cost management, customer acquisition and retention and new products/pricing.

Cost Management

With baseline programs in place (360-degree customer views and personalization), digital- and data-mature insurers can make significant gains in cost management. For starters, satisfied and loyal customers cost less to serve. Technology is a critical component of cost management, segmentation and customized pricing goals. Let’s start with cost management.

Customer Acquisition

Digitally mature insurers can improve customer acquisition by leveraging segment differences uncovered from a new wealth of customer intelligence. Opportunities are exposed by consumer analytics and competitor information gleaned from internal and external data sources. Real-time consumer and competitor data can be a goldmine for uncovering segment opportunities.

McKinsey has reported that while the motivation for insurance companies to invest in analytics has never been greater, firms should not underestimate the challenge of capturing business value.

New Products and Pricing

Real-time and third-party information is increasingly having an impact on pricing. Only insurers with robust customer and competitor data and analytics can take advantage of this. Insurers with ACE across multiple channels are best poised to exploit opportunities for new products and customized pricing to drive business growth.

An enterprise-wide, validated, timely view of all consumer interactions with the enterprise (from structured, semi and un-structured data) composes the first 360. Integrating this internal view with the consumer’s relevant online interactions adds another 360 degrees and far more data and touch points for influencing consumer behavior. Online is where buying decisions are being influenced and, often, made. Do you know which brands your consumer‘s friends are touting or bashing online? Can you predict a spike in demand or a specialty product, before your competitors? Developing a full 720-degree view of consumers is the next level of advanced consumer engagement.

Imagine having the ability to tap into customer behavior with the help of a self-teaching solution that continues to learn over time with each customer interaction, enriching each profile. This is the reality of today, supporting a comprehensive platform for consumer identification, attribute enrichment and engagement that enables personalized consumer conversations that evolve and improve throughout the lifecycle of the relationship. The ability to develop new products that can be delivered to consumers who want them, through their preferred channel, at a lower cost, is here today. The 360-degree view is essential for improving both bottom-line and top-line performance. Reliable, unified customer views enable major gains in customer service (retention) and marketing effectiveness (cross-sell and upsell), not to mention claims and fraud. The consumer 360 was the backbone and first step one insurer took to drive cross-sales revenue. This large insurance and financial services firm was able to quantify marketing effectiveness and audience behavior, enabling the company to make informed tactical decisions that ensure more efficient marketing spending.

In this case, the development and implementation of closed-loop marketing analytics across key enterprise business units, utilizing predictive models, segmentation algorithms, churn analysis, modeling and funnel analysis, delivered the ability to continuously analyze and understand data from more than 25 million customers and prospects every week. With 360-degree customer views, insights can be delivered from data that allow this insurer to clearly see how enterprise marketing efforts can improve cross-sell and boost revenues.

Personalization

Once an insurer has a reliable customer view, the work of improving customer experience and satisfaction can begin. Consumers value personalized experience. Two-thirds of consumers are more likely to trust and engage with brands that allow them to customize and share personalization and contact preferences. More than half of consumers feel more positive about a brand when messages are personalized. According to Harris Interactive, 86% of consumers quit doing business with a company because of a bad customer experience, up from 59% four years ago. That statistic should serve as a wake-up call to invest in personalization -- the key to enhancing consumer engagement.

Implementing advanced consumer engagement (ACE) via a variety of data management and analytic strategies and solutions, there are five key elements of personalization:

The 360-degree view is essential for improving both bottom-line and top-line performance. Reliable, unified customer views enable major gains in customer service (retention) and marketing effectiveness (cross-sell and upsell), not to mention claims and fraud. The consumer 360 was the backbone and first step one insurer took to drive cross-sales revenue. This large insurance and financial services firm was able to quantify marketing effectiveness and audience behavior, enabling the company to make informed tactical decisions that ensure more efficient marketing spending.

In this case, the development and implementation of closed-loop marketing analytics across key enterprise business units, utilizing predictive models, segmentation algorithms, churn analysis, modeling and funnel analysis, delivered the ability to continuously analyze and understand data from more than 25 million customers and prospects every week. With 360-degree customer views, insights can be delivered from data that allow this insurer to clearly see how enterprise marketing efforts can improve cross-sell and boost revenues.

Personalization

Once an insurer has a reliable customer view, the work of improving customer experience and satisfaction can begin. Consumers value personalized experience. Two-thirds of consumers are more likely to trust and engage with brands that allow them to customize and share personalization and contact preferences. More than half of consumers feel more positive about a brand when messages are personalized. According to Harris Interactive, 86% of consumers quit doing business with a company because of a bad customer experience, up from 59% four years ago. That statistic should serve as a wake-up call to invest in personalization -- the key to enhancing consumer engagement.

Implementing advanced consumer engagement (ACE) via a variety of data management and analytic strategies and solutions, there are five key elements of personalization:

Choose platforms that will allow you to grow by scaling hardware, rather than doing costly rewrites. Assume that your next step is market domination. This allows the enterprise to focus on innovative customer experiences rather than performance tuning.

Choose platforms that will allow you to grow by scaling hardware, rather than doing costly rewrites. Assume that your next step is market domination. This allows the enterprise to focus on innovative customer experiences rather than performance tuning.

Invest in architecture and standards that enable agility. Solutions should be as simple as possible.

Invest in architecture and standards that enable agility. Solutions should be as simple as possible.

Quality should always trump quantity, when it comes to data. Value your data by focusing on core data-quality issues, first. Information will always be more valuable to your consumers than data. Reliable information comes from quality data in context.

Quality should always trump quantity, when it comes to data. Value your data by focusing on core data-quality issues, first. Information will always be more valuable to your consumers than data. Reliable information comes from quality data in context.

Position your ACE program to engage with consumers and quickly adapt to consumer feedback. Build in processes to show you value consumer feedback. Provide updates and enhancements quickly in smaller releases, continually enhancing the customer experience. By 2020, the customer will manage 85% of the relationship with an enterprise without interacting with a human, according to Gartner. There is plenty of room for improvement via quick iteration, especially in the realm of customer self-service.

Position your ACE program to engage with consumers and quickly adapt to consumer feedback. Build in processes to show you value consumer feedback. Provide updates and enhancements quickly in smaller releases, continually enhancing the customer experience. By 2020, the customer will manage 85% of the relationship with an enterprise without interacting with a human, according to Gartner. There is plenty of room for improvement via quick iteration, especially in the realm of customer self-service.