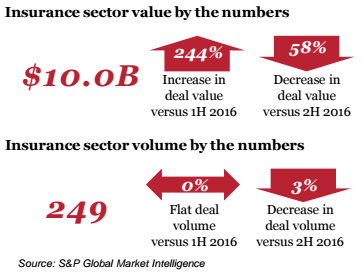

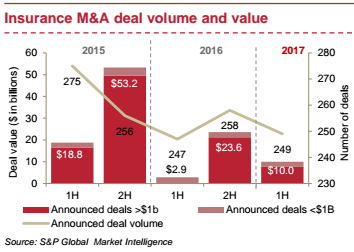

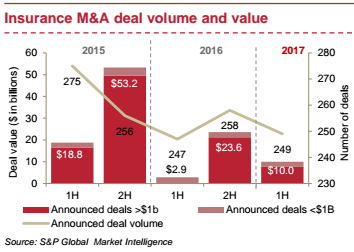

Deal value in the U.S. insurance sector more than tripled to $10 billion in the first half of 2017, compared with $2.9 billion in the first half of 2016.

The U.S. insurance sector announced that deal value has more than tripled to $10 billion in the first half of 2017, compared with $2.9 billion in the first half of 2016.

Activity remains robust in the brokerage sector. The largest announced deal in the period was the acquisition of insurance broker USI by an investor group including private equity firm KKR and Canadian pension fund CDPQ for $4.3 billion.

Among insurers, megadeals have been affected by uncertainty in terms of the direction of tax and regulatory reforms, although some clarity has come by way of the implementation of the Department of Labor’s fiduciary rule.

A healthy appetite for deals should continue in the second half of the year as insurers seek to divest capital-intensive or underperforming businesses, and newly funded PE-backed insurers continue to pursue U.S. insurance sector assets.

Highlights of 1H 2017 deal activity

Evolving nature of deals in 1H 2017

Highlights of 1H 2017 deal activity

Evolving nature of deals in 1H 2017

There were only three announced deals valued in excess of $1 billion, amounting to a total of $7.8 billion, in the first half of 2017:

- An investor group including private equity firm KKR & Co. and Canadian pension fund CDPQ completed a $4.3 billion acquisition of USI Insurance Services from Onex.

- In a separate deal announced in June 2017, USI agreed to acquire Wells Fargo Insurance Services in a transformational transaction. Terms were not disclosed.

- In May 2017, a special purpose acquisition company, CF Corporation, including funds affiliated with Blackstone and Fidelity National Financial, announced a $1.8 billion acquisition of annuities and life insurer Fidelity & Guaranty Life. The transaction followed the lapse of Anbang Insurance Group’s agreement to acquire U.S. Fidelity & Guaranty Life after failing to secure the necessary regulatory approvals.

- Canada’s largest P&C insurer, Intact Financial, acquired specialty insurer OneBeacon from White Mountains for $1.7 billion.

See also: Insurtech: How to Keep Insurance Relevant

Other significant deals emphasized interest in expanding digital capabilities, specialty offerings and small- to middle-market presence, as well as focus on managing capital, including:

-

- An investor group including New Mountain Capital LLC, Achilles Acquisition LLC, acquired small to mid-size employee benefits agency One Digital Health and Benefits for $560 million.

- Markel Corporation acquired SureTec Financial Corporation for $250 million and renamed its specialty and U.S. insurance segment Markel Surety Corporation.

Deals that did not meet our S&P screening, but are notable for their scale or intent, include:

- Travelers announced the purchase of U.K.-based Simply Business, a digital commercial broker, for $490 million.

- Aegon (Transamerica) offloaded its two largest U.S. run-off businesses, payout annuities and bank-owned/corporate-owned life insurance to Wilton Re via reinsurance.

Key trends and insights

Sub-sector highlights

Key trends and insights

Sub-sector highlights

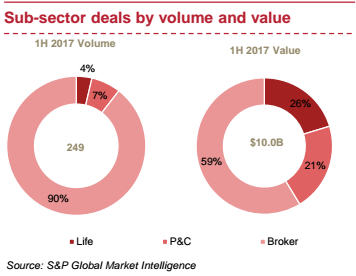

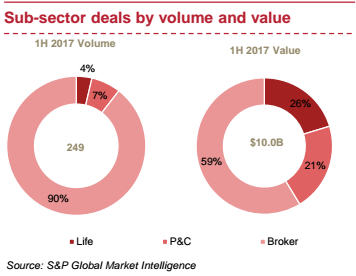

- Life and Annuity: The sector has been suffering through a persistent low-interest-rate environment that has weighed on insurers’ investment portfolios. Nevertheless, the U.S. Federal Reserve has raised the fed funds rate two times this year, and there are signs that other central banks are considering tighter monetary policies as inflation increases. Opportunities remain for insurers to exit capital-intensive or non-core businesses, with continuing investor interest in closed blocks and narrow concentrations. In a recent reinsurance deal, Canadian pension owned Wilton Re acquired two run-off blocks (annuities and COLI/BOLI) from Aegon/Transamerica.

- Property & Casualty: Deal activity declined in the first half of 2017, as companies continue to manage macro pressures. However, opportunities remain for small to medium-size companies to build much-needed scale through consolidation.

- Insurance Brokers: The segment continued to be the most active in terms of deal volume in 1H 2017. The most activity came from several serial acquirers buying regional brokers, further consolidating the market. The five most active acquirers were Hub International, NFP, Arthur J. Gallagher, AssuredPartners and Acrisure.

See also: Insurance Coverage Porn

Conclusion and outlook

See also: Insurance Coverage Porn

Conclusion and outlook

Even though announced deals have been light in the first half of 2017 compared with the second half of 2016, activity should intensify in the remainder of 2017 as insurers focus on cutting costs, achieving scale and enhancing and streamlining or consolidating dated technologies.

- Macroeconomic environment: The muted economic recovery, persistent low interest rates and geopolitical uncertainty continue to constrain insurers’ revenues and profitability. Life insurers have used both divestitures and acquisitions to manage the low-return environment and transform business models.

- Regulatory environment: Increased oversight and uncertainty have heavily influenced insurers’ business models and strategies, forcing many to exit businesses, often through divestiture. The current presidential administration appears to favor the easement of certain regulations, which could be a positive for insurers subject to the SIFI rule. Furthermore, the U.S. Department of Labor Fiduciary Rule has officially gone into effect, which may have implications for insurers that use exclusive agents.

- Technology: Insurers have been slower to adopt new technologies compared with banks and other financial services companies. But the times may be changing; insurers are increasing technology investments, including the recent acquisition of Simply Business by Travelers.

- Asian inbound interest: The past several years have seen Asian firms expand their footprint in the U.S. insurance market. While Asian investors maintain a global appetite, regulatory and shareholder skepticism remains a hurdle. A bid by Anbang to acquire Fidelity and Guaranty fell through in April, and China Oceanwide’s acquisition of Genworth has yet to close and is facing a new CFIUS review.

- Canada, too: Closer to home, there is evidence of increased appetite from Canadian buyers. In the first half of 2017, the second largest pension manager in Canada teamed up with KKR & Co. to acquire broker USI Insurance Services, and the largest P&C insurer in Canada, Intact Financial, acquired specialty insurer OneBeacon.

- Public offerings: Several major global insurers have responded to the low-growth environment in the U.S. with significant divestitures or restructuring. After receiving final approval in June, MetLife plans to spin off its U.S retail business, the new Brighthouse Financial, in August. A.XA announced in May its intention to exit its U.S. operations in a 2018 IPO. There is market speculation that other large insurance companies have similar divestiture or restructuring plans.

- Private equity/Hedge Funds/Family Offices: Insurance brokerage has historically been the most active insurance subsector for private equity given the limited regulatory environment, straightforward operating model and attractive, leverageable cash flows. However, private equity firms have been entering the life and annuity market with confidence that they are better investment managers than insurers.

Highlights of 1H 2017 deal activity

Evolving nature of deals in 1H 2017

There were only three announced deals valued in excess of $1 billion, amounting to a total of $7.8 billion, in the first half of 2017:

Highlights of 1H 2017 deal activity

Evolving nature of deals in 1H 2017

There were only three announced deals valued in excess of $1 billion, amounting to a total of $7.8 billion, in the first half of 2017:

Deals that did not meet our S&P screening, but are notable for their scale or intent, include:

Deals that did not meet our S&P screening, but are notable for their scale or intent, include:

Key trends and insights

Sub-sector highlights

Key trends and insights

Sub-sector highlights

See also: Insurance Coverage Porn

Conclusion and outlook

Even though announced deals have been light in the first half of 2017 compared with the second half of 2016, activity should intensify in the remainder of 2017 as insurers focus on cutting costs, achieving scale and enhancing and streamlining or consolidating dated technologies.

See also: Insurance Coverage Porn

Conclusion and outlook

Even though announced deals have been light in the first half of 2017 compared with the second half of 2016, activity should intensify in the remainder of 2017 as insurers focus on cutting costs, achieving scale and enhancing and streamlining or consolidating dated technologies.