My grandchildren are curious, a trait they definitely inherited from me. Whenever they get a cool new toy or technology gadget (yes, even the 1½-year-old loves these!) and have put it through its paces for a while, their attention inevitably turns to trying to figure out how the thing really works. This can result in the destruction of the item to get a glimpse of its guts, to see how the parts all work together to create the engaging experience they just had.

They are the perfect audience for the book series The Way Things Work by David Macaulay. The simple text and detailed, colorful drawings in these books “pull apart” items “from levers to lasers, from cameras to computers” to show curious kids (and their parents) the inventive thinking and innovation that goes into the things that make life easier, engaging and more enjoyable.

If there was an illustration in this book of traditional insurance distribution, what do you think it would look like? Maybe something like a Rube Goldberg contraption? (For those who don’t know the name, he drew cartoons in which Professor Butts solved a simple task in the most complicated, inefficient and hilarious way possible.) Most people studying the diagram of insurance distribution, especially customers, would agree that the process is complicated, confusing and inefficient -- needing an innovative makeover!

I have previously highlighted the increasing use of ecosystems and partnerships to expand beyond the traditional agent/broker distribution channel. This creates a win-win-win for insurers, their ecosystem partners and most importantly their customers. Insurers and their partners can quickly tap into new markets, and both potential and current customers benefit from more purchase and service options. Distribution ecosystems also help meet customers where and when they want to buy, creating friction-free experiences and evolving insurance from something that had to be sold to something people want to buy.

These ecosystems create a satisfying experience, just like that cool new toy that your kids and grandkids spend time with.

Embedded Insurance: Creating Innovative and Interesting Partnerships

Distribution options fall across a spectrum of channels, including direct to customer, agent/broker, other insurers, marketplace exchange or platform and embedded. Embedded insurance is among the newest options, and numerous interesting examples of partnerships between insurers and other industries are popping up, including with GM, Ford, Tesla, SoFi, Petco, Airbnb, Uber and Intuit.

Insurance can be “soft” embedded, offered as an opt-in option during the purchase of another item; “hard” embedded, included as an opt-out option with the purchase of another item; or “invisible,” included in the purchase of another product without the option to remove it (e.g., bumper-to-bumper warranty with a new car).

I’m convinced that ecosystems will play a big role in the future of the industry. So, until the next The Way Things Work book adds a chapter on them, let's do our own examination of how embedded insurance can produce a better result for all stakeholders customers, insurers and ecosystem partners.

The Customer Is the Critical Core Component

Majesco has long promoted/used a framework of three macro trends to help explain the forces driving change in the industry: people, technology and market boundaries. Multi- and digi-channel ecosystem/partnership strategies embody all these categories. No innovation in insurance would be possible without all three, but people are the most important. The greatest, most innovative technology or business model will only last if individuals and business owners see the value in it.

Why do people see value in ecosystem/partnership and embedded distribution models? Some clues can be found by looking at three different models of how people think and make decisions especially about insurance.

Jobs to Be Done

The famous business professor Theodore Levitt gets cited often as a pioneer of the Jobs to Be Done (JTBD) concept, with his quote, “People don’t want a quarter-inch drill, they want a quarter-inch hole.” The idea is that customers don’t necessarily think about products the way the businesses selling them do. To customers, products are an input to accomplishing a larger task, while the business is narrowly focused on making the sale. In his book, The Jobs to Be Done Playbook, Jim Kalbach says: “JTBD is not about your product, service or brand. Instead of focusing on your own solution, you must first understand what people want and why it’s important to them. Accordingly, JTBD deliberately avoids mention of particular solutions in order to first comprehend the process that people go through to solve a problem.”

In traditional distribution, the insurer takes a narrow, inside-out view, where the policy purchase is viewed as the beginning and end of the “job.” But, while customers do want to complete the purchase, it’s just one task in a series they need to do to complete their “job,” which could range from being able to drive their car or buy a home, to setting up their financial wellness plan, and more.

See also: Embedded Insurance — Both Old and New

With embedded distribution, the insurer recognizes that insurance is just one task in the customer’s job and makes it easier for the customer to complete this task by stringing it together with one or more other tasks in the job. This allows the customer to save time and effort by completing several tasks at once instead of dealing with them separately.

System 1 and System 2 Thinking

In his book, Thinking, Fast and Slow, the Nobel Prize-winning behavioral economist Daniel Kahneman described human decision making and thinking as a two-part system. System 1 thinking produces quick (i.e., instantaneous and sub-conscious) reflexive, automatic decisions based on instinct and past learnings… the familiar “gut reaction.” System 2 is slow, deliberate and reason-based and requires cognitive effort.

Good decisions about complex issues like insurance should be based on System 2 thinking. The problem with System 2 is that it’s hard! And our natural preference as humans is to minimize effort. During the traditional research and buying processes, the effort that is needed can lead many customers to seek shortcuts to in-depth research and analysis or delay a decision altogether. Embedded distribution can ease some of the System 2 effort because the insurance offering is viewed in the context of the “job” the customer is currently doing, making it easier to understand how it will be used and what it does (and doesn’t) do.

Fogg Behavior Model

Another very useful framework for understanding people’s decisions and behaviors is the Fogg Behavior Model, developed by BJ Fogg, the director of the Behavior Design Lab at Stanford University that we highlighted in our customer research and that a number of insurtech startups have used in designing their business models. The model translates behavior into a simple formula consisting of just three components: prompts, motivation and ability, all of which must occur in the same moment for a behavior to occur.

This model highlights an inverse relationship between motivation and ability. If someone has low ability for a behavior (i.e., it’s hard to do), a high level of motivation is needed (plus a prompt) to make it happen. Similarly, if someone has low motivation for a behavior, whoever wants them to do it must make it extremely easy (and provide the right prompt). Using this model as a lens for how people make insurance decisions reveals the weaknesses of traditional insurance distribution that ecosystems and embedded insurance can exploit. Let’s take a look at the three components.

Prompts

What triggers people to think about buying insurance?

There are two basic categories of prompting events that align with mandatory and discretionary insurance. Simple examples of mandatory prompts are auto and homeowners insurance in personal lines or workers compensation in commercial – the customer must buy these to own the car or home or to run a business that has employees.

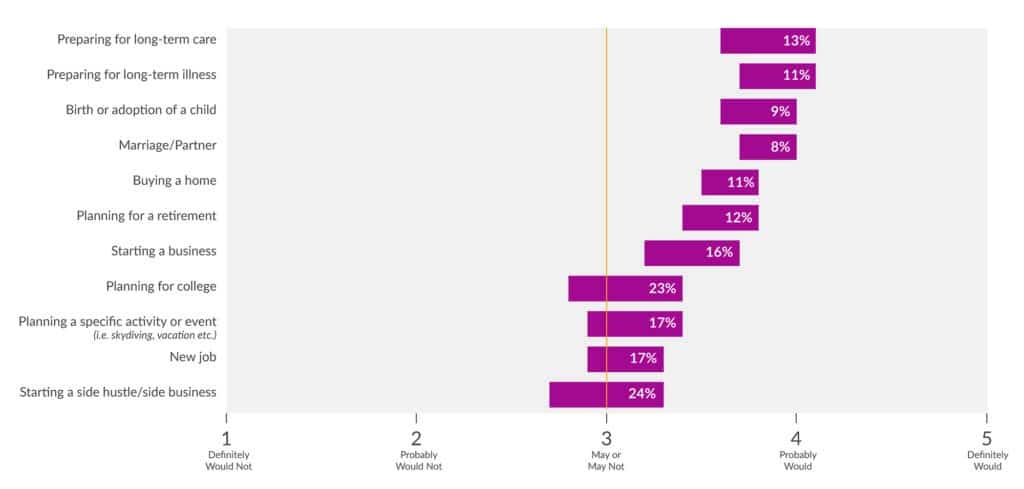

Discretionary prompts align with other events that cause people to think about protection of the things that are important to them. In our 2020 consumer research on life insurance, we actually found that life events had a stronger impact on younger generations in terms of considering life insurance purchases, as seen in Figure 1, which shows the gaps in the ratings between Gen Z / millennials and Gen X / Boomers.

Figure 1: Gaps between generations in impact of life events on L&A insurance purchase consideration

In the traditional distribution model, insurers need to fight for share of mind so people think of them when one of these prompts occurs. Large personal lines insurers like GEICO, Progressive and State Farm spend millions of dollars on advertising – not to cause people to drop what they’re doing and begin the buying process but to stay top of mind for the times when important events cause people to think about the need to buy or update their insurance.

In the embedded approach, the insurer receives in-the-moment top-of-mind awareness because the offering is placed directly in the path of purchase of another product or service… at the right time and in the right place. This is a great strategy for well-known brands and startups alike. A startup insurer won’t have the same brand equity as one of the major advertisers, but it can get some “rub-off” equity as a featured option by a trusted ecosystem partner from whom the customer is purchasing a product or service, or the startup could be white labeled with the partner’s brand.

Motivation

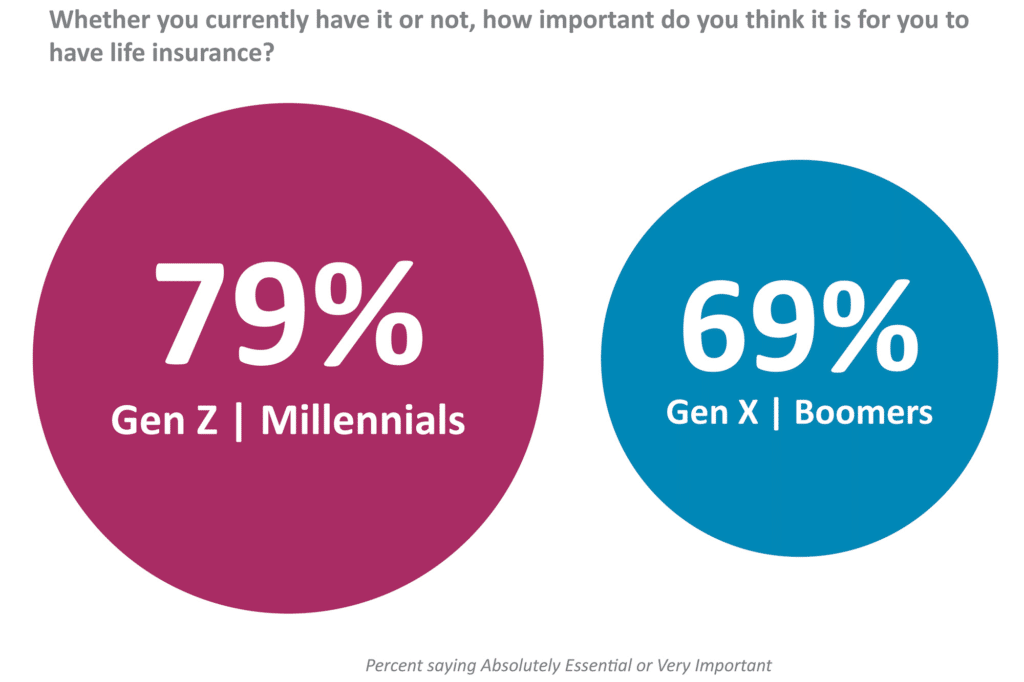

Motivation, with respect to insurance, is closely related to prompts and has two types I like to call “forced” and “fuzzy” that align with the mandatory and discretionary prompt categories. Mandatory coverages can be highly motivating, but to some people they can carry a negative feeling of being “forced” to buy insurance (of course, most people probably would buy these coverages even if not mandatory). “Fuzzy” motivation is a more emotional feeling about the value and importance of insurance… and it’s vitally important to the purchase of discretionary products like life insurance. Fortunately, Gen Z / Millennials place high importance on life insurance, even more so than their older counterparts, as we found in our 2020 consumer research.

Figure 2: Importance of life insurance

In traditional distribution, insurers rely on these two types of motivation to drive customers to their websites, agents or call centers. It’s a strategy based on hope. In embedded insurance, the insurer piggybacks on the motivation that has driven the customer to buy a product or service. This is a strategy based on intimate knowledge of your current and potential customers.

Ability

Most customers do not think of insurance as being “easy to do business with.” In some of our early consumer research, we found that insurance ranked at or near the bottom in terms of being easy to research, buy and service compared with other businesses customers interact with. The life and annuity industry ranked worse than property and casualty. Even cable and mobile phone companies ranked higher in many categories, two industries with traditionally poor customer service.

Since then, many insurers have made great strides in simplifying processes and products with new data sources, digital technologies and cloud-based platforms. However, JD Power’s recent study on customers’ P&C insurance digital experience reveals that insurers are having a hard time keeping up with continually rising expectations for digital capabilities; the study says insurers are “stuck at providing only ‘good enough’ digital user experience.”

In the traditional distribution model, insurers rely on motivated prospects who have been prompted by an important event to reach out to them to research and buy insurance. If the insurer’s processes and products are too complex and exceed the prospect’s abilities (and patience), the insurer loses the business. In the embedded model, motivated customers can add insurance to a product or service during the purchase process, usually with just a few clicks. Easy peasy!

See also: Why Open Insurance Is the Future

Make Multi- and Digi-Channel Distribution Your Strategy

Traditional distribution channels have served the insurance industry well for hundreds of years. They still work and are vitally important. But people, technology and market boundaries have changed dramatically in just the past few years, and insurance distribution must keep up. The new and growing spectrum of channel options now available, especially the exciting opportunities for embedded insurance, will give innovative insurers and their partners tremendous opportunities for growth, with new markets, new offerings, satisfied and loyal customers…and growing books of business.

What is prompting you to adopt a multi- and digi-channel distribution strategy? Are you motivated to take action? Do you have the ability? These are the components that drive decisions and actions…and innovative insurers are deciding to act!