On Oct. 22, 2012, a tropical wave off the Caribbean coast of Nicaragua strengthened into a depression. Two days later, it had intensified to a Category 1 hurricane and made landfall in Kingston, Jamaica, before moving on to strike Cuba as a Category 3, with wind speeds of 105mph. The tempest then blew through the Bahamas and weakened a little before regrouping to take its infamous "left turn" and slamming into New Jersey on Oct. 29.

On its deadly path, it left 70% of Jamaican residents without power, caused catastrophic rain and mudslides in Haiti, inundated the streets of the Dominican Republic capital Santo Domingo and damaged the historic city of Santiago in Cuba. Most of the Eastern Seaboard of the U.S. was affected, with a storm surge in New York City that flooded the subway system and parts of Manhattan, Brooklyn and Staten Island. The New York Stock Exchange closed for two days during prolonged power outages that lasted for weeks in some areas of the region, and the eerily dark skyline of Manhattan became an enduring image of the catastrophe.

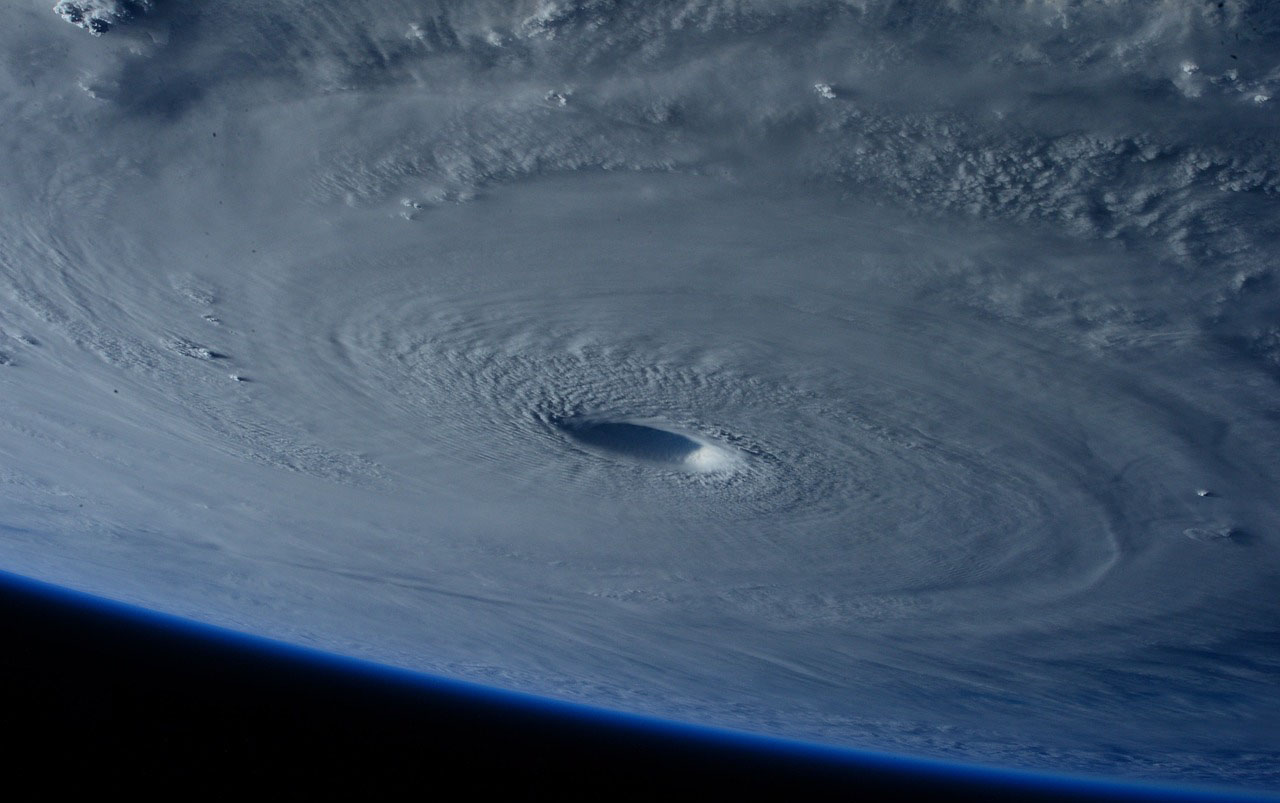

With a monumental diameter of around 900 miles, or 1,450km, at its greatest extent, Superstorm Sandy was the deadliest windstorm to occur in the north-eastern U.S. for 40 years and is the third-costliest hurricane in U.S. history (after Katrina in 2005 and Ida in 2021). It incurred around $30 billion of insured losses and over $60 billion in economic damages. But the human cost was even more devastating – more than 280 people died, including at least 54 direct deaths in Haiti and over 70 in the U.S. Many thousands were left without shelter.

What made Superstorm Sandy so extraordinary?

A number of factors converged to make Hurricane Sandy a "superstorm" – a term used for particularly intense storms that defy conventional classification – with some commentators going so far as to label it a "Franken-storm."

Superstorm Sandy had been widely expected by weather modelers to travel north-east out into the Atlantic, which is generally typical of hurricanes in the region, rather than hitting the U.S. Instead, an unusual weather pattern forced it to pivot left toward the coast, which maximized the winds and storm surge directed at the shores of Long Island, Connecticut and New Jersey.

Superstorm Sandy then hit the New York Metro area during high tide, which dramatically increased the height of the storm surge. On top of that, it was a full moon, which raises high tides along the Eastern Seaboard by about 20%. Finally, the storm was massive in geographical area, as well as slow-moving, meaning it could deliver more sustained damage over a large area.

Claims support and challenges

In the aftermath of the storm, Allianz handled around 900 customer claims, ranging from damaged cargo to flooded premises, and estimated the total impact at the time to be $590 million (€455 million). Economic losses in the city of New York alone were estimated to be $19 billion (€14 billion).

“Gaining access to loss sites to evaluate damages was a major challenge,” remembers Thomas Tesoriero, executive general adjuster at AGCS. “Traffic was limited by local authority restrictions along the coast, subway lines weren’t running because a lot of underground lines were damaged, and many buses had been flooded where they were stored during the storm. Power outages meant gas stations had problems pumping gas, which led to long lines and delayed truck deliveries, and with so many offices closed, communication with our customers and colleagues was difficult. Many companies suffered infrastructure and technology damage. Some found their backup sites were too close to the damage location.”

How things have changed. Today, drones could provide aerial shots of property damage from a safe distance, news media and ‘citizen journalists’ could quickly upload video footage from phones or security devices, and video conferencing or social media could gather key personnel in a group call or chat.

See also: How to Prepare for Catastrophe Claims

Hurricanes and climate change – what we know now

Analysis of more than 530,000 corporate insurance industry claims valued at €88.7 billion over the past five years by AGCS shows that natural catastrophes are the second top cause of losses globally for businesses overall, according to value of claims (15%), ranking behind only fire and explosion (21%). (Download the AGCS Global Claims Review.)

A deeper look at the major causes of natural catastrophe losses, based on analysis of more than 20,000 such claims around the world with an approximate value of €13.7 billion, shows that hurricanes/tornados rank at the top, accounting for 29% of the value of all claims. A major driver is the fact that two Atlantic hurricane seasons out of the previous five (2017 and 2021) are now among the top three most active and costliest seasons on record. Windstorm ranks second (19%), meaning storm activity accounts for close to 50% of the value of nat cat claims globally over the past five years. Flooding ranks third (14%).

Losses continue to rise with climate change, higher property and asset values, more complex supply chains and changes to exposures (such as increasing economic activity in natural catastrophe zones). Soaring inflation will only challenge claims costs further. Property and construction insurance claims, in particular, are exposed to higher inflation, as rebuilds and repairs are linked to the cost of materials and labor, while shortages and longer delivery times inflate business interruption values.

Hurricanes and climate change – what we know now

The meteorological conditions that boosted the power of Superstorm Sandy turbocharged the debate about climate change back in 2012. While it is still hard to prove the effect of climate change on the frequency of hurricanes, there is now broader consensus that global warming is increasing their intensity and therefore the damage they can cause. A modeling study from 2021 attributed some of the economic damages wrought by Superstorm Sandy to rising sea levels caused by human-induced climate change and even put a figure on it – $8.1 billion.

Karen Clark & Co. (KCC) has also linked climate change to increasing insurance damages from hurricanes. The risk modeler says its analysis shows losses are 11% higher today than they would have been if global temperatures had not increased. It notes that a 1°C increase in temperature likely results in a 2.5% increase in hurricane wind speeds, so the 1.1°C increase in global temperature since 1900 might have caused a 2.8% increase in wind speeds, leading to exponentially higher losses. Karen Clark wrote recently that “climate change and increasing property values in coastal areas will continue to accelerate the annual increases in hurricane risk and insured loss potential. Social inflation is also putting upward pressure on hurricane losses. The percentage of litigated claims is rising with each storm, and the cost of a litigated claim is multiples of a non-litigated claim.”

Thomas Varney, regional manager for Allianz Risk Consulting, North America, at AGCS, adds: “We are all vulnerable to climate-related risks, and climate change is starting to play a critical role in terms of risk management. The latest Allianz Risk Barometer survey shows how the lines are blurring between natural catastrophe, which was ranked third overall in the list of corporate risks, and climate change, which rose to its highest-ever position at sixth. The extreme impact of nat-cat events and their occurrence in locations or at times of year previously deemed safe is creating challenges for businesses and insurance carriers.

“As a result of climate change," Varney says, "we are seeing increases in three main areas – physical loss impact, supply chain impact and operational impact. These can play out as increased property damages from extreme weather events, business interruption caused by delays in supply chains or higher costs for heating, cooling or possibly relocating operations.

“Something is changing across the globe in terms of the types and severity of losses we are seeing. Until Hurricanes Fiona and Ian in September, the 2022 hurricane season had got off to a very quiet start, but we still expect to see another above-average season, with forecasters predicting up to 10 hurricanes in the Atlantic. Businesses have a responsibility to their customers, shareholders and stakeholders to mitigate this risk.”

Are businesses adequately prepared?

The north-east portion of the U.S. is susceptible to tropical storms and hurricanes, even if they occur infrequently. We know that sea level rise is increasing the severity of storm surge along the Atlantic and Gulf coasts of the U.S. With hurricanes, the primary sources of damage are from high winds and wind-driven water – storm surge – and between those two, it’s storm surge that generally causes more damage.

Enhancements can be made to buildings to withstand high winds relatively easily, but improvements made to increase a building’s resilience to storm surge can be more costly, time-consuming and complicated to implement. Looking ahead is key.

“Some of our clients have made changes that enable them to react quickly if their region is hit by a hurricane and flooding,” Varney says. “For example, one customer provides temporary on-site housing for essential staff members whose homes might be affected by flooding. Another large client has placed trailer-mounted generators in various locations which can be dispatched to provide power backup in the case of an electricity outage. We also have a client that entrenches training by having its 200 employees back their vehicles into parking spaces daily so that if evacuation is needed, it can be done in an orderly fashion and without delays.

“One of our manufacturing clients is using storm tracking capability to prepare for the aftermath of a hurricane. It overlays the storm path as it relates to their internal critical facilities and key suppliers. These approaches have minimized or eliminated impacts to production after the storm.”

Despite such measures being taken by some companies, most are still not fully prepared for the effects of these storms. If businesses have never been affected by one of these infrequent events, it can be easy for them to lose focus on maintaining a quality emergency preparedness plan. The question is not whether an extreme weather event will affect a business but when.

See also: 2022 Hurricane Season Update

Five steps to boost storm resilience

Give your business the best chance of withstanding and recovering from an extreme weather event by putting the following procedures in place:

1) Update and test your emergency preparedness plans: Preparation before the storm minimizes property damage and reduces business interruption. Ensure your business has a comprehensive written emergency response plan for extreme weather events, including high winds and flood. A good plan has the support of senior management, site-specific recommendations and clear delineation of responsibilities.

2) Test and update business continuity plans annually: The crucial role of business contingency plans has become more apparent as a result of recent natural catastrophes. Superstorm Sandy hit the Northeast on a Monday, which made it difficult for employees to develop and implement business contingency plans while preparing their homes and families for the storm. A well-developed contingency plan provides businesses with the tools to get back up and running as quickly as possible.

3) Understand your insurance policy: Business owners should take the time to read their current policy and discuss with their brokers what is covered and where there may be gaps. Determine if the limits of liability are in line with the current dollar value of the cost to repair or replace the damage. Consider adding an extended period of indemnity clause to the business interruption coverage to support the business until it returns to its pre-loss financial condition.

4) Know what to prepare for: Planning for a wind event involves different preparation than planning for flooding. In the case of Superstorm Sandy, the majority of preparation was based on a high-wind event, leaving many businesses unprepared for the flooding caused by the storm surge. As more sophisticated tracking models are introduced, more accurate information will be available.

5) Consider making improvements to the building and site: The following enhancements could help your business withstand the high winds and flooding that can accompany a windstorm.

a. Emergency generators for loss of power

b. Floodgates and flood doors

c. Raising critical equipment above highest anticipated flood levels

d. Protecting the building envelope from high winds (this refers to the physical boundaries between the interior and exterior of a building, such as the roof, windows and doors). This could include measures such as using impact-resistant doors and glass or better securing the roof covering system to the roof deck.