Among the issues not addressed by the 2016 ballot proposition is how to handle the state's highly complex workers' comp system.

If a million people say a foolish thing, it is still a foolish thing.

Anatole France

Maybe that quote should be, “If 1.3 million people. . . . “ That’s because Tim Draper, having spent $5 million, secured 1.3 million signatures and put a measure on the 2016 California ballot that would split the Golden State into six states.

Calling himself the “risk master,” the 56-year-old, billionaire tech investor expresses his quirky desire to “reboot and refresh our state government” by creating separate areas that would be more governable – think “Hunger Games.”

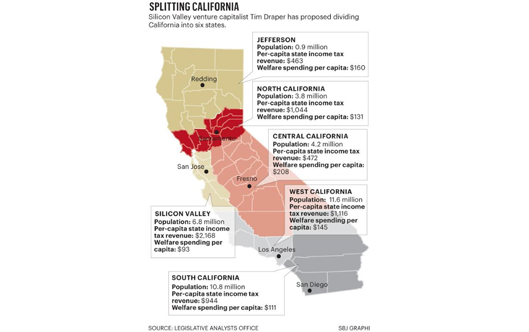

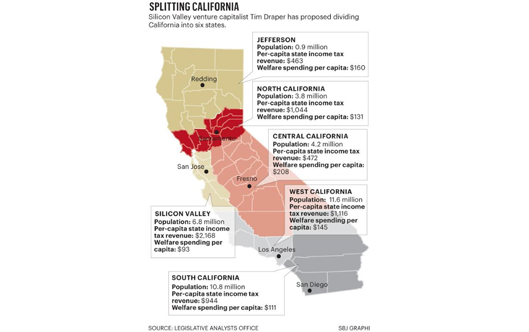

California is the largest state by population, with 38 million people (12% of the U.S.’s total of 316 million), and third largest by area behind Alaska and Texas. It is the world’s 8

th-largest economy. If Draper’s measure were approved, the new state of Silicon Valley would be the wealthiest in the country. Central California would be the poorest.

No state has been created from an existing one since West Virginia split from Virginia in 1863. But California has had at least 30 serious proposals to divide it into multiple states since its statehood in 1850, including a proposal passed by the state senate in 1965 to divide California into two states with the boundary at the Tehachapi Mountains, near Bakersfield. In 1992, the state assembly passed a bill to allow a referendum to partition California into three states: North, Central and South. Pundits referred to these proposed states as Log Land, Fog Land and Smog Land.

It is said that the area of the state adjacent to Oregon, long known by the fiercely independent locals as Jefferson State, produces 60% of the U.S. marijuana crop. Three years ago, ex-Google engineer-turned-political-economist Patri Friedman

came up with a goofy proposal to build his own floating libertarian nation 12 miles off the coast of California – Googleland?

Assuming the current state legislature and Congress both approve of Draper’s nonsensical measure, the area we currently call California would have 12 senators in Congress, not two. As much as Texans like their beer, I’m not sure they’d like to see California get a six-pack of senators.

Among the serious repercussions that Draper fails to address are vital state infrastructure issues. These include water distribution, transportation systems, state prisons, the University of California system of 10 campuses and two national laboratories – and the largest and most progressive workers’ compensation system in the country.

Workers’ compensation laws in the U.S. are promulgated on a state-by-state basis. Besides a myriad of workers’ compensation laws, each state’s bureaucracy must produce and enforce a plethora of complex regulations, licensing procedures, collateralization requirements and other rules. States have choices to make about self-insurance, including about workers’ comp pools of smaller employers.

Perhaps one or more of the new six California states would be monopolistic – where workers’ compensation coverage is purchased through the state (as in North Dakota, Ohio, Washington and Ohio). Another possibility is an “opt-out” program (as in Texas, Oklahoma and Tennessee) that allows employers to litigate injuries in the civil system, as an alternative to the “exclusive remedy” system.

As if this weren’t enough to be concerned about, the legacy of the current active California workers’ compensation claims would be an issue.

Three key institutions were created by the state legislature and are operated like private companies: the State Compensation Insurance Fund (SCIF); the California Insurance Guaranty Fund (CIGA); and the Self-Insurers’ Security Fund (SISF). SCIF is the state’s largest workers’ comp insurer and provides an insurance alternative to those companies doing business in California that are unable or unwilling to: (1) purchase workers’ compensation coverage from private competitive insurance carriers, or (2) self-insure. CIGA provides insolvency insurance for property casualty insurers admitted to doing business in the state. SISF provides protection to the state and taxpayers for non-public, self-insured entities by taking over workers’ compensation obligations from entities that have defaulted (79 since its formation in 1984).

These three entities combined cover billions of dollars of known and incurred but not reported (IBNR) workers’ compensation with open claims going back as far as World War II. Their combined assets total in the billions.

How would those three entities be broken up into six pieces and reestablished?