P&C insurers started a new momentum in 2018.

Net incomes more than doubled in the first half compared to 2017, and P&C net premiums written

rose 12.7 percent. With continuing economic traction, rising interest rates and higher investment income promised for 2019, this year could follow a similar trend, according to Deloitte.

To continue the momentum, however, the industry will need to attend to some distinct challenges.

How well insurers fit into an environment where customers are demanding greater personalization and more dynamic engagement, will depend upon insurers’ collective ability to incorporate new technologies and provide more customized coverage to meet the evolving needs of their consumer populations.

Taking a Look Back at 2018

An improving economy and a bit of good luck provided wind for the sails of P&C insurers in 2018.

Insurers witnessed growth in their insurable exposure base thanks to a drop in the unemployment rate and overall positive GDP gains, combined with

elevated consumer spending. As proof of rising consumer confidence, Adobe Analytics reported a

23.6 percent jump in online Black Friday sales over 2017, with total sales ringing in

five to nine percent higher than the previous year.

A lower number of natural disasters in the first half also provided breathing room, dropping by one-third globally over the same time period the

previous year and helping insurers to prepare for the onslaught of the 2018 hurricane season.

As of early December 2018, insurable losses from Hurricane Michael had reached $4 billion and Hurricane Florence had netted $10 billion, according to

Munich Re. Additionally, AIR Worldwide estimates that wildfire payouts are expected to

exceed $9 billion before the 2018 tallies come to a close.

Despite the large-scale cost of second-half natural disasters, total cat losses from 2018 are anticipated to be in line with a

$50 billion industry average. It’s a vast improvement over the $78 billion Munich Re

estimates for 2017, and should set the industry up for a healthier new year.

Looking Toward the Year Ahead

While the short-term outlook remains positive for 2019, insurers won’t realize the benefits in equal measure. The industry still faces many challenges in meeting consumer expectations at a time when their habits and preferences are evolving rapidly.

EY reports that

80 percent of consumers are willing to utilize digital channels of engagement, including web, chat, email, mobile apps, video and phone, to interact with their insurers. Preferences like these make digital transformation a top 2019 priority, but many insurers won’t make the grade.

For example, while

7 out of 10 insurers are now embracing cloud technology, taking advantage of lower-cost transformations and faster speed to market than on-premise system overhauls, the numbers also serve to highlight that some insurers are still behind the technological trends, fighting ailing legacy systems to meet consumer expectations in a digital age.

New product development is another area where all insurers don’t and won’t fare equally. Startups continue to enter the industry, often supported by insurer-led incubators, offering fresh products that meet the needs of consumers.

To maintain positive momentum, insurers will need to bring new products to market faster and find ways to create customized insurance solutions.

See also: De-Siloing Data for P&C Insurers

Breaking Down Technology Barriers

Technology remains an area that separates topperforming insurers from those who face extinction. According to J.D. Power,

45 percent of consumers use multiple channels when purchasing coverage, with a growing preference for online engagements.

The J.D. Power 2018 Insurance Digital Experience StudySM revealed that insurers are falling short of consumer expectations. Attractive user interfaces have proven a poor substitute for core functionality, leaving consumers unable to complete simple tasks, such as quoting and purchasing a policy, completely through online channels.

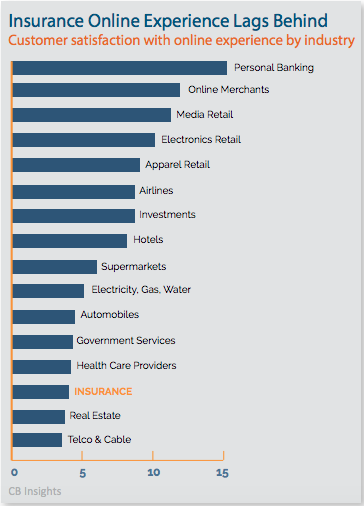

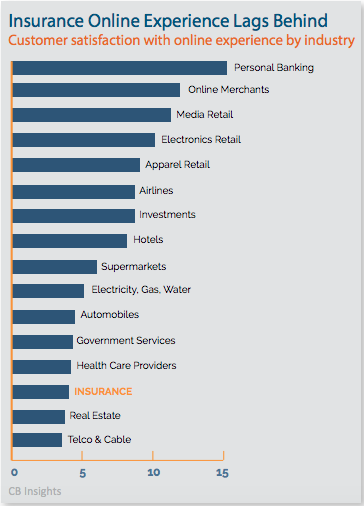

Information from CB Insights further confirms the industry’s poor showing on the digital front. According to their research, insurance continues to trail other industries when it comes to creating satisfying online experiences.

While many insurers have mastered the web-presence portion of the digital equation, allowing customers to research coverage and maybe even request a quote, this experience falls short of customer expectations driven by an Amazon-buying culture. If insurers are unable to provide web quoting, binding and issuance, they have failed to deliver the functionality consumers expect and risk losing future business.

Half of insurers

responding to a Willis Towers Watson survey agree that the industry has been too slow to respond to digital trends and must now play catch up to evolve their capabilities to consumer standards.

Eighty-five percent of CEOs are worried about the speed of technological change and their organization’s ability to develop the capabilities they need to compete.

According to a

new study conducted by North Carolina State University’s Poole College of Management’s Enterprise Risk Management (ERM) Initiative and global consulting firm Protiviti, “C-suite leaders are most concerned about their company’s ability to transform its operations and infrastructure to successfully compete with organizations that are born digital”.

Who will win on the digital front in the end: InsurTechs or incumbent players? It seems the industry is split when it comes to making a prediction, with

45 percent of insurers saying that incumbents will be the future digital disruptors. An equal number gives a nod to the startups.

Willis Towers Watson predicts that the reality will be far different as insurers instead partner with startups on digital pathways.

According to PwC, nearly half of insurance executives responding to the 21st CEO survey are planning to enter strategic alliances in 2019 as the partnership ecosystem continues to expand.

“We just think it is cheaper to buy technologies and external teams to help us get access to new capabilities,” said a director of strategy at a U.S. insurer when responding to the Willis Towers Watson Survey. “Developing our own systems is expensive and difficult."

Analytics Lead the Future

In addition to digital distribution, a growing trend toward analytics investments will be another technology-related area of focus for future-conscious insurers. While carriers are recognized for the quality of their data, managing this information for use by analytics is a challenge given the disparity between policy administration systems.

Before insurers can invest in the next stage of analytics discovery and the application of artificial intelligence, they need to have their policy silos not only in order but communicating with each other. Digital distribution platforms have proven beneficial at uniting backend systems and delivering the single view of the customer necessary for insightful analytics applications.

By using a digital distribution platform, insurers gain a single view of the customer and all applicable data. Analytics can then be applied to provide insights that fuel more personal communication between insurer and insured or more applicable products.

Insurers are also able to offer online quoting, binding and issuance, in the streamlined environment customers expect. The cost is minimal when compared to internal systems overhauls and allows insurers to meet consumers’ digital demands without the lengthy timeframes associated with core systems upgrades.

Reinventing the Insurance Product Line

While insurers are partnering with InsurTech innovators to gain critical technological capabilities, particularly in the area of digital distribution, InsurTech innovation will provide a challenge to incumbents on the new product front.

While much of early InsurTech funding focused on the healthcare space, CB Insights has witnessed the infusion of InsurTech dollars across the P&C sector,

rising rapidly from 2015 and peaking in 2017. They estimate a $210 billion opportunity awaits across personal auto. The homeowners market represents an additional $74 billion for tech savvy startups bent on disruption.

Currently, customer recognition of new entrants is low, but many are gaining ground. Bain’s 2018 Customer Behavior and Loyalty in Insurance Study reports that Lemonade is outperforming incumbents on the aspects of the buying experience that matter most to consumers.

The study also revealed that

60 percent of the 174,000 respondents said they were open to purchasing insurance through new entrants.

In 2019 and beyond, insurers will need to innovate and bring new products to market faster to keep pace with InsurTech innovation. The trend is driven by a number of consumer demands, including those for coverage that includes expanded risks as well as innovative ways of insuring assets.

The sharing economy is one example where societal and technological changes are driving the need for insurance product innovation. One quarter of those participating in the sharing economy who believe they are at risk for doing so, want coverage they can turn on and off as needed. Deloitte predicts that insurers will need to increasingly “blur the lines” between personal and commercial coverage to meet these needs, providing hybrid policies that encompass malpractice, product, auto and cyber liability in one policy

InsurTech Innovation Marches On

- Root, a usage-based auto insurance carrier raises $51 million in Series C funding. Root “insures only safe drivers” by using data acquired through Smartphone apps to determine consumer driving behavior. Premiums are priced accordingly.

- At-Bay, a “proactive cyber security monitoring service” offering related insurance coverage, raises $13 million in Series A funding, adding up to $19 million in total funds.

- Buddy offers on-demand, supplemental accident coverage for people who participate in active, higherrisk activities, such as skiing, hunting or hiking. Coverage is turned on and off via a smartphone app. The company was selected as one of only 10 companies admitted into the inaugural class of the MetLife Digital Accelerator.

While competition is entering the industry, CB Insights reveals that most insurers have focused on forming InsurTech partnerships with companies that complement their existing business over developing new products. Providing ancillary services, such as roadside assistance or organizational tools that help consumers compare the cost of car repairs, for example, has proven advantageous for insurers. According to Bain,

80 percent of consumers are interested in ecosystem services and willing to pay a higher premium to get them.

While many insurers shy away from product innovation in favor of ancillary services, others are beginning to invest in InsurTech incubators or accelerator programs. In December of last year, The Hartford announced ten new startups that would participate in its second program launching in 2019. Accepted entrants are offering a wide range of products, including item insurance purchased through a mobile snapshot (Pineapple) and on-demand coverage for drones (Skywatch).

See also: Keys to Loyalty for P&C Customers

See Your Box, specializes in collecting and analyzing data from IoT devices. According to Deloitte, sensor-based telematics policies are poised to become “a major force in product development” in 2019 despite emerging carrier disillusionment.

Nearly

one-third of insurance CIOs surveyed by Ovum stated that the cost and complexity of implementing IoT-based products was a deterrent to implementation. Nearly

25 percent find low appetite from customers for the coverage.

Consumers and businesses are looking for customerfriendly products designed to protect them and their assets without breaking the bank. For instance, a recent survey conducted by Ovum revealed that 50 percent of U.S. firms have not purchased cyber security coverage despite the fact that 61 percent expect a breach in the next 12 months.

Lack of value is considered to be one of the biggest deterrents. Only a quarter of firms feel that premiums are accurately aligned to their risk profiles, and

23 percent believe the industry is unclear about their approaches to policy pricing. Sixteen percent of respondents who have purchased policies say they aren’t covered for all risks.

To consistently maintain and gain market share, insurers need to deliver on customer needs. That means protecting them against liability and their assets against loss, but in ways that deliver value and meet cost expectations. According to Bain’s analysis of their recent study, consumers “want to be able to choose from a good selection of policies at reasonable prices”.

While some insurers will initiate incubators or accelerators to win InsurTech partnerships that enhance product lineups, others will go it alone, using vast stores of data to develop products that more closely fit the needs of customers today.

Of course, not all insurers will have an appetite for expanded risks or the need to develop new product types when their primary customer base is covered by more traditional policies. All insurers, whether developing new products in house, supporting an incubator, or relying on their current product stack can benefit from a market network.

Market networks will grow in 2019 as a way to enhance product selection and meet the need for more customized coverage. As insurers offer their products through the network, they are also able to utilize policies offered by other carriers to meet the needs of their customers when they don’t have an appetite for the risk or don’t have a product in house. Customizing coverage in this way allows insurers to meet the customers’ needs and price points while maintaining the renewal and the customer relationship.

A market network operates as part of a distribution platform, providing insurers with digital distribution capabilities that unite product silos and enhance analytics applications. Insurers can provide a digital environment that allows consumers to select from a broad range of coverage to more accurately meet their insurance needs.

You can download the report here. While many insurers have mastered the web-presence portion of the digital equation, allowing customers to research coverage and maybe even request a quote, this experience falls short of customer expectations driven by an Amazon-buying culture. If insurers are unable to provide web quoting, binding and issuance, they have failed to deliver the functionality consumers expect and risk losing future business.

Half of insurers responding to a Willis Towers Watson survey agree that the industry has been too slow to respond to digital trends and must now play catch up to evolve their capabilities to consumer standards. Eighty-five percent of CEOs are worried about the speed of technological change and their organization’s ability to develop the capabilities they need to compete.

According to a new study conducted by North Carolina State University’s Poole College of Management’s Enterprise Risk Management (ERM) Initiative and global consulting firm Protiviti, “C-suite leaders are most concerned about their company’s ability to transform its operations and infrastructure to successfully compete with organizations that are born digital”.

Who will win on the digital front in the end: InsurTechs or incumbent players? It seems the industry is split when it comes to making a prediction, with 45 percent of insurers saying that incumbents will be the future digital disruptors. An equal number gives a nod to the startups.

Willis Towers Watson predicts that the reality will be far different as insurers instead partner with startups on digital pathways. According to PwC, nearly half of insurance executives responding to the 21st CEO survey are planning to enter strategic alliances in 2019 as the partnership ecosystem continues to expand.

“We just think it is cheaper to buy technologies and external teams to help us get access to new capabilities,” said a director of strategy at a U.S. insurer when responding to the Willis Towers Watson Survey. “Developing our own systems is expensive and difficult."

Analytics Lead the Future

In addition to digital distribution, a growing trend toward analytics investments will be another technology-related area of focus for future-conscious insurers. While carriers are recognized for the quality of their data, managing this information for use by analytics is a challenge given the disparity between policy administration systems.

Before insurers can invest in the next stage of analytics discovery and the application of artificial intelligence, they need to have their policy silos not only in order but communicating with each other. Digital distribution platforms have proven beneficial at uniting backend systems and delivering the single view of the customer necessary for insightful analytics applications.

By using a digital distribution platform, insurers gain a single view of the customer and all applicable data. Analytics can then be applied to provide insights that fuel more personal communication between insurer and insured or more applicable products.

Insurers are also able to offer online quoting, binding and issuance, in the streamlined environment customers expect. The cost is minimal when compared to internal systems overhauls and allows insurers to meet consumers’ digital demands without the lengthy timeframes associated with core systems upgrades.

Reinventing the Insurance Product Line

While insurers are partnering with InsurTech innovators to gain critical technological capabilities, particularly in the area of digital distribution, InsurTech innovation will provide a challenge to incumbents on the new product front.

While much of early InsurTech funding focused on the healthcare space, CB Insights has witnessed the infusion of InsurTech dollars across the P&C sector, rising rapidly from 2015 and peaking in 2017. They estimate a $210 billion opportunity awaits across personal auto. The homeowners market represents an additional $74 billion for tech savvy startups bent on disruption.

Currently, customer recognition of new entrants is low, but many are gaining ground. Bain’s 2018 Customer Behavior and Loyalty in Insurance Study reports that Lemonade is outperforming incumbents on the aspects of the buying experience that matter most to consumers.

The study also revealed that 60 percent of the 174,000 respondents said they were open to purchasing insurance through new entrants.

In 2019 and beyond, insurers will need to innovate and bring new products to market faster to keep pace with InsurTech innovation. The trend is driven by a number of consumer demands, including those for coverage that includes expanded risks as well as innovative ways of insuring assets.

The sharing economy is one example where societal and technological changes are driving the need for insurance product innovation. One quarter of those participating in the sharing economy who believe they are at risk for doing so, want coverage they can turn on and off as needed. Deloitte predicts that insurers will need to increasingly “blur the lines” between personal and commercial coverage to meet these needs, providing hybrid policies that encompass malpractice, product, auto and cyber liability in one policy

InsurTech Innovation Marches On

While many insurers have mastered the web-presence portion of the digital equation, allowing customers to research coverage and maybe even request a quote, this experience falls short of customer expectations driven by an Amazon-buying culture. If insurers are unable to provide web quoting, binding and issuance, they have failed to deliver the functionality consumers expect and risk losing future business.

Half of insurers responding to a Willis Towers Watson survey agree that the industry has been too slow to respond to digital trends and must now play catch up to evolve their capabilities to consumer standards. Eighty-five percent of CEOs are worried about the speed of technological change and their organization’s ability to develop the capabilities they need to compete.

According to a new study conducted by North Carolina State University’s Poole College of Management’s Enterprise Risk Management (ERM) Initiative and global consulting firm Protiviti, “C-suite leaders are most concerned about their company’s ability to transform its operations and infrastructure to successfully compete with organizations that are born digital”.

Who will win on the digital front in the end: InsurTechs or incumbent players? It seems the industry is split when it comes to making a prediction, with 45 percent of insurers saying that incumbents will be the future digital disruptors. An equal number gives a nod to the startups.

Willis Towers Watson predicts that the reality will be far different as insurers instead partner with startups on digital pathways. According to PwC, nearly half of insurance executives responding to the 21st CEO survey are planning to enter strategic alliances in 2019 as the partnership ecosystem continues to expand.

“We just think it is cheaper to buy technologies and external teams to help us get access to new capabilities,” said a director of strategy at a U.S. insurer when responding to the Willis Towers Watson Survey. “Developing our own systems is expensive and difficult."

Analytics Lead the Future

In addition to digital distribution, a growing trend toward analytics investments will be another technology-related area of focus for future-conscious insurers. While carriers are recognized for the quality of their data, managing this information for use by analytics is a challenge given the disparity between policy administration systems.

Before insurers can invest in the next stage of analytics discovery and the application of artificial intelligence, they need to have their policy silos not only in order but communicating with each other. Digital distribution platforms have proven beneficial at uniting backend systems and delivering the single view of the customer necessary for insightful analytics applications.

By using a digital distribution platform, insurers gain a single view of the customer and all applicable data. Analytics can then be applied to provide insights that fuel more personal communication between insurer and insured or more applicable products.

Insurers are also able to offer online quoting, binding and issuance, in the streamlined environment customers expect. The cost is minimal when compared to internal systems overhauls and allows insurers to meet consumers’ digital demands without the lengthy timeframes associated with core systems upgrades.

Reinventing the Insurance Product Line

While insurers are partnering with InsurTech innovators to gain critical technological capabilities, particularly in the area of digital distribution, InsurTech innovation will provide a challenge to incumbents on the new product front.

While much of early InsurTech funding focused on the healthcare space, CB Insights has witnessed the infusion of InsurTech dollars across the P&C sector, rising rapidly from 2015 and peaking in 2017. They estimate a $210 billion opportunity awaits across personal auto. The homeowners market represents an additional $74 billion for tech savvy startups bent on disruption.

Currently, customer recognition of new entrants is low, but many are gaining ground. Bain’s 2018 Customer Behavior and Loyalty in Insurance Study reports that Lemonade is outperforming incumbents on the aspects of the buying experience that matter most to consumers.

The study also revealed that 60 percent of the 174,000 respondents said they were open to purchasing insurance through new entrants.

In 2019 and beyond, insurers will need to innovate and bring new products to market faster to keep pace with InsurTech innovation. The trend is driven by a number of consumer demands, including those for coverage that includes expanded risks as well as innovative ways of insuring assets.

The sharing economy is one example where societal and technological changes are driving the need for insurance product innovation. One quarter of those participating in the sharing economy who believe they are at risk for doing so, want coverage they can turn on and off as needed. Deloitte predicts that insurers will need to increasingly “blur the lines” between personal and commercial coverage to meet these needs, providing hybrid policies that encompass malpractice, product, auto and cyber liability in one policy

InsurTech Innovation Marches On