Leap Year: Season 2, Episode 2 - One Of Those Nights

For many businesses, a business owner policy can be a lifesaver and keep a temporary setback like a break-in or a fire from becoming something that truly threatens the future of their businesses.|

For many businesses, a business owner policy can be a lifesaver and keep a temporary setback like a break-in or a fire from becoming something that truly threatens the future of their businesses.|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Small businesses can raise their public profile through providing helpful news and information and avoiding risks and possible mistakes.|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

SB 863 introduced new requirements for California private workers' comp self-insured employers and self-insured groups.

Under the new requirements of SB 863, California private (non-public entity) workers' comp self-insured employers and self-insured groups (SIGs) starting this year are required to submit an actuarial study and an actuarial summary form to the Department of Industrial Relation's Office of Self-Insured Plans (OSIP). Private self-insured employers' actuarial submissions are due on May 1 and SIGs are due on April 15. The new actuarial study and summary form must both be prepared by a qualified actuary, as defined by OSIP.

Under SB 863, the method for calculating OSIP's required security deposits has changed from the old method involving the Estimated Future Liabilities (EFL) formula (multiplied by a factor of 1.35 - 2.00) to the new actuarial methodology. This is considered the "gold standard" by insurers, captives, and other state Guaranty Funds as well. Self insurers are still required to submit their self-insured employers' annual reports to OSIP as they have always done. This annual report covers the self-insured entity's open workers' comp claims by calendar year.

Those 340+ self-insured entities in the Alternative Security Program (ASP) of the Self-Insurers' Security Fund (SISF) are part of the annual composite deposit program wherein SISF provides OSIP with their security deposit guarantee. They post nothing. Therefore, their security deposits are "notional" since SISF covers them. SISF's ASP member assessments in July, 2013 will be adjusted (i.e. rebalanced) to reflect the new actuarial standard. Some ASP entities may experience increases or decreases in their annual assessments as a result of their restated open claim liabilities using a uniform actuarial standard. Currently, SISF member security deposits are based on factors of 135% to over 200% of their total EFL.

SISF's excluded entities are those that are required to post collateral (cash, LOC, securities, or security bonds) with OSIP. The 25 active California SIG's already post security deposits based upon an actuarial figure, but in 2013 SIG security deposits — like individual self-insureds — is at the undiscounted "expected level" versus the previous standard of an 80% confidence level.

Each self-insured's actuarial report must include: Incurred But Not Reported (IBNR) liabilities, Allocated Loss Adjustment Expense (ALAE), and Unallocated Loss Adjusted Expense (ULAE), less any credit for applicable excess insurance. Each of these amounts will be reported on the actuarial summary form. There are currently 55 single-entity self-insureds that will now be required to post their OSIP security deposit based upon their 2012 actuarial report submittal.

The new OSIP self-insured actuarial summary form was just placed on the OSIP website on February 14, 2013. (Note: These new requirements do not apply to government entities and JPA's).

The actuarial valuation report of the self-insured's open workers' comp claims must be as of December 31 of the previous year (i.e. 12/31/2012). Actuaries may roll forward liabilities to the December 31 date instead of having a separate study performed if the self-insured already has actuarial studies that use a different valuation date.

It's important to note that with nearly 500 self-insured entities being impacted in 2013 by SB 863 changes, exceptions to the requirement to file an actuarial summary are being developed and will be contained in a regular rulemaking package that should be publically announced within the next four to six weeks. The proposed exceptions will most likely only pertain to self-insurers that have a few open claims or a very low total ELF.

David Axene, a healthcare actuary and an Insurance Thought Leadership author and advisory board member, recommends Jeffrey R. Jordan and Frederick W. Kilbourne as actuaries who would be able to help you with the actuarial study and actuarial summary form now required as a result of the passage of SB 863:

Jeffrey R. Jordan, FCAS, MAAA

Phone: 818.879.1299

Send Jeffrey an Email

Frederick W. Kilbourne, FCAS, MAAA, FSA

Phone: 858.793.1300

Website: www.thekilbournecompany.com

Send Frederick an Email

Additional Resources To Help You Find An Actuary

Society of Actuaries

Online Directory of Actuarial Memberships

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

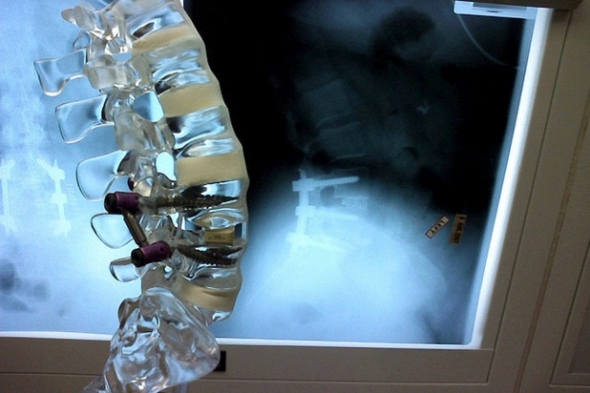

The only way the Healthcare industry can manage their musculoskeletal disorder cases is by adopting the the EFA-STM baseline test, which is an objective, evidence-based tool designed to measure the functional status of an injured worker and to identify return-to-work opportunities. We are pleased to include a phone interview with Dr. Reaston with this article through a special media partnership with WRIN.tv.|The only way the Healthcare industry can manage their musculoskeletal disorder cases is by adopting the the EFA-STM baseline test, which is an objective, evidence-based tool designed to measure the functional status of an injured worker and to identify return-to-work opportunities. We are pleased to include a phone interview with Dr. Reaston with this article through a special media partnership with WRIN.tv.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Water system renewal can be a confusing process and certainly not a hands-off affair for the insurer. A qualified owner's representative is needed to help navigate the landscape of technologies and contractors who sell them.

In the heyday of the real estate bubble, developers flipped tens of thousands of apartment structures into condominiums — with little regard for the condition of the potable water system. Many of these galvanized steel or early copper systems are rapidly approaching the end of their service life. Unseen, a small leak can cause thousands of dollars of damage and a ruptured main riser can amount to millions of dollars in claims and severe hardship for the community of homeowners.

While it may be tempting to react to failure statistics, not all water systems are equal. Water chemistry varies substantially across the country, as do workmanship and materials quality — these variables may have a greater influence on mode and consequences of the failure than the age of the system itself. The least appropriate action may be for the insurer to put the community in an emergency situation. Poor or rushed Homeowners Association (HOA) decisions can end up costing everyone far more than a properly replaced system that is well planned.

Insurers must first help the community to resolve to replace their potable water system. Then, they must encourage the community to have a comprehensive piping condition assessment overseen by a qualified engineering representative. It is essential to determine the stability of the existing system without the threat of policy cancellation. Small leaks may be tolerable as long as the possibility of a large rupture is fairly remote — they are not necessarily related conditions. Once these probabilities are known, then good decisions regarding a replacement system can be made.

Unfortunately, the Homeowners Association board is often left with a daunting task of selecting the right technology that both heals the pain and fits the budget. All pipe renewal solutions have different risks and vulnerabilities and many Homeowners Associations can fall for a slick contractor peddling inferior products. Potable water is a matter than requires rational analysis.

Piping Materials:

The three main classifications of piping renewal materials on the market include epoxy liner, copper re-pipe, or a variety of plastic products. All have vulnerabilities and limitations so it is important for the insurer to take a deep hard look at the risks while the Homeowners Association can focus on the costs.

Epoxy Pipe Liner

Epoxy pipe liner is a continuous paint-like coating that is blown through an existing pipe system that has been cleaned by an abrasive sandblasting. Epoxy has the advantage of being relatively fast and minimally invasive. The problem with epoxy is there is no certain way to know the pipe is clean on the inside and no certain way to know if the cleaning process compromises the strength of the pipe. Finally, if we were to test the epoxy, and adhesion is shown to be poor — then what? There is no way to remove the epoxy and breaking the continuity of the coating breaks the protection. Our research has found that an epoxy failure can very likely happen at the exact place where the pipe is already at its weakest. This does little to mitigate the peril of the multi-million dollar rupture claim. While we are confident that epoxy may be applied correctly, we are not confident the epoxy would be risk/cost competitive over a far superior re-pipe.

New Copper Re-pipe

Copper is very familiar to most people from its use in the penny. The tarnish that forms on copper actually protects it from corrosion. Under the right conditions, a 50-year service life is a reasonable expectation if that tarnish coat is not disrupted. Copper plumbing has been extensively studied and many professional codes and standards apply to its use. Consequently, many copper failures can be traced directly back as failures to apply these standards: improper design, poor workmanship, aggressive water chemistry, or inferior materials, etc. All are known perils, which may be avoided or mitigated with the assistance of a good technical advisor representing the best interest of the owners.

Cross Linked Polyethylene (PEX)

PEX is a white or colored plastic that is fairly stiff but also quite flexible. A slightly weaker form is commonly used in plastic milk jugs. PEX has been used in the US for 20-25 years, and has demonstrated an excellent track record in millions of installations. PEX is easy to install, relatively low cost, and enjoys broad market acceptance. PEX has two main problems — both of which are avoidable. Lawsuits have been filed over failures due to "dezincification" of low cost brass fittings. It is extremely important to avoid some sources of fittings with high zinc composition in alloy. Lawsuits have also been filed over the leaching of chemical compounds from types A and C PEX — the use of Type B PEX largely eliminates this problem. Again, a good owner's representative can help navigate this landscape. Many other plastic piping materials exist, but not without similar controversies.

New Polypropylene Pipe

A newcomer to the pipe materials selection is polypropylene — polypropylene is a common recyclable material with important uses in medical and food grade applications. Polypropylene is a very simple molecule of carbon and hydrogen — nothing bad goes in so nothing bad can leach out. While new to the US, we have traced its use in Europe to at least 30 years back with a very low failure incident rate. Polypropylene has excellent thermal and acoustic properties and is widely considered the most environmentally friendly piping material available. Some disadvantages are that special fusing irons and specially trained installers are required.

Water system renewal can be a confusing process — and certainly not a hands-off affair for the insurer. A qualified owner's representative is needed to help navigate the landscape of technologies and contractors who sell them. When the project is complete, the representative can help petition the underwriter, the financial industry, and the real estate market for adjustments that reflect the value of your renewed new system. The technical representative can help eliminate engineering and construction risks without interfering with the normal dynamics of a wise and proactive homeowners association.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

We need a strong public/private partnership to combat property crime. Underwriters must answer the question, "How can we encourage policyholders to use video alarms and police response to reduce losses?"

Traditional burglar alarms have lost much of their value as a tool for loss control, but video alarms are taking their place. Police response to burglar alarms is degrading and in many cases police departments have stopped responding to traditional alarms unless they are verified.

Millions of traditional alarm systems have created an enormous problem, wasting shrinking police resources on millions of false alarms. It is a big concern that has the attention of national law enforcement leadership.

International Association of Chiefs of Police (IACP) president, Chief Craig Steckler specifically addressed false alarms as a key issue in his inaugural address of October, 2012, "According to studies, last year there were more than 38 million false alarm calls in the United States. In many agencies alarm calls were the number one call for service, and statistically, these calls often account for nearly ten percent of all the calls for service the agency handles on an annual basis. Additionally, every study of the issue continually finds that 95 to 99 per cent of all alarms are false." Chief Steckler bluntly states, "We must take a critical look and unbiased look at false burglar alarms, and determine whether in the new norm, this type of call (police responding to alarms) is truly a prudent use of severely limited resources."

Chief Steckler is not exaggerating. Police consider traditional burglar alarms an enormous waste of resources. Officers no longer make arrests, and alarm companies focus on selling deterrence instead of apprehensions. From the police perspective, many simply no longer care.

The situation has degraded to the point that many major cities like Las Vegas, Salt Lake City, San Jose, and Milwaukee stopped responding to traditional burglar alarms altogether. This trend is gathering momentum. The public/private partnership of the police/alarm company/insurance industry has atrophied, and neither the police nor underwriters find effective loss control in traditional burglar alarms.

In contrast, this video underscores the value that law enforcement places on video verified alarms to combat property crime. The president of the National Sheriffs Association describes Priority Response and how effective they are at delivering arrests. There are many actual video clips of real burglaries in the video itself.

Response Differentials

Video verified alarms are an increasingly important evolution to combat property crime. They continue to deliver priority police response and lead to arrests. The reason is the video verified alarms mean that police respond faster to the alarm, making arrests and reducing claims.

The "response differential" between a traditional alarm and a video verified alarm is significant. The following chart illustrates the differences in different sample cities across the USA: large and small, east and west, north and south. The key issue is that video verified alarms deliver police response faster, around 15 minutes faster in many jurisdictions. Those 15 minutes makes a big difference in reducing claims for property crime.

| Jurisdiction | Video Alarm | Traditional | Differential |

| Boston, MA | 7:38 | 21:00 | 13:22 |

| Charlotte, NC | 5:10 | 13:30 | 8:20 |

| Chula Vista, CA | 5:05 | 19:18 | 14:13 |

| Watertown, MA | 4:00 | 23:00 | 19:00 |

| Fairfax County, VA | 6:00 | 18:02 | 12:02 |

| Salinas, CA | 2:54 | 39:25 | 36:19 |

| Amarillo, TX | 10:06 | 19:24 | 9:18 |

Real Examples Of Alarm/Police Interaction

Perhaps the most effective way to illustrate the value of video verified alarms is to show 4 actual examples of real events with different outcomes based upon the alarm and jurisdiction. This is what the alarm business really looks like from the police side of things. Two of these examples lead to arrests. Insurers must realize the importance of central station dispatchers using video to become virtual eyewitnesses to a crime in progress.

All of the examples are not positive. In the final alarm, the 911 call taker says to the central station operator: "This doesn't meet our criteria for response," meaning that the municipality won't respond to the alarm without the video verification. The central station operator sounds a bit stunned on the phone. But this is the scenario that is happening increasingly around the country. This last example is what insurers are trying to avoid by promoting video verified alarms to their policy holders.

Now What?

We need a strong public/private partnership to combat property crime. Underwriters must answer the question, "How can we encourage policyholders to use video alarms and police response to reduce losses?"

One answer would be to join the Partnership for Priority Video Alarm Response (PPVAR), a nonprofit public/private partnership based in St. Paul, Minnesota. The organization brings together alarms companies, insurers, and law enforcement to promote Priority Response and Video Alarms to reduce property crime and insurance losses. The PPVAR board of directors includes law enforcement, alarm companies and the National Insurance Crime Bureau (NICB) that is supported by 1,100 property/casualty insurance companies.

To further strengthen leadership from the insurance industry, the PPVAR recently added Verisk Crime Analytics Vice President Anthony Canale to its board of directors. There are now two strong insurance organizations to help build the partnership with law enforcement and the alarm companies. Verisk owns and operates national crime databases that provide services to the construction, retail, transportation, manufacturing and insurance industries.

"Our involvement with the PPVAR fits with the mission of Verisk Crime Analytics to use data and analytical tools to support public safety operations and to help our clients reduce the impact of crime," said Canale.

As the successes grow, the PPVAR is expanding its membership in the insurance industry — individual insurance companies joining the partnership and embracing the message. The PPVAR welcomes additional insurance companies and associations to work with us to help use video alarms to reduce claims and losses.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Once the currently undocumented can legally remain in the US and continue to work in the industries they occupy, it is more likely that they will opt to go to their home country for medical treatment should they get injured on the job.

Five years ago, members of a risk management discussion group I belong to on Yahoo Groups raised the question of whether or not illegal immigrants (i.e., undocumented immigrants) were entitled to workers' compensation benefits. The answer most of the respondents gave was yes, but with some restrictions depending upon the state. One respondent in particular even provided the group with documents from the Independent Insurance Agents & Brokers of America, Inc. (IIABA) that gave the pros and cons in the debate on whether undocumented immigrants were entitled to benefits or not.

The purpose of this article is not to rehash the debate points, but to explore what impact impending immigration reform, which has been promised by the Obama administration in the upcoming second term of the president, will have on workers' compensation and the likelihood that injured newly legal immigrant workers, especially from Mexico and other Latin American countries, will avail themselves of the benefits of medical tourism to their home countries as an option if injured on the job.

According to the IIABA White Paper, which cited a Pew Hispanic Center report published in 2006, there are probably 11 to 12 million undocumented immigrants in the US, depending upon how many have "self-deported" recently due to the current US economic slowdown. Demographically, this represents 5.4 million men, 3.9 million women, and 1.8 million children. In addition, there are 3.1 million children who are US citizens, having been born here (64% of all children of the undocumented) from one or more parent.

President Obama's Executive Order last year gave many of these children a reprieve from deportation while they are attending college here and until more comprehensive reform can be achieved for all undocumented immigrants. Undocumented immigrants account for almost one-third of all foreign-born residents of the US, and about 80% of these are from Mexico and other Latin American countries.

The report also states that out of the total number of 9.3 million undocumented adults, 7.2 million (77%) are employed and account for around 5% of the US workforce. They comprise a disproportionate percentage in some industries, such as 24% of farm workers, 17% of cleaning workers, 14% of construction workers, and 12% of food preparers.

These industries typically account for much of the claims filed under the US workers' compensation system. Within a particular industry, undocumented workers comprise a higher percentage of more hazardous occupations. For example, 36% of insulation workers and 29% of all roofing employees are estimated to be undocumented.

In my blog post, The Stars Aligned, I briefly touched upon the issue of immigration reform's impact on medical tourism for workers' compensation in regard to Mexican workers in the US. But since President Obama and Florida Senator Marco Rubio have recently outlined different reform plans, which I will discuss here in this post, it is important to mention first how undocumented workers are treated under the various laws each state has established to govern their workers' compensation systems.

A document I mentioned in that blog post was a chart of the laws governing workers' compensation and undocumented workers that one of the respondents had forwarded to the discussion group.

Undocumented workers are entitled to workers' compensation benefits in thirty-eight states; however, six states have statutes that allow or restrict benefits for various reasons such as:

Three states — California, Georgia and Nebraska — have statutes that indicate that undocumented workers are not entitled to benefits in certain situations. California case law establishes that undocumented workers could be refused vocational rehabilitation benefits. Georgia case law establishes that disability benefits are not payable if the worker is unable to work due to his status and not his injury. And, Nebraska case law established that a worker named Ortiz could be refused vocational rehabilitation benefits because he could not legally work in the US and did not plan to return to Mexico to work.

Only Wyoming has a statute that expressly includes only "legally employed ... aliens." And case law in 1999 confirmed that undocumented workers were not entitled to benefits. Eleven states — Alaska, Delaware, Indiana, Maine, Missouri, Rhode Island, South Dakota, Vermont, Washington, West Virginia and Wisconsin — were listed in the chart as unknown as to whether or not undocumented immigrants are entitled to benefits.

As we begin the second Obama Administration, immigration reform has risen to the top of the list, only to be preceded by the debt crisis and the fiscal cliff. As I mentioned above, both President Obama and Florida Senator Marco Rubio have outlined their own versions of what immigration reform would look like. Senator Rubio's plan would rely more on skilled workers such as engineers and seasonal farm workers while tightening border enforcement and immigration law. Senator Rubio's plan would not provide blanket amnesty to those already here.

On the other hand, President Obama's plan, as outlined in a recent New York Times article, would seek to give undocumented workers a path to citizenship. Sen. Rubio's plan would focus more on merit and skill as prerequisites for entry into the US, much like earlier immigration laws passed in the 1920s and other decades. The president's plan would be broader and more immediate, and would probably have less of an impact on the economic stability of those industries that currently rely on undocumented workers.

Whatever form immigration reform will take, the opportunities to offer medical tourism as an option to injured undocumented workers, once they achieve some legal form of citizenship, will no doubt increase. The likelihood that something will be done this year has already been the topic of many news programs and even has been discussed by congressional leaders such as Harry Reid, the Senate Majority leader.

Once the currently undocumented can legally remain in the US and continue to work in the industries they occupy, it is more likely that they will opt to go to their home country for medical treatment should they get injured on the job. With the benefits of doing so, such as not having language barriers, cultural barriers, and being able to be visited by friends and family living there, they will be more open to receiving treatment at facilities they normally could never get into. And as many of these countries are fast becoming "rising stars" as medical tourism destinations, the more likely they will want to get treated at the best hospitals in their countries, which will have a huge impact on their recovery, their well-being and their standing with friends and family. And the financial burden of not having to look for a job back home and being able to return to the US will convince them to opt for medical tourism as injured workers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Come July 1, 2013, many areas of Workers' Compensation that have "gap" problems will simply go away. And the parties will fully participate in the independent medical review process on all claims. Until that time, however, we must continue to infer what the legislature intended, and litigate items such as this, if necessary.

In an attempt to simplify the ever-confusing Workers' Compensation world in the great State of California, our legislative branch drafted SB 863 in 2012. With the stroke of his pen, Governor Brown enacted sweeping legislation, with effective and varying start dates for various provisions of the new law. However, with varying start dates comes confusion regarding various provisions. A spinal surgery request is one of the areas which appears to have a problem with the implementation date of July 1, 2013.

Effective January 1, 2013, provisions under Labor Code § 4062(b) pertaining to the spinal surgery second opinion process have been eliminated from the Labor Code. Overall, this is a positive result for the Defendant from SB 863. The new independent medical review (IMR) process kicks in on July 1, 2013, for dates of injury prior to January 1, 2013. However, a new question has surfaced as a result of this substantial change. How do we address spinal surgery requests for dates of injury prior to January 1, 2013?

The new regulations and the Labor Code conflict in their guidance. Labor Code § 4062 (b) reads: "For injuries on or after 1/1/2013 and for UR decisions communicated on or after 7/1/2013, regardless of date of injury, all employee objections to utilization review disputes under Lab Code § 4610 are resolved only IMR pursuant to 4610.5 and not through the QME process." Simple enough. Yet with the provisions of Labor Code § 4610.5 regarding the IMR process not starting until July 1, 2013, we have a sizeable gap of six months where the parties are seemingly unable to participate in a second opinion process as well as the independent medical review process.

Causing even more confusion is the second half of Labor Code § 4062(b) which reads: "For injuries on or after 1/1/2013 and for objections to diagnosis of treatment recommendations within the MPN, regardless of the date of injury, all employee objections to diagnosis or treatment recommendations within the MPN are also resolved only through independent medical review pursuant to § 4610.5."

Curiously, this seems to imply that the independent medical review process is the method which should be used, since a request for spinal surgery is clearly a request for care. Further, the process is to be implemented "regardless of the date of injury." That being said, we must note that the objections must come from care within the medical provider network (if applicable). Further, it appears that this section refers only to "employee" (not employer) objections.

So what is the correct answer? In my research, I consulted with numerous publications. I also consulted with fellow colleagues. All presented varying answers. Ultimately, I found the answer in Labor Code § 4610(g)(3) which provides: "(3) (A) Decisions to approve, modify, delay, or deny requests by physicians for authorization prior to, or concurrent with, the provision of medical treatment services to employees shall be communicated to the requesting physician within 24 hours of the decision. Decisions resulting in modification, delay, or denial of all or part of the requested health care service shall be communicated to physicians initially by telephone or facsimile, and to the physician and employee in writing within 24 hours for concurrent review, or within two business days of the decision for prospective review, as prescribed by the administrative director. If the request is not approved in full, disputes shall be resolved in accordance with Section 4610.5, if applicable, or otherwise in accordance with Section 4062."

As Labor Code § 4610.5 is not applicable until July 1, 2013, Labor Code § 4062 will apply and the medical-legal process takes over. Which means the Defendant would adhere to the requirements under the guidelines established under the utilization review process when we are faced with a spinal surgery request.

Upon receipt of the request, they must proceed with a timely and proper review and furthermore must properly convey the denial for care as indicated above. It is important to remember that the Defendant must notify the "employee" by a copy to the employee and their attorney. In their notice to the physician, the correct, identified physician must be served as indicated above. Finally, it is my recommendation that with any utilization review determination, a proof of service should accompany the final, written decision. Although this step may be seen as a small one and potentially burdensome, a proof of service signed under penalty of perjury usually eliminates a claim of late or improper service, and can be a very valuable tool at the time of a hearing.

Assuming the utilization review process was completed properly and a denial issued, the parties would then proceed with a medical-legal evaluation under Labor Code § 4062 to resolve the dispute.

Come July 1, 2013, many areas of Workers' Compensation that have these sorts of "gap" problems will simply go away. And the parties will fully participate in the independent medical review process on all claims. Until that time, however, we must continue to infer what the legislature intended, and litigate items such as this, if necessary.

*Special thanks to Jake Jacobsmeyer.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

While we can hope our health care industry will promote consumer involvement in decisions through education and transparency, it may take a more disruptive intervention to shift perceptions.

You knew it was coming. Reality TV has come to health care.

WDEY network began filming a new reality show last month — it's called Medicine Unlocked1. It follows real patients navigating the health care system in search of treatment for their ailments. Each two-hour episode focuses on four patients who share a specific preliminary diagnosis; one week it's back pain, another it may be gall bladder problems or men with suggested prostate cancer.

Each patient-contestant receives a pre-loaded health savings account and debit card and earns "keys" that allow passage through a series of decision "gates." Gate 1 is Who (will be their doctor); Gate 2 is What (confirming their diagnosis); Gate 3 is How (the problem will be treated); and Gate 4 is Where (the treatment will occur). By successfully getting through the gates to a successful treatment, patients become eligible for a $1 million grand prize.

The reason this is a reality show rather than a documentary is that the Who, What and How gates consists of a choice among three options. Two options are real, one is fictional. As an example, in the arthritis episode, a pretend bone-specialist convinces one patient that a new nano-Teflon coating can be applied to his knee with a robotic needle at half the price of knee replacement. For gallstones, a radiologist explains how the small dots on the image were actually undigested items blocking her bile duct ("Tell me, have you ever swallowed your gum in the past, Mrs. Jefferson?").

If the patient selects a real option, he or she pays the cost of the option, gets a key and passes through the gate. If the patient chooses the phony option, he or she must pay a stiff penalty, and choose a new, non-sham treatment to get their key. Expert judges comment on the contestants' choices and what they might have done differently. Not surprisingly, they don't all agree.

For the final Where gate, things get even more challenging. Patients select from three treatment locations (all real). To earn the final gold key, they must not only select the facility they want to use, but also rank order the facilities by their safety ranking (1st, 2nd, 3rd) and by cost of the surgery (1st, 2nd, 3rd). They only have four hours to investigate using whatever online or phone or other resources they want. The ultimate winner is the contestant with enough money left in the health savings account to get the treatment, who correctly ranks the greatest number of facilities. While six out of six correct rankings gives them $1M eligibility, TV viewers get the last word as they choose their favorite among the qualifiers.

If you are like me, you won't know whether to be impressed or appalled by this series. Useful, teachable moments occur at every gate. The viewing public sees first-hand the disturbing level of uncertainty, inconsistency, and misinformation faced by almost every patient. However, the authentic pain and emotion borders on exploitation. The detailed discussion of the potential consequences facing one prostate cancer patient (impotence, incontinence) will leave a pit in most viewers' stomachs. And, without spoiling the story, there is one tragic result in a mid-season episode.

Maybe we need a show like this.

For readers who haven't looked at the footnote yet, there is no reality show, except in my imagination. But the more I learn about the gap between what consumers know and care about, and what the experts say about quality and safety, the more I daydream (obviously) about ways to shift popular culture to prompt more active questioning of the safety, quality, and cost of health care.

It's not a coincidence that the reality show idea coincides with this week's release of Altarum Institute's latest consumer survey results. Some trends are encouraging. The majority of respondents reported wanting to play a primary role in making decisions. Younger consumers report asking about cost and quality more often. When choosing a hospital for surgery, consumers rate safety and experience as most important.

On the other hand, other areas reveal a great opportunity for building awareness. To name a few:

One can interpret these findings in several ways. Some have suggested to me that many consumers do not have the interest or the ability to be involved in decisions about care. Some say it is a generational bias reflecting our parents' experience that "doctors know best." While these explanations may have elements of truth, my sense is that the general public has simply lacked reasons to pay attention and examples to emulate. It is more reassuring to think of medicine as concrete, scientific, and altruistic than to acknowledge its inherent risk, fallibility, and perverse business incentives. So, most depictions of medicine have heroes and affordable, happy endings.

While we can hope our health care industry will promote consumer involvement in decisions through education and transparency, it may take a more disruptive intervention to shift perceptions.

Anyone want to volunteer for Season 1?

1 WDEY stands for "We Don’t Exist Yet." The show does not exist. I dreamed it up.

This article first appeared on the website of Altarum Institute

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Logic would dictate that the lack of actual shared losses would also indicate the lack of risk distribution. The IRS may soon test this question in the Tax Court. If logic prevails, then many risk sharing pools will be in trouble.

What if a captive insurance company has virtually no real practical risk except to its own related insured? Is risk distribution really present?

Every captive insurance company must demonstrate, among other things, that it has sufficient "risk distribution" to qualify as an insurance company for tax purposes. This concept was first mentioned by the United States Supreme Court in 1941 with little further definition or guidance. As a result, since that time, many judicial opinions and two Revenue Rulings have attempted to interpret and quantify the "law of large numbers" inherent in the idea of distributing risk.

This article will not analyze all of the case law on the subject, but instead will highlight the typical manner in which captives today attempt to achieve risk distribution and will question whether the attempts will ultimately prove successful.

The Internal Revenue Service issued two Revenue Rulings in 2002 that set their standard for determining whether a captive insurance company has "adequate" risk distribution to be considered an insurance company for tax purposes. This determination is critical since the ability of the taxpayer to deduct premiums paid to a captive is dependent on a finding that the captive qualifies as an insurance company for tax purposes. The standards set forth in the Rulings are arguably tougher than those found in the judicial opinions on the subject, but they remain the basis on which the IRS conducts audits of captive insurance companies.

The two Revenue Rulings represent two different paths to risk distribution. Revenue Ruling 2002-90 examines the number of related companies that must be insured in order to sufficiently distribute risk. If the insured cannot provide a sufficient number of separate insureds, then the captive must rely on Revenue Ruling 2002-89. That Ruling establishes the amount of third party risk that a captive must carry in order to qualify as an insurance company for tax purposes.

Revenue Ruling 2002-90 requires that the captive insure at least 12 separate companies (single member LLCs do not count), with no one company representing more than 15% of the total premium paid to the captive. [In practice, the IRS seems to accept as few as 6 separate insureds with none paying more than 45% of the total premium, but it is difficult to rely too heavily on such practice as it may change without notice.]

Most closely-held companies cannot meet the standard of Revenue Ruling 2002-90. While the entrepreneur may own separate companies for real estate, distribution, etc., usually there is one main operating company that carries the bulk of the exposures.

Captives insuring those companies must therefore rely on Revenue Ruling 2002-89 for guidance as to risk distribution. That Ruling states that the captive must show that "more than 50%" of its risk comes from unrelated third parties. ("Risk" in this case is typically measured by premium). [For captives located in the Western United States, a Ninth Circuit Court of Appeals case reduces that percentage to 30%, but the opinion is not binding on the IRS outside of that jurisdiction.]

The typical way for small captives (such as those qualified under section 831(b) of the Code) to accept risk from unrelated parties is through a pooling mechanism where a number of unrelated captives "swap risk." This risk sharing is accomplished a number of ways, with two common forms:

In theory, either one of these approaches to third-party risk should qualify under Revenue Ruling 2002-89. But in actual practice, questions arise.

Many risk sharing programs exempt the first $250,000 of any loss of any single captive from the pooling arrangement. In other words, if the captive pays its insured less than $250,000 on any single claim, that captive will have no right to receive reinsurance from the other captives in the pool. Indeed, it is possible that the captive could pay multiple claims — each less than $250,000 — and still not have any reinsurance. On the other hand, any client considering such a pool might feel comfortable that his captive would not be at much risk to pay reinsurance out to other captives, absent a large loss.

These pools are constructed so that in a catastrophic loss, at least 50% is paid by the other captives. They therefore argue that the pool still qualifies under 2002-89. But few captive pools ever suffer such losses — particularly pools that share risk among 831(b) captives. The types of risks generally insured by these types of small captives rarely generate large losses. Indeed, one captive manager boasts that in 12 years, no captive in his pool has ever suffered a loss above that first "no reinsurance" layer.

So, is this really risk distribution?

Large group captives typically use a similar A/B loss structure, but the nature of the risks insured by group captives (auto, general liability and workers' compensation) commonly result in losses above the A layer, so risk distribution is not an issue.

The judicial opinions on the subject of third-party risk have never addressed the question of layers within a risk sharing pool. Perhaps that is why these types of pools apparently continue to pass muster when one of their captives faces an IRS audit.

Several years ago at a national captive insurance conference, an IRS representative stated that if he found that actual captive losses always fell within an exempted layer, he would deny the existence of sufficient risk distribution. But he has now retired and there is no current indication that the IRS is thinking that way.

Logic would dictate that the lack of actual shared losses would also indicate the lack of risk distribution. The IRS may soon test this question in the Tax Court. If logic prevails, then many risk sharing pools will be in trouble.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|