Rates Continue to Climb

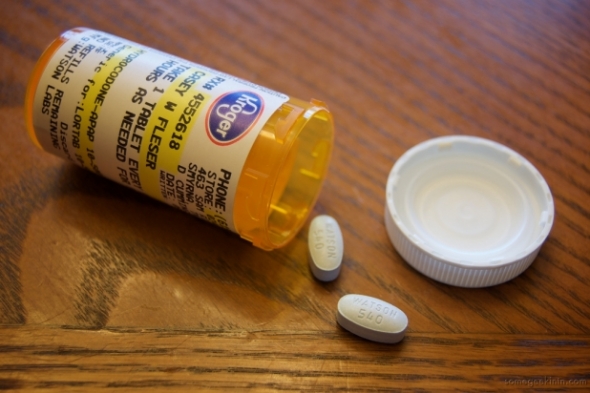

In most of the U.S., rates for workers’ compensation insurance are continuing to climb, driven by rising medical costs, the low-interest-rate environment and the general unprofitability of the line of business. This is in spite of the fact that many states have undertaken regulatory reform aimed at controlling medical costs and driving costs out of the system. Despite significant investment in medical management efforts, workers’ compensation costs are consistently higher than group health costs for the same diagnosis. Why is this? Numerous studies have shown that a small percentage of medical providers are driving a large percentage of the workers’ compensation costs. Implementing treatment guidelines, drug formularies and utilization review protocols is a step in the right direction. However, until regulators find a way to remove abusive medical providers from the workers’ compensation system, high costs will always be a problem. Rather than treating the symptoms, we need to address the causes of rising costs.

The Potential Expiration of TRIPRA

Unless Congress takes action, the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) will expire on Dec. 31, 2014. Carriers are now writing coverage without the backstop of TRIPRA. What does this mean to the workers’ compensation industry? Companies with high employee concentrations in certain cities are already seeing fewer options, with some carriers scaling back their writings to reduce their exposure to a potential terrorism event. Some carriers are setting policy expiration dates to coincide with the expiration of TRIPRA or are advocating for unilateral mid-term premium increases if TRIPRA is not renewed or is materially modified. Many workers’ compensation underwriters are pushing for higher rates because of this issue. If TRIPRA is allowed to expire, companies in certain industries and geographic areas may have no option but to obtain future coverage from their state funds as the commercial marketplace pulls back to avoid the increased risk. The longer it takes Congress to act, the more pronounced this issue will become.

Impact of the Affordable Health Care Act (AHCA)

There has been much speculation about the potential impact that the ACHA will have on workers’ compensation. Some feel it will increase leakage from group health to workers’ compensation, while others feel it will have the opposite effect. One thing for certain is that with increased coverage being provided on the group health side, the overall utilization of services will go up. With a finite number of medical providers available, this means it is imperative that workers’ compensation payers identify the providers who deliver the best clinical outcomes for injured workers. The focus on workers’ compensation medical networks in the future will need to shift from fee-for-service discounts to quality of care and best outcomes. This may cost more on a fee-for-service basis, but getting appropriate and timely care will generally lead to faster return-to-work, ensure the proper treatment and ultimately lower costs.

Integrated Disability Management

More employers are realizing that the impact of federal employment laws like the Americans with Disabilities Act (ADA) and the Family Medical Leave Act (FMLA) must be considered on workers’ compensation claims. Companies are also realizing the value of managing non-occupational disability so that valued employees can get back to the workplace and be productive. As a result, companies are requesting that their TPAs develop integrated disability management programs designed to handle both occupational and non-occupational disability in a consistent and effective manner. These integrated disability management programs are the next generation of claims handing and will expand in the future.

State Legislative Issues

Several states that passed significant reform legislation in the last two years are working to implement those reforms. Passing a law is only the first step, as the rules, regulations and implementation of those laws determines if they will achieve their intended purpose. The most significant issues to watch are in California, New York and Oklahoma.

When California passed SB 863 in 2012, the expectation from the state’s legislature was that it would increase benefits to injured workers while lowering costs for employers in the state. While the benefit levels for permanent disability have been increased, the savings components are still a work in progress. Litigation and unanticipated consequences of the bill have resulted in increased complexity and continually rising insurance rates. For example, a significant component of the intended cost savings was to result from the new Independent Medical Review (IMR) process. However, in recent months the volume of IMR requests has been many times what was anticipated, preventing the IMR provider from meeting the required turn-around guidelines and adding significant administrative costs to the system. Based on their analysis of the higher costs, the California WCIRB recommended an 8.7% pure premium increase for 2014. There is currently talk of potential clean-up legislation to go along with the continued efforts at implementation. We will know by the end of the year whether SB 863 will be able to produce the promised cost savings.

New York streamlined its assessment process, resulting in a significant reduction of the assessment rate for most employers. These rates are adjusted annually and have varied significantly in the past few years. It remains to be seen if these assessment savings will continue into the future. In addition, New York has been struggling to implement the reforms that were passed in 2007 legislation, and it was 2013 before the last of the regulations were issued for this law. This 2007 bill was another piece of legislation that promised cost savings that have yet to fully materialize.

The big news in Oklahoma is the bill that allowed employers to opt-out of workers’ compensation starting in February 2014. The Oklahoma Supreme Court recently upheld the constitutionality of the legislation, clearing the way for its implementation. However, there have been delays in developing the rules and regulations supporting the opt-out plans, and this has in turned delayed carriers’ development of policies to cover new benefit plans. It appears unlikely that everything will be in place so that employers will be able to opt out beginning in February. In addition, the Oklahoma legislation included significant reforms to the underlying workers’ compensation system, so many employers considering opt-out will wait to see the impact these system changes will have on their workers’ compensation costs before proceeding.

Vendor Consolidation

In the last few years, there has been significant vendor consolidation in the worker’s compensation industry. First on the TPA side, and most recently on the medical management side. Much of this consolidation was driven by private equity investments where the tremendous medical spend in workers’ compensation is seen as an opportunity for a profitable return on investment.

All this consolidation is making buyers of these services uneasy. They question how this consolidation will affect the quality of the services they receive and wonder how their goals of reducing costs align with private equity’s goals of increasing revenues. These are legitimate concerns, and it is imperative that buyers remain vigilant concerning vendor partners.

Analytics

Despite the huge amount of premium, exposure and claims data produced by the workers’ compensation industry, many complain about the lack of actionable information. Dashboards and many other analytic tools do a nice job pulling data together in one place, but ultimately the data is only as good as what one does with it. As an industry, we will see a continued focus on the use of more meaningful analytics that can assist in identifying savings opportunities, formulating action plans and measuring the impact of change.

Assessing Return on Investment for Medical Cost Management Efforts

In the last few years, the money spent on medical management has been steadily increasing. Programs including bill review, utilization review and nurse case management are all necessary components of any successful workers’ compensation program. However, it is important that these programs are constantly monitored to ensure they are being utilized appropriately. If left unchecked, these “cost-saving” issues can actually become cost drivers.

Impact of Presumption Laws on Municipal Budgets

In 2013, there were a handful of municipalities that filed for bankruptcy because of large underfunded workers’ compensation and pension obligations. This trend is not only likely to continue, but could get worse. The presumption laws in most states can turn common health conditions like heart disease and cancer into workers’ compensation claims. In California and Nevada, for example, a large number of retired police officers and firefighters are collecting both their pension and the benefits from a workers’ compensation presumption claim. The statute of limitations for linking these diseases to the workplace has been extended to more than 10 years in some jurisdictions. The resulting burden for paying the costs of these benefits in the case of public entities ends up falling on taxpayers.

Medicare Set-Asides

Many felt that the passage of the SMART Act in January 2013 was the end of the battle on Medicare Secondary Payer compliance issues. In fact, this was just the beginning of the fight. Implementation of the SMART Act has been slower than expected and the legislation did nothing to address the huge costs associated with Medical Set-Aside arrangements. The rules and case law associated with Medicare are constantly evolving, and now it appears that these reimbursement rights will be expanded to Medicaid coverage, which would create an entirely new monitoring and compliance area. This is an issue payers need to remain diligent on.

Please join me on Jan. 15, 2014, for a Marsh-sponsored webinar to discuss these issues and other potential legislative developments to watch in 2014. Click here to register.