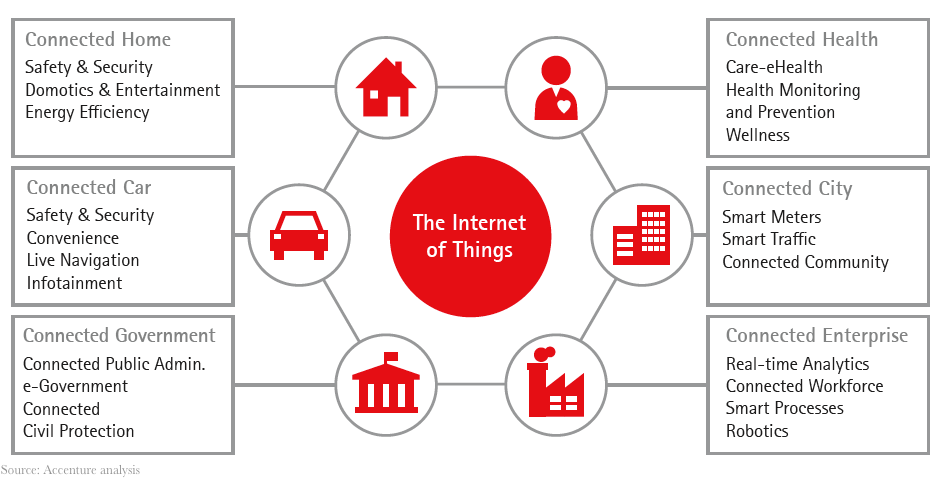

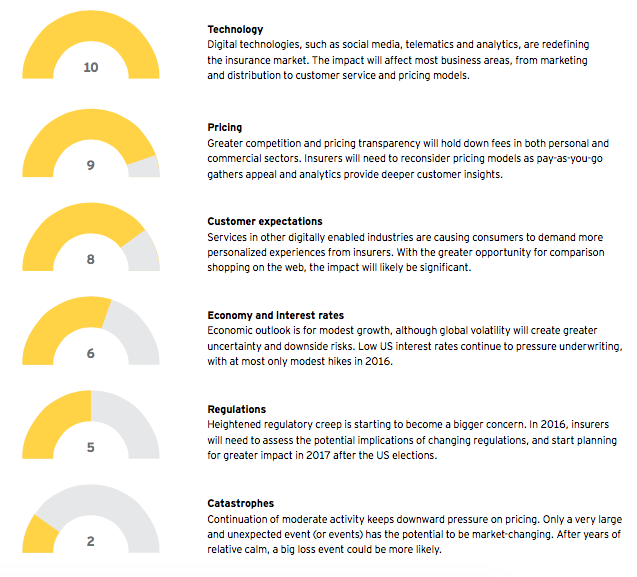

For U.S. property-casualty insurers, 2016 will be a year of continuing disruptive change. Digital technologies, such as social media, analytics and telematics, will continue to transform the market landscape, recalibrating customer expectations and opening new ways to reach and acquire clients. The rise of the "sharing economy," under which assets like cars and homes can be shared, is requiring carriers to rethink traditional insurance models. Combined with an outlook for slower economic growth, increased M&A and greater regulatory uncertainty, the stage is set for innovative firms to capitalize on an industry in flux. Insurers that stay ahead of these shifts should reap substantial benefits, while laggards risk falling behind, or even out of the race.

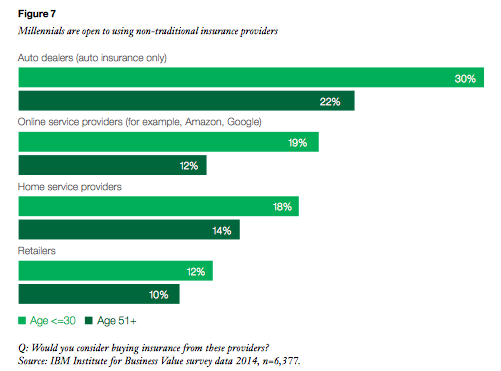

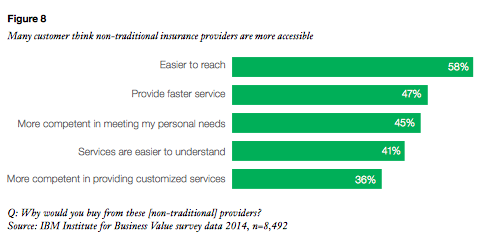

Competitive pressures in the insurance industry have been building as cost-effective solutions in digital communication, distribution and infrastructure become widely available. Digital technology is eroding the advantages of scale enjoyed by established insurers and empowering smaller players to compete for market share through more flexible pricing models and new distribution channels. The recent launch of Google Compare, which enables customers to comparison shop for insurance, is the start of a larger wave of "InsuranceTech" activity in 2016.

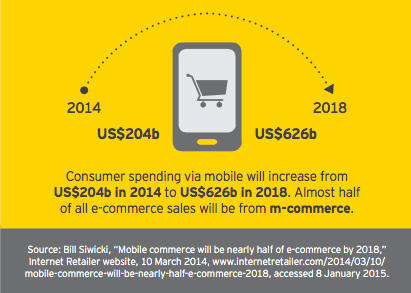

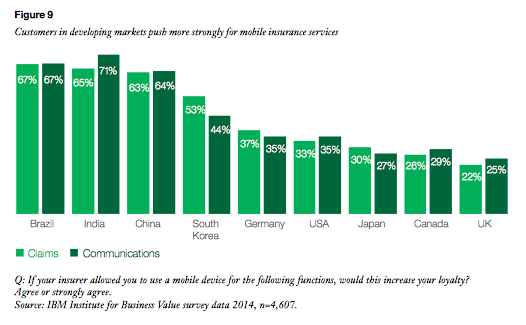

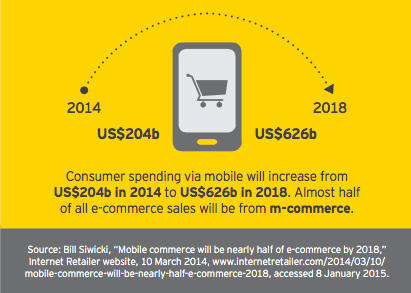

At the same time, customer expectations and behaviors are evolving at a rapid pace, often faster than traditional mechanisms can react. Driven by their interactions in other digitally enabled industries, such as retail and banking, property-casualty customers are increasingly demanding a more sophisticated and personalized experience - including digital distribution, anytime access, premiums accurately reflecting usage and individual risk and higher levels of product customization and advice. Policyholders are also seeking coverage of broader risks, such as cybersecurity risk and under-protected property exposure.

Significant change to insurance ecosystem

Almost eight years after the global financial crisis, most major economies are still operating at well below potential. Although the U.S. is doing better than many countries, forecast growth of less than 2.5% for 2016 is unlikely to boost employment or wage growth significantly. With little sign that inflation is picking up, the Fed is intent on keeping interest rates near their current lows for the foreseeable future. Meanwhile, concern around the slowdown in China and other key emerging markets will continue to dampen U.S. growth prospects.

Despite sluggish economic conditions, property-casualty insurers should do well next year because of the favorable underwriting performance of the commercial lines sector and rising personal lines premiums. Softness in reinsurance pricing may increase opportunities for companies to cede capacity into the reinsurance and alternative capital markets, as well as achieve more stable reinsurance protection through broader terms and conditions. The industry will enter 2016 with a strengthened balance sheet and a strong base of invested assets from several years of solid reserve development and benign catastrophe experience.

But that is where the good news ends. In 2016, return on investment for firms is likely to continue to slip from its 2014 peak because of a combination of capital accumulation, competitive pricing, weakening investment returns and rising loss costs. Losses and expenses are growing faster than revenue, forcing companies to actively seek new solutions. In personal automobile and workers’ compensation, rising frequency and severity are beginning to erode loss ratio performance.

Competition is putting downward pressure on pricing, particularly in the commercial property and liability lines. This is compounded by slowing growth in commercial exposures because of economic weakness.

Regulatory headwinds ahead

In 2016, property-casualty insurers will face heightened political and regulatory uncertainty. An open presidential election for both parties, along with congressional and state elections, creates the potential for radical change with taxation and regulatory repercussions. Meanwhile, the Fed is preparing new capital standards for significant insurance companies, and HUD and the Federal Insurance Office may intensify investigations into the affordability and accessibility of personal lines insurance to customers from different backgrounds. The IAIS is also pursuing international capital standards through field testing, and the results may come into clearer focus in 2016.

The NAIC and states may separately advance their expectations of best practices in risk management, governance and solvency as current programs enter their second year of full rollout. All jurisdictions will likely push for better information, reporting and compliance in such areas as accounting, solvency, fair practices, transparency, governance and marketplace equity.

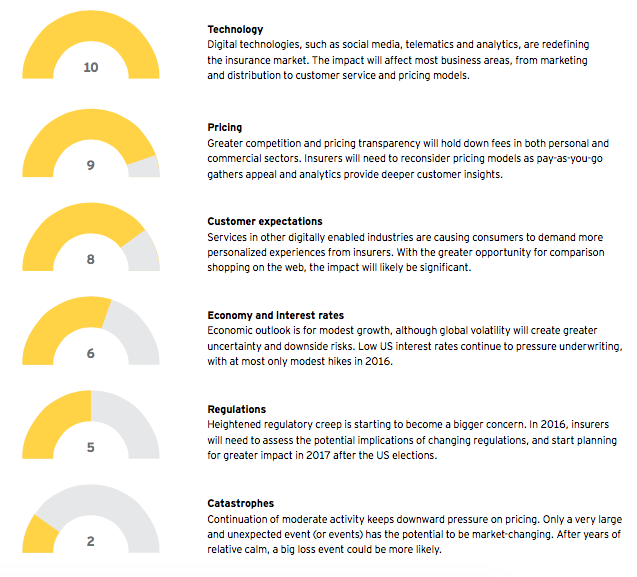

Impact of external forces on the US property-casualty market in 2016 (0 = Very low impact, 10 = Very high impact)

Coping with transformative change: priorities for 2016

In such a fluid, fast-changing environment, insurance firms need to build a road map for strategic transformation aligned to new customer imperatives. Refining legacy products and approaches is not enough - what is required is a fresh, outside-in approach that starts with the customer and carries through to digital trends and market shifts, both inside and outside the insurance industry.

1. Position Your Organization for Digital Leadership

Preparing for further digital disruption

As digital service models become more common in other industries, the property-casualty sector will need to align to the rising expectations of consumer and commercial customers. Digital technologies, such as mobility, social media and telematics, will continue to disrupt all parts of the property-casualty insurance value chain - from client acquisition to claims and servicing. Although the industry is ripe for digital transformation, many traditional insurers still display a low level of digital maturity, struggling to develop digital strategies that enhance the customer experience, extract efficiencies and drive future growth.

Priorities for 2016

Lay the groundwork for digital transformation. To meet changing expectations, insurers need to digitize interactions with customers, employees and suppliers. Building new distribution channels and working closely with existing distribution partners to enhance the customer experience is a strategic imperative.

Build a back-office to support the digital frontline. In 2016, carriers must continue to invest in back-office systems to enable digital enterprise platforms. These should be designed to allow

for future expansion, omni-channel distribution and an improved customer experience, while minimizing customer service costs and protecting against escalating cyber risks.

Start new market initiatives now. As back-office systems are being readied, leading insurers should not wait for full integration, but push forward with next-generation portals, redefining customer experience, data access, queries and navigation. With the rise of real-time risk monitoring, there is a knowledge shift taking place between customers and insurers. Insurers need to tap into client and industry data sources to take full advantage of this new risk-information flow.

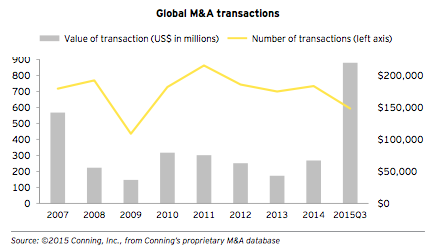

2. Prepare for the next wave of M&A activity

M&A will accelerate in 2016

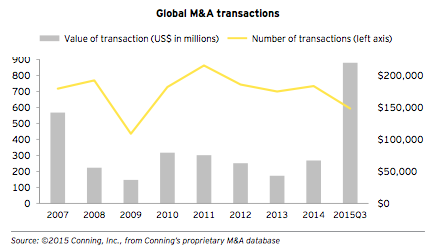

Uncertain economic and regulatory conditions have caused insurers to cut costs and expand product and geographic diversification. Under growing pricing pressure and competition from non-traditional sources, in 2015 insurers turned to transformative mergers to achieve these goals. This surge in M&A activity is

expected to continue in 2016, as acquirers seek to build scale and access US markets.

Priorities for 2016

Establish a well-defined process for post-merger integration. Mega consolidations require immense integration of systems and data. Companies involved in M&A should assemble the necessary building blocks to create single technology platforms, self-service customer portals and omni-channel distribution systems. Replacing duplicative technology, outdated service centers and first-generation mobile-enabled distribution will remove cost redundancies and inefficient processes. Successful mergers could create lower-cost infrastructures, which will enable these combined entities to invest in data sources and analytical tools that improve pricing, risk analysis and claims management.

Gain greater access to insurance buyers through M&A. Consolidation in the insurance broker and independent agent markets has tipped the balance of power toward distribution. In response, insurers in 2016 will look to gain direct customer access by purchasing specialty distribution and continue the trend of underwriters acquiring managing general agencies with exclusive books of business to increase premiums in less price-sensitive lines. Access to captive distribution should help tilt the scales back toward underwriters.

Take steps to protect against tougher competition. Insurers that refrain from the M&A frenzy will require a strategy to compete more effectively against larger, better capitalized companies. Recruiting human capital will become paramount, as will accessing distribution that provides high-retention, profitable business.

M&A activity in 2016 will make insurers vulnerable to takeovers, particularly those with the potential to provide an acquirer with greater product diversification, wider market access, stronger analytics and increased cost efficiencies.

3. Create a culture of continuous innovation

The innovation imperative

The rise in usage-based insurance, digital distribution channels and other disruptors is shaking up the industry. Widespread data availability and advanced analytical techniques are enabling new market entrants to absorb risk that was once the exclusive territory of insurers. Larger and more efficient capital providers entering the industry are siphoning off premium that ordinarily flowed to insurers. To stay relevant, traditional insurers need to shed their conservative orientation and cultivate a culture of innovation.

Priorities for 2016

Explore new technologies and start-up models. Competition is heating up as an array of new Fintech companies offer services that were once the exclusive domain of traditional insurers. To cope, insurers will need to adopt, acquire or even fund new technologies and experimental models that may even compete with their existing businesses. Recently introduced property-casualty insurance products, such as insurance for cyber risk, ridesharing and drone exposures, suggest that insurers can rise to the innovation challenge.

Be prepared to cannibalize parts of your business, before competitors do. The property-casualty insurance industry has not been known as a change leader. A growing asset base is a vital sign of stability for clients, but, as a business grows, more processes are added, creating bureaucratic layers that stymie innovation. To offset these institutionalized barriers to change, insurers will need to develop a culture of innovation that allows for internal competition.

4. Shift from a product to a service orientation

Staying relevant in a fluid marketplace

Changing customer needs are making many of today's insurance services less relevant. With a few notable exceptions, the traditional product suite has been relatively static and has not kept pace with evolving risks. Personal lines insurers are seeing reduced demand for their services because of advanced safety technology, the growth of the sharing economy and changing demographics and customer behaviors. Likewise, commercial lines insurers are coming to grips with new industries, emerging risks and a client base with significant access to their own risk data. Access to better data and analytics empowers customers to retain more risk, and much of the risk at the other end of the spectrum has been taken by capital market alternatives, leaving traditional carriers scrambling for the leftovers.

Priorities for 2016

Think outside-in, not inside-out. To adapt to this fast-evolving marketplace and differentiate themselves from competitors, insurers must enhance their service capabilities while developing products better able to serve new customer needs and behaviors. By providing services that build on the customer experience and changing expectations, insurers can foster stronger, more holistic relationships with clients and ultimately improve policy retention and generate higher margins.

Take a value-added, advisory approach. Customers are increasingly looking to their insurance partners for risk advice, not just insurance products. To enhance their brand and improve performance, insurers must be ready to provide customer-centric services to satisfy these expectations. Insurers will need to analyze their clients' exposures and develop risk-mitigation strategies and insurance coverage tailored to their needs. The rise of real-time risk data in both personal and commercial lines provides an opportunity for innovative insurers to address uncovered or mispriced risks.

5. Build a next-generation distribution platform

The rise of omni-channel distribution

Independent and captive agents have dominated the property-casualty insurance industry for decades. Even today, many insurance buyers rely on a trusted adviser to assist them with personal and business insurance purchases. But the days of a single distribution channel are over for many insurers. Consumers are demanding omni-channel access to insurance products. Insurance buyers want the same flexibility to learn, compare, purchase and report a claim as they have become accustomed to in other industries.

Priorities for 2016

Come to grips with pricing transparency. Creating an effective omni-channel platform is critical, as it allows insurers to promote their customer service capabilities, product differences and claims-response times more widely. But the rise of aggregator and non-traditional comparison models has also made it easier for buyers to shop for the best rates. In a digitally enabled environment of price transparency, there will be further pressure in 2016 for insurers to streamline costly and duplicative infrastructure.

Consider acquiring captive distribution. As insurance products become more commoditized, insurers may want to acquire captive distribution to add customers and boost business. By acquiring managing general agents (MGAs), insurers can gain access to experienced underwriters able to secure and retain profitable business, along with the systems and tools for underwriting and processing that business. Insurers will need to integrate these systems into core underwriting platforms to avoid duplicating costs.

Rethink compensation plans for distributors. Private equity-financed broker consolidation, going on for nearly a decade, will continue to shift bargaining power in favor of distributors. Agent and broker control of profitable businesses has allowed some large distributors to negotiate greater compensation. This power shift is happening at a time when rate softening has become the norm. As a result, insurers in 2016 should consider changing the industry's level-commission compensation standards in favor of greater up-front payments that reward access to new profitable customers.

6. Drive performance through analytics

The new role of analytics

Disparities in frequency and severity trends among several large personal auto insurers highlights the importance of data and analytics in driving underwriting results. Harnessing large volumes of data from real-time sources can help insurers develop new products and refine pricing strategies. When combined with a robust operating strategy, advanced analytics can significantly increase underwriting profitability and provide a valuable market differentiator.

Priorities for 2016

Apply proven analytics to the homeowners market. In 2016, personal lines insurers will increasingly apply analytical capabilities developed in the personal auto sector to the homeowners market. Greater adoption of technological innovation in the home creates an opportunity for both real-time risk assessment and pricing strategies, similar to the trend unfolding in the personal auto market. As insurers move back into the homeowner market, they will be better equipped to understand and price risks.

Use analytics to manage commercial market risks. As risks rise, small business owners are seeking broader insurance coverage and a simpler sales process. Insurers with the analytical capabilities to manage evolving risks and the technological know-how to create an automated sales experience will be better equipped to meet fast-changing customer needs. The experience in using analytics in the small commercial market will provide insurers with a blueprint for gaining efficiencies in the larger commercial market.

7. Develop and attract the right talent to lead change

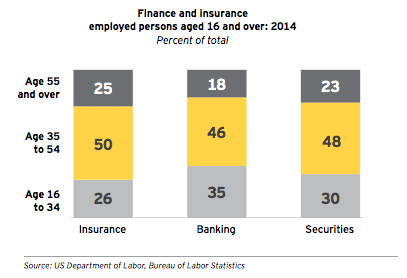

Coping with a widening talent gap

Existing insurance teams often are not prepared for today's fast-changing digital marketplace. But filling the talent gap can be challenging, because the insurance industry is not often the first choice of new graduates from top colleges and universities. With finance, technology and consulting attracting most of the promising students, a talent chasm is forming in the property-casualty industry. Insurers must recruit and retain next-generation innovators and leaders - while retooling existing teams with new skills.

Priorities for 2016

Develop new roles to facilitate change. As insurers embrace innovation and adopt more advanced digital platforms, they will need to establish new business roles to drive these initiatives. For instance, the stronger focus on analytics is increasing the demand for data scientists - able to apply predictive analytics and other sophisticated quantitative tools to support underwriting and claims- handling processes.

Create an environment that rewards innovation. A culture of innovation will help attract Millennials and entrepreneurial talent with fresh perspectives. Bringing in new ideas and skills will be essential for insurers pursuing technological innovation in an industry not known for change. To acquire and retain this new crop of talent, insurers will need to set up systems to reward innovation and risk-taking in alignment with new strategic imperatives.

Expand risk advisory capabilities. Customers are increasingly interested in working with true risk advisers and finding insurance solutions that match their lifestyles. Traditional product approaches directed at individual risks are falling out of favor as customers seek more holistic solutions. In 2016, insurance teams will need to develop expertise in health, wealth and risk advisory, so that they can bundle products and provide value-added services to customers.

8. Make risk management a C-suite priority

Coping with complexity

Economic, financial and political uncertainty, combined with linked global markets and disruptive technological change, has created a more complex and volatile landscape for insurance firms - heightening the need for best-in-class risk management. Faced with a challenging environment and driven by regulatory demands, insurers have made risk management a C-suite and board-level priority, with risk managers being held accountable for improved financial performance and value creation.

Priorities for 2016

Keep on top of changing regulations. Emerging regulatory regimes include calls for greater uniformity at the state, federal and global levels, but the ultimate form of these requirements is far from settled. As always, insurers will need to stay on top of shifting regulatory frameworks, communicate the industry impacts and respond to changes as they emerge.

Watch for emerging risks, such as cyber-attacks. With access to growing volumes of sensitive data, both large and small insurers are seeking greater cyber risk protection. Corporate boards are becoming increasingly aware of the damage a cyber-attack can cause, including potential liability at the board level and the destruction of reputation and brand. Risk managers must stay ahead of the ever-increasing sophistication of hackers.

Remember, protection is only as strong as the weakest link in the chain. Even if an insurer is well insulated from cyber-attacks, its outside vendors may be vulnerable. Vendors that have access to an insurance company's systems, such as its underwriting platform, can inadvertently provide hackers with a conduit to valuable company data. Risk managers must be careful with data released to third party vendors for any reason, especially when that data is subsequently returned to the company.

This article was written by David Hollander, Thomas Cranley, Gail McGiffin and Jay Votta. To access the full white paper, click here.