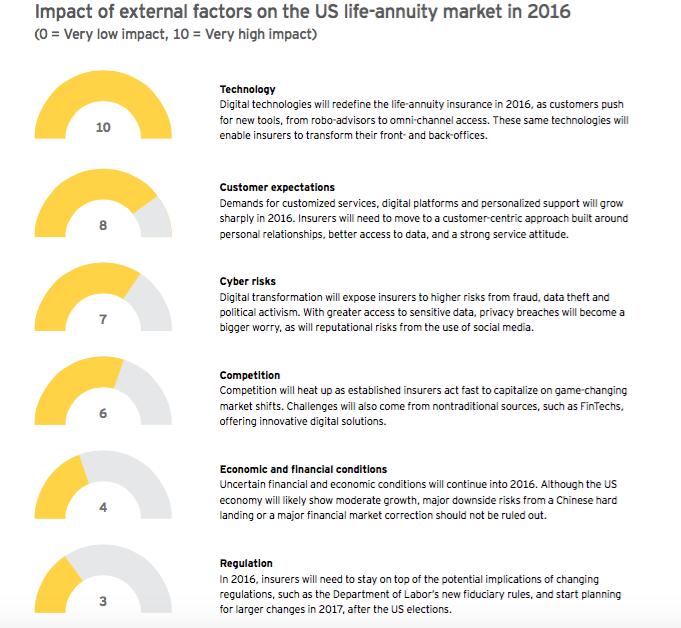

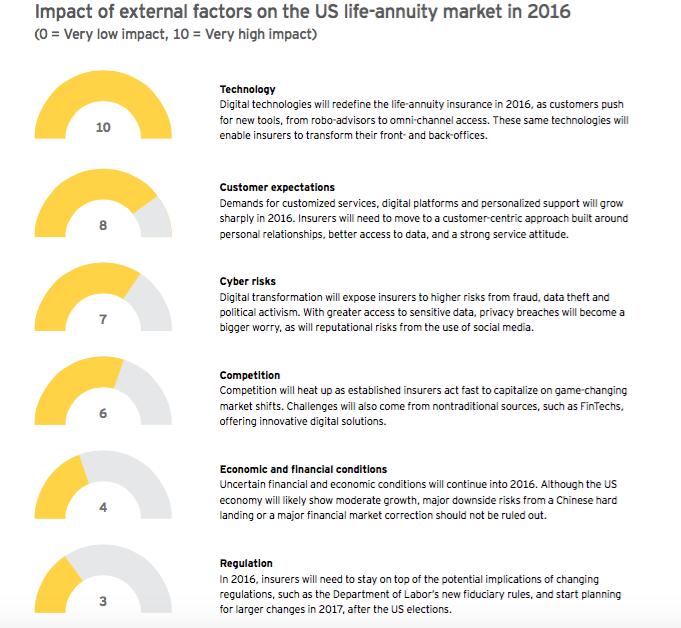

U.S. life-annuity insurers will enter 2016 in relatively good financial condition but facing exponential changes from rapid advances in technology, rising customer expectations and growing competition. These market shifts will require insurers to reinvent their strategies, services and processes, while coping with nagging financial, economic and regulatory uncertainty. Fortunately, after years of bolstering their balance sheets, life-annuity firms are in a strong position to invest in the innovations and technologies needed to fuel future growth.

Growing customer expectations

Digital technology will continue to transform the life-annuity industry in the coming year. From anytime, any-device digital delivery to customized services, today's diverse insurance customers will demand flexible solutions that go beyond one-size-fits-all product offerings. To take advantage of these trends, insurers will need to adopt a customer-centric approach that relies on deeper relationships, more personalized advice and more rigorous information. At the same time, life-annuity insurers must integrate emerging distribution technologies to reach customers through multiple channels, all without disrupting traditional distribution.

Millennials and mass-affluent consumers, in particular, are seeking the latest digital tools, such as on-demand insurance apps and robo-advisers for automated, algorithm-based financial advice. Meanwhile, insurers are establishing omni-channel platforms to reach and service customers more effectively and exploring the use of wearables and health monitors for usage-based life insurance. Advanced analytics, such as predictive models, combined with cloud and on-demand technologies, will provide insurers with the instruments to re-engineer front and back offices.

To fast-track digital transformation, insurers are turning to partnerships and acquisitions. For example, in 2015, Northwestern Mutual purchased online planner LearnVest to provide more customized support to customers. Other insurance firms, such as Transamerica and Mass Mutual, have set up venture capital firms to invest in digital service providers.

But digital innovation also carries greater risks. Digital technologies make insurers more vulnerable to financial fraud, data theft and political activism. Privacy breaches are becoming a bigger concern as insurers gain wider access to sensitive financial and health data. Even the use of social media is exposing firms to risks from reputational damage.

Competitive pressures are building

As digital technology becomes more pervasive, insurers will face greater competition from new digital start-ups. Although much of the recent innovation in financial services has occurred in the banking and payments sector, insurance is now squarely in the cross-hairs of new digital providers. One example is PolicyGenius, which is offering digital platforms to help consumers shop for insurance. With the recent launch of Google Compare, the rise of InsuranceTech will gain momentum in 2016.

But competition will also come from existing insurers leveraging new digital solutions and business models. For example, John Hancock recently launched Protection UL with Vitality, which rewards life-insurance policyholders for health-related activities monitored through personalized devices. In 2016, more insurance stalwarts will jump on the digital bandwagon through new product development, acquisitions and alliances. At the same time, changing insurance attitudes and practices among Millennials will spread to other age groups. Insurance firms reluctant to embrace innovations for fear of cannibalizing their own market space may be overtaken by more nimble firms able to capitalize on a shifting insurance landscape.

Uncertain economic and regulatory conditions

Life-annuity insurers are operating in a tenuous economic and financial environment with sizable downside risk. In 2016, global economic weakness will continue to be a worry, particularly as emerging market growth decelerates, financial volatility escalates and the U.S. economy muddles through a presidential election year. Regulatory and monetary tinkering will further complicate macro conditions.

The political landscape is likely to remain gridlocked at the federal and state levels as the election cycle concludes. Tax policies are unlikely to change in 2016, but insurers should prepare for new post-election regulatory headwinds in 2017. Insurers should also stay on top of the Department of Labor's evaluation of fiduciary responsibility rules, which will remain a disruptive force in 2016.

Regulations originally designed for other industries and jurisdictions are being extended into the U.S. insurance market. International regulators are moving ahead with further development of Solvency II and IFRS. The NAIC and state insurance departments are adjusting risk-based capital charges and will react to the first year of ORSA implementation.

Mixed impact on life-annuity insurers

Premiums will grow moderately in 2016. Individual life premium growth will be particularly sluggish, as consumers remain focused on retirement savings. Faced with equity market volatility, consumers will continue to invest in fixed and indexed annuities and avoid variable annuities.

To cope with torpid market conditions, insurers will focus on growing premium and investment income, managing risks and controlling costs. Companies will continue to identify opportunities to improve return on equity through active balance sheet and back-book management. Among the strategies are investments in organic and inorganic growth, seeking reinsurance and capital market capacity and returning excess capital to shareholders. M&A activity will likely accelerate in 2016 as Asian insurers and private equity firms continue their interest in U.S. insurance companies.

Margin compression will dictate sustained emphasis on cost management through centralized control, technology upgrades and better integration of business units. With mission-critical information becoming more accessible, data-driven business decisions are moving to the C-suite. At the same time, regulatory demands and business imperatives are elevating risk management responsibility to the C-suite and board.

STAYING IN FRONT OF CHANGE: PRIORITIES FOR 2016

In 2016, life-annuity insurers will need to take decisive measures to cope with market upheavals - or risk the consequences. By staying in front of change, insurers can strengthen customer relationships, build market share and gain competitive advantage. Tapping their strong capital positions, insurers will invest in new technologies, systems and people that will allow them to capture their future.

Specifically, leading insurers will focus on the following pathway to change:

1. Pick up the pace of business transformation and innovation

Time to reboot

The life and annuity industry has never been considered highly innovative or nimble. But the convergence of technological, regulatory and customer trends is creating a perfect storm, with the power to upend the industry. EY's 2015 Retail Life and Annuity Survey of senior executives identified the need to embrace new market realities in 2016, highlighting innovation as a top strategic priority. To cope, industry leaders must act now to rethink their business approach:

Priorities for 2016

Create a company-wide culture of innovation. To foster transformation, insurers will need to break away from their conservative leanings, and create a culture that encourages new thinking. Such a culture should allow for greater experimentation, and even short-term failures, to achieve long-term success. Senior leaders through to middle-managers should champion change and avoid the danger of the status quo.

Drive innovation through cross-functional teams. In 2016, life and annuity insurers will need to cut across organizational silos to drive innovation. Establishing cross-functional teams of sales, underwriting and policy administration can lead to new ideas

that enrich the customer and distributor experience. Similarly, a cross-functional team of actuarial, finance and risk management can help build consensus around new analytical and risk approaches.

Share information openly. Overcoming departmental silos will not be easy. Executives should ensure that information-sharing occurs at the right time and that teams are working from the same set of high-quality data. To avoid time-consuming reconciliations, managers will want to address data discrepancies across business units. Using skilled program managers to track progress against timelines and budgets can help.

2. Reinvent products and services for the new digital consumer

Addressing ever-rising customer expectations

In 2016, life insurance and annuity products will need to come to grips with tectonic shifts in consumer expectations and behaviors. Driven by their experiences in other industries, customers will demand greater digital access, better information and quicker service. Failure to respond will make it difficult for insurers to acquire and retain customers. Fast-moving insurers are redefining their customer relationships and products and services to cope with these new market dynamics.

Priorities for 2016

Offer anytime, anywhere, any-device access. Banks now provide customers with unprecedented 24/7 access and self-service on multiple devices, from PCs to smartphones. In 2016, life insurance customers will expect a similar anytime, any-device experience from insurers from point of sale and throughout the relationship.

Provide greater transparency to customers. In today's digital world, customers expect clearer product information and pricing transparency. To respond, insurers should reduce the complexity and definitional rigidity of current life insurance products, while providing a more streamlined and transparent issuance process.

Deliver more flexible solutions. Insurers will need to emphasize product flexibility to cost-conscious customers and offer hybrid products that combine income protection, such as long-term care and disability insurance, with life and retirement coverage. For high-net-worth customers, insurers should stress the tax advantages of life insurance and annuities and develop features to compete with alternative investment products.

Build continuing engagement with customers. The life and annuity industry has long suffered from "low engagement" with customers following the initial sale. More customer engagement will minimize the risk of customer indifference and potential disintermediation. Developing an integrated, personalized digital experience that leverages the latest mobile and video technology will be a key to success.

Move toward a service orientation. To differentiate themselves, insurers will want to shift from a product placement to a trusted adviser approach. With established personal relationships in place, and access to more flexible products and services, new sales will occur more naturally in response to customer needs.

3. Adjust distribution strategies for technological and regulatory shifts

The rise of omni-channel distribution

Technological and regulatory changes are prompting life and annuity insurers to think beyond traditional distributors. For example, robo-advisers, growing in popularity in the wealth industry, could offer insurers a way to reach the underserved mass-affluent market. Yet, unlike property and casualty carriers, life and annuity insurers have made little progress in selling through digital channels. Looking ahead to 2016, life and annuity insurers may find themselves losing market share if they fail to adapt to an omni-channel world.

Priorities for 2016

Prepare for new fiduciary standards. In 2016, the Department of Labor's proposed fiduciary rule could upend existing distribution models. The rule strengthens consumer protection, constrains distributors and alters compensation for advisers providing retirement advice. Similar changes in the UK widened the gap in personal financial guidance between wealthy and mid-market customers - a potential impact in the U.S. The ability to recommend specific products may become more difficult, creating a ripple effect on retirement sales and advice.

Adapt services for new distribution models. Insurance firms, particularly those focusing on retirement services, will find themselves under pressure to transform their distribution platforms. In 2016, insurers should consider developing products for an "adviser-less" distribution model that delivers financial and product information directly to consumers through digital platforms. Insurers will need to adjust compensation systems to meet new fiduciary requirements, while maintaining existing distributor relationships.

Explore the use of robo-advisers. Robo-advisers represent a new self-service channel aimed particularly at younger, tech- focused consumers. In 2016, insurers will need to consider the best way to incorporate robo-advisers into their current distribution platforms-through internal development, partnership or acquisition. To help make that decision, insurers should ask themselves: Would the robo-adviser be a new distribution channel, a supporting tool for current distributors or some combination of the two approaches? Insurers will need to evaluate the costs and potential impact of integrating systems to improve sales and service. And with regulations in flux, firms will want to give compliance and suitability careful attention.

4. Reengineer processes to drive efficiency and market growth

Building operational agility

Changing customer expectations are opening up new opportunities for life-annuity insurers to grow their business through innovative products, solutions and go-to-market strategies that focus on the customer experience. However, existing process silos and legacy systems can restrict operational flexibility, so insurers may need to focus on reengineering processes and systems in the year ahead.

Priorities for 2016

Determine if your systems are ready for rapid market change. Today's assembly line approach to policy quoting, issuance and administration can slow application turnaround and detract from the customer and distributor experience. Once a policy is issued, legacy administrative systems can limit the ability of customers and distributors to access current account information, especially policy values, and to self-service their accounts. This problem can be exacerbated as customers purchase additional products from the insurer, particularly if those purchases are on different platforms.

Ensure that your systems can stand up to new regulatory rigors. Policy issuance and administration are not the only areas affected by process silos and legacy systems. Regulatory changes and risk management imperatives are putting pressure on finance to improve the quality and speed of reporting, as well as the use of advanced analytics for predicting and stress testing trends. As companies expand into new geographic markets and lines of business, the complexity of reporting and analyzing data is multiplied. A review of your systems through a regulatory lens could be helpful.

Invest in next-generation processes and analytics. Recognizing the importance of operational excellence to future strategies, insurers will continue to invest in straight-through-processing in 2016 to speed application turnaround times. They will also use more advanced analytics to enable underwriters to minimize the amount of required medical data, slash decision- making time and improve accuracy. Data consolidation projects will remain a high priority for many IT departments.

Revamp IT systems built for simpler times. During 2016, insurers will need to improve and replace IT systems that have reached the end of their useful life and are no longer fit for purpose. Unlike past investment cycles in IT systems, when one generation of hardware replaced another, the emergence of cloud technologies and on-demand solutions create new flexible options that can be implemented more quickly.

Consider partnerships that will facilitate transformation. To support critical business data processes, life-annuity insurers should explore creating strategic alliances with outside specialists. Insurers have already worked on consolidating legacy information systems and integrating data from around the firm, which will facilitate their transition to cloud and on-demand platforms. However, management must clearly understand the auditing, control and business risks of taking that leap.

5. Bring in the right talent to lead innovation

A growing talent gap

Life and annuity insurers are finding that driving innovation will take fresh ideas and new talent. As they age, distribution teams are falling out of sync with emerging consumer demographics.

The result: Life insurance and annuity sales to younger generations are declining, a trend that will only build momentum over time. In 2016, insurers will want to meet this challenge head-on by developing initiatives to attract young, diverse workers.

Priorities for 2016

Take concrete actions to compete for talent. The talent shortage affects every layer of the organization, from gaps in senior executive roles to deficiencies in technical skills. At the same time, the industry's image as staid and risk-averse often does not appeal to the brightest and most promising young people, who view fast-growing technology companies as their employers of choice. Insurers will need to compete fiercely for the talent required to build the next-generation insurance company.

Go beyond image-building to attract fresh blood. Executives recognize that simply burnishing the industry's image will not be enough to draw in new talent, such as data scientists and digital experience designers. In 2016, insurers need to offer greater flexibility in work locations, find creative ways to motivate and reward employees and fine-tune talent management programs.

Make diversity a strategic imperative. Workforce diversity is more than a compliance exercise; it offers a powerful way to achieve key strategic objectives. An employee base that reflects the customer universe is better-equipped to respond to changing customer needs. Diverse teams make better decisions by avoiding groupthink. In 2016, life and annuity insurers will broaden their efforts to attract a workforce representing a mix of cultural, demographic and psychographic backgrounds.

6. Put cybersecurity high on the corporate agenda

Escalating cyber risks

Leveraging social media, the cloud and other digital technologies will expose life and annuity insurers to greater cyber risks in 2016. These risks can run the gamut from financial fraud and corporate terrorism to privacy breaches and reputational damage. To protect their businesses and their clients, insurers will need to take strong measures to keep their technical platforms air-tight.

Priorities for 2016

Make cybersecurity a priority. Inadequate cybersecurity can cause a serious financial, legal and reputational fallout. In today's digital age, hacking often involves organized crime looking to steal data and trade secrets for financial gain. Cyber attacks can also be politically motivated to disrupt organizations. Whatever the motive, insurers will want to ensure that growing digital connections between their systems and outside parties are well-protected.

Take a broad view of the potential risks. Cybersecurity is not the only data-related risk for insurers to consider. Privacy issues surrounding consumer and distributor information are a mounting area of concern, especially as insurers use that data in product pricing, underwriting and target marketing. In addition, social media can make insurers vulnerable to reputational risks - in real time.

Safeguard customer data from misuse. Although consumers have grown accustomed to providing personal information to third parties, there is still uneasiness over usage, especially when it involves sensitive consumer medical and financial information. Insurance firms, particularly those with a global client base, need to stay abreast of emerging privacy regulations that could affect the use of digital technology and analytics. Crucially, insurers must invest in internal firewalls that protect personal data from misuse.

Assess your exposure to data sovereignty risks. As insurers move toward cloud computing and on-demand solutions, issues surrounding data sovereignty are becoming more complex. In a hyperconnected world - where a U.S. insurer might partner with a Dutch firm using a data service in India - the concept of data residing in one jurisdiction is difficult to apply. To cope, insurers will want to set up processes to monitor changing data regulations around the world and their impact on their businesses.

This piece was written by Doug French and Mike Hughes. For the full white paper, click here.