Why Insurance WILL Be Disrupted

Following an article on why insurance won't be disrupted, here is a point-by-point response. Big change is, in fact, coming soon.

Following an article on why insurance won't be disrupted, here is a point-by-point response. Big change is, in fact, coming soon.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Doubling down on what worked in the past isn't enough. You need digital sales growth, and that means a new set of tools.

CEOs entering 2016 convinced they can succeed by doubling down on what worked in the past may be reading from the wrong playbook.

According to a recently released Forrester/Odgers Berndtson study, "The State of Digital Business 2015," most companies remain unprepared for digital transformation" -- an absolute must for growth. Yet executives representing the diverse sectors examined in the study expect the majority of their sales to be digital by 2020. How will they get there?

If your transformation plan to capture at least a fair share of an expanding digital sales pie is not well underway, and you feel behind the eight ball, that may be for good reason - digital transformation leading to adopting a meaningful new business model or new technology can take years. And it demands operating along a different set of practices that used to work.

Growth is within reach of any CEO...

The CEO must be the Chief Growth Officer. Hiring a chief digital officer or chief innovation officer or someone else carrying a fashionable CXO title assigns daily responsibility for actions to close the digital gap. This can be a good move. The CEO cannot be everyplace at all times, and, besides, micromanagement from the top of the C-suite is deadly. When it works, this added role introduces skills, fosters enterprise-wide external partnerships, signals commitment inside and outside the organization and creates the digital blueprint for buy-in by colleagues. But the CEO alone has and must use his or her authority to coordinate growth levers and make the tough calls.

The CEO is also the Chief Culture Officer. Culture is not the job of HR or any other designee. Culture is the sum of the hundreds of choices everyone makes every day. People respond to the behaviors of their leaders. What do growth behaviors look like? Think about orchids in a greenhouse. Like orchids, new and different ideas are fragile and require special care. They may need protection from the outdoors - the conditions through which a mature business can operate, but that will kill a still-emerging concept. The CEO must advance a culture of a greenhouse, using governance to support both the work wherever growth businesses are being incubated, and a smooth transfer to the mainstream at the right time.

A lot has changed, but strategy is still the starting point for execution that gets results. Good strategy means having a clear view of where you are, an intended destination and a map of the terrain with a logical path to get there. Good strategy allows for good prioritization of short- and long-term moves, including the digital agenda. Strategy is still what gives all members of an organization a common view of goals. Strategy must evolve from what it has become in too many companies -- a financial extrapolation supported by a sales-y PowerPoint presentation and ungrounded assumptions.

You must govern to engage and create accountability. Bring the whole C-suite into the act - no bystanders or anonymous choristers allowed. It's a great idea to ask your CMO or CIO (or both) to lead the digital acceleration effort, but what about the rest of the C-suite? Put a governance process in place that fosters a constructive dialog with all of the CEO's direct reports, including the P&L leaders and functional heads. Governance must reinforce that every member of this team has "skin in the game" to achieve growth results. No one is exempt from being part of the solution.

You have to update the risk/reward equation. Face it - the traditional American corporation was built to be predictable - to control risk. But nowadays, avoiding deviation from the status quo may be the riskiest path of all. I'll paraphrase how Joi Ito, director of the MIT Media Lab, described the issue at a recent talk: To the corporate leader, downside risk is determined by aggregating variables that are stress-tested through complex analyses in an attempt to account for unknowns. And the potential of digital is full of unknowns, so it can easily be discounted down to where it is assumed to just have incremental impact.

But here's a whole different view: To a venture capitalist, the maximum downside is the loss of 100% of his or her investment. That investment is meted out in small chunks as milestones are passed, so exposure is clear, measurable and contained. And the upside is viewed as exponential (though low-odds).

Food for thought: Reframing the risk/reward inputs and calculation can be a liberating and responsible course of action.

Digital transformation is a non-starter without the right talent. Seek evidence beyond the skills that seem urgent now but come with an expiration date -- what matters is hybrid thinking, continuous learning and a record of delivering meaningful results. Is "fit" simply a euphemism for "people like me"? Go after your complements, and even some people who don't fit your mold, but for whom you are committed to make room. The continued homogeneity of the faces on the "Team" section of most corporate and start-up websites in this day and age reinforces the untapped opportunity to invite others in and reap the rewards.

You must measure client outcomes. What gets measured gets done. And the wrong metrics stifle innovation. Applying yesterday's metrics with blunt force is a death sentence for new ideas. The CEO must take a stand on how to gauge digital progress. Implement metrics that: 1. Align to the strategy. 2. Reveal how well you are delivering outcomes to the client (i.e., fulfilling the benefits that brought them to you in the first place). 3. Focus on how well the team is delivering results to clients. 4. Relate to drivers of the P&L and overall franchise health now and in three to five years.

You need to generate speed and momentum through constant progress in small chunks. It beats all-at-once precision that misses the market. Iterate, iterate, iterate, as fast as you can. Make live prototypes and show them to clients. Test and learn. Be flexible to new data and insight. The word "failure" does not appear in this playbook. "Failure" is something you bring upon your team when you don’t take the learning from a study, a test, a prototype, a client conversation and have it fuel the next improvement, however large or small, to allow you to move closer to success. "Failure" is what happens when the water cooler talk echoes with, "That doesn't work, so we killed it." A culture of "failure" has gum in its gears.

You must pursue three stages to finding your digital leverage: Step one: Identify the sources of revenue from new clients or relationship expansion (see above point on speed) and the drivers to win this business. Step two: Define the profit model. Step three: Go for scale. I worked under a CEO who set up this one-sentence approach during our early days of digital transformation: "Find the unit profit model and then see if you can scale it."

You need to collaborate. Some people are wired to collaborate. Others are expert at advancing their own goals through silos. Evidence of growth effectiveness: an environment where colleagues build on each other's ideas with the goal of shared success. Make collaboration a hiring competency that is taken seriously. Make it an expectation and demonstrate through your own behavior what that means.

Finally, you must get out there and get your hands dirty. We all learn by doing. Fast and valuable knowledge exchange takes place when corporates and start-ups interact. Corporates will find the speed, iteration and absence of failure as a concept inspiring. Start-ups are always looking for mentors and advisers with financial, marketing and operating experience. This quid pro quo can be the basis for a mutually beneficial and mind-expanding relationship. Make the meeting ground any space that is not a corporate conference room.

This post is also published in Amy's regular column on Huffington Post.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Among other ways that insurers are disrupting themselves: embracing change and looking at customers in a whole new light.

Coming from the Insurance Executive Conference earlier this month in New York, I am extremely excited by what I heard regarding where the industry is heading.

I attended both the life insurance and P&C tracks, picking up the following insights about how the industry is disrupting itself before others can:

Killian acknowledged that realizing a company's vision of customer experience requires investment and pointed out that Principal is committed to making the right investments to accomplish this. He remarked "We have invested a lot in Lean Six Sigma. It's amazing how much energy you can unlock through these processes."

Joe Beneducci, chairman, president and CEO of Prosight Specialty Insurance, said, "Technology is a catalyst that affords us options." Life insurance executives discussed their expectation that the analytics movement will affect carriers' entire value chain. They also saw predictive analytics enable insurance carriers to be learning organizations.

West Hunt, vice president and chief data officer at Nationwide, discussed the capability of scaling human expertise through cognitive computing. At the same time, the rise of robo-advisers and their potential threat to the business was mentioned. Finally, the recent trend toward digital and what it means to the industry was raised. Technology was discussed all over the conference.

I was happy to participate in the conference and felt energized by the discussion of new topics that position the industry to continue to thrive into the future.

What do you think? Post your comments below!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Cars, homes, livestock, pets, even bees -- it's hard to think of something these days that can't be connected to the Internet (and hacked).

Many exciting TV shows and movies include hacking as standard fare - overriding security systems, changing traffic lights, causing explosions, even committing untraceable murders. Hacking makes for interesting entertainment. The frightening part? It's all possible.

The digital connections in our world are multiplying faster than we realize. It is difficult to even think of anything that cannot be connected. Connected cars and connected homes are advancing by leaps and bounds. Livestock such as cattle and sheep are tracked electronically, and your dog or cat may have an embedded chip. Even bees are being outfitted with tiny RFID backpacks. Roads, buildings and transportation systems are beaming real-time information to servers in the cloud. The rapid rise of wearables, hearables, implantables and personal medical devices means that an increasingly large number of people are connected.

The increasingly connected world provides terrific opportunities to improve life on earth. But with opportunity often comes threat - in this case the threat of hacking. And the facts are scarier than the fiction.

The word "hacking" conjures up images of millions of credit cards being stolen from banks or retailers, or perhaps the stealing of corporate secrets or even cyber-espionage between countries. Insurers have been at the forefront of this battle, designing cyber risk coverages and policies to help individuals or businesses address the financial exposure of hacking. But the connected world increases the hacking potential in incalculable ways. Here are just a few examples of other existing vulnerabilities:

Fortunately many of these incidents were the work of white hat hackers hired to expose weaknesses. Unfortunately, most of the exposures still exist, and every new chip, sensor and connected device becomes a target. There are several key implications for insurers and individuals:

It's an exciting time to be alive. And it's an exciting time to be in the insurance industry. Technology, with all of its benefits, is advancing fast - but faster than we can regulate and manage it.

New risks and threats from connected devices definitely exist. But connected devices also provide great opportunities for the insurance industry to play to its strength - protecting valuable assets, promoting safety and providing peace of mind to individuals and businesses alike.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

An Aetna study on the benefits of genetic testing accidentally eviscerates the fiction that wellness programs save money.

The Wall Street Journal just reported that Genetic Testing May Be Coming to Your Office Soon. This is all well and good, assuming employees want their health insurer's buddies collecting their DNA for no good reason, handling it, selling it and possibly losing it.

This is not us talking. This is what the genetic testing company itself says on its website. You can read all about it here.

We will focus on the fact that this genetic testing simply doesn't save money - even according to a study by the main proponents of this dystopian scheme, Aetna and its buddies at the ironically named Newtopia.

If engineers learn more from one bridge that falls down than from 100 that stay up, this new Aetna-Newtopia study is the Tacoma Narrows of wellness industry study design. No article anywhere - including our most recent in Harvard Business Review - has more effectively eviscerated the fiction that wellness saves money than Aetna just did in a self-financed self-immolation published in the Journal of Occupational and Environmental Medicine. We hope the people who give out Koop Awards to their customers and clients will read this article and finally learn that massive reductions in cost associated with trivial improvements in risk are because of self-selection by participants, not because of wellness programs. And certainly not because of wellness programs centered on DNA collection.

Aetna studied Aetna employees who, by Aetna's own admission, didn't have anything wrong with them, other than being at risk for developing metabolic syndrome, defined as "a cluster of conditions that increase your risk for heart attack, stroke and diabetes."

In other words, Aetna took the wellness industry's obsession with hyperdiagnosis to its extreme: The "diagnosis" of those Aetna studied was that they were at risk for being at risk. Not only did they not have diabetes or heart disease, they didn't even have a syndrome that put them at risk for developing diabetes or heart disease. You and I should be so healthy.

As this table shows, after one year, the changes in health indicators between the control and study groups were trivial (e.g., a difference in waist measurement of less than 3/10 of an inch), only the change in triglycerides was statistically significant, and just barely (p=0.05). The control group actually outperformed the study group in three of the six measured variables, as would be predicted by chance. Bottom line: Nothing happened.

Yet Aetna reported savings of $1,464 per participant in the first year. This figure is more than 20 times higher than what Aetna's own HERO Report says gets spent in total on medical events that could be affected by wellness programs. The figure is also far higher than Katherine Baicker's claim of a 3.27-to-1 return on wellness spending. (Yes, in keeping with wellness industry tradition, Aetna cited the claim even though it has been thoroughly discredited and basically retracted; only now, because the Baicker study is six years old, Aetna feels compelled to insist that it is "recent.")

How did Aetna achieve such a high savings figure in a legitimate, randomized controlled trial (RCT)? Simple. That savings was not the result of the legitimate RCT. Having gone through the trouble of setting up an RCT, Aetna largely ignored that study design.

As Aetna's own table above shows, nothing happened. Spending was a bit lower for the invited group, but obviously there couldn't have been attribution to the program. A responsible and unbiased researcher might have said: "While there is a slight positive variance between the spending on the control group and the spending on the invitee group that wouldn't begin to cover the cost of our DNA testing, we can't attribute that variance to this program anyway. The subjects were healthy to begin with, there was no change in clinical indicators and we didn't measure wellness-sensitive medical events even though we know from our own HERO report both that those represent only a tiny fraction of total spending, and that those are the only thing that a wellness program can influence."

Instead, Aetna coaxed about 14% of the invitees to give up their DNA and measured savings on that small sample. (More than coincidentally, that decidedly uninspiring 14% participation rate was about the same as the Aetna-Newtopia debacle at the Jackson Labs reference site-from-hell. Basically, employees don't want their DNA collected, and DNA turns out to be quite controversial as a tool to predict heart disease down the road, let alone during the next 12 months. Further, Newtopia admits that it stores employee DNA, that lots of people have access to it and that Newtopia could lose it.)

The DNA seems to have had precious little to do with the actual wellness program. This Aetna program seems like a classic wellness intervention of exactly the type that has never been shown to work, with the DNA being only an entertaining sidebar. The subjects themselves exhibited no interest in hearing about their DNA-based predictions.

This is the first time a study has compared the result of an RCT to the result of a participants-only subset of the same population. The result: a mathematically and clinically impossible savings figure on the subset of active participants, and an admission of no separation in actual health status between the control and invitee groups by the end of the program period.

So Aetna accidentally proved what we've been saying for years about the fundamental bias in wellness study design that creates the illusion of savings:

Participants in wellness studies will always massively outperform non-participants - even when the program doesn't change health status and even when there was no program for the "participants" to participate in.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

After a data breach, companies often offer credit monitoring to those affected, but the current approach does little to prevent fraud.

Chances are you have received a letter stating that your personal data may have been compromised. Perhaps you were one of the 80 million people with an Anthem health insurance plan. Maybe you were one of the 21 million current or former employees of the federal government, or you could have been one of the 40 million who shopped at Target. There are countless examples where organizations failed to protect sensitive data and then were required to notify the affected individuals.

These notifications typically reveal how the breach happened, what steps are being taken to prevent another incident and what a company is doing to protect you from identity theft. Most organizations offer some form of credit monitoring and ID theft remediation services. Some states are beginning to mandate at least one year of credit monitoring under certain circumstances.

The Limits of Credit Monitoring

Offering credit monitoring seems to be a necessary post-breach strategy, and the very least a company would do. However, a deeper dive into what it does - and what it does not do – is long overdue.

Credit monitoring immediately notifies an individual that an attempt was made to obtain some form of credit in her name. Credit restoration services are usually offered when identity theft occurs. This is a valuable service that restores a victim's good credit, saves time and alleviates stress.

Credit monitoring does not prevent identity theft. The only way to prevent an identity thief from accessing a victim's credit is to either place a 90-day fraud alert on a credit file or freeze credit lines.

Legal Ramifications of Offering Credit Monitoring

Offering credit monitoring can cost an organization even more than the dollars spent. In Remijas v. Neiman Marcus, the plaintiffs alleged that 350,000 payment cards were affected when hackers gained access to Neiman Marcus networks. Even though a small fraction of the cards were affected by fraudulent activity, the Seventh Circuit Court of Appeals granted the plaintiffs legal standing, allowing the class action to proceed, because card holders had a legitimate fear of future identity theft. Because Neiman Marcus offered credit monitoring to the card holders after the breach, the court concluded that it was conceding that future identity theft was entirely possible.

The state regulatory environment, coupled with recent appellate court decisions, leaves organizations in a difficult position. States are beginning to require credit monitoring following a data breach. Organizations that do not offer credit monitoring face scrutiny by attorneys general, potential fines for non-compliance and a public relations fiasco. Yet those that offer credit monitoring will incur significant costs and, as evidenced in Remijas v. Neiman Marcus, may actually hurt their defense in a class action lawsuit.

A Better Way to Protect Your Identity

A more rational approach is needed to identity protection. Organizations and state regulators reacting to data breaches involving sensitive data elements need to address ways to prevent identity theft. As of this writing, organizations cannot legally freeze a consumer's credit for him, and have little means to prevent identity theft on his behalf. However, with the full support of state officials, a more efficient process to freeze credit can better protect identities and mitigate costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mediation can close those nagging, old cases where the worker represents himself and may not even state a recognizable claim.

You know the claims I'm talking about: the really old claims where the injured worker is representing himself. Let's call them the SRAs, self-represented applicants. Active SRAs file one court paper after another, causing the insurer or self-insured employer to fund what seems like a never-ending stream of visits by a representative to the board.

The SRA's papers may not state a recognizable claim. Pressed for time, the information and assistance officer may give the SRA short shrift. Defense attorneys with varying degrees of patience usually do, too.

But what if what the parties really need is a sort of an interpreter, a mediator?

Mediating an SRA's claim demonstrates respect for the SRA. The feeling of lack of respect and inability to get heard is often what drives the SRA to keep summoning the employer to court.

You may ask: "Why would I waste time and money on a worthless claim?" Because you're spending time and money now, and mediation is a way to end that endless cycle.

Sometimes the SRA has a bona fide complaint but without professional assistance has not been able to communicate it. The neutral mediator is often able to re-state the concern in a way the parties can address and get past. The mediator can help each party see the other side's point of view.

Animosity can obstruct effective communication. Caucusing allows parties to avoid direct confrontation. The parties are separated, and the mediator shuttles between rooms. The mediator presents the parties' views in a way most likely to lead to resolution.

At a minimum, mediation can improve communication and relations between the parties.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

The doctor couldn't be on time. The math problem for scheduling was far too complex. But new tools can cut delays -- and everyone's costs.

Why is it that every time I go to a doctor, I am given an appointment for a precise time, and then every single time the doctor shows up at least 20 minutes late? Does the healthcare system hate me? Do doctors not want to fix the problem? Or are they just simply incompetent?

To dig deeper into the question, we at LeanTaaS dove into the operations of more than 50 healthcare providers this past year. We looked at resource utilization profiles at three different types of clinics - cancer infusion treatment, oncology and hematology - to understand the problem and how best to solve it.

The truth is that most healthcare providers have the patient's interest at heart and are trying their level best. However, "optimal patient slotting" is a lot more complex than might appear on the surface - in fact, it is "googol-sized" in complexity. The good news is it's a problem solvable with advanced data science; the sobering news is it MUST be solved if we are to handle the incoming onslaught of an increasing, aging patient population all carrying affordable insurance over the next 20 years.

The Doctor Will Be Right With You. NOT.

There are few things I take for granted in life, and waiting to see a doctor is one of them. The average wait time for a routine visit to a physician is 24 minutes. I am sure I am not the only one who has sat in a doctor's waiting room thinking, "You said you would see me at 3:00 p.m. - why am I being called at 3:24? This happens every time; I bet you could have predicted it. So, why didn't you just ask me to come at 3:24 instead?"

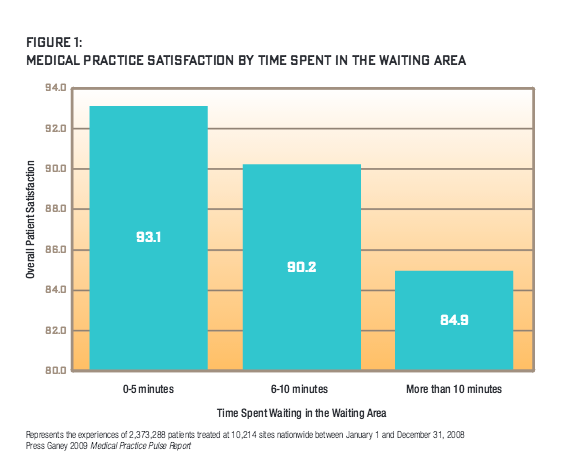

A Press Ganey study of 2.3 million patients at 10,000 sites nationwide found that a five-minute wait can drop patient satisfaction by 5%, a 10-minute wait by 10% and more than 10 minutes by 20%.

That 24-minute stat is, in fact, not so bad compared with anyone who has had to get an infusion (chemo) treatment, visit a diabetes clinic, prepare for surgery or see just about any specialist. Those wait times can be hours.

Just visit any hospital or infusion center waiting room, and you will see the line of patients who have brought books, games and loved ones along to pass that agonizing wait time before the doctor sees them.

I spent the past year researching this problem and saw for myself just how overworked and harried nurses and doctors operating across the healthcare system are. I spoke to several nurses who have had days they were not able to take a single bathroom break. Clinics routinely keep a "missed meal metric" - how often nurses miss lunch breaks - and most of the ones I spoke to ring that bell loudly every day. I even heard of stories of nurses suing hospitals for having to go a whole day without breaks or meals.

The fact is that long patient wait times are terrible for hospitals, too. Long wait times are symptomatic of chronically inefficient "patient flow" through the system, and that has serious negative impact on the hospital's economic bottom line and social responsibility:

Hospital leaders know this well. Every administrator I spoke to in my research - CEO / CAO / CNO - has some kind of transformation effort going on internally to improve patient flow - "lean" teams, 6-sigma teams, rules for how to schedule patients when they call into various clinics and so on. Leaders know that if patients could be scheduled perfectly and doctors could see them on time, the resulting "smoothing of patient flow" throughout the system would make their facilities, staff and the bottom line much better off.

The Real Reason

It's not for a lack of motivation that the system is broken. It's just a complex math problem.

The system is broken because hospitals are using a calculator, standard electronic health record (EHR) templates and a whiteboard to solve a math problem that needs a cluster of servers and data scientists to crunch.

To illustrate why scheduling is such a complex problem, let's take the case of a mid-sized infusion (chemo) treatment center I studied during my research.

This infusion center has 33 chairs and sees approximately 70 patients a day. Infusion treatments come in different lengths (e.g., 1-2 hours, 3-4 hours and 5-plus hours long), and the typical daily mix of patients for these three types are 35 patients, 25 patients and 10 patients, respectively. The center schedules patients every 15 minutes starting at 8:00 a.m. with the last appointment offered at 5:30 p.m. So there are 39 possible starting times: 8:00 a.m., 8:15 a.m., 8:30 a.m., etc, ending at 5:30 p.m. The center can accommodate three simultaneous starts because of the nursing workload of getting a patient situated, the IV connected, etc. That makes a total of 39*3 = 117 potential "appointment start slots."

That may not seem like a lot, but it results in 2.6 times 10 to the 61st power possible ways to schedule a typical, 70-patient day. (I'll save you the math.) That's 26 million million million million million million million million million million possibilities.

And that number is just the start. Now add in the reality of a hospital - some days nurse schedules are different from others, the pattern of demand for infusion services varies widely by day of week, doctors' schedules are uneven across the week, special occurrences like clinical trials or changes in staff need to be considered and so on. You are looking at a problem that you can't solve with simple heuristics and rules of thumb.

How Today's "Patient-Centric" Scheduling Often Works - and Backfires

Very few hospitals I spoke to understand or consider this math. Rather, in trying to "make the patient happy," most providers have been trained to use a "first come, first served" approach to booking appointments. Sometimes, providers use rules of thumb based on their knowledge of busy times of day or week, e.g., start long appointments in the morning and shorter ones later.

If hospitals were scheduling patients for one chair, one nurse and the same treatment type, some simple rules could work. But reality is a lot more complicated - the right schedule would need to consider varying treatment times across patients, include multiple treatment rooms/chairs, varying staff schedules, lab result availability and so on. Without sophisticated tools, there is an almost zero chance a scheduler can arrange appointments so treatment durations fall like Tetris blocks that align perfectly over the course of the day, and seamlessly absorb patients as they arrive, orchestrating doctor, nurse and room availability, while accounting for all the other constraints of the operation.

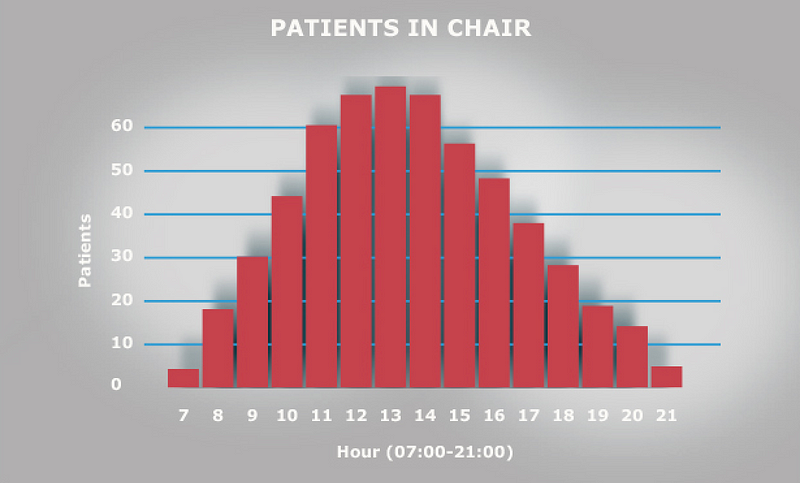

In effect, hospitals are scheduling "blind," not taking into account the effect of appointments already scheduled before, during or soon after the slot being allotted on a first-come basis. Schedule currently is like adding traffic to rush hour and almost always results in a "triangle shaped utilization curve" - massive peaks in the middle of the day and low utilization on either side.

Each of the 50 hospitals I spoke to identified precisely with this utilization curve. In fact, they identify with "the midday rush and slower mornings and evenings" so well that they have given them affectionate names - one called it their "Mount Everest," another "Mount Rainier."

From a cancer center's standpoint, this chair utilization curve has several issues even beyond long patient wait times:

In effect, when hospitals think they are scheduling in patient-centric ways, they are doing exactly the opposite.

They are promising patients what they cannot deliver - instead of giving the patient that 10:00 a.m. Wednesday appointment, an 11:40 a.m. appointment may have been much better for the patient and the whole system.

As we will see, the patient could have had a 70% shorter wait time, the hospital could have seen 20% more patients that week, every nurse could have taken a lunch break every day and a lot less (if any) overtime would have been required.

So How Do You Solve This "Googol-Sized Patient Slotting" Problem?

The solution lies in data science and mathematics, using inspiration from lean manufacturing practices pioneered by Toyota decades ago, such as push-pull models, production leveling, reducing waste and just-in-time production.

In mathematical terms, it means taking those 10^61 possibilities and imposing the right set of "constraints" - demand patterns, staffing schedules, desired breaks and whatever is unique to the hospital's specific situation - to come up with a much tighter set of possible patient arrangements that solve for maximizing the utilization of hospital resources and therefore the number of patients seen.

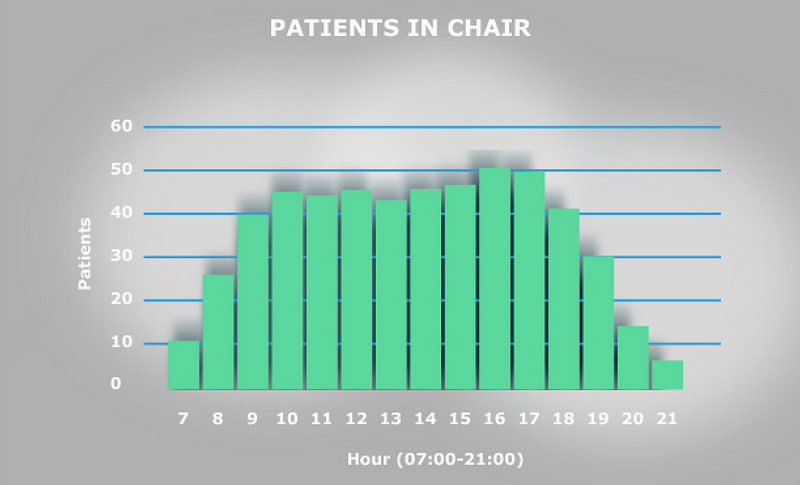

In the case of the infusion center, the algorithm optimizes utilization of infusion chairs, making sure they are occupied uniformly for as much of the day as possible as opposed to the "peaks and valleys" in Figure 3. In essence, "rearranging the way the Tetris blocks (patients) come in" so they appear in the exact order they can be met by a nurse, prepped and readied for a doctor whose schedule has been incorporated into the algorithm.

The first step in doing this is mining the pattern of prior appointments to develop a realistic estimate of the volume and mix of appointment types for each day of the week.

The second step is imposing the real operational constraints in the clinic (e.g., the hours of operation, doctor and nurse schedules, the number of chairs, various "rules" that depend on clinic schedules, as well as patient-centric policies such as that treatments longer than four hours should be assigned to a bed and not a chair).

Finally, constraint-based optimization techniques can be applied to create an optimal pattern of "slots," which reflect the number of "appointment starts" of each duration.

In the case of the infusion center, that means how many one-hour duration, three-hour duration and five-hour duration slots can be made available at each appointment time (i.e. 7:00 a,m., 7:15 a.m., 7:30 a.m. and so on).

Doing this optimally results in moving the chair utilization graph from the "triangle that peaks somewhere between 11:00 a.m. and 2:00 p.m." in Figure 3 to a "trapezoid that ramps up smoothly between 7:00 a.m. and 9:00 a.m., stays flat from 9:00 a.m. until 4:00 p.m. and then ramps down smoothly from 4:00 p.m. on" in Figure 4.

Coming up with realistic slots that keep patients moving smoothly throughout the day cuts patient waiting times drastically, reduces nurse overtime without eliminating breaks and keeps chair utilization as high as possible for as long as possible. Small perturbations in this system are more like a fender bender at midnight, a small annoyance that causes a few minutes of delay for a small number of people instead of holding up rush hour traffic for hours.

Smoothing Patient Flow - A Large Economic Opportunity

The above graphs are sanitized versions of real data from a cancer infusion treatment center at a real hospital that used these techniques to solve their flow problems. The results they achieved are staggering and point to the massive economic and social opportunity optimal patient flow presents.

Post implementation of a product called "LeanTaaS iQueue," they now experience:

Imagine applying this kind of performance improvement to every clinic, hospital and surgery suite in the country and the impact it will have on population health through increased patient access to the system.

The Problem Is Going to Get a Lot Worse Unless Providers Address It Now

This problem is going to get a lot worse for a simple reason - the demand for medical services has never been stronger, and it's only going to increase. Just looking at the U.S. market:

The Good News

Most healthcare providers are waking up to the fact that their operations need a data-driven, scientific overhaul much the same way as auto manufacturing, semiconductor manufacturing and all other asset-intensive, "flow"-based systems have experienced.

The good news is that there are tools, software and resources that can be used to bring about this transformation. Companies like LeanTaaS are at the forefront of this thinking and are applying complex data science algorithms to help hospitals solve these problems.

Hospitals that are serious about solving patient flow issues and the related problems now have access to the best computational minds and tools.

I see a world in which our healthcare system can see every patient on time without imposing hardship on care providers, disruption on current processes or increasing cost of services.

Here's to that world!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Blue Marble is tackling a thorny problem: how to provide microinsurance that helps poor economies develop and their citizens thrive.

As with many modern businesses, Blue Marble Microinsurance began with a question-the same question entrepreneurs and innovators ask themselves every day: What can we do differently that will eliminate inefficiencies and redirect resources to a more value-accretive cause?

The underlying mission of Blue Marble is tied to the recognition that insurance is important to economic development around the world. Without prefinancing losses, societies are vulnerable. Following disasters, people who show potential for emerging into the middle class frequently fall back to the bottom of the economic pyramid.

With the knowledge that fortifying the economic progression of the poor would add untold benefits to the global economy, to our industry and, of course, to the poor themselves, we asked another simple question: What needs to change in the insurance and reinsurance industry to make it relevant to the poor?

To examine this question further, Blue Marble's founders needed to be open-minded about doing things differently and having a willingness to learn while leading. Only by researching the facts could Blue Marble articulate the problem that the founders set out to solve and establish a mission backed by a business model.

The problem was clearly identified in research literature. For example, Swiss Re reported that in the last 10 years, cumulative total damage to global property as a result of natural disasters was $1.8 trillion-only 30% of which was insured, resulting in a protection gap of $1.3 trillion. This gap is even wider when general property risk such as fire, water damage and burglary are considered. And the gap is likely to continue to grow as a result of trends such as global warming and urbanization. While this research covers a scope broader than microinsurance, we have identified the significance of the protection gap and its ever increasing trend.

Other research has underscored how uninsured losses eventually become the responsibility of governments and society at large, resulting in a drag on the economic growth of nations. In emerging nations, 80% to 100% of disaster losses are uninsured, according to Swiss Re.

Haiti, the poorest country in the Western Hemisphere, is an example that warrants examination. The United Nations World Food Program reports that 75% of Haitians live on less than $2 a day. In January 2010, the dire situation was worsened by a magnitude 7.0 earthquake. According to the Inter-American Development Bank, about 230,000 people died, and nearly 1.5 million Haitians were displaced. Economic losses were estimated at about $8 billion- approximately 120% of GDP—with insurance penetration at around 0.3% of GDP.

In another example-the recent earthquake disaster in Nepal-we estimate the damages at 35% to 50% of GDP, with little to no aid delivered as of yet. The effect of the protection gap on developing nations and the consequence on the poor is crippling.

The poor, with no safety nets other than informal systems of caring for each other, are disproportionately affected by catastrophes. The safety nets break down in a village or community following a disaster, thrusting complete communities to the bottom of the economic pyramid for years to follow. In Nepal, communities rich with heritage and dependent on tourism are now struggling to survive with a safety net under stress. Without mechanisms for prefinancing risk, smallholder farmers, shop owners and artisans who lack savings fall deeper into poverty.

With an understanding of the problem that Blue Marble planned to address, a business case for the consortium was established. The problem was viewed as significant and the solution relevant to the global economy, our industry and the poor.

A Role for the Insurance Industry

The potential solutions include charity and public-private partnerships, but what role might the insurance industry assume? While some companies have attempted to enter the microinsurance market in hopes of providing risk protection to the poor, few actually succeeded. Some have been able to show profitability, but most lacked evidence of the double bottom line: the ability to deliver protection that also creates incentives and enables the poor to make better economic choices in their lives.

This is a crucial point. Risk protection, in and of itself, will not enable economic progression. Incentives embedded in the risk protection are the key drivers. Policies should be designed to encourage growth and expansion. For example, by creating a more certain outcome, a policy can enable the smallholder farmer to cultivate two hectors of land as opposed to one hector. Another example is enhancing a micro-entrepreneur's willingness to expand his or her sewing business-to buy another sewing machine and hire an employee-all enabled by a reduction in the fear of theft.

Making It Work

A review of prior experiences-many unsuccessful-suggested that Blue Marble needed a different business model. The business model needed to recognize the vast array of talent required to address the protection needs within the context of poverty entrapment. From within the insurance industry, expertise was needed to support product development, regulatory environment and risk pricing. Other areas of expertise likely found outside of the industry included an understanding of the poverty ecosystem and how to partner with entities in the supply chain of the poor.

At the same time, the business model had to address the many barriers to success in microinsurance:

Recognition of the barriers to success in microinsurance and the need for a unique talent model led Blue Marble to a collaborative approach: the formation of a legal entity owned by eight significant insurance entities with a dedicated management team supported by employees from the consortium members. Through collaboration, we would share the cost of innovation and be able to "mutualize" talent from within and beyond the industry. By stepping forward and collaborating among the eight, we developed a public-private outreach partnership with a shared goal.

Blue Marble was established as a legal entity owned by the eight but with a long- term focus. A dedicated management team was retained to give focus to the problem at hand and was backed by a governance model involving senior leaders from the consortium members.

The talent model was unique: The eight consortium companies represent 250,000 employees operating in 170 countries. A virtual business unit was established giving Blue Marble access to talent from the consortium members on a secondment basis. The win-win is that Blue Marble has access to both strategic and technical talent on an as-needed basis. For example, if a Spanish-speaking actuary with knowledge of agriculture risk in Peru is needed, we can identify the person and gain access to her expertise for a limited time. Likewise, Blue Marble facilitates reverse benefits in terms of employee engagement and an appreciation for the relevancy of our day-to-day work.

Why the Name Blue Marble?

Employees of all participating companies were informed about the microinsurance consortium initiative, and their ideas for names were solicited. The communication heads for each company coordinated the outreach and then narrowed the submissions. The board ultimately selected "Blue Marble."

The name was nominated by Denise Addis, an executive assistant from Guy Carpenter. Addis wrote: "Blue Marble is a nickname for our planet...Technology and social media have made the world an even smaller place, and the planet itself has become a community more than ever before. I think this venture will expand that community."

The Blue Marble name captures our holistic view of our world. Underscoring our mission to extend insurance protection to a broader portion of the population and to advance the role of insurance in society in a socially responsible and sustainable way, it reminds us that we all share the planet. It is up to us to connect with citizens around the world to make life better for us all.

This article first appeared in Carrier Management. Joan Lamm-Tennant spoke to Carrier Management about Blue Marble Microinsurance during a videotaped interview at the IICF Women in Insurance Global Conference in June. Excerpts of the interview are presented below.

What is microinsurance?

Lamm-Tennant: Microinsurance is risk protection for the poor-artisans, small- scale farmers, shop owners. We address their specific risk protection needs and enable them to have stable consumption, which allows them to invest, improve productivity and grow through the economic pyramid.

What are the greatest benefits for carriers that take part in the microinsurance consortium?

Lamm-Tennant: It's an opportunity to have an impact, to be relevant, to work in public-private partnerships and solve the protection gap. By solving the protection gap and being a part of the financial inclusion initiatives, we in fact enable a massive emerging middle class...

Today, we have seven billion people in the world. The middle class is only 1.8 billion. We could double that in the next 15 years.

The opportunity is also significant in terms of solving our own problems within the insurance industry. It's an opportunity to be forced to innovate because being successful in these markets is not about lifting and shifting products that are on our shelves. It's about being more efficient, being more focused on the value proposition within our products, and it's about new distribution channels.

Because we're forced to innovate, we'll have the opportunity to reverse innovate. Last of all, we have a talent challenge within the insurance industry. The Millennials are not necessarily interested in investing their brilliance, their talent, in our causes. So this is a way in which we join them in their cause for relevancy.

Exactly how does the collaboration work? How do carriers share the costs, premiums and claims? Whose paper are policies written on?

Lamm-Tennant: We're a service entity. Our objective is to prepare a complete turnkey, cost-efficient package for the carriers so that they can enter the market...

What are the component parts of that package? It could be everything from policy design to distribution mechanisms to social impact metrics. In essence, by delivering this package to the carriers, they then will have to add risk capital, using this enabler to enter the market. Their goal is to create the market.

Yes, one of them will lead, and that's a part of our governance structure. Collectively, among the eight carriers, we have licenses in many markets. A lead, perhaps, would be somebody who is already present with a license...Within and among the eight of us, to fill the demand, our goal is to engage local carriers and other partners. [What] we're trying to do is make it cost-efficient, by sharing the development cost, so that they can enter with risk capital at a profitable level.

In what areas do you expect microinsurance carrier participants to innovate and reverse innovate?

Lamm-Tennant: Success will not occur by simply reducing a few zeros off the line and saying, "Here, we've made this a smaller product. So won't you buy it?"...There has to be a clear value statement...

The second part is our distribution mechanisms have to be efficient. I'm not suggesting abandonment of the agency distribution system, [but the question is] how do we enable that system to be very efficient with technology?

The third is how we measure success...If we truly want to be relevant, let's put some broad measures of social impact in our products and not carve it off into a CSR initiative.

Those are three platforms that are going to be critical to our success and create an opportunity for the carriers to then rethink similar issues in their traditional business.

How are microinsurance products distributed?

Lamm-Tennant: We've seen some success in some markets with the distribution through utility companies, mobile phone operators, even seed manufacturers. [But] the embedded distribution costs are quite high...Some of these products distributed on those platforms could have a claims ratio of 10 or 20 and a distribution cost of 50 or 60. So we can't just roll ourselves into those platforms.

We have to think about how to utilize those platforms yet still do it in an efficient way and not impose such distribution costs. Having said that, we are an arm's throw away. It is within our reach that the poor will move from mobile phones to smartphones...

How will you measure the success of the venture?

Lamm-Tennant: Success to us is having demonstrated evidence that those who are benefiting from our products are benefiting in a sense that they are moving up the economic pyramid-that we're seeing behavioral change. We're seeing them put risk aside and invest in their businesses, grow their land, sustain their consumption if it's a food sustainability motive that we're looking at.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Faced with more technological change, rising customer expectations and competitive pressure, life-annuity firms must tackle six priorities.

U.S. life-annuity insurers will enter 2016 in relatively good financial condition but facing exponential changes from rapid advances in technology, rising customer expectations and growing competition. These market shifts will require insurers to reinvent their strategies, services and processes, while coping with nagging financial, economic and regulatory uncertainty. Fortunately, after years of bolstering their balance sheets, life-annuity firms are in a strong position to invest in the innovations and technologies needed to fuel future growth.

Growing customer expectations

Digital technology will continue to transform the life-annuity industry in the coming year. From anytime, any-device digital delivery to customized services, today's diverse insurance customers will demand flexible solutions that go beyond one-size-fits-all product offerings. To take advantage of these trends, insurers will need to adopt a customer-centric approach that relies on deeper relationships, more personalized advice and more rigorous information. At the same time, life-annuity insurers must integrate emerging distribution technologies to reach customers through multiple channels, all without disrupting traditional distribution.

Millennials and mass-affluent consumers, in particular, are seeking the latest digital tools, such as on-demand insurance apps and robo-advisers for automated, algorithm-based financial advice. Meanwhile, insurers are establishing omni-channel platforms to reach and service customers more effectively and exploring the use of wearables and health monitors for usage-based life insurance. Advanced analytics, such as predictive models, combined with cloud and on-demand technologies, will provide insurers with the instruments to re-engineer front and back offices.

To fast-track digital transformation, insurers are turning to partnerships and acquisitions. For example, in 2015, Northwestern Mutual purchased online planner LearnVest to provide more customized support to customers. Other insurance firms, such as Transamerica and Mass Mutual, have set up venture capital firms to invest in digital service providers.

But digital innovation also carries greater risks. Digital technologies make insurers more vulnerable to financial fraud, data theft and political activism. Privacy breaches are becoming a bigger concern as insurers gain wider access to sensitive financial and health data. Even the use of social media is exposing firms to risks from reputational damage.

Competitive pressures are building

As digital technology becomes more pervasive, insurers will face greater competition from new digital start-ups. Although much of the recent innovation in financial services has occurred in the banking and payments sector, insurance is now squarely in the cross-hairs of new digital providers. One example is PolicyGenius, which is offering digital platforms to help consumers shop for insurance. With the recent launch of Google Compare, the rise of InsuranceTech will gain momentum in 2016.

But competition will also come from existing insurers leveraging new digital solutions and business models. For example, John Hancock recently launched Protection UL with Vitality, which rewards life-insurance policyholders for health-related activities monitored through personalized devices. In 2016, more insurance stalwarts will jump on the digital bandwagon through new product development, acquisitions and alliances. At the same time, changing insurance attitudes and practices among Millennials will spread to other age groups. Insurance firms reluctant to embrace innovations for fear of cannibalizing their own market space may be overtaken by more nimble firms able to capitalize on a shifting insurance landscape.

Uncertain economic and regulatory conditions

Life-annuity insurers are operating in a tenuous economic and financial environment with sizable downside risk. In 2016, global economic weakness will continue to be a worry, particularly as emerging market growth decelerates, financial volatility escalates and the U.S. economy muddles through a presidential election year. Regulatory and monetary tinkering will further complicate macro conditions.

The political landscape is likely to remain gridlocked at the federal and state levels as the election cycle concludes. Tax policies are unlikely to change in 2016, but insurers should prepare for new post-election regulatory headwinds in 2017. Insurers should also stay on top of the Department of Labor's evaluation of fiduciary responsibility rules, which will remain a disruptive force in 2016.

Regulations originally designed for other industries and jurisdictions are being extended into the U.S. insurance market. International regulators are moving ahead with further development of Solvency II and IFRS. The NAIC and state insurance departments are adjusting risk-based capital charges and will react to the first year of ORSA implementation.

Mixed impact on life-annuity insurers

Premiums will grow moderately in 2016. Individual life premium growth will be particularly sluggish, as consumers remain focused on retirement savings. Faced with equity market volatility, consumers will continue to invest in fixed and indexed annuities and avoid variable annuities.

To cope with torpid market conditions, insurers will focus on growing premium and investment income, managing risks and controlling costs. Companies will continue to identify opportunities to improve return on equity through active balance sheet and back-book management. Among the strategies are investments in organic and inorganic growth, seeking reinsurance and capital market capacity and returning excess capital to shareholders. M&A activity will likely accelerate in 2016 as Asian insurers and private equity firms continue their interest in U.S. insurance companies.

Margin compression will dictate sustained emphasis on cost management through centralized control, technology upgrades and better integration of business units. With mission-critical information becoming more accessible, data-driven business decisions are moving to the C-suite. At the same time, regulatory demands and business imperatives are elevating risk management responsibility to the C-suite and board.

STAYING IN FRONT OF CHANGE: PRIORITIES FOR 2016

In 2016, life-annuity insurers will need to take decisive measures to cope with market upheavals - or risk the consequences. By staying in front of change, insurers can strengthen customer relationships, build market share and gain competitive advantage. Tapping their strong capital positions, insurers will invest in new technologies, systems and people that will allow them to capture their future.

Specifically, leading insurers will focus on the following pathway to change:

1. Pick up the pace of business transformation and innovation

Time to reboot

The life and annuity industry has never been considered highly innovative or nimble. But the convergence of technological, regulatory and customer trends is creating a perfect storm, with the power to upend the industry. EY's 2015 Retail Life and Annuity Survey of senior executives identified the need to embrace new market realities in 2016, highlighting innovation as a top strategic priority. To cope, industry leaders must act now to rethink their business approach:

Priorities for 2016

Create a company-wide culture of innovation. To foster transformation, insurers will need to break away from their conservative leanings, and create a culture that encourages new thinking. Such a culture should allow for greater experimentation, and even short-term failures, to achieve long-term success. Senior leaders through to middle-managers should champion change and avoid the danger of the status quo.

Drive innovation through cross-functional teams. In 2016, life and annuity insurers will need to cut across organizational silos to drive innovation. Establishing cross-functional teams of sales, underwriting and policy administration can lead to new ideas that enrich the customer and distributor experience. Similarly, a cross-functional team of actuarial, finance and risk management can help build consensus around new analytical and risk approaches.

Share information openly. Overcoming departmental silos will not be easy. Executives should ensure that information-sharing occurs at the right time and that teams are working from the same set of high-quality data. To avoid time-consuming reconciliations, managers will want to address data discrepancies across business units. Using skilled program managers to track progress against timelines and budgets can help.

2. Reinvent products and services for the new digital consumer

Addressing ever-rising customer expectations

In 2016, life insurance and annuity products will need to come to grips with tectonic shifts in consumer expectations and behaviors. Driven by their experiences in other industries, customers will demand greater digital access, better information and quicker service. Failure to respond will make it difficult for insurers to acquire and retain customers. Fast-moving insurers are redefining their customer relationships and products and services to cope with these new market dynamics.

Priorities for 2016

Offer anytime, anywhere, any-device access. Banks now provide customers with unprecedented 24/7 access and self-service on multiple devices, from PCs to smartphones. In 2016, life insurance customers will expect a similar anytime, any-device experience from insurers from point of sale and throughout the relationship.

Provide greater transparency to customers. In today's digital world, customers expect clearer product information and pricing transparency. To respond, insurers should reduce the complexity and definitional rigidity of current life insurance products, while providing a more streamlined and transparent issuance process.

Deliver more flexible solutions. Insurers will need to emphasize product flexibility to cost-conscious customers and offer hybrid products that combine income protection, such as long-term care and disability insurance, with life and retirement coverage. For high-net-worth customers, insurers should stress the tax advantages of life insurance and annuities and develop features to compete with alternative investment products.

Build continuing engagement with customers. The life and annuity industry has long suffered from "low engagement" with customers following the initial sale. More customer engagement will minimize the risk of customer indifference and potential disintermediation. Developing an integrated, personalized digital experience that leverages the latest mobile and video technology will be a key to success.

Move toward a service orientation. To differentiate themselves, insurers will want to shift from a product placement to a trusted adviser approach. With established personal relationships in place, and access to more flexible products and services, new sales will occur more naturally in response to customer needs.

3. Adjust distribution strategies for technological and regulatory shifts

The rise of omni-channel distribution

Technological and regulatory changes are prompting life and annuity insurers to think beyond traditional distributors. For example, robo-advisers, growing in popularity in the wealth industry, could offer insurers a way to reach the underserved mass-affluent market. Yet, unlike property and casualty carriers, life and annuity insurers have made little progress in selling through digital channels. Looking ahead to 2016, life and annuity insurers may find themselves losing market share if they fail to adapt to an omni-channel world.

Priorities for 2016

Prepare for new fiduciary standards. In 2016, the Department of Labor's proposed fiduciary rule could upend existing distribution models. The rule strengthens consumer protection, constrains distributors and alters compensation for advisers providing retirement advice. Similar changes in the UK widened the gap in personal financial guidance between wealthy and mid-market customers - a potential impact in the U.S. The ability to recommend specific products may become more difficult, creating a ripple effect on retirement sales and advice.

Adapt services for new distribution models. Insurance firms, particularly those focusing on retirement services, will find themselves under pressure to transform their distribution platforms. In 2016, insurers should consider developing products for an "adviser-less" distribution model that delivers financial and product information directly to consumers through digital platforms. Insurers will need to adjust compensation systems to meet new fiduciary requirements, while maintaining existing distributor relationships.

Explore the use of robo-advisers. Robo-advisers represent a new self-service channel aimed particularly at younger, tech- focused consumers. In 2016, insurers will need to consider the best way to incorporate robo-advisers into their current distribution platforms-through internal development, partnership or acquisition. To help make that decision, insurers should ask themselves: Would the robo-adviser be a new distribution channel, a supporting tool for current distributors or some combination of the two approaches? Insurers will need to evaluate the costs and potential impact of integrating systems to improve sales and service. And with regulations in flux, firms will want to give compliance and suitability careful attention.

4. Reengineer processes to drive efficiency and market growth

Building operational agility

Changing customer expectations are opening up new opportunities for life-annuity insurers to grow their business through innovative products, solutions and go-to-market strategies that focus on the customer experience. However, existing process silos and legacy systems can restrict operational flexibility, so insurers may need to focus on reengineering processes and systems in the year ahead.

Priorities for 2016

Determine if your systems are ready for rapid market change. Today's assembly line approach to policy quoting, issuance and administration can slow application turnaround and detract from the customer and distributor experience. Once a policy is issued, legacy administrative systems can limit the ability of customers and distributors to access current account information, especially policy values, and to self-service their accounts. This problem can be exacerbated as customers purchase additional products from the insurer, particularly if those purchases are on different platforms.

Ensure that your systems can stand up to new regulatory rigors. Policy issuance and administration are not the only areas affected by process silos and legacy systems. Regulatory changes and risk management imperatives are putting pressure on finance to improve the quality and speed of reporting, as well as the use of advanced analytics for predicting and stress testing trends. As companies expand into new geographic markets and lines of business, the complexity of reporting and analyzing data is multiplied. A review of your systems through a regulatory lens could be helpful.

Invest in next-generation processes and analytics. Recognizing the importance of operational excellence to future strategies, insurers will continue to invest in straight-through-processing in 2016 to speed application turnaround times. They will also use more advanced analytics to enable underwriters to minimize the amount of required medical data, slash decision- making time and improve accuracy. Data consolidation projects will remain a high priority for many IT departments.

Revamp IT systems built for simpler times. During 2016, insurers will need to improve and replace IT systems that have reached the end of their useful life and are no longer fit for purpose. Unlike past investment cycles in IT systems, when one generation of hardware replaced another, the emergence of cloud technologies and on-demand solutions create new flexible options that can be implemented more quickly.

Consider partnerships that will facilitate transformation. To support critical business data processes, life-annuity insurers should explore creating strategic alliances with outside specialists. Insurers have already worked on consolidating legacy information systems and integrating data from around the firm, which will facilitate their transition to cloud and on-demand platforms. However, management must clearly understand the auditing, control and business risks of taking that leap.

5. Bring in the right talent to lead innovation

A growing talent gap

Life and annuity insurers are finding that driving innovation will take fresh ideas and new talent. As they age, distribution teams are falling out of sync with emerging consumer demographics.

The result: Life insurance and annuity sales to younger generations are declining, a trend that will only build momentum over time. In 2016, insurers will want to meet this challenge head-on by developing initiatives to attract young, diverse workers.

Priorities for 2016

Take concrete actions to compete for talent. The talent shortage affects every layer of the organization, from gaps in senior executive roles to deficiencies in technical skills. At the same time, the industry's image as staid and risk-averse often does not appeal to the brightest and most promising young people, who view fast-growing technology companies as their employers of choice. Insurers will need to compete fiercely for the talent required to build the next-generation insurance company.

Go beyond image-building to attract fresh blood. Executives recognize that simply burnishing the industry's image will not be enough to draw in new talent, such as data scientists and digital experience designers. In 2016, insurers need to offer greater flexibility in work locations, find creative ways to motivate and reward employees and fine-tune talent management programs.

Make diversity a strategic imperative. Workforce diversity is more than a compliance exercise; it offers a powerful way to achieve key strategic objectives. An employee base that reflects the customer universe is better-equipped to respond to changing customer needs. Diverse teams make better decisions by avoiding groupthink. In 2016, life and annuity insurers will broaden their efforts to attract a workforce representing a mix of cultural, demographic and psychographic backgrounds.

6. Put cybersecurity high on the corporate agenda

Escalating cyber risks

Leveraging social media, the cloud and other digital technologies will expose life and annuity insurers to greater cyber risks in 2016. These risks can run the gamut from financial fraud and corporate terrorism to privacy breaches and reputational damage. To protect their businesses and their clients, insurers will need to take strong measures to keep their technical platforms air-tight.

Priorities for 2016

Make cybersecurity a priority. Inadequate cybersecurity can cause a serious financial, legal and reputational fallout. In today's digital age, hacking often involves organized crime looking to steal data and trade secrets for financial gain. Cyber attacks can also be politically motivated to disrupt organizations. Whatever the motive, insurers will want to ensure that growing digital connections between their systems and outside parties are well-protected.

Take a broad view of the potential risks. Cybersecurity is not the only data-related risk for insurers to consider. Privacy issues surrounding consumer and distributor information are a mounting area of concern, especially as insurers use that data in product pricing, underwriting and target marketing. In addition, social media can make insurers vulnerable to reputational risks - in real time.

Safeguard customer data from misuse. Although consumers have grown accustomed to providing personal information to third parties, there is still uneasiness over usage, especially when it involves sensitive consumer medical and financial information. Insurance firms, particularly those with a global client base, need to stay abreast of emerging privacy regulations that could affect the use of digital technology and analytics. Crucially, insurers must invest in internal firewalls that protect personal data from misuse.

Assess your exposure to data sovereignty risks. As insurers move toward cloud computing and on-demand solutions, issues surrounding data sovereignty are becoming more complex. In a hyperconnected world - where a U.S. insurer might partner with a Dutch firm using a data service in India - the concept of data residing in one jurisdiction is difficult to apply. To cope, insurers will want to set up processes to monitor changing data regulations around the world and their impact on their businesses.

This piece was written by Doug French and Mike Hughes. For the full white paper, click here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|