At

American Family Ventures, we think advances in product development will have a dramatic impact on the insurance industry. We’re also excited about new insurance experiences that combine “Insurance 2.0” distribution, structural and product innovation. We’ll discuss both subjects below.

Product

Before we dive in, let’s define a few things. We consider an “insurance product” to be the entire financial protection experience. From a

whole product perspective, this definition includes processes inherent in the creation and the use of such products, including methods of underwriting and activities like claims and policy administration.

We’re watching two product trends in particular: behavioral disaggregation and the unbundling of policy time and coverages.

Behavioral Disaggregation

As the world becomes increasingly connected through mobile devices, sensors, networks and information sharing, new context becomes available for managing risk. Dynamic insurance products that react to comprehensive information on behavior will be a direct result of these increases in contextual information.

See Also: Insurance 2.0: How Distribution Evolves

The concept of contextual insurance is not new. In fact, the purpose of insurance underwriting is to segment and accurately price insurance using information about the applicant. Even behavior-based pricing is not a new concept. Since the 1950s, insurers have used access to DMV records to

adjust rates in the event of speeding tickets or other traffic violations. However, the innovation we’re seeking goes a few steps further.

An insurance provider that accurately understands the discrete behaviors influencing the safety of an asset and its users could also offer novel and effective ways to protect both. Behavioral data could be generated through connected devices, more robust asset histories and inventory tracking, collaboration with the owner on risk mitigating activities and the like. Using enhanced access to relevant behavioral information, new products would offer increased customization, accessibility, frictionless coverage acquisition and live reconfiguration. Perhaps someday we’ll see dynamic, multi-factor insurance policies that continuously and automatically adjust to choices the policyholder makes.

Consider the following homeowners insurance example: A homeowner replaces an old fireplace with a new model that has important safety features. Of course, this fireplace is “connected.” As soon as the fireplace cloud tells the homeowner’s insurance carrier the new model is installed and active, the homeowner’s premium payment drops by 10%. Impressed with this outcome, the homeowner tells three of her neighbors about the product, and they promptly replace their own rickety fireplaces. As a result of the newly safe cul-de-sac , rates drop an incremental 3% for all residents in the neighborhood. Soon after, one of the neighbors is shocked to discover that his new model was incorrectly installed, creating a small gas leak that would become dangerous over time. Fortunately, his insurer, in coordination with the manufacturer, flags this issue and repairs the unit before it becomes a hazard. A week later, the three homeowners who originally purchased the product, dining out with their insurance savings, all decide to purchase water-leak-detection systems, for which they are promptly rewarded with an additional insurance discount.

We’re still in the early innings of behavior-based insurance, but, as you can see, its impacts are meaningful. Contextual data doesn’t have all the answers, but it will drive new insights and, perhaps more importantly, prevent losses.

Unbundling Policy Time and Coverages

Existing insurance products bundle coverages. For example, consider that a

standard homeowners policy consists of four types of coverages:

- Coverage for the structure of your home

- Coverage for your personal belongings

- Liability protection

- Additional living expenses if your home is temporarily unlivable

Each of these coverage areas then insures against loss from a number of specific perils (fire, lightning, wind, etc.). Each also has distinct exclusions. These coverages are put together, often in very standard ways, to create homeowner’s insurance.

However, insurers might also unbundle coverages and fragment coverage time periods to create tailored coverage systems that react to the risks present (and absent) in various circumstances. These strategies subdivide coverage profile and duration into more relevant and accurate segments, offering more accurate pricing or supporting new forms of self-insurance.

Fragmenting coverage time can be accomplished with on-demand or transactional insurance. As we all witness large portions of our lives becoming managed services —

transportation, home ownership, fitness — paying to be protected against loss only when specific risks are present or a unique event occurs is an increasingly useful option. This could imply securing insurance only when circumstances or behavior indicate need, or using broad, umbrella-type coverage for losses in everyday activities and ratcheting up coverage for specific types of risk.

For example, imagine an insurance service that uses access to a mobile calendar and other apps to offer timely insurance products based on daily activities. If your morning commute is in a Zipcar (that doesn’t drive itself… yet), you might be offered short-term, simplified personal auto insurance options before you leave. If you instead decide to walk to work that morning, you receive credit toward discounted health and life products. If you’re taking a long flight during inclement weather, you’re prompted with an offer to increase your term life insurance amount. If your job requires you to travel to an unsavory place, your employer is reminded to add

kidnapping and ransom insurance to its existing commercial policy (yes, that exists).

Unbundling coverage can be done with a la carte policies. In using a la carte features, insurers can offer insureds more control over the assumption or transfer of risk and, in turn, greater capacity to segment and self-insure (alone or in groups) specific parts of an asset, incidents or

perils. This allows for the personal assumption of precise risks by excluding them from coverage. This is accomplished today, in part, through the selection of deductible levels, but we think there are ways to push the concept further.

Of note, we believe the inverse of unbundling — “super-bundling”— is also quite powerful. This refers to insurance products that increase the scope of protection until the insured is no longer required to consider insurance at all. In essence, they abstract the idea of insurance from the buyer. Instead, as long as any obligations the customer owes the insurer (payments or data) are fulfilled, everything and anything is covered. Of course, this convenience is likely to carry additional costs.

These contrasting approaches to providing insurance offer distinct benefits. Unbundling offers maximum economic efficiency in exchange for increased engagement and complexity, whereas super-bundling offers maximum simplicity in exchange for decreased control and higher costs.

Additional Considerations and Questions

Balancing the interests of the individual with the interests of society and public policy is a key question surrounding product innovation. For example, assuming unbundling scenarios are economically viable for the individual, how do we ensure the presence of coverage for liability-related incidents and the protection of third parties?

Other questions that need answering as product innovation advances include:

- How will privacy and data sharing be addressed in mutually beneficial and safe ways? Customers will expect value in exchange for sharing information about behavior, so data recipients must create the right incentives and will have to protect personal data vigilantly.

- How does the unbundling of insurance consumption affect the way risk is aggregated and spread across large groups of people?

- Will frequent, accessible and granular self-insurance create adverse selection issues?

- Can unbundled customers effectively select risks to self-insure, or will people fall victim to the ludic fallacy, applying oversimplified statistical models to complex systems?

- And, as with any product, what is the appropriate balance between customization and ease of use?

Combinations

Insurance distribution and structural/product innovation support one another in ways that are both reactive and complex. As a result, they can be used in coordination to create entirely new insurance experiences.

One example we often discuss is the idea of “entire life” insurance. This is not the same as

whole life insurance but rather describes a “super-bundled” risk management product offering the maximum amount of simplicity and flexibility to the insured. In short, entire life insurance would offer a single policy that captures information related to all of your daily needs (transportation, housing, health, travel, etc.) and wraps it into a dynamically priced instrument that indemnifies you against loss from anything bad that might happen. In contrast to the on-demand insurance, usage of entire life insurance is abstracted from the buyer. Instead, the policyholder has a single policy that represents the entire cost to insure that individual based on dynamically adjusted, minute-by-minute protection for all activities.

Such a product, if at all feasible, would require a substantial amount of behavioral data and insight. The makers of this product, at least at first, might also need to discover new approaches to capital raising and risk pooling to offer the product within the bounds of state and federal law. Finally, it stands to reason that a product so deeply integrated with other services and data sources might be sold most effectively via some form of digitally enhanced adviser or life concierge service. Think

Jarvis for financial security.

See Also: P2P Start-Ups From Around the World

We also think that combinations like entire life create barriers to entry. If we revisit the simple Venn diagram from our first post, you can imagine a defensibility gradient, where increasingly challenging activities — from a technical, regulatory or human capital perspective — build on each other to create complex, difficult-to-replicate models and relationships.

Defensibility across three areas of Insurance 2.0

While the gradient diagram above portrays the center as the most difficult to replicate, it’s not hard to imagine the dark portion of the circle shifting based on the source of competition. In other words, it may be that, when comparing tech startups to insurance incumbents, barriers to entry are shifted toward the product, but when considering incumbent defensibility against market share erosion from incidental channels (competing directly with carriers), the gradient shifts towards distribution.

________________________________

In the past few posts, we’ve offered some guesses on what the future holds for insurance. However, given the speed of change and complexity of the systems in play, we've surely missed things and made mistakes. So, instead of making internal forecasts that are precisely wrong, we opted to share our observations with you, in the hopes you can incorporate or transform these ideas into your own.

If you’re working on changing insurance in these or new ways, let us know!

Defensibility across three areas of Insurance 2.0

While the gradient diagram above portrays the center as the most difficult to replicate, it’s not hard to imagine the dark portion of the circle shifting based on the source of competition. In other words, it may be that, when comparing tech startups to insurance incumbents, barriers to entry are shifted toward the product, but when considering incumbent defensibility against market share erosion from incidental channels (competing directly with carriers), the gradient shifts towards distribution.

________________________________

In the past few posts, we’ve offered some guesses on what the future holds for insurance. However, given the speed of change and complexity of the systems in play, we've surely missed things and made mistakes. So, instead of making internal forecasts that are precisely wrong, we opted to share our observations with you, in the hopes you can incorporate or transform these ideas into your own.

If you’re working on changing insurance in these or new ways, let us know!

Defensibility across three areas of Insurance 2.0

While the gradient diagram above portrays the center as the most difficult to replicate, it’s not hard to imagine the dark portion of the circle shifting based on the source of competition. In other words, it may be that, when comparing tech startups to insurance incumbents, barriers to entry are shifted toward the product, but when considering incumbent defensibility against market share erosion from incidental channels (competing directly with carriers), the gradient shifts towards distribution.

________________________________

In the past few posts, we’ve offered some guesses on what the future holds for insurance. However, given the speed of change and complexity of the systems in play, we've surely missed things and made mistakes. So, instead of making internal forecasts that are precisely wrong, we opted to share our observations with you, in the hopes you can incorporate or transform these ideas into your own.

If you’re working on changing insurance in these or new ways, let us know!

The first wave is based on a distribution model where "friends and family" risk pools self-insured each other's deductibles to lower premiums.

Then we saw the carrier model, wave 2. Here, the pools are the primary bearers of risk, and they share in any retained premiums not paid out in claims.

Wave 3 is the self-governing model, A back-to-the-future model that takes us further toward a mutual insurance than we’ve seen to-date.

To find out more, I Skyped with

The first wave is based on a distribution model where "friends and family" risk pools self-insured each other's deductibles to lower premiums.

Then we saw the carrier model, wave 2. Here, the pools are the primary bearers of risk, and they share in any retained premiums not paid out in claims.

Wave 3 is the self-governing model, A back-to-the-future model that takes us further toward a mutual insurance than we’ve seen to-date.

To find out more, I Skyped with

What are some of the most significant non-Medicare covered expenses?

What are some of the most significant non-Medicare covered expenses?

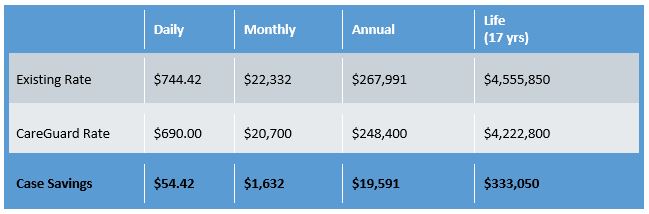

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day less than the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case.

In this case, CareGuard was able to negotiate a rate with the facility that was about $54 a day less than the carrier had been paying. This reduced rate over 17 years generated a significant savings that allowed the carrier and claimant to find a middle ground and to settle the case. Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1% and 2% over the past five years, that nursing facility costs have risen approximately 4% per year and that, in the last year alone, rates for adult day care rose almost 6% nationwide. There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away any time soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator help get everyone on the same page so claimants can feel confident that they’ve made an informed choice when they settle their case.

Non-Medicare covered expenses will continue to become more significant components of settlements. Reports indicate that home health attendant costs have risen between 1% and 2% over the past five years, that nursing facility costs have risen approximately 4% per year and that, in the last year alone, rates for adult day care rose almost 6% nationwide. There is also enormous price inflation and variance in the cost of the prescriptions. These challenges are not going away any time soon. As the parties to a settlement try to come to a resolution, knowing and using real-world pricing through a platform such as CareGuard can help bridge the gap.

Don’t let the discrepancy in estimates of non-Medicare costs become a huge sticking point in your negotiations. Instead, introduce visibility into the cost and let a professional administrator help get everyone on the same page so claimants can feel confident that they’ve made an informed choice when they settle their case.