IT Security: A Major Threat for Insurers

IT security is still a low priority for CIOs and mid-level managers. Less than 10% of an insurer’s IT budget is typically focused on security.

IT security is still a low priority for CIOs and mid-level managers. Less than 10% of an insurer’s IT budget is typically focused on security.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mitch Wein is senior vice president of research and consulting at Novarica with international expertise in IT leadership and transformation as well as technology strategy for life, annuities, health, personal lines, commercial lines, wealth management and banking.

Consider that a claims adjuster could directly tune in via VR for a detailed view of property damage, via a gig worker who is on-site.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Robin Roberson is the managing director of North America for Claim Central, a pioneer in claims fulfillment technology with an open two-sided ecosystem. As previous CEO and co-founder of WeGoLook, she grew the business to over 45,000 global independent contractors.

Companies must increasingly rely on technology to achieve more with less — so one type of manager is dangerous.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Ernie Bray, chairman and CEO of ACD, has more than 20 years of experience in the insurance and automobile claims industry. Bray is a dynamic force in driving innovation and technology to transform the auto claims industry and connect a highly fragmented business sector.

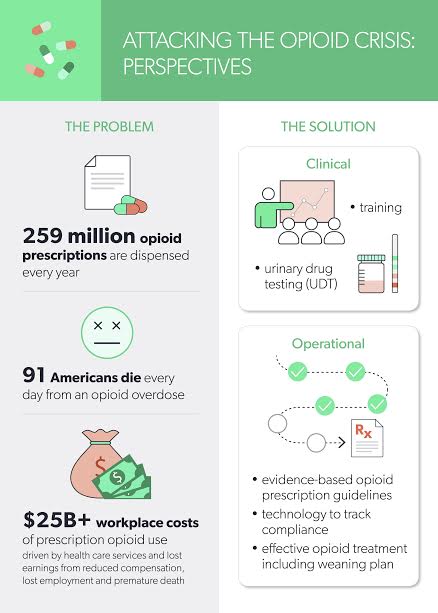

A medical director at an insurance carrier said, “When I see the second opioid prescription come through the system, I [prep] for detox.”

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Laura B. Gardner is chief scientist and vice president, products, CLARA analytics. She is an expert in analyzing U.S. health and workers’ compensation data with a focus on predictive modeling, outcomes assessment, design of triage and provider evaluation software applications, program evaluation and health policy research.

Digital MGAs are appearing, but stalwart MGAs have an amazing opportunity to reinvent themselves once again in the digital world.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Pauli is a former principal at SMA. She has comprehensive knowledge about how technology can drive improved results, innovation and transformation. She has worked with insurers and technology providers to reimagine processes and procedures to change business outcomes and support evolving business models.

How do we create the wanting without having to sell insurance? What if we create a competition that rewards good behavior?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Shahzadi Jehangir is an innovation leader and expert in building trust and value in the digital age, creating scalable new businesses generating millions of dollars in revenue each year, with more than $10 million last year alone.

Carriers must not blame young professionals for their lack of interest in insurance and instead work on raising awareness.

The Insurance Careers Movement began as a grassroots, industry-wide initiative to combat the coming talent shortage and the ill-fated perception of the industry. We endeavor to empower young professionals who already work in insurance to share their feedback and experiences, educating their peers and students about the vast career opportunities available to them. As a part of the annual Insurance Careers Month each February, we conducted interviews with more than 30 millennials from a wide range of insurance carriers and agencies about their thoughts on the industry.

Contrary to the general perception outsiders have of insurance, findings from the interviews revealed that many younger workers view insurance as a dynamic field with significant opportunities for growth and development of personal relationships with customers and coworkers. In fact, their responses largely resemble the theme of the movement, referring to insurance as, “the career trifecta,” to emphasize the idea that pursuing a profession in insurance is stable, rewarding and limitless.

Here are the three recurring themes mentioned across all the interviews:

1.It’s Stable

In many of the interviews, one of the distinct benefits of working in insurance is the extensive career options, and the flexibility to try different sections of companies. A recent graduate can begin with underwriting, then branch into marketing, risk management or any other career path she wishes to pursue.

See also: 10 Commandments for Young Professionals

The insurance industry holds a long, rich history and is in nearly every part of the world. Therefore, there is a vast number of opportunities available in many areas of the field, adding to the stability factor. Ashley Jenkins, controller at Pioneer State Mutual Insurance, said, “Insurance companies are very stable compared with many other industries. As an example, my current insurance employer and prior insurance employer did not have to lay off any employees during the major financial crises in 2008 and 2011.” Additionally, according to the National Insurance Brokers Association, the median salaries in insurance are all well above the national average at around $30,000 a year. With more than 75,000 jobs opening up due to retirement, members of younger generations are being afforded regular growth opportunities, promoting a stable career path that doesn’t exist in many fields; today’s young employee tends to change jobs four times before they’re age 32.

2.It’s Rewarding

Although many jobs require employees to sit in cubicles, a career in insurance allows people to interact and cultivate relationships with other customers and coworkers. Koory Esquibel, TRAC risk analyst at Marsh, said, “One of my favorite parts about this industry, and the reason why it is so easy to recommend to students and new graduates, is the ability to form so many strong relationships with colleagues and business partners.” This is a pivotal time in insurance where improved employee and customer interaction is happening at all points of the workflow. Between mobile technologies to better interact with customers and analytics to improve speeds of underwriting and claims processes, the industry has never prioritized innovation so aggressively.

According to the survey conducted as a part of the Insurance Careers Movement, more than 92% of millennials working in insurance said that they are proud to work within the industry and want to promote the benefits and opportunities it provides. Their answers also revealed that millennials are already putting efforts into recruiting their peers, as 73% of respondents said that they have tried to convince at least one of their friends to choose a career in the risk management and insurance industry.

3.It’s Limitless

With the wave of digital innovation looming and new regulations and product offerings being created daily, the insurance industry is more dynamic than ever before. Employees at all levels, regardless of their areas of focus, are challenged to come up with creative solutions to tackle emerging problems. Yasmin Ahmed at Marsh said that she was “drawn to work in insurance because of the career mobility and succession planning. Seasoned insurance professionals plan to retire within the next five years, providing more career advancement for young people.”

In fact, according to the Jacobson Group and Ward Group Insurance Labor Outlook Study, the insurance industry has added 100,000 new jobs in the past five years, and 66% of insurers expect to increase staff this year. The number of opportunities and intellectual challenge are perfect for millennials as, according to the My Path survey, new graduates are more interested in career advancement possibilities (25%) and learning opportunities (20%) when considering a job than older generations. Therefore, young professionals consider development within their careers more important than salary or benefits.

While the industry remained largely stagnant for years, the technological disruption is closing the experience gap and opening important roles for those interested in data science careers combined with creativity. In fact, Accenture’s fintech report found that investments in insurtech more than tripled from $800 million in 2014 to more than $2.6 billion in 2015. In addition to the heavy focus and investments in IT, startups like Lemonade are joining the industry with new technology-based business models. The entrance of startups has already brought recent changes as it motivated insurance giants to expand their focus. Some of the world’s largest insurers, such as Aviva, Axa and XL Catlin, announced their efforts to establish in-house venture capital funds and stated that they will be dedicating more than $1 billion investments in startups to spearhead digital transformation. This focus on new technology also creates more opportunities for the younger generation, as they can make contributions to their team regardless of the job titles.

See also: Can We Disrupt Ourselves?

Most say that millennials are known for job-hopping. However, according to a recent Census study, once they’re satisfied, most will stay at the place of employment for three to six years. The bottom line is that carriers must not blame the generation for their lack of interest in insurance and instead work on raising awareness about the value the industry offers. Right now, a lack of talent is one of the biggest challenges for innovation growth. Insurers will have to make concerted efforts to follow through the recruitment process and provide robust training program to attract and retain young professionals. Through recognizing the underlying cause of the crisis and making an industry-wide endeavor, the insurance industry will be able to grow as a whole and successfully combat the talent shortage.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kirstin Marr is the executive vice president of data solutions at Insurity, a leading provider of cloud-based solutions and data analytics for the world’s largest insurers, brokers and MGAs.

Here are four ways to make sure you don't fall into common traps and make hasty decisions based on bad data.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Johansen is a senior vice president at Majesco. He leads the company's data strategy and business intelligence consulting practice areas. Johansen consults to the insurance industry on the effective use of advanced analytics, data warehousing, business intelligence and strategic application architectures.

An opportunity is upon us to cut Social Security Disability Insurance costs while helping workers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

David Stapleton is the director of Mathematica’s Center for Studying Disability Policy. He also directs Mathematica’s Disability Research Consortium cooperative agreement with SSA.

It doesn't have to end that way. Traditional insurers are already positioned well -- if they play their cards right.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Robin Roberson is the managing director of North America for Claim Central, a pioneer in claims fulfillment technology with an open two-sided ecosystem. As previous CEO and co-founder of WeGoLook, she grew the business to over 45,000 global independent contractors.