1. Solve Real Problems

Successful pull platforms solve real problems in an unconventional way. Not just frictions, but the real problem; the problem behind the financial need. Using technology, they enable their customers to be more in control, to learn and be better informed, to make better and faster decisions and to get better service, geared to their need.

Nike+

Each time I go running, I activate the Nike+ running app. It registers distance, speed and routes, I can track my progress over time, connect with friends to keep each other going or compete and when I’m traveling. It helps me to find popular routes in cities abroad.

Nike+ is changing the conversation with its customers on all levels: business model, brand, proposition and customer experience. Nike's proposition now is no longer about shoes that may or may not have shock-absorbing soles. It's also about a range of new services that key in on real underlying needs: making athletes enjoy their sport even more. While, obviously, Nike could easily use all the information to determine exactly when you need a new pair of running shoes, Nike is becoming a company that isn't just focused on products and sales, but also on creating services and building relationships.

Alipay

"Solving the real problem" is less trivial than it may sound. Let’s take Alipay, the successful payment system of Alibaba, used by millions of shop owners and other merchants throughout China (and beyond). Sabrina Peng, president, Alipay International, shared with us: “Alipay isn't just about payments; it's about customer relationships. The whole idea is to bring more value to the merchants and to the users. Payment is nothing more than just a part of the purchase cycle. Merchants don't want a new payment system. They want more customers." This insight is Alipay’s starting point to assist retailers in connecting with Alipay users in all sorts of ways. Merchants can use Alipay to market their services, including special offers, coupons or vouchers. Alipay users can see all the merchants nearby, see pictures, use unique discount codes and post reviews - resulting in more traffic, customers and revenue for merchants. The payment system plays a key role in the model but resides in the background.

Alipay shows that it is essential to really understand the context to provide real added value and to play an active role in the ecosystem of that context. People are not interested in a mortgage, but in a house. The context of a nice house and easy living offers more opportunities to add value to customers than just the mortgage, or the home insurance, and more opportunities for new revenue streams.

1. Solve Real Problems

Successful pull platforms solve real problems in an unconventional way. Not just frictions, but the real problem; the problem behind the financial need. Using technology, they enable their customers to be more in control, to learn and be better informed, to make better and faster decisions and to get better service, geared to their need.

Nike+

Each time I go running, I activate the Nike+ running app. It registers distance, speed and routes, I can track my progress over time, connect with friends to keep each other going or compete and when I’m traveling. It helps me to find popular routes in cities abroad.

Nike+ is changing the conversation with its customers on all levels: business model, brand, proposition and customer experience. Nike's proposition now is no longer about shoes that may or may not have shock-absorbing soles. It's also about a range of new services that key in on real underlying needs: making athletes enjoy their sport even more. While, obviously, Nike could easily use all the information to determine exactly when you need a new pair of running shoes, Nike is becoming a company that isn't just focused on products and sales, but also on creating services and building relationships.

Alipay

"Solving the real problem" is less trivial than it may sound. Let’s take Alipay, the successful payment system of Alibaba, used by millions of shop owners and other merchants throughout China (and beyond). Sabrina Peng, president, Alipay International, shared with us: “Alipay isn't just about payments; it's about customer relationships. The whole idea is to bring more value to the merchants and to the users. Payment is nothing more than just a part of the purchase cycle. Merchants don't want a new payment system. They want more customers." This insight is Alipay’s starting point to assist retailers in connecting with Alipay users in all sorts of ways. Merchants can use Alipay to market their services, including special offers, coupons or vouchers. Alipay users can see all the merchants nearby, see pictures, use unique discount codes and post reviews - resulting in more traffic, customers and revenue for merchants. The payment system plays a key role in the model but resides in the background.

Alipay shows that it is essential to really understand the context to provide real added value and to play an active role in the ecosystem of that context. People are not interested in a mortgage, but in a house. The context of a nice house and easy living offers more opportunities to add value to customers than just the mortgage, or the home insurance, and more opportunities for new revenue streams.

2. Leverage content, tools and connections

Pull platforms have a large added value when there is an imperfect, fragmented market, with lots of suppliers, many products that are difficult to compare, products that are distributed sub-optimally, a lot of detailed information on various locations, many who are interested in that information or products and asymmetry in information. That also explains the popularity of comparison sites for financial services and the large role given to search engines by consumers in the path to purchase. Successful pull initiatives put a specific set of content, tools and connections at the user's disposal.

See also: 3 Keys to Selecting the Right Platform

Danone’s BLX

Danone developed a pull platform that supports mothers in all kinds of ways, from “becoming pregnant” to their child's first five years, the “early nutrition” stage. Tom de Waard, global digital experience director at Danone Nutricia Early Life Nutrition: “The BLX platform supports mothers in all kinds of ways, from 'becoming pregnant' to their child's first 1,000 days, the 'early life nutrition' stage that lays the foundation for future health. It includes being present in online places, owned, earned and paid, where mothers gather information and discuss matters with each other, a branded mobile app helping mothers 24/7 with relevant information and services. All these various data sources are used to provide tailor-made services to every parent with the right content, services and tools, and personal advice and offerings – precisely in sync with, for example, the exact age and health situation of the child. Months in advance of the birth, we are in frequent contact with the parents. That provides all kinds of possibilities to establish a connection. The result is that, from the birth on, our products are a natural given. The results of the platform are exceeding expectations by far on ‘brand of first choice’, NPS and the rate of interaction with the brand.”

3. Build Communities

A vast number of pull initiatives we looked at fulfill a community function or make use of it. Many offer consumers the opportunity to play an active role or to share all kinds of content. This way, they lend the authority of credible consumers. Think of the community that Danone is building. Connecting peers ensures that all involved gain value from the interactions. More users result in more interactions, which in turn results in more value. Creating such an upward spiral is the real challenge.

eToro

The vast majority of private bankers and investment advisers we know are performing worse than the market. That is a serious imperfection. At social investment network eToro, private investors can compare their portfolio with that of others. It is sort of the Facebook of private investors. You can see who has performed well for years in a row. eToro lets you invest along with the most successful investors. Your portfolio proportionally copies the trades of the Popular Investor of your choosing. When he buys, you buy. When he sells, you sell.

Yoni Assia, CEO of eToro, says, “64% of all trades via eToro are copy trades. Being followed and copied can be a lucrative business for our most popular traders. Our ‘Popular Investor Program’ allows traders to earn up to 2% of the assets they are passively managing.” eToro is one of the best examples we know of new conversations in financial services. Transparent information exchange is at the core of the business model. Trust in peers is leveraged and creates huge value for eToro members and eToro alike. eToro has more than 5 million registered users.

2. Leverage content, tools and connections

Pull platforms have a large added value when there is an imperfect, fragmented market, with lots of suppliers, many products that are difficult to compare, products that are distributed sub-optimally, a lot of detailed information on various locations, many who are interested in that information or products and asymmetry in information. That also explains the popularity of comparison sites for financial services and the large role given to search engines by consumers in the path to purchase. Successful pull initiatives put a specific set of content, tools and connections at the user's disposal.

See also: 3 Keys to Selecting the Right Platform

Danone’s BLX

Danone developed a pull platform that supports mothers in all kinds of ways, from “becoming pregnant” to their child's first five years, the “early nutrition” stage. Tom de Waard, global digital experience director at Danone Nutricia Early Life Nutrition: “The BLX platform supports mothers in all kinds of ways, from 'becoming pregnant' to their child's first 1,000 days, the 'early life nutrition' stage that lays the foundation for future health. It includes being present in online places, owned, earned and paid, where mothers gather information and discuss matters with each other, a branded mobile app helping mothers 24/7 with relevant information and services. All these various data sources are used to provide tailor-made services to every parent with the right content, services and tools, and personal advice and offerings – precisely in sync with, for example, the exact age and health situation of the child. Months in advance of the birth, we are in frequent contact with the parents. That provides all kinds of possibilities to establish a connection. The result is that, from the birth on, our products are a natural given. The results of the platform are exceeding expectations by far on ‘brand of first choice’, NPS and the rate of interaction with the brand.”

3. Build Communities

A vast number of pull initiatives we looked at fulfill a community function or make use of it. Many offer consumers the opportunity to play an active role or to share all kinds of content. This way, they lend the authority of credible consumers. Think of the community that Danone is building. Connecting peers ensures that all involved gain value from the interactions. More users result in more interactions, which in turn results in more value. Creating such an upward spiral is the real challenge.

eToro

The vast majority of private bankers and investment advisers we know are performing worse than the market. That is a serious imperfection. At social investment network eToro, private investors can compare their portfolio with that of others. It is sort of the Facebook of private investors. You can see who has performed well for years in a row. eToro lets you invest along with the most successful investors. Your portfolio proportionally copies the trades of the Popular Investor of your choosing. When he buys, you buy. When he sells, you sell.

Yoni Assia, CEO of eToro, says, “64% of all trades via eToro are copy trades. Being followed and copied can be a lucrative business for our most popular traders. Our ‘Popular Investor Program’ allows traders to earn up to 2% of the assets they are passively managing.” eToro is one of the best examples we know of new conversations in financial services. Transparent information exchange is at the core of the business model. Trust in peers is leveraged and creates huge value for eToro members and eToro alike. eToro has more than 5 million registered users.

4. Think Beyond Customers

Users of Danone’s BLX platform don’t have to be a customer to have access to all the tools and services. That means it also attracts interested potential consumers who otherwise wouldn't even show up on the radar. Financial institutions primarily think about services they can offer when someone already has been taken on as a customer. Most of the time, the number of non-customers is significantly larger. Why wouldn't you develop services for this much larger target group? Other financial institutions foster this route, too.

Rabobank's Hypotheekdossier

Rabobank's Hypotheekdossier, “mortgage file,” allows consumers, whether they are a customer or not, to do the math when they are looking for a new house or refinancing their mortgage. Because the information and tools are better than elsewhere, the platform has a large appeal and is an excellent lead generator.

Another example is Personal Capital, an American wealth manager that provides all kinds of tools to non-customers, letting them experience some of Personal Capital's expertise.

4. Think Beyond Customers

Users of Danone’s BLX platform don’t have to be a customer to have access to all the tools and services. That means it also attracts interested potential consumers who otherwise wouldn't even show up on the radar. Financial institutions primarily think about services they can offer when someone already has been taken on as a customer. Most of the time, the number of non-customers is significantly larger. Why wouldn't you develop services for this much larger target group? Other financial institutions foster this route, too.

Rabobank's Hypotheekdossier

Rabobank's Hypotheekdossier, “mortgage file,” allows consumers, whether they are a customer or not, to do the math when they are looking for a new house or refinancing their mortgage. Because the information and tools are better than elsewhere, the platform has a large appeal and is an excellent lead generator.

Another example is Personal Capital, an American wealth manager that provides all kinds of tools to non-customers, letting them experience some of Personal Capital's expertise.In essence, these companies are using pull platforms to move upstream. They are building the brand in an active manner, among the target audience, branding by doing. On top of that, they get direct access to tomorrow's customers, while being much less dependent on search engines and comparison sites.

5. Look Beyond Data

In all the pull platforms we have discussed so far, the use of data plays a pivotal role. Pull initiatives offer the possibility to gather much deeper consumer insights about what is going on in the consumer's life around a particular life event or product. It is an important side effect of pull initiatives. They provide customer insights that can be translated into better products, or even real-time services.

Unilever’s All Things Hair

Unilever is the third-largest player in the global hair care market, but struggles to achieve growth. Consumers are tired of hair category clichés in advertising and go online in search of answers and inspiration. According to Google, there are around one billion (!) searches related to hair each month – from how to take care of split ends, to how to style your hair for a wedding. Half of all online beauty shoppers watch a related video on YouTube while looking for products to buy. But only 3% go to videos by beauty brands; vloggers control the other 97%. Facing these challenges, Unilever decided to launch All Things Hair, a YouTube channel where consumers can browse the latest trends, tips and treatments. What makes All Things Hair special is that it leverages partnerships with Google and a team of leading vloggers, many of whom have several million followers in their own right. Google's data-mining capabilities allow Unilever to gain real-time insight in what people are looking for with regard to hair, such as insights in growing search terms and trending topics such as celeb's hair or holiday seasons. It even helps Unilever to predict hair trends as much as three months in advance. These insights are used to brief a team of beauty vloggers, who are paid by Unilever to create bespoke tutorials. This content features relevant products from Unilever brands, such as Toni & Guy, Dove and VO5. All Things Hair became the No. 1 one hair care channel in just 10 weeks, with 50 million views in the first year - wedged between Rihanna and Nicki Minaj in YouTube's engagement ranking.

6. Foster beyond the traditional vertical

Successful pull platforms dare to take on other roles. Danone is shifting from purely product to offering a broad array of services, as well. Alipay is choosing to have a different role in the value chain than the traditional role of a payment solutions provider; the company actively supports retailers to increase their revenues. If you want to solve the actual problems that customers face, then often there is more required than delivering a financial product. Successful pull initiatives dare to take on other roles. That not only fulfills the needs of customers better but also helps to open up new revenue streams.

TDC’s Get

The Get platform of Danish telco TDC comprises 12 services, from online newspapers and magazines, to pay-TV and Bet25.dk, online betting (35% of all Danes watch soccer via TDC). This way, TDC is developing its business model from subscriptions to a content play.

Ping An

China's leading personal financial service provider Ping An adopted the strategy of the synergistic development of traditional and non-traditional businesses by creating all sorts of portals in non-traditional domains such as home, health NS car, but also food and entertainment. All these platforms have large numbers of users and interactions, and advanced data mining and precision marketing capabilities. Each and every one of them are new business lines that create new value for themselves, as well as for Ping An. Only when relevant and timely are Ping An's traditional banking and insurance activities brought into contact with customers. The new business lines are not only increasing their own value; by moving upstream, they are increasing relevancy and enlarging the total customer base, and by allowing new synergies they also increase the value of the entire ecosystem of Ping An enterprises.

5. Look Beyond Data

In all the pull platforms we have discussed so far, the use of data plays a pivotal role. Pull initiatives offer the possibility to gather much deeper consumer insights about what is going on in the consumer's life around a particular life event or product. It is an important side effect of pull initiatives. They provide customer insights that can be translated into better products, or even real-time services.

Unilever’s All Things Hair

Unilever is the third-largest player in the global hair care market, but struggles to achieve growth. Consumers are tired of hair category clichés in advertising and go online in search of answers and inspiration. According to Google, there are around one billion (!) searches related to hair each month – from how to take care of split ends, to how to style your hair for a wedding. Half of all online beauty shoppers watch a related video on YouTube while looking for products to buy. But only 3% go to videos by beauty brands; vloggers control the other 97%. Facing these challenges, Unilever decided to launch All Things Hair, a YouTube channel where consumers can browse the latest trends, tips and treatments. What makes All Things Hair special is that it leverages partnerships with Google and a team of leading vloggers, many of whom have several million followers in their own right. Google's data-mining capabilities allow Unilever to gain real-time insight in what people are looking for with regard to hair, such as insights in growing search terms and trending topics such as celeb's hair or holiday seasons. It even helps Unilever to predict hair trends as much as three months in advance. These insights are used to brief a team of beauty vloggers, who are paid by Unilever to create bespoke tutorials. This content features relevant products from Unilever brands, such as Toni & Guy, Dove and VO5. All Things Hair became the No. 1 one hair care channel in just 10 weeks, with 50 million views in the first year - wedged between Rihanna and Nicki Minaj in YouTube's engagement ranking.

6. Foster beyond the traditional vertical

Successful pull platforms dare to take on other roles. Danone is shifting from purely product to offering a broad array of services, as well. Alipay is choosing to have a different role in the value chain than the traditional role of a payment solutions provider; the company actively supports retailers to increase their revenues. If you want to solve the actual problems that customers face, then often there is more required than delivering a financial product. Successful pull initiatives dare to take on other roles. That not only fulfills the needs of customers better but also helps to open up new revenue streams.

TDC’s Get

The Get platform of Danish telco TDC comprises 12 services, from online newspapers and magazines, to pay-TV and Bet25.dk, online betting (35% of all Danes watch soccer via TDC). This way, TDC is developing its business model from subscriptions to a content play.

Ping An

China's leading personal financial service provider Ping An adopted the strategy of the synergistic development of traditional and non-traditional businesses by creating all sorts of portals in non-traditional domains such as home, health NS car, but also food and entertainment. All these platforms have large numbers of users and interactions, and advanced data mining and precision marketing capabilities. Each and every one of them are new business lines that create new value for themselves, as well as for Ping An. Only when relevant and timely are Ping An's traditional banking and insurance activities brought into contact with customers. The new business lines are not only increasing their own value; by moving upstream, they are increasing relevancy and enlarging the total customer base, and by allowing new synergies they also increase the value of the entire ecosystem of Ping An enterprises.

DIA Amsterdam 2018 will take place on May 16th and 17th in the awesome Westergasfabriek venue, close to the vibrant city center.

7. Use network effects

Google finances online advertising purchases by merchants. Obviously, Google has a fair idea of the track record of the merchant, in terms of marketplace success – traffic, sales figures, customer reviews and satisfaction scores – as well as financial reliability and debtor risk. Amazon follows the same strategy as Google, providing loans to independent sellers on the Amazon platform. Everybody is expecting Apple to eventually use the vast pool of iTunes users, including their credit card data, for financial services.

Stored value

Both Google and Amazon can kick start such activities based on the millions of merchants they are already in contact with. That is their strength: they are capable of generating so-called network effects. Along the way, they have accumulated all kinds of assets; so-called stored value. Traffic figures, customer reviews and satisfaction scores are examples of such stored value. These accumulated assets are deployed later to develop new revenue streams with, if necessary, other business models. With every new service, the companies strengthen their position. Network effects can also be created by freeriding on the activity of established allied platforms. PayPal, for instance, grew on top of eBay.

There is currently much debate and speculation about how Amazon will enter the insurance market. Many fear that the company will launch a full-stack insurer, more or less similar to the ones we know. Looking at how Amazon leverages stored value to offer loans to merchants, it may in fact follow a totally different strategy. It may be interesting to look at all the stored value the company has and then think of what totally new insurance concepts would leverage this stored value to the max.

8. Create unconventional value

When financial institutions use pull initiatives to take on a different role in the value chain, we see that they not only strengthen their current business – for example by brand building or lead generation – but they also explore new revenue streams and business models. Ping An and TDC Get are explicitly doing so with various platforms.

See also: Insurtech: Where’s the Beef?

PostFinance Card-Linked Offers

PostFinance (Switzerland) is partnering with Strands to provide transaction-driven marketing. The integration with Card-Linked Offers (CLO) enables the bank’s systems to analyze customer transactions, make contextual offers, recommend marketing strategies to merchants and continuously learn from customers' responses. For example, businesses can reward loyal customers, gain competitors’ share of clients or re-activate customers that haven’t made a purchase for a while. Eligible customers receive the coupon on their mobile from the bank with a discount, which they accept or reject. The discount is redeemed automatically in the customer’s account; he just has to make the payment with the bank’s card. PostFinance charges a percentage of the revenue generated by the coupons, for instance 5%. So if a customer spends 3,000 CHF a year using the coupons, the bank gets 150 CHF in revenue from this customer. PostFinance has full control of the CLO platform, including multiple pricing options and monitoring capabilities.

DIA Amsterdam 2018 will take place on May 16th and 17th in the awesome Westergasfabriek venue, close to the vibrant city center.

7. Use network effects

Google finances online advertising purchases by merchants. Obviously, Google has a fair idea of the track record of the merchant, in terms of marketplace success – traffic, sales figures, customer reviews and satisfaction scores – as well as financial reliability and debtor risk. Amazon follows the same strategy as Google, providing loans to independent sellers on the Amazon platform. Everybody is expecting Apple to eventually use the vast pool of iTunes users, including their credit card data, for financial services.

Stored value

Both Google and Amazon can kick start such activities based on the millions of merchants they are already in contact with. That is their strength: they are capable of generating so-called network effects. Along the way, they have accumulated all kinds of assets; so-called stored value. Traffic figures, customer reviews and satisfaction scores are examples of such stored value. These accumulated assets are deployed later to develop new revenue streams with, if necessary, other business models. With every new service, the companies strengthen their position. Network effects can also be created by freeriding on the activity of established allied platforms. PayPal, for instance, grew on top of eBay.

There is currently much debate and speculation about how Amazon will enter the insurance market. Many fear that the company will launch a full-stack insurer, more or less similar to the ones we know. Looking at how Amazon leverages stored value to offer loans to merchants, it may in fact follow a totally different strategy. It may be interesting to look at all the stored value the company has and then think of what totally new insurance concepts would leverage this stored value to the max.

8. Create unconventional value

When financial institutions use pull initiatives to take on a different role in the value chain, we see that they not only strengthen their current business – for example by brand building or lead generation – but they also explore new revenue streams and business models. Ping An and TDC Get are explicitly doing so with various platforms.

See also: Insurtech: Where’s the Beef?

PostFinance Card-Linked Offers

PostFinance (Switzerland) is partnering with Strands to provide transaction-driven marketing. The integration with Card-Linked Offers (CLO) enables the bank’s systems to analyze customer transactions, make contextual offers, recommend marketing strategies to merchants and continuously learn from customers' responses. For example, businesses can reward loyal customers, gain competitors’ share of clients or re-activate customers that haven’t made a purchase for a while. Eligible customers receive the coupon on their mobile from the bank with a discount, which they accept or reject. The discount is redeemed automatically in the customer’s account; he just has to make the payment with the bank’s card. PostFinance charges a percentage of the revenue generated by the coupons, for instance 5%. So if a customer spends 3,000 CHF a year using the coupons, the bank gets 150 CHF in revenue from this customer. PostFinance has full control of the CLO platform, including multiple pricing options and monitoring capabilities.

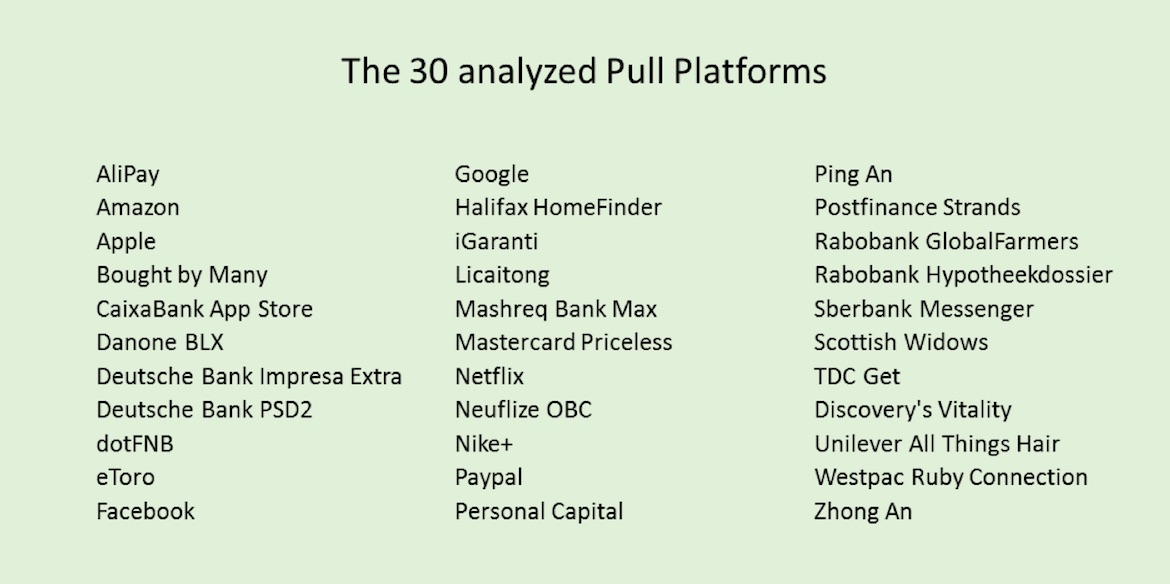

Pull platforms are digital flagships

After mobile, social, and connected devices, pull platforms are offering a new interface with customers. Eduard de Wilde (director digital VODW) calls them examples of digital flagships, no less -- comparable to the flagship stores of renowned retail chains at the best locations in the most important cities to show their brand and what it offers in full depth. The best practices that we included show that pull platforms can take so many different shapes. Some seem to be detached from the systems; others seem fully integrated. Some of them are using a specific medium; others use different media simultaneously, seamlessly matched to each other. But they also have a single point of departure in common. Real problem solving requires that financial institutions need to speak to their customers at the moments when customers need them most. Consequently, pull platforms need to be designed around the customer journey and building the two-way relationship, to enhance top-of-mind position, brand loyalty and advocacy.

The focus on problem solving also means it is about selling without selling. Self-serving content is out. The shift from push to pull is not just about shifting budget to pull platforms. How you reach customers is not the only thing that is important. It is what you do for them that counts even more. Consequently, brands need to adjust, from “how can we make sure people will buy more from us” to “how can we do more for them?” That is the way brands are built, and the way to become less dependent on search engines and comparison sites and escape the commodity trap.

If you would like to read more about pull platforms, check our book "Reinventing Customer Engagement. The next level of digital transformation for banks and insurers," in English or in German

Obviously, we will ample attention to platforms at DIA Amsterdam, May 16 and 17.

Pull platforms are digital flagships

After mobile, social, and connected devices, pull platforms are offering a new interface with customers. Eduard de Wilde (director digital VODW) calls them examples of digital flagships, no less -- comparable to the flagship stores of renowned retail chains at the best locations in the most important cities to show their brand and what it offers in full depth. The best practices that we included show that pull platforms can take so many different shapes. Some seem to be detached from the systems; others seem fully integrated. Some of them are using a specific medium; others use different media simultaneously, seamlessly matched to each other. But they also have a single point of departure in common. Real problem solving requires that financial institutions need to speak to their customers at the moments when customers need them most. Consequently, pull platforms need to be designed around the customer journey and building the two-way relationship, to enhance top-of-mind position, brand loyalty and advocacy.

The focus on problem solving also means it is about selling without selling. Self-serving content is out. The shift from push to pull is not just about shifting budget to pull platforms. How you reach customers is not the only thing that is important. It is what you do for them that counts even more. Consequently, brands need to adjust, from “how can we make sure people will buy more from us” to “how can we do more for them?” That is the way brands are built, and the way to become less dependent on search engines and comparison sites and escape the commodity trap.

If you would like to read more about pull platforms, check our book "Reinventing Customer Engagement. The next level of digital transformation for banks and insurers," in English or in German

Obviously, we will ample attention to platforms at DIA Amsterdam, May 16 and 17.