Interview with Nick Gerhart (Part 3)

The former Iowa insurance commissioner discusses the best practices of insurers in compliance reporting, as well as future trends.

The former Iowa insurance commissioner discusses the best practices of insurers in compliance reporting, as well as future trends.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Burch LaPrade is the CEO of Gain Compliance. Gain Compliance leverages a semantic modeling approach to solve the hard problems of data meaning and consistency across the enterprise.

We don't often look for headlines about ourselves, but we hope this partnership will turn out to be the most important thing we've done since our founding.

While we often emphasize that we're about thought leadership, not news, this week I'll focus on two items in the news.

The first is about an investment in and partnership involving...ITL. We don't often look for headlines about ourselves, but we hope this partnership will turn out to be the most important thing we've done since our founding.

We are announcing today that The Institutes have made an investment in ITL as part of a strategic relationship. I trust you're all familiar with The Institutes' continuing education courses and their offerings of professional designations, including the CPCU. I hope you also know about their RiskBlock consortium, which is leading the way for the industry on developing blockchain applications in insurance. If not, you should—assuming you would benefit from blockchain in your future.

We will help The Institutes broaden the creation and distribution of thought leadership on innovation and technology, supporting the industry's transformation goals. At the same time, they will help us spread our wings among their members, both in terms of ITL and in terms of our Innovator's Edge platform for tracking insurtechs and our Innovator's Studio strategy coaching services.

As you might imagine, we're in the very early days of coordinating the new relationship, but there will be plenty more to say both from our vantage point and theirs in the coming weeks and months. Stay tuned.

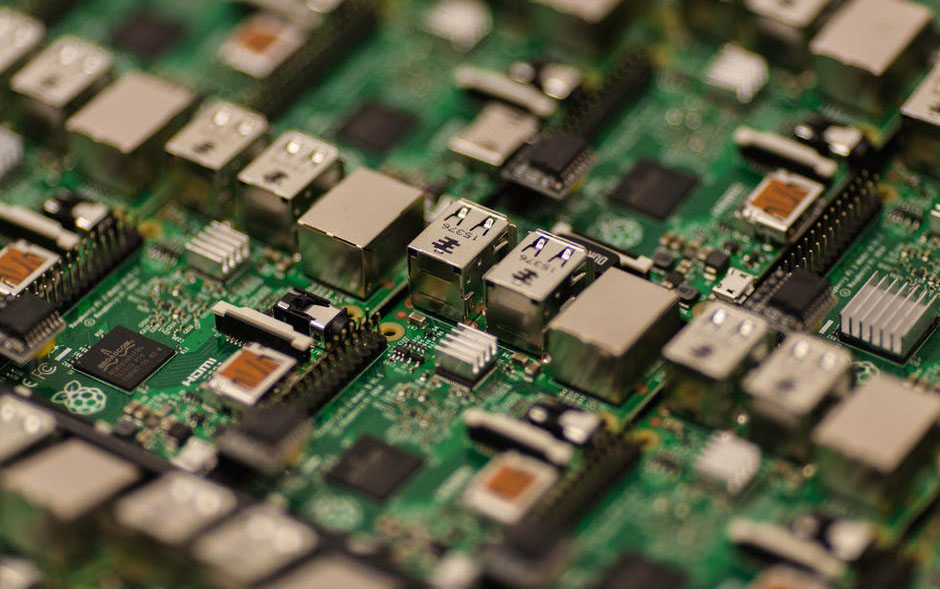

Second news item is the story about Spectre, Meltdown and the flaw in Intel microprocessors that opens up a whole new attack vector that the bad guys can use to get to information they shouldn't have. The issue reads like rocket science—a whole series of illicit commands can be slipped into the work stream of the processor, but only if they are timed to the billionth of a second—and it just so happens that we have a rocket scientist on staff: Joe Estes, our Chief Technology Officer, who is a veteran of the NASA Jet Propulsion Lab.

Joe has written an article that I want to call to your attention because it provides a timely explanation on a complex but important topic. (I feel smarter already.) The article also draws on research in our Innovator's Edge platform, where we are tracking 250 insurtech startups focused on cyber issues. Joe lays out the three main approaches that insurtechs are making and recommends a few to check out. I recommend the piece highly.

Cheers,

Paul Carroll,

Editor in Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

A combination of insurtechs' strategies can minimize the reverberations created by something like Spectre and Meltdown.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Joe Estes has worked with startups, enterprises and government agencies for more than 14 years, to develop successful and lasting software products. He has been at the forefront of mobile app development - leading the work at <a href="http://www.jpl.nasa.gov/">NASA's Jet Propulsion Laboratory</a>, then, at iViu, developing an indoor, micro-granular location service that is used by some of the largest retailers in the world. Joe co-founded <a href="http://goalabilityapp.com">Goalability</a>, whose app is used all over the world to achieve goals by motivating social networks.

A great example is reading forms, yes--actually reading forms, to distinguish whether coverage actually exists!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.

New and perhaps unforeseen risks are likely to emerge, including significantly increased cyber-exposures and the potential for mega-accidents.

The way that people and goods move around in the future will be very different from what we are used to today. In fact, a number of technologies and demographic/sociological factors are going to converge to create a new era of mobility. Electric vehicles, shared mobility, autonomous vehicles, smart cities and others are big factors and the topics of much discussion at CES2018. Insights from four sessions at CES on the future of mobility can help to provide us with some perspectives on different aspects of this future:

What will all this mean for insurers? The conventional wisdom is that accidents will decrease dramatically over time, because 94% are caused by human error. If that were the end of the story, it would be a formula for vehicle insurance to become obsolete. On the other hand, new and perhaps unforeseen risks are likely to emerge, including significantly increased cyber-exposures and the potential for mega-accidents.

Another consideration is that as mobility becomes easier and safer, vehicle usage and mileage may actually increase. Seniors and the disabled may have more access to transportation, allowing them to travel more. People, in general, may make more trips. In a shared mobility world, vehicle ownership is likely to decline. That possibility, combined with increasing autonomy, raises questions of which entities will need to be insured for transportation.

And, as debated in the session led by AIG, the questions of liability loom large. It may be a decade or two before there is a tipping point regarding autonomous vehicles on the road. But the opportunities and challenges that have surfaced at CES2018 will be the subject of important discussions, policies and strategies for insurers, governments, automakers and others in the near (and the far) term.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

AI could transform the relationship between insurer and regulator, with implications for public trust and executive careers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Duncan Minty is an independent ethics consultant with a particular interest in the insurance sector. Minty is a chartered insurance practitioner and the author of ethics courses and guidance papers for the Chartered Insurance Institute.

Can you make buying insurance something that customers actively engage in? Yes, if you understand how they think.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Onno Bloemers is one of the founding partners at First Day Advisory Group. He has longstanding experience in delivering organizational change and scalable innovation in complex environments.

All too often, overzealous adjusters try to manufacture ways to deny claims. The industry needs to return to its long-standing, high standards.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Robotic process automation provides huge benefits, but insurers may invest too heavily in RPA if they treat it as a long-term answer.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeff Goldberg is head of insurance insights and advisory at Aite-Novarica Group.

His expertise includes data analytics and big data, digital strategy, policy administration, reinsurance management, insurtech and innovation, SaaS and cloud computing, data governance and software engineering best practices such as agile and continuous delivery.

Prior to Aite-Novarica, Goldberg served as a senior analyst within Celent’s insurance practice, was the vice president of internet technology for Marsh Inc., was director of beb technology for Harleysville Insurance, worked for many years as a software consultant with many leading property and casualty, life and health insurers in a variety of technology areas and worked at Microsoft, contributing to research on XML standards and defining the .Net framework. Most recently, Goldberg founded and sold a SaaS data analysis company in the health and wellness space.

Goldberg has a BSE in computer science from Princeton University and an MFA from the New School in New York.

While agencies use social media and email to connect with prospects and clients and actively update websites, the language they use is key.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Ori Ben-Yishai is executive vice president and chief marketing officer, North America personal risk services, at Chubb. He oversees marketing and client experience for the personal lines property and casualty business that serves affluent and successful clients in the U.S. and Canada.