In the 1973, Bachman Turner Overdrive hit song,

Taking Care of Business, it talks about employees getting annoyed and becoming self-employed, something that is happening 45 years later in the new gig economy. The growth of new small and medium businesses and the fight for talent is creating challenges and opportunities for insurers. And just like the song … in today’s rapidly changing marketplace with new products and competitors, insurers must take care of SMB businesses to grow, let alone survive.

Change is being forced on insurers, whether they like it or not. A new insurance paradigm is being crafted, regardless of whether incumbent insurers choose, or are able, to play to compete in a new digital era …

Digital Insurance 2.0.

Uniquely, SMBs are at the forefront of this digital shift and at the center of business creation, business transformation and growth in the economy. Representing the vast majority of all U.S. businesses, SMBs promise huge market potential for insurers to provide coverage for both traditional and new, emerging risks. However, the business models and products from Insurance 1.0, present during the last 30-plus years and built around the Silent and Baby Boomer generation business owners, will not work in a Digital Insurance 2.0 era that is driven by Millennial and Gen Z business owners. Succeeding in the SMB market requires an understanding of the unique characteristics of individual segments and developing appropriate strategies for each.

New Expectations and Behaviors Set a New Competitive Bar

To help insurers capture these opportunities and adapt to Digital Insurance 2.0, Majesco recently conducted a new primary research study. The study built on last year’s research,

The Rise of the Small-Medium Business Insurance Customer, which revealed increasingly higher participation rates in digital trends and technologies as well as interest in considering new insurance-related digital capabilities, new products and new business models. In this year’s research, we dived deeper into these new products, business models and capabilities to assess their interest and their potential to accelerate the shift to Digital Insurance 2.0 offerings — offerings that could challenge traditional Insurance 1.0 business models. We decomposed a range of new products and business models into individual attributes and gauged reactions to them across both business size and owner generation. The results provide insight on the competitive bar set by these emerging new innovations and competitors.

So, what did we find?

The new research report,

Insights for Growth Strategies: The New SMB Insurance Customer, underscores an acceleration in digital-driven SMB behaviors and expectations, as well as strong openness to considering buying and switching to new products, services, capabilities and business models that reflect Digital Insurance 2.0. In analyzing the data, we found that the differences across the business size and owner generation segments have vital implications for insurers on why and how they must shift to engage and provide innovative, relevant products to an increasingly digitally oriented SMB market.

Interestingly, between the 2016 and 2017 Majesco surveys, we found an acceleration of as much as 20% in digital behaviors and the use of new technologies, particularly for Gen X and Boomers. Gen Z and millennials also maintained their digital leadership position, with 80%-90% across all company sizes engaging in at least one trend or technology, but often engaging in multiple trends or technologies. These technology-driven behaviors signal an acceleration across all business sizes and generations in reshaping insurance to Digital Insurance 2.0. Increasingly, these behaviors and technologies are embedded in new products and business models introduced by new competitors, which will attract new customers and encourage existing customers to switch.

See also: How Small Insurers Can Grow

The top trends and technologies across all the business sizes and generational groups included:

- hired a freelancer/independent contractor for a limited period,

- used cloud-based subscription fee software (e.g. Microsoft Office),

- paid for something with ApplePay/Samsung Pay,

- used smart devices within the office/building,

- worked as a freelancer/contractor,

- and used an app to monitor the business office or building for security or equipment.

Most striking, the relationships between generation and company size accentuates two significant gaps; a growing generational gap

and a widening gap between Insurance 1.0 and Digital Insurance 2.0, whereby participation is greater for the larger and younger segments, and decreases for the smaller and older segments. This sets the stage for customers shifting to fresh, innovative products and business models introduced by new competitive players.

New Innovations and Competition to Take Care of SMB Businesses

The digital revolution is rewriting the rules of business and, with it, redesigning organizational and business model structures. Insurers are faced with a predictive dilemma: Among all of the new models and products emerging in the insurance market, which ones will gain traction in the market? How fast? And for whom?

Based on our research, a number of top-rated attributes with overwhelmingly strong appeal offer immediate options for insurers to test and learn in the market. For example, reducing costs and risks through

value-added services, quote and buy and

social networking options are areas where insurers can immediately begin to innovate. There are numerous additional possibilities for tailoring combinations of attributes to meet unique generation and company size segment preferences that offer innovative opportunities.

In particular, younger generation business owners from the two larger business sizes are

the most interested in innovations for insurance and therefore more likely to consider new products and competitors. Many of the new competitors are using different combinations of the 30 attributes we assessed as building blocks to innovate their products and business models. We tested SMB reactions to some of these new business model concepts launched in the market the last several years.

The results highlight strong interest in these new business models, particularly among the younger generations and larger SMB segments. Initial reactions to the business models generally showed positive ratings of 50% or higher. But when adding the neutral “swing groups,” interest significantly rose to more than 80%. This suggests

a strong openness to consider these new models. The next question is, will they purchase?

The answer is, “Yes, they will.” Gen Z and Millennials, in particular, indicate positive “likelihood to purchase” ratings of 50%. But, when adding the “swing groups,” purchase potential jumps to 70%-90% across most of the segments, emphasizing how rapidly swing groups will likely shift the market. While these new models’ long-term viability is yet to be determined, the growing interest and likelihood to purchase suggests they have significant potential to capture the market opportunity, particularly the next generation of SMB business owners.

Generational Transition of Leadership … It’s a Matter of Time and Experience

SMB’s market potential is significant: U.S. Census data show that those with fewer than 10 employees represent

nearly 80% of all businesses in the U.S. And while distribution economics dictate that the optimal way to reach them is through digital channels, with direct-to-business models via self-service, the research results indicate a “one size fits all” approach will not work. Two powerful forces are compelling insurers to make the transition to meet the needs of this important market: time and experience.

First, it’s just a matter of time before traditional operating models will no longer work based on a combination of new factors. By 2020,

more than 60% of small businesses in the U.S. will be owned by millennials and Gen Xers — two groups that greatly prefer digital engagement. The 2016 Upwork and the Freelancers Union’s annual survey,

Freelancing in America, estimated that 35% of the U.S. workforce is made up of freelancers and independent contractors, the basis of the new gig economy. Furthermore, globally, millennials appear to be more active in the startup space. Dubbed “millennipreneurs,” they are starting more companies per person, managing bigger staffs and

targeting higher profits than their baby boomer predecessors did. And finally, a 2016 survey of U.S. young adults 15-32 years old, Gen Z and millennials, showed that

55% expressed interest in starting their own business or non-profit someday.

Second, it’s about experience. Digital experience. As the transition of SMB businesses from the baby boomers and Gen X to the next generation of Gen Z and millennials continues to accelerate, digital experience matters more and more. The older generations have extensive experience with Insurance 1.0, but despite their increasing use of new trends and technologies, they lag in digital experience and comfort in embracing Digital Insurance 2.0. In contrast, Gen Z and millennial SMB owners are overwhelmingly embracing and expecting Digital Insurance 2.0 models.

The question is … are you ready?

Bridging the Business Gap of Insurance 1.0 to Digital Insurance 2.0 to Take Care of SMB Business

While Insurance 1.0 preferences are firmly in place with the smallest businesses and older-generation business owners, insurance companies must rapidly adapt and innovate to retain them as the businesses move to a younger generation of leaders. Adding fuel to the shift, the growth in the gig economy and SMBs’ rising Digital Insurance 2.0 preferences are creating a significant business gap in products and business models that insurers need to bridge, rapidly.

How to proceed?

Insurers can use these findings to strategize, prioritize and develop unique business plans to capture these diverse SMB market segments. With the pronounced differences in patterns across generations and business sizes, different market and product strategies are necessary. To facilitate this thinking, we developed SMB segment playbooks that highlight the attributes (the “ingredients”) that constitute the “ideal” insurance offerings (“the innovations”) for each segment (the “recipe model”). But regardless of segment, insurers must rapidly move to a new generation of digital insurance platforms that personalize and maximize the customer journey with deeper engagement, enable process digitization, use digital data-driven insights, adapt to rapid market changes or opportunities and enable rapid rollout of new products and capabilities … a Digital Insurance 2.0 platform.

See also: Secret Sauce for New Business Models?

It is a new age of insurance — a digital age. And it’s all about taking care of business … small-medium businesses. For those willing to bridge the business gap from Insurance 1.0 to Digital Insurance 2.0 … join the chorus with the new generation of SMB customers!

And we be taking care of business (every day)

Taking care of business (every way)

We’ve been taking care of business (it’s all mine)

Taking care of business and working overtime.

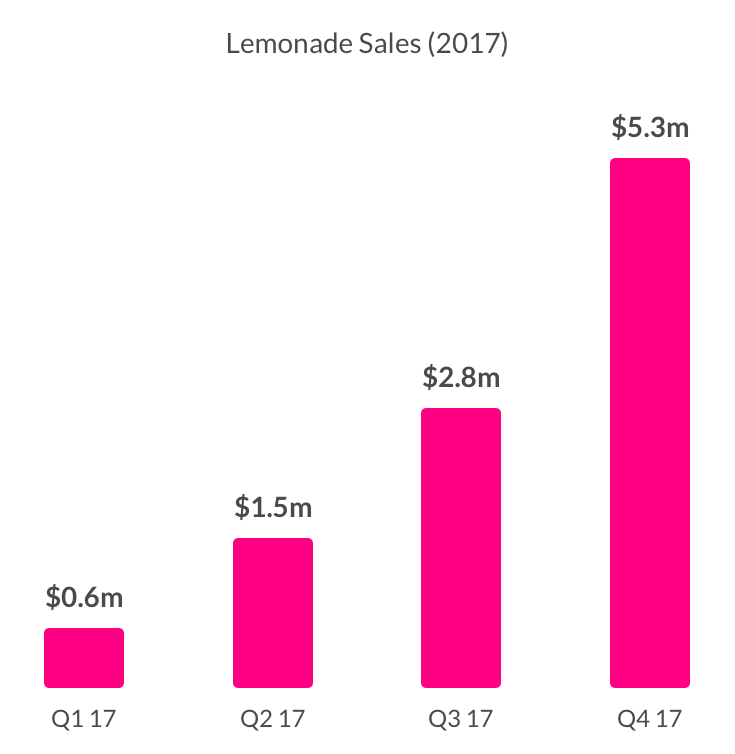

But as the hours turned to days, and days to weeks, questions remained. A full year’s worth of data now offers some answers, and what follows are the highlights, and lowlights, of 2017.

1. “Nobody will trust a company called ‘Lemonade’!”

A major early question was whether a newborn company, with a juvenile name, could engender the necessary trust. Everything was riding on our contrarian theory: that Lemonade’s newness and uniqueness would make it more trustworthy, not less.

You see, traditional insurers often equate trustworthiness with financial strength, which they project by erecting monumental buildings that dominate the skyline.

But as the hours turned to days, and days to weeks, questions remained. A full year’s worth of data now offers some answers, and what follows are the highlights, and lowlights, of 2017.

1. “Nobody will trust a company called ‘Lemonade’!”

A major early question was whether a newborn company, with a juvenile name, could engender the necessary trust. Everything was riding on our contrarian theory: that Lemonade’s newness and uniqueness would make it more trustworthy, not less.

You see, traditional insurers often equate trustworthiness with financial strength, which they project by erecting monumental buildings that dominate the skyline.

Skyscrapers weren’t within our budget, but in any event we believed such extravagance sends the wrong signal. People worry their insurer lacks the will to pay, not the means. So we established Lemonade as a public benefit corporation, with a view to signaling something very different. We hoped today’s consumers would find our approach refreshing and trustworthy.

The data suggest that they have.

Skyscrapers weren’t within our budget, but in any event we believed such extravagance sends the wrong signal. People worry their insurer lacks the will to pay, not the means. So we established Lemonade as a public benefit corporation, with a view to signaling something very different. We hoped today’s consumers would find our approach refreshing and trustworthy.

The data suggest that they have.

On launch day, we thought of our team as pioneers and true believers. But after our first year, we know it is our community of more than 100,000 who deserve those accolades. It is they who entrusted billions to a brand new insurer, and it is that trust that is powering the change.

Which brings us to the second thing we now know. We know our customers.

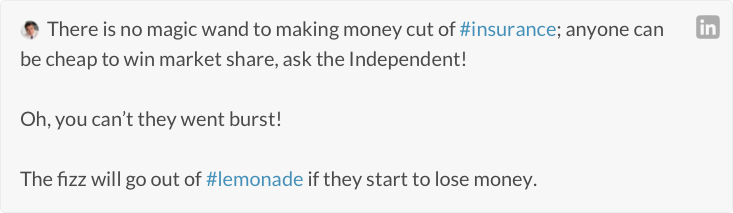

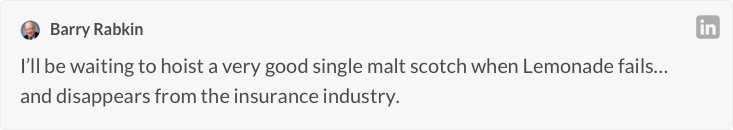

2. “Being the cheapest attracts customers — but the wrong customers”

The boogeyman in insurance is adverse selection. As an insurer, you set your price based on what a customer should cost you on average. But if, instead of attracting average customers, you attract the kind who switch frequently, or claim excessively, you’re selling at a loss, and your days are numbered. Adverse selection is a particular threat to price leaders.

On launch day, we thought of our team as pioneers and true believers. But after our first year, we know it is our community of more than 100,000 who deserve those accolades. It is they who entrusted billions to a brand new insurer, and it is that trust that is powering the change.

Which brings us to the second thing we now know. We know our customers.

2. “Being the cheapest attracts customers — but the wrong customers”

The boogeyman in insurance is adverse selection. As an insurer, you set your price based on what a customer should cost you on average. But if, instead of attracting average customers, you attract the kind who switch frequently, or claim excessively, you’re selling at a loss, and your days are numbered. Adverse selection is a particular threat to price leaders.

And we were determined to be a price leader.

But while we designed our business for value, we also designed it for values – and it was important to us that our customers appreciate both. Value alone selects adversely, but values select advantageously.

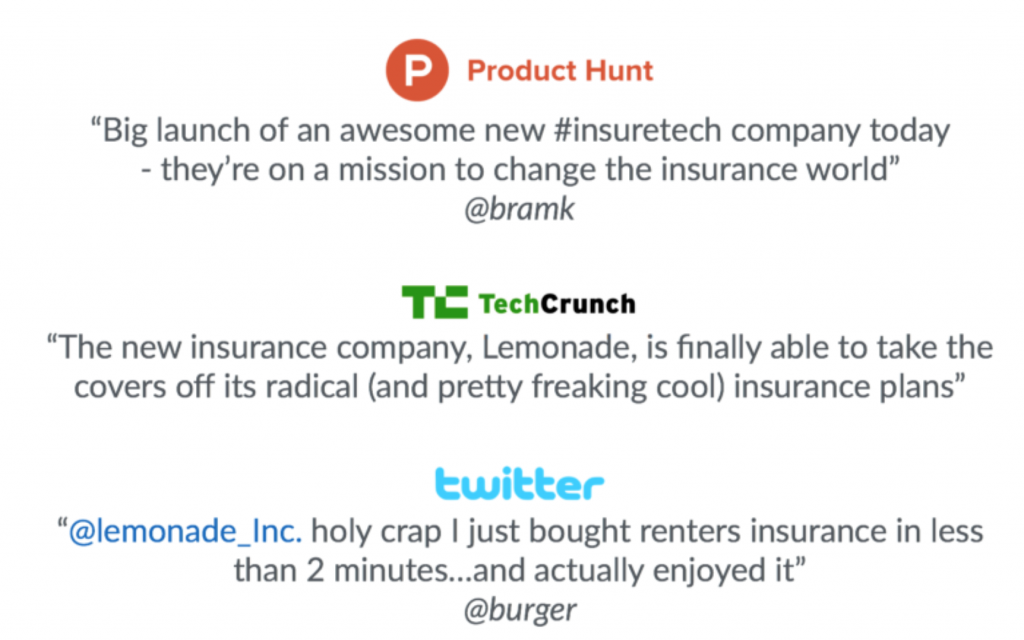

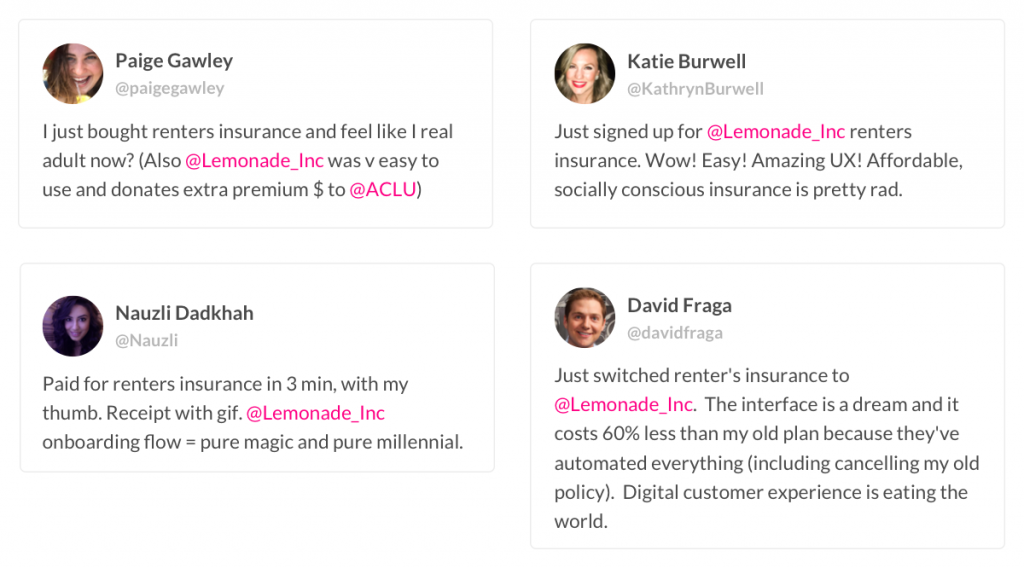

We breathed a sigh of relief when customers tweeted about Lemonade’s low prices a lot, but about its B-Corp and Giveback even more. The tweeting was an encouraging early data point.

And we were determined to be a price leader.

But while we designed our business for value, we also designed it for values – and it was important to us that our customers appreciate both. Value alone selects adversely, but values select advantageously.

We breathed a sigh of relief when customers tweeted about Lemonade’s low prices a lot, but about its B-Corp and Giveback even more. The tweeting was an encouraging early data point.

As more data came in during the course of the year, our assessment of the adverse selection threat became more rigorous. See, throughout the many decades, the insurance industry has learned that people’s education and job are highly predictive of what kind of risk they represent. If Lemonade’s customers were below average by these measures, we’d have a problem, no matter what our Twitter feed said.

Good news: They are not.

The stats on Lemonade customers (who, by the way, are 50:50 male and female) suggest our members are more than 100% over-indexed for both graduate degrees and really high-paying jobs. All this notwithstanding the fact that 75% of our members are under the age of 35!

The upshot: Lemonade is attracting the next generation of outstanding insurance customers.

3. “Making claims easy will lead to a flood of claims”

It’s an open secret in the insurance industry that a painful claims process discourages claims. There’s only so many times you can hear that "your call is important to us and will be answered in the order in which it was received," before you say "to hell with it" and give up on your claim.

Instant claims? That could unleash a torrent of frivolous claims.

As more data came in during the course of the year, our assessment of the adverse selection threat became more rigorous. See, throughout the many decades, the insurance industry has learned that people’s education and job are highly predictive of what kind of risk they represent. If Lemonade’s customers were below average by these measures, we’d have a problem, no matter what our Twitter feed said.

Good news: They are not.

The stats on Lemonade customers (who, by the way, are 50:50 male and female) suggest our members are more than 100% over-indexed for both graduate degrees and really high-paying jobs. All this notwithstanding the fact that 75% of our members are under the age of 35!

The upshot: Lemonade is attracting the next generation of outstanding insurance customers.

3. “Making claims easy will lead to a flood of claims”

It’s an open secret in the insurance industry that a painful claims process discourages claims. There’s only so many times you can hear that "your call is important to us and will be answered in the order in which it was received," before you say "to hell with it" and give up on your claim.

Instant claims? That could unleash a torrent of frivolous claims.

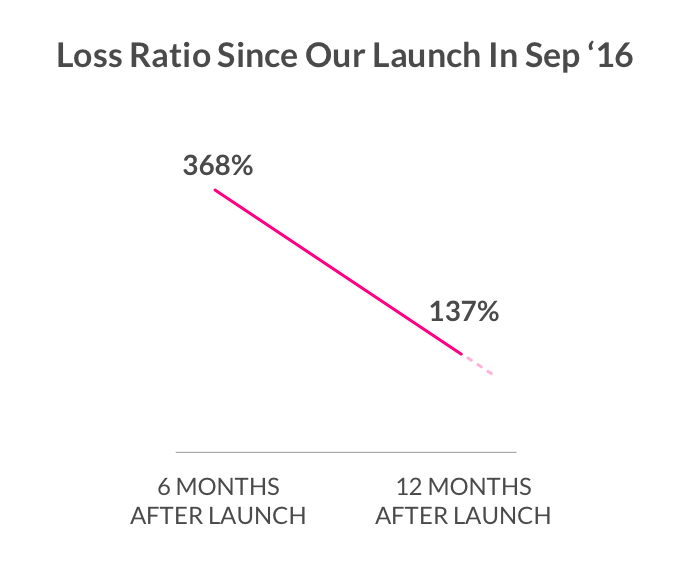

Truth be told, things were hairy for a while. Early in 2017, a couple of large claims arrived in rapid succession. We only had a few customers at that time, and as a proportion of our revenue (known as a "loss ratio") these few claims were daunting. Statistics taught us to expect this kind of lumpiness in the early days, but we still slept fitfully until our business grew and our loss ratio began to normalize. We were in a much healthier place by year’s end (we report our 2017 loss ratio to regulators next month), and the frequency of claims is in line with our modeling.

Truth be told, things were hairy for a while. Early in 2017, a couple of large claims arrived in rapid succession. We only had a few customers at that time, and as a proportion of our revenue (known as a "loss ratio") these few claims were daunting. Statistics taught us to expect this kind of lumpiness in the early days, but we still slept fitfully until our business grew and our loss ratio began to normalize. We were in a much healthier place by year’s end (we report our 2017 loss ratio to regulators next month), and the frequency of claims is in line with our modeling.

Beyond the noisiness that is a byproduct of small numbers, our system seemed to have improved as we fed it more data. For example, our loss ratio among policies sold in 2016 is more than 2X that of policies sold in 2017. This suggests that our underwriting was pretty shoddy in our early days. Definitely a lowlight.

Since then, we’ve taught our systems to be far more careful when underwriting policies, and our bot Maya declined to quote more than $17 million of business in 2017. This has markedly improved the underlying health of our business – but there’s still a ways to go. Early mistakes will continue to drag down our reported loss ratio for awhile.

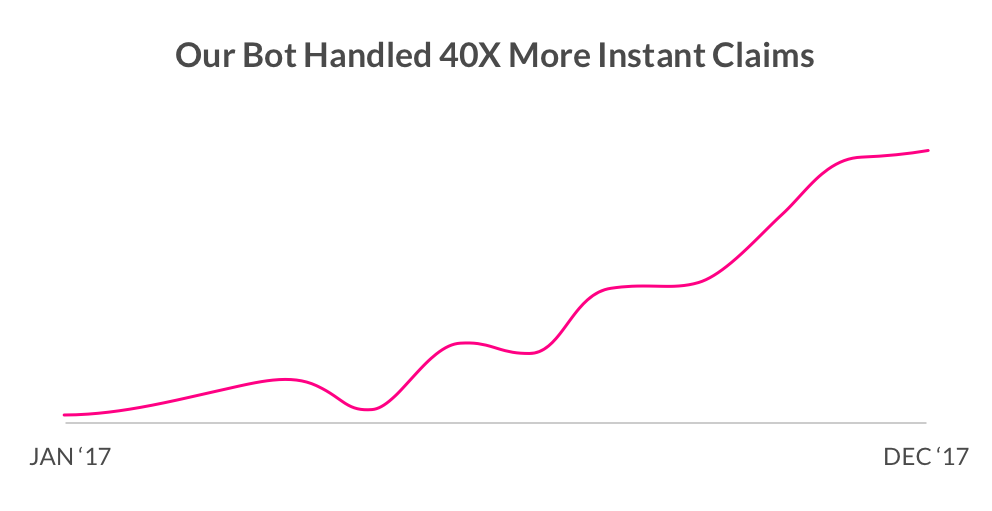

Our knight in shining armor? That’d have to be our claims bot, Jim. When we announced his ability to review, approve and pay a claim in seconds, we surprised a few. Happy to report that, during 2017, AI Jim grew his capacity to pay claims 40X.

[caption id="attachment_30120" align="alignnone" width="570"]

Beyond the noisiness that is a byproduct of small numbers, our system seemed to have improved as we fed it more data. For example, our loss ratio among policies sold in 2016 is more than 2X that of policies sold in 2017. This suggests that our underwriting was pretty shoddy in our early days. Definitely a lowlight.

Since then, we’ve taught our systems to be far more careful when underwriting policies, and our bot Maya declined to quote more than $17 million of business in 2017. This has markedly improved the underlying health of our business – but there’s still a ways to go. Early mistakes will continue to drag down our reported loss ratio for awhile.

Our knight in shining armor? That’d have to be our claims bot, Jim. When we announced his ability to review, approve and pay a claim in seconds, we surprised a few. Happy to report that, during 2017, AI Jim grew his capacity to pay claims 40X.

[caption id="attachment_30120" align="alignnone" width="570"] See also: Lemonade’s New Push: Zero Everything [/caption]

Our algorithms are getting better at flagging attempts at fraud, and we reported several of these to the authorities. Yet overall the data shows that honesty is rampant among our members, and what behavioral economists dub reciprocity is alive and well: About 5% of our customers contact us, after their claim is paid, to say their stuff turned up and they want to return the money. Our team has centuries of combined experience in insurance, but this was a first for them all!

See also: Lemonade’s New Push: Zero Everything [/caption]

Our algorithms are getting better at flagging attempts at fraud, and we reported several of these to the authorities. Yet overall the data shows that honesty is rampant among our members, and what behavioral economists dub reciprocity is alive and well: About 5% of our customers contact us, after their claim is paid, to say their stuff turned up and they want to return the money. Our team has centuries of combined experience in insurance, but this was a first for them all!

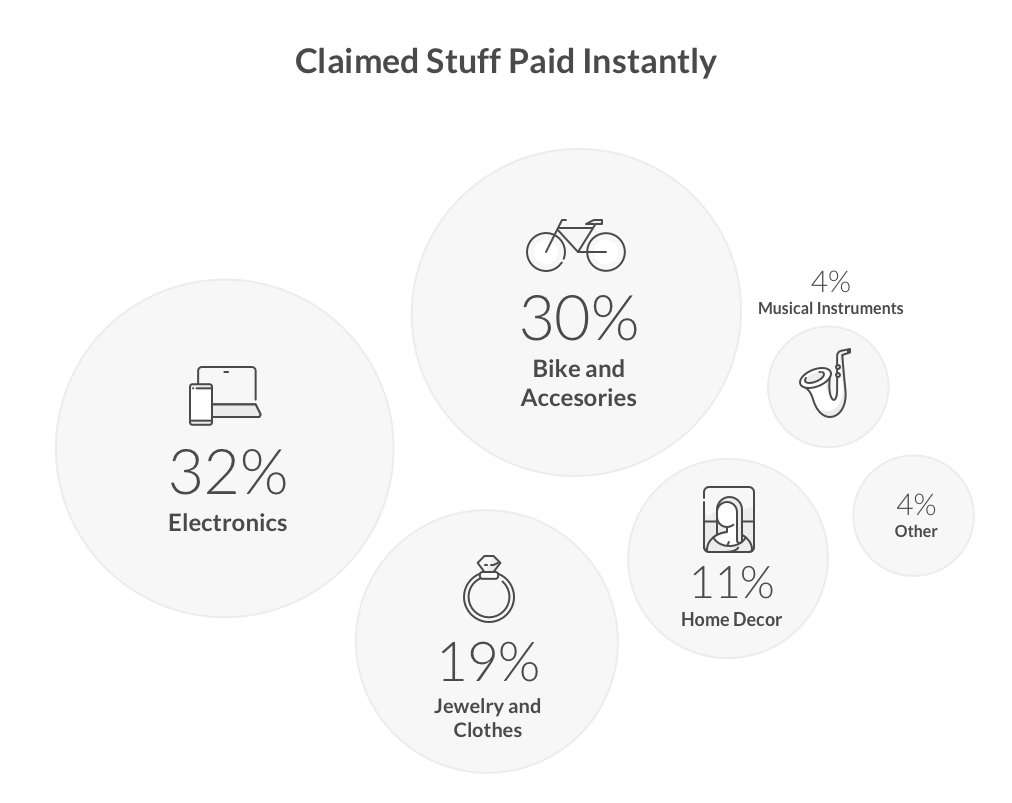

A quick look at the instant claims suggests our members spend a lot of time on phones and bikes. But this year had all kinds of losses: big ones like fires and smaller ones like stolen headphones.

A quick look at the instant claims suggests our members spend a lot of time on phones and bikes. But this year had all kinds of losses: big ones like fires and smaller ones like stolen headphones.

We are proud to say that we were (and are!) there for our community in times of need.

[caption id="attachment_30123" align="alignnone" width="570"]

We are proud to say that we were (and are!) there for our community in times of need.

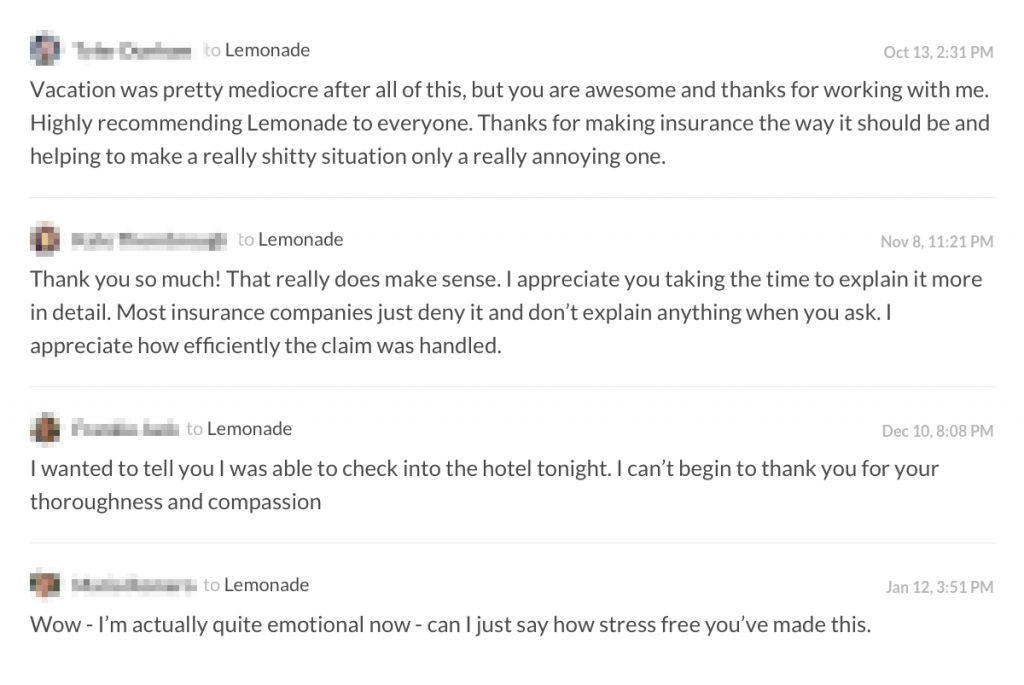

[caption id="attachment_30123" align="alignnone" width="570"] Positive reviews of Lemonade's instant claims[/caption]

Stopping to smell the roses

2017 wasn’t all roses. We saw shockingly high loss ratios in the first half of the year, some vicious responses to our stand on guns and knock-off attempts by some of the Goliaths of the industry.

At the same time, we saw tremendous adoption by our customers, exciting advances in our tech, licenses from 25 states and a Giveback that amounted to 10% of our revenues.

We’re extremely grateful to our team, our customers and our regulators for making 2017 all that it could be. No doubt 2018 won’t be all roses, either, but we will stop to smell them whenever we can. ?

Positive reviews of Lemonade's instant claims[/caption]

Stopping to smell the roses

2017 wasn’t all roses. We saw shockingly high loss ratios in the first half of the year, some vicious responses to our stand on guns and knock-off attempts by some of the Goliaths of the industry.

At the same time, we saw tremendous adoption by our customers, exciting advances in our tech, licenses from 25 states and a Giveback that amounted to 10% of our revenues.

We’re extremely grateful to our team, our customers and our regulators for making 2017 all that it could be. No doubt 2018 won’t be all roses, either, but we will stop to smell them whenever we can. ?