Solving Insurtech's People Challenge

There must be a bridge, a forceful individual who can drive the agenda of the new team/tool into the host company and vice versa.

There must be a bridge, a forceful individual who can drive the agenda of the new team/tool into the host company and vice versa.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Alexander Cherry leads the research behind Insurance Nexus’ new business ventures, encompassing summits, surveys and industry reports. He is particularly focused on new markets and topics and strives to render market information into a digestible format that bridges the gap between quantitative and qualitative.Alexander Cherry is Head of Content at Buzzmove, a UK-based Insurtech on a mission to take the hassle and inconvenience out of moving home and contents insurance. Before entering the Insurtech sector, Cherry was head of research at Insurance Nexus, supporting a portfolio of insurance events in Europe, North America and East Asia through in-depth industry analysis, trend reports and podcasts.

Business models of the past 50 years have been based on products, processes and channels for the Silent and Baby Boomer generations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Denise Garth is senior vice president, strategic marketing, responsible for leading marketing, industry relations and innovation in support of Majesco's client-centric strategy.

Last week's announcement of a healthcare venture by Amazon, Berkshire Hathaway and JPMorgan Chase may finally shift the debate in the U.S.

Last week's announcement of a healthcare venture by Amazon, Berkshire Hathaway and JPMorgan Chase may finally shift the debate in the U.S. in what I firmly believe is the right direction.

The debates on the Affordable Care Act and then on "repeal and replace" have largely focused on who pays for care. The real issue is the incredibly high cost of care in the U.S. If we can start to fix that problem, then the issue of who pays becomes easier. If we don't, the issue of who pays will keep getting hairier. And the venture could take a whack at healthcare costs, first for the three companies' employees, then for the whole market.

In theory, health insurers use their size and market power to keep prices down. In fact, health insurers have basically become a tax on the system. Whatever healthcare costs are, insurers get their 20%. Yes, insurers have incentives to push back on individual claims—many of us have learned the hard way—but the higher that costs are in the aggregate, the more the insurers earn. Netting 20% of $1 trillion a year is great, but why stop there if you can collect 20% of nearly $4 trillion? (Healthcare spending was $3.3 trillion in the U.S. in 2016, or 18% of GDP, and is still increasing rapidly. That percentage is roughly twice as high as in other major Western countries, even though Americans consume about as much medicine and services and have relatively low life expectancy.)

Pharmacy benefit managers (PBMs) were, likewise, supposed to protect us on prices, but they've been co-opted, too, by the immense profits to be had. Rather than just negotiate drug prices on behalf of employers and health plans, the PBMs now take payments from all comers, including drug makers—and the U.S. pays prices roughly twice those in other major countries.

Other ideas have been floated, notably "consumerization"—making consumers more accountable for their care by assigning them responsibility for some portion of every payment, while giving them far more information than they have now about prices and the quality of caregivers and value of medicines and procedures. That approach makes some sense, but it requires changing the whole system—and the system will fight back. Patients' cost are the system's revenue, and it has become so large and powerful that it will battle as hard as can be to protect that revenue.

The best idea I've seen, the one that could actually be the point of the spear that pierces the healthcare system's armor, sounds rather like the Amazon/Berkshire Hathaway/JPMorgan Chase deal (which some are calling ABC, after Amazon, Berkshire and Chase).

The notion is that employers—initially, big employers—can lead the way on a form of consumerization because they have both the right incentives and the right scale. Individual consumers carry no particular weight, and we can hardly be expected to sort out the mind-boggling complexity that is healthcare. But big employers that self-insure can hire expertise to negotiate directly with providers and get better prices than if the employers rely on health insurers and pay the middlemen their 20%. Big employers can also draw on their data analytics expertise to measure outcomes and locate the best treatment for employees through programs such as Centers of Excellence. Prices may well be higher for these highest-quality providers, but the centers avoid unnecessary treatment (not something that a revenue-maximizing system is especially good at policing) while providing care that is more likely to be right the first time; that both avoids cost and reduces complications for patients. Employers can also cut through the fog that cloaks drug charges and insist on better prices either from PBMs or directly from makers.

Essentially, big employers kick insurers out of the picture and go toe to toe with healthcare providers and PBMs to both lower prices and improve care. That's the theory, anyway.

The details about ABC, while still sketchy, suggest it is the best example thus far of this approach. If ABC works, and other examples follow, they might just provide a market-based solution to a major drag on Americans. Individuals would initially be left out, but some way could eventually be found to let them benefit from the prices negotiated by corporations or Medicare.

There are, of course, plenty of reasons to be skeptical. If you'll allow me, ABC isn't as simple as A, B, C. Even if the deal works as advertised, what's to stop the combined companies from becoming just another power that jacks up healthcare prices for individuals while working for their own benefit? Amazon's Jeff Bezos, Berkshire Hathaway's Warren Buffett and Chase's Jamie Dimon aren't exactly known for turning down profits.

Still, for now, let's call ABC progress and keep a close eye on where it goes. That's pretty much the initial take among our thoughts leaders, three of whose articles on the subject I've included below. (One, Brian Klepper, has organized an impressive array of thinkers on a listserv on healthcare costs that has done much to shape my thinking.)

I'll keep my fingers crossed. If this approach doesn't work....

Have a great week.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Recognizing our cognitive bias toward loss aversion can help us avoid making ill-advised underwriting decisions.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Thiel is a senior underwriter for Gen Re's casualty facultative department in Philadelphia. He is also a member of the reinsurance interest group for the CPCU Society's Philadelphia chapter. Thiel joined Gen Re in 2014 after roles in both underwriting and claims.

Firms can provide coverage for the un/underinsured, focusing on specific needs for emerging customers and making them excited about insurance.

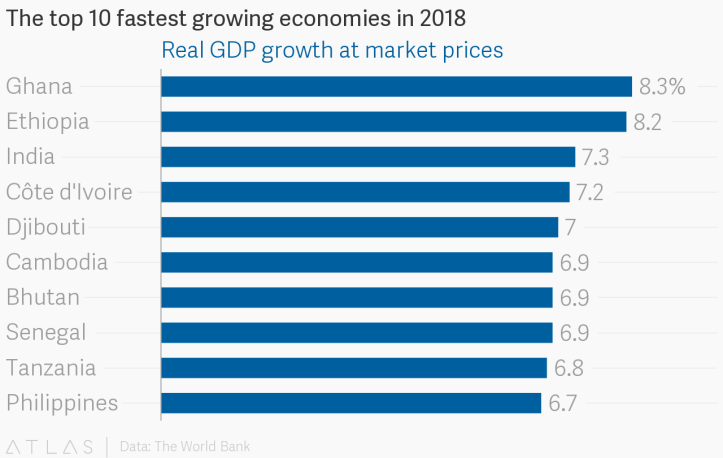

Source: https://www.theatlas.com/charts/BJOKD67VG[/caption]

The blend of under-penetration plus fast growth shows a lot of opportunity for microinsurance in these areas, one which MicroEnsure is very aware of.

See also: A ‘Nudge’ Toward Microinsurance

What Is MicroEnsure?

MicroEnsure is a specialist provider of insurance for customers in emerging markets and has registered more than 55 million customers in 10 different countries in Asia and Africa.

MicroEnsure designs, builds and operates their business by having products that are simple to understand and with distribution partners that can help to reach the masses. They don’t carry the risk themselves and partner with more than 70 different insurers. Their biggest shareholder is AXA, alongside Omidyar Network, IFC and South Africa’s Sanlam.

Because the majority of the consumers in these markets do not have any insurance, Peter indicated to me that the marketing strategies that they deploy help them to introduce an insurance solution and meet an untapped need.

An example of this was when Peter first moved to Ghana. The company partnered with Tigo Telecom to offer free life insurance. The process worked like this:

Source: https://www.theatlas.com/charts/BJOKD67VG[/caption]

The blend of under-penetration plus fast growth shows a lot of opportunity for microinsurance in these areas, one which MicroEnsure is very aware of.

See also: A ‘Nudge’ Toward Microinsurance

What Is MicroEnsure?

MicroEnsure is a specialist provider of insurance for customers in emerging markets and has registered more than 55 million customers in 10 different countries in Asia and Africa.

MicroEnsure designs, builds and operates their business by having products that are simple to understand and with distribution partners that can help to reach the masses. They don’t carry the risk themselves and partner with more than 70 different insurers. Their biggest shareholder is AXA, alongside Omidyar Network, IFC and South Africa’s Sanlam.

Because the majority of the consumers in these markets do not have any insurance, Peter indicated to me that the marketing strategies that they deploy help them to introduce an insurance solution and meet an untapped need.

An example of this was when Peter first moved to Ghana. The company partnered with Tigo Telecom to offer free life insurance. The process worked like this:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stephen Goldstein is a global insurance executive with more than 10 years of experience in insurance and financial services across the U.S., European and Asian markets in various roles including distribution, operations, audit, market entry and corporate strategy.

Through collaboration, marketers can target not just new customers but those who will stay longer and be more profitable.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sandeep Kharidhi is general manager of data and analytics platforms at Deluxe Corporation.

To encourage new ideas and attract talented people, the insurance industry must have an educational program for newcomers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

David Disiere is founder and CEO of QEO Insurance Group, an agency that provides commercial transportation insurance to clients throughout the U.S.

Those who buy healthcare at employers and unions are acutely aware that they’re being taken advantage of by every industry sector.

Tuesday’s announcement about Amazon, Berkshire Hathaway and JPMorgan (A/BH/JP

Healthcare organizations were shaken. Bloomberg Markets reported that:

Pharmacy-benefit manager Express Scripts Holding Co. fell as much as 11 percent, the most intraday since April, at the open of U.S. trading Tuesday, while rival CVS Health Corp. dropped as much as 6.4 percent. Health insurers also fell, with Anthem Inc. losing as much as 6.5 percent and Aetna, which is being bought by CVS, sliding as much as 4.3 percent.

As expected, these firms’ stock prices rebounded the next day. But you could interpret the drops as reflections of the perceived fragility of healthcare companies’ dominance and traders’ confidence in the potential power of Amazon’s newly announced entity. Legacy healthcare firms, with their well-earned reputations for relentlessly opaque arrangements and egregious pricing, are vulnerable, especially to proven disruptors who believe that taming healthcare’s excesses is achievable. Meanwhile, many Americans have come to believe in Amazon’s ability to deliver.

Those who buy healthcare for employers and unions probably quietly rejoiced at the announcement. For them, the prospect of a group that might actually transform healthcare would be a breath of fresh air. In my experience, at least, the CFOs and benefits managers at employers and unions are acutely aware that they’re being taken advantage of by every healthcare industry sector. They’re genuinely weary, and they’d welcome a solid alternative.

See also: The Dawn of Digital Reinsurance

Their healthcare intentions notwithstanding, the A/BH/JPM group is formidable, representing immense strength and competence. Amazon is an unstoppably proven serial industry innovator, continuing to consolidate its position in the U.S. and in key markets globally. Berkshire Hathaway harbors significant financial strength and a stop-loss unit, U.S. Medical Stop Loss, fluent in underwriting healthcare risk, which should be handy. In addition to the fact that JPMorgan is the nation’s largest bank, with assets worth nearly $2.5 trillion in 2016, it has a massive list of prospective buyers in its commercial client base.

This triumvirate knows that, in healthcare, they have an advantage. There are proven but mostly untapped approaches in the market that effectively manage healthcare clinical, financial and administrative risk, consistently delivering better health outcomes at significantly lower cost. In the main, legacy healthcare organizations have ignored these solutions, because efficiencies would compromise their financial positions.

To put this into perspective, consider that, since early 2009, when the Affordable Care Act was passed, the stock prices of the major health plans have grown a spectacular 5.3 to 9.6 times -- in aggregate, 3.7 times as fast as the S&P 500 and 3.2 times as fast as the Dow Jones Industrial Average.

At the end of the day under current fee-for-service arrangements, healthcare’s legacy organizations make more and have rising value if healthcare costs more. If they take advantage of readily available solutions that make healthcare better and cost less, earnings, stock price and market capitalization will all tumble. They’re in a box.

What little we know about Amazon’s intentions indicates that they are ambitious. Presumably, they’ll begin by bringing technology tools to bear. That could cover a lot of territory, but assembling and integrating high-value narrow networks by identifying the performance of different healthcare product/service providers seems like a doable and powerful place to begin. High-performance vendors exist in a broad swath of high-value niches. Arranging these risk management modules under a single organizational umbrella can easily result in superior outcomes at dramatically less cost than current health care spending provides.

Amazon has developed a relationship with industry-leading pharmacy benefits manager (PBM) Express Scripts (ESI), likely to operationalize mail order and facility-based pharmacies. Given ESI’s history of opacity and hall-of-mirrors transactions – approaches that are directly counter to Amazon’s ethos – it’s tempting to imagine that that relationship is a placeholder until Amazon can devise or identify a more value-based model.

Also, a couple weeks ago, Amazon hired Martin Levine, MD, a geriatrician who had run the Seattle clinics for Boston-based Medicare primary care clinic firm Iora Health. This could suggest that Amazon aspires to deliver clinical services, likely through both telehealth and brick-and-mortar facilities.

All this said, we should expect the unexpected. The A/BH/JPM announcement wasn’t rushed, but the result of a carefully thought through, methodical planning exercise. As it has done over and over again – think Prime video; two-day, free shipping; and the Echo – it is easy to imagine that Amazon could present us with powerful healthcare innovations that seem perfectly intuitive but weren’t previously on anyone’s radar.

See also: How to Make Smart Devices More Secure

What is most fascinating about this announcement is that it appears to pursue the pragmatic urgency of fixing a serious problem that afflicts every business. At the same time, it may represent an effort to subvert and take control of healthcare’s current structure.

So, while we may be elated that a candidate healthcare solution is raising its head, we should be skeptical of stated good intentions. Warren Buffett’s now-famous comment that ballooning healthcare costs are “a hungry tapeworm on the American economy” rings a little hollow when we realize that Berkshire Hathaway owns nearly one-fifth of the dialysis company Da Vita, a model of hungry health industry tapeworms.

Finally, we should not doubt that this project has aspirations far beyond U.S. health care. The corporatization and distortion of healthcare’s practices is a global problem that will be susceptible to the same solutions of evidence and efficiency everywhere.

All this is promising in the extreme, but there’s also a catch. The U.S. healthcare industry’s excesses undermine our republic and have become a threat to our national economic security. The solutions that this A/BH/JPM project will leverage could become an antidote to the devils we all know plague our country’s healthcare system. That said, we should be mindful that, over the long term, our saviors could become equally or more problematic.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Brian Klepper is principal of Healthcare Performance, principal of Worksite Health Advisors and a nationally prominent healthcare analyst and commentator. He is a former CEO of the National Business Coalition on Health (NBCH), an association representing about 5,000 employers and unions and some 35 million people.

Many experts discount the Amazon/Berkshire Hathaway/JPMorgan announcement, but the effects could well be far-reaching.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Joseph Paduda, the principal of Health Strategy Associates, is a nationally recognized expert in medical management in group health and workers' compensation, with deep experience in pharmacy services. Paduda also leads CompPharma, a consortium of pharmacy benefit managers active in workers' compensation.

Most firms articulate a business purpose that makes for good annual report copy but doesn’t translate into tangible action.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jon Picoult is the founder of Watermark Consulting, a customer experience advisory firm specializing in the financial services industry. Picoult has worked with thousands of executives, helping some of the world's foremost brands capitalize on the power of loyalty -- both in the marketplace and in the workplace.