Following on from our previous post on

product development, which concluded the key themes section of our Global Trend Map, we now examine the insurance and insurtech trends in the world's major markets via our dedicated regional profiles. We focus on seven key regions.

In our forthcoming posts, we will be referring back — on a regional and comparative basis — to the stats presented across our earlier installments on: Industry Challenges, Insurtech Perspectives, Insurer Priorities, Services, Investments & Job Roles, Analytics & AI, Digital Innovation, Internet of Things, Marketing & Customer-Centricity, Distribution, Claims, Fraud, Cybersecurity, Investment Management, Regulation and Product Development. Additionally, we supplement our statistics with perspectives and discussion from a range of local correspondents in each region.

In this post, which introduces our regional profiles, we present a brief preview of each region including key external and internal challenges, as well as insurer priorities. Each preview kicks off with a Top-Trumps-style summary table of key stats (an exhaustive key explaining each measure is included in the

full report).

In our

Profile on Europe, we draw on the expert opinions of Switzerland-based venture capitalist Spiros Margaris, VC (InsureScan.net, moneymeets & kapilendo), and Charlotte Halkett, former General Manager of Communications at UK-based telematics provider Insure The Box (now MD of Buzzvault at Buzzmove). For all their insights, simply download the full version of the report. Below is a sneak preview of the stats and themes we discuss in the full profile.

"Europe presents us with a potentially gloomy picture, with the on-going issues of low interest rates and weak growth prospects, to which we may add growing regulatory burdens and political uncertainty – especially in the wake of the UK’s Brexit vote. However, we have nonetheless gathered plenty of evidence that incumbents have the tools in place both to come through and to hold their own against new entrants." — Helen Raff, Head of Content at Insurance Nexus

i) The External Challenges: Europe

In Europe, the top three external challenges facing the insurance industry as a whole follow the global trend we outlined in our

earlier post on Industry Challenges: 'Technological advancement', 'Changing customer expectations' and 'Digital channel capabilities'.

Looking further down the table, some points of note are the higher position attained by ‘Increased regulation’ and the lower positions of ‘New emerging risks’ and ‘Catastrophe risk’. Compared to some of the other regions we examine, like Africa and Asia-Pacific, Europe is relatively sheltered from natural catastrophes and the associated risks that they bring with them, which possibly explains the lower scores we find for ‘New emerging risks’ and ‘Catastrophe risk’.

As for the prominence of the regulatory challenge, we need look no further than the EU’s Solvency II, which came into effect at the start of 2016 and represents the first major shakeup of the landscape since the 1970s.

--- ii) The Internal Challenges: Europe

Internally, the top challenges are close to the global trend we outlined in our

earlier post on Industry Challenges: ‘Lack of innovation capabilities’ and ‘Legacy systems’ take first and second place respectively, with ‘Siloed operations’ edging out ‘Finding and hiring talent’in third place.

--- iii) Insurer Priorities: Europe

--- iii) Insurer Priorities: Europe

These are the priority areas on which European insurers lead our other regions, out of our shortlist of 15 priority areas presented in our

earlier post on Insurer Priorities:

"Customer-centricity is an important issue because insurance is a 'trusted good'. To address social values and preferences is important. Customer-centricity means building trust, branding and a business model based on relational values. Not for nothing: Empirical evidence shows that identity is the strongest customer KPI." — Andreas Staub, Manager Partner at FehrAdvice

In our

full profile for Europe, we dig deeper into these challenges and priority areas on a more qualitative note, with insights from our two regional contributors, Spiros Margarisand Charlotte Halkett. Key focal points of our discussion include:

- Growth opportunities in a relatively saturated market

- The European consumer and Europe’s ‘early adopter’ status

- How European insurers are using new technologies to deliver on their customer promise

- Dynamic, real-time insurance and IoT

- Progress on developing connected insurance models across the continent as a whole

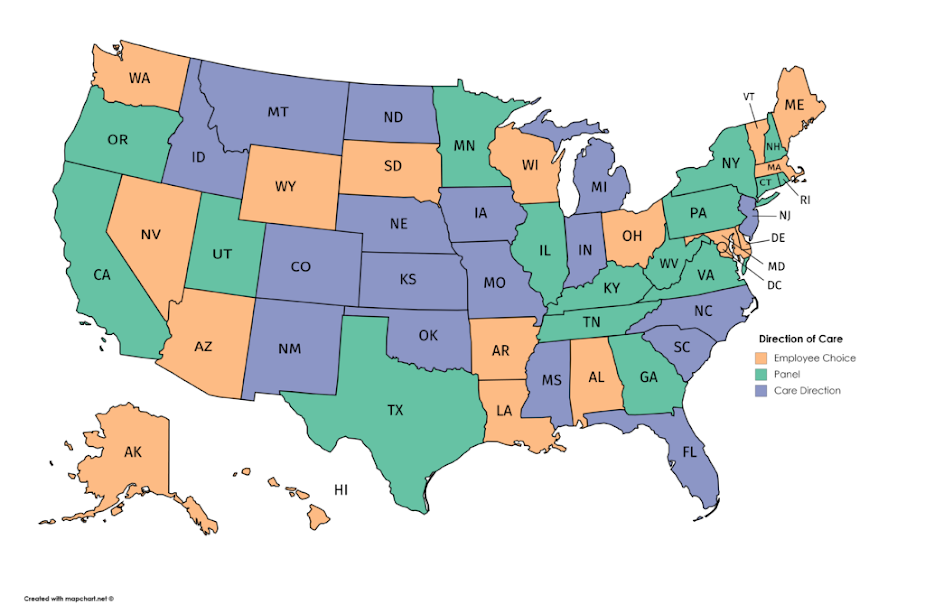

NORTH AMERICA PROFILE: Preview

In our profile on North America, we corroborate, and expand on, our stats via the seasoned perspectives of Chicago-based Stephen Applebaum, Managing Partner at Insurance Solutions Group, and Boston-based Matthew Josefowicz, CEO at Novarica. Below is a sneak preview of the themes we tackle in the full profile.

"Rising claims costs – both attritional and catastrophic – against a backdrop of low interest rates calls for a new approach to insurance in North America. That the lion’s share of Insurtech deal money has been going to US companies suggests that this change of approach may not be long in coming." — Marsha Irving, Head of Innovation / Commercial Director at Insurance Nexus

--- i) The External Challenges: North America

In North America, the top external challenges for the insurance sector as a whole follow the global trend from our

earlier post on Industry Challenges, with ‘Technological advancement’ and ‘Changing customer expectations’ taking 1st and 2nd place respectively, except that in 3rd place we find ‘New emerging risks’. In comparison, this comes 4th globally and only makes 6th place in Europe – which, as we indicated in our Europe preview above, likely reflects some parts of the world being more exposed to disasters (and hence concomitant risks) than others. Further down the table, 'Increased competition' moves up a place, knocking 'Increased regulation' down one spot to 7th.

See also: How Is Insurtech Different in Asia?

--- ii) The Internal Challenges: North America

Looking internally, the top challenges reflect the global trend we outlined in our

earlier post on Industry Challenges, except that ‘Legacy systems’ wrests the top slot from ‘Lack of innovation capabilities’ (which, by way of comparison, comes first in Europe and Asia-Pacific).

Innovation is, at its heart, customer-driven, and, as part of our Regional Profiles, we compare the insurer-customer relationship in North America with what we find in our other key regions – and this may well explain the different positions ascribed to ‘Lack of innovation capabilities’ in their respective challenge tables. The parallel suggestion is that ‘Legacy systems’ play more of a role in North America, which is another theme our full profile investigates in more depth.

"Legacy systems has long been a core challenge for executives across functions within insurance carriers who are focused on innovation, customer experience and efficiency. Impacting product development, applying analytics, claims modernization, marketing optimization and more, it’s no surprise this is such a top priority for insurers. In the future, I think we’ll see more legacy system upgrades across insurers looking to digitize and streamline operations." —Emma Sheard, Head of Strategy at Insurance Nexus

--- iii) Insurer Priorities: North America

These are the priority areas on which North American insurers lead our other regions, out of our shortlist of 15 priority areas as presented in our

earlier post on Insurer Priorities:

In our full profile for North America, we return to these challenges and priority areas, bouncing them off our two regional contributors, Stephen Applebaum and Matthew Josefowicz. Some of our key points of interest that emerge, and which we discuss in detail, are:

- Insurers’ renewed focus on their primary underwriting business in the face of low interest rates and impending market disruption

- The rise of the ‘new consumer’ and how this is changing the insurer-customer relationship

- Customer-centricity as the prime mover of distribution and product

- The impact of legacy systems and regulation on (re)insurers’ innovation and transformation efforts

- How insurers are to unlock new sources of growth in a mature market

ASIA-PACIFIC PROFILE: Preview

Our exploration of Asia-Pacific brings into play, alongside our statistics, the experience and perspectives of three in-region commentators: Steve Tunstall, CEO at Singapore-based Insurtech start-up Inzsure, João Neiva, Head of Innovation, IT and Business Change at Zurich Topas Life in Indonesia, and HK-based David Piesse, Chairman of IIS Ambassadors &Ambassador Asia Pacific at the International Insurance Society (IIS). What follows is a preview of our Asia-Pacific Profile (full thing

here).

--- i) The External Challenges: Asia-Pacific

In Asia-Pacific, the top external challenges facing insurance as a whole follow the global trend familiar from our

earlier post on Industry Challenges, with ‘Technological advancement’ and ‘Changing customer expectations’ taking first and second place respectively, except that, as in North America, in third place we find ‘New emerging risks’(by way of comparison, this challenge only makes 6th place in Europe).

One possible explanation for the higher ranking of ‘New emerging risks’ is to be found in the related challenge of ‘Catastrophe risk’ – which also results one place higher in Asia-Pacific than was the global trend.

While natural catastrophes are not emerging risks, in the sense that they have always occurred, their consequences are becoming more multifaceted as a result of the massive growth in urban areas and the rife interconnection of business in today’s globalised economy. This has introduced a new class of accumulation risk which could justifiably be called ‘emerging’.

We know anecdotally that this phenomenon is particularly pronounced in the APAC region, which boasts some of the densest urban and business conglomerations in the world, in and among noted catastrophe zones, and the trend towards urbanisation and megacities is only set to continue.

See also: Insurtech Ecosystem Emerging in Asia

Another detail we notice with the external challenges is the relatively high position attained by ‘Increased competition’ (two places up on the global trend), and we believe this is a natural consequence of the expansion opportunities on offer in the region. As we uncover in the course of our full Regional Profile for Asia-Pacific, this uneasy marriage of high growth and high competition is in many ways APAC’s defining market characteristic: to win is only ever to win big (

get the full profile).

"The most significant challenges for insurers in Asia, from an IT perspective are: firstly, moving services to online sales – for agents, brokers, bancassurance and direct to customers; secondly, providing instant and ideally paperless servicing on claims management; and finally, the development of Chinese Insurtech players if they decide to compete outside of their local market." — Ash Shah, Regional CIO and Chief of Staff Property and Casualty at AXA Asia

--- ii) The Internal Challenges: Asia-Pacific

The internal challenges highlighted by APAC respondents exactly replicate the global trend we staked out in earlier post on Industry Challenges, with a top three constituted by: ‘Lack of innovation capabilities’, ‘Legacy systems’ and ‘Finding and hiring talent’.

--- iii) Insurer Priorities: Asia-Pacific

--- iii) Insurer Priorities: Asia-Pacific

The following 6 priority areas are those on which insurers in Asia-Pacific lead our other regions, out of our shortlist of 15 priority areas introduced in our earlier post on Insurer Priorities:

"Doing nothing is not an option any longer. The top priority for many CEOs is to acquire the capabilities to deliver true digital innovation that achieves competitive advantage in a very short period of time. Understanding the agile and flexible lean techniques used within the start-up world can help. Analytics, the IoT or mobile are just enablers to ease such transformation." — Sabine VanderLinden, Managing Director at Startupbootcamp

"Doing nothing is not an option any longer. The top priority for many CEOs is to acquire the capabilities to deliver true digital innovation that achieves competitive advantage in a very short period of time. Understanding the agile and flexible lean techniques used within the start-up world can help. Analytics, the IoT or mobile are just enablers to ease such transformation." — Sabine VanderLinden, Managing Director at Startupbootcamp

We return to these regional constellation of challenges and priority areas in our full Regional Profile for Asia-Pac, in which we present the direct market testimonies of Steve Tunstall, Joao Neiva and David Piesse. Key areas that we drill down into are:

- The high-growth, high-competition dynamic inherent in the Asia-Pacific insurance market

- The new calling for customer-centricity and the related question of disruption

- Using data and analytics to create more customer-centric products, such as personalised, on-demand insurance

- APAC distribution landscape and what insurers are doing to ensure scale for their products

- How to successfully manage back-office digital transformation

PROFILES FOR LATAM, MIDDLE EAST, AFRICA AND CENTRAL ASIA

We are unable, given the constraints of this post, to provide full previews of our profiles for these regions. Suffice it to say, like the profiles that are presented here, they are fundamentally structured around discussion with in-region correspondents:

--- LATAM

Luiz Bruzadin, Founder at Brazil-based Insurtech Segure.me, and Hilario Itriago, CEO at VC fund Bullfrog Venture

--- MIDDLE EAST

Cherian John, 2017-18 Regional Chairman - Europe, Middle East & Africa at Million Dollar Round Table (MDRT), Ahmad Al-Qarishi, Chief Risk Officer and Chief Actuary at Saudi Re, and Israel-based Dani Cozer, Reinsurance Operations at I.D.I. Direct Insurance

--- AFRICA

George Otieno Ochieng, Claims Manager at Britam General Insurance Company, and Belhassen Tonat, Head of Non-Life at Munich Reinsurance Company of Africa Ltd

--- CENTRAL ASIA

Kevin Hartnett, Chief Operating Officer at The Insurance Corporation of Afghanistan (ICA)

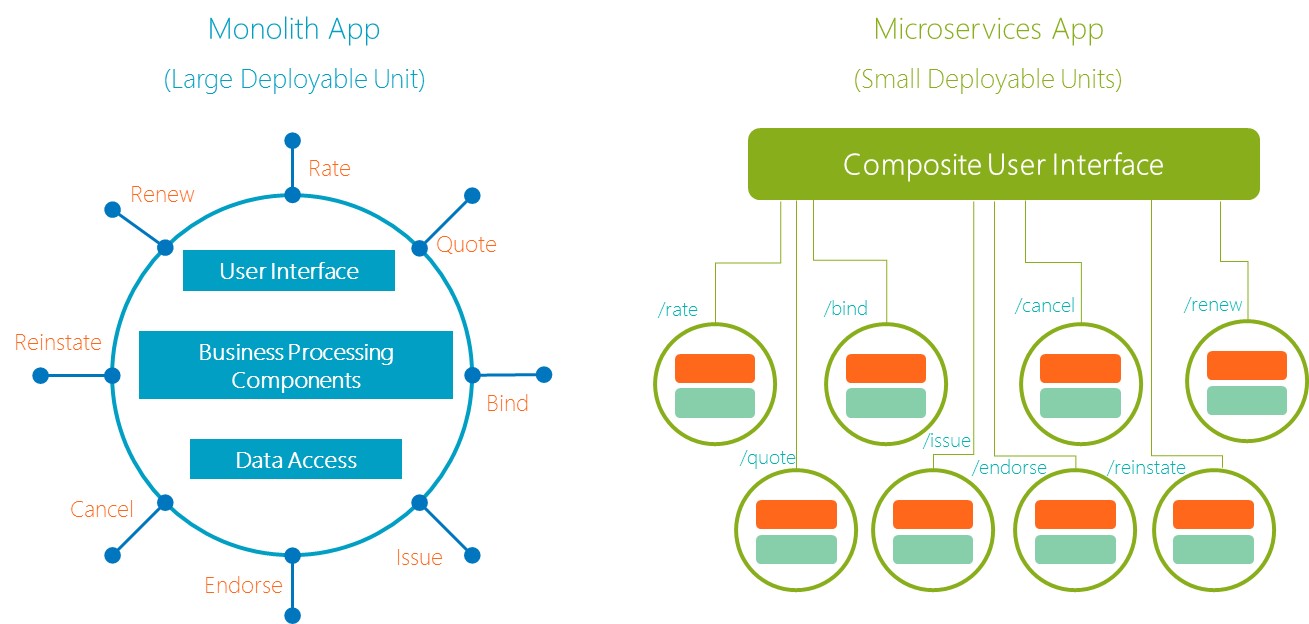

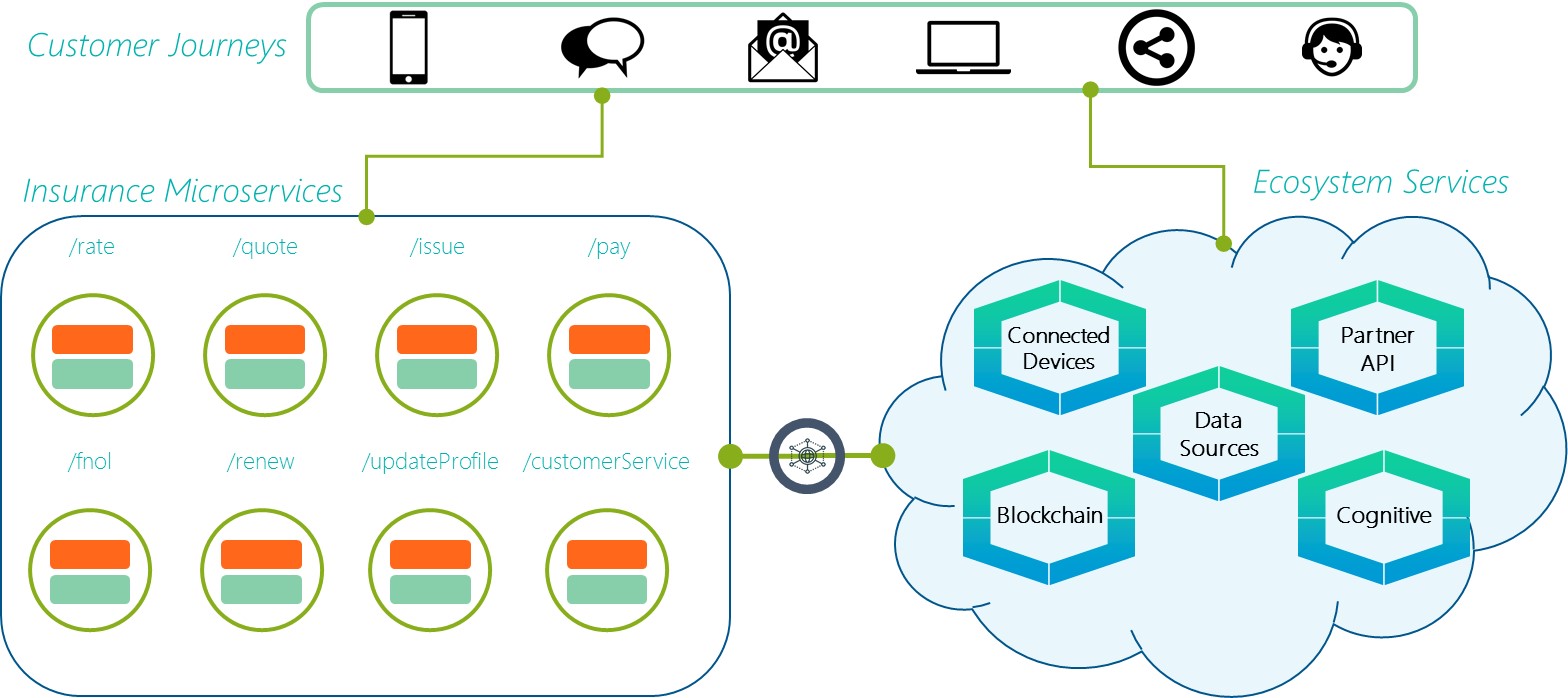

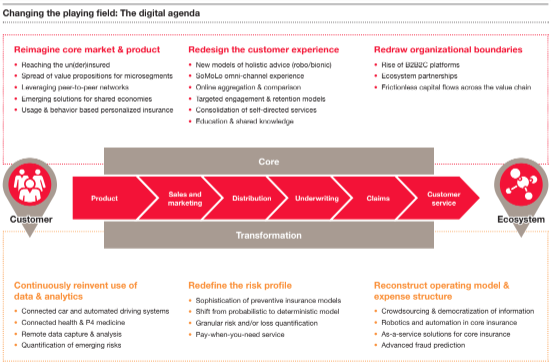

Building a digital platform

Although we tend to understand digital transformation and modernization of technology platforms as sequential, multi-year events with multi-million dollar price tags, finite delivery dates and fixed realization periods, true modernization requires a foundational

shift in the organizational culture, operating model, and underlying architecture that enables business flexibility and agility.

Building a digital platform that will take your company into the future — not just respond to current needs — is critical to prolonged success.

Insurers are currently enabling access to data across various domains and dimensions, but the companies going the extra mile to design a futuristic platform architecture are the most likely to benefit in the long term. Future-oriented platform architectures should be able to:

Building a digital platform

Although we tend to understand digital transformation and modernization of technology platforms as sequential, multi-year events with multi-million dollar price tags, finite delivery dates and fixed realization periods, true modernization requires a foundational

shift in the organizational culture, operating model, and underlying architecture that enables business flexibility and agility.

Building a digital platform that will take your company into the future — not just respond to current needs — is critical to prolonged success.

Insurers are currently enabling access to data across various domains and dimensions, but the companies going the extra mile to design a futuristic platform architecture are the most likely to benefit in the long term. Future-oriented platform architectures should be able to: