4 Key Qualities to Leverage Insurtech

Most companies lack the vision to connect even obvious dots if they’ve never before been connected. Don’t be most companies!

Most companies lack the vision to connect even obvious dots if they’ve never before been connected. Don’t be most companies!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Roi Agababa is CEO of Novidea, provider of the first cloud-based platform for real-time business intelligence and agency/brokerage workflow management for the insurance distribution market.

Costs for workers’ comp could triple by 2030 with no change in indemnity benefit levels, raising questions about the viability of the system.

At the WCRI Annual Issues & Research Conference, Dr. Richard Victor, former CEO of WCRI and currently a senior fellow with Sedgwick Institute, discussed his views of workers’ compensation in the future.

The workers’ compensation system was a compromise between labor and business designed to provide no-fault benefits in an environment that gave exclusive remedy protections to employers. Over the years, there have been ebbs and flows to the system in an effort to maintain balance. There is a constant struggle to balance benefits to workers with the costs of the system paid by employers. In the past, when the workers’ compensation system got out of balance, it was due to actions from those within the system. That is something the system could correct with regulatory change. However, right now, there are things happening outside of the workers’ compensation system that could significantly affect it and cause a rethinking of the grand bargain.

Emerging labor shortages

Retiring baby boomers will cause labor shortages in healthcare and the insurance industry, which will delay claims and medical care. This will ultimately increase claims costs.

See also: The State of Workers’ Compensation

In addition, a stronger economy is ultimately going to lead to a severe labor shortage. When you pair the aging workforce and people retiring with a growing job market, you end up with not enough qualified applicants to fill the positions. Employers have to relax their hiring standards. This leads to unqualified applicants being hired. These people will likely have higher accident rates.

Changes in the non-occupational health system

As workers see their out-of-pocket health insurance costs rise, it becomes more attractive to try to shift illness and injury episodes into the workers’ compensation system. Richard feels that this shifting will result in a 25% increase in workers’ compensation claims by 2030. With soft tissue injuries, it would be very easy for the worker to indicate the injury happened at work instead of at home. Disproving that would be very challenging for employers. Higher deductibles will greatly encourage workers to look for these cost-shifting possibilities.

Millions of workers losing health insurance

The number of uninsured workers is expected to decrease significantly as elements of the Affordable Care Act are repealed or weakened. These uninsured workers are also highly encouraged to shift their treatment into the workers’ compensation system. Richard estimates a 15% increase in workers’ compensation claims due to this.

Aging workforce

The injury rates for the older workers is higher than for younger workers. As the U.S. workforce ages, we will see higher injury rates across the employee population.

Federal immigration policies and practices

Limiting the flow of immigrants into the U.S. at a time there is a labor shortage will only compound the problem. The only way to grow our workforce to keep up with the demand is with immigrants. All of the growth in the labor force going forward is projected to come from immigrants. Roughly 15% of all healthcare workers in the U.S. are foreign-born. If we discourage immigration into this country, Richard feels it could cause a labor shortage in the healthcare industry. It does not even take a change in policy to see a change in immigration flow. After the Brexit vote there was a significant reduction in European nurses registering to work in the U.K. This is even though there had yet to be a policy change in the country.

See also: Healthcare Reform’s Effects on Workers’ Compensation

Conclusions

Taking all of the outside factors into consideration, Richard estimates a 55% increase in the number of workers’ compensation claims by the year 2030. When you add in medical inflation the costs of the workers’ compensation system could triple by 2030 with no change in indemnity benefit levels. With this significant increase in costs, there will be questions about the continued viability of workers’ compensation.

What is the solution? Are there viable options to traditional workers’ compensation? ERISA-style plans like the opt out in Texas have been widely criticized for providing inadequate protections for injured workers. Union carveout plans only apply to a very small sector of the workforce. Could we see workers’ compensation claims organizations become accountable to both employers and workers, with employees having the ability to choose which claims organization they want to use?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Walls is the vice president, client engagement, at Safety National.

He is also the founder of the Work Comp Analysis Group on LinkedIn, which is the largest discussion community dedicated to workers' compensation issues.

For health insurers, digital technology offers new ways to manage risk that rely less on face-to-face and traditional clinical assessment.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Ross Campbell is chief underwriter, research and development, based in Gen Re’s London office.

As the world becomes more connected, cyber risk appears as a bigger threat on the digital transformation journey of insurance companies.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Zeynep Stefan is a post-graduate student in Munich studying financial deepening and mentoring startup companies in insurtech, while writing for insurance publications in Turkey.

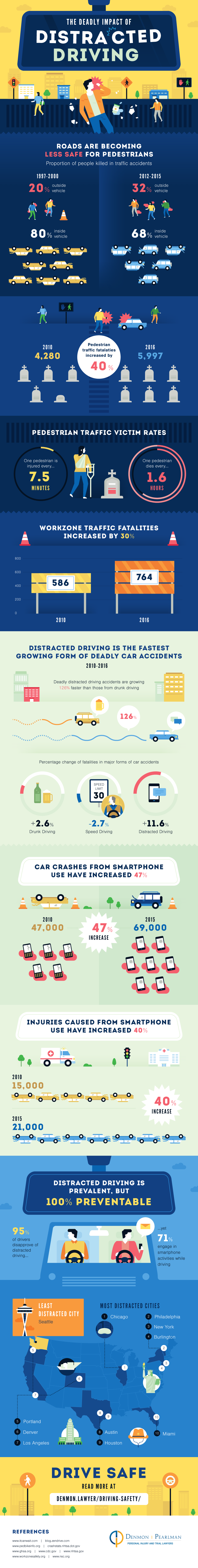

Despite awareness campaigns, 52% of accidents had significant phone distraction beforehand, according to Cambridge Mobile Telematics.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Christian Denmon is a Tampa, Florida trial lawyer specializing in personal injury and divorce. He is the founding partner of Denmon & Denmon. A truly progressive firm, the firm offers fixed fee engagements, service guarantees and a focus on picking the right process to lead to a principled settlement for the client. He lives in St. Petersburg with his wife and two children.

Bank customers must use both a physical debit card and a PIN. For increased security, insurers need similar multifactor identification.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Patrick Cox is chairman and CEO of TRUSTID, which enables companies to increase the efficiency of their fraud-fighting efforts through pre-answer caller authentication and the creation of trusted caller flows that avoid identity interrogation, allowing resources to be focused on real threats.

Customers are acquiring insurance policies much faster and easier with the help of automated processes.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike de Waal is senior vice president of sales at Majesco.

It’s time to dedicate resources on several fronts to get back to the original intent of the workers' compensation system.

Workers’ compensation was designed to reduce litigation by trading out the employee’s right to sue his or her employer for negligence in exchange for limited guarantee of care and compensation. This exclusive remedy “bargain” was the justification for why the system was created a little more than 100 years ago. If we look at intent and where we are today, it’s a failure (albeit a fixable one).

Currently, the workers’ comp system is thought of as one of the more litigious marketplaces for insurance and healthcare. It doesn’t reduce litigation; it simply changes (and in some cases streamlines) the fight. We need to wake up and say ENOUGH! It’s time to dedicate resources on several fronts to get back to the original intent of this system.

Impact Analysis

In 2014, California Workers’ Compensation Institute released a study that provided a strong scientific approach to quantifying impact. The study showed that, if an injured party hired a lawyer, the associated costs went up on average by $40,000 for permanent disability payments and $25,000 in terms of temporary total disability benefits — even if the case never went to court. That is staggering!

Prior to this study, there was a general understanding that the system was not functioning as intended, but, when the hard numbers were presented in a very defensible analysis, it was truly shocking. More importantly, the study demonstrated that the injured worker doesn’t benefit from a litigious fight, either. It isn’t good for anyone (except maybe the lawyers) when things devolve to the point where attorneys become involved with a claim.

See also: 2018 Workers’ Comp Issues to Watch

To determine whether things have improved since the release of the CWCI study, and if so by how much, I am involved with a new study. If the initial findings hold up, I can assure you that the situation has not gotten better. It’s far more likely that it’s only gotten worse. Doing a bit more digging on the impact of litigation on claims costs, we examined data culled from multiple claims companies. Several points stood out from the early informal analysis, most notably that, across all claims, on average:

These numbers are considerable and don’t even focus on the out-of-pocket costs of the attorney’s fees, direct litigation costs or the impact the additional friction causes in claims overhead costs. One of the more provocative initial findings shows that, when carriers distinguish between claims that are litigated and claims that are just represented and haven’t escalated to litigation, there is little difference in outcomes. If anything, initial figures suggest the worst outcomes are more likely in the claims that are represented but not litigated (carriers have different criteria for these categories, so it’s not a conclusive finding).

It is clear that, once the injured worker decides he or she needs to get an attorney, the horse is already out of the barn. We have to get IN FRONT of this event — and not just react to it. The future health of the workers’ comp industry depends on this.

See also: States of Confusion: Workers Comp Extraterritorial Issues

There are lots of opinions on where to go from here. But real solutions are on the table. Before we examine all of this, however, it’s important to understand why injured workers hire attorneys to begin with. (Hint: It’s rarely because they are looking to score a massive payout). In my next article, I will dive into these reasons and how to remedy them so that we can return the workers’ comp system to its original intent.

As first published in WorkCompWire.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Gregory Moore is the former chief commercial officer of CLARA Analytics, a division of LeanTaaS and a leading predictive analytics company for workers’ compensation.

Prior to joining CLARA Analytics, Moore founded Harbor Health Systems, which he led for 16 years.

Combining workplace data with evolving data analytics and machine learning can improve productivity, safety and fraud rates.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Walls is the vice president, client engagement, at Safety National.

He is also the founder of the Work Comp Analysis Group on LinkedIn, which is the largest discussion community dedicated to workers' compensation issues.

As Steve Jobs said, “Picasso had a saying, ‘Good artists copy, great artists steal.’" Innovators need to be like Picasso.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Vivek Wadhwa is a fellow at Arthur and Toni Rembe Rock Center for Corporate Governance, Stanford University; director of research at the Center for Entrepreneurship and Research Commercialization at the Pratt School of Engineering, Duke University; and distinguished fellow at Singularity University.