Why 5G Will Rock the Insurance World

After mobile internet, smart phones and 4G changed the way customers consumed, 5G is about to change everything again.

After mobile internet, smart phones and 4G changed the way customers consumed, 5G is about to change everything again.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Dr. Robin Kiera has worked in several management positions in insurance and finance. Kiera is a renowned insurance and insurtech expert. He regularly speaks at technology conferences around the world as a keynote or panelist.

GDPR is the most significant data privacy regulation ever. The implications reach way beyond Europe--and create a major opportunity.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Innovation Event

We're going to try something new this week. Our CTO, Joe Estes, has built some exceptional chat capabilities into our Innovator's Edge platform, and I'd like to see if we can't use them to jointly make progress on a crucial topic: How do we measure our progress toward innovation? How do we kill bad ideas as quickly (and inexpensively) as possible while making sure the good ideas get identified and nurtured and produce the biggest possible wins for the company?

Our mantra at ITL is, "Nobody is as smart as everybody," so we'd like to get everybody involved in the discussion, which will be guided by a powerhouse group of experts on the topic and which will last for at least the next week. To join us, if you aren't already a registered user of IE, just click here and enroll. (It's quick and free.) Then click here to go directly to the group, called "KPIs: How to Use Analytics to Measure and Drive Innovation." Click join group and join the conversation.

Please let me know at paul@insurancethoughtleadership.com if you have any problems or questions.

We'll be joined by:

--Michael Schrage, a researcher at the MIT Media Lab and a prolific author on innovation.

--Amy Radin, who has a distinguished career at several financial services firms, including as CMO at AXA, and who is the author of the forthcoming "The Change Maker's Playbook: How to Seek, Seed and Scale Innovation in Any Company."

--Guy Fraker, ITL's chief innovation officer, whose decades in the insurance industry include some of the most successful innovation programs yet produced.

Much more detail on our guides, plus materials that are the basis for the discussion, are available inside IE.

I think this will be a great discussion. I hope you'll join us.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

The potential business use cases and high business value of geographic information systems (GIS) warrant serious attention.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

Four main problems have prevented life insurance companies from embracing digital transformation in their claims processes.

Outdated Processes: The life insurance industry is a 258-year-old industry, and, though claims may make it in the top 10 list of issues for the CIO, the focus for the company as a whole tends to be on generating revenue. The claims staff works overtime to come up with various duct-tape systems filled with Excel spreadsheets, Access databases or various systems to balance the needs of regulators, old processes (this is how we have always done things) and beneficiaries. Beneficiaries wind up supplying the same information in multiple documents, sending the same documentation multiple times and chasing down faxes/mails for next steps.

See also: How IOT Will Change Claims Process

Legacy Systems: On average, the claims staff touches four to 10 systems to process one claim. The claims module is most likely attached to policy administration systems in which modules don’t get updated often. To innovate claims processes gives CIOs headaches because they have to rip apart the monolithic and old systems that run the entire business. The mentality – “If it ain’t broke, don’t fix it” -- creeps in.

Unclaimed Claims: There is more than $14 billion of unclaimed life insurance policies, and the number keeps growing $1 billion a year. Why is that? Ask yourself one simple question: How many times have you been asked to update your beneficiaries? Ask yourself another simple question: Have you informed your beneficiaries about policies you have for them? One of our co-founders could have been another drop in the bucket for unclaimed claims. He was at his father’s funeral, and one of his father’s co-workers came to give Jason his condolences. The co-worker said, “If you need help with paperwork, please let me know.” Jason said, “What paperwork?” He learned that his dad had a life insurance policy.

Laws Changing: Each state and country has its own governing laws that need to be abided with when processing claims. One state may require a death certificate while another state may ask for additional documentation.

How might claims departments innovate in the face of outdated processes, legacy systems, data that needs clean-up and changing regulation?

There are three key recommendations:

Keep Learning – Insurtech is HOT! Books are being written, conferences are popping up and fresh faces (like me) are appearing. Keep reading, attending and talking to learn what is happening in the space and how to navigate change.

Keep Seeking – Insurtech is HOT! Which means, there are startups that are popping up to help solve complex problems. Benekiva is my startup with three other founders, and we are on a mission to help bridge the gap between life insurance companies and the intended beneficiaries, through beneficiary management and claims automation. What is cool about us – we can work with legacy systems, so you don’t have to pour millions into the work. There are other insurtech startups that are solving other pain points. What’s great about startups – they are small, nimble and hungry, which equates to: They will do whatever you need them to do…to a certain extent. Partnering with startups can leapfrog your innovation efforts and their startup mentality may rub-off on your staff.

Keep Trying – You eat an elephant one bite at a time. I see claims processes as a big elephant, and the only way to improve is by “bitsizing.” What is one area of claims that can be improved? Identify that and try to find or partner up on a solution. Remember: Insurtech is HOT! I’ve seen organizations want to tackle the “elephant,” and unfortunately, those projects can take two years and longer and your strong talent is burned out at the end. What you get at the end is an “old” system – two years is a long time in tech.

See also: Making Life Insurance Personal

To innovate in claims, the C-suite needs to make claims a priority and see it as a customer-experience issue.

My five-year vision is to have the following experience when giving presentations about Benekiva:

“Bobbie, I just submitted a claim, and I instantly received notification that money is available in the account. I also received a text message from an adviser whom my dad was using and who is going to help me plan for my future.”

Outdated Processes: The life insurance industry is a 258-year-old industry, and, though claims may make it in the top 10 list of issues for the CIO, the focus for the company as a whole tends to be on generating revenue. The claims staff works overtime to come up with various duct-tape systems filled with Excel spreadsheets, Access databases or various systems to balance the needs of regulators, old processes (this is how we have always done things) and beneficiaries. Beneficiaries wind up supplying the same information in multiple documents, sending the same documentation multiple times and chasing down faxes/mails for next steps.

See also: How IOT Will Change Claims Process

Legacy Systems: On average, the claims staff touches four to 10 systems to process one claim. The claims module is most likely attached to policy administration systems in which modules don’t get updated often. To innovate claims processes gives CIOs headaches because they have to rip apart the monolithic and old systems that run the entire business. The mentality – “If it ain’t broke, don’t fix it” -- creeps in.

Unclaimed Claims: There is more than $14 billion of unclaimed life insurance policies, and the number keeps growing $1 billion a year. Why is that? Ask yourself one simple question: How many times have you been asked to update your beneficiaries? Ask yourself another simple question: Have you informed your beneficiaries about policies you have for them? One of our co-founders could have been another drop in the bucket for unclaimed claims. He was at his father’s funeral, and one of his father’s co-workers came to give Jason his condolences. The co-worker said, “If you need help with paperwork, please let me know.” Jason said, “What paperwork?” He learned that his dad had a life insurance policy.

Laws Changing: Each state and country has its own governing laws that need to be abided with when processing claims. One state may require a death certificate while another state may ask for additional documentation.

How might claims departments innovate in the face of outdated processes, legacy systems, data that needs clean-up and changing regulation?

There are three key recommendations:

Keep Learning – Insurtech is HOT! Books are being written, conferences are popping up and fresh faces (like me) are appearing. Keep reading, attending and talking to learn what is happening in the space and how to navigate change.

Keep Seeking – Insurtech is HOT! Which means, there are startups that are popping up to help solve complex problems. Benekiva is my startup with three other founders, and we are on a mission to help bridge the gap between life insurance companies and the intended beneficiaries, through beneficiary management and claims automation. What is cool about us – we can work with legacy systems, so you don’t have to pour millions into the work. There are other insurtech startups that are solving other pain points. What’s great about startups – they are small, nimble and hungry, which equates to: They will do whatever you need them to do…to a certain extent. Partnering with startups can leapfrog your innovation efforts and their startup mentality may rub-off on your staff.

Keep Trying – You eat an elephant one bite at a time. I see claims processes as a big elephant, and the only way to improve is by “bitsizing.” What is one area of claims that can be improved? Identify that and try to find or partner up on a solution. Remember: Insurtech is HOT! I’ve seen organizations want to tackle the “elephant,” and unfortunately, those projects can take two years and longer and your strong talent is burned out at the end. What you get at the end is an “old” system – two years is a long time in tech.

See also: Making Life Insurance Personal

To innovate in claims, the C-suite needs to make claims a priority and see it as a customer-experience issue.

My five-year vision is to have the following experience when giving presentations about Benekiva:

“Bobbie, I just submitted a claim, and I instantly received notification that money is available in the account. I also received a text message from an adviser whom my dad was using and who is going to help me plan for my future.”

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Bobbie Shrivastav is founder and managing principal of Solvrays.

Previously, she was co-founder and CEO of Docsmore, where she introduced an interactive, workflow-driven document management solution to optimize operations. She then co-founded Benekiva, where, as COO, she spearheaded initiatives to improve efficiency and customer engagement in life insurance.

She co-hosts the Insurance Sync podcast with Laurel Jordan, where they explore industry trends and innovations. She is co-author of the book series "Momentum: Makers and Builders" with Renu Ann Joseph.

The conventional annuity looks tired in the digital world. It’s an old world approach long overdue for a refresh and reinvention.

The financial literacy problem

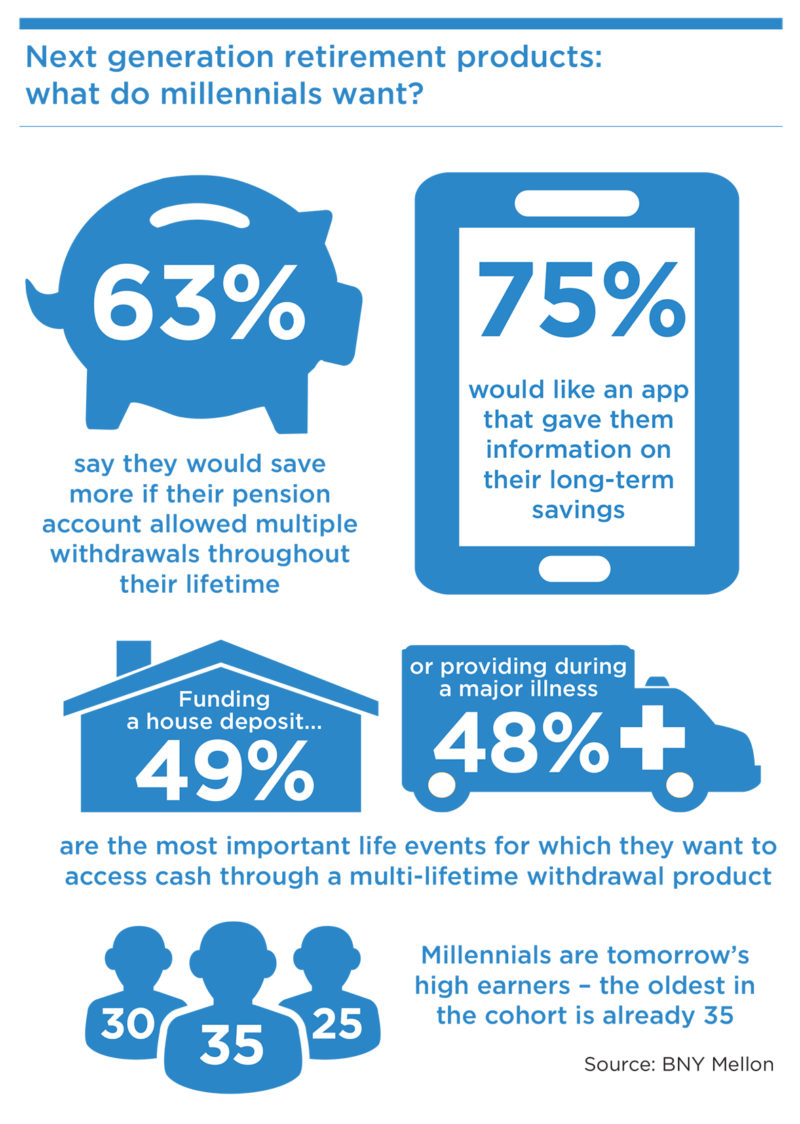

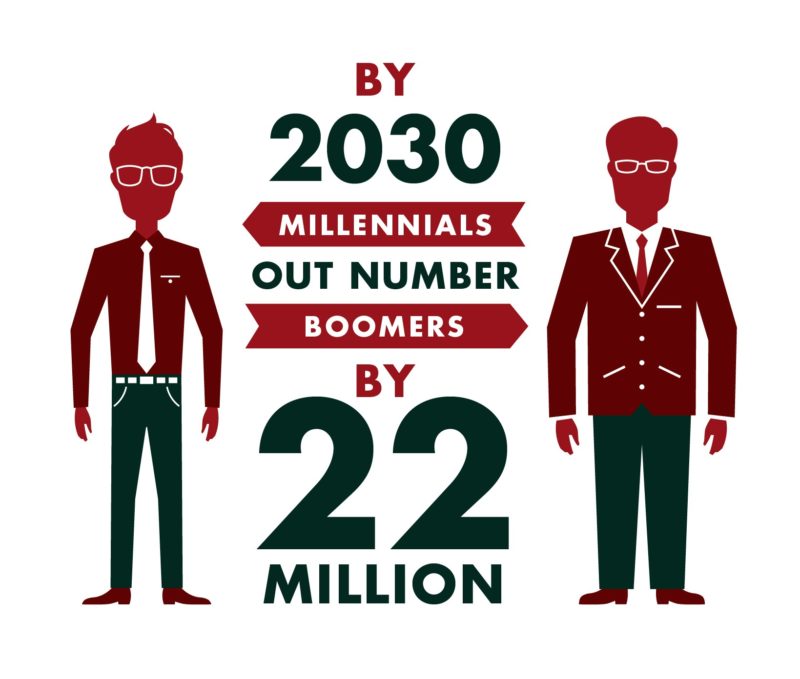

There is another dynamic that is important to consider when looking at how the wealth management industry serves the millennial generation. Financial literacy, or the lack of it!

The millennial generation may be more informed than their predecessors, but not necessarily in everything. They are more likely to know who Kim Kardashian is than to understand the impact of inflation on their savings over time.

In itself, there’s nothing new in this, but the fact is that the level of financial literacy in the U.S. has been dropping for years.

According to survey results by U.S. regulator FINRA, the level of personal finance literacy has fallen every three years since 2009. They found that 76% of millennials lack basic financial knowledge. Which is hardly surprising when only 14% of U.S. students are required to take a personal finance class in school.

See also: Raising the Bar on User Experience

The FINRA survey also reported a massive gap between the level of financial understanding and the desire to have one. The survey found that 70% of adults aged between 18 and 39 years old “know they will need to be more financially secure, they just don’t know how to get there.”

What is clear from the survey is that this lack of financial literacy is causing stress and anxiety among millennials (who, remember, now account for 40% of the adult population).

The financial literacy problem

There is another dynamic that is important to consider when looking at how the wealth management industry serves the millennial generation. Financial literacy, or the lack of it!

The millennial generation may be more informed than their predecessors, but not necessarily in everything. They are more likely to know who Kim Kardashian is than to understand the impact of inflation on their savings over time.

In itself, there’s nothing new in this, but the fact is that the level of financial literacy in the U.S. has been dropping for years.

According to survey results by U.S. regulator FINRA, the level of personal finance literacy has fallen every three years since 2009. They found that 76% of millennials lack basic financial knowledge. Which is hardly surprising when only 14% of U.S. students are required to take a personal finance class in school.

See also: Raising the Bar on User Experience

The FINRA survey also reported a massive gap between the level of financial understanding and the desire to have one. The survey found that 70% of adults aged between 18 and 39 years old “know they will need to be more financially secure, they just don’t know how to get there.”

What is clear from the survey is that this lack of financial literacy is causing stress and anxiety among millennials (who, remember, now account for 40% of the adult population).

For the rest of the article, click here.

For the rest of the article, click here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Rick Huckstep is chairman of the Digital Insurer, a keynote speaker and an adviser on digital insurance innovation. Huckstep publishes insight on the world of insurtech and is recognized as a Top 10 influencer.

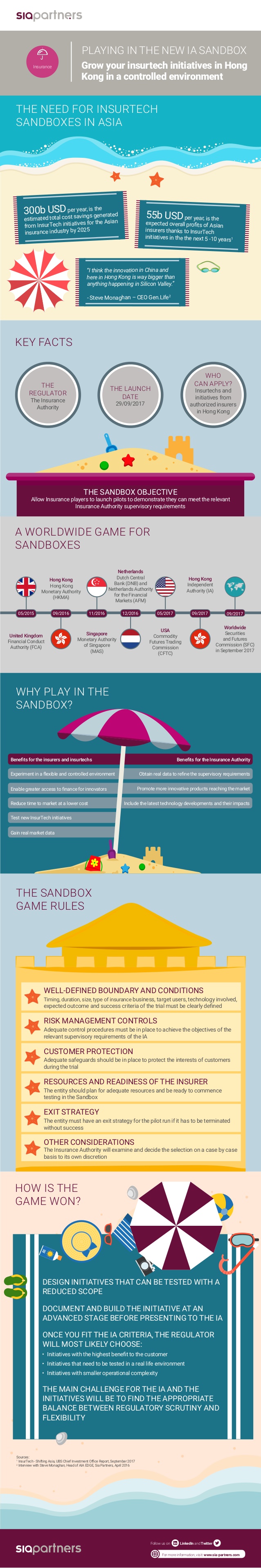

Hong Kong, among others, is helping startups build an initiative in a mentored environment before formally presenting it to regulators.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Charlotte Mery leads the insurance thought leadership for Sia Partners in Asia, a global management consultancy. As an innovation enthusiast, she specializes in supporting organizations in transforming their business to winning the marathon of ever-changing technologies and customer expectations.

Compliance functions need the agility to adjust to business changes and to the inevitable surprises inherent in a dynamic business climate.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Learning from how a Hemingway character went bankrupt, Canada is becoming a regulatory innovation hub for the global insurtech community.

Quebec’s regulator, the AMF, has publicly expressed that it is "open for business" in terms of insurtech/ fintech under CEO Louis Morisset and Superintendent of Solvency Patrick Déry.

FSCO has recently moved to be more flexible within the tight bounds of its mandate, and its successor, FSRA, will be a modern independent agency purposely built for adaptability; it emerges from its cocoon under the guidance of a professional board and the stewardship of its CEO, Mark White, in April 2019.

FSRA and the AMF are positioning themselves to allow experimentation via regulatory sandboxes, whereby players can test initiatives in the field. This sandbox methodology is modeled after the Ontario Security Commission’s LaunchPad initiative.

See also: Global Trend Map No. 19: N. America (Part 1)

You may not have noticed it, but the regulatory ground in two of Canada’s largest provinces has shifted, and the stage is being set for ever-faster innovation in the Canadian insurtech space. In fact, in conversations with Guy Fraker, chief innovation officer at California-based Insurance Thought Leadership and emcee for the InsurTech North Conference in Gatineau in October, he advises that Canada is being looked at as a regulatory innovation hub by the global insurtech community.

Even under the old FSCO regime, Canada’s largest insurer, Intact, pulled off what might be a master stroke in July 2016 when it issued a fleet policy to Uber, providing coverage to tens of thousands of Uber drivers when engaged in Uber activities. So, in one fell swoop, a single insurer swept up tens of thousands of drivers. Intact pulled another coup by partnering with Turo in Canada. Turo is a peer-to-peer car-sharing marketplace that is busy disrupting the sleepy and sloppy car rental industry. This again gives Intact access to thousands of drivers with the stroke of a pen. Further, Intact may be able to leverage the access it has to those drivers to provide full auto coverage and even residential coverages. When these risks are gone, they’re lost to the rest of the market. Striking deals with the likes of Uber and Turo changes the game. In the U.S., Turo partners with Liberty Mutual, and with Allianz in Germany. Uber partners with Allstate, Farmers, James River and Progressive in the U.S. Aviva has pulled off a similar deal in Canada with Uber’s nemesis, Lyft.

Quebec’s regulator, the AMF, has publicly expressed that it is "open for business" in terms of insurtech/ fintech under CEO Louis Morisset and Superintendent of Solvency Patrick Déry.

FSCO has recently moved to be more flexible within the tight bounds of its mandate, and its successor, FSRA, will be a modern independent agency purposely built for adaptability; it emerges from its cocoon under the guidance of a professional board and the stewardship of its CEO, Mark White, in April 2019.

FSRA and the AMF are positioning themselves to allow experimentation via regulatory sandboxes, whereby players can test initiatives in the field. This sandbox methodology is modeled after the Ontario Security Commission’s LaunchPad initiative.

See also: Global Trend Map No. 19: N. America (Part 1)

You may not have noticed it, but the regulatory ground in two of Canada’s largest provinces has shifted, and the stage is being set for ever-faster innovation in the Canadian insurtech space. In fact, in conversations with Guy Fraker, chief innovation officer at California-based Insurance Thought Leadership and emcee for the InsurTech North Conference in Gatineau in October, he advises that Canada is being looked at as a regulatory innovation hub by the global insurtech community.

Even under the old FSCO regime, Canada’s largest insurer, Intact, pulled off what might be a master stroke in July 2016 when it issued a fleet policy to Uber, providing coverage to tens of thousands of Uber drivers when engaged in Uber activities. So, in one fell swoop, a single insurer swept up tens of thousands of drivers. Intact pulled another coup by partnering with Turo in Canada. Turo is a peer-to-peer car-sharing marketplace that is busy disrupting the sleepy and sloppy car rental industry. This again gives Intact access to thousands of drivers with the stroke of a pen. Further, Intact may be able to leverage the access it has to those drivers to provide full auto coverage and even residential coverages. When these risks are gone, they’re lost to the rest of the market. Striking deals with the likes of Uber and Turo changes the game. In the U.S., Turo partners with Liberty Mutual, and with Allianz in Germany. Uber partners with Allstate, Farmers, James River and Progressive in the U.S. Aviva has pulled off a similar deal in Canada with Uber’s nemesis, Lyft.

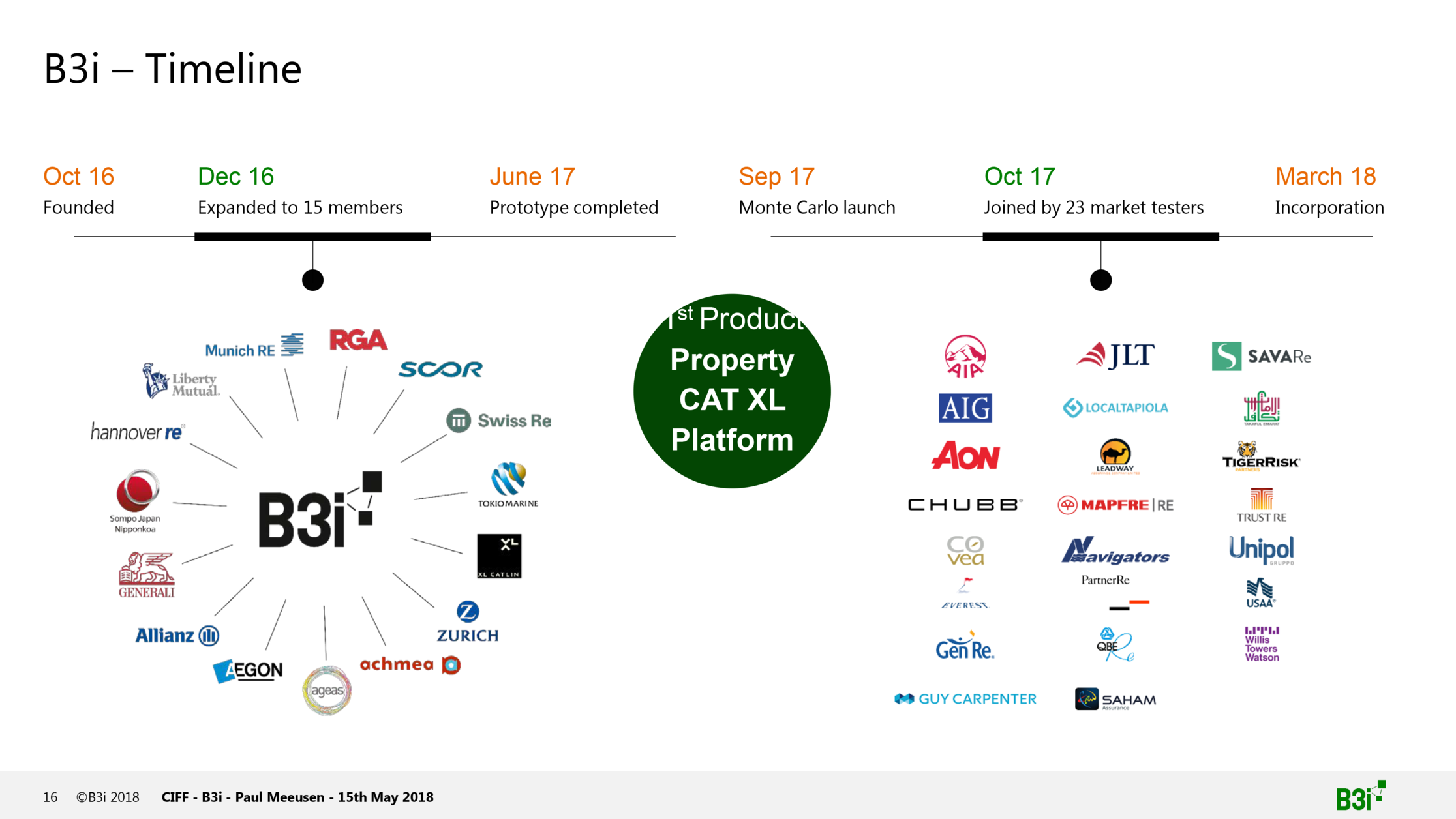

Further afield, B3i, the industry blockchain initiative has been established with the support of 15 large insurers/reinsurers. It is just starting up, but its mission is to remove friction from insurer/reinsurer transactions and risk transfer. When friction goes, so will costs. It is starting out slowly, but things may change suddenly – reshaping whole segments of the market. In addition to the original 15, the initiative has been joined by 23 industry testers.

Further afield, B3i, the industry blockchain initiative has been established with the support of 15 large insurers/reinsurers. It is just starting up, but its mission is to remove friction from insurer/reinsurer transactions and risk transfer. When friction goes, so will costs. It is starting out slowly, but things may change suddenly – reshaping whole segments of the market. In addition to the original 15, the initiative has been joined by 23 industry testers.

In the U.S., The Institutes (the educational body behind the CPCU designation) launched a similar blockchain consortium called RiskBlock, which currently counts 18 members:

In the U.S., The Institutes (the educational body behind the CPCU designation) launched a similar blockchain consortium called RiskBlock, which currently counts 18 members:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Joel Baker founded MSA Research, the analytical research and financial publishing firm entrusted to provide independent, accurate research and analysis to all those who have a stake in the Canadian insurance industry.

The answer is as simple as the smartphone. Sensor data from it can stratify driver risk eight times better than credit scores.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|