Where Is All the Contents Insurance?

28% of U.K. households had no contents insurance whatsoever. That leaves 16 million people and £266 billion of household possessions unprotected.

28% of U.K. households had no contents insurance whatsoever. That leaves 16 million people and £266 billion of household possessions unprotected.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Alexander Cherry leads the research behind Insurance Nexus’ new business ventures, encompassing summits, surveys and industry reports. He is particularly focused on new markets and topics and strives to render market information into a digestible format that bridges the gap between quantitative and qualitative.Alexander Cherry is Head of Content at Buzzmove, a UK-based Insurtech on a mission to take the hassle and inconvenience out of moving home and contents insurance. Before entering the Insurtech sector, Cherry was head of research at Insurance Nexus, supporting a portfolio of insurance events in Europe, North America and East Asia through in-depth industry analysis, trend reports and podcasts.

It's time to consider whether crime victim compensation funds should be used to provide compensation to victims of mass shootings.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

The future lies in leveraging smart technology to streamline sales, increase conversions and have more productive agents and brokers.

Sales is changing. That's a fact.

If your agency is still picking up the phone and hoping for the best, things probably aren't going to turn out the way you imagined.

The real future of insurance lies in leveraging the power of smart technology to streamline the sales process, increase conversions and have more productive agents and brokers.

Sounds like a dream for your business, right?

Every agent and broker wants to be able to sell more efficiently, hitting the right customers with the best products for their needs, and not waste time. Operating this way lets sales professionals shine and provides excellent customer service — something consumers expect today.

So how do you get there?

One way is through the right CRM system. These systems work in three main areas, which we're going to cover in this post:

Smarter Sales Via AI-Powered Sales Insights

Consumers today expect a lot more from brokers and agents than ever before. It's not enough to provide some information and call it a day.

Nope, consumers can get that part done on their own. Thanks to the internet, most consumers have already spent some time researching online and finding the basics. Now, what they are interested in is getting deeper insight and information from sales professionals.

Consumers want to know how a particular product is going to affect their business, where they will be able to see value in their investment and if customer service will continue after purchase.

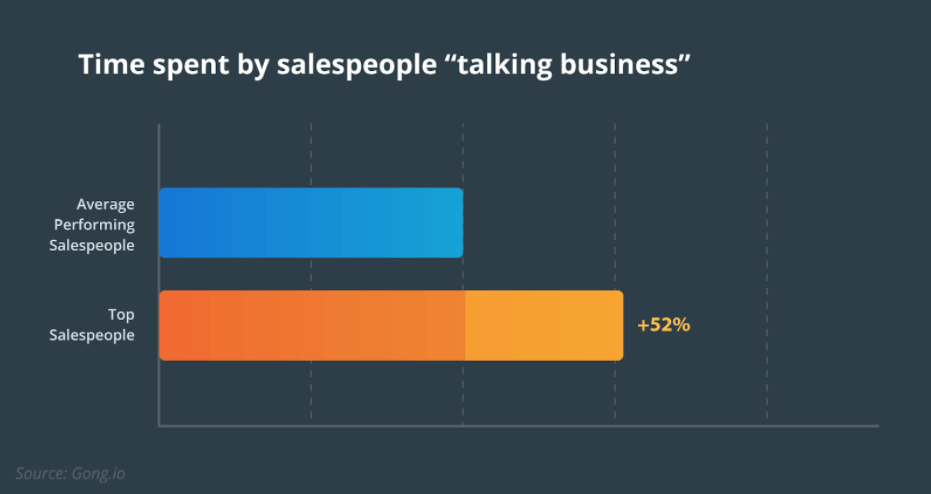

See also: Strategist’s Guide to Artificial IntelligenceThe salespeople who are getting the best results are those who have seen this shift and have adjusted their approach to leads with this in mind. In fact, after analyzing almost 1 million sales calls, Gong Labs found the best performing "superstar" sales representatives talk about business and value 52% more than their peers.

That focus from merely highlighting features to deeply providing value on how a product or service can help their business can make all the difference when it comes to closing deals.

One area that is helping to drive this shift toward discussing the business and value is through sales insights. Tools today can use AI, predictive analytics and automated insights to offer agents and brokers data from lead scoring to opportunities for cross-selling and upselling customers.

Plus, integrated platforms allow for workflows to be managed across one system, removing back office backlogs and data silos that can get in the way of closing deals. Now, an agent can look at leads and use a data-driven approach to determine which are most likely to close, maximizing their potential.

Faster Sales Via Productivity-Boosting Features

When it comes to sales, downtime is not a good thing. After all, being as productive as possible accelerates the process of closing deals.

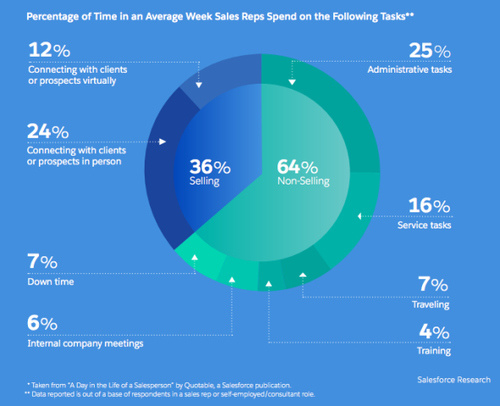

And yet, a study by Salesforce found only 36% of the average salesperson's week is spent selling.

As you can see from the chart, the majority of the time gets dedicated to administrative tasks, service tasks, meetings and traveling.

This is not a sustainable formula for the future of insurance agents and brokers (or sales in general).

The best agents and brokers are also the most productive. They keep track of their leads and customers and are quick to spot any potential issues, such as deals that are slowing down. They also know when to suggest action.

No, this isn't a unique gift; instead, top brokers and agents know how to analyze the data by utilizing the right tools. Here's where actionable intelligence can help streamline processes and boost productivity, providing sales professionals with the information they need to prioritize the most promising opportunities.

CRMs that utilize actionable intelligence and workflow automation can update and append activity records and call notes, automatically update the sales pipeline and even configure real-time prices and quotes for customers.

Timeliness matters. After all, in a survey from Demand Gen, 72% of respondents said the timeliness of a vendor's response to a quote was very important. When brokers and agents can come back with accurate quotes generated with a few clicks within minutes, it makes a big impression on leads and a huge difference in close rates.

More Flexible Sales Processes

It's rare to find two different insurance businesses that sell in the same way. Companies have their own processes, methods and even brand culture that differentiates one from another, especially when it comes to sales.

With that being said, flexibility in the sales process is essential. A management system that is too rigid can hinder the opportunities for some brokers and agents while having zero focus on the workflow and see a dramatic increase in employee turnover. Both need to be avoided at all costs.

Here's where introducing a new management system that offers data-driven insights can help provide the flexibility needed without the potential for critical data to slip through the cracks. Automated systems pull data from every corner of the platform consistently and in real time, giving brokers and agents access to lead scores, upsell and cross-sell potential, red flag issues and retention rates.

All of this information can be used in many ways.

The data can be used to populate customizable forms and reports, which can provide leads with policy details, for example. Plus, information is accessible by agents and brokers as well as the back office and management, removing bottlenecks in the system and allowing the necessary parties to get involved at a moment's notice to move a lead through the pipeline or save a sale.

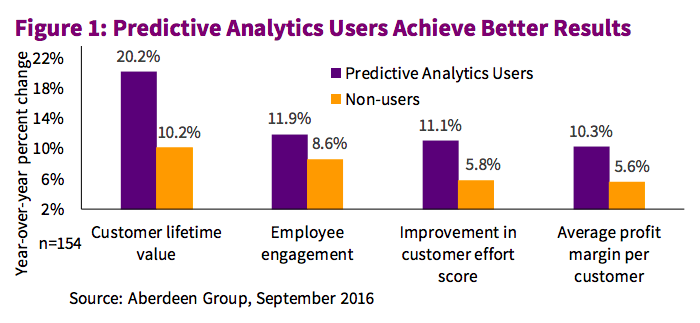

See also: The Most Important (and Overlooked) TechFlexibility also matters when it comes to customer service. Here is where smart CRM systems can make a massive impact. Studies have shown that companies embracing technology such as predictive analytics see much better results on everything from customer lifetime value to average profit margin per customer.

Numbers like these are essential when you consider that customer retention and upselling to existing customers are some of the best ways to increase revenue.

Having flexibility in the sales process, thanks to better systems and data, can not only convert new customers but keep existing customers happy and coming back for more.

The Bottom Line

The future of insurance is here, and it rests with automation, predictive analytics and AI-powered tools.

The sales professionals who are ready to go all in on it are those who are poised to fully take advantage of the potential and benefits not only offered to them but to their customers, as well.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Roi Agababa is CEO of Novidea, provider of the first cloud-based platform for real-time business intelligence and agency/brokerage workflow management for the insurance distribution market.

It is estimated that roughly one-third of blockchain use cases are in the insurance industry. Here are the leading examples.

Blockchain and smart contracts have enabled the development of new approaches in the insurance industry, as they begin to replace outdated business models (with excessive paperwork, communication problems, multiple data operating systems and duplication of processes and the inability of syndicates to mine their data). By digitizing payments and assets—thus eliminating tedious paperwork—and facilitating the management of contracts, blockchain and smart contracts can help cut operational costs and improve efficiency. Smart contracts also allow for automation of insurance claims and other processes as well as privacy, security and transparency. It is estimated that roughly one-third of blockchain use cases are in the insurance industry.

How Blockchain Is Used in Insurance

How will blockchain and smart contracts transform the insurance industry?

The insurance industry has traditionally been associated with tedious administration, paperwork and mistrust; the incorporation of blockchain, however, has the ability to transform this image by bringing operational efficiency, security, and transparency. The long-term strategic benefits of blockchain are thus clear.

Top insurance blockchain projects:

AIG (American International Group) – Smart contract insurance policies HQ: New York Description: AIG, in conjunction with IBM, has developed a “smart” insurance policy utilizing blockchain to manage complex international coverage. Blockchain network: Bitcoin Deployment: In June 2017, AIG and IBM announced the successful completion of their “smart contract” multinational policy pilot for Standard Chartered Bank. It is said to be the first such policy to employ the blockchain digital ledger technology.

Fidentiax - Marketplace for tradable insurance policies HQ: Singapore Description: As “the world’s first marketplace for tradable insurance policies,” Fidentiax hopes to establish a trading marketplace and repository of insurance policies for the masses through the use of blockchain technology. Blockchain network: Ethereum Deployment: Fidentiax succeeded in raising funds for the project through its Crowd Token Contribution (CTC, aka ICO) in December 2017.

See also: How Insurance and Blockchain Fit

Swiss Re – Smart contract management system HQ: Zurich, Switzerland Description: Swiss Re, a leading wholesale provider of reinsurance, insurance and other insurance-based forms of risk transfer, has partnered with 15 of Europe’s largest insurers and reinsurers (Achmea, Aegon, Ageas, Allianz, Generali, Hannover Re, Liberty Mutual, Munich Re, RGA, SCOR, Sompo Japan Nipponkoa Insurance, Tokio Marine Holdings, XL Catlin and the Zurich Insurance Group) to incorporate and evaluate the use of blockchain technology in the insurance industry. The Blockchain Insurance Industry Initiative (B3i) hopes to educate insurers and reinsurers on the employment of the blockchain technology in the insurance market. It serves as a platform for blockchain knowledge exchange and offers access to research and information on use case experiments.

As of yet, there have only been individual company use cases in the industry. B3i is working to facilitate the widespread adoption of blockchain across the entire insurance value chain by evaluating its implementation as a viable tool for the industry in general and customers in particular. The initiative envisions efficient and modern management of insurance transactions with common standards and practices. To this end, it has developed a smart contract management system to explore the potential of distributed ledger technologies as a way to improve services to clients by making them faster, more convenient and secure.

B3i was launched in in October 2016. On Sept. 7, 2017, B3i presented a fully functional beta version of its blockchain-run joint distributed ledger for reinsurance transactions. On March 23, 2018, the B3i Initiative incorporated B3i Services company to continue to promote the B3i Initiative’s goal of transforming the insurance industry through blockchain technology.

Sofocle – Automating claim settlement HQ: Northern Ireland, U.K. Description: Through smart contracts, AI and mobile apps, Sofocle employs blockchain technology to automate insurance processes. All relevant documents can be uploaded by customers via mobile app, thus minimizing paperwork. Use of smart contracts allows for a far more efficient and faster settlement process. Claims agents can verify insurance claims, which are recorded on the blockchain in real time. The smart contracts allow for verification of a predetermined condition by an external data source (trigger), following which the customer automatically receives the claims payment. Blockchain network: Bitcoin

Dynamis – P2P Insurance HQ: U.K. Description: Dynamis’ Ethereum-based platform provides peer-to-peer (P2P) supplementary unemployment insurance, using the LinkedIn social network as a reputation system. When applying for a policy, the applicant’s identity and employment status is verified through LinkedIn. Claimants are also able to validate that they are seeking employment through their LinkedIn connections. Participants can acquire new policies or open new claims by exercising their social capital within their social network. Blockchain Network: Ethereum and Bitcoin Deployment: The goal of Dynamis is the creation of a decentralized autonomous organization (DAO) to restore trust and transparency in the insurance industry. Its community-based unemployment insurance employs smart contracts and runs on the Ethereum blockchain platform. Using social networking data and validation points, Dynamis verifies a claimant’s employment status among peers and colleagues. It also depends on Bitcoin-powered smart contracts to automate claims.

Conclusion

Recognizing the benefits of blockchain and smart contracts, the insurance industry has begun to explore their potential. With the traditional insurance model, validating an insurer’s claim is a lengthy, complicated process. Blockchain has the ability to combine various resources into smart contract validation. It also offers transparency, allowing the customer to play an active role in the process and to see what is being validated. This fosters trust between the insurer and the customer.

Despite the obvious benefits of blockchain for insurers, reinsurers and customers, the industry has yet to adopt blockchain on a large scale. The primary reason for this is that blockchain adoption has until now required in-depth knowledge and skills in blockchain-specific programming languages. The limited number and high cost of hiring blockchain experts have rendered the technology out of reach for many businesses in the industry. Without access to the technology, exposure to blockchain and the ability to reap its benefits will remain limited for insurance companies.

How can these obstacles be overcome? The key is accessibility to enable all parties within the insurance ecosystem to reap the benefits of blockchain and smart contracts. There is a dire need for a bridge between the blockchain technology and these industry players. This is the role that the iOlite platform fulfills. iOlite provides mainstream businesses with easy access to blockchain technology. iOlite is integrated via an IDE (integrated development environment) plugin, maintaining a familiar environment for programmers and providing untrained users simple tools to work with. The iOlite platform thus enables any business to integrate blockchain into its workflow to write smart contracts and design blockchain applications using natural language.

How it works? iOlite’s open-source platform translates any natural language into smart contract code available for execution on any blockchain. The solution uses CI (collective intelligence), in essence a crowdsourcing of coder expertise, which is aggregated into a knowledge database, i.e. iOlite Blockchain. This knowledge is then used by the iOlite NLP grammar engine (based on Stanford UC research), the Fast Adaptation Engine (FAE), to migrate input text into the target blockchain executable code.

See also: Blockchain – What Is It Good for?

The future of blockchain in insurance With a clear direction of blockchain adoption for the future, insurance companies will be forced to adapt or be left behind. The adoption of blockchain by the insurance industry is no longer a question of if but how.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Yael Tamar is the co-founder and CEO of SolidBlock, which offers an end-to-end platform that lets asset owners easily tokenize their real estate assets, dividing it up into digital shares that can be traded among investors.

Out of 30 European jurisdictions reviewed, GDPR fines were found to be insurable in only two countries: Finland and Norway.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Once a customer seems interested, insurers head straight to the transaction. We have to take time to orient customers about the process.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Maria Ferrante-Schepis is the managing principal of insurance and financial services innovation at Maddock Douglas.

Advantages of using applications already developed are self-evident, but building from scratch can be a key differentiator.

Exploring the initial steps of any development includes the question: “Stay in or go out?” which translates to, do we build in-house or can we use off-the-shelf applications? Advantages of using applications already developed are self-evident: They save time and resources spent on recreating common code that similar platforms need. The frustrating downside, though, is the need to often modify the off-the-shelf technology so extensively for passable integration that time and resources are ultimately not saved and the results are sub-par.

Incumbent carriers are struggling to deal with legacy-based policy management systems that have been in place since the 1980s. One of the difficulties with off-the-shelf solutions is that carriers can’t migrate all the data from their legacy platforms into a cloud-based platform. Even if they come up with a potentially relevant solution, there is still a significant risk of disrupting their customer portfolio.

This was the dilemma facing us at Hippo Insurance as we discussed what a system that effortlessly supports home insurance agents and consumers would look like. The highly regulated, slow-moving and traditional home insurance industry seemed poised to benefit from widely applicable innovations and rapidly changing technology, motivating me and our team at Hippo to see about making such a system a reality.

When our director of software architecture, Adrian Olariu, joined Hippo to help build out the company’s home insurance tech platform, we analyzed what was currently available and looked for an off-the-shelf service we could mold into something we would use for years to come. After trying to work within the legacy systems of the industry, we discovered outdated functionality and limited capabilities that not only made it difficult for insurance carriers to maintain cost-effective and compliant policies, but also made it difficult for us to provide a positive user experience for carriers and customers alike.

So, we decided to build a policy management system in-house at Hippo, starting from the beginning. This undertaking, while risky, seemed to be the best option to create a streamlined offering we knew the system – and those using it – needed. Our goal was to launch an initial working version in three months and a fully functioning system in six months.

See also: Trends in Policy Admin System Replacement

The complexity of the system we were building continued to reveal itself yet further reinforced our decision to build in-house. We successfully developed patent-pending technology that balances regulatory compliance with a user-friendly experience that saves time and money for agents, underwriters and support staff, ultimately passing along those savings to the customer. Our focus included:

Exploring the initial steps of any development includes the question: “Stay in or go out?” which translates to, do we build in-house or can we use off-the-shelf applications? Advantages of using applications already developed are self-evident: They save time and resources spent on recreating common code that similar platforms need. The frustrating downside, though, is the need to often modify the off-the-shelf technology so extensively for passable integration that time and resources are ultimately not saved and the results are sub-par.

Incumbent carriers are struggling to deal with legacy-based policy management systems that have been in place since the 1980s. One of the difficulties with off-the-shelf solutions is that carriers can’t migrate all the data from their legacy platforms into a cloud-based platform. Even if they come up with a potentially relevant solution, there is still a significant risk of disrupting their customer portfolio.

This was the dilemma facing us at Hippo Insurance as we discussed what a system that effortlessly supports home insurance agents and consumers would look like. The highly regulated, slow-moving and traditional home insurance industry seemed poised to benefit from widely applicable innovations and rapidly changing technology, motivating me and our team at Hippo to see about making such a system a reality.

When our director of software architecture, Adrian Olariu, joined Hippo to help build out the company’s home insurance tech platform, we analyzed what was currently available and looked for an off-the-shelf service we could mold into something we would use for years to come. After trying to work within the legacy systems of the industry, we discovered outdated functionality and limited capabilities that not only made it difficult for insurance carriers to maintain cost-effective and compliant policies, but also made it difficult for us to provide a positive user experience for carriers and customers alike.

So, we decided to build a policy management system in-house at Hippo, starting from the beginning. This undertaking, while risky, seemed to be the best option to create a streamlined offering we knew the system – and those using it – needed. Our goal was to launch an initial working version in three months and a fully functioning system in six months.

See also: Trends in Policy Admin System Replacement

The complexity of the system we were building continued to reveal itself yet further reinforced our decision to build in-house. We successfully developed patent-pending technology that balances regulatory compliance with a user-friendly experience that saves time and money for agents, underwriters and support staff, ultimately passing along those savings to the customer. Our focus included:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

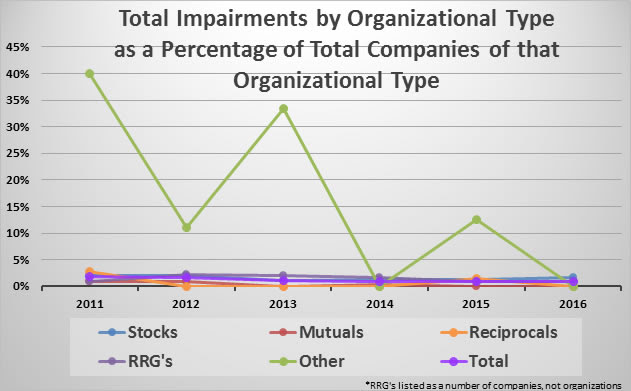

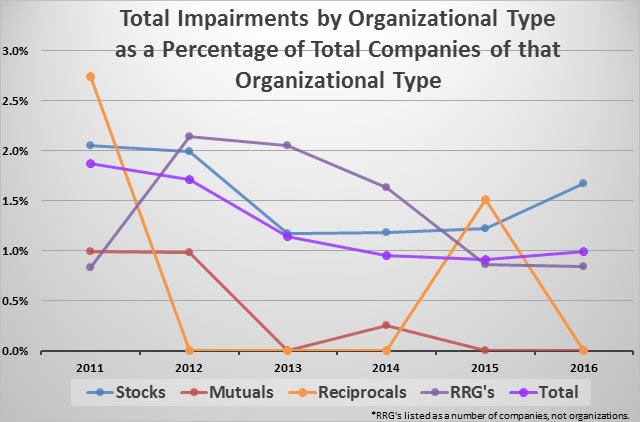

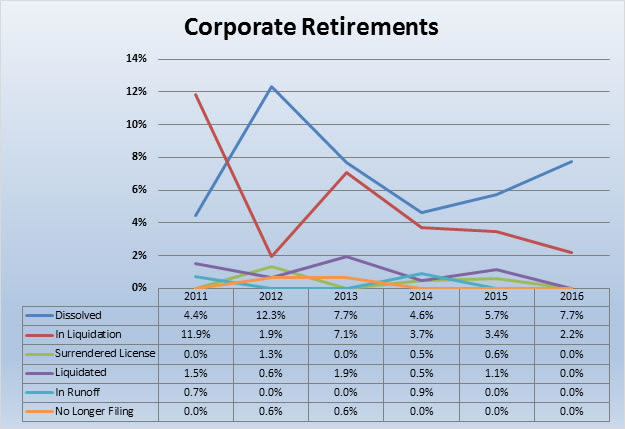

Insolvencies and impairments are so low in P&C that most agents pay little attention to the possibility one of their companies may fail.

Source: A.M. Best[/caption]

[caption id="attachment_32497" align="alignnone" width="570"]

Source: A.M. Best[/caption]

[caption id="attachment_32497" align="alignnone" width="570"] Source: A.M. Best[/caption]

[caption id="attachment_32496" align="alignnone" width="570"]

Source: A.M. Best[/caption]

[caption id="attachment_32496" align="alignnone" width="570"] Source: A.M. Best[/caption]

These kinds of companies may not be covered under the state guaranty funds. One of the results of low insolvencies is that the agency community has lost some collective intelligence regarding what to do if a company goes insolvent. I find many agency people have no idea a guaranty fund even exists, much less the parameters involved. Agents largely have a duty to advise clients whether the entity with which they are placing that client's policy is covered under the state guaranty fund. This includes surplus lines.

Risk retention groups and captives have quite different funding in many cases than traditional carriers. Often, insureds are potentially responsible for "assessments." Different companies and different types of these alternative carriers use different technical legal terms regarding whether these items are technically "assessments," but, to most people, when an insurance company tells an insured it needs to pay more money because the company is out of surplus, it feels like an assessment. For this purpose, I'm going to therefore use "assessment."

I find that a large percentage of agency people selling these policies have completely and absolutely failed to read the key details in the policy language. Even when the policy requires that a power of attorney be signed, somehow the agents have not noticed that the vast majority of insurance policies do not require POAs be signed. A halfway curious agent might just wonder why a particular company wants the insured to sign a POA rather than just thinking it is just another piece of paper. When an agent tells an insured to sign a POA and something goes wrong with that carrier, especially involving an assessment, impairment or insolvency, the insured may have strong cause for coming back against the agent.

Bluntly, I do not understand how agents, and I've interviewed dozens and dozens, do not notice these POAs. A word of advice to agents: If you have an insurance company that requires the insured to sign a POA, pay attention! Think about it! POWER OF ATTORNEY! Why would an insurance company want the insured to give it power of attorney over the insurance policy? Isn't this just a little different than normal?

The pain of a wobbly company to the agent is not considered in these statistics either. When a company has to sell a division to raise capital, the company may be saved from impairment. The agent, though, may have to do a whole lot of extra work. Just an FYI, companies sell divisions primarily to raise capital or because they are incompetent in managing those divisions, which may indicate issues in and of themselves. Such sales can be dressed up, but be sure the reality is that someone has put lipstick on a pig.

Another example is actually smart, if it was not nefarious. This is where a wobbly company raises rates far more than other carriers. The company say things like, the other carriers will follow, or that the company needs to make money in this line or that line or all lines. The company has to say things like this. In reality, the company is raising rates in hopes that agents will move the business because the company may not have the surplus to support its writings. The No. 1 goal is to get agents to move as much premium as possible. If the company makes some more profit with what sticks, then so much the better. That is gravy, though. The goal is to increase the surplus ratio or reduce premiums.

See also: 3 Major Areas of Opportunity

While the frequency of impairments might not be different from one kind of insuring of facility to another and while impairment of frequency is not a major issue, don’t become complacent. Impairments are severity issues, and it pays to remain diligent and knowledgeable and protect yourself from E&O claims.

You can find the article originally published here.

Source: A.M. Best[/caption]

These kinds of companies may not be covered under the state guaranty funds. One of the results of low insolvencies is that the agency community has lost some collective intelligence regarding what to do if a company goes insolvent. I find many agency people have no idea a guaranty fund even exists, much less the parameters involved. Agents largely have a duty to advise clients whether the entity with which they are placing that client's policy is covered under the state guaranty fund. This includes surplus lines.

Risk retention groups and captives have quite different funding in many cases than traditional carriers. Often, insureds are potentially responsible for "assessments." Different companies and different types of these alternative carriers use different technical legal terms regarding whether these items are technically "assessments," but, to most people, when an insurance company tells an insured it needs to pay more money because the company is out of surplus, it feels like an assessment. For this purpose, I'm going to therefore use "assessment."

I find that a large percentage of agency people selling these policies have completely and absolutely failed to read the key details in the policy language. Even when the policy requires that a power of attorney be signed, somehow the agents have not noticed that the vast majority of insurance policies do not require POAs be signed. A halfway curious agent might just wonder why a particular company wants the insured to sign a POA rather than just thinking it is just another piece of paper. When an agent tells an insured to sign a POA and something goes wrong with that carrier, especially involving an assessment, impairment or insolvency, the insured may have strong cause for coming back against the agent.

Bluntly, I do not understand how agents, and I've interviewed dozens and dozens, do not notice these POAs. A word of advice to agents: If you have an insurance company that requires the insured to sign a POA, pay attention! Think about it! POWER OF ATTORNEY! Why would an insurance company want the insured to give it power of attorney over the insurance policy? Isn't this just a little different than normal?

The pain of a wobbly company to the agent is not considered in these statistics either. When a company has to sell a division to raise capital, the company may be saved from impairment. The agent, though, may have to do a whole lot of extra work. Just an FYI, companies sell divisions primarily to raise capital or because they are incompetent in managing those divisions, which may indicate issues in and of themselves. Such sales can be dressed up, but be sure the reality is that someone has put lipstick on a pig.

Another example is actually smart, if it was not nefarious. This is where a wobbly company raises rates far more than other carriers. The company say things like, the other carriers will follow, or that the company needs to make money in this line or that line or all lines. The company has to say things like this. In reality, the company is raising rates in hopes that agents will move the business because the company may not have the surplus to support its writings. The No. 1 goal is to get agents to move as much premium as possible. If the company makes some more profit with what sticks, then so much the better. That is gravy, though. The goal is to increase the surplus ratio or reduce premiums.

See also: 3 Major Areas of Opportunity

While the frequency of impairments might not be different from one kind of insuring of facility to another and while impairment of frequency is not a major issue, don’t become complacent. Impairments are severity issues, and it pays to remain diligent and knowledgeable and protect yourself from E&O claims.

You can find the article originally published here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.

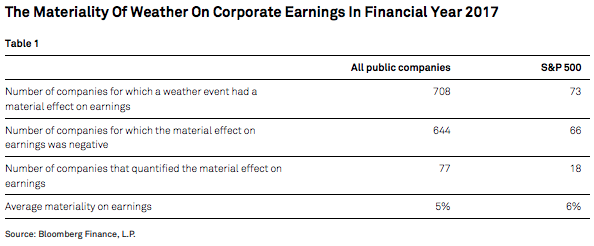

The effect of climate risk and severe weather events on corporate earnings is meaningful. If left unmitigated, the impact could increase.

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

A review of the earnings call transcripts of S&P 500 companies in the past 10 years revealed that "climate" and "weather" combined were among the most frequently discussed topics among executives, even more common than "Trump," "the dollar," "oil" and "recession."

Discussions of climate risk and its effect on companies' earnings are now reaching the CEO's office. Of the earnings calls in financial year 2017 where weather was mentioned as having a material effect on corporate earnings, more than half (53%) of these disclosures were made directly by the CEO. The CEO and CFO combined made 86% of all disclosures of climate-related impact on earnings.

Moreover, CEOs and other top company executives often cite climate and weather as a risk factor beyond the control of management.

You can find the full article here.

Climate Risk and Weather Events Are Top Topics Among the CEOs of Publicly Traded Companies

A review of the earnings call transcripts of S&P 500 companies in the past 10 years revealed that "climate" and "weather" combined were among the most frequently discussed topics among executives, even more common than "Trump," "the dollar," "oil" and "recession."

Discussions of climate risk and its effect on companies' earnings are now reaching the CEO's office. Of the earnings calls in financial year 2017 where weather was mentioned as having a material effect on corporate earnings, more than half (53%) of these disclosures were made directly by the CEO. The CEO and CFO combined made 86% of all disclosures of climate-related impact on earnings.

Moreover, CEOs and other top company executives often cite climate and weather as a risk factor beyond the control of management.

You can find the full article here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Ferguson is a director in the U.S. Energy Infrastructure group at S&P Global Ratings in New York City. He works on the merchant power and midstream energy team, covering a portfolio of project-financed power plants, infrastructure assets and independent power producers.

As technology speeds the pace of daily life and business, the product development cycle continues to represent a drag on P&C insurers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Hammond is the chief strategy officer at Confie. He was previously the president of U.S. operations at Bolt Solutions.