As insurers leverage the power of cutting-edge technologies like machine learning, artificial intelligence, and third-party data integrations to improve their data-driven decision-making, they're faced with the critical task of ensuring the security and control of sensitive data, which is essential for maintaining customer trust and regulatory compliance. One promising solution to this challenge is a collaborative intelligence ecosystem where multiple parties come together to form a shared knowledge pool that facilitates secure and collective learning through multi-party computations. Each person’s sensitive data and information remain private and undisclosed.

Munich Re Life North America’s Integrated Analytics team believes this innovative technology has the capacity to unlock significant computing and analytics opportunities within the insurance industry. They investigated its capabilities by partnering with an external vendor to conduct a proof of concept (POC). This article shares the details of our POC experience, which evaluated the performance, accuracy, efficiency, and scalability of the vendor’s multi-party computation platform.

Purpose

A vast amount of data is generated daily and growing exponentially due to technologies like social media, cloud services, the Internet of Things (IoT), and artificial intelligence (AI). While this data holds significant value for businesses, concerns about privacy, trust, and other risks leave much of it inaccessible. This is especially true for industries like insurance, where sensitive personal information is prevalent and privacy is a priority.

However, advancements in privacy-retaining technologies offer a more secure framework for collaborative research. Multi-party computation is a cryptographic technique that allows participants to jointly compute a function on their private inputs without revealing those inputs to each other. Our overarching POC goal was to evaluate its potential promise in reducing challenges around data transfers, barriers to collaboration, and vulnerability to bad actors in driving insurance use cases for Munich Re.

How does the technology work?

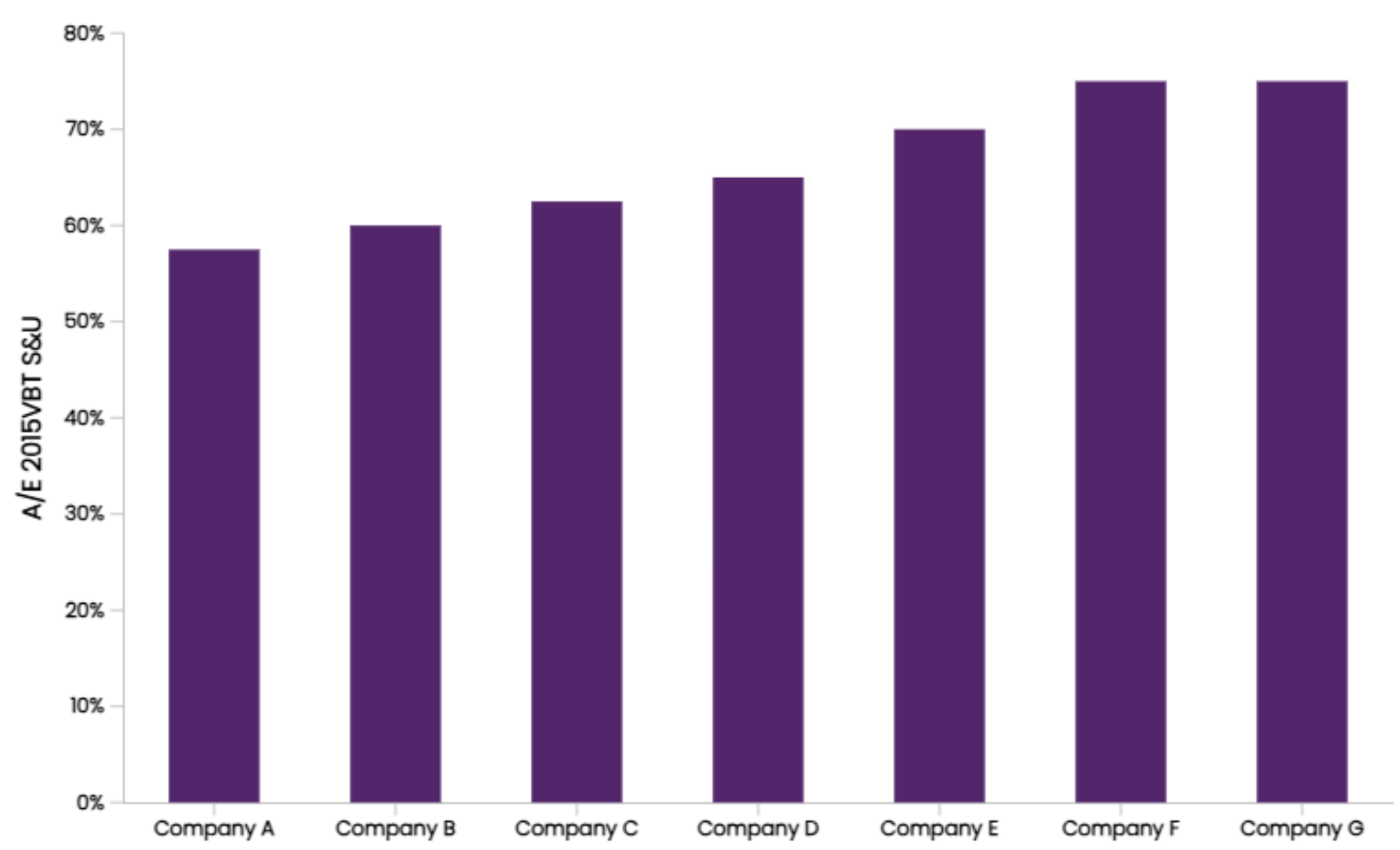

We worked with a vendor experienced in developing and deploying privacy-enhancing technologies for commercial use. They have pioneered cryptographic privacy-preserving computation technology for analytics and machine learning. Their product enables sensitive data to be distributed across teams, organizations, and regulated jurisdictions by deploying privacy zones (on-premises or cloud) within the infrastructure and network of each party sharing insights.

Through these privacy zones, a compile function is run on each local network using its own data. The function then sends updates to a central server that aggregates the results across parties, effectively keeping sensitive information private within the respective local networks.

For example, if the goal is to train a global machine learning model using insights from different sources, each source would train a local model on its own data and only send the updated model parameters (e.g., weight) to the central server. In our case, the central server was a part of a cloud-based Software as a Service (SaaS) framework provided by the POC vendor.

This concept is called federated learning, which is a decentralized machine learning approach that leverages multi-party computation principles to allow parties to train a model collaboratively, with each preserving its data locally. Instead of sharing raw data, parties share model updates or encrypted data, allowing for secure computation and aggregation of model parameters.

Method of evaluation

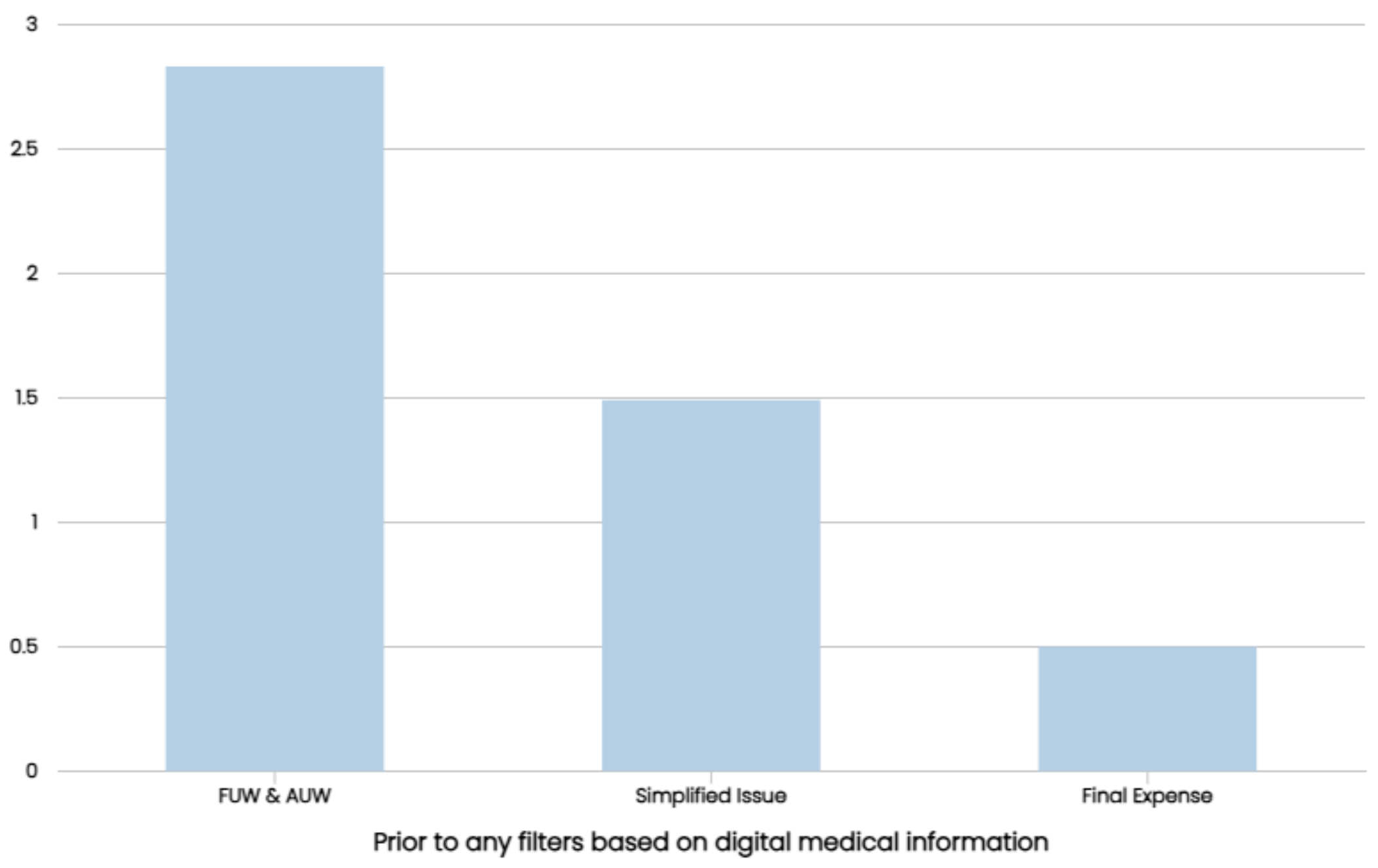

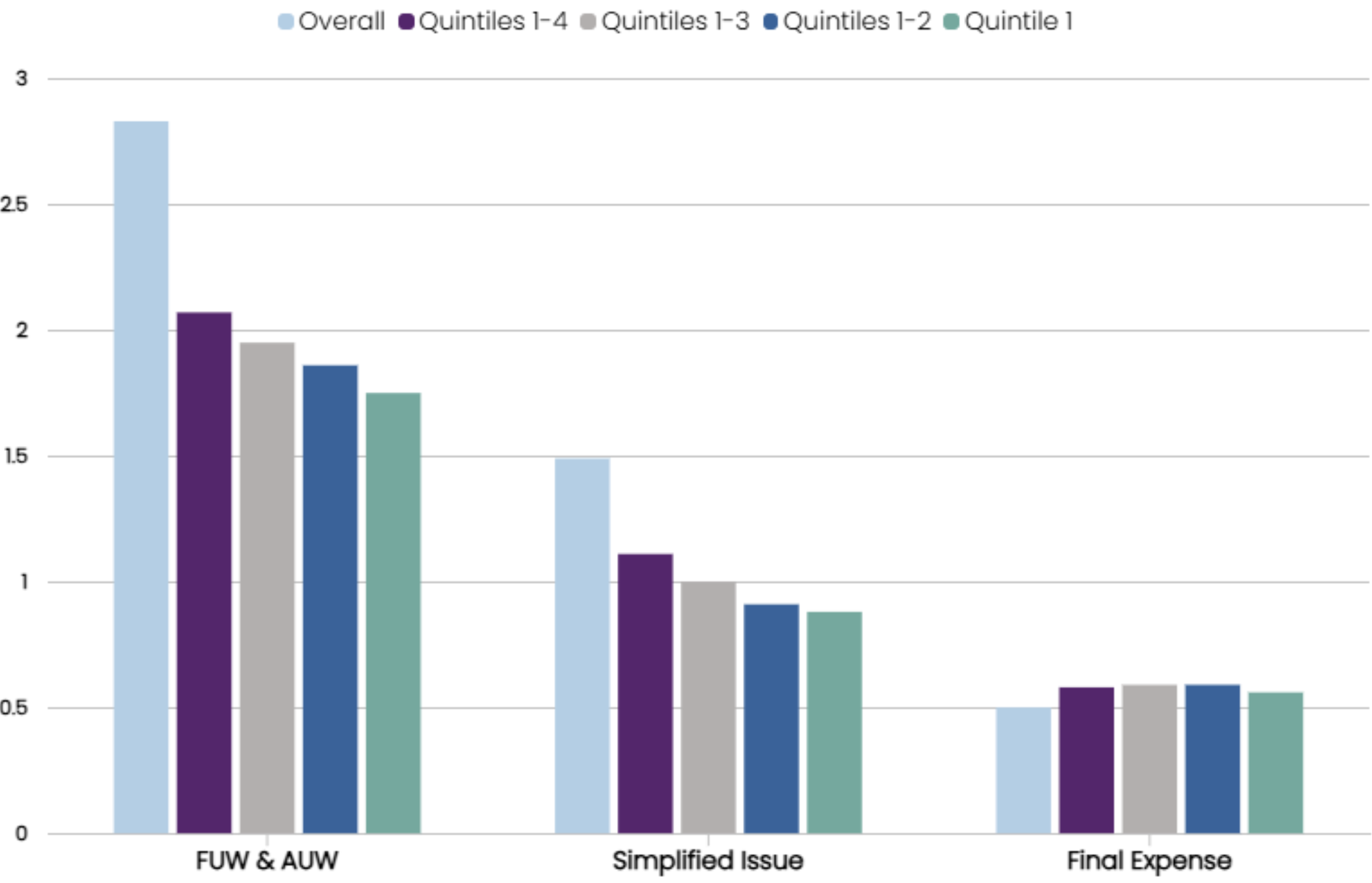

The POC had two phases: Phase I assessed the basic multi-party computation functionality within the vendor’s sandbox environment, while Phase II ran a synthetic two-party computation within Munich Re’s cloud environment. For the latter, we trained a popular advanced machine learning algorithm on the multi-party computation platform. This allowed us to securely leverage insights from our internal historical data, which was hosted in one privacy zone, and enhance it with externally acquired sociodemographic data, which was hosted in another.

We ultimately drew insights from both datasets while ensuring privacy within each computation zone. Our goal was to evaluate the predictive accuracy of the resulting model, lift from increasing samples and features, ease of setup, and efficacy of the privacy-preserving computation process.

Our evaluation was split into four broad categories:

Functionality:

- Preservation of data privacy and security behind each party’s firewall

- Dedicated functions to join private data (private set intersections)

- Granular data privacy controls

- Complex operations available to be implemented for data preparation

- Functionality to run advanced algorithms

Efficiency:

- Speed and quality of technical support

- Speed and efficiency in running functions and algorithms

- Extent of coordination required among parties for data processing and modeling

Correctness:

- Accuracy of results from running statistical functions, algorithms, and data processing operations

Scalability:

- Potential to scale up for faster, optimized multi-thread processing

- Level of data engineering expertise required for initial setup

Overall, our assessment of the technology and its potential is favorable. We believe the integration of innovative techniques like multi-party computation can provide a reliable way to enhance business capabilities, enabling secure and private data sharing and analysis across multiple stakeholders while maintaining data confidentiality and integrity.

Potential use cases

Internally within larger companies: To utilize data across entities/departments to increase data size and features for analytics or model development.

Externally with partners and third-party data vendors: For fast and efficient data evaluation. Raw data is never shared, and sensitive information is protected, mitigating data security and privacy risks.

We believe this technology holds significant potential. It offers an efficient way to meet existing privacy compliance and data sharing best practices in building collaborative intelligence ecosystems within and across organizations.

It's only a matter of time before companies use multi-party computation frameworks to enhance their informational edge.

Sponsored by ITL Partner: Munich Re