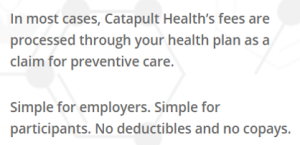

Phew! At least it’s free to taxpayers because Catapult’s expenses and profits are “already in your budget” and “fees are processed through your health plan.”

Except that the state of Arkansas is its own health plan. There is no “Don’t worry. Insurance will pay for it” here. The state is self-insured, meaning it picks up the tab, not some nameless insurance company.

But, hey, at least this program will save money, right?

The return-on-investment for the state is allegedly 3.27-to-1, as shown by the so-called “Harvard Study,” conducted by Katherine Baicker.

Except that the Harvard study has been proven wrong, not just by the nonprofit, nonpartisan highly respected RAND Corporation (and I myself chimed in, as well), but by an ace researcher named Damon Jones, part of the prestigious National Bureau for Economic Research. His work showed that wellness accomplishes virtually nothing other than the expenditure of money. (Don’t worry—insurance will pay for it.)

See also: Wellness Vendors Keep Dreaming

But, hey, maybe Professor Jones is wrong. After all, why should he care what Professor Baicker thinks, right?

Um, because he reports to her? Yep, he’s an associate professor at the exact same school of public health where she is now dean. Just guessing here, but it would seem a subordinate would have to be pretty darn sure of his findings (and they are rock solid, and completely in agreement with all the other recent research, summarized here) to publicly humiliate his own dean.

Even Baicker doesn’t defend her findings any more. She says: “It’s too early to tell.” That means she is running away from her very widely cited signature study, upon which essentially the entire wellness industry’s economic justification is based. This would be like Arthur Laffer, whose Laffer curve created supply-side economics, which has been used to justify two tax cuts, saying, “Well, maybe it’s not right. I dunno. Let’s wait and see.”

But, hey, at least forced wellness improves employee health, right?

Apparently not. Forcing people to get annual wellness checkups doesn’t benefit them, according to the New York Times, the New England Journal of Medicine, the Journal of the American Medical Association and Consumer Reports. (Before dismissing the credibility of those sources due to possible political bias, keep in mind that Newsmax, the Federalist and Laura Ingraham hate “pry, poke and prod” programs, too.)

Forced wellness also takes teachers away from the classrooms to be pried, poked and prodded, stresses them out and hurts morale.

Further, sending “record rates” of employees into lifestyle and disease management is classic hyperdiagnosis – braggadocio-fueled misunderstandings of the arithmetic of lab results, resulting in large numbers of people getting told they need coaching and care they don’t want or, in general, need. Nothing makes a wellness vendor happier than to hyperdiagnose as many employees as possible.

But, hey, maybe teachers are a special case. Maybe the impact of “pry, poke and prod” programs is different for them?

It sure is. The single school district for which the data has been compiled is Boise, Idaho. According to the wellness vendor’s own data, the health of the teachers got somewhat worse as a result of this pry, poke and prod program. (The vendor, an outfit called Wellsteps, also admitted that it flouted clinical guidelines and fabricated its only positive outcome. The company also previously admitted that costs went way up as a result of its program. The company later suppressed that admission. Wellness vendors are not known for their integrity.)

So the health of teachers may deteriorate, creating more medical expense. but don’t worry. Insurance will pay for it.

But, hey, at least the teachers like it, right?

According to Catapult, employees love the program. Ask the employees, and you might get a different impression. Indeed, I was tipped off to this program by an Arkansas teacher who hates it, like most of her colleagues do — and that’s before they learn that they are actually paying for it…keep reading.

Obviously, if teachers wanted to submit to a “pry, poke and prod” program, the state wouldn’t have to threaten them with massive fines – almost $1,000/year, which appears to be close to a record for any "pry, poke and prod" program anywhere — for refusing to let a private, out-of-state corporation play doctor on them at state expense.

But, hey, at least the state taxpayers save money by fining the teachers who don’t want to play doctor, right?

Actually, wellness makes claims costs go up, probably by more than the fines. There are lots of unneeded lab tests and other tests. For instance, the state of Connecticut admitted that, in addition to throwing away all its money on the actual wellness program, the state spent more on health care. The state comptroller who administered the program said the increased spending was “a good thing.” I guess he wasn’t worried because insurance was paying for it.

See also: Ethics of Workplace Wellness Industry

But, hey, at least the teachers don’t pay for it.

Actually, they do. The state’s human resources department brilliantly figured out that it could launder its wellness spending by hiring this outfit. By paying extra to Catapult (a multiple of what an effective wellness program would cost), the state is able to pick up the tab for wellness using the extra paperwork of a medical claim, as opposed to an outsized administrative expense in a separate line item. The latter would clearly need to be picked up by the taxpayers…and the state would have an incentive to control this highly visible figure.

By contrast, paying for “pry, poke and prod” as a medical claim will never be noticed, like Steve McQueen and David McCallum sprinkling the dirt from the tunnel around the stalag. On the other hand, the program will increase overall medical spending by 2% to 3% (the cost of the screening plus the added hyperdiagnosis expenses).

Here comes the evil genius part: At the next contract negotiation, the state can limit wage increases (or reduce benefits) by pointing out how high the health spending is.

So the teachers get pried, poked and prodded, hyperdiagnosed with hidden illnesses most of them don’t have – all against their will…and then they have to pay for the privilege in reduced wages.

Wow…the teachers are getting screwed. But, hey, at least they can’t sue the state, right, so taxpayers won’t have to pick up that bill, as well?

Starting in January, this program will be in blatant violation of two laws, the Americans with Disabilities Act and the Genetic Information Non-Discrimination Act. Those laws disallow forced wellness checkups but allow so-called “voluntary” ones.

Until recently, “voluntary” meant “do wellness or pay a big fine” like this one. But thanks to a lawsuit by AARP, the rules are changing in January so that “voluntary” must mean voluntary, like a dictionary would define the word. (This summary has the links to all you need to know about the case.) To get these fines back, teachers will be able to sue the state, possibly even as a class action, and possibly being awarded punitive damages. Exposure to lawsuits could cost the state millions more in addition to its current expenditure on Catapult Health.

And that doesn’t even cover the costs of a possible teacher walkout, like the one in West Virginia that was spurred in part by – you guessed it – the wellness program.

But, don’t worry. Insurance will pay for it.

Phew! At least it’s free to taxpayers because Catapult’s expenses and profits are “already in your budget” and “fees are processed through your health plan.”

Except that the state of Arkansas is its own health plan. There is no “Don’t worry. Insurance will pay for it” here. The state is self-insured, meaning it picks up the tab, not some nameless insurance company.

But, hey, at least this program will save money, right?

The return-on-investment for the state is allegedly 3.27-to-1, as shown by the so-called “Harvard Study,” conducted by Katherine Baicker.

Except that the Harvard study has been proven wrong, not just by the nonprofit, nonpartisan highly respected RAND Corporation (and I myself chimed in, as well), but by an ace researcher named Damon Jones, part of the prestigious National Bureau for Economic Research. His work showed that wellness accomplishes virtually nothing other than the expenditure of money. (Don’t worry—insurance will pay for it.)

See also: Wellness Vendors Keep Dreaming

But, hey, maybe Professor Jones is wrong. After all, why should he care what Professor Baicker thinks, right?

Um, because he reports to her? Yep, he’s an associate professor at the exact same school of public health where she is now dean. Just guessing here, but it would seem a subordinate would have to be pretty darn sure of his findings (and they are rock solid, and completely in agreement with all the other recent research, summarized here) to publicly humiliate his own dean.

Even Baicker doesn’t defend her findings any more. She says: “It’s too early to tell.” That means she is running away from her very widely cited signature study, upon which essentially the entire wellness industry’s economic justification is based. This would be like Arthur Laffer, whose Laffer curve created supply-side economics, which has been used to justify two tax cuts, saying, “Well, maybe it’s not right. I dunno. Let’s wait and see.”

But, hey, at least forced wellness improves employee health, right?

Apparently not. Forcing people to get annual wellness checkups doesn’t benefit them, according to the New York Times, the New England Journal of Medicine, the Journal of the American Medical Association and Consumer Reports. (Before dismissing the credibility of those sources due to possible political bias, keep in mind that Newsmax, the Federalist and Laura Ingraham hate “pry, poke and prod” programs, too.)

Forced wellness also takes teachers away from the classrooms to be pried, poked and prodded, stresses them out and hurts morale.

Further, sending “record rates” of employees into lifestyle and disease management is classic hyperdiagnosis – braggadocio-fueled misunderstandings of the arithmetic of lab results, resulting in large numbers of people getting told they need coaching and care they don’t want or, in general, need. Nothing makes a wellness vendor happier than to hyperdiagnose as many employees as possible.

But, hey, maybe teachers are a special case. Maybe the impact of “pry, poke and prod” programs is different for them?

It sure is. The single school district for which the data has been compiled is Boise, Idaho. According to the wellness vendor’s own data, the health of the teachers got somewhat worse as a result of this pry, poke and prod program. (The vendor, an outfit called Wellsteps, also admitted that it flouted clinical guidelines and fabricated its only positive outcome. The company also previously admitted that costs went way up as a result of its program. The company later suppressed that admission. Wellness vendors are not known for their integrity.)

So the health of teachers may deteriorate, creating more medical expense. but don’t worry. Insurance will pay for it.

But, hey, at least the teachers like it, right?

According to Catapult, employees love the program. Ask the employees, and you might get a different impression. Indeed, I was tipped off to this program by an Arkansas teacher who hates it, like most of her colleagues do — and that’s before they learn that they are actually paying for it…keep reading.

Obviously, if teachers wanted to submit to a “pry, poke and prod” program, the state wouldn’t have to threaten them with massive fines – almost $1,000/year, which appears to be close to a record for any "pry, poke and prod" program anywhere — for refusing to let a private, out-of-state corporation play doctor on them at state expense.

But, hey, at least the state taxpayers save money by fining the teachers who don’t want to play doctor, right?

Actually, wellness makes claims costs go up, probably by more than the fines. There are lots of unneeded lab tests and other tests. For instance, the state of Connecticut admitted that, in addition to throwing away all its money on the actual wellness program, the state spent more on health care. The state comptroller who administered the program said the increased spending was “a good thing.” I guess he wasn’t worried because insurance was paying for it.

See also: Ethics of Workplace Wellness Industry

But, hey, at least the teachers don’t pay for it.

Actually, they do. The state’s human resources department brilliantly figured out that it could launder its wellness spending by hiring this outfit. By paying extra to Catapult (a multiple of what an effective wellness program would cost), the state is able to pick up the tab for wellness using the extra paperwork of a medical claim, as opposed to an outsized administrative expense in a separate line item. The latter would clearly need to be picked up by the taxpayers…and the state would have an incentive to control this highly visible figure.

By contrast, paying for “pry, poke and prod” as a medical claim will never be noticed, like Steve McQueen and David McCallum sprinkling the dirt from the tunnel around the stalag. On the other hand, the program will increase overall medical spending by 2% to 3% (the cost of the screening plus the added hyperdiagnosis expenses).

Here comes the evil genius part: At the next contract negotiation, the state can limit wage increases (or reduce benefits) by pointing out how high the health spending is.

So the teachers get pried, poked and prodded, hyperdiagnosed with hidden illnesses most of them don’t have – all against their will…and then they have to pay for the privilege in reduced wages.

Wow…the teachers are getting screwed. But, hey, at least they can’t sue the state, right, so taxpayers won’t have to pick up that bill, as well?

Starting in January, this program will be in blatant violation of two laws, the Americans with Disabilities Act and the Genetic Information Non-Discrimination Act. Those laws disallow forced wellness checkups but allow so-called “voluntary” ones.

Until recently, “voluntary” meant “do wellness or pay a big fine” like this one. But thanks to a lawsuit by AARP, the rules are changing in January so that “voluntary” must mean voluntary, like a dictionary would define the word. (This summary has the links to all you need to know about the case.) To get these fines back, teachers will be able to sue the state, possibly even as a class action, and possibly being awarded punitive damages. Exposure to lawsuits could cost the state millions more in addition to its current expenditure on Catapult Health.

And that doesn’t even cover the costs of a possible teacher walkout, like the one in West Virginia that was spurred in part by – you guessed it – the wellness program.

But, don’t worry. Insurance will pay for it.The Evil Genius of a Wellness Program

A wellness program for Arkansas teachers shows how "pry, poke and prod" programs raise expenses while likely harming health.

Phew! At least it’s free to taxpayers because Catapult’s expenses and profits are “already in your budget” and “fees are processed through your health plan.”

Except that the state of Arkansas is its own health plan. There is no “Don’t worry. Insurance will pay for it” here. The state is self-insured, meaning it picks up the tab, not some nameless insurance company.

But, hey, at least this program will save money, right?

The return-on-investment for the state is allegedly 3.27-to-1, as shown by the so-called “Harvard Study,” conducted by Katherine Baicker.

Except that the Harvard study has been proven wrong, not just by the nonprofit, nonpartisan highly respected RAND Corporation (and I myself chimed in, as well), but by an ace researcher named Damon Jones, part of the prestigious National Bureau for Economic Research. His work showed that wellness accomplishes virtually nothing other than the expenditure of money. (Don’t worry—insurance will pay for it.)

See also: Wellness Vendors Keep Dreaming

But, hey, maybe Professor Jones is wrong. After all, why should he care what Professor Baicker thinks, right?

Um, because he reports to her? Yep, he’s an associate professor at the exact same school of public health where she is now dean. Just guessing here, but it would seem a subordinate would have to be pretty darn sure of his findings (and they are rock solid, and completely in agreement with all the other recent research, summarized here) to publicly humiliate his own dean.

Even Baicker doesn’t defend her findings any more. She says: “It’s too early to tell.” That means she is running away from her very widely cited signature study, upon which essentially the entire wellness industry’s economic justification is based. This would be like Arthur Laffer, whose Laffer curve created supply-side economics, which has been used to justify two tax cuts, saying, “Well, maybe it’s not right. I dunno. Let’s wait and see.”

But, hey, at least forced wellness improves employee health, right?

Apparently not. Forcing people to get annual wellness checkups doesn’t benefit them, according to the New York Times, the New England Journal of Medicine, the Journal of the American Medical Association and Consumer Reports. (Before dismissing the credibility of those sources due to possible political bias, keep in mind that Newsmax, the Federalist and Laura Ingraham hate “pry, poke and prod” programs, too.)

Forced wellness also takes teachers away from the classrooms to be pried, poked and prodded, stresses them out and hurts morale.

Further, sending “record rates” of employees into lifestyle and disease management is classic hyperdiagnosis – braggadocio-fueled misunderstandings of the arithmetic of lab results, resulting in large numbers of people getting told they need coaching and care they don’t want or, in general, need. Nothing makes a wellness vendor happier than to hyperdiagnose as many employees as possible.

But, hey, maybe teachers are a special case. Maybe the impact of “pry, poke and prod” programs is different for them?

It sure is. The single school district for which the data has been compiled is Boise, Idaho. According to the wellness vendor’s own data, the health of the teachers got somewhat worse as a result of this pry, poke and prod program. (The vendor, an outfit called Wellsteps, also admitted that it flouted clinical guidelines and fabricated its only positive outcome. The company also previously admitted that costs went way up as a result of its program. The company later suppressed that admission. Wellness vendors are not known for their integrity.)

So the health of teachers may deteriorate, creating more medical expense. but don’t worry. Insurance will pay for it.

But, hey, at least the teachers like it, right?

According to Catapult, employees love the program. Ask the employees, and you might get a different impression. Indeed, I was tipped off to this program by an Arkansas teacher who hates it, like most of her colleagues do — and that’s before they learn that they are actually paying for it…keep reading.

Obviously, if teachers wanted to submit to a “pry, poke and prod” program, the state wouldn’t have to threaten them with massive fines – almost $1,000/year, which appears to be close to a record for any "pry, poke and prod" program anywhere — for refusing to let a private, out-of-state corporation play doctor on them at state expense.

But, hey, at least the state taxpayers save money by fining the teachers who don’t want to play doctor, right?

Actually, wellness makes claims costs go up, probably by more than the fines. There are lots of unneeded lab tests and other tests. For instance, the state of Connecticut admitted that, in addition to throwing away all its money on the actual wellness program, the state spent more on health care. The state comptroller who administered the program said the increased spending was “a good thing.” I guess he wasn’t worried because insurance was paying for it.

See also: Ethics of Workplace Wellness Industry

But, hey, at least the teachers don’t pay for it.

Actually, they do. The state’s human resources department brilliantly figured out that it could launder its wellness spending by hiring this outfit. By paying extra to Catapult (a multiple of what an effective wellness program would cost), the state is able to pick up the tab for wellness using the extra paperwork of a medical claim, as opposed to an outsized administrative expense in a separate line item. The latter would clearly need to be picked up by the taxpayers…and the state would have an incentive to control this highly visible figure.

By contrast, paying for “pry, poke and prod” as a medical claim will never be noticed, like Steve McQueen and David McCallum sprinkling the dirt from the tunnel around the stalag. On the other hand, the program will increase overall medical spending by 2% to 3% (the cost of the screening plus the added hyperdiagnosis expenses).

Here comes the evil genius part: At the next contract negotiation, the state can limit wage increases (or reduce benefits) by pointing out how high the health spending is.

So the teachers get pried, poked and prodded, hyperdiagnosed with hidden illnesses most of them don’t have – all against their will…and then they have to pay for the privilege in reduced wages.

Wow…the teachers are getting screwed. But, hey, at least they can’t sue the state, right, so taxpayers won’t have to pick up that bill, as well?

Starting in January, this program will be in blatant violation of two laws, the Americans with Disabilities Act and the Genetic Information Non-Discrimination Act. Those laws disallow forced wellness checkups but allow so-called “voluntary” ones.

Until recently, “voluntary” meant “do wellness or pay a big fine” like this one. But thanks to a lawsuit by AARP, the rules are changing in January so that “voluntary” must mean voluntary, like a dictionary would define the word. (This summary has the links to all you need to know about the case.) To get these fines back, teachers will be able to sue the state, possibly even as a class action, and possibly being awarded punitive damages. Exposure to lawsuits could cost the state millions more in addition to its current expenditure on Catapult Health.

And that doesn’t even cover the costs of a possible teacher walkout, like the one in West Virginia that was spurred in part by – you guessed it – the wellness program.

But, don’t worry. Insurance will pay for it.

Phew! At least it’s free to taxpayers because Catapult’s expenses and profits are “already in your budget” and “fees are processed through your health plan.”

Except that the state of Arkansas is its own health plan. There is no “Don’t worry. Insurance will pay for it” here. The state is self-insured, meaning it picks up the tab, not some nameless insurance company.

But, hey, at least this program will save money, right?

The return-on-investment for the state is allegedly 3.27-to-1, as shown by the so-called “Harvard Study,” conducted by Katherine Baicker.

Except that the Harvard study has been proven wrong, not just by the nonprofit, nonpartisan highly respected RAND Corporation (and I myself chimed in, as well), but by an ace researcher named Damon Jones, part of the prestigious National Bureau for Economic Research. His work showed that wellness accomplishes virtually nothing other than the expenditure of money. (Don’t worry—insurance will pay for it.)

See also: Wellness Vendors Keep Dreaming

But, hey, maybe Professor Jones is wrong. After all, why should he care what Professor Baicker thinks, right?

Um, because he reports to her? Yep, he’s an associate professor at the exact same school of public health where she is now dean. Just guessing here, but it would seem a subordinate would have to be pretty darn sure of his findings (and they are rock solid, and completely in agreement with all the other recent research, summarized here) to publicly humiliate his own dean.

Even Baicker doesn’t defend her findings any more. She says: “It’s too early to tell.” That means she is running away from her very widely cited signature study, upon which essentially the entire wellness industry’s economic justification is based. This would be like Arthur Laffer, whose Laffer curve created supply-side economics, which has been used to justify two tax cuts, saying, “Well, maybe it’s not right. I dunno. Let’s wait and see.”

But, hey, at least forced wellness improves employee health, right?

Apparently not. Forcing people to get annual wellness checkups doesn’t benefit them, according to the New York Times, the New England Journal of Medicine, the Journal of the American Medical Association and Consumer Reports. (Before dismissing the credibility of those sources due to possible political bias, keep in mind that Newsmax, the Federalist and Laura Ingraham hate “pry, poke and prod” programs, too.)

Forced wellness also takes teachers away from the classrooms to be pried, poked and prodded, stresses them out and hurts morale.

Further, sending “record rates” of employees into lifestyle and disease management is classic hyperdiagnosis – braggadocio-fueled misunderstandings of the arithmetic of lab results, resulting in large numbers of people getting told they need coaching and care they don’t want or, in general, need. Nothing makes a wellness vendor happier than to hyperdiagnose as many employees as possible.

But, hey, maybe teachers are a special case. Maybe the impact of “pry, poke and prod” programs is different for them?

It sure is. The single school district for which the data has been compiled is Boise, Idaho. According to the wellness vendor’s own data, the health of the teachers got somewhat worse as a result of this pry, poke and prod program. (The vendor, an outfit called Wellsteps, also admitted that it flouted clinical guidelines and fabricated its only positive outcome. The company also previously admitted that costs went way up as a result of its program. The company later suppressed that admission. Wellness vendors are not known for their integrity.)

So the health of teachers may deteriorate, creating more medical expense. but don’t worry. Insurance will pay for it.

But, hey, at least the teachers like it, right?

According to Catapult, employees love the program. Ask the employees, and you might get a different impression. Indeed, I was tipped off to this program by an Arkansas teacher who hates it, like most of her colleagues do — and that’s before they learn that they are actually paying for it…keep reading.

Obviously, if teachers wanted to submit to a “pry, poke and prod” program, the state wouldn’t have to threaten them with massive fines – almost $1,000/year, which appears to be close to a record for any "pry, poke and prod" program anywhere — for refusing to let a private, out-of-state corporation play doctor on them at state expense.

But, hey, at least the state taxpayers save money by fining the teachers who don’t want to play doctor, right?

Actually, wellness makes claims costs go up, probably by more than the fines. There are lots of unneeded lab tests and other tests. For instance, the state of Connecticut admitted that, in addition to throwing away all its money on the actual wellness program, the state spent more on health care. The state comptroller who administered the program said the increased spending was “a good thing.” I guess he wasn’t worried because insurance was paying for it.

See also: Ethics of Workplace Wellness Industry

But, hey, at least the teachers don’t pay for it.

Actually, they do. The state’s human resources department brilliantly figured out that it could launder its wellness spending by hiring this outfit. By paying extra to Catapult (a multiple of what an effective wellness program would cost), the state is able to pick up the tab for wellness using the extra paperwork of a medical claim, as opposed to an outsized administrative expense in a separate line item. The latter would clearly need to be picked up by the taxpayers…and the state would have an incentive to control this highly visible figure.

By contrast, paying for “pry, poke and prod” as a medical claim will never be noticed, like Steve McQueen and David McCallum sprinkling the dirt from the tunnel around the stalag. On the other hand, the program will increase overall medical spending by 2% to 3% (the cost of the screening plus the added hyperdiagnosis expenses).

Here comes the evil genius part: At the next contract negotiation, the state can limit wage increases (or reduce benefits) by pointing out how high the health spending is.

So the teachers get pried, poked and prodded, hyperdiagnosed with hidden illnesses most of them don’t have – all against their will…and then they have to pay for the privilege in reduced wages.

Wow…the teachers are getting screwed. But, hey, at least they can’t sue the state, right, so taxpayers won’t have to pick up that bill, as well?

Starting in January, this program will be in blatant violation of two laws, the Americans with Disabilities Act and the Genetic Information Non-Discrimination Act. Those laws disallow forced wellness checkups but allow so-called “voluntary” ones.

Until recently, “voluntary” meant “do wellness or pay a big fine” like this one. But thanks to a lawsuit by AARP, the rules are changing in January so that “voluntary” must mean voluntary, like a dictionary would define the word. (This summary has the links to all you need to know about the case.) To get these fines back, teachers will be able to sue the state, possibly even as a class action, and possibly being awarded punitive damages. Exposure to lawsuits could cost the state millions more in addition to its current expenditure on Catapult Health.

And that doesn’t even cover the costs of a possible teacher walkout, like the one in West Virginia that was spurred in part by – you guessed it – the wellness program.

But, don’t worry. Insurance will pay for it.