How to Help Microinsurance Spread

Nearly 6.5 billion residents live in developing countries, so the scale of the microinsurance opportunity is vast.

Nearly 6.5 billion residents live in developing countries, so the scale of the microinsurance opportunity is vast.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Lauren Gore is a principal and co-founder of LDR, a growth and innovation advisory firm, as well as a graduate from the U.S. Military Academy and Harvard Law School.

A consortium of companies and industry groups should design and lobby for high-level legislative clarifications suitable for all jurisdictions.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Barry Thompson is a 35-year-plus industry veteran. He founded Risk Acuity in 2002 as an independent consultancy focused on workers’ compensation. His expert perspective transcends status quo to build highly effective employer-centered programs.

To thoroughly understand the idea of a product vision, it is important to also understand two other concepts: strategy and tactics.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Patrick Tsao is a builder at heart. Having worked at world-class tech companies such as Uber, Redfin and Microsoft, he brings a unique perspective to the executive team at Getsafe.

The risk is that insurers will not do the thorough risk analysis necessary before launching and implementing significant technology initiatives.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

OSHA reports that 2 million incidents occur each year, many of which (non-fatal incidents like bullying or harassment) go unreported.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Walls is the vice president, client engagement, at Safety National.

He is also the founder of the Work Comp Analysis Group on LinkedIn, which is the largest discussion community dedicated to workers' compensation issues.

If a policyholder has some marijuana—or is growing it within state-mandated limits—will a homeowners policy cover the loss in a fire?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Nick DiUlio is an analyst and writer for insuranceQuotes.com, which publishes in-depth studies, data and analysis related to auto, home, health, life and business insurance.

Too few people in the corporate world act on the recognition that their people, policies and processes can absolutely affect startups’ survival.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Amy Radin is a transformation strategist, a scholar-practitioner at Columbia University and an executive adviser.

She partners with senior executives to navigate complex organizational transformations, bringing fresh perspectives shaped by decades of experience across regulated industries and emerging technology landscapes. As a strategic adviser, keynote speaker and workshop facilitator, she helps leaders translate ambitious visions into tangible results that align with evolving stakeholder expectations.

At Columbia University's School of Professional Studies, Radin serves as a scholar-practitioner, where she designed and teaches strategic advocacy in the MS Technology Management program. This role exemplifies her commitment to bridging academic insights with practical business applications, particularly crucial as organizations navigate the complexities of Industry 5.0.

Her approach challenges traditional change management paradigms, introducing frameworks that embrace the realities of today's business environment – from AI and advanced analytics to shifting workforce dynamics. Her methodology, refined through extensive corporate leadership experience, enables executives to build the capabilities needed to drive sustainable transformation in highly regulated environments.

As a member of the Fast Company Executive Board and author of the award-winning book, "The Change Maker's Playbook: How to Seek, Seed and Scale Innovation in Any Company," Radin regularly shares insights that help leaders reimagine their approach to organizational change. Her thought leadership draws from both her scholarly work and hands-on experience implementing transformative initiatives in complex business environments.

Previously, she held senior roles at American Express, served as chief digital officer and one of the corporate world’s first chief innovation officers at Citi and was chief marketing officer at AXA (now Equitable) in the U.S.

Radin holds degrees from Wesleyan University and the Wharton School.

To explore collaboration opportunities or learn more about her work, visit her website or connect with her on LinkedIn.

Disruptive leaders stand in the middle – able to speak both the language of the legacy world and the language of the startup world.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Marina Cvetkovic is a trusted C-suite coach and adviser focusing on innovation, agility and disruption. She combines her strong financial services background with coaching expertise to help companies and executives redefine their processes and build a culture of agility and innovation.

A report by The Insurance Insider last week that AXA won't contribute more funding to its insurtech venture fund underscores just how hard innovation can be for big corporations, even when you have the sort of all-star cast that a fund like XL Innovate can assemble.

Picking winners and losers among investments is plenty hard—the rule of thumb is that nine out of 10 startups fail. On top of that, corporate venture funds typically have conflicted agendas.

To get top talent, you have to pay handsomely for good returns—Silicon Valley titans like John Doerr and Vinod Khosla set the bar, having become billionaires as VCs. Chasing those returns, the VCs want to be able to invest in anything with great promise. Fair enough. But here's where it gets tricky.

The corporation typically isn't just looking for a return on investment. It wants to find a product, a line of business, a business model, a something that could produce a step change for the company or even reinvent the business. Basically, the corporation is looking to be Dayton Hudson, a stodgy family retailer that in 1962 let one of the brothers test an idea for a discount retailer—when I tell you that the name he chose was Target, you realize just how successful he was; his experiment subsumed the rest of the company.

The XL Innovate early investment in Lemonade illustrates the tension. Lemonade is now a unicorn, valued at $1.5 billion to $2 billion, so the fund has generated a spectacular return. Yet Lemonade's renters and home insurance, even together with its slick interface, aren't likely to move the needle for AXA's life and health lines or its financial services.

And XL's Lemonade experience is for a company being sophisticated about how to innovate. Our chief innovation officer, Guy Fraker, tells of being at State Farm years ago, in the pre-insurtech days, and trying to get the company to invest in Relay Rides. Guy was sure that the peer-to-peer, car-sharing service would succeed, and the $500,000 investment finally happened, but only because a senior executive cut through the review process and expensed it. Guy later learned that State Farm sold its stake in the company (now called Turo) after a year and tripled its money, but it's not as though that extra $1 million moved the needle for the mammoth insurance company.

Historically, the best insurance companies have been run by financial geniuses, who have figured out super-smart ways to use all the capital they amass. Warren Buffett, for instance, has used Berkshire Hathaway's insurance assets to finance much of his wizardry. And there's a lot to be said for the insurance industry's financial sophistication. The industry financed the recovery from Katrina, Maria, 9/11, etc., and is rebuilding sections of California following the devastating wildfires, all without taking on debt.

But the game is changing, and financial brilliance is no longer enough. The bad news is that the challenges will be tough, as the AXA report shows. The good news is that the industry seems to be coming to grips with the change. A.M. Best's decision to start rating companies on their innovation capabilities, in particular, will not only provide companies with incentive but will help steer them toward the right path.

Cheers,

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

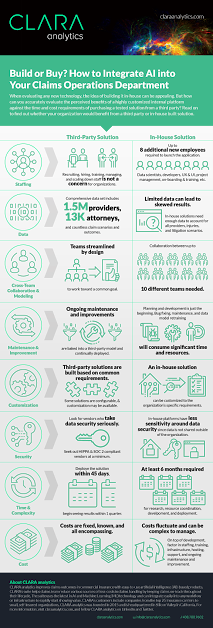

As AI infiltrates commercial insurance, do you develop a custom solution in-house or purchase a third-party solution already on the market?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|