The insurance industry is often depicted as resistant to innovation, skeptical of the cost, and unsure of the benefits from embracing innovation and new technologies. So, it was gratifying to hear from a number of insurance leaders who are optimistic about insurtechs and innovation, confident about the opportunities they can create for incumbents, and actively taking steps to change their product offerings and business models.

This was the view from Canada, which ITL’s Chief Innovation Officer Guy Fraker and Chief Operating Officer Paul Winston both experienced as participants and observers at the InsurTech North conference, held last week in Toronto. The conference featured a number of incumbent insurers, advisers and investors, accelerators and insurtechs—all active within the innovation ecosystem of Canada and North America.

Some of the biggest takeaways are:

- A growing number of Canadian insurers—from both the life and P/C sides of the business—are embracing innovation systems and practices and are willing to candidly share challenges and successes with peers.

- Two consistent themes emerged from innovation success stories: The C-Suite is convinced of the need to be successful with innovation, and leveraging carefully crafted constraints propels innovation.

- A key "break-through moment" shared by incumbent carriers actively pursuing new concepts came when they took a candid introspective look at their company and recognized they needed new partners with specific capabilities to successfully innovate.

- Innovation success comes from also understanding the human side of innovation, and that clarity of purpose can help minimize incumbent cultural resistance.

- The insurance industry, now feeling more experienced with various innovation models, seems be expressing not only a sense of arrival but also a mistaken perception that it is not facing disruption, just an acceleration of incremental change.

The conference also presented many valuable lessons, tactics, and strategies for the benefit of attendees that we felt worth sharing with the broader innovation community. Highlights from selected sessions follow:

Meeting the expectations of VCs

Two venture capital investors shared their perspective on insurtechs and what makes a startup an attractive investment.

Commenting on the growth of the insurtech "ecosystem," Maor Amar, Managing Director of Toronto-based Impression Ventures, estimated that he has looked at more than 1,300 startups since June 2017, and in that time has invested in only nine companies.

Among the reasons for VC selectivity, he said, is that within the universe of insurtech startup CEOs, the number of experienced, second-generation leaders—those who have already had one successful exit under their belt—is extremely low.

Being attractive to VCs also requires that insurtechs have more than "selling to insurers" as a plan, added Jonathan Kalman, General Partner of EOS Venture Partners in Philadelphia. Most insurers have a long buying cycle—typically three years—and their innovation budgets are relatively small, he said. In addition, insurer IT budgets are predominantly devoted to maintenance of systems, with almost none allocated to new technologies and solutions, he said.

Does innovation success require commitment from and communications with "The Top"?

To be successful at innovation requires a leadership team that is convinced it’s a strategic priority and allocates resources for these efforts, said Rowan Saunders, president and CEO of Economical Insurance, based on Waterloo, Ontario. Companies may use an incubator to get an idea off the ground, but for the company to get the full benefit of the innovation it must be moved inside the organization, he said.

Saunders also shared his thoughts about the future of insurance with a statement both equally profound and clear: "In the next 10 years, insurance leaders will move from rating and repair to prediction and prevention." (We at ITL certainly support this forecast.)

Can incumbents overcome technological and cultural logjams?

The so-called logjams that delay and complicate the adoption of new technology and integration of insurtech solutions with incumbents are not unique to insurance, said Ryan Spinner, head of innovation and disruptive partnerships for Aviva Canada. These obstacles can be endemic in any large organization that is trying to innovation, he said.

Spinner also gave the participants an important piece of advice by sharing from his own experience: "It takes humility and honesty for an incumbent to admit that it might be better to buy than build," he said.

Wolfpack Competition

The Wolfpack competition among five startups illustrated an important concept: Success in systematic innovation, while minimizing the frequency and severity of "fail fast and learn" experiences, requires clarity and understanding the human side of innovation. At this year's competition, Finaeo won both the "People’s Choice" award from the audience and the Conference Award from the Wolfpack judges.

Founding CEO Aly Dhalla announced he was not there to make a pitch, but to tell a story. He then proceeded to tell a compelling story with a casual and engaging style. This is not to suggest the business model, as well as the technological solution, embedded in his story is not equally compelling. However, the best innovations are often shared, described, and arise from a well-told compelling story that rarely focuses on the technological details. The lesson from this 90- minute competition is how not to fall in love with the cool, new and shiny, but instead understand how the cool, new and shiny will be relevant to people’s lives.

Build, buy or partner – is this time-tested decision framework still the best approach?

Innovation should be viewed as a process, not a goal in and of itself, according to Peter Primdahl, VP of Emerging Business Models for Guelph, Ontario-based Co-Operator’s Insurance. "It’s an enabler of a company’s priorities and business objectives," he said, adding that innovation should start with a well-articulated problem statement.

In partnership with Slice Labs, Co-Operator’s launched an on-demand insurance product for home-sharing hosts as a standalone company called Duuo. "We wanted to create something new, not use this launch as a lever to transform the overall company," Primdahl said, noting that it would be hard to take advantage of such opportunities if the overall organization had to change first before it could implement new policies and procedures.

Alice Keung, Chief Transformation Officer of Waterloo-based Economical Insurance, said that her company took the view that the entire company must become more agile and flexible, and adopt a culture that is open to innovation. Economical launched a direct to consumer digital business, called Sonnet, that represented a big change from its traditional distribution partners, agents.

"We don’t want to be disrupted; we want to disrupt ourselves," Keung said.

Sun Life Financial faced some internal doubters and skeptics when it started on its innovation journey, noted Anna Foat, Director of Global Digital Transformation Office in London, Ontario. But as soon as the company showed its initiatives were generating revenue, that made them into converts, she said.

For lasting success, innovation needs to be repeatable, Foat said. "It’s like building an innovation muscle, which helps to overcome inertia" on additional projects, she said.

Another key to innovation success, Co-Operator’s Primdahl said, is greater recognition by senior leadership of the value of learning from innovation experiments, even if they don’t pan out. He said he's optimistic that more companies today "are likely to accept innovation stumbles as a learning process, not failures."

Another driver of innovation is competition. "Every company wants to be seen as innovative. There’s a fear of missing out," said Primdahl, who added that he believes companies should approach innovation as an informed choice, not simply fear of falling behind.

Is achieving scale possible without the wheels coming off?

As a startup, "it’s easy for us to innovate—we have no customers," said Tim Attia, CEO and founder of Slice Labs, in a conversation about how scaling for growth with Guy Fraker. "Scaling is much more challenging, especially if you have something that no one wants to buy."

As many insurance incumbents are evaluating startups and whether their solution is a fit, "insurtechs look at incumbents and evaluate if they can help them to scale," Attia said.

Citing transportation network giants Lyft and Uber, as well as Airbnb, Tesla, and automakers with subscription models, Attia and ITL’s Fraker engaged in a lively exchange about models of embedded and on-demand insurance. Both agreed that the emergence of new business models and industry entrants will continue to apply pressure on the core incumbent business model.

A.I. will continue impacting insurance, so now what?

Three firms who are leaders in the application of artificial intelligence openly shared how they are leveraging A.I. technological capabilities in the context of insurance. Conference attendees had the opportunity to learn a simple, yet game changing, lesson from the world of technologies from Pypestream President Donna Peeples, Abhay Raman, who is VP at Sun Life Financial, and Cameron Schuler, VP of Industry Innovation at the Vector Institute. Many insurtechs and specific technologies are a "what," whereas artificial Intelligence stands out as a "how." A.I. is now as ubiquitous as connectivity, requiring the selection of carefully designed applications.

Barbarians at the Gate

Some of the big tech giants have shown signs of interest in insurance, "but it’s not clear they’ll be successful, that they’ll be the barbarians to take down the Roman empire of insurance," said Eric Weisburg, Vice President, Research and Consulting for Novarica in Boston.

Insurers have done a great job with regulation and capital requirements, and also have a very different risk tolerance compared with non-insurance companies, so it’s unlikely that tech giants will take away significant market share from incumbents, said David Wechsler, Executive Director of Channels and Partnerships for Philadelphia-based Comcast Infinity. "That’s not to say they might not take an interest in insurance if it means serving their customers," he added, noting that currently he views it as more advantageous for companies like Comcast to partner with insurers than compete with them.

Aly Dhalla of Finaeo, the startup that won the Wolfpack pitch competition at Insurtech North, said "don’t underestimate a VC fund’s ability to transform an industry, such as if Softbank decides to put $50 billion into the market to disrupt an industry."

Sridhar Manyem, Director, Industry Research and Analytics for A.M. Best Co., said that for tech companies to enter the insurance market requires more than a risk appetite. They also have a return perspective and it has to be attractive, he said.

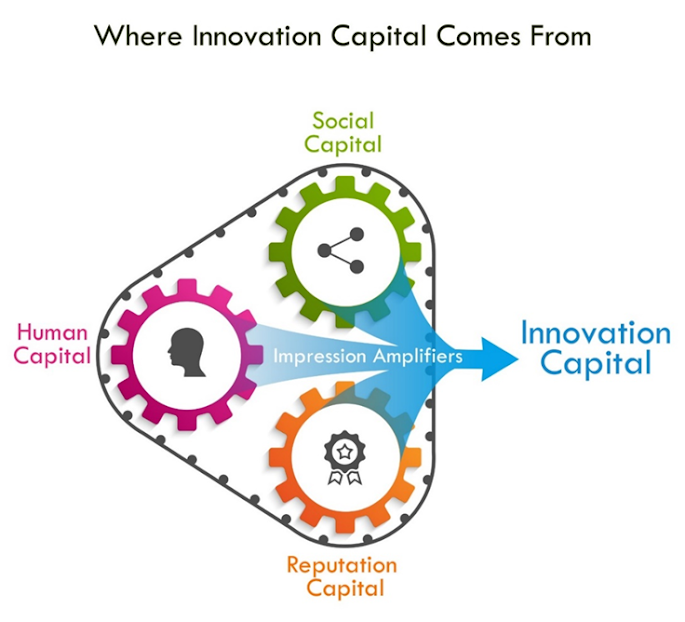

These combined parts work together like gears in an engine (which is why we have depicted the figure above as a set of gears). As you get each gear moving, it can have a flywheel effect. The flywheel effect, first coined by management expert Jim Collins, refers to the process of getting a huge flywheel (say, a massive 5,000-pound metal disk) into motion. Initially, attempts to move the flywheel produce almost no movement—it is almost impossible to imagine the flywheel at speed. Then, slowly, the wheel gathers speed, and suddenly the momentum of the flywheel kicks in your favor. You push no harder than during the first rotation, but the flywheel goes faster and faster. Each turn builds on the work done earlier, compounding your investment of effort. Eventually, the huge, heavy disk flies, with almost unstoppable momentum. The innovation-capital engine—with its three gears and the lubricant of impression amplifiers—can propel a person’s innovation capital in a similar way.

This analogy is relevant because building your innovation capital starts with small steps that can eventually have big outcomes. Innovation capital outliers—leaders like Bezos and Musk, who are numbers one and two in our ranking—didn’t start out being that different from the rest of us. They accumulated their innovation capital through small steps and then got momentum from the flywheel cycle. Today, they have more good ideas to champion because more people bring good ideas to them; they develop more social connections because of their reputation—people want to know them. And because they have access to a greater number of good ideas and more social connections, they can build their reputation for innovation by launching more innovations. These components are related in a positive way—more of one component leads to more of another (academics call this relationship mutual causality, but you might just think of these components as reinforcing each other). Resource holders simultaneously consider all three components when deciding to give someone their time or resources for an innovation project.

These combined parts work together like gears in an engine (which is why we have depicted the figure above as a set of gears). As you get each gear moving, it can have a flywheel effect. The flywheel effect, first coined by management expert Jim Collins, refers to the process of getting a huge flywheel (say, a massive 5,000-pound metal disk) into motion. Initially, attempts to move the flywheel produce almost no movement—it is almost impossible to imagine the flywheel at speed. Then, slowly, the wheel gathers speed, and suddenly the momentum of the flywheel kicks in your favor. You push no harder than during the first rotation, but the flywheel goes faster and faster. Each turn builds on the work done earlier, compounding your investment of effort. Eventually, the huge, heavy disk flies, with almost unstoppable momentum. The innovation-capital engine—with its three gears and the lubricant of impression amplifiers—can propel a person’s innovation capital in a similar way.

This analogy is relevant because building your innovation capital starts with small steps that can eventually have big outcomes. Innovation capital outliers—leaders like Bezos and Musk, who are numbers one and two in our ranking—didn’t start out being that different from the rest of us. They accumulated their innovation capital through small steps and then got momentum from the flywheel cycle. Today, they have more good ideas to champion because more people bring good ideas to them; they develop more social connections because of their reputation—people want to know them. And because they have access to a greater number of good ideas and more social connections, they can build their reputation for innovation by launching more innovations. These components are related in a positive way—more of one component leads to more of another (academics call this relationship mutual causality, but you might just think of these components as reinforcing each other). Resource holders simultaneously consider all three components when deciding to give someone their time or resources for an innovation project.