Lowering Costs of Customer Acquisition

One reason new customer costs are so high in insurance is that the industry has lagged in adopting digital technologies.

One reason new customer costs are so high in insurance is that the industry has lagged in adopting digital technologies.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Hammond is the chief strategy officer at Confie. He was previously the president of U.S. operations at Bolt Solutions.

By what right should insurers deny coverage to an American seeking medical treatment through cannabis in Australia?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

We need a global set of rules on permissible uses of personal data, and the insurance industry would gain much by taking the lead.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stephen Applebaum, managing partner, Insurance Solutions Group, is a subject matter expert and thought leader providing consulting, advisory, research and strategic M&A services to participants across the entire North American property/casualty insurance ecosystem.

California's workers' comp alternative dispute resolution system emphasizes cooperation rather than use a win-lose model.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael D. Peabody received his Juris Doctorate and Certificate in Alternative Dispute Resolution from Pepperdine University School of Law and was admitted to practice law in 2002. He has practiced in the fields of workers compensation and employment law, including workplace discrimination and wrongful termination.

How does an agent/company win when big competitors keep pounding the "commodity" claim? By treating each customer as an individual.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.

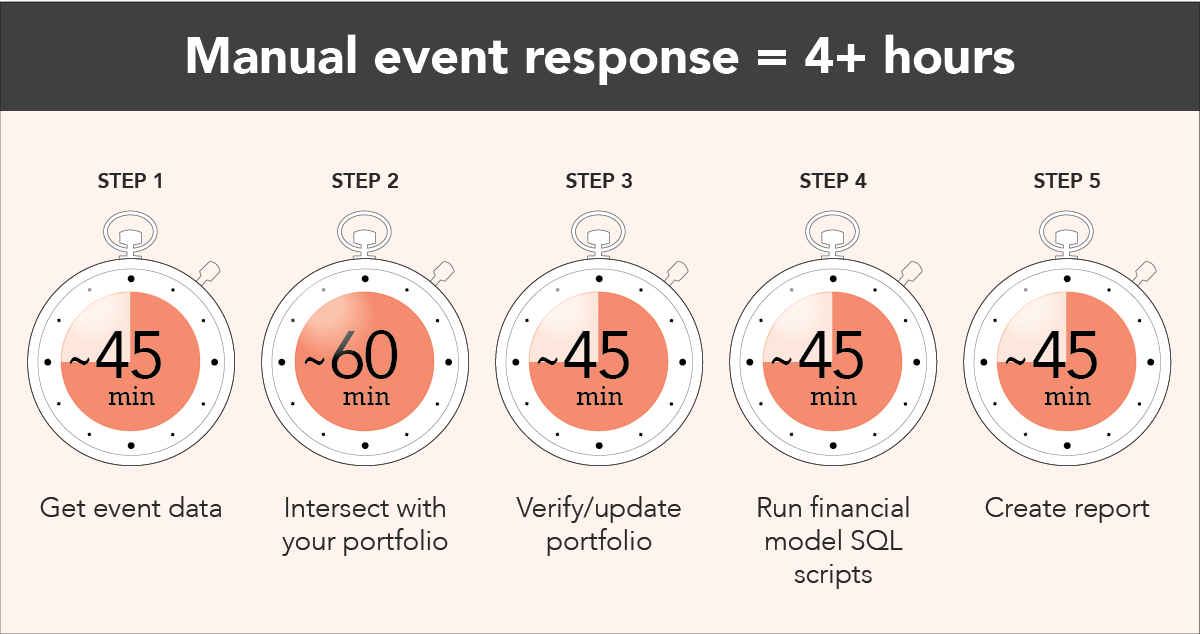

Speed and quality of response following catastrophes can bolster your organization, but only if you automate event response operations.

1) Get event data

You go to the NOAA website, pull down wind datasets from the latest update and work to get them into a usable format.

2) Intersect with your portfolio

Now, it’s time to intersect the footprint with your portfolio data, which may take another hour or so.

3) Update portfolio

After you get everything set up, you realize your portfolio is six months old, which may over- or underestimate your actual exposure. Do you pull an updated snapshot of your exposures? Probably not, because there isn’t enough time!

4) Run financial model SQL scripts

With a manual intersection process, you are likely unable to easily access the impact of policy terms and conditions, so you’ll need to run some financial model scripts to determine the actual exposure for this event.

5) Create and share reports

You finally get some financial numbers ready and format them into a nice report for management.

Then, you think about what you actually had on your to-do list for the day before the hurricane was in the picture...or, wait, maybe not...because just then you see that NOAA has published the next snapshot of the hurricane.

Rinse and repeat. It’s going to be a long night.

See also: How to Predict Atlantic Hurricanes

Let’s face it, if you can’t extract insight from data fast enough to mitigate damage or provide a timely course of action, your operational efficiency and downstream customer satisfaction go downhill fast. And just think, this was for a single data source. Realistically, you have to perform these same steps across multiple sources to gain a complete understanding of this event. (e.g. KatRisk, Impact Forecasting, JBA flood, NOAA probability surge).

What makes the process so inefficient?

1) Get event data

You go to the NOAA website, pull down wind datasets from the latest update and work to get them into a usable format.

2) Intersect with your portfolio

Now, it’s time to intersect the footprint with your portfolio data, which may take another hour or so.

3) Update portfolio

After you get everything set up, you realize your portfolio is six months old, which may over- or underestimate your actual exposure. Do you pull an updated snapshot of your exposures? Probably not, because there isn’t enough time!

4) Run financial model SQL scripts

With a manual intersection process, you are likely unable to easily access the impact of policy terms and conditions, so you’ll need to run some financial model scripts to determine the actual exposure for this event.

5) Create and share reports

You finally get some financial numbers ready and format them into a nice report for management.

Then, you think about what you actually had on your to-do list for the day before the hurricane was in the picture...or, wait, maybe not...because just then you see that NOAA has published the next snapshot of the hurricane.

Rinse and repeat. It’s going to be a long night.

See also: How to Predict Atlantic Hurricanes

Let’s face it, if you can’t extract insight from data fast enough to mitigate damage or provide a timely course of action, your operational efficiency and downstream customer satisfaction go downhill fast. And just think, this was for a single data source. Realistically, you have to perform these same steps across multiple sources to gain a complete understanding of this event. (e.g. KatRisk, Impact Forecasting, JBA flood, NOAA probability surge).

What makes the process so inefficient?

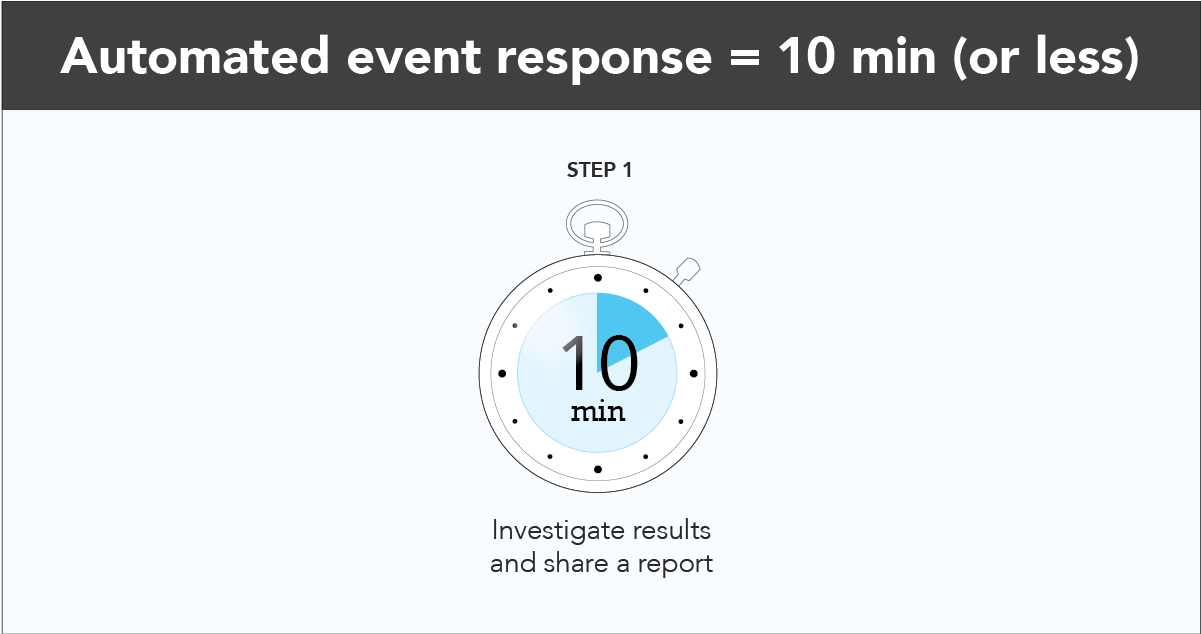

Within moments of NOAA publishing an update, you receive an email notifying you of the financial and insured impact. With the click of a button, you’re in a live dashboard, investigating the event, your affected exposures and more.

You still have to get those numbers to management, but this time you can breathe easy knowing that your numbers are not only accurate, but that the whole process took a fraction of the time. Now when NOAA (or any other public or private data provider) pushes the next update, you’ll be set with a highly scalable infrastructure that enriches your data, calculates financial impact and produces a report within minutes.

Why was this process much more efficient?

Within moments of NOAA publishing an update, you receive an email notifying you of the financial and insured impact. With the click of a button, you’re in a live dashboard, investigating the event, your affected exposures and more.

You still have to get those numbers to management, but this time you can breathe easy knowing that your numbers are not only accurate, but that the whole process took a fraction of the time. Now when NOAA (or any other public or private data provider) pushes the next update, you’ll be set with a highly scalable infrastructure that enriches your data, calculates financial impact and produces a report within minutes.

Why was this process much more efficient?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Rebecca Morris has 13 years of insurance industry experience and a passion for problem-solving. With a background in insurance analytics, she has put her mathematics expertise into action by leading the development and delivery of SpatialKey’s financial model.

Deploying insurtech is letting insurers launch digital life and annuity products in months instead of years and leverage public data.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Rex Tessendorf is the CFO of <a href="https://se2.com/">SE2</a>, a leader in digital technology-enabled third-party administration services for the U.S. life and annuity insurance industry.

The digital insurance concept has lost most of its popularity. Insurers have learned that digitalizing the traditional process is not enough.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Hasan Meral is the head of product and process management at Unico Insurance. He has a BA in actuarial science, an MA in insurance and a PhD in banking.

The publicity for the first IPO of a European insurtech relied on "attention hacking" in social media via influencers.

Dr. Robin Kiera (left), founder of Digital Scouting, and Lutz Kiesewetter, head of IR and PR at DFV

RK: Waiting for Lutz in the lobby, I saw heavy construction going on on the ground floor. There was free Wi-Fi everywhere, easy access for all. Actual investments were taking place, in contrast to so many other companies that talk a lot about modernization but lack any real action. Lutz was also a little younger than I expected, making it clear that young people had responsibility here, not only after serving 30 years.

The conversation with the founder and CEO, Dr. Stefan Knoll, was also quite memorable. The fact that he was willing to share his crystal-clear analysis of the insurance industry was surprising. That he let me film and publish it was even more so.

I was given the opportunity to look under the hood of the company, learning more about the impressive, homegrown, event-based IT system that allows end-to-end, real-time business processes. While the pure business numbers were way above industry average, I was even more impressed by the open minds and agile approach of the employees. Guided by a smart and dedicated CEO, this motivated team was thriving within their work culture, willing to go all in on new communication approaches to ultimately position the company for the IPO.

See also: Insurtech Needs a Legislative Framework

Lesson #1: Go against all rules and go all in

LK: The publicity for the first IPO of a European insurtech and fully digital insurer in the Western world could not be done with classic, conservative PR. Thankfully, being a little different is part of our DNA, It was, therefore, clear that attention hacking in social media via influencers would play an important role. This strategy led us to work with Robin and deploy his unusual “attention hacking,” which means using a flood of content on social media, vlogging and conference appearances to support our IPO mission.

RK: For me, it was a go/no-go requirement that we would ignore most classic communication rules and go all in on social media, influencer marketing and content marketing.

Lesson #2: Share your story

RK: In a matter of weeks, we laid out our master plan and began to implement. We shot the first set of videos sharing the story of DFV, and we began to flood the internet with relevant, highly targeted content.

I also made a lot of behind-the-scenes introductions to highly influential people within the international community. This was easy for me, because, first, I have known a lot of decision makers personally for years. Some are good friends. Second, the story of DFV was compelling: a seemingly conservative insurer with a long German name embracing modern technology, ripping apart its old IT system, creating innovative insurance products, investing heavily into team and technology and serving half a million clients already, making significant revenue and profit while a lot of other decision makers still were hesitant to invest in change and while a lot of startups presented vanity key performance indicators (KPIs) but not real sales numbers. The story was almost too good to be true.

All around the world, insurance and insurtech experts were interested in hearing more.

LK: The PR campaign kicked off with a DFV event series on April 26. DFV positioned itself as the only insurtech with a working insurance business model to the public, the insurance industry, journalists and the trade press. The live presentation covered features like the in-house event- and Java-based core system, the AI-based service that can settle a claim in 45 seconds, and the use of Alexa as a sales channel. The fact that DFV, with just 100 employees, not only covers the complete value chain of an insurance company but also works 100% digitally and is profitable, with hundreds of thousands of clients, while acting as a risk carrier for its products, was something that garnered attention.

Lesson #3: Meet and serve the community

RK: Sharing your story massively on social media is good. Meeting the decision makers of different ecosystems is even better. We decided to meet the movers and shakers in person by choosing to attend the most important conferences around the world. So, we went for example to Insuretech Connect in Las Vegas and DIA in Munich. We helped DFV share its fresh story backed by real KPIs on the most renowned stages in front of thousands of insurance professionals. Why? After speaking on stage, interested parties approach you; it’s not the other way around any more. Also, we produced social media content from the events that reached people around the world via the Digitalscouting channels.

In addition to speaking at and breathing in the exciting atmosphere of these events, we met a lot of decision makers from my network. Many people welcomed DFV with open arms, keeping their fingers crossed for the IPO. Each time I saw this happen, it moved me personally, because it reminded me how many amazing people are working in this industry.

LK: For the IPO and initial financial market communication, we implemented broad, multi-channel PR. The intention to go public was exclusively picked up by Wirtschaftswoche, one of the leading magazines in Germany. The story quickly spread throughout the world via Bloomberg and Reuters. Our 360-degree strategy included standard media and communication channels, as well as intensive attention hacking via social media and the visits to insurtech events such as DIA in Munich and ITC in Las Vegas. The first insurtech IPO in Europe received considerable attention within the community and also received from the financial and business media.

See also: Insurtech Ingredients? We Just Want Cake

The last weeks, days and hours before the IPO were dramatic. The first IPO attempt needed to be called off because the order books were not full. For the second date, results looked a little better. But it was not clear until the morning of the day if the IPO would be successful. So, when the stock exchange employee announced the first stock price of 12.30 EUR, the relief for management was huge. With a ring of a bell, DFV raised 55 million USD.

I, personally, was happy to be present and part of this insurtech success story. A small insurer from Frankfurt seized the moment, using tools and tactics that were against all traditional rules to prepare an IPO, helped across the finish line by a supportive community of international insurance and insurtech professionals.

Now the company focuses on delivering on its promises.

Dr. Robin Kiera (left), founder of Digital Scouting, and Lutz Kiesewetter, head of IR and PR at DFV

RK: Waiting for Lutz in the lobby, I saw heavy construction going on on the ground floor. There was free Wi-Fi everywhere, easy access for all. Actual investments were taking place, in contrast to so many other companies that talk a lot about modernization but lack any real action. Lutz was also a little younger than I expected, making it clear that young people had responsibility here, not only after serving 30 years.

The conversation with the founder and CEO, Dr. Stefan Knoll, was also quite memorable. The fact that he was willing to share his crystal-clear analysis of the insurance industry was surprising. That he let me film and publish it was even more so.

I was given the opportunity to look under the hood of the company, learning more about the impressive, homegrown, event-based IT system that allows end-to-end, real-time business processes. While the pure business numbers were way above industry average, I was even more impressed by the open minds and agile approach of the employees. Guided by a smart and dedicated CEO, this motivated team was thriving within their work culture, willing to go all in on new communication approaches to ultimately position the company for the IPO.

See also: Insurtech Needs a Legislative Framework

Lesson #1: Go against all rules and go all in

LK: The publicity for the first IPO of a European insurtech and fully digital insurer in the Western world could not be done with classic, conservative PR. Thankfully, being a little different is part of our DNA, It was, therefore, clear that attention hacking in social media via influencers would play an important role. This strategy led us to work with Robin and deploy his unusual “attention hacking,” which means using a flood of content on social media, vlogging and conference appearances to support our IPO mission.

RK: For me, it was a go/no-go requirement that we would ignore most classic communication rules and go all in on social media, influencer marketing and content marketing.

Lesson #2: Share your story

RK: In a matter of weeks, we laid out our master plan and began to implement. We shot the first set of videos sharing the story of DFV, and we began to flood the internet with relevant, highly targeted content.

I also made a lot of behind-the-scenes introductions to highly influential people within the international community. This was easy for me, because, first, I have known a lot of decision makers personally for years. Some are good friends. Second, the story of DFV was compelling: a seemingly conservative insurer with a long German name embracing modern technology, ripping apart its old IT system, creating innovative insurance products, investing heavily into team and technology and serving half a million clients already, making significant revenue and profit while a lot of other decision makers still were hesitant to invest in change and while a lot of startups presented vanity key performance indicators (KPIs) but not real sales numbers. The story was almost too good to be true.

All around the world, insurance and insurtech experts were interested in hearing more.

LK: The PR campaign kicked off with a DFV event series on April 26. DFV positioned itself as the only insurtech with a working insurance business model to the public, the insurance industry, journalists and the trade press. The live presentation covered features like the in-house event- and Java-based core system, the AI-based service that can settle a claim in 45 seconds, and the use of Alexa as a sales channel. The fact that DFV, with just 100 employees, not only covers the complete value chain of an insurance company but also works 100% digitally and is profitable, with hundreds of thousands of clients, while acting as a risk carrier for its products, was something that garnered attention.

Lesson #3: Meet and serve the community

RK: Sharing your story massively on social media is good. Meeting the decision makers of different ecosystems is even better. We decided to meet the movers and shakers in person by choosing to attend the most important conferences around the world. So, we went for example to Insuretech Connect in Las Vegas and DIA in Munich. We helped DFV share its fresh story backed by real KPIs on the most renowned stages in front of thousands of insurance professionals. Why? After speaking on stage, interested parties approach you; it’s not the other way around any more. Also, we produced social media content from the events that reached people around the world via the Digitalscouting channels.

In addition to speaking at and breathing in the exciting atmosphere of these events, we met a lot of decision makers from my network. Many people welcomed DFV with open arms, keeping their fingers crossed for the IPO. Each time I saw this happen, it moved me personally, because it reminded me how many amazing people are working in this industry.

LK: For the IPO and initial financial market communication, we implemented broad, multi-channel PR. The intention to go public was exclusively picked up by Wirtschaftswoche, one of the leading magazines in Germany. The story quickly spread throughout the world via Bloomberg and Reuters. Our 360-degree strategy included standard media and communication channels, as well as intensive attention hacking via social media and the visits to insurtech events such as DIA in Munich and ITC in Las Vegas. The first insurtech IPO in Europe received considerable attention within the community and also received from the financial and business media.

See also: Insurtech Ingredients? We Just Want Cake

The last weeks, days and hours before the IPO were dramatic. The first IPO attempt needed to be called off because the order books were not full. For the second date, results looked a little better. But it was not clear until the morning of the day if the IPO would be successful. So, when the stock exchange employee announced the first stock price of 12.30 EUR, the relief for management was huge. With a ring of a bell, DFV raised 55 million USD.

I, personally, was happy to be present and part of this insurtech success story. A small insurer from Frankfurt seized the moment, using tools and tactics that were against all traditional rules to prepare an IPO, helped across the finish line by a supportive community of international insurance and insurtech professionals.

Now the company focuses on delivering on its promises.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Dr. Robin Kiera has worked in several management positions in insurance and finance. Kiera is a renowned insurance and insurtech expert. He regularly speaks at technology conferences around the world as a keynote or panelist.

A little-known part of my professional career was a four-year stint as an entrepreneurship professor at a private university. All my students fell into one of three buckets: those who wanted to actually learn and were always prepared; those who just didn’t care; and those (the majority) who wanted to know what they needed to do to get the desired grade.

That's how we see insurance industry incumbents when it comes to their innovation strategies. Some want to excel. Some don’t seem to care as much. Most want to know what they need to do to get a good innovation assessment score from A.M. Best, as part of a general hope to remain relevant or maintain market share.

As we have said repeatedly, we don’t see that treading water is a strategy for growing and gaining an innovation advantage. Yet too many companies are being tutored on their innovation education by advisory firms that seem to support just checking the boxes for a passing grade from A.M. Best.

We have read through paper after paper, release after release and promotion after promotion from advisories on how to score well on the A.M. Best Innovation Assessment. These advisories promise to help incumbents stockpile evidence about leadership on innovation, about culture shift, about resource commitment and allocation. These advisories will help incumbents show that they have a process in place and a structure to follow.

But do they support real, measurable results? Not so much.

The insurance industry historically has been an amazingly innovative community when it comes to asset and investment management and financing the risks we know, measure and understand. How many industries could take hits like hurricanes Harvey, Irma and Maria and California’s wildfires—all in just the last couple of years—and come out intact? But the industry's innovative DNA does not extend to technology advancement and how to serve a customer base that historically were captive buyers—their only real choice was which company to buy from—but now has alternatives.

So how should insurance industry incumbents think about innovation, if they want to do more than the minimum? How can insurers innovate and use technology to improve margins or to produce new, organic revenue growth, based on core premiums and, perhaps, on revenue not related to insurance?

Obviously, it has to begin with a process that focuses on results, not checking boxes. Most of the advisory firms that have served the insurance industry for decades are very effective at enhancing the industry's "financially innovative" DNA. But too many have limited, if any, experience guiding incumbents through an innovation system designed, from the beginning, to produce measurable results within a short time. Many traditional advisories are fluent in financial innovation or perhaps core systems deployment but not in digital innovation. ITL has seen this issue up close, as we have been brought in after some advisory firms have finished innovation engagements.

Just like a student who wants to learn, companies must be willing to ask non-obvious questions and do more than simply follow the herd.

Don’t misread what I am saying here. We believe that Best’s inclusion of an innovation assessment as part of its rating process is terrific and, based on what we know, will drive companies toward effective innovation.

But I challenge the industry (and the advisories that counsel insurers): Do not innovate for a passing Best assessment score. Do better than that.

Apply a little genetic engineering to your own innovative DNA. Stretch those innovation muscles, and move courageously into the future.

Here's a free bit of advice: As you think about building an innovative system, realize that, as surely as trust follows respect, culture follows success.

Wayne Allen

CEO

Insurance Thought Leadership

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Insurance Thought Leadership (ITL) delivers engaging, informative articles from our global network of thought leaders and decision makers. Their insights are transforming the insurance and risk management marketplace through knowledge sharing, big ideas on a wide variety of topics, and lessons learned through real-life applications of innovative technology.

We also connect our network of authors and readers in ways that help them uncover opportunities and that lead to innovation and strategic advantage.