Having watched about as much sports as humanly possible over the holidays, I thought I'd borrow the bit that Scott Van Pelt uses to open his SportsCenter broadcast on ESPN: "Best Thing I Saw Today." In my case, the best thing I've seen lately is this video interview of Marc Andreessen, officially on "Why You Should Be Optimistic About the Future" but also on how to think about innovating so you can thrive in that future.

I'm not much of a consumer of video—during my days at the Wall Street Journal, the line was that "one word is worth a thousand pictures"—but this video provides as clear a window into Silicon Valley thinking as I can imagine. You can spend a bunch of time in Silicon Valley meeting with executives, or you can spend half an hour watching that video and pick up nearly as good a sense of things. (Allow 45 minutes if you stay to the end, as the discussion veers off into the future of government, capitalism and civilization itself—self-doubt not being a trait much valued in the Valley). The production values wouldn't cut it on ESPN, but the video displays all of the intelligence mixed with arrogance, the blue-sky thinking mixed with hard-won experience and the intensity mixed with playfulness that make up the Silicon Valley ethos.

I'll call out some insights for those of you who won't devote half an hour to the video, but let me first explain who the players are.

Andreessen has perhaps the highest profile of any VC these days, as one of the two name partners in one of the most successful firms in the Valley, Andreessen-Horowitz. He also carries the residual fame from having led the development of the first commercial browser, initially as a college student and then as the chief technologist at Netscape in the mid- to late 1990s. (I've always had a soft spot for Andreessen because, when he burst onto the scene, an interviewer had him list his favorite books of all time, and one I'd written on IBM's travails of the time made his top five. I've also long been amused that, while Andreessen is a billionaire, his net worth always seems to be about half that of his father-in-law, whose major insight on technology and innovation was... land. The father-in-law got a basketball scholarship to Stanford, where he majored in geography, of all things, and decided that all that farmland in the Valley would be worth a lot more as office space. He bought all he could way back in the 1960s and became the area's biggest commercial developer.)

The interviewer, Kevin Kelly, is a big deal in his own right. (He's the one on the left, rocking the Alexander Solzhenitsyn-like beard.) Kelly co-founded Wired magazine and has evolved into a guru on the future of technology.

For the insights, here is a chronological summary, including a few time stamps, in case you want to jump right to that spot:

After some chit-chat, including a funny story illustrating that even the most eminent technologists can be fooled by the pace of change, Andreessen quickly makes his first bold assertion: that the internet is just beginning to change culture. He says the technology first had to become universal, to form a sort of global mind, and that's just about happened. So, he says, we're now at the threshold of major change in how people think and interact, all around the world.

Asked how he determines what technologies will work and what won't, he kiddingly objects to the question. He says that just about all technologies work—after they've failed for a long time, usually at least 25 years. He says Radio Shack introduced the first smartphone in 1982, but all smartphones failed until Apple came along with the iPhone in 2007. Videoconferencing traces back at least to the 1960s and a demo at the World's Fair but has only come into its own recently. He says fiber optics were invented in the 1840s but took almost a century and a half to catch hold. So, he says the real question about technology isn't whether, but when (which he admits is a really hard question).

For me, the most important part of the conversation begins at about the 6:50 mark. It concerns the future of AI. In particular, is AI a feature or an architecture?

Andreessen says that most of the startup pitches he sees treat AI as a feature—he jokes that AI tends to be the sixth and final bullet point in a deck because the founders only realize they need to include it after they've written up the rest of the bullet points. But he sees AI as a platform and thinks the implications are profound.

He says that, when you have a new layer of architecture, everything above that layer has to be rewritten and will end up being different. As examples, he cites the changes that occurred when the internet became a layer of the tech architecture and that are happening now because of the mobile and cloud platforms. He says AI could, for instance, do away with the need for forms and databases that people search through; instead an AI could just give you the answer. He notes that this is the approach that Google is trying to take with search. It doesn't want to give you loads of pages of results to search through, as it did early on; it wants to give you the answer.

Andreessen offers a qualified endorsement of voice technology. He says it will play a key role, perhaps in conjunction with AI, and thinks it has crossed a threshold that will lead to very fast improvement from here on. But he doesn't see that voice can be a straight replacement for the keyboard or touch screens.

He also expects that 5G will improve at a super-rapid pace because leadership in the technology has become a point of honor for nations, especially the U.S. and China.

At about the 25-minute mark, he and Kelly go back and forth on why innovating via analogies doesn't seem to work very well. They talk about all the "Uber for X" business models that were expected, and Andreessen explains why such analogies often prove dangerously facile.

If you're interested in the history of venture capital, at about the 27-minute mark Andreessen traces its roots all the way back to the 1600s. He says the term "carry"—the roughly 20% of profits that VCs take on their investments—began as the amount of the fish that investors in a whaling expedition were entitled to carry off. Who knew?

More importantly, he explains the importance of the portfolio approach that VCs take to their investments—an approach that is increasingly understood by innovators in corporate environments but that, in my opinion, still needs to penetrate much deeper. Andreessen says you have to assume failure for many ventures, because that's just how the world works. The trick is to test in a rigorous, inexpensive way so you limit the expense of the failures. Then the successes can more than cover for the failures.

I hope you find the video half as insightful as I did. Maybe you, too, will even get a chuckle out of things like Andreessen's reference to the inventions of the transistor and microchip as "not obvious"—Silicon Valley speak for "abso-freaking-lutely brilliant and totally out of the blue, but I have to maintain my detached persona and certainly don't want you to think I'm acknowledging that those inventors were smarter than I am."

Cheers,

Paul Carroll

Editor-in-Chief

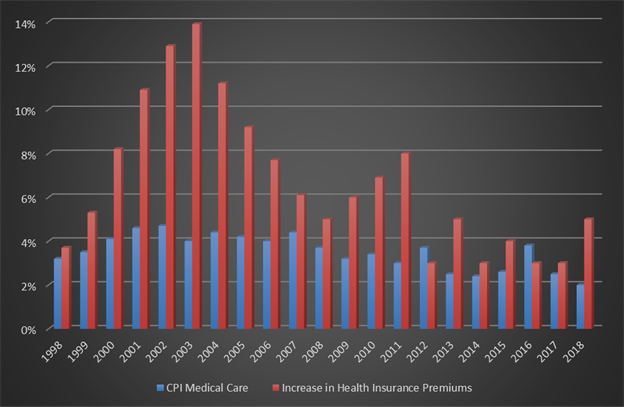

One might say, "Well, this means the insurance companies are overcharging!" That is a possibility, but if the insurance commissioners of America are that bad at reviewing rate filings, which I doubt, then all the insurance commissioners and their staffs should be replaced ASAP. Another reason I don't think the difference can be accounted for by declaring insurance companies are grossly overcharging is that between the combination of the ACA, which to some degree limits their profit margin, and a review of their financials, their profit margins do not suggest this level of overcharging.

Another perspective is that government-sponsored healthcare expenses do not increase nearly as much as the costs covered by insurance companies. Medical care is medical care, unless if under government programs patients get materially less care or the insurance companies subsidize government programs by overcharging everyone who buys their own insurance.

A third alternative is that the Bureau of Labor Statistics' numbers are just plain wrong. I trust the Kaiser numbers because they are associated with Kaiser Permanente Insurance, so they know what premiums are being charged. Premiums are easier to verify, too.

See also: The Science That Is Reinventing Healthcare

In your day-to-day world, what difference does all this make? Maybe none except by adding to your humor or frustrations. Or, perhaps it adds to your conspiracy theories. In selling benefits, though, I think it helps the intelligent and educated producer sell and advise the educated and intelligent buyer. Understanding the true inflation of medical care will help people make better decisions.

One might say, "Well, this means the insurance companies are overcharging!" That is a possibility, but if the insurance commissioners of America are that bad at reviewing rate filings, which I doubt, then all the insurance commissioners and their staffs should be replaced ASAP. Another reason I don't think the difference can be accounted for by declaring insurance companies are grossly overcharging is that between the combination of the ACA, which to some degree limits their profit margin, and a review of their financials, their profit margins do not suggest this level of overcharging.

Another perspective is that government-sponsored healthcare expenses do not increase nearly as much as the costs covered by insurance companies. Medical care is medical care, unless if under government programs patients get materially less care or the insurance companies subsidize government programs by overcharging everyone who buys their own insurance.

A third alternative is that the Bureau of Labor Statistics' numbers are just plain wrong. I trust the Kaiser numbers because they are associated with Kaiser Permanente Insurance, so they know what premiums are being charged. Premiums are easier to verify, too.

See also: The Science That Is Reinventing Healthcare

In your day-to-day world, what difference does all this make? Maybe none except by adding to your humor or frustrations. Or, perhaps it adds to your conspiracy theories. In selling benefits, though, I think it helps the intelligent and educated producer sell and advise the educated and intelligent buyer. Understanding the true inflation of medical care will help people make better decisions.

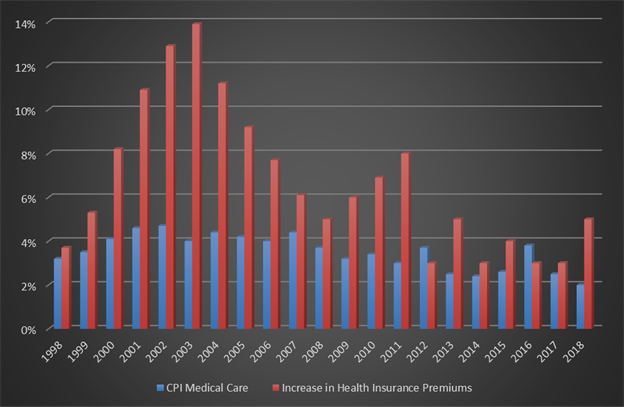

One might say, "Well, this means the insurance companies are overcharging!" That is a possibility, but if the insurance commissioners of America are that bad at reviewing rate filings, which I doubt, then all the insurance commissioners and their staffs should be replaced ASAP. Another reason I don't think the difference can be accounted for by declaring insurance companies are grossly overcharging is that between the combination of the ACA, which to some degree limits their profit margin, and a review of their financials, their profit margins do not suggest this level of overcharging.

Another perspective is that government-sponsored healthcare expenses do not increase nearly as much as the costs covered by insurance companies. Medical care is medical care, unless if under government programs patients get materially less care or the insurance companies subsidize government programs by overcharging everyone who buys their own insurance.

A third alternative is that the Bureau of Labor Statistics' numbers are just plain wrong. I trust the Kaiser numbers because they are associated with Kaiser Permanente Insurance, so they know what premiums are being charged. Premiums are easier to verify, too.

See also: The Science That Is Reinventing Healthcare

In your day-to-day world, what difference does all this make? Maybe none except by adding to your humor or frustrations. Or, perhaps it adds to your conspiracy theories. In selling benefits, though, I think it helps the intelligent and educated producer sell and advise the educated and intelligent buyer. Understanding the true inflation of medical care will help people make better decisions.

One might say, "Well, this means the insurance companies are overcharging!" That is a possibility, but if the insurance commissioners of America are that bad at reviewing rate filings, which I doubt, then all the insurance commissioners and their staffs should be replaced ASAP. Another reason I don't think the difference can be accounted for by declaring insurance companies are grossly overcharging is that between the combination of the ACA, which to some degree limits their profit margin, and a review of their financials, their profit margins do not suggest this level of overcharging.

Another perspective is that government-sponsored healthcare expenses do not increase nearly as much as the costs covered by insurance companies. Medical care is medical care, unless if under government programs patients get materially less care or the insurance companies subsidize government programs by overcharging everyone who buys their own insurance.

A third alternative is that the Bureau of Labor Statistics' numbers are just plain wrong. I trust the Kaiser numbers because they are associated with Kaiser Permanente Insurance, so they know what premiums are being charged. Premiums are easier to verify, too.

See also: The Science That Is Reinventing Healthcare

In your day-to-day world, what difference does all this make? Maybe none except by adding to your humor or frustrations. Or, perhaps it adds to your conspiracy theories. In selling benefits, though, I think it helps the intelligent and educated producer sell and advise the educated and intelligent buyer. Understanding the true inflation of medical care will help people make better decisions.