Text Your Way to Customer Loyalty

Here are three tips that insurers can use to build meaningful relationships with customers via text messaging.|

Here are three tips that insurers can use to build meaningful relationships with customers via text messaging.|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tara Kelly is founder, president and CEO of Splice Software. She has a passion for enabling clients to engage in a meaningful, data-driven dialog with their customers.

While 8K TVs are intriguing, many other tech products and advancements at CES2020 have important implications for P&C insurance. |

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

The key is to view what may seem to be common buzzwords not only as trends, but also as technologies and concepts that will push the industry forward.|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Vinod Kachroo is the visionary responsible for leading innovation at SE2 to develop a technology platform that’s future-proofed.

Research identifies three factors that differentiate what some people do that allows them to harness failure for success while others simply fail.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Amy Radin is a transformation strategist, a scholar-practitioner at Columbia University and an executive adviser.

She partners with senior executives to navigate complex organizational transformations, bringing fresh perspectives shaped by decades of experience across regulated industries and emerging technology landscapes. As a strategic adviser, keynote speaker and workshop facilitator, she helps leaders translate ambitious visions into tangible results that align with evolving stakeholder expectations.

At Columbia University's School of Professional Studies, Radin serves as a scholar-practitioner, where she designed and teaches strategic advocacy in the MS Technology Management program. This role exemplifies her commitment to bridging academic insights with practical business applications, particularly crucial as organizations navigate the complexities of Industry 5.0.

Her approach challenges traditional change management paradigms, introducing frameworks that embrace the realities of today's business environment – from AI and advanced analytics to shifting workforce dynamics. Her methodology, refined through extensive corporate leadership experience, enables executives to build the capabilities needed to drive sustainable transformation in highly regulated environments.

As a member of the Fast Company Executive Board and author of the award-winning book, "The Change Maker's Playbook: How to Seek, Seed and Scale Innovation in Any Company," Radin regularly shares insights that help leaders reimagine their approach to organizational change. Her thought leadership draws from both her scholarly work and hands-on experience implementing transformative initiatives in complex business environments.

Previously, she held senior roles at American Express, served as chief digital officer and one of the corporate world’s first chief innovation officers at Citi and was chief marketing officer at AXA (now Equitable) in the U.S.

Radin holds degrees from Wesleyan University and the Wharton School.

To explore collaboration opportunities or learn more about her work, visit her website or connect with her on LinkedIn.

Dorian would have upended the industry if it had stalled over Palm Beach, not the Bahamas, with its 185 mph winds and 40 inches of rain.

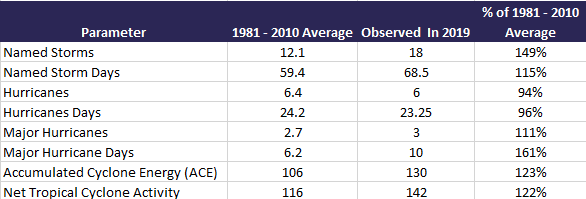

Key parameters that track the overall activity during a hurricane season. Source: NHC and Colorado State University[/caption]

What is, perhaps, even more interesting is that, of the 18 named storms, eight of them lasted two days or less, and some didn’t even last 24 hours. Two storms (Olga and Imelda) ended up being named storms for only six hours. The number of named storm days totaled 68.5, which is 115% of the expected 59.5 average (1981 – 2010). This year clearly showed the bias to satellite observations, as several of the named storms this year likely would not have been named in the pre-satellite era.

Even these short named storms can be destructive to the insurance industry, such as Imelda, which hit parts of eastern Texas with 43 inches of rainfall. This highlights that the category is not always indicative of how destructive a hurricane might be. In fact, the named tropical storms of Imelda, Nestor and Olga accounted for 42% of the total U.S. insurance industry loss this season, which should likely ultimately settle for under $2 billion. The named storm average annual loss for the U.S. is over $15 billion annually, so the U.S. insurance industry was lucky this year, especially considering Dorian.

The season will clearly be remembered for major hurricane Dorian, which stalled over the northern Bahamas as a Category 5 hurricane for nearly two days and gave south Florida a good scare when the monster storm refused to leave the area. The insured loss impacts to the Bahamas are expected to surpass $3.5 billion. Even though the strongest winds remained off the coast of the U.S., impacts were still felt in Florida, Georgia, South Carolina and North Carolina (but not Alabama). This will be the largest insured loss event for the U.S. this season, at over $500 million.

See also: Grasping the Perils of Extreme Weather

We also can’t forget about Dorian’s impact to eastern Canada, which is expected to hit around $2 billion (CAD) of loss and had a wide-ranging impact. This is a good reminder that strong named storms can easily affect New England during a hurricane season. With saturated ground and trees being in full leaf, many large trees were uprooted across eastern Canada, leading to long-term power outages, a major source of loss after strong wind events. Around 80% of the homes and businesses lost power in Nova Scotia at one point, a reminder that the insurance industry can easily suffer losses from long-term business interruption payments.

How Lucky

I’m not sure if the worldwide insurance industry truly understands the bullet that was dodged this hurricane season, as we saw the most intense hurricane to ever hit the Bahamas, which also tied the record with the 1935 Labor Day hurricane for the strongest landfall anywhere in the Atlantic. hurrThe losses could have easily reached $75 billion of insured loss and maybe more. The winds alone would have caused considerable damage to almost every single insured property in southeast Florida. The storm surge and flooding rains would have likely had a major impact on the National Flood Insurance Program and many of the new private markets now writing flood business in Florida. Even with 11 consecutive years (2006 – 2016) of no major hurricane catastrophes in Florida, there have been other loss issues across the state that have already strained parts of the market. Such a catastrophic event at this time would have been a big stress test for the Florida Hurricane Catastrophe Fund, considering such a Dorian-type event would be near the 100-year to 250-year event that many companies plan for on a yearly basis.

The other noteworthy (positive) impacts on the insurance industry might be the huge void of hurricane activity in the Caribbean Sea and Gulf of Mexico. In fact, only hurricanes Dorian and Barry reached hurricane-strength in those areas, which again is welcome news for the insurance industry. It always amazes me when a named storm can hit the tiny insurance hub of Bermuda, which happened this year with Hurricane Humberto.

A look ahead to 2020:

It’s way too early to make predictions for the 2020 Atlantic hurricane season, but some of the climate forcers to think about for 2020 are listed below.

See also: Risks, Opportunities in the Next Wave

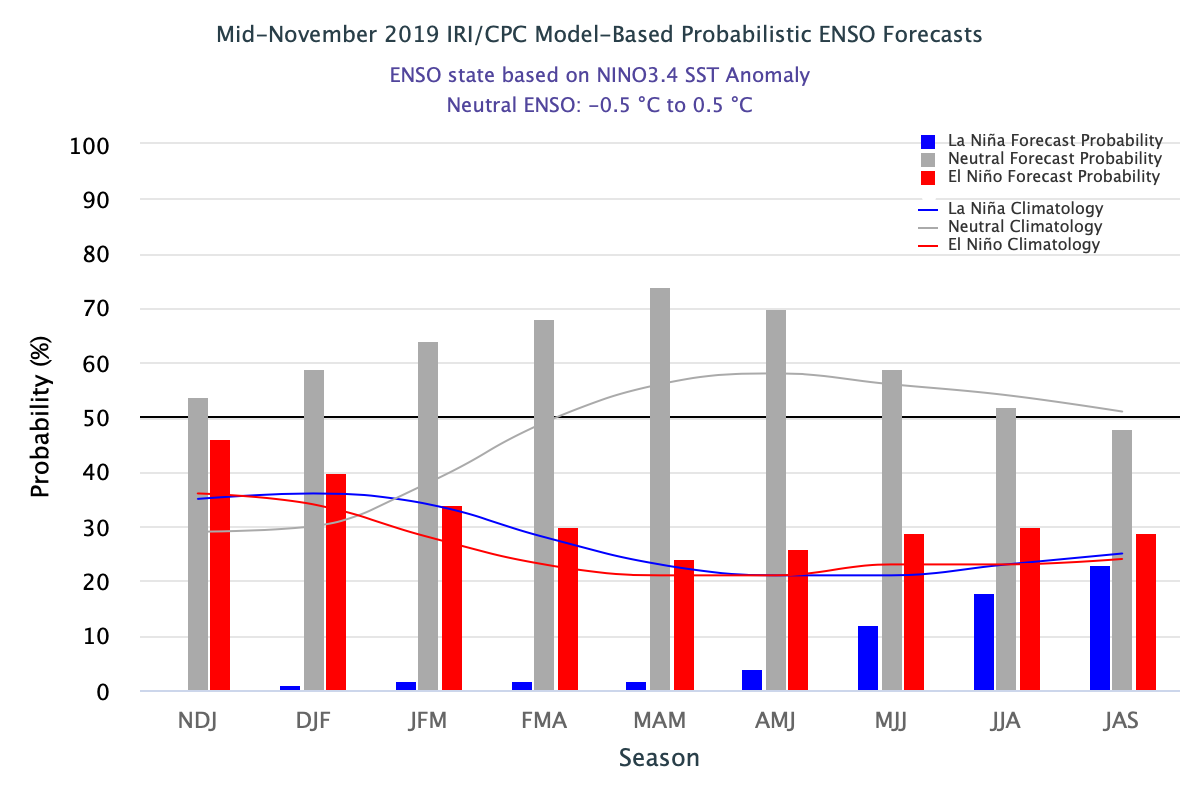

*El Niño Southern Oscillation (ENSO) is currently in a neutral state and is forecasted to stay there for the beginning of the 2020 Atlantic Hurricane Season. If this is the case, neither La Niña nor El Niño will have a large influence on wind shear or storm tracks.

[caption id="attachment_37448" align="alignnone" width="570"]

Key parameters that track the overall activity during a hurricane season. Source: NHC and Colorado State University[/caption]

What is, perhaps, even more interesting is that, of the 18 named storms, eight of them lasted two days or less, and some didn’t even last 24 hours. Two storms (Olga and Imelda) ended up being named storms for only six hours. The number of named storm days totaled 68.5, which is 115% of the expected 59.5 average (1981 – 2010). This year clearly showed the bias to satellite observations, as several of the named storms this year likely would not have been named in the pre-satellite era.

Even these short named storms can be destructive to the insurance industry, such as Imelda, which hit parts of eastern Texas with 43 inches of rainfall. This highlights that the category is not always indicative of how destructive a hurricane might be. In fact, the named tropical storms of Imelda, Nestor and Olga accounted for 42% of the total U.S. insurance industry loss this season, which should likely ultimately settle for under $2 billion. The named storm average annual loss for the U.S. is over $15 billion annually, so the U.S. insurance industry was lucky this year, especially considering Dorian.

The season will clearly be remembered for major hurricane Dorian, which stalled over the northern Bahamas as a Category 5 hurricane for nearly two days and gave south Florida a good scare when the monster storm refused to leave the area. The insured loss impacts to the Bahamas are expected to surpass $3.5 billion. Even though the strongest winds remained off the coast of the U.S., impacts were still felt in Florida, Georgia, South Carolina and North Carolina (but not Alabama). This will be the largest insured loss event for the U.S. this season, at over $500 million.

See also: Grasping the Perils of Extreme Weather

We also can’t forget about Dorian’s impact to eastern Canada, which is expected to hit around $2 billion (CAD) of loss and had a wide-ranging impact. This is a good reminder that strong named storms can easily affect New England during a hurricane season. With saturated ground and trees being in full leaf, many large trees were uprooted across eastern Canada, leading to long-term power outages, a major source of loss after strong wind events. Around 80% of the homes and businesses lost power in Nova Scotia at one point, a reminder that the insurance industry can easily suffer losses from long-term business interruption payments.

How Lucky

I’m not sure if the worldwide insurance industry truly understands the bullet that was dodged this hurricane season, as we saw the most intense hurricane to ever hit the Bahamas, which also tied the record with the 1935 Labor Day hurricane for the strongest landfall anywhere in the Atlantic. hurrThe losses could have easily reached $75 billion of insured loss and maybe more. The winds alone would have caused considerable damage to almost every single insured property in southeast Florida. The storm surge and flooding rains would have likely had a major impact on the National Flood Insurance Program and many of the new private markets now writing flood business in Florida. Even with 11 consecutive years (2006 – 2016) of no major hurricane catastrophes in Florida, there have been other loss issues across the state that have already strained parts of the market. Such a catastrophic event at this time would have been a big stress test for the Florida Hurricane Catastrophe Fund, considering such a Dorian-type event would be near the 100-year to 250-year event that many companies plan for on a yearly basis.

The other noteworthy (positive) impacts on the insurance industry might be the huge void of hurricane activity in the Caribbean Sea and Gulf of Mexico. In fact, only hurricanes Dorian and Barry reached hurricane-strength in those areas, which again is welcome news for the insurance industry. It always amazes me when a named storm can hit the tiny insurance hub of Bermuda, which happened this year with Hurricane Humberto.

A look ahead to 2020:

It’s way too early to make predictions for the 2020 Atlantic hurricane season, but some of the climate forcers to think about for 2020 are listed below.

See also: Risks, Opportunities in the Next Wave

*El Niño Southern Oscillation (ENSO) is currently in a neutral state and is forecasted to stay there for the beginning of the 2020 Atlantic Hurricane Season. If this is the case, neither La Niña nor El Niño will have a large influence on wind shear or storm tracks.

[caption id="attachment_37448" align="alignnone" width="570"] IRI ENSO forecast model Based Probability showing Neutral ENSO Conditions next hurricane season July August September (JAS)[/caption]

IRI ENSO forecast model Based Probability showing Neutral ENSO Conditions next hurricane season July August September (JAS)[/caption]

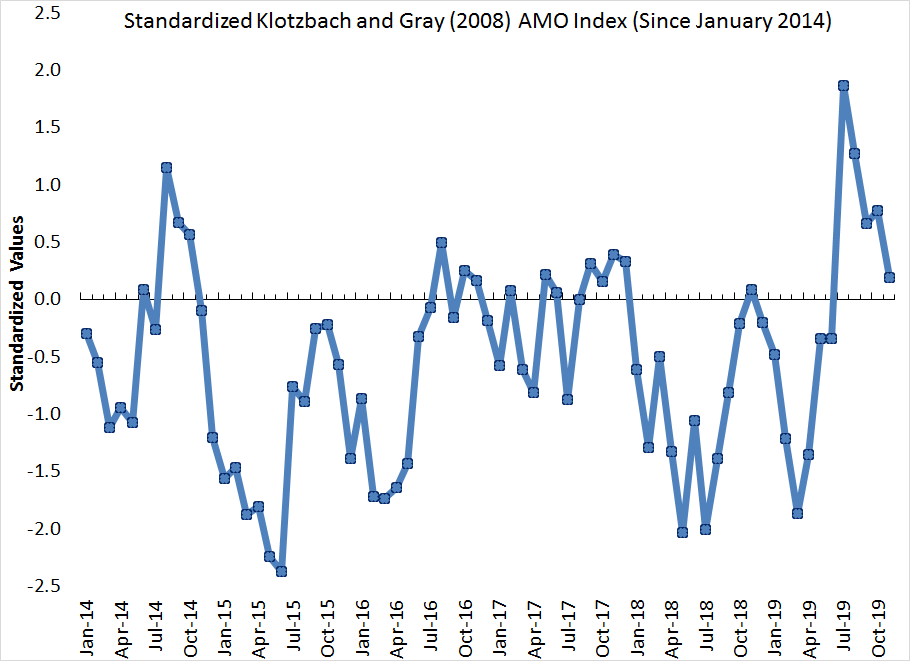

After spiking this summer, the Atlantic Multi-decadal Oscillation (AMO) index dipped back to near average in November.[/caption]

*Madden-Julian Oscillation, which is associated with an upper-air wave that moves across the tropics every 30 to 60 days, will continue to drive periods of activity in 2020. It is important to watch these waves move from the western Pacific into the eastern Pacific, as they will ultimately help named storm formation in the Atlantic Ocean.

After spiking this summer, the Atlantic Multi-decadal Oscillation (AMO) index dipped back to near average in November.[/caption]

*Madden-Julian Oscillation, which is associated with an upper-air wave that moves across the tropics every 30 to 60 days, will continue to drive periods of activity in 2020. It is important to watch these waves move from the western Pacific into the eastern Pacific, as they will ultimately help named storm formation in the Atlantic Ocean.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andrew Siffert is vice president and senior meteorologist within BMS Re U.S. catastrophe analytics team. He works closely with clients to help them manage their weather-related risks through catastrophe response, catastrophe modeling, product development and scientific research and education.

In 2018, a staggering 56% of all catastrophe claims came from just four states: California, Colorado, Florida and North Carolina.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

George Hosfield is senior director, home insurance, for LexisNexis Risk Solutions.

Careful carriers and unenthusiastic buyers mean that the part of the economy being insured just keeps getting safer. It's time for a rethink.

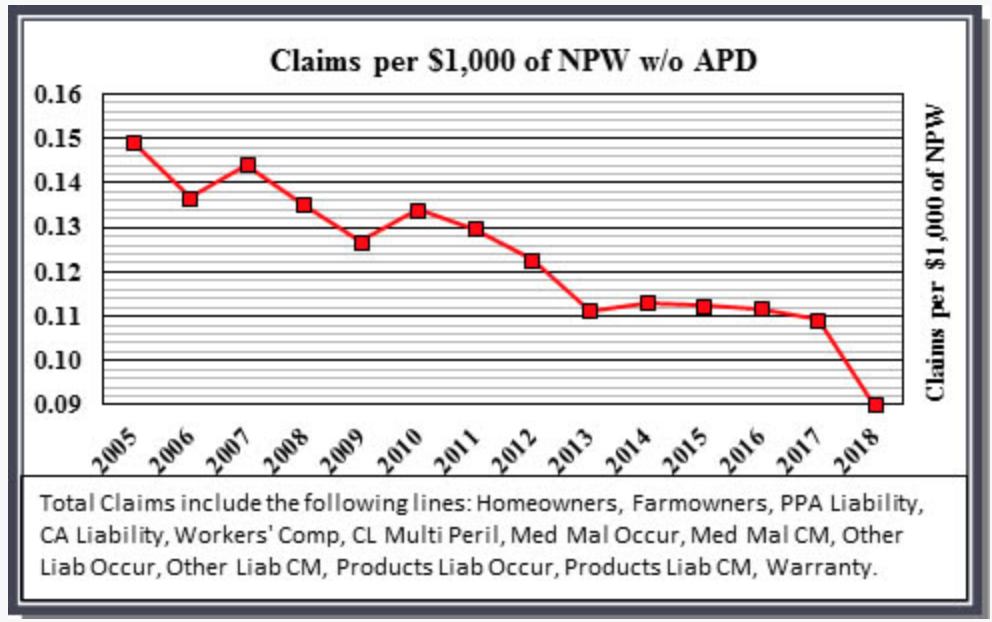

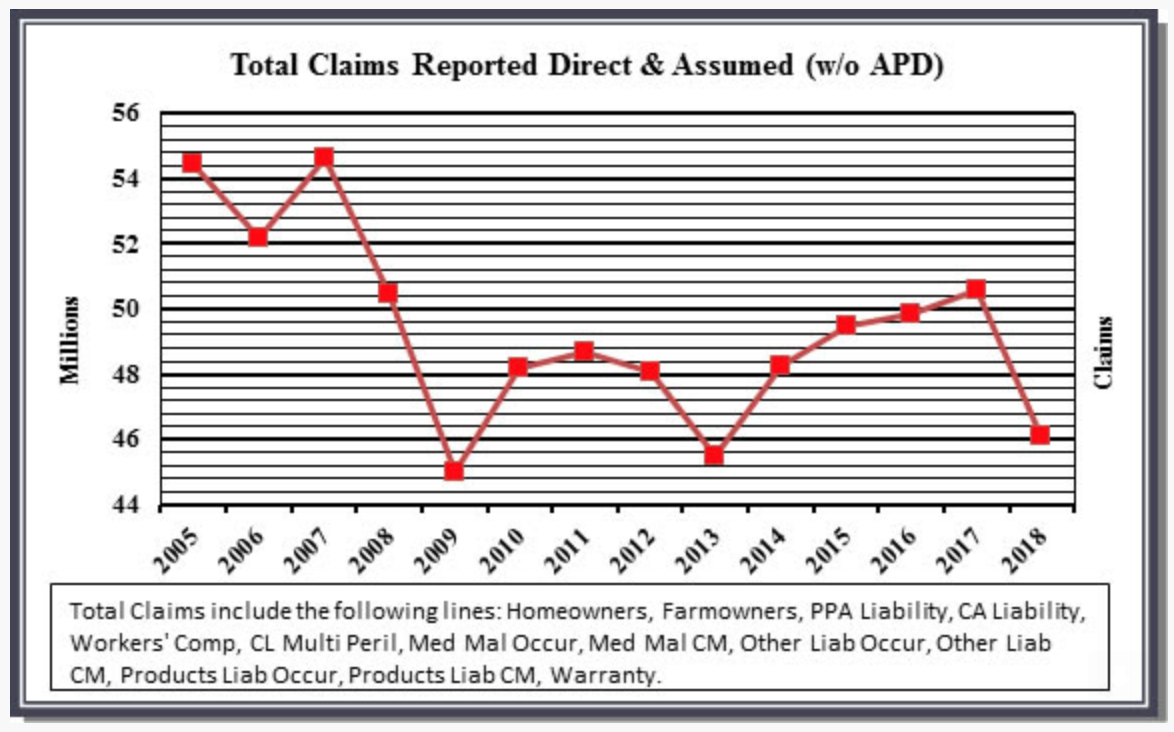

These charts exclude physical damage to autos because that one single line defies other trends. In other words, hail and flood auto claims are not becoming less frequent. The charts above do consider non-auto property hail claims, however, and, even with those claims, which include damage to hundreds of thousands of properties over the last few years (primarily in four states), the absolute number of claims is less. Considering that there are hundreds of thousands more businesses, people, homes and drivers, claims have decreased from around 54 million per year to, even in a cat year like 2017 (2018 numbers have not fully developed), only 50 million. The insured world is safer.

See also: Road to Success for P&C Insurers

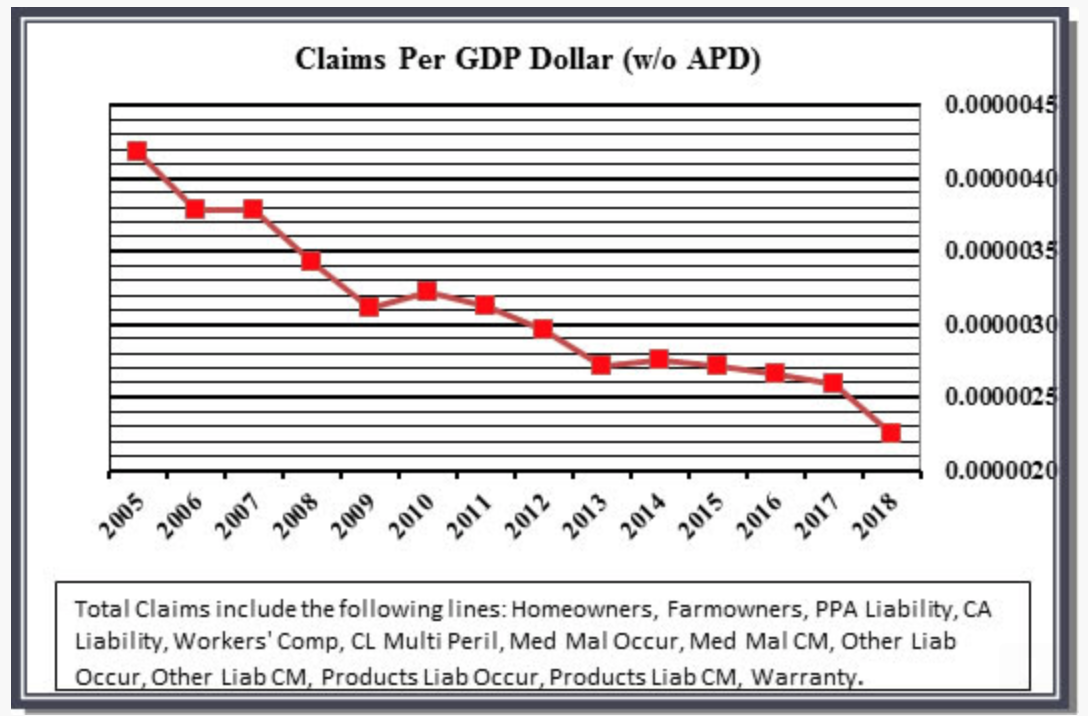

The chart below clearly shows that claims relative to GDP are in a steady decline. Even if auto physical damage claims are added to these charts, the overall trend does not change. The difference is that the steepness of the decline moderates.

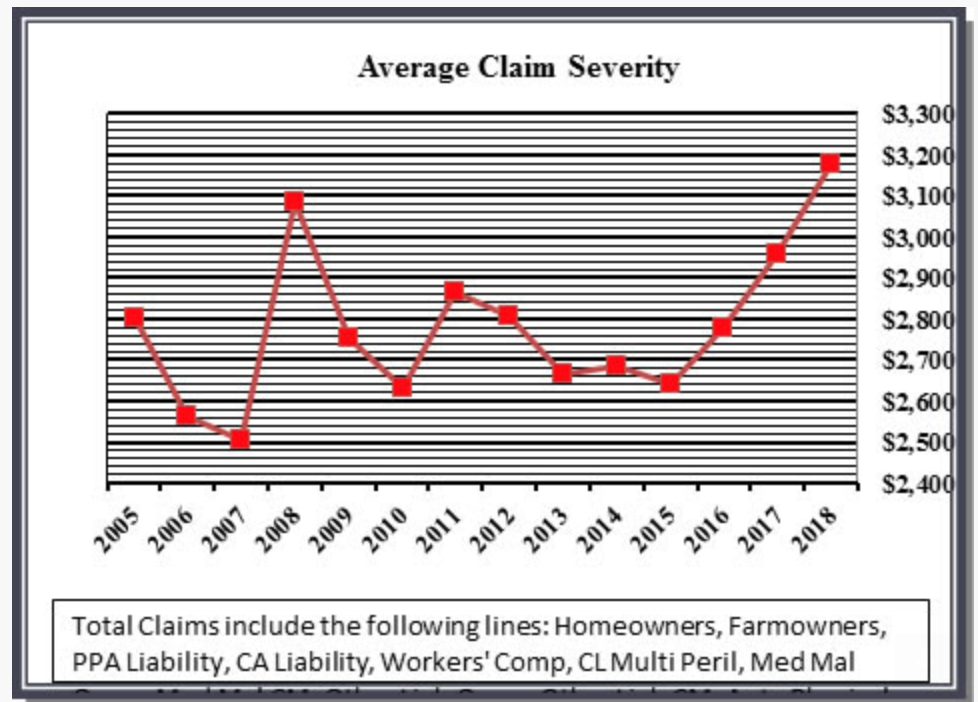

If it was not for severity increasing in pure dollar terms, which should be expected, the decrease would be even more pronounced. I do not have the definitive data, but my guess is the severity increase over the last three years is due to the hail storms and the horrible California fires. I can personally testify to hail claims totaling cars -- if you don't live in a severe hail state, it is difficult to appreciate the damage a hail stone the size of a golf ball, much less a tennis ball, can do.

The increasing safety of the insured world is a threat to carriers' and agents' existence because the problem is likely to grow. The safety improvements in vehicles, blue collar work environments and, perhaps especially, water shut-off devices, along with technology that will reduce exposures, means insurance will become even less valuable soon.

These charts exclude physical damage to autos because that one single line defies other trends. In other words, hail and flood auto claims are not becoming less frequent. The charts above do consider non-auto property hail claims, however, and, even with those claims, which include damage to hundreds of thousands of properties over the last few years (primarily in four states), the absolute number of claims is less. Considering that there are hundreds of thousands more businesses, people, homes and drivers, claims have decreased from around 54 million per year to, even in a cat year like 2017 (2018 numbers have not fully developed), only 50 million. The insured world is safer.

See also: Road to Success for P&C Insurers

The chart below clearly shows that claims relative to GDP are in a steady decline. Even if auto physical damage claims are added to these charts, the overall trend does not change. The difference is that the steepness of the decline moderates.

If it was not for severity increasing in pure dollar terms, which should be expected, the decrease would be even more pronounced. I do not have the definitive data, but my guess is the severity increase over the last three years is due to the hail storms and the horrible California fires. I can personally testify to hail claims totaling cars -- if you don't live in a severe hail state, it is difficult to appreciate the damage a hail stone the size of a golf ball, much less a tennis ball, can do.

The increasing safety of the insured world is a threat to carriers' and agents' existence because the problem is likely to grow. The safety improvements in vehicles, blue collar work environments and, perhaps especially, water shut-off devices, along with technology that will reduce exposures, means insurance will become even less valuable soon.

The above charts show obvious points. Improved regulations involving better zoning distances, airbags and even OSHA have all made our world safer. I am glad many of the tort reforms seem to have minimized or at least in some states reduced some of the ludicrous litigation that seems to benefit no one but a few plaintiff attorneys and the defense attorneys hired to defend against those nebulous suits. The fewer the losses, the less important insurance is. The less important insurance is, the less people will pay for it. Add record surplus, and talk of a true hard market becomes obvious wishful thinking unless some key carriers have managed to underestimate their reserves by large amounts.

The increasing safety of the world is out of the industry's control. We must adjust. Two other factors affecting the results shown in these charts are within our control. The first is how carriers adjust claims and underwrite. Based on real world experience with agents every day and some interesting published articles, some of which are more direct in their accusations, it is thought that some carriers have taken approaches that make getting a payout for a legitimate claim so difficult that frequency and severity are depressed. Similarly, some of the public has become aware, and agents definitely are aware and often educate their customers, that filing small claims should be avoided. These claims should be avoided because the pricing penalties assessed for minor claims are far too high.

This situation presents an opportunity in my mind for carriers that don't suppress claims or make processing claims inordinately difficult to let the world know they are easier to deal with in a claim situation. It is also an opportunity for agents to educate clients on the differences in claims-paying behaviors. Every agent knows different companies' tendencies with regard to claims, but many agents are reluctant to discuss those tendencies. Just as with any situation where full disclosure is limited, those with more dubious practices get the benefit, and those with the best practices fail to get full credit. Maybe use one of the publicly published claims satisfaction surveys or create your own.

The second way in which the industry almost certainly needs to change to offset the safer insured world is to change its current focus on insuring 1950s America. 1950 was about manufacturing. 2020 is about services and data. It seems every insurance company is telling every agency that their target market is manufacturers, which is proof of 1950s thinking. The industry needs to insure today’s economy.

Ever try to buy a full data policy for self-created data (which obviously is the most valuable data for a huge proportion of businesses)? Ever try to buy a policy providing coverage for intangible assets? How about intellectual property? Today’s economy is built on intangible assets, data and intellectual property. Most machines and buildings are almost unimportant because most are fairly easily replaced, or substitutes can often be easily identified (excluding highly specialized firms). Companies and governments run on data, not lathes. Few companies go out of business because they can't find a temporary building following a fire. Businesses do go out of business after cyber-attacks, reputational damage, theft of data and theft of intellectual property. In fact, think of it this way: What is the bigger danger even to a manufacturer -- the building burning down or someone in another country stealing the company's design and then undercutting the price by 50%? There is only one answer to that question.

See also: Provocative View on Future of P&C Claims

The Hartford did a study in 2015 showing reputational harm was the most severe small business claim (40% more than the average fire claim). I can only imagine that the spread has increased. In 2017, Deloitte published a study that reputation was more important than getting the strategy wrong for 87% of executives. A CNBC article from Oct. 13, 2019, reported on a study by Hiscox stating that 60% of small businesses go out of business within six months of a cyber-attack. Many other studies support the same statistics but carriers and agents continue to focus on $x liability limits, $x property and workers' comp.

Some readers may be thinking that policies exist for cyber, reputational harm, etc. (notwithstanding the fact that many cyber policies are arguably worse than no policy at all because at least not having a policy is free). Those readers are missing the point. A BOP or package policy provides coverage if a machine or building burns or is stolen or is blown away. Where is the same property coverage for a destroyed reputation or the theft of self-created data? I know Lloyd's has some coverages available, but 99% of carriers are focused on what was important in 1950. Customers are concerned with what is important today. Carriers and agents that continue trying to insure the needs of 1950 will have a short life.

Another reason today's exposures are not covered is that many agents do not understand business income coverage, so they either don't sell it or they don't sell it correctly. Next to cyber, business income is arguably the most difficult coverage to understand. Furthermore, the simplified solution that many agents choose to follow is offering the same business income solution to every client, as if all insureds were identical (and if you are thinking ALS is a universal solution, you are wrong). This is just bad thinking. Business income coverage in and of itself is far more important for many insureds, especially if one includes true contingent business income that goes beyond standard forms.

Whether you are working for a carrier or an agency, you need to insure the economy of today and tomorrow. You have complete control over this aspect of the insurance industry's diminishing in economic importance. If you focus on what is important in today's economy, you become a hero with a much more secure future by using the tools that are already invented such as business income coverages, much less creating tools to insure data and intangible assets. Let’s finally let go of 1950s thinking.

Find out more at www.burandeducation.com/3d-

The above charts show obvious points. Improved regulations involving better zoning distances, airbags and even OSHA have all made our world safer. I am glad many of the tort reforms seem to have minimized or at least in some states reduced some of the ludicrous litigation that seems to benefit no one but a few plaintiff attorneys and the defense attorneys hired to defend against those nebulous suits. The fewer the losses, the less important insurance is. The less important insurance is, the less people will pay for it. Add record surplus, and talk of a true hard market becomes obvious wishful thinking unless some key carriers have managed to underestimate their reserves by large amounts.

The increasing safety of the world is out of the industry's control. We must adjust. Two other factors affecting the results shown in these charts are within our control. The first is how carriers adjust claims and underwrite. Based on real world experience with agents every day and some interesting published articles, some of which are more direct in their accusations, it is thought that some carriers have taken approaches that make getting a payout for a legitimate claim so difficult that frequency and severity are depressed. Similarly, some of the public has become aware, and agents definitely are aware and often educate their customers, that filing small claims should be avoided. These claims should be avoided because the pricing penalties assessed for minor claims are far too high.

This situation presents an opportunity in my mind for carriers that don't suppress claims or make processing claims inordinately difficult to let the world know they are easier to deal with in a claim situation. It is also an opportunity for agents to educate clients on the differences in claims-paying behaviors. Every agent knows different companies' tendencies with regard to claims, but many agents are reluctant to discuss those tendencies. Just as with any situation where full disclosure is limited, those with more dubious practices get the benefit, and those with the best practices fail to get full credit. Maybe use one of the publicly published claims satisfaction surveys or create your own.

The second way in which the industry almost certainly needs to change to offset the safer insured world is to change its current focus on insuring 1950s America. 1950 was about manufacturing. 2020 is about services and data. It seems every insurance company is telling every agency that their target market is manufacturers, which is proof of 1950s thinking. The industry needs to insure today’s economy.

Ever try to buy a full data policy for self-created data (which obviously is the most valuable data for a huge proportion of businesses)? Ever try to buy a policy providing coverage for intangible assets? How about intellectual property? Today’s economy is built on intangible assets, data and intellectual property. Most machines and buildings are almost unimportant because most are fairly easily replaced, or substitutes can often be easily identified (excluding highly specialized firms). Companies and governments run on data, not lathes. Few companies go out of business because they can't find a temporary building following a fire. Businesses do go out of business after cyber-attacks, reputational damage, theft of data and theft of intellectual property. In fact, think of it this way: What is the bigger danger even to a manufacturer -- the building burning down or someone in another country stealing the company's design and then undercutting the price by 50%? There is only one answer to that question.

See also: Provocative View on Future of P&C Claims

The Hartford did a study in 2015 showing reputational harm was the most severe small business claim (40% more than the average fire claim). I can only imagine that the spread has increased. In 2017, Deloitte published a study that reputation was more important than getting the strategy wrong for 87% of executives. A CNBC article from Oct. 13, 2019, reported on a study by Hiscox stating that 60% of small businesses go out of business within six months of a cyber-attack. Many other studies support the same statistics but carriers and agents continue to focus on $x liability limits, $x property and workers' comp.

Some readers may be thinking that policies exist for cyber, reputational harm, etc. (notwithstanding the fact that many cyber policies are arguably worse than no policy at all because at least not having a policy is free). Those readers are missing the point. A BOP or package policy provides coverage if a machine or building burns or is stolen or is blown away. Where is the same property coverage for a destroyed reputation or the theft of self-created data? I know Lloyd's has some coverages available, but 99% of carriers are focused on what was important in 1950. Customers are concerned with what is important today. Carriers and agents that continue trying to insure the needs of 1950 will have a short life.

Another reason today's exposures are not covered is that many agents do not understand business income coverage, so they either don't sell it or they don't sell it correctly. Next to cyber, business income is arguably the most difficult coverage to understand. Furthermore, the simplified solution that many agents choose to follow is offering the same business income solution to every client, as if all insureds were identical (and if you are thinking ALS is a universal solution, you are wrong). This is just bad thinking. Business income coverage in and of itself is far more important for many insureds, especially if one includes true contingent business income that goes beyond standard forms.

Whether you are working for a carrier or an agency, you need to insure the economy of today and tomorrow. You have complete control over this aspect of the insurance industry's diminishing in economic importance. If you focus on what is important in today's economy, you become a hero with a much more secure future by using the tools that are already invented such as business income coverages, much less creating tools to insure data and intangible assets. Let’s finally let go of 1950s thinking.

Find out more at www.burandeducation.com/3d-

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.

Happy New Year!

I figure we should dub this year "Hindsight." After all, hindsight is 20/20, right? So, let's imagine it's Dec. 31, 2020, and we're looking back on the year. What will we see that the industry accomplished?

Having read a bazillion forecasts over the holidays, I think lots of prognosticators are on the right track. Yes, there will be loads more AI, more use of big data/insurtech in underwriting, more chatbots and other technology in customer relations. Yes, insurance will become more modular, as companies figure out how to plug in the industry's best, say, claims technology and process rather than using just home-grown systems. No, Big Tech doesn't look likely to do a cannonball into insurance and splash all the water out of the pool, though Big Tech will probably continue to do deals like Amazon's move into distributing pharmaceuticals and pull away certain buckets of profits.

But I think 2020 will be most notable because the industry will start to get better in an even more important way than has been described in the forecasts I've read. I believe the industry will begin to get better at... getting better.

I trace this concept back to Doug Engelbart, a monumental figure in the history of computing. In 1968, he held what has become known as The Mother of All Demos, which laid the groundwork for graphical user interfaces, hyperlinks (as in, the World Wide Web) and networked computers. He even hand-carved a scrolling device out of wood, which came to be known as a mouse because the wire running out the back of the little brown block looked like a tail.

Engelbart also contributed seminal thinking on a variety of topics, including what he described as A, B and C processes in corporations. Every company has A processes; they're how the business is run. Good companies, he said, also have B processes—ways of making the A processes better. Great companies, he argued, also have C processes—ways of improving the B processes that improve the A processes. In other words, great companies keep getting better at getting better.

(Quick aside: About 20 years ago, when I lived in Silicon Valley, I attended a birthday party at a neighbor's house and struck up a conversation with an elderly gentleman who seemed a bit left out. We got talking about innovation—that's what you did in Atherton in those days—and I mentioned that I had just published an article on A, B and C processes in a magazine I edited. He said, "But that's my idea." I corrected him: "No, that idea came from Doug Engelbart." He said, "And I'm Doug Engelbart." He was, too. He lived next door to my friend.)

I believe that 2020 could mark the year when the insurance industry makes a breakthrough in getting better at getting better.

We've been in heavy innovation mode for several years now, so we're learning about what works and what doesn't.

If you're an incumbent engaging with an insurtech, no, you can't operate on your normal planning cycle. By the time you pull together your annual technology road map and tee the insurtech up for your quarterly budget review to see what funds are available, that insurtech has gone belly up. It needed to make payroll by Friday. Seven months ago.

We've also learned about the sorts of tools, such as the cloud and X-as-a-service, that can speed innovation. We've become more attuned to what technologies are available outside our companies and maybe picked up a bit of experience on how to incorporate them. We've seen the need for small, focused innovation teams and for quick, inexpensive prototypes that can let us test customer reaction in the wild.

In Engelbart terms, we began several years ago with those A processes. Then we engaged B processes and began to innovate on those A processes. Now, we know enough about those attempts at B processes, those attempts at innovation, to set up ways to systematically improve on them, too.

That's my hope, at least, as we embark on 2020.

May the year treat us all well.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Employers face challenges implementing safety training across their organizations, and technology has answered the bell.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Matt Hesemann is currently a senior client services representative at Safety National Casualty. He works with insureds to introduce and implement the company’s robust online risk control resource platform.

Editor’s Note: This is the fourth in a series of posts in which CJ Lotter, a 15-year industry veteran, shares lessons learned in the form of guidance to MGAs on the steps required to build a successful program. The earlier articles are available here.

By now, you’ve become familiar with our series of posts on program business. We’ve covered the processes for identifying a market to target and for validating the opportunity through research. Now comes one of the most important steps, analyzing competition. Much like the other steps, analyzing the competition can be boiled down to three things:

Gathering Available Data

After all your research, you should have a program plan narrowed down to a specific class code with a need gap. Now it’s time to do some research on the players already in the space. Insurance is one of the only industries in which your competitors must file their business plan, and anyone can pull the filings of anyone else. That’s exactly what we are going to do in this section.

You have already selected an industry segment to target. Now, pull the filings of each competitor in that space, and all the product offerings. This will provide the raw information for your analysis in the next two sections. If, by chance, your competition is offering a non-admitted product, you will need to go elsewhere.

Work with an industry focus group to ask about the type of insurance offerings available and gather information that way, or do market research on the product offerings available. Ideally, you will use the data you gather to answer several key questions. The most important ones will depend on your organizational goals, and we will cover those in the section on qualitative research.

See also: 10 Steps to Successful Insurance Program

Analyzing the Competition

After gathering all the available competitive data, it’s time to develop the insights that will help us decide who our real competition will be. Figure out how much market share each major competitor possesses in your targeted industry. Consider these potential market share scenarios:

Each scenario will require a different set of strategies. Which of these is more appealing? If you were to pursue “Scenario 1,” you would be attacking a single dominant player. In “Scenario 2,” you would enter a market with a variety of players offering a variety of solutions.

What you decide depends on the attributes you are competing on. Traditionally, with programs, it is easier to enter a market with one established player. Ideally, this player is clunky, does business slowly and can’t react quickly enough. In this world, you can easily compete with better technology, better costs or better service, preferably all three.

A word of advice if you choose to compete on cost: Unless the cost saving is 15% or more, it will be hard to get customers to switch from an incumbent.

Profiling the Competitors

With the market data pulled and analyzed, you can now move on to a qualitative analysis of the individual competitors and ultimately decide how and where to deploy your new program. Combining the data you’ve gathered, the “word on the street” from insureds in your target market and additional market research, you’ll build profiles of the major competitors. These are the attributes you should start with:

The goal is to apply this data to understand which companies you will realistically compete with. Using the example we introduced in our prior post, the top provider of tow truck insurance may only serve the Midwest and Pacific Northwest, leaving open an opportunity in a Northeast market like New York. Or, perhaps there is a cost saving you can offer with a new product package.

A four-quadrant (i.e. 2x2) matrix can be a good tool here, too. Pick two important variables, one for each axis, and place all the competitors onto the graph. For example, one axis could be company size, while the other represents geographic reach (from regional to national operators).

Going as far as to do a full SWOT (strengths, weaknesses, opportunities and threats) analysis on each competitor may also be a good practice and will help illuminate the competitors you stack up against most favorably. A good resource for SWOT templates can be found here.

See also: How to Improve the Customer Journey

Final Thoughts

Through diligent research, and a good measure of analysis, you should uncover a path for potential new business. Making the right decision on where to deploy, at what price point, with which distribution model and other vital issues can make or break a program launch. Some of these will be the topics of future blog posts.

When planning a program, it is vitally important to have the conviction that you are bringing a product to the market that solves a problem better than the competition. Better pricing, better distribution or better product design are great examples of value that will improve your chance of success.

Excerpted with permission from Instec. A complete collection of Instec’s insurance industry insights can be found here.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|