This article was written by Ronnie Klein for the International Insurance Society, a sister organization of Insurance Thought Leadership, under the umbrella of The Institutes. To see more IIS articles by Ronnie and other IIS experts, visit internationalinsurance.org.

There is a saying in German: “Traue keiner Statistik, die du nicht selbst gefälst hast.” This translates as, “Do not believe any statistic that you have not forged yourself.”

Many credit this saying to Winston Churchill, but Nazi propagandists actually made up the quote and attributed it to Churchill as a way of impugning him as a liar. It appears that “fake news” is not a new phenomenon.

An example of misleading statistics is when determining whether to take a medical test for a rare but serious disease like spina bifida. This rare disease causes the spine of a baby to form improperly and can lead to serious mobility impairments and possible organ malfunctions. Many doctors will recommend that the patient undergo a blood test to detect this disease. The test has improved over time and is now 95% accurate.

This sounds like an easy choice. The test is 95% accurate and can detect a horrible disease. But let’s explore.

The probability of contracting the disease, according to the U.S. Centers for Disease Control and Prevention (CDC), is 1 out of 2,758. Therefore, out of 1 million pregnancies, there should be approximately 363 babies, or 0.03%, born with spina bifida.

Assuming that all 1 million women opt for the test and that no false negatives occur, there will be 363 actual positives and about 49,982 false positives ((1,000,000 – 363) x .05) for a total of 50,345 positive tests. Receiving a positive result now means that the baby has a 363 in 50,345 chance of having spina bifida — or 0.7%.

Does this sound like a test with 95% accuracy?

Further, once a woman receives a positive test for fetal spina bifida, she must undergo follow-up tests that are a bit more invasive to more accurately determine the status of the baby. However, those additional tests take time to schedule and to generate results.

How much stress is the woman under during this time? What effect could this have on the unborn child? None of this is usually discussed with the mother.

How can a test that is 95% accurate change the probability of contracting the disease from 0.04% (363 out of 1 million) to 0.7% (363 out of 50,345)? Should an expectant mother take a test for a disease that will affect 363 babies out of 1 million? Armed with the correct statistics, an expectant mother will be much better prepared to make an informed decision.

COVID-19 statistics can also be misleading. The most common misstatement is that the disease only kills the elderly. According to the most recent data from the CDC at the time of this writing, 80.5% of COVID-19 deaths have occurred in people ages 65 and over in the U.S. On the surface, this seems like a daunting fact.

Of the nearly 540,000 U.S. deaths attributed to COVID-19 as of this writing, almost 435,000 are from people age 65 and over. Breaking it down further, 58% of all COVID-19 deaths occur in people age 75 and over. It is no wonder that most of the attention has been given to the most vulnerable people in these age groups. Why worry about those under age 65 when only 20% of COVID deaths can be attributed to this cohort?

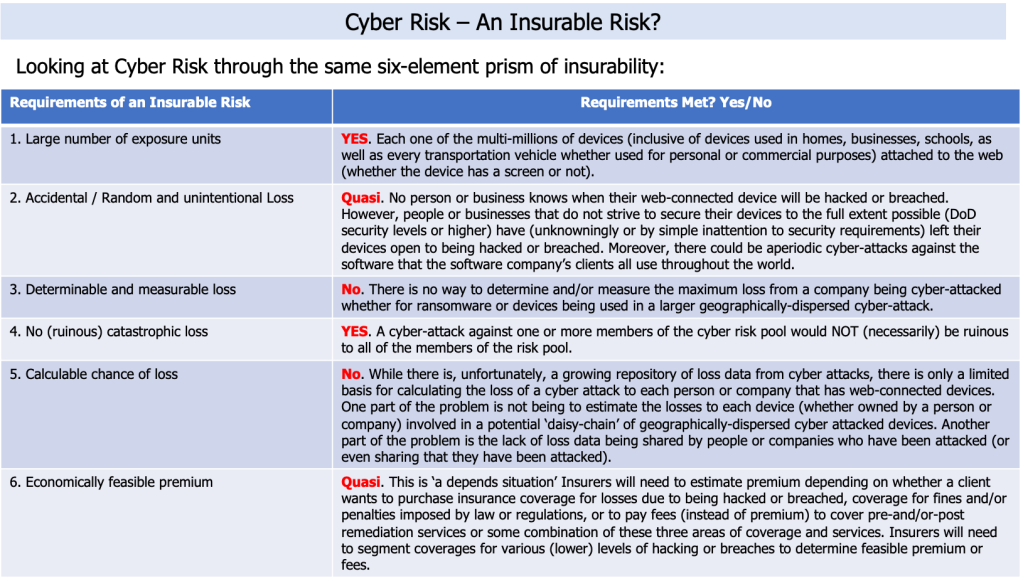

Examining mortality by age for all causes shows that the statistics for COVID deaths do not vary greatly from all-cause mortality. Said another way, COVID deaths by age are highly correlated to deaths by all causes (see Figure 1).

Figure 1: COVID-19 Mortality vs. All-Cause Mortality by Age Group

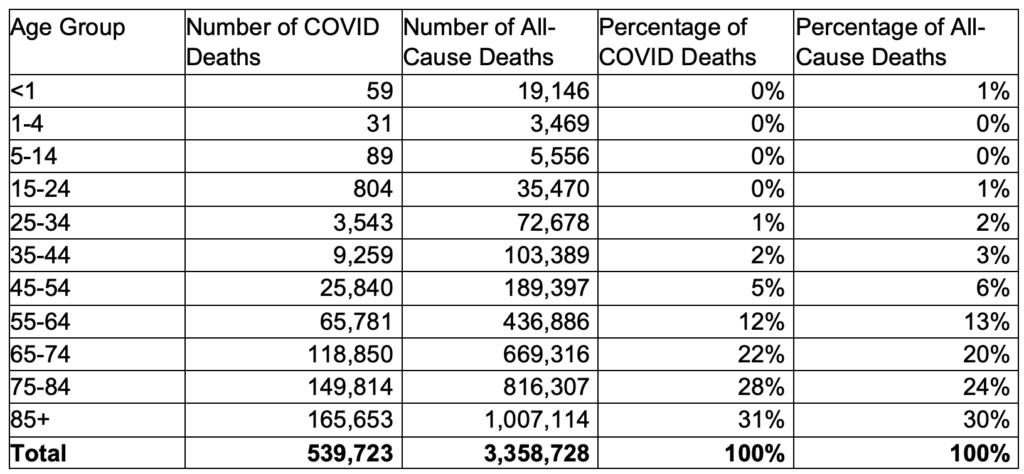

Limiting the analysis to age groups over 25, which basically eliminates infant mortality and teen auto accidents, shows an even stronger correlation (see Figure 2).

Figure 2: COVID-19 Mortality vs. All-Cause Mortality by Age Group (25+)

While the media is quick to broadcast that approximately 80% of COVID-19 deaths occur in people over age 65, it fails to state that, in a given year, almost 75% of all-cause mortality occurs in the same age group.

Exploring the data for those ages 25 and up shows that people ages 75 and over account for 59% of all COVID-19 deaths and 56% of all-cause mortality – not far off. This virus is not only a worry for older people, it affects younger adults in a similar proportion to other causes of death.

What this means is that the target life insurance-buying population (people ages 30-60) should be very interested in purchasing life insurance to protect against this and future pandemics. COVID-19 increases mortality for adults of all ages at similar percentages. However, this very important fact is not widely broadcast in the news. And the life insurance industry has remained relatively silent on this topic, as evidenced by the continued flat sales of life insurance during the pandemic.

In the largest life insurance market in the world, the U.S., premium sales in 2020 actually dropped while number of policies showed a slight increase. Considering that there are no infectious disease exclusions in the vast majority of life insurance policies and that the world is in the midst of the worst pandemic in the past 100 years, one would think that sales of life insurance would be skyrocketing.

Every life insurance sales person will be familiar with the term “share of wallet.” Potential customers only have so much disposable income, and only a portion of that can be allocated to life insurance. While the pandemic should certainly highlight the need for life insurance, the ensuing financial crisis brought on by travel restrictions, hotel closures, restaurant closures and other lockdowns make certain that a person’s share of wallet is more focused on food, housing, medical supplies and other essentials. Life insurance has been moved further down the list.

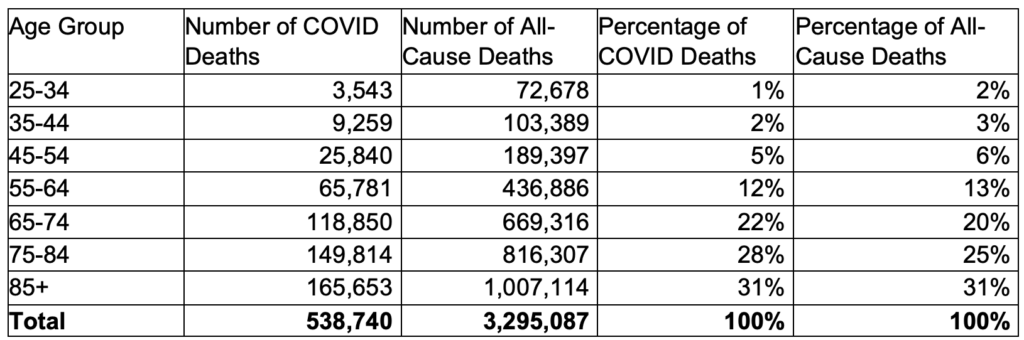

A survey performed by the U.S. Census Bureau revealed that more than 60% of low-income families experienced “income shocks” during the pandemic. This includes food insecurity and delinquencies on rent or mortgage payments. The percentage is even higher for families with children (see Figure 3).

When choosing between paying rent or purchasing life insurance, there is no question at all. However, as bad as things are for these families, it will become much worse if the breadwinner dies due to COVID-19.

Figure 3: Share of Families Experiencing an Income Shock by Household Income and Presence of Children

The U.S. Congress recently passed the American Rescue Plan, which provides aid to all citizens and disproportionately helps low-income families. A family of four earning less than $150,000 per year received $6,400 in cash and possibly other benefits, including extended unemployment, tax credits and lower health insurance premiums.

If a family of four is earning $50,000 per year, this is more than a 12% increase in pay — and the money has already arrived. Similar packages have been offered in most developed countries in the world that are experiencing the same adverse mortality and economic downturn as the U.S.

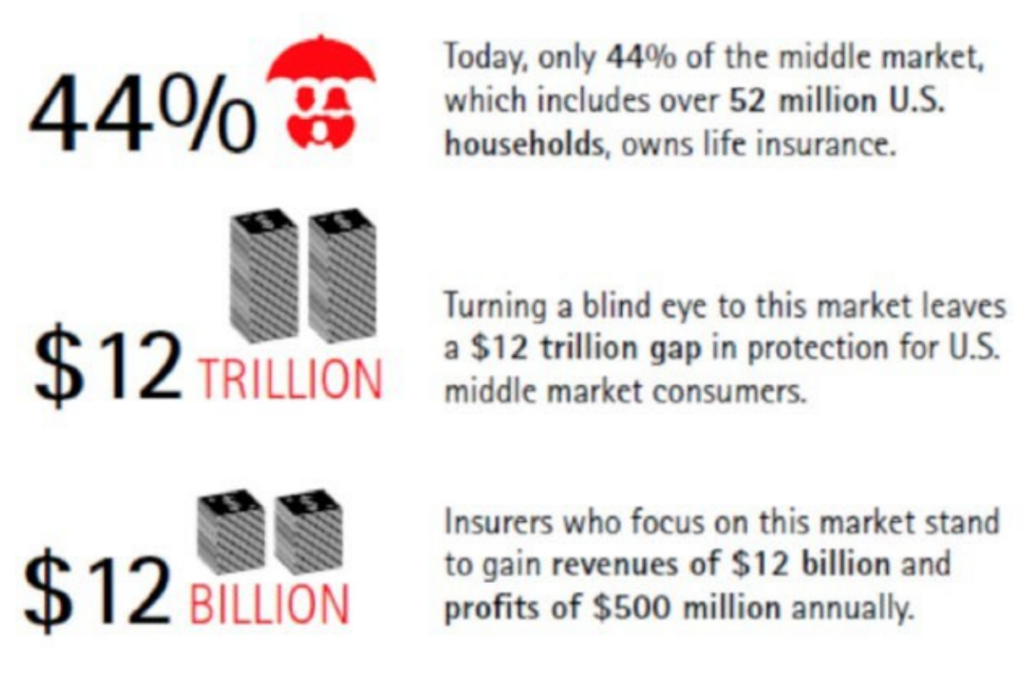

These low- and middle-income people are suffering from a huge protection gap. One estimate places the middle-market protection gap in the U.S. at $12 trillion (see Figure 4). This is exactly the market that the life insurance industry has been talking about addressing, but failing to reach, for decades.

Wouldn't this be a great opportunity to approach these people, as they receive a relatively sizable lump sum of cash? A small term policy that costs less than one-per-thousand for most of these ages would help to protect those families most in need.

Figure 4

But the window for action by the insurance industry is short, as these funds have already been distributed. This money will not sit around waiting to be spent on life insurance.

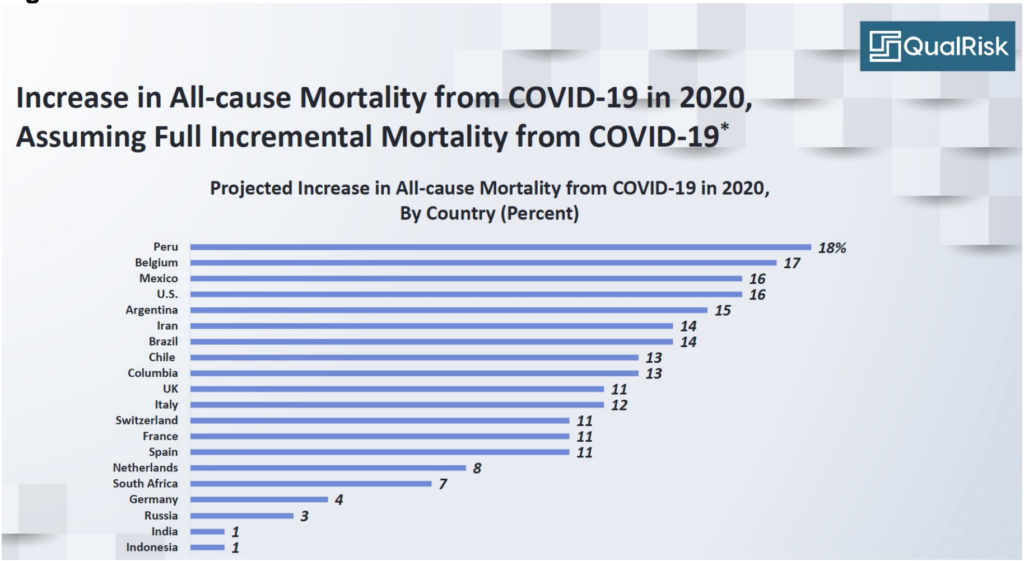

Selling pure protection to the middle markets during a pandemic is a great opportunity for the customer and the insurer. It provides much-needed protection during a time when excess deaths due to COVID-19 in the U.S. are estimated at about 16% (see Figure 5). It benefits insurers as a way to reach a market that has thus far eluded the insurance industry. And, it will help inform the middle markets of the importance of life insurance and may win over many customers for life.

Figure 5

The life insurance industry has long lived by the motto, “Let sleeping dogs lie.” During a 1-in-100-year pandemic, would it be worthwhile to attempt to make a change and tout the industry’s many benefits – especially to middle-income families? For example, would this be a good time for life insurers to contact all of their existing policyholders to remind them that policies are valid for death due to COVID-19? In-house lawyers can put in all of the caveats such as, “assuming all premium payments are current, assuming the policy is not accident-only, etc.”

J.D. Power performed a life insurance survey in late 2020 and concluded that “…a combination of infrequent client communications and a pervasive perception of high cost and transaction complexity have suppressed consumer interest and customer satisfaction with life insurance providers.”

Following the results of the survey, Robert Lajdziak, a senior consultant for J.D. Power, said that policyowners’ satisfaction with their life insurance products declines the moment the sale is completed. Lajdziak showed his surprise that this trend would continue during a pandemic and implores the industry to “rachet up” its client contact, not just its communication with agents.

To some, telling customers that they are covered for death due to disease is not necessary — but is this really the case? Just one Google search with the tagline, “Does life insurance pay for COVID-19 death?” will show how many articles have been written on this subject.

Why do customers need to get this information from a third party? While there may be risks to offering it to in-force policyholders, the benefits of this positive communication could dramatically outweigh these risks.

The life insurance industry protects policyholders from the financial hardships of premature death or disability of a breadwinner. This is especially important during a pandemic. However, sales of life insurance have been flat in most mature insurance markets for decades.

If a pandemic that is responsible for about an eighth of all deaths of people ages 25-64 cannot generate interest among the general population to purchase insurance, at a time when lump-sum stimulus payments are being made to lower-income earners, it is difficult to imagine what will cause an increase in sales. But consumers will not run to purchase this insurance. The industry must think of a coordinated, thoughtful and compelling message.

Epsilon Marketing estimated that there are about 50 million middle-market households in the U.S. A survey performed for this report revealed that reaching the middle market was a top priority for 25 of the 35 life insurance companies that responded. This survey was performed in 2014, so these companies and others had approximately seven years to work out a plan to reach this market.

Now is the time to “pull out all stops” and market aggressively. Doing that will generate sales and create an entire class of new life insurance purchasers who will be able to tell positive stories in the future. Starting this process may be as simple as communicating with existing policyholders about the benefits of their policies. Word of mouth among friends may be the best sales channel to reach the underserved middle markets and to help close the protection gap.

Selling more life insurance during a pandemic can bring peace of mind to customers and help protect their families. Yet, with all of the talk about new technologies to market, underwrite and speed policies to customers, there has been virtually no perceptible increase in life insurance sales.

This can be easily evidenced by QualRisk’s assessment that, in 2020, all-cause mortality increased in the U.S. by 16%, but there was only a 3% increase for individual life insurance. Some in the industry may look at this as a favorable outcome. What it really shows is the vast protection gap that exists in the U.S. and in all mature insurance markets in the world. It is time to do something differently and reach underserved markets. Now is a perfect time to begin.

Read more at internationalinsurance.org.