Life is big. Customer choices are complex. When life changes for most of the population, the impact ripples across most industries. Over the past two years, insurance has moved from seeing the effects of change on the horizon to feeling the impact of customer change in the decision-making process. COVID has been a powerful catalyst for change in two areas that deeply affect P&C insurers: housing and transportation.

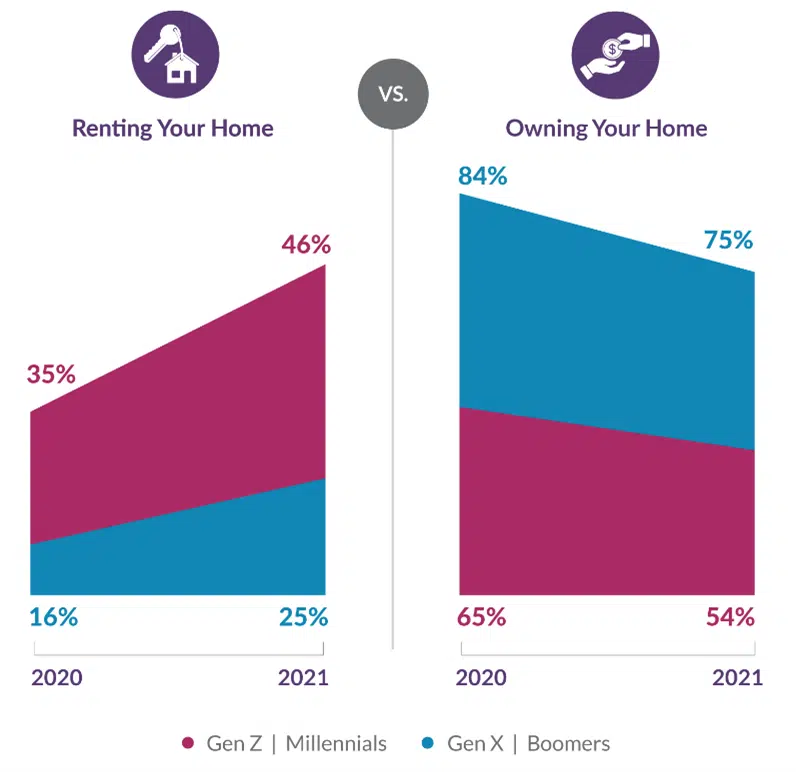

For instance, population migration is now an insurance concern that affects P&C. According to the U-Haul Growth Index, the top five states for growth due to migration are Texas, Florida, Tennessee, South Carolina and Arizona — all Southern states where job opportunities abound, the cost of living is lower and taxes are, in general, more friendly. Work-from-home and occupational trends have made it easier for people to move. Some insurers struggle in these states, especially in Florida, where risk is high and litigation is common. For those regions, such as California and Illinois, with a population downturn, every move means a loss of premium. Overall housing trends are even more volatile due to rising real estate costs and fewer homes for sale. Property values continue to increase, with the average increase last year at 12% but with some states reporting 15% to 28% increases. Renting is on the rise (see Figure 1), and home-sharing on an online platform is skyrocketing. How will insurers handle the volatility? How will insurance technology help meet the demand for new products and services and better underwriting to drive growth and profitability?

In mobility, the story is different, but the volatility isn’t. Automobile use is down and will not return to pre-pandemic levels any time soon, due to today’s new work-from-home culture. How people live their daily lives has shifted, with more goods and services delivered to their homes, including groceries, take-out, medicine and clothing, resulting in fewer trips. But then, other types of trips may increase, such as camping, going to the park, hiking and road trips. The nature of personal risk for automobiles is changing.

In addition, the automotive sector is facing some real issues that may affect insurers. Chip shortages depleted car inventories, which raised the overall price of both new and used vehicles. Automotive debt is climbing. The loan default rate is expected to climb. The cost of gas and inflation are high. Consumers will be looking for any means to regulate or lower their premiums, including the use of telematic pricing. This fits with what Majesco has found in our proprietary research.

Majesco’s 2022 Consumer Research report, Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time, sheds light on the details of consumer trends that are affecting insurance. In today’s blog, we are taking a close look at some of the most relevant trends in housing and transportation — trends that will affect P&C insurance products, services and customer experiences that can adapt to consumer volatility. We will look closely at:

- Home- and rental-related activities, insurance products, value-added services and trends in customer experience.

- Auto insurance activities and products, value-added services, relevant purchase channels and the desire for new methods of pricing and claims management.

Population on the move — Home- and rental-related activities

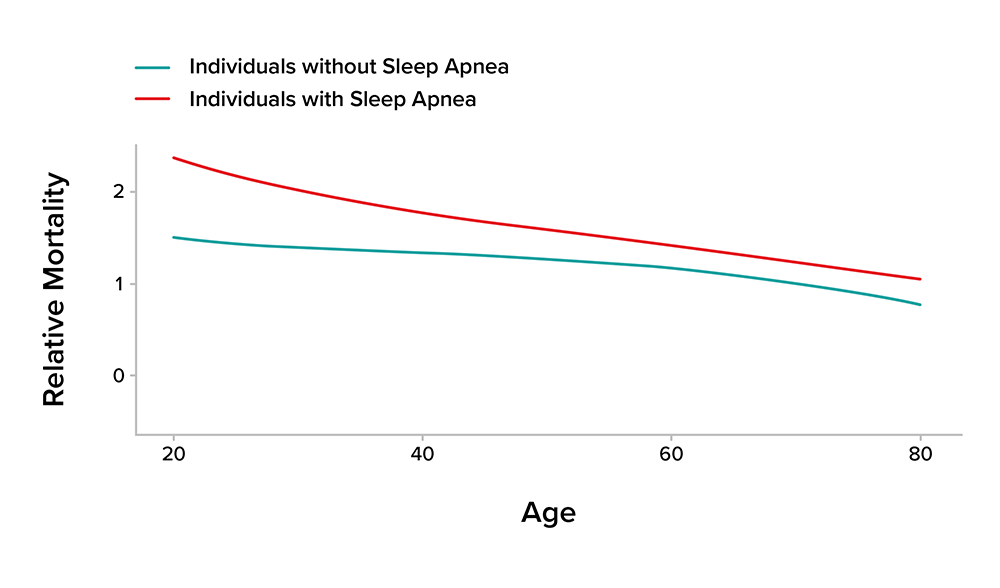

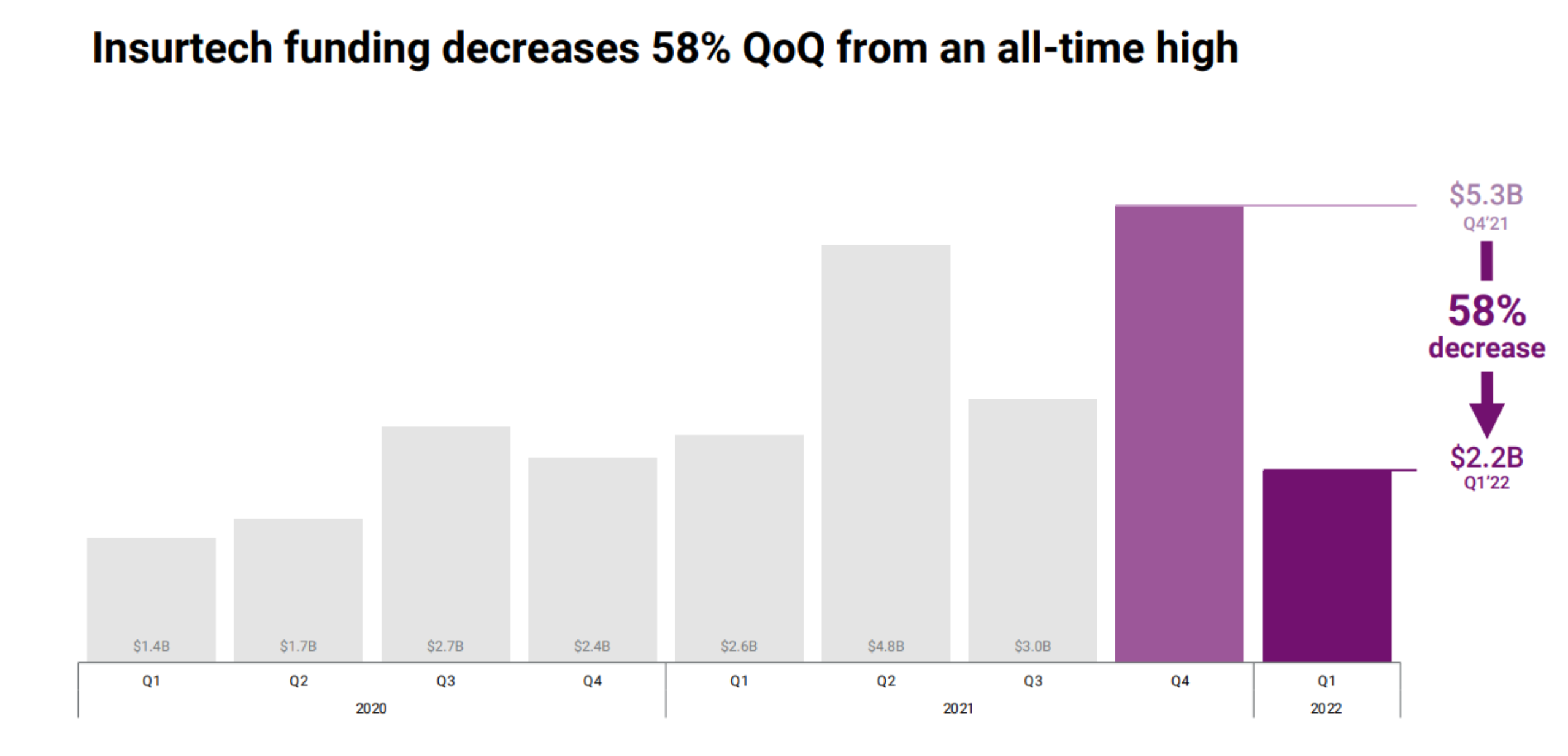

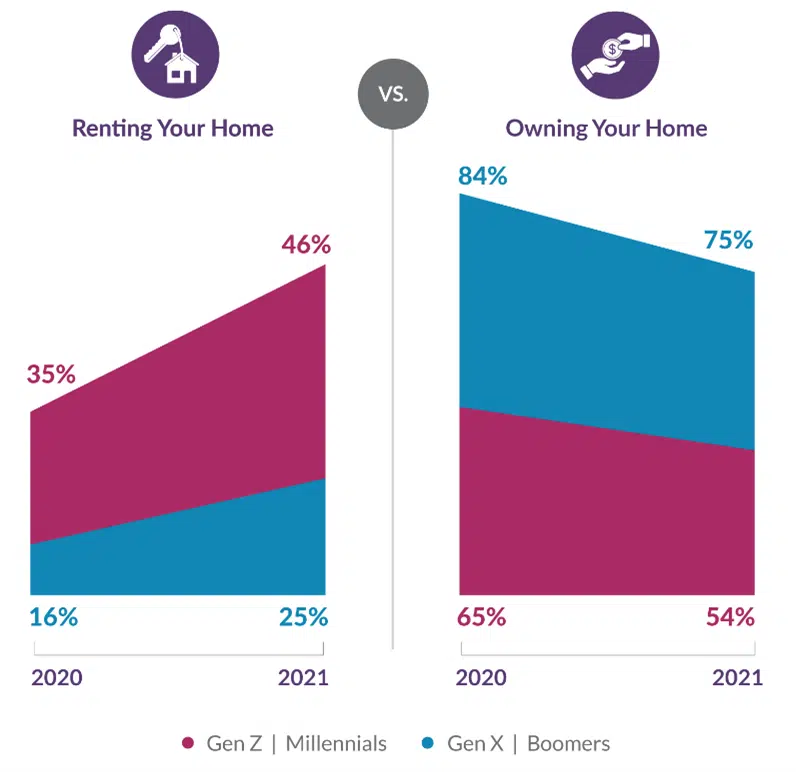

Gen Z and Millennials’ home ownership declined 11 percentage points as compared with the start of 2020 (Figure 1). Gen X and Boomers had a similar decline of nine percentage points. This is undoubtedly a reflection of COVID’s impact on many people’s financial conditions due to job losses, the “Great Resignation,” people moving to other locals and renting instead of buying due to challenges of limited housing, and many Gen Z and Millennials moving back home.

Whether owning or renting, 33% of consumers invested in their home environment by setting up a work-from-home space, remodeling or renovating or setting up a home gym, according to McKinsey research, a response to the population’s increase in time spent at home, which rose to 62% in 2020 from 50% in 2019. This reflects increased investment in the home or other assets that may need additional coverage, but have insurers assessed this opportunity?

Figure 1: Rates of home ownership vs. renting

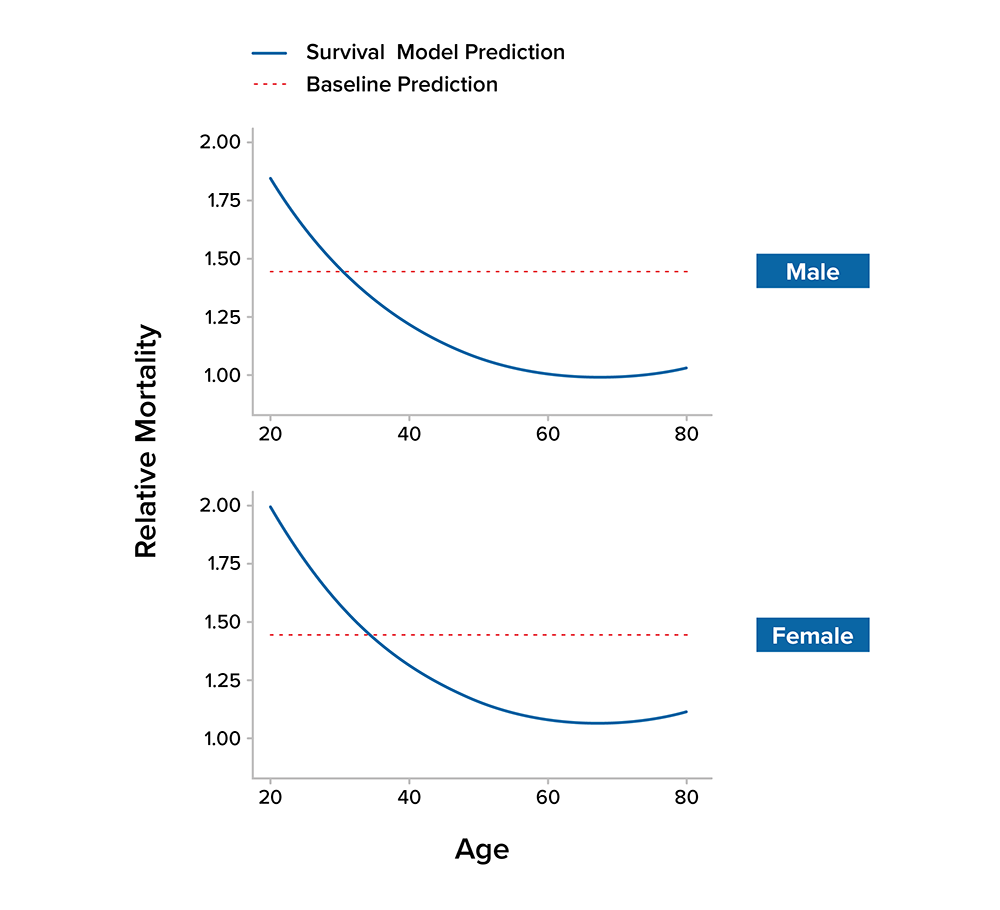

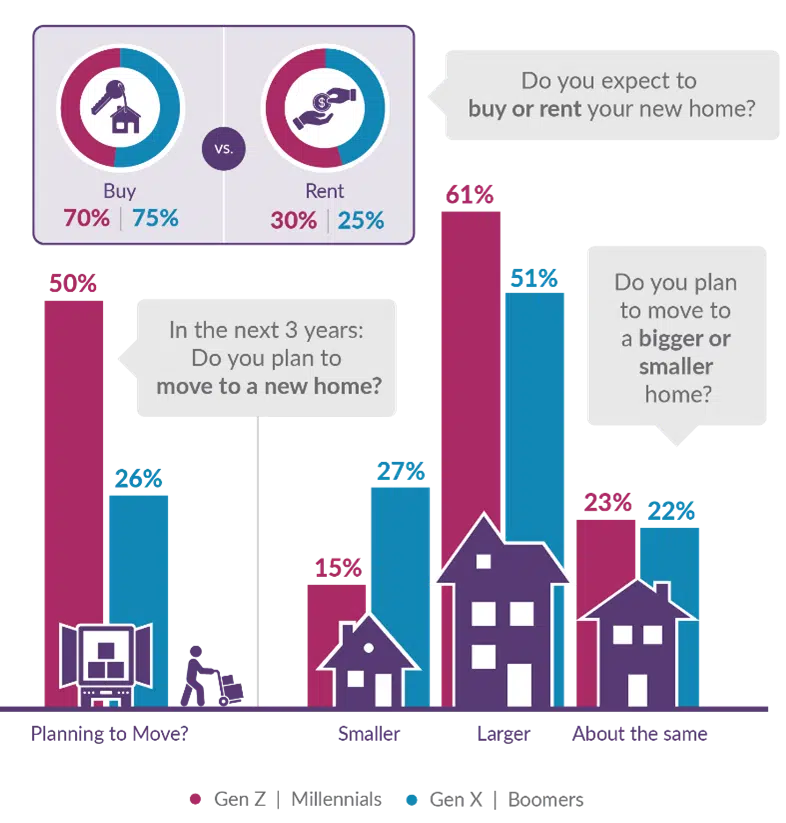

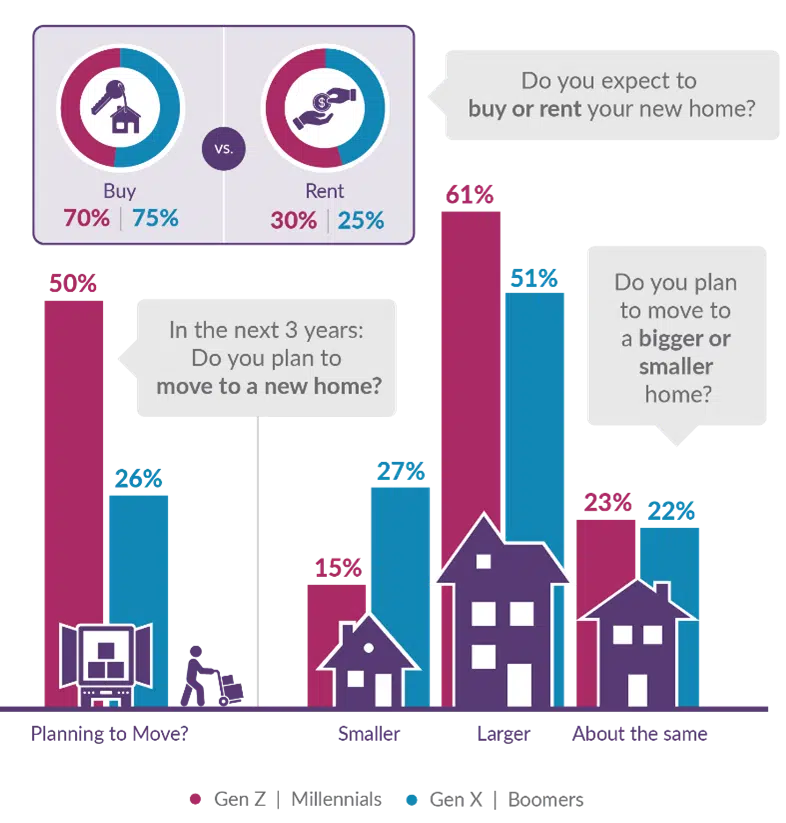

50% of Gen Z and Millennials plan to move to a new home within the next three years, with 70% buying and 30% renting. With 61% of these young movers expecting to have a larger home, there is a huge market opportunity for those who can connect with them when and where they want. But the choices about where they buy will likely be different, given the transient nature of this generation and the expectation of working from home. (Figure 2)

Figure 2: Expectations for a new home in the next 3 years

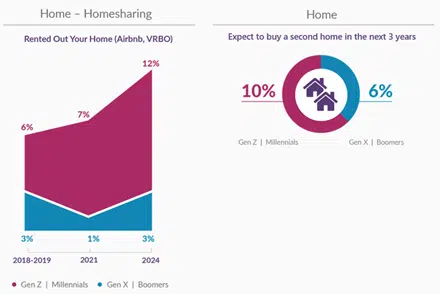

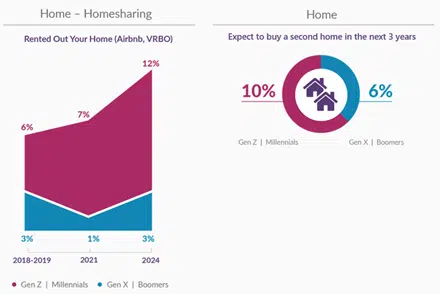

Adding to the Gen Z and Millennial expectations, they are four times more likely to rent their home on a home-sharing platform in the next three years, adding risk complexity and multi-use complexity to their insurance needs. The number using their properties, particularly second homes, for home-sharing will likely continue to increase to provide alternative income streams to address the financial challenges of high inflation. 10% anticipate buying a second home, creating an additional opportunity to expand the customer relationship and drive revenue growth. (Figure 3)

Figure 3: Home-sharing trends and expectations for purchasing a second home

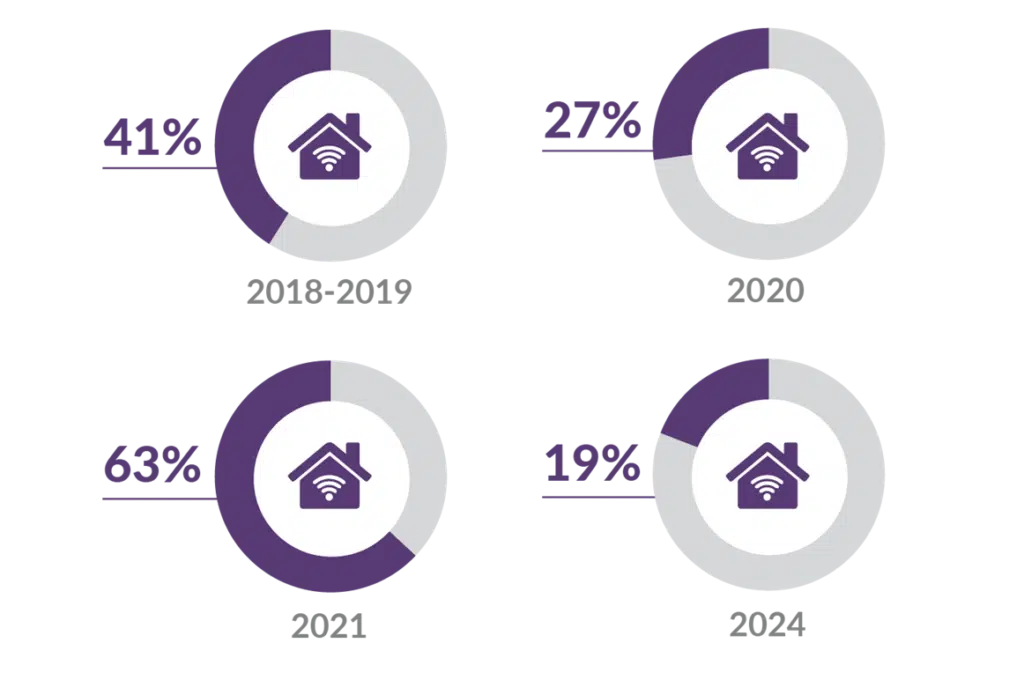

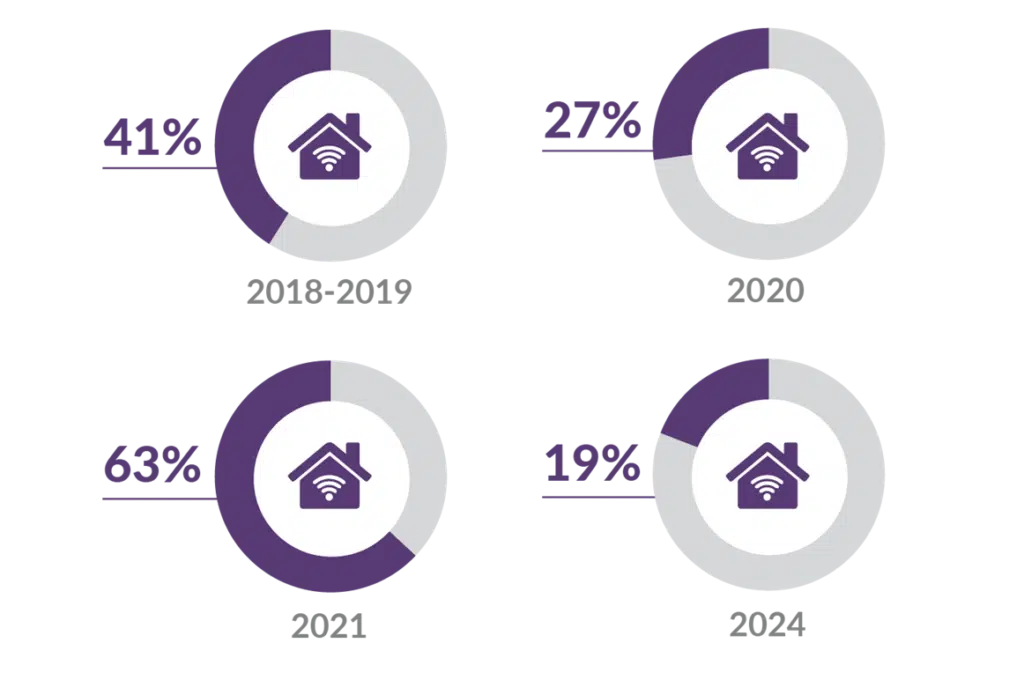

Representing still further market opportunities, Gen Z and Millennials are clear-cut leaders in the use of connected/smart home devices like thermostats, smoke/CO detectors, video doorbells and home security devices/services, outpacing Gen X and Boomers (Figure 4). With this usage comes new expectations on how the devices could be used to enhance insurance coverage, address lifestyle needs and provide other value-added services, likely shifting their alliance to insurers who can meet these expectations. A great example is the use of these devices to help the elderly live more safely in their homes by providing monitoring for falls, alerts for taking medicines or doctor appointments and much more. The possibilities are tremendous but require outside-the-box thinking to leverage the technology to meet changing lifestyle needs.

See also: Homeowners, Renters Are Overlooking Risks

Figure 4: Historical and predicted gaps in smart home device usage between Gen Z/Millennials and Gen X/Boomers

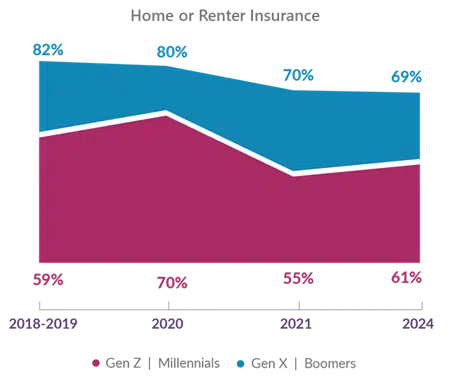

The shifting need for homeowners and rental insurance

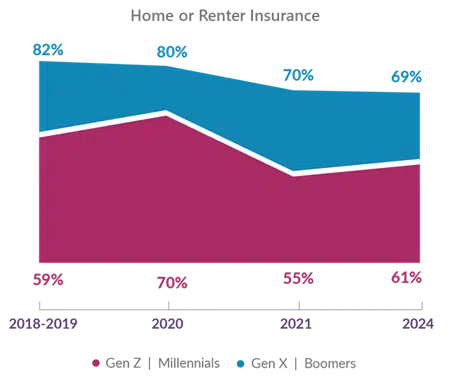

When comparing past results with this year for ownership of either homeowners or renter insurance, there was a sizable drop in 2021 within both generational segments, as seen in Figure 5. Gen Z and Millennials anticipate increased home ownership, which offers further market growth opportunities. The key is to anticipate their needs with the right products at the right time in the right channel. For those with existing relationships through rental insurance, the experience will be a key factor in whether they look to those insurers for homeowners insurance. Capturing the customer early in their life and understanding their lifestyle needs and changes creates tremendous opportunity to grow with them as they adapt to changes in their lives.

Figure 5: Households with home or renter insurance

The growing desire for value-added services to make life easier

Insurers offering value-added services in addition to the basic risk product will be more successful in capturing and retaining both generational segments as reflected in Figure 6. Value-added services that help manage prevention and recovery are the top areas of interest.

Both generations are likely to use sensors and alerts for preventing or mitigating losses from fires, carbon monoxide, water leaks or severe weather. Concierge services generate strong interest in both generations. However, Gen Z and Millennials’ interest reflects a generational shift, where they seek services to help them in their daily lives – like food and grocery delivery, Amazon delivery and mobile dog grooming.

Approximately 62% of Gen X and Boomers and 81% of Gen Z and Millennials are interested in home monitoring for the elderly and children. Some innovative insurers have begun experimenting with this to be prepared for the massive number of aging adults expected in the next 10 to 20 years.

The sky is the limit when thinking about value-added services. They are low-hanging fruit that provide personalized, regular customer engagement that extends the value of the insurance risk product. In today’s world, customers look at the combination of the risk product, customer experience and value-added services as the product.

Figure 6: Interest in home or renter insurance value-added services

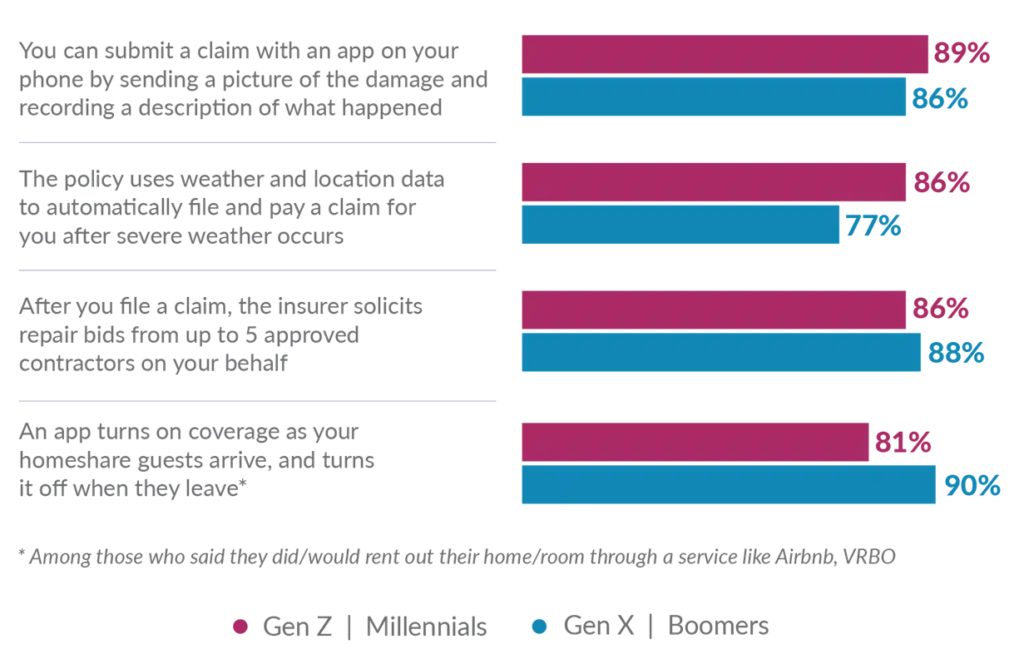

Claims made easy — the generations agree that digital claims experience wins out

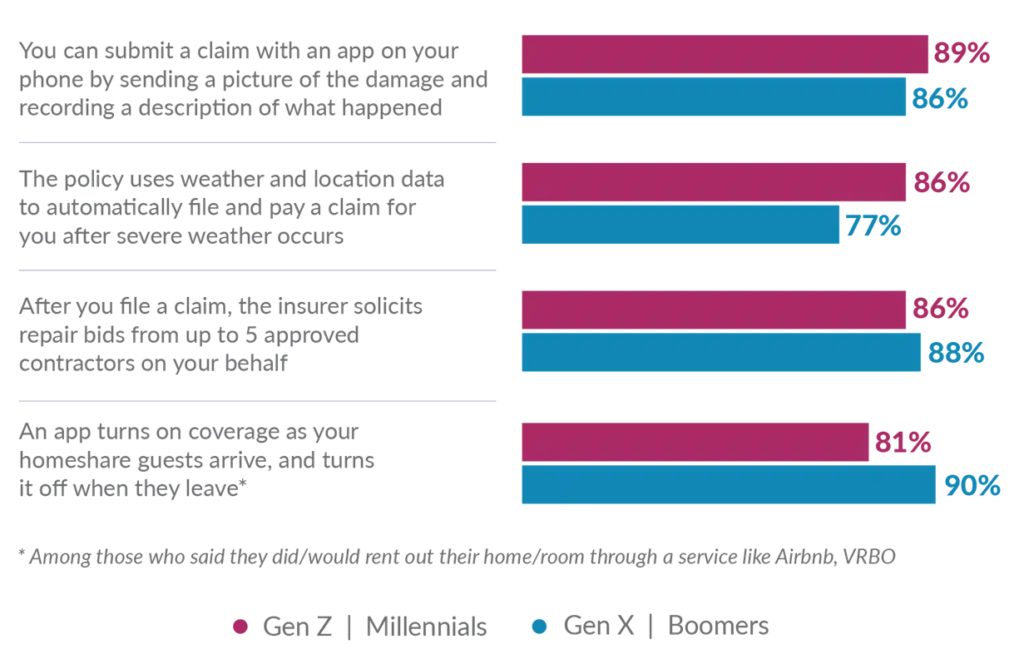

There is strong agreement among the generational segments regarding claims options. The ease and convenience of submitting a claim with a photo of the damage via a smartphone app to using weather and location data to automatically submit a claim is exceptionally high, at 77% to 89%. Taking convenience one step further, customers would like insurers to solicit repair bids from approved contractors on their behalf, by 86% to 88%. For those who want home-sharing on-demand insurance, the importance of the ease of turning on and off the insurance is also very high, at 81% to 90% (Figure 7).

These results highlight a key customer experience demand -- making customers’ lives easier with digital solutions that enhance the relationship, particularly during the claims process -- insurance’s moment of truth.

Figure 7: Interest in ways to activate the claims or coverage process

“Bring on the embedded options” — Purchase channel preferences for homeowners and renters insurance

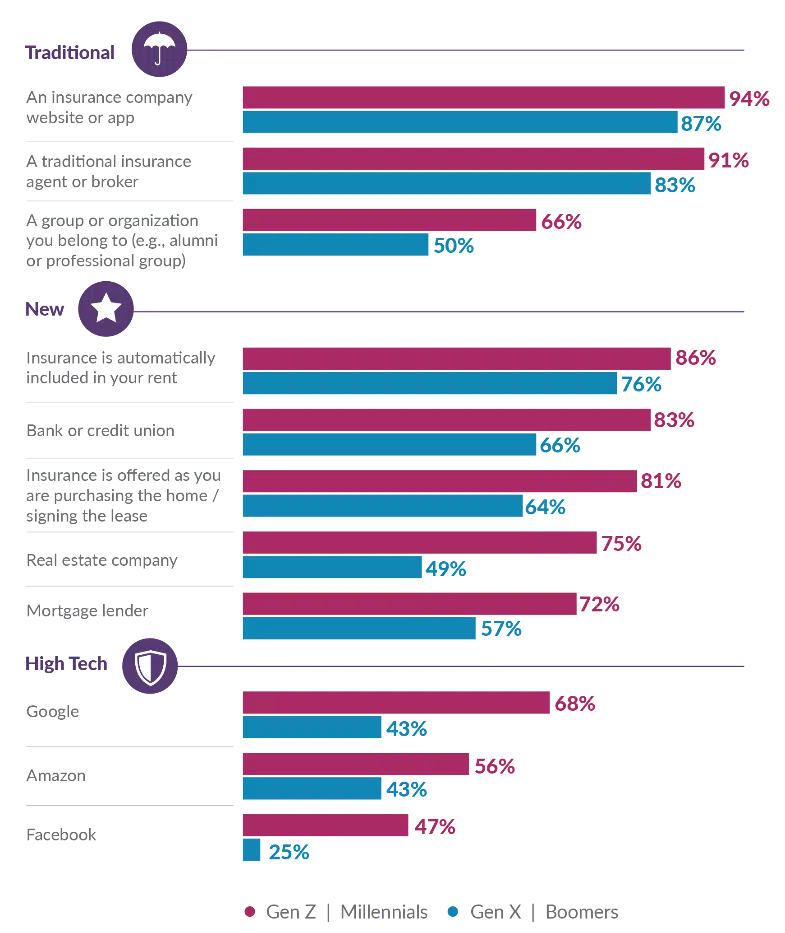

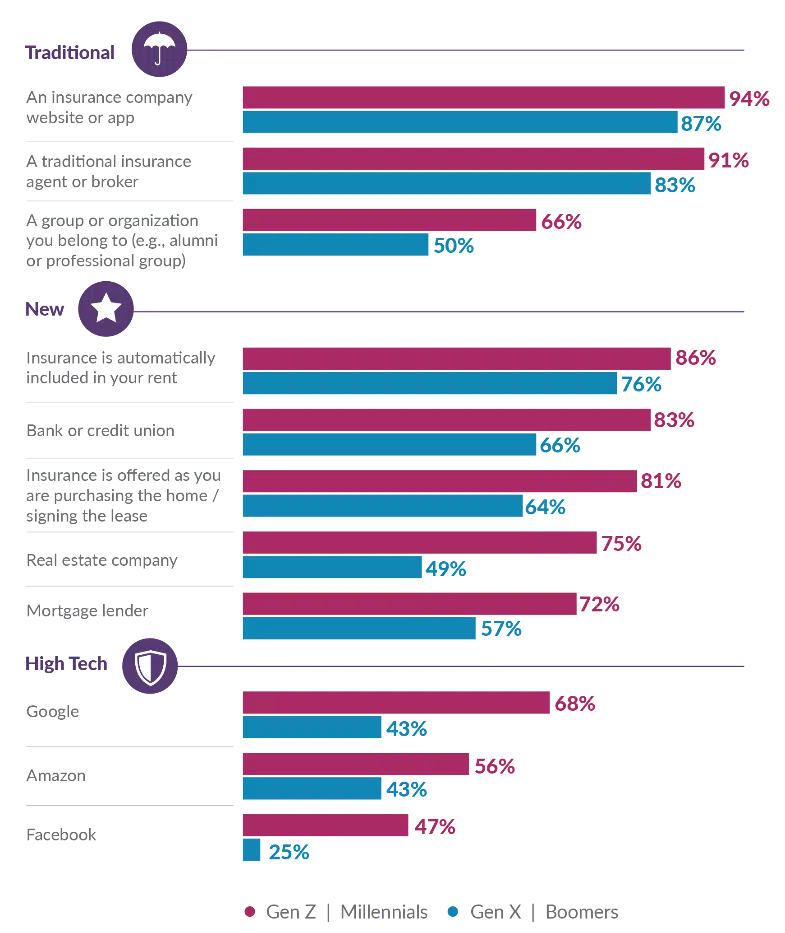

A solid risk product teamed with useful value-added services and customer experience is not enough to stack the odds in an insurer’s favor. The final key component is making it easy for customers to purchase when, where and how they want. Both generational segments strongly agree that traditional insurance company and agent channels continue to deliver the best purchase experience for home and renter insurance, as reflected in Figure 8.

However, Gen Z and Millennials are very open to buying insurance through another channel, such as part of the home-buying or renting process, whether through their bank or credit union, mortgage company or rental leasing company. There is very high interest in having the renter insurance included in the monthly rental fee (86% of Gen Z and Millennials and 76% of Gen X and Boomers). High-tech options like Amazon and Google have a strong interest from the younger generation.

The bottom line is that customers are increasingly moving away from the traditional siloed, separate purchase of insurance to one that is offered or embedded at the time of purchase or renting. This is a major distribution channel shift that will require new partnerships and relationships to meet customers on their terms. For an in-depth overview of today’s channel spectrum, read Majesco’s latest thought-leadership report, Distribution Management: Connecting the Dots to Build Future Market Success.

Figure 8: Interest in home or renter insurance purchase channels

Auto Insurance

Auto insurance need in decline? Let’s take a deep dive into what is going on.

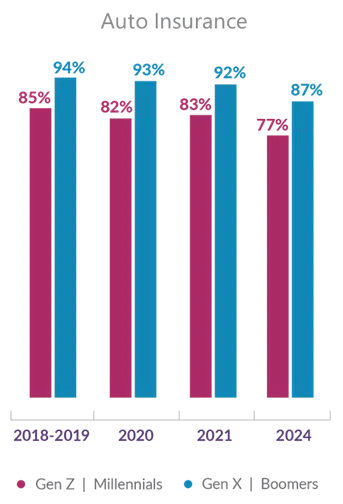

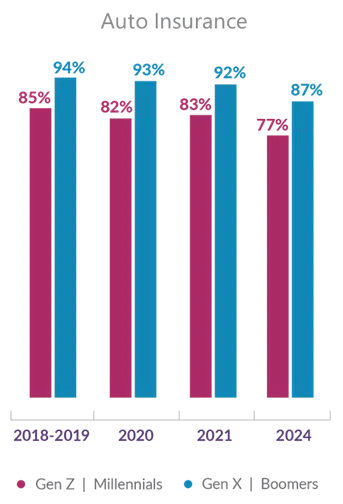

Ownership of auto insurance remains consistently high, but both generational segments expect to see a slight decline of five to six percentage points in the next three years (Figure 9). This decline could suggest a shift to the use of embedded insurance in the purchase or lease of a car, eliminating the need to purchase auto insurance or the elimination of vehicles, given that more people are working from home and given the continued high cost of purchasing, maintaining and using a vehicle.

Figure 9: Households with auto insurance

“Show me the data” — Value-added services for auto insurance include info to make life easier

Gen Z and Millennials are very interested in services that provide real-time information on driving safety and performance, keeping their vehicle safe and maintained, maintaining license and registration renewals and knowing the market value of their vehicle (Figure 10). For both generational groups, these value-added services offer new value beyond the auto risk product to drive satisfaction, reduce risk and retain customers. They help customers manage their lives and the assets around them more effectively.

Figure 10: Interest in auto insurance value-added services

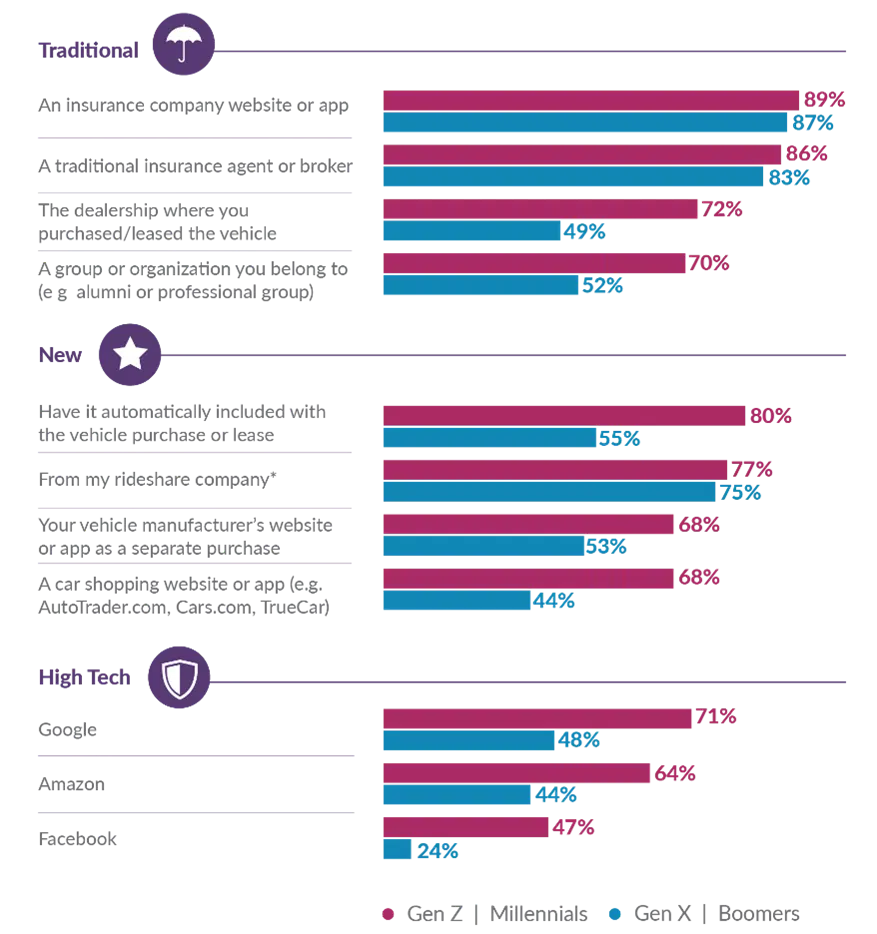

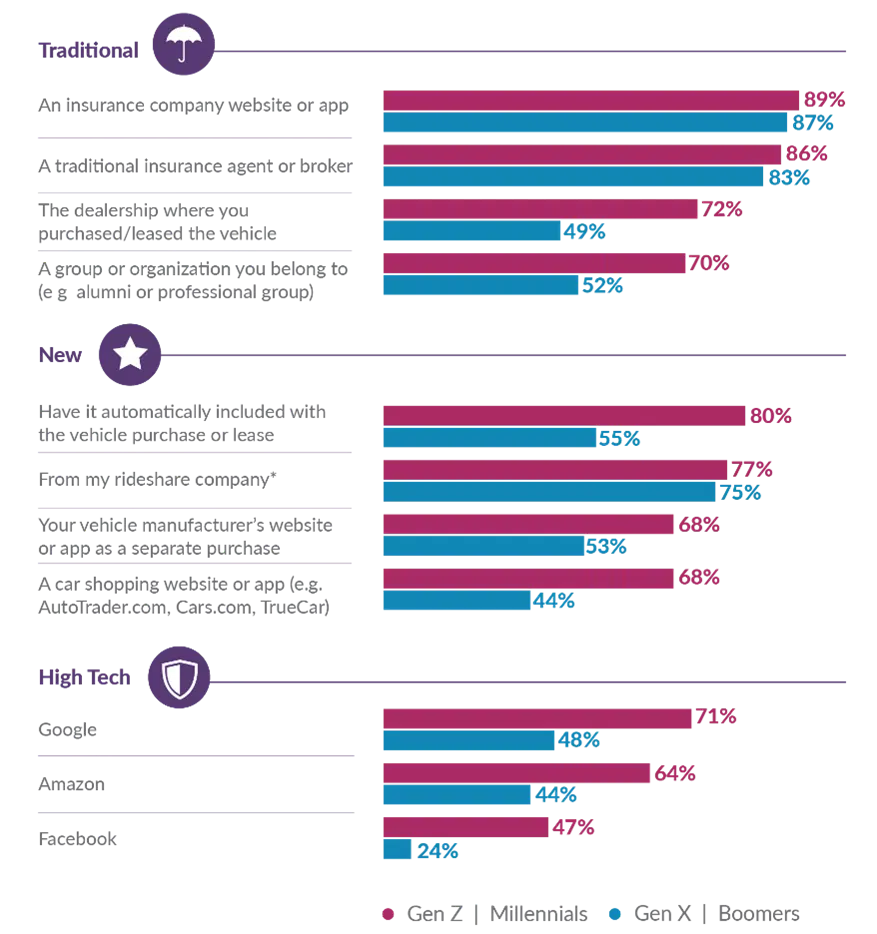

Trust and Convenience — the customer experience within auto insurance purchase channels

Traditional channels, including insurer websites or apps and agents, are overwhelmingly the preferred method of purchase for both generational segments (Figure 11). However, among other traditional channels, such as purchasing from a dealership or through another organization, the older generation’s interest drops as much as 23 percentage points compared with the younger generation.

This trend continues when looking at the new and “high-tech” channels, where there are huge gaps (up to 25 percentage points) between the younger and older generations.

Consistently, the Gen Z and Millennial segment is broadly open to all channels. This highlights the need for insurers to offer and partner with other entities to meet them where and when they want to purchase insurance, moving into a multi-channel world. Gen X and Boomers are still comfortable with traditional channels. Do insurers understand the nuances of channel preference?

While Gen Z and Millennials see the value of traditional channels, they are more focused on convenience and trust, which is why they are open to other new or high-tech channels. Their experience and trust with companies like Google and Amazon meet both their needs. Insurers that offer or embed insurance at the point of sale directly, or with partners, will transform the purchase process to one that is convenient, seamless and quick. The bottom line…partnerships with other entities are increasingly crucial to not only retain but grow the auto insurance business by addressing how consumers are shifting where and from whom auto insurance is bought.

Figure 11: Interest in auto insurance purchase channels

Strong, growing interest in alternative pricing

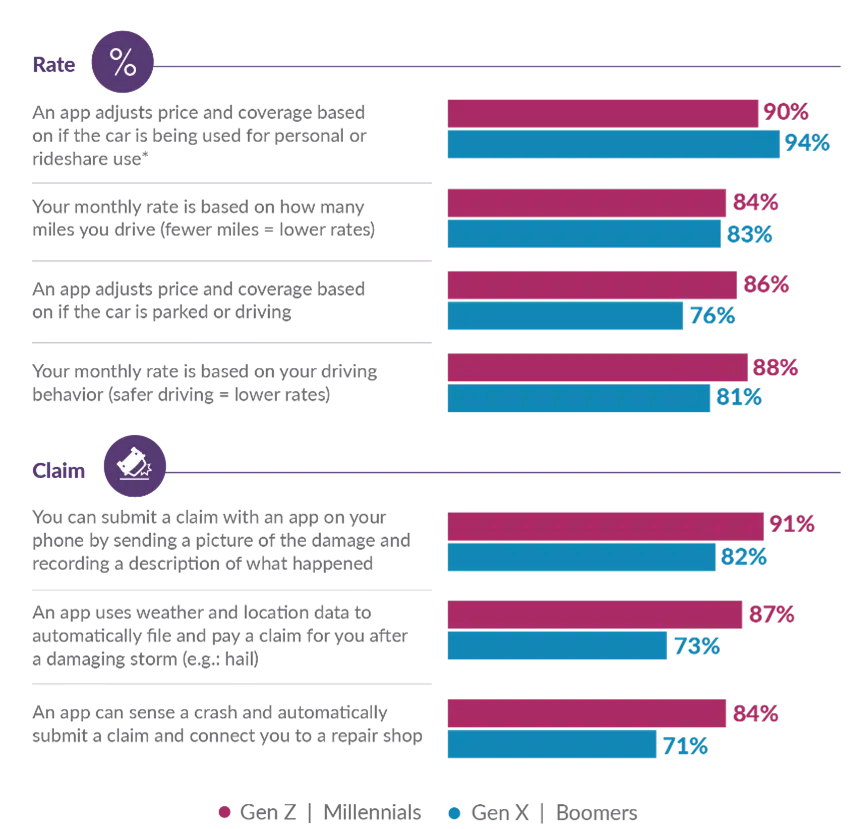

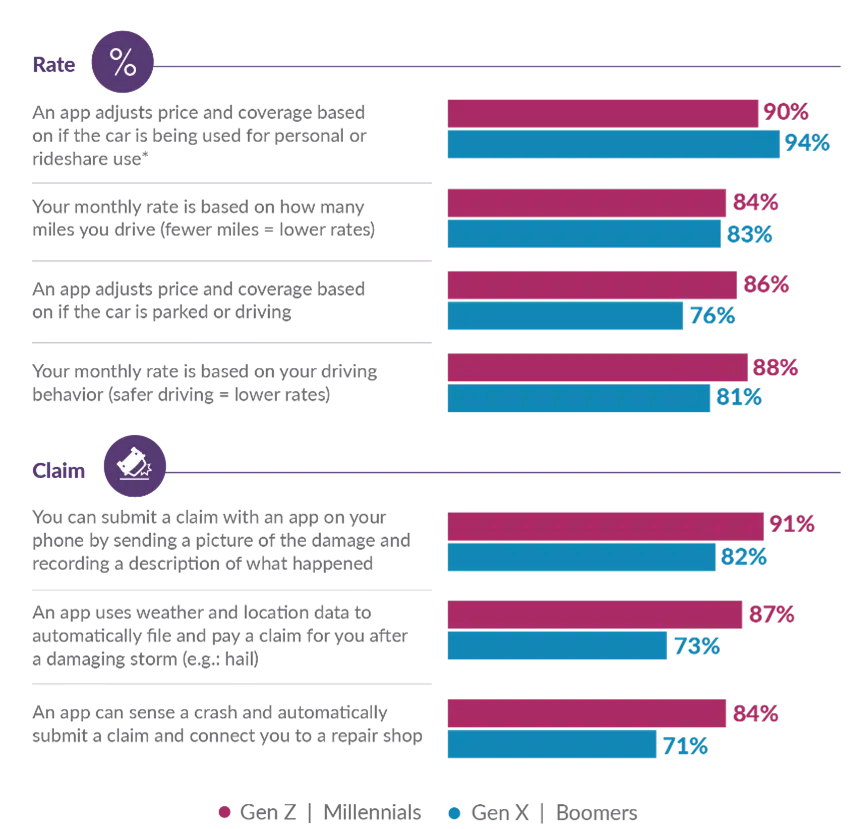

As we stated at the outset, both generations are open to a wide range of pricing and claims options (Figure 12).

- Over 80% would use pricing based on driving behavior and number of miles driven, which accelerated in use during the pandemic. Even monthly rates based on whether the car is parked or driving show a strong interest (over 76%).

- Both generational groups have a strong interest in app-assisted claims processes. The nuanced difference between Gen X and Boomers reflects a desire for control. In contrast, the younger generation is very interested in parametric or automated claims processes, which once again tie to their desire for digital convenience.

Regardless, the strong results highlight the growing demand for new pricing and claims options for auto insurance that customers will expect as they consider buying or renewing their insurance.

Figure 12: Interest in ways to activate and determine the cost of auto insurance

How to respond?

Today’s insurance process can be difficult, complex and time-consuming. At a high level, what can insurers do to respond to the growing demand for new types of insurance products, services and experiences? How can they reduce the impact of population volatility and increase the opportunity to capitalize on market trends?

For the most part, digital tech and automation will run the future of every business, including insurance. “Pay-as-you-live,” “Protect-as-you-go,” “Buy where, when and how you need it,” “Simplify my life and experience” and “Prevent-as-you-live” technologies and insurance are commanding insurers’ strategic and operational attention.

In addition, many insurtechs and existing insurer innovations are refocusing to a “buying” over a “selling” approach, through a multi-channel strategy that meets customers where, when and how they want to buy. If distribution channels are easy to use with products that are easy to understand, have value-added services to make their lives easier and provide a great customer experience…then insurance has an opportunity to grow through friction-free, multi-channel distribution.

With the increasing competitive challenges to attract and retain customers, insurers have an opportunity to grow by putting the customer first.